Perforated Impression Trays Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432065 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Perforated Impression Trays Market Size

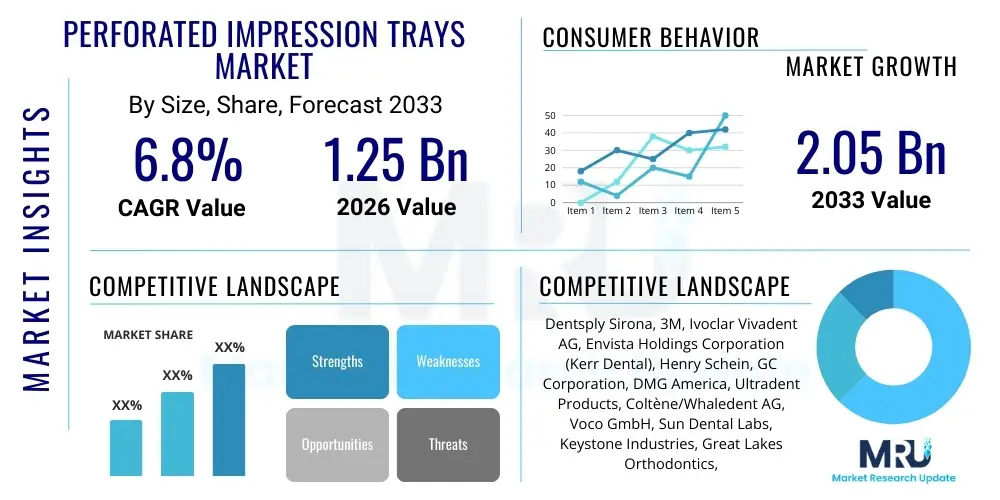

The Perforated Impression Trays Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 2.05 Billion by the end of the forecast period in 2033.

Perforated Impression Trays Market introduction

The Perforated Impression Trays Market encompasses the manufacturing and distribution of specialized dental instruments used to hold impression material (such as alginate or silicone) during the process of creating a negative mold of the patient's oral structures. Perforations are a critical design feature, allowing excess impression material to escape and providing mechanical interlocking for better retention of the material, which significantly enhances the accuracy and stability of the final impression. These trays are indispensable tools in restorative dentistry, orthodontics, and prosthodontics, serving as the foundational element for creating dentures, crowns, bridges, and aligners. The demand is intrinsically linked to the increasing prevalence of dental disorders, a growing geriatric population requiring prosthetic solutions, and heightened aesthetic consciousness among consumers globally, driving volume in dental procedures.

The primary benefit of utilizing perforated trays is the superior impression accuracy they facilitate, which minimizes the need for costly and time-consuming remakes. Available in various sizes and materials, including disposable plastics and reusable metals, these trays cater to diverse clinical needs, ranging from full arch impressions to quadrant-specific procedures. Major applications include the fabrication of fixed and removable prostheses, preparation for complex implant surgeries, and diagnostic modeling for orthodontic treatment planning. The versatility and necessity of accurate impressions ensure that these trays remain a core consumable product within the dental supply chain. Key driving factors involve technological advancements in impression materials, alongside rising disposable incomes in emerging economies, enabling greater access to advanced dental care services.

The dental industry’s shift toward minimizing patient discomfort and maximizing clinical efficiency further supports the adoption of high-quality perforated trays. While digital scanning technologies offer an alternative, conventional impression techniques using trays remain the standard in many clinical settings due to their cost-effectiveness, reliability, and necessity in specific complex cases where deep tissue capture is required. The global expansion of dental chains and the increasing focus on preventive and cosmetic dentistry are major macroeconomic catalysts accelerating market growth. Furthermore, continuous product innovation aimed at improving tray ergonomics and ensuring compatibility with modern hydrophilic impression materials contributes substantially to sustaining market momentum throughout the forecast period.

Perforated Impression Trays Market Executive Summary

The Perforated Impression Trays Market is characterized by robust growth, primarily driven by the expanding scope of prosthodontic applications and rising global dental expenditure. Business trends indicate a strong focus on materials science, particularly the development of high-impact disposable plastic trays offering sterilization convenience without compromising rigidity, alongside metal trays featuring advanced autoclavable coatings for extended lifespan. Mergers and acquisitions are common among key players seeking to consolidate distribution channels and integrate tray production with complementary impression material portfolios, thus offering bundled solutions to dental practitioners. The market also observes an increasing penetration of custom-molded tray systems, which, while more costly, offer superior accuracy for highly complex restorative cases, pushing average selling prices upwards and contributing to overall revenue growth.

Regionally, North America and Europe maintain dominance, driven by well-established dental insurance frameworks, high awareness of oral health, and rapid adoption of premium dental technologies. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), fueled by healthcare infrastructure modernization, surging medical tourism, and a vast, underserved population requiring basic to advanced dental interventions. Regulatory harmonization across major markets, particularly concerning material safety and sterilization protocols for reusable trays, influences market entry and product commercialization strategies. Economic stability in key developing nations directly correlates with increased patient visits and subsequent demand for consumable dental products like impression trays.

Segment trends highlight the leading position of the stock tray segment due to its versatility and lower cost, making it the preference for general dentistry and diagnostic models. Concurrently, the customized tray segment, often leveraging 3D printing and CAD/CAM technologies for precise fit, is experiencing rapid growth, driven by specialized dental centers and large hospitals undertaking intricate implant and prosthetic work. Material segmentation shows plastics holding a significant share due to disposable convenience and infection control benefits, although high-grade stainless steel trays remain essential for durability and repeated sterilization cycles in high-volume clinics. The end-user analysis confirms dental clinics and private practices as the largest consumers, benefiting from continuous supply chain optimization and just-in-time inventory systems provided by major distributors.

AI Impact Analysis on Perforated Impression Trays Market

User queries regarding AI’s influence on the Perforated Impression Trays Market primarily center on the potential displacement of traditional impression methods by highly accurate intraoral scanners (IOS) integrated with AI algorithms, which streamline digital workflow and reduce chair time. Users are concerned about whether AI-driven diagnostics will entirely negate the need for physical molds. Key themes analyzed suggest that while AI enhances digital dentistry—improving diagnosis, planning prosthetic design, and optimizing 3D printing of models—it primarily acts as a complementary technology rather than a direct replacement for impression trays, especially in cases requiring subgingival detail or specific material impressions. The expectation is that AI will optimize the *use* of trays by refining indications and designing custom trays more efficiently, rather than eliminating them, particularly in low-resource settings or specialized areas where physical impressions remain clinically superior or cost-effective. AI is expected to revolutionize custom tray fabrication via generative design, reducing material waste and improving fit accuracy significantly.

- AI optimizes prosthetic design based on scanned data, influencing the necessity for and accuracy of subsequent impressions.

- Generative AI algorithms facilitate the automated design of highly customized perforated trays, minimizing material usage and maximizing rigidity.

- Predictive analytics determine the ideal impression material and tray type for complex cases, reducing clinical errors associated with tray selection.

- AI-driven image processing enhances the validation of traditional impressions, quickly identifying flaws or distortion in the physical mold before casting.

- Integration of AI in inventory management systems forecasts demand for specific tray sizes and types based on patient demographic and procedural trends in clinics.

- Advanced machine learning models are used to train new dental professionals on optimal impression techniques, analyzing simulation feedback related to tray seating and material loading.

DRO & Impact Forces Of Perforated Impression Trays Market

The dynamics of the Perforated Impression Trays Market are dictated by a balanced interplay of strong drivers related to global demographic shifts and technological progress, significant restraints associated with digital disruption and material costs, and compelling opportunities in emerging markets and material science. The primary driver is the accelerating aging population worldwide, which inherently increases the demand for restorative and prosthetic dental solutions, necessitating accurate impressions. Conversely, the most potent restraint is the accelerating adoption of high-resolution digital intraoral scanners, which bypass the need for physical trays in many elective and routine procedures. Opportunities lie in developing biodegradable and advanced composite materials for trays, addressing environmental concerns while maintaining clinical performance, and expanding access to high-quality disposable trays in large, price-sensitive Asian and Latin American markets. These forces combine to create a moderately competitive environment where innovation in both physical products and digital integration is paramount for sustained market leadership.

Drivers: The market is strongly driven by the increasing incidence of dental caries, periodontal diseases, and tooth loss, directly correlating with the need for crowns, bridges, and dentures. Furthermore, the rising awareness regarding aesthetic dentistry and the associated boom in orthodontic treatments, including clear aligner therapy which often starts with precise physical impressions, contributes significantly. Government initiatives globally promoting oral health check-ups and preventative care indirectly boost the utilization of impression trays for baseline diagnostic models. Additionally, product innovations focusing on ergonomic design, such as self-adjusting or quadrant-specific trays that improve patient comfort and clinical outcome, enhance market acceptance.

Restraints: Significant restraints include the high initial investment and operational costs associated with certain premium tray systems, particularly customized metal trays, deterring small practices. The primary long-term threat remains the technological superiority and workflow convenience offered by intraoral scanning systems, which are becoming increasingly affordable and integrated into dental school curricula. Furthermore, concerns regarding infection control and the stringent sterilization requirements for reusable trays pose logistical and cost challenges, especially in resource-constrained environments. Fluctuations in raw material prices (polymers and specialized metals) also create pricing instability, impacting manufacturers’ profit margins.

Opportunities: Major opportunities exist in the development and commercialization of trays made from recyclable or bio-based polymers, aligning with global sustainability trends and appealing to environmentally conscious practitioners. Untapped potential lies in penetrating rural and remote areas of developing countries through subsidized programs or partnerships with local healthcare providers, offering cost-effective disposable tray solutions. Moreover, the integration of smart features, such as temperature-sensitive coatings or integrated depth gauges within the trays, offers performance differentiation and premium pricing potential. Collaborative research between dental manufacturers and universities to standardize impression protocols also presents a pathway for market expansion.

Impact Forces: The overarching impact force is technological substitution (digital scanning), which continuously pressures manufacturers to justify the value of physical impressions through improved material science and tray design accuracy. Regulatory changes regarding material biocompatibility and disposable waste management act as strong external forces shaping product development and regional market access. Economic fluctuations, particularly changes in discretionary healthcare spending, directly affect patient demand for elective procedures that rely heavily on accurate initial impressions, thus influencing the purchasing power of dental practices.

Segmentation Analysis

The Perforated Impression Trays Market is comprehensively segmented based on material, type, application, and end-user, providing a granular view of demand patterns and strategic areas for investment. Segmentation by material is crucial as it determines cost, reusability, and infection control compliance, with plastics dominating volume due to disposable convenience, while metals capture value due to durability. Type segmentation distinguishes between stock (off-the-shelf) trays, which are universally used for routine procedures, and custom trays, which are essential for high-precision prosthetics and surgical guides. Application segmentation highlights the core clinical uses, primarily prosthodontics and orthodontics, representing the highest consumption segments. Understanding these segments is vital for manufacturers to tailor their production capabilities and marketing efforts effectively across the highly diversified dental market.

The dynamics within the segmentation reveal a trend towards hybrid solutions. For instance, while custom trays offer the best fit, the cost and time involved in their fabrication have spurred the development of specialized stock trays (e.g., dual-arch trays) that aim to bridge the gap between efficiency and accuracy. Furthermore, end-user segmentation clearly indicates that private dental clinics and independent practices are the largest consumers, demonstrating a preference for reliable, easy-to-use disposable plastic trays that simplify sterilization protocols and reduce turnaround time. Conversely, large hospitals and academic research institutions often utilize a higher proportion of metal trays and highly specialized custom impression systems due to the complexity of the cases they manage and their rigorous research requirements. This diverse consumption profile necessitates a multi-faceted product strategy for market players.

Geographic segmentation is equally critical, as regulatory environment, reimbursement policies, and oral health expenditure vary significantly by region. North America leads in adopting premium, specialized trays, whereas APAC focuses heavily on cost-effectiveness and volume demand for standard plastic trays. Consequently, pricing strategies must be localized to maintain competitive advantage. Overall, the growth trajectory suggests that while stock trays will continue to command the largest market share by volume, the custom tray segment, fueled by advancements in 3D printing and digital impression planning, is poised for the fastest expansion in terms of revenue, reflecting the industry's increasing emphasis on precision dentistry and personalized patient care outcomes.

- Material

- Plastic Impression Trays (Disposable, dominant by volume)

- Metal Impression Trays (Reusable, including Stainless Steel and Aluminum)

- Other Materials (e.g., Specialized Composites, Bio-degradable Polymers)

- Type

- Stock Trays (Quadrant, Full Arch, Anterior)

- Custom Trays (Vacuum-formed, 3D Printed, Light-cured Acrylic)

- Application

- Prosthodontics (Dentures, Crowns, Bridges)

- Orthodontics (Treatment Planning, Aligners, Retainers)

- Restorative Dentistry

- Surgical Procedures (Implant Planning)

- End-User

- Dental Clinics and Private Practices

- Hospitals and Academic Research Centers

- Dental Laboratories

Value Chain Analysis For Perforated Impression Trays Market

The value chain for the Perforated Impression Trays Market begins with upstream suppliers providing essential raw materials, primarily medical-grade polymers (polypropylene, polystyrene) and high-quality stainless steel alloys. These suppliers face stringent quality controls regarding material purity and biocompatibility, particularly for products that come into contact with oral tissues. The core manufacturing stage involves precision molding, stamping, or 3D printing processes, focusing on achieving exact anatomical shapes and ensuring consistent perforation patterns crucial for impression accuracy. Cost efficiency and scale of production are key determinants of success at this stage, especially for high-volume disposable plastic trays. Effective quality assurance and regulatory compliance (e.g., FDA, CE marking) are integrated throughout the manufacturing process, validating product specifications and safety profiles.

The distribution channel represents the midstream segment, which is complex and layered, involving direct sales, partnerships with large dental distributors (e.g., Henry Schein, Patterson Dental), and localized dealer networks. Direct channels are often utilized for large institutional customers or for specialized, high-cost custom tray systems, allowing manufacturers greater control over pricing and technical support. Indirect channels, through specialized third-party dental distributors, dominate the market, leveraging established logistical networks to reach numerous smaller dental clinics efficiently. These distributors often bundle trays with impression materials and other consumables, offering convenience and discounted purchasing options to practitioners, making strong distributor relationships critical for market penetration and inventory management.

The downstream analysis focuses on the end-users—dental practitioners, hygienists, and lab technicians—who utilize the trays in clinical and laboratory settings. The efficiency and accuracy achieved during the impression-taking process directly impacts the quality of the final prosthetic or restoration. Post-usage, the chain involves waste management (especially for disposable plastic trays, raising environmental concerns) and sterilization protocols for reusable metal trays. Market profitability is highly sensitive to the cost of raw materials and the distribution markups. Successful companies often vertically integrate key material processing or invest heavily in automation to optimize the manufacturing stage, ensuring competitive pricing and reliable supply, thereby maximizing value delivered to the end-user through highly reliable products.

Perforated Impression Trays Market Potential Customers

The primary consumers and end-users of perforated impression trays are professional dental practitioners across various specialties, as these trays are fundamental diagnostic and preparatory tools for nearly all dental restoration and alignment procedures. Private dental clinics and independent practices constitute the largest customer base globally, driven by the volume of routine general dentistry, cosmetic procedures, and common restorative work like crown and bridge preparations. These customers prioritize cost-effectiveness, convenience, and reliable sterile options, favoring high-quality disposable plastic trays for their ease of use and reduced cross-contamination risk, typically purchasing through established national distributors.

Another significant segment comprises specialized dental institutions, including large regional hospitals and academic medical centers. These customers often handle more complex surgical and prosthetic cases, such as full-mouth reconstructions or maxillofacial surgery, requiring highly precise, often customized, metal impression trays or advanced stock trays compatible with specific, high-viscosity impression materials. Their purchasing decisions are often centralized, focusing on durability, longevity, and bulk purchasing agreements, with procurement heavily influenced by technical specifications and clinical efficacy documentation provided by manufacturers. Research centers also consume trays for material testing and educational purposes.

Furthermore, commercial dental laboratories represent a critical, though indirect, customer segment. While labs rarely take the initial impression, they often utilize perforated trays (or specialized vacuum-formed tray blanks) to create working models from the initial impression material provided by the clinician. The trend toward digital dentistry means labs are increasingly dealing with digital scans, but physical model fabrication remains necessary for high-precision casting and certain prosthetic fabrications, maintaining a steady demand for lab-specific trays and modeling materials. Finally, the growing market for clear aligners, supplied through specialized orthodontic laboratories, further reinforces the demand for highly accurate initial impressions, often utilizing specialized dual-arch or partial-arch trays.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 2.05 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dentsply Sirona, 3M, Ivoclar Vivadent AG, Envista Holdings Corporation (Kerr Dental), Henry Schein, GC Corporation, DMG America, Ultradent Products, Coltène/Whaledent AG, Voco GmbH, Sun Dental Labs, Keystone Industries, Great Lakes Orthodontics, Hu-Friedy Group, Dentatus, Zhermack S.p.A., Shofu Inc., Dental Technologies Inc., Hager & Werken, Parkell Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Perforated Impression Trays Market Key Technology Landscape

The technology landscape for perforated impression trays is evolving beyond traditional molding and stamping towards advanced manufacturing techniques, most notably additive manufacturing (3D printing). While standard stock trays rely on high-volume, cost-efficient injection molding for plastics and precise stamping/welding for metal, the increasing demand for customized, patient-specific trays is driving the integration of digital workflow technologies. Clinicians are utilizing intraoral scanners and CAD software not just for direct digital impressions, but also for designing perfectly fitting custom trays, which are then rapidly manufactured using stereolithography (SLA) or Digital Light Processing (DLP) 3D printers. This shift allows for unprecedented accuracy in tray dimensions, leading to superior final prosthetic fit and reduced clinical adjustment time, representing a crucial technological advancement that differentiates high-end products.

Material science innovation also plays a vital role. Manufacturers are increasingly incorporating advanced polymers designed for greater dimensional stability, rigidity, and reduced distortion during impression material setting. Specialized coatings are being developed for metal trays to enhance infection control properties and improve adhesion with hydrophilic impression materials, thereby optimizing the clinical performance of reusable instruments. Furthermore, there is a push towards eco-friendly materials; some companies are exploring biodegradable polylactic acid (PLA) or other bio-composites for disposable plastic trays to mitigate the environmental impact of single-use dental waste. The compatibility of these new tray materials with modern, fast-setting impression pastes (such as vinyl polysiloxane or polyether) is a key focus area, ensuring reliable performance in demanding clinical situations.

Digital integration extends beyond 3D printing into auxiliary technologies. Advanced tray systems are being developed with embedded markers or geometric features that facilitate easier alignment and registration when the physical impression is scanned back into the digital environment (reverse engineering), thus improving the seamless transition between analog and digital workflows. Furthermore, quality control in manufacturing is now heavily reliant on high-precision optical scanning and computer vision systems to verify that perforation sizes and placement meet stringent specifications across the entire manufacturing batch. These technological enhancements ensure that, even in the face of digital competition, the traditional impression tray method continues to offer high precision and operational efficiency for specific dental procedures where physical fidelity remains critical.

Regional Highlights

The global Perforated Impression Trays Market exhibits distinct regional consumption and growth patterns, heavily influenced by healthcare spending, regulatory frameworks, and technological adoption rates. North America, encompassing the United States and Canada, currently holds the largest market share, characterized by high expenditure on advanced dental procedures, strong adoption of both premium reusable metal trays and high-quality disposable systems, and an early embrace of custom 3D-printed trays. The presence of major market players and well-established dental insurance schemes further solidifies this region’s dominance. The high demand is also linked to the mature cosmetic dentistry sector and extensive utilization of implantology, both requiring highly accurate initial impressions for successful outcomes.

Europe represents the second-largest market, displaying high consumption driven by favorable reimbursement policies in key nations like Germany, the UK, and France, coupled with strict regulatory emphasis on sterilization and infection control, favoring certified, high-standard reusable trays and compliant disposable options. Western European countries demonstrate a preference for technologically advanced products, while Eastern Europe is rapidly increasing adoption rates as dental care access expands. Asia Pacific (APAC) is the fastest-growing market, projected to outperform other regions in CAGR over the forecast period. This exponential growth is underpinned by massive population bases, rising economic prosperity leading to increased discretionary spending on dental health, and significant government investments in improving primary healthcare infrastructure, particularly in countries like China, India, and South Korea. While price sensitivity is higher, the sheer volume of dental procedures drives market expansion, favoring high-volume, cost-effective plastic disposable trays.

Latin America and the Middle East & Africa (MEA) currently hold smaller but significant market shares. Growth in Latin America is driven by expanding middle-class populations and improving dental practitioner density, with Brazil serving as a key regional hub for dental manufacturing and distribution. The MEA region is witnessing growth largely concentrated in the GCC states (Saudi Arabia, UAE) due to high healthcare tourism and substantial government investment in modernizing clinical facilities. However, market penetration in many MEA countries remains constrained by limited insurance coverage and reliance on imported products. Overall regional success is tied to a company's ability to navigate diverse regulatory landscapes and customize product offerings and pricing to match local economic realities, ensuring optimal tray material and type availability for various clinical standards.

- North America: Market leader; driven by advanced prosthodontics, high dental expenditure, and high adoption of custom 3D-printed trays.

- Europe: Second largest market; stringent infection control standards, favoring premium reusable metal trays and high-quality disposable options.

- Asia Pacific (APAC): Fastest-growing region; powered by rapid economic development, increasing dental tourism, and large, underserved populations requiring volume-driven, cost-effective solutions.

- Latin America: Moderate growth; focused on expanding access to general dentistry services, with Brazil as the regional commercial center.

- Middle East & Africa (MEA): Growth centered around GCC countries; driven by luxury healthcare facilities and implant dentistry expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Perforated Impression Trays Market.- Dentsply Sirona

- 3M

- Ivoclar Vivadent AG

- Envista Holdings Corporation (Kerr Dental)

- Henry Schein

- GC Corporation

- DMG America

- Ultradent Products

- Coltène/Whaledent AG

- Voco GmbH

- Sun Dental Labs

- Keystone Industries

- Great Lakes Orthodontics

- Hu-Friedy Group

- Dentatus

- Zhermack S.p.A.

- Shofu Inc.

- Dental Technologies Inc.

- Hager & Werken

- Parkell Inc.

Frequently Asked Questions

Analyze common user questions about the Perforated Impression Trays market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between metal and plastic perforated impression trays?

Metal trays are typically reusable, offer superior rigidity for precise impressions, and are designed for repeated sterilization, making them a high-initial-cost, durable investment. Plastic trays are generally disposable, prioritizing infection control and convenience, and are more cost-effective for high-volume, routine dental procedures, though they may lack the rigidity required for the most complex cases.

How is digital dentistry impacting the demand for perforated impression trays?

Digital intraoral scanning (IOS) is reducing the need for traditional impressions in routine diagnostic and restorative procedures. However, perforated trays remain essential for complex implantology, full-arch prosthetics requiring subgingival detail, and in practices where IOS is not yet cost-justified, particularly in emerging markets, ensuring the continued relevance of physical trays.

Which geographic region dominates the consumption of perforated impression trays?

North America currently holds the largest market share due to high dental healthcare expenditure, established insurance coverage, and early adoption of specialized and custom tray technologies for advanced prosthodontic and cosmetic procedures.

What key material innovations are expected in the impression tray market?

Key innovations include the development of biodegradable polymers for disposable trays to address environmental concerns, and advanced composites and specialized coatings that enhance rigidity, improve material adhesion, and simplify sterilization processes for reusable metal trays.

What are the main advantages of using custom perforated trays over standard stock trays?

Custom trays, often fabricated via 3D printing based on patient anatomy, offer significantly improved fit, which requires less impression material and ensures superior accuracy and dimensional stability, drastically reducing distortion and the need for remakes in highly complex or technically demanding dental procedures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager