Perforated Stretch Film Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435834 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Perforated Stretch Film Market Size

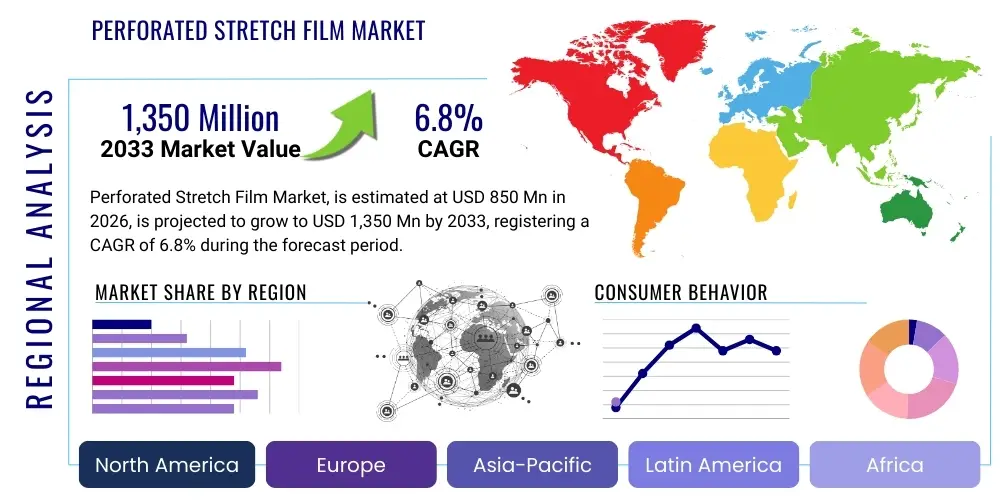

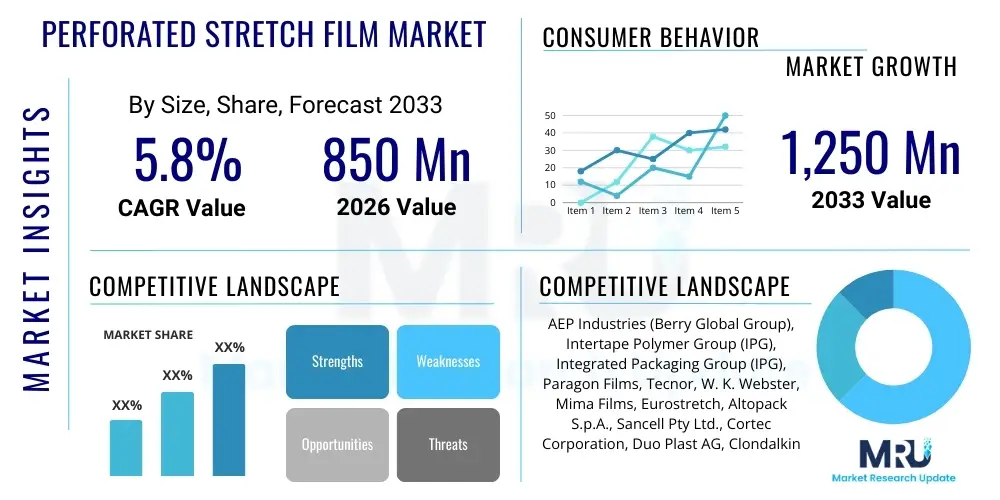

The Perforated Stretch Film Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 850 million in 2026 and is projected to reach USD 1,350 million by the end of the forecast period in 2033.

Perforated Stretch Film Market introduction

The Perforated Stretch Film Market encompasses specialized packaging materials designed with evenly distributed holes or vents, fundamentally differentiating them from traditional solid stretch films. This feature provides essential ventilation, crucial for goods that require airflow during storage and transportation, primarily perishable items such as fresh produce, baked goods, and frozen foods, as well as products susceptible to condensation or excessive heat buildup. The primary function of perforation is to allow moisture and heat to escape from the palletized load, thereby mitigating spoilage, preventing mold growth, and maintaining product integrity, significantly extending shelf life and reducing logistics losses.

The evolution of high-speed automated stretch wrapping machinery has propelled the demand for consistent and robust perforated films, ensuring seamless application without tears or jamming. Modern perforated stretch films are often manufactured using advanced linear low-density polyethylene (LLDPE) resins, offering exceptional puncture resistance and high load containment despite the perforations. Key applications span across agriculture for palletizing crops sensitive to respiration, beverages where condensation is a concern, and the pharmaceutical industry for temperature-sensitive shipments. The growing global focus on food waste reduction, coupled with stringent quality control standards in international trade, reinforces the necessity for packaging solutions that optimize preservation capabilities during extended supply chain cycles.

Driving factors for this specialized market include the rapid expansion of cold chain logistics globally, necessitating ventilated wraps for refrigerated and chilled goods. Furthermore, the increasing consumer preference for fresh, locally sourced, and high-quality produce requires sophisticated packaging that can withstand varying environmental conditions during transit. The benefits of using perforated stretch film—such as improved load stabilization combined with effective aeration—outweigh the marginal cost difference compared to standard films for sensitive loads. This balance between stabilization and breathability is the core value proposition that continues to attract major players in the food processing, retail, and logistics sectors.

Perforated Stretch Film Market Executive Summary

The global Perforated Stretch Film Market is currently characterized by moderate yet steady growth, driven predominantly by the escalating demand from the food and beverage sectors, particularly in fast-developing economies across Asia Pacific and Latin America. Business trends indicate a strong shift towards bio-based and recyclable perforated film solutions, addressing increasing corporate sustainability mandates and stricter regulatory environments concerning plastic waste management. Key market players are heavily investing in multilayer co-extrusion technologies to enhance film strength and elongation properties while maintaining consistent perforation patterns, thereby improving performance on high-speed wrapping lines and optimizing material usage, which is critical for cost management and environmental impact reduction.

Regional trends highlight North America and Europe as established markets focused on technological refinement, standardization of perforation sizes (microporous versus standard), and the adoption of advanced automation in warehousing and distribution centers. Conversely, the Asia Pacific region is expected to exhibit the highest growth rate, fueled by substantial governmental investments in cold chain infrastructure development, coupled with rapid urbanization that increases the dependency on complex supply chains for fresh food distribution. The competitive landscape is becoming more concentrated, with multinational packaging giants acquiring smaller, specialized manufacturers to integrate proprietary perforation technologies and expand their geographical reach into high-growth agricultural regions.

Segment trends reveal that the manual application segment remains significant in emerging markets due to lower upfront equipment costs, but the automated machine wrap segment is overwhelmingly dominating in terms of volume and value, aligning with modern industrial logistics requirements for speed and consistency. In terms of material type, the Low-Density Polyethylene (LDPE) and Linear Low-Density Polyethylene (LLDPE) films still constitute the market backbone, although there is a notable rise in demand for specialized, high-performance films designed for extremely heavy or geometrically challenging loads, requiring maximum tear resistance despite the perforations. The application segment focused on fruits and vegetables is the largest consumer, reflecting the essential requirement for respiration control during transit to prevent rapid deterioration.

AI Impact Analysis on Perforated Stretch Film Market

Common user questions regarding AI's influence on the Perforated Stretch Film Market primarily revolve around how machine learning can optimize the packaging process, predict material failure, and integrate quality control. Users often inquire about AI's role in inventory management optimization, specifically predicting the exact stretch film type and volume needed based on fluctuating perishable shipment schedules, seasonal variations in produce volume, and environmental conditions during transport. Furthermore, concerns are raised regarding the potential for AI-driven manufacturing processes to minimize material inconsistencies, refine perforation accuracy, and ultimately reduce production waste, ensuring that films meet strict aeration requirements necessary for sophisticated climate-controlled storage solutions. The expectation is that AI will move the industry from reactive quality assurance to proactive process optimization, enhancing sustainability and operational efficiency across the entire supply chain, particularly through predictive maintenance on high-speed wrapping machines to eliminate costly downtime.

AI's primary impact on the manufacturing side involves optimizing the extrusion and perforation processes. Machine learning algorithms analyze real-time data from production lines, including material flow, temperature profiles, and perforation punch consistency, to identify anomalies instantaneously. This level of precise control ensures films meet specified mechanical properties, such as necessary stretch ratio and tear resistance, while maintaining the required ventilation rates. By minimizing variance in thickness and hole distribution, AI-powered systems contribute significantly to waste reduction and energy efficiency during the complex fabrication of perforated materials.

Within the logistics and end-user environment, AI algorithms are being integrated with warehouse management systems (WMS) to determine the optimal wrapping tension and layering patterns for different types of perishable loads based on their fragility, weight, and transit route climate projections. Predictive analytics, leveraging historical data on spoilage rates related to packaging techniques, allows logistics providers to dynamically select the most suitable perforated film specification (e.g., hole size, film thickness, number of wraps) for maximum protection and preservation. This data-driven approach moves beyond standard operating procedures, offering customized packaging solutions that maximize product viability upon arrival, leading to substantial cost savings related to product loss and enhancing customer satisfaction.

- AI-driven optimization of perforation patterning and hole consistency during film extrusion manufacturing.

- Predictive maintenance analytics for high-speed automated wrapping machinery, reducing operational downtime in logistics centers.

- Integration of machine vision and AI for real-time quality control checks of film integrity and load stabilization after wrapping.

- Algorithmic determination of optimal film tension and wrapping cycles based on cargo type, environmental exposure, and transit duration.

- Demand forecasting and inventory management refinement for specialized film types using machine learning to predict seasonal consumption peaks.

- Development of AI models linking supply chain climate data (temperature, humidity) with specific film ventilation requirements to minimize condensation and spoilage.

DRO & Impact Forces Of Perforated Stretch Film Market

The Perforated Stretch Film Market is subject to a complex interplay of driving forces, inherent restraints, and emerging opportunities, all impacting its trajectory and growth potential. The fundamental driver remains the critical necessity for ventilation in palletized perishable goods, particularly within the expanding global cold chain network and the high-volume, quick-turnover sectors of fresh produce and horticulture. This demand is reinforced by increasing governmental regulations aimed at curbing food waste, compelling retailers and logistics firms to adopt superior preservation packaging like perforated stretch film. Furthermore, technological advancements in film manufacturing, resulting in stronger films with consistent aeration properties, enable their reliable use in highly automated environments, boosting operational throughput and efficiency for large-scale operations.

However, the market faces significant restraints, primarily centered around the cost differential when compared to standard, non-perforated stretch films. While the benefit of spoilage reduction often offsets this higher material cost, initial procurement budgets can be restrictive for smaller logistics companies or distributors in price-sensitive markets. Another major constraint is the persistent volatility in raw material prices, particularly petrochemical-derived resins like LLDPE, which directly impacts manufacturing costs and profit margins across the value chain. Additionally, the increasing global scrutiny and consumer backlash against single-use plastics present a long-term challenge, pushing manufacturers to rapidly invest in sustainable alternatives such as bio-based or highly recyclable polymers, which often have higher production costs and different processing characteristics.

Opportunities for market expansion are abundant, particularly through geographical penetration into nascent cold chain markets in Southeast Asia, Africa, and specific regions of Latin America where modern logistics infrastructure is rapidly developing. Product innovation also presents significant growth avenues, including the development of next-generation films that incorporate anti-microbial additives alongside perforations, offering dual-action protection against spoilage and pathogenic contamination. Furthermore, the burgeoning e-commerce sector for specialty food items and temperature-sensitive products creates unique logistical challenges that perforated films are perfectly positioned to solve, requiring tailored, high-performance breathable packaging solutions for direct-to-consumer delivery models. The successful navigation of environmental pressures by developing certified compostable or truly circular perforated films will unlock massive segments currently constrained by plastic reduction mandates.

Segmentation Analysis

The Perforated Stretch Film Market is segmented based on several critical factors including Material Type, Application Method, End-Use Industry, and Region, providing a detailed view of market dynamics and specialized demand areas. The choice of segmentation reflects the diverse requirements of end-users, where material properties like tear strength and stretch yield must be balanced against the specific perforation pattern needed for aeration. The segmentation by application method, specifically between manual and machine applications, is crucial for understanding technological adoption rates and investment levels in automated warehouse infrastructure across different global regions, directly influencing volume demand and film specifications.

Material segmentation, dominated by LLDPE, addresses the need for films that offer high elasticity and robust load containment necessary for high-volume palletization. However, the emerging segments of sustainable and bio-based materials represent future growth frontiers, driven by legislative pressures and corporate sustainability goals. End-use segmentation clearly highlights the dominance of the fresh produce sector due to the inherent requirement for prolonged post-harvest respiration, but the growth in chilled and frozen goods, pharmaceuticals, and floriculture segments demonstrates the versatility and expanding utility of breathable packaging solutions beyond traditional applications.

Analyzing these segments provides strategic insights for market participants, enabling them to tailor product development and marketing efforts. For instance, focusing on the automatic machine application segment necessitates investment in film quality control to ensure uniform thickness and consistent elasticity for high-speed wrapping, whereas targeting the floriculture segment might require films with specific UV stabilization properties alongside optimal ventilation. The detailed segmentation mapping allows for precise forecasting of localized demand shifts and adaptation to regional logistics standards and environmental mandates, optimizing resource allocation for manufacturing and distribution networks.

- By Material Type:

- Linear Low-Density Polyethylene (LLDPE)

- Low-Density Polyethylene (LDPE)

- Polypropylene (PP)

- Others (e.g., Bio-based and Recycled Polymers)

- By Application Method:

- Manual Application

- Machine Application

- Semi-Automatic

- Automatic High-Speed

- By End-Use Industry:

- Food and Beverages (Fresh Produce, Dairy, Bakery, Frozen Foods)

- Horticulture and Floriculture

- Pharmaceuticals and Healthcare

- Chemicals and Fertilizers

- Logistics and Warehouse Distribution

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Perforated Stretch Film Market

The value chain of the Perforated Stretch Film Market begins with the upstream procurement of specialized polymer resins, primarily LLDPE, which are derived from petrochemical sources. The efficiency and cost-effectiveness at this stage are heavily influenced by global oil and gas price volatility, creating a primary cost driver for manufacturers. Key resin suppliers focus on providing grades of polyethylene optimized for stretch and puncture resistance, which are crucial properties that must be retained even after the complex perforation process. Successful integration backward into resin production or establishing long-term, favorable contracts with leading polymer manufacturers provides a competitive advantage in mitigating input cost risks and ensuring a consistent supply of high-quality raw material necessary for advanced film properties.

The core manufacturing process involves film extrusion, followed by the actual perforation, which can be achieved through various techniques such as hot needle perforation, cold mechanical punching, or advanced laser perforation, with laser methods offering superior precision for specialized microporous films. This manufacturing stage requires high capital expenditure for advanced co-extrusion and perforation equipment, demanding high operational efficiency to maintain thin-gauge films with consistent hole placement. Distribution channels are varied: direct sales often target large-scale food processing plants, major retailers, and multinational logistics firms that require customized specifications, ensuring technical support and tailored solutions. Indirect distribution relies heavily on regional packaging distributors and wholesalers who service smaller businesses and diverse end-users across various industries, offering standardized product lines and managing local inventory.

Downstream analysis focuses on the end-users, primarily the logistics providers, warehousing operations, and final product manufacturers (e.g., food packers, horticultural producers). The effectiveness of the perforated film is ultimately judged by its performance on automated wrapping machines and its ability to maintain load integrity and product quality during transit. Feedback from these downstream users regarding performance metrics—such as stretch yield, load retention, and prevention of condensation—is crucial for manufacturers to refine their product offerings and ensure market relevance. The value chain concludes with waste management and recycling initiatives, as end-users are increasingly demanding take-back schemes or highly recyclable film structures to comply with growing circular economy requirements, thus integrating sustainability into the final stage of the material lifecycle.

Perforated Stretch Film Market Potential Customers

Potential customers for perforated stretch film are predominantly centered around industries dealing with temperature-sensitive, high-moisture, or perishable goods that necessitate critical ventilation during palletization and transportation. The largest segment of buyers includes major food processing and packaging companies, particularly those involved in fresh produce (fruits, vegetables, herbs), where managing respiration and preventing condensation buildup is non-negotiable for preserving quality and extending shelf life. These buyers require consistent film quality, high machine performance ratings, and often demand bulk volumes tailored to their specific wrapping machinery and load sizes. The reliance on just-in-time delivery models for retail distribution amplifies the need for reliable, breathable packaging that minimizes product damage during rapid transit cycles.

Beyond the fresh food sector, major logistics and third-party logistics (3PL) providers represent a significant customer base, especially those specializing in cold chain management for chilled and frozen commodities, including seafood, dairy, and specialized gourmet items. These 3PL firms purchase film on a contractual basis, prioritizing films that offer maximum load stability across diverse climatic zones and varied transport modalities (truck, rail, air). The ability of perforated film to manage thermal transfer within the pallet stack without compromising mechanical containment is a key purchasing criterion. Furthermore, pharmaceutical and healthcare companies, handling temperature-sensitive medications and biological samples, are increasingly adopting perforated solutions to maintain controlled environmental conditions and prevent moisture damage within climate-controlled shipping containers, requiring highly certified and trackable film products.

Other vital customer segments include the floriculture and horticulture industries, where delicate plants and cut flowers require constant airflow to prevent wilting and degradation during transit from growers to retail florists. Large agricultural cooperatives and chemical manufacturers, particularly those dealing with fertilizers or sensitive raw materials prone to off-gassing or heat buildup, also constitute important buyers, often requiring specialized, heavy-duty perforated films. The buying decision across all segments is a strategic balance between the slightly higher material cost of perforated film and the significant return on investment generated by drastically reduced product spoilage, enhanced brand reputation associated with high-quality deliveries, and regulatory compliance in food safety and temperature control.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 million |

| Market Forecast in 2033 | USD 1,350 million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Malpack, Samuel Grant Group, ITW Muller, Signode Industrial Group, Sigma Plastics Group, DUO PLAST, Pro-Pal, Film & Foil Solutions, Fabbri Group, RKW Group, Berry Global Inc., Amcor plc, Intertape Polymer Group (IPG), Integrated Packaging Group, Trioplast Industrier AB, Megaplast, Thong Guan Industries Berhad, Sealed Air Corporation, AEP Industries, Toray Plastics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Perforated Stretch Film Market Key Technology Landscape

The technology landscape of the Perforated Stretch Film Market is dominated by advancements in film extrusion and precision perforation techniques designed to enhance mechanical properties while ensuring optimal ventilation. Multilayer co-extrusion technology remains paramount, allowing manufacturers to combine different polymer layers, such as specialized tack layers for self-adhesion and robust core layers for load stability and puncture resistance. This technology is critical because it enables the creation of thinner gauge films that perform comparably to traditional thicker films, thus achieving source reduction targets and improving sustainability profiles without sacrificing the essential load containment force required for heavy pallet loads during dynamic transit conditions.

The actual perforation method is a crucial technological differentiator. Hot needle perforation, while traditional and cost-effective, is being challenged by more advanced techniques. Laser perforation technology represents a significant leap forward, offering unparalleled precision in hole size and spacing, enabling the creation of 'microporous' films with highly consistent ventilation rates that are necessary for exceptionally sensitive cargo like high-value pharmaceuticals or specific horticultural products. Furthermore, advancements in film formulation include the integration of high-performance metallocene catalysts in LLDPE, dramatically improving film tenacity and stretch characteristics, allowing the film to elongate further while maintaining its pre-perforated structural integrity, which is essential for maximizing yield on automatic wrapping equipment.

Beyond material fabrication, smart packaging integration is emerging as a key technological trend. This involves embedding indicators or RFID tags within the stretch film itself, allowing real-time monitoring of temperature or humidity fluctuations within the pallet. While still nascent, this technology leverages the surface area of the perforated film as a functional component of the intelligent supply chain. Continuous research focuses on developing bio-based polymers that can undergo the rigorous perforation process without tearing, alongside machinery designed for rapid changeovers between different perforation patterns, providing manufacturers with the necessary flexibility to serve diverse end-use applications across the global cold chain logistics network effectively and efficiently.

Regional Highlights

The global Perforated Stretch Film Market exhibits distinct regional dynamics driven by varying levels of cold chain infrastructure maturity, agricultural output, and regulatory frameworks concerning food preservation and plastic usage. North America and Europe currently represent the largest market share in terms of value, characterized by early adoption of automated packaging systems and stringent regulatory standards governing food safety and cold chain adherence. These regions prioritize high-performance, machine-grade perforated films capable of high-speed application and superior load containment, investing heavily in smart warehousing technologies that integrate advanced wrapping solutions. Demand here is strongly influenced by large-scale retailers and major international food exporters seeking zero-spoilage transit solutions.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market, primarily due to the massive expansion of organized retail, rapid urbanization, and significant government-backed initiatives to modernize agricultural logistics and cold storage capabilities, especially in populous nations like China and India. The immense agricultural base and the growing necessity to transport fresh produce over long domestic distances are driving substantial demand for both manual and semi-automatic application films. While price sensitivity is higher in parts of APAC, the increasing emphasis on export quality standards is rapidly accelerating the adoption of premium perforated film solutions, moving away from cheaper, non-ventilated alternatives.

Latin America and the Middle East and Africa (MEA) represent emerging markets where growth is linked to the development of new trade routes, increased foreign investment in food processing facilities, and the gradual modernization of logistics infrastructure. In Latin America, major agricultural exporters are driving demand for specific perforated films suitable for perishable exports to North America and Europe, requiring durable, climate-resistant packaging. In the MEA region, the need for effective ventilation is particularly acute due to extreme heat conditions, necessitating advanced films that prevent rapid temperature buildup within pallet stacks, ensuring that imported and locally distributed fresh goods maintain quality across varied transit temperatures.

- North America: Dominant market, characterized by high automation adoption, strict FDA and USDA compliance, and significant demand from large-scale food distribution centers and pharmaceutical logistics. Focus on high-gauge, high-retention perforated films.

- Europe: Mature market focused heavily on sustainability and circular economy mandates. Strong demand driven by cross-border perishable goods trade, leading to increased need for bio-based and recyclable perforated films. High standardization across the supply chain.

- Asia Pacific (APAC): Highest projected growth rate, fueled by cold chain infrastructure investment, expanding e-commerce for groceries, and large domestic and international agricultural output (China, India, Southeast Asia). Rapid shift from manual to semi-automatic wrapping.

- Latin America (LATAM): Growth driven by major agricultural export hubs (e.g., Brazil, Chile) needing optimized packaging for long-distance international shipping of fruits, vegetables, and flowers. Focus on cost-effective, yet reliable ventilation solutions.

- Middle East and Africa (MEA): Emerging market where demand is rising due to increased temperature sensitivity and humidity management requirements. Growth linked to food security initiatives and expanding logistics hubs in the UAE and Saudi Arabia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Perforated Stretch Film Market.- Malpack

- Samuel Grant Group

- ITW Muller

- Signode Industrial Group

- Sigma Plastics Group

- DUO PLAST

- Pro-Pal

- Film & Foil Solutions

- Fabbri Group

- RKW Group

- Berry Global Inc.

- Amcor plc

- Intertape Polymer Group (IPG)

- Integrated Packaging Group

- Trioplast Industrier AB

- Megaplast

- Thong Guan Industries Berhad

- Sealed Air Corporation

- AEP Industries

- Toray Plastics

Frequently Asked Questions

Analyze common user questions about the Perforated Stretch Film market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using perforated stretch film over standard film in logistics?

The primary benefit is effective ventilation, which allows heat, moisture, and respiration gases (like ethylene from produce) to escape the palletized load. This mechanism prevents condensation, minimizes mold and bacterial growth, and significantly extends the shelf life of perishable items, thus reducing product spoilage and associated financial losses during transit and storage.

In which industries is perforated stretch film most critically applied?

Perforated stretch film is most critically applied in the food and beverage industry, particularly for fresh produce (fruits, vegetables), dairy, and frozen goods, and within the horticulture sector for flowers and plants. It is also increasingly vital in pharmaceutical cold chain logistics for securing temperature-sensitive medications while allowing controlled air circulation.

How does the material composition of perforated film impact its performance on automated wrapping machines?

High-performance perforated films are typically made from LLDPE blends, often incorporating metallocene technology, which provides superior tear resistance and high stretch yield. This robust composition ensures the film maintains its integrity despite the perforations, preventing costly breakage or jamming on high-speed automated wrapping equipment, optimizing operational efficiency.

Are sustainable options available in the perforated stretch film market?

Yes, sustainability is a key development area. Manufacturers are rapidly introducing options based on post-consumer recycled (PCR) content, bio-based polymers (derived from renewable resources like sugarcane), and thin-gauge solutions designed for source reduction, helping end-users meet their corporate environmental commitments and comply with plastic reduction regulations.

What technological advancements are driving precision in perforated film manufacturing?

Laser perforation technology is the primary driver of precision, allowing for highly consistent and minute hole sizing (microporous films) essential for specialized applications. Additionally, multilayer co-extrusion technology enables the creation of complex films that balance high mechanical strength for load stability with optimal breathability, crucial for effective cold chain management.

How do varying perforation patterns affect different types of pallet loads?

Varying perforation patterns, including hole density and size, are tailored based on the cargo's respiration rate and fragility. For highly sensitive produce, a microporous pattern may be used for controlled airflow, while heavier, less sensitive loads might utilize larger, less dense perforations to release bulk heat rapidly. Proper pattern selection is key to moisture control and temperature equalization within the pallet.

What role does the cold chain expansion play in the market growth?

The massive expansion of the global cold chain, especially in emerging economies, is a central market driver. As refrigerated and frozen goods travel longer distances and across diverse climates, the requirement for packaging that actively manages condensation and temperature spikes increases. Perforated film is essential for minimizing thermal shock and ensuring product quality throughout the extended cold supply chain.

What is the distinction between manual and machine applied perforated film?

Manual application film is typically lower gauge and designed for lower-volume use or irregular pallet shapes, applied using handheld dispensers. Machine applied film is high-gauge, designed for maximum stretch and high tension on automatic or semi-automatic wrappers, prioritizing speed, consistency, and superior load retention for industrial-scale operations.

How do raw material price fluctuations impact the profitability of perforated stretch film manufacturers?

Raw material price fluctuations, particularly in crude oil and LLDPE resin markets, directly affect the cost of goods sold, often leading to compressed profit margins for manufacturers. Companies mitigate this by securing long-term supply agreements and optimizing manufacturing processes to achieve significant gauge reduction without compromising film performance.

Why is load stabilization still a critical factor despite the perforations in the film?

Load stabilization remains critical because the primary role of stretch film is to contain and secure the palletized cargo against movement, vibration, and shifting during transport. Advanced perforated films are engineered to maintain high levels of puncture and tear resistance, ensuring that adequate containment force is applied to the load, effectively balancing ventilation needs with mechanical security.

What regulations in Europe specifically influence the demand for sustainable perforated films?

The European Union’s Packaging and Packaging Waste Directive, along with national mandates aiming for high rates of plastic recycling and reduction, heavily influence demand. This regulatory environment pushes manufacturers to develop perforated films that are mono-material for easier recycling or are certified compostable or biodegradable, fulfilling circular economy requirements.

How does AI contribute to improving the quality control of perforated film during production?

AI utilizes machine vision systems and deep learning algorithms to continuously monitor the film during extrusion, detecting real-time inconsistencies in film thickness, hole size, and perforation distribution. This proactive quality control minimizes material defects, ensures uniform ventilation performance, and significantly reduces the amount of wasted material rejected downstream.

What are the challenges of introducing perforated film in emerging markets like Africa?

Challenges include the high initial cost relative to standard films, fragmented logistics infrastructure, and lower levels of automation adoption, which limits the use of high-speed machine film. However, the critical need for spoilage reduction due to high ambient temperatures is accelerating gradual adoption, particularly through manual application films and government-supported cold chain initiatives.

Is perforated film suitable for wrapping frozen goods, and if so, what are the specifications?

Yes, perforated film is highly suitable for frozen goods. It prevents the accumulation of frost and moisture (sweating) on the packaging surface when the goods transition between different temperature zones (e.g., from freezer to staging area). Films designed for frozen applications must maintain elasticity and strength at extremely low temperatures without becoming brittle, often requiring specialized LLDPE formulations.

How do manufacturers ensure consistency in the film’s mechanical properties after perforation?

Consistency is maintained through stringent process controls during the manufacturing phase, particularly by optimizing the heat application or mechanical tension during the perforation stage. High-precision laser systems ensure minimal thermal damage or structural weakening around the hole edges. Post-process testing for ultimate stretch, retention force, and puncture resistance validates that the necessary mechanical integrity is retained.

What is the typical difference in cost between perforated and standard stretch film?

Perforated stretch film typically carries a 10% to 30% higher cost per roll compared to standard stretch film due to the complexity of the manufacturing process, specialized perforation technology, and often the use of higher-grade polymer resins to compensate for the reduction in material integrity caused by the holes. This premium is justified by the savings achieved in product loss mitigation.

How is the market addressing the increasing demand for thinner gauge films?

The market is addressing this demand through the use of high-performance resins (like metallocene LLDPE) and advanced co-extrusion technology. These technological innovations allow for the creation of multi-layered, thin-gauge films (down to 15 microns or less) that achieve the same load containment force and stretch ratio as much thicker traditional films, reducing material usage and shipping weight.

In what way does perforated film assist in handling products prone to off-gassing?

Products that off-gas, such as certain fruits that release ethylene (a ripening hormone), require perforated film to allow these gases to escape the confined pallet environment. Without ventilation, the concentration of ethylene would accelerate spoilage and ripening. The perforations facilitate gas exchange, stabilizing the environment within the wrapped load.

What is the competitive landscape like for key players in this specialized market segment?

The competitive landscape is moderately consolidated, dominated by large global packaging corporations that leverage extensive distribution networks and R&D capabilities to offer specialized high-tech perforated films. Competition is primarily based on film performance (strength, stretch, consistency), customization capabilities (perforation size), and adherence to sustainability certifications, rather than solely on price.

How do end-users measure the effectiveness of perforated stretch film performance?

End-users measure effectiveness primarily through reduced product spoilage rates upon arrival, minimized condensation visible inside the wrapping, the film’s ability to maintain optimal load containment force (measured via monitoring systems), and the stretch yield (footage used per pallet), which relates directly to cost efficiency on automated lines.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager