Performance Bank Guarantee Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433000 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Performance Bank Guarantee Market Size

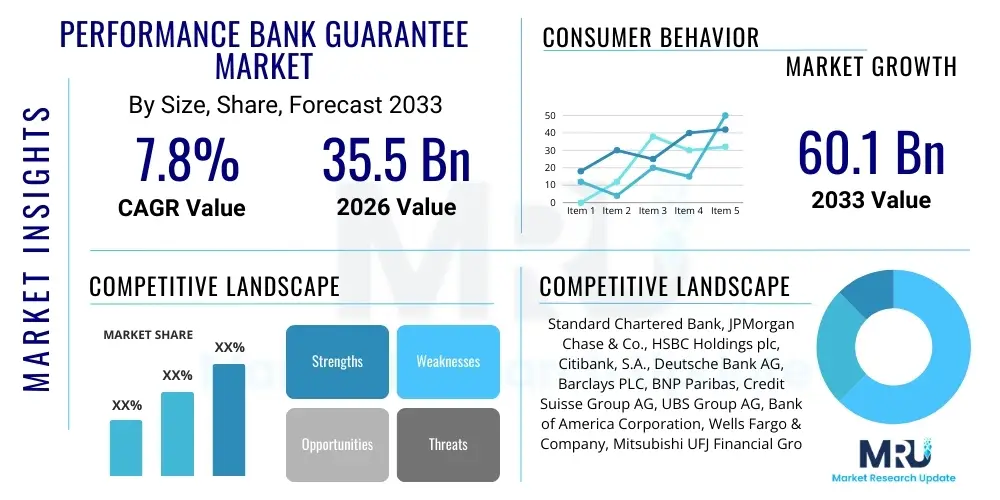

The Performance Bank Guarantee Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 35.5 Billion in 2026 and is projected to reach USD 60.1 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the global surge in infrastructure development projects, increased international trade activities, and the essential requirement for reliable risk mitigation tools in large-scale commercial contracts. The demand profile is highly correlated with capital expenditure cycles in the construction, energy, and telecommunications sectors, where performance assurance is a contractual necessity.

The calculation of market size encompasses the aggregate face value of guarantees issued and the associated fee income generated by issuing banks worldwide. While the face value provides a macro indicator of project volume being undertaken, the fee income represents the direct revenue stream for financial institutions. Growth acceleration is particularly noticeable in emerging economies that are undergoing rapid urbanization and industrialization, necessitating complex contractual frameworks backed by robust financial instruments like Performance Bank Guarantees (PBGs). Regulatory stability and the adoption of standardized international practices, such as the Uniform Rules for Demand Guarantees (URDG), further enhance the market’s reliability and subsequent growth.

Performance Bank Guarantee Market introduction

The Performance Bank Guarantee (PBG) Market involves the provision of a financial assurance instrument by a bank to a beneficiary (often a project owner or buyer) on behalf of an applicant (usually a contractor or seller). This guarantee ensures that if the applicant fails to fulfill their contractual obligations—such as timely delivery, project completion, or adherence to specified quality standards—the bank will compensate the beneficiary up to a stipulated maximum amount. PBGs are non-funded credit facilities, acting as crucial risk transfer mechanisms essential for fostering trust and ensuring accountability in complex commercial transactions, particularly in sectors requiring high capital outlay and long execution cycles, such as construction, engineering, and manufacturing.

Major applications of PBGs span across public and private sector procurement, particularly in large infrastructure projects, cross-border supply chains, and procurement of sophisticated machinery or services. Key benefits derived from utilizing PBGs include enhanced counterparty risk mitigation, facilitated access to high-value contracts requiring financial security, and reduced collateral requirements compared to conventional letters of credit in specific scenarios. Driving factors propelling market expansion include favorable governmental regulations supporting infrastructure investment, global economic recovery leading to increased private sector capital expenditure, and the continuous necessity for structured payment assurance systems to underpin global commerce and safeguard stakeholders against performance default.

The instrument’s operational mechanism typically requires the bank to verify the applicant's creditworthiness and the nature of the underlying contract, thereby introducing a third-party assurance layer that significantly stabilizes contractual relationships. The market’s dynamism is increasingly influenced by geopolitical stability, trade tariffs, and the underlying commodity price environment, which directly impact the volume and value of projects requiring performance assurances. The evolution towards digital PBGs utilizing blockchain technology is beginning to redefine issuance speed and verification integrity, contributing significantly to future market growth trends.

Performance Bank Guarantee Market Executive Summary

The global Performance Bank Guarantee (PBG) Market is entering a robust growth phase, propelled by significant business trends focusing on sustainable infrastructure and digital trade facilitation. Business trends indicate a shift towards standardized documentation and higher volumes of electronically issued guarantees, reducing processing times and operational costs for major financial institutions. Regional trends show rapid acceleration in Asia Pacific, driven by Belt and Road Initiative projects and massive domestic infrastructure programs in India and Southeast Asian nations. While mature markets like North America and Europe maintain stable demand rooted in highly regulated construction and energy sectors, they are leading the adoption curve for sophisticated digital guarantee platforms and smart contract integration, enhancing transparency and mitigating fraud risks.

Segments trends reveal that the Construction & Infrastructure segment remains the largest end-user due to the inherently high performance risk associated with long-term projects. However, the Technology & Telecommunications segment is experiencing the fastest proportional growth, reflecting the need for performance security in large-scale 5G deployment contracts and complex IT outsourcing agreements. The market is also witnessing segment diversification based on the type of guarantee structure, with conditional guarantees requiring detailed scrutiny showing moderate growth, while unconditional (demand) guarantees maintain high popularity due to their speed and simplicity, despite presenting higher risk to the issuing bank.

Overall, the market landscape is characterized by competitive innovation, where leading banks leverage technological advancements, particularly AI-driven underwriting and risk assessment models, to optimize capital allocation and pricing structures for guarantee services. The regulatory environment, particularly concerning Basel III requirements for non-funded credit lines, dictates the capital efficiency strategies of major banking players. Strategic partnerships between fintech providers and traditional banks are becoming pivotal in scaling digital transformation efforts and penetrating SME segments seeking accessible and efficient PBG solutions.

AI Impact Analysis on Performance Bank Guarantee Market

Common user questions regarding AI's impact on the Performance Bank Guarantee Market center heavily on efficiency gains, fraud detection capabilities, and the potential for automated underwriting. Users frequently inquire about whether AI can accurately assess performance risk in complex, bespoke contracts where historical data might be limited, and how regulatory compliance (KYC/AML) will be integrated into automated processes. There is significant interest in AI's role in standardizing guarantee language across jurisdictions and its capacity to manage the inherent volatility of underlying contract performance metrics. The prevailing expectation is that AI will drastically reduce manual processing, improve risk-weighted asset (RWA) calculations, and enable financial institutions to offer faster, more competitive PBG pricing while simultaneously enhancing the integrity of guarantee lifecycle management, from issuance to cancellation, thereby transforming the core operational framework.

- AI-powered risk underwriting reduces manual review time by analyzing contractual terms, counterparty credit histories, and sectoral economic indicators, leading to faster approval processes.

- Enhanced fraud detection capabilities utilize machine learning models to identify anomalies in guarantee applications, beneficiary claims, and documentation patterns, minimizing bank exposure.

- Predictive analytics forecasts the probability of default or claim activation based on project status updates and macroeconomic shifts, allowing banks to proactively manage portfolio risk.

- Natural Language Processing (NLP) standardizes the interpretation of complex, often ambiguous, legal texts within the underlying contracts and the guarantees themselves.

- Automation of compliance checks (KYC, AML, sanctions screening) streamlines the application workflow, ensuring adherence to global financial regulations with higher consistency.

- AI facilitates dynamic pricing models, optimizing fee structures based on real-time risk assessments, credit ratings, and capital efficiency requirements.

- Implementation of smart contracts, guided by AI, prepares the ground for self-executing guarantees upon verifiable breach events, improving speed and transparency in the claims process.

DRO & Impact Forces Of Performance Bank Guarantee Market

The Performance Bank Guarantee (PBG) Market is shaped by a confluence of accelerating drivers, stringent restraints, and evolving opportunities, all contributing to significant impact forces across the industry structure. Key drivers include the accelerated global trend toward privatization of public utilities and infrastructure assets, mandatory requirements for performance security in almost all high-value contracts, and the increasing complexity of cross-border trade demanding robust risk assurance instruments. Conversely, the market faces significant restraints, notably the regulatory capital requirements (Basel III) mandating banks to hold capital against contingent liabilities, which increases the cost of issuance. Additionally, the inherent manual nature of guarantee verification and the global prevalence of documentary fraud pose persistent operational and financial challenges.

Opportunities for growth are abundant, particularly through technological innovation, such as the digitization of guarantee issuance via enterprise blockchain solutions, which promises immediate issuance and enhanced security. Furthermore, penetration into high-growth segments like renewable energy projects, requiring long-term performance assurances, presents a substantial avenue for market expansion. The impact forces are currently pushing the market toward greater efficiency and standardization. The bargaining power of beneficiaries remains high, particularly in sectors where non-performance leads to catastrophic financial losses, compelling applicants to seek highly reputable banks. The competitive intensity among banks is increasing, forcing them to differentiate services through technological speed and tailored risk pricing.

The collective effect of these forces results in a market environment prioritizing operational resilience and capital efficiency. Banks are incentivized to invest heavily in digital platforms to process higher volumes of guarantees without commensurately increasing operational headcount, thereby mitigating the restraint imposed by high capital costs. The ability to quickly and accurately assess bespoke contractual risks remains a key differentiator, where deep industry expertise complements technological sophistication, allowing leading institutions to capture premium market share in complex project finance guarantees.

Segmentation Analysis

The Performance Bank Guarantee Market is segmented primarily based on the Type of Guarantee, the Application/End-User Sector, and the Geographical Region. Analyzing these segments provides critical insights into market demand elasticity, sectoral risk profiles, and regional growth trajectories. Segmentation by type differentiates between Conditional Guarantees, which require detailed investigation and proof of default before payment, and Unconditional Guarantees (Demand Guarantees), which require payment solely upon the beneficiary's written demand, making them faster but inherently riskier for the issuer. End-user segmentation highlights the sectors driving demand, ranging from heavy infrastructure to intricate service agreements. This detailed analysis assists financial institutions in tailoring their guarantee products, aligning risk management practices with specific sectoral exposures, and optimizing resource allocation for underwriting and claim processing.

- By Type of Guarantee:

- Conditional Guarantees

- Unconditional (Demand) Guarantees

- By Application/End-User Sector:

- Construction and Infrastructure

- Energy and Power (Oil & Gas, Renewables)

- Manufacturing and Industrial

- Trade and Commerce (Supply Chain)

- Technology and Telecommunications

- Public Sector and Government Procurement

- By Value Threshold:

- Small-Value Guarantees (Below USD 1 Million)

- Medium-Value Guarantees (USD 1 Million to USD 10 Million)

- Large-Value Guarantees (Above USD 10 Million)

- By Issuer Type:

- Commercial Banks

- Specialized Financial Institutions

- Development Banks

Value Chain Analysis For Performance Bank Guarantee Market

The value chain of the Performance Bank Guarantee market initiates with upstream activities involving liquidity and capital provision, moving through the core processing steps, and culminating in downstream distribution and servicing. Upstream analysis focuses on the regulatory capital markets and interbank liquidity, as these factors determine the capacity and cost structure for banks offering non-funded credit facilities. Key upstream challenges include optimizing regulatory capital allocation against contingent liabilities, necessitating sophisticated internal risk models to comply with Basel III frameworks. The sourcing of reliable data for counterparty assessment, utilizing credit rating agencies and sector-specific analysts, is also a critical upstream input.

The core processing segment includes the application submission, due diligence (KYC/AML), technical underwriting, pricing, issuance, and maintenance of the guarantee lifecycle. This segment is increasingly focused on digitization, utilizing API integration with corporate treasury systems and specialized trade finance platforms to accelerate processing. Downstream activities involve the distribution channel—whether direct through major corporate banking relationships or indirect via specialized brokers and correspondent banking networks, particularly for cross-border guarantees. Effective distribution requires a global network of trusted correspondent banks to ensure the guarantees are recognized and accepted in foreign jurisdictions, a process often streamlined by adherence to URDG 758 standards.

The shift toward digital distribution channels is significantly altering the value proposition, providing applicants with real-time tracking and faster amendments. Direct interaction with large multinational corporations allows major banks to tailor complex performance instruments. However, indirect channels remain vital for servicing SMEs and facilitating guarantees in regions where the issuing bank lacks a physical presence. Optimizing this value chain through technology reduces the transaction cost and the risk of error, ultimately enhancing the competitive edge for institutions that can manage the end-to-end process efficiently and securely.

Performance Bank Guarantee Market Potential Customers

Potential customers for Performance Bank Guarantees (PBGs) primarily comprise entities engaged in high-value, long-duration contractual commitments where non-performance poses significant financial risk to the project owner or buyer. The key end-users are contractors, manufacturers, suppliers, and service providers who need to provide security deposits or assurances to secure major contracts. These customers typically operate in capital-intensive industries such as civil engineering firms undertaking public infrastructure projects (roads, bridges, ports), energy companies developing power plants (conventional and renewable), and large-scale manufacturing enterprises fulfilling bulk supply orders for critical equipment.

Beyond traditional heavy industries, the customer base is expanding to include high-growth sectors such as technology integrators managing complex IT infrastructure deployment projects and telecommunication providers securing contracts for network build-out, where penalties for delay are severe. Furthermore, government bodies and public sector organizations, both as applicants (when guaranteeing their own performance) and beneficiaries, are significant consumers of PBG services. The demand profile is segmented based on credit rating and project scale; large multinational corporations require substantial guarantees backed by global banks, while SMEs often utilize specialized local banks or government-backed schemes.

The need for PBGs is intrinsically linked to procurement cycles. Any buyer (beneficiary) requiring absolute assurance that goods or services will be delivered according to specifications, timeline, and quality benchmarks will mandate a PBG. This makes large procurement departments, project finance institutions, and investment funds managing asset portfolios across various sectors—from real estate development to large-scale commodity trade—the ultimate drivers of demand for reliable performance assurance mechanisms provided by the banking sector.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 60.1 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Standard Chartered Bank, JPMorgan Chase & Co., HSBC Holdings plc, Citibank, S.A., Deutsche Bank AG, Barclays PLC, BNP Paribas, Credit Suisse Group AG, UBS Group AG, Bank of America Corporation, Wells Fargo & Company, Mitsubishi UFJ Financial Group (MUFG), Industrial and Commercial Bank of China (ICBC), Agricultural Bank of China (ABC), China Construction Bank (CCB), ICICI Bank, State Bank of India (SBI), Qatar National Bank (QNB), Riyad Bank, Saudi National Bank (SNB) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Performance Bank Guarantee Market Key Technology Landscape

The Performance Bank Guarantee market is undergoing a fundamental technological shift driven by the need for enhanced security, speed, and standardization. The primary technology enabling this transformation is Distributed Ledger Technology (DLT), specifically blockchain, which offers an immutable record of issuance, amendments, and claims, drastically reducing the possibility of fraud and improving transparency for all parties involved. Banks are actively participating in global consortia and utilizing private blockchain platforms to create secure ecosystems for digital guarantees, ensuring seamless acceptance across correspondent banking networks. This digital transition is vital for mitigating the current reliance on paper documentation and cumbersome manual verification processes inherent in traditional guarantee issuance.

Furthermore, Application Programming Interfaces (APIs) are crucial components of the modern PBG technology stack. APIs enable deep integration between a bank’s trade finance systems and its corporate clients’ Enterprise Resource Planning (ERP) or treasury management systems. This integration allows for automated application submission, real-time status tracking, and faster reconciliation, significantly improving the client experience and reducing the processing cycle time from days to hours. The adoption of cloud-based platforms is also accelerating, providing scalability and flexibility, allowing banks to manage high-volume transactional flows efficiently without requiring massive upfront investment in proprietary infrastructure.

The confluence of AI/Machine Learning for risk underwriting and blockchain for secure record-keeping defines the cutting edge of the PBG technology landscape. These technologies are supported by robust cybersecurity frameworks, given the high financial value and sensitive nature of the underlying contracts. Standardized messaging protocols, particularly those conforming to ISO 20022, are facilitating better interoperability across different financial institutions and regional platforms, streamlining cross-border transactions and reinforcing the move toward a fully digital, globally interconnected guarantee market.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by unparalleled levels of government investment in infrastructure (roads, rail, renewable energy), particularly in China, India, and ASEAN countries. The region benefits from large-scale connectivity projects, such as the Belt and Road Initiative, which necessitate complex, multi-jurisdictional PBGs. The market is highly competitive, with local banks increasingly digitizing their trade finance offerings to compete with global institutions.

- North America: This region represents a mature and highly regulated market, characterized by large-scale, high-value guarantees, particularly in the energy, heavy construction, and defense sectors. Growth is stable, focusing on renewal energy projects and sophisticated project financing. North American banks are leading the implementation of digital guarantees and using advanced analytics for risk-weighted capital optimization, driving efficiency rather than volume growth.

- Europe: The European market demonstrates steady growth, influenced by stringent regulatory requirements (e.g., EU directives on public procurement) and strong demand from the manufacturing and aerospace industries. The focus is on standardization and cross-border harmonization. Platforms dedicated to electronic bank guarantees (e-BG) are gaining traction, aiming to streamline transactions across the Eurozone and comply with evolving sustainable finance regulations.

- Middle East and Africa (MEA): Growth in the MEA region is strongly linked to large governmental energy and diversification projects (e.g., NEOM in Saudi Arabia, major oil and gas expansions). PBGs are critical instruments in the region's project finance landscape. While the market offers high-risk, high-reward opportunities, the adoption of digital technologies is rapid, supported by large financial hubs in the GCC focused on modernizing trade finance infrastructure.

- Latin America: The market faces regulatory fragmentation and economic volatility across various countries, making PBG issuance complex. Demand is primarily driven by mining, oil exploration, and governmental infrastructure tenders. Key opportunities arise from regional trade agreements and stability initiatives, promoting the use of guarantees to stabilize long-term capital projects and mitigate political risk exposure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Performance Bank Guarantee Market.- Standard Chartered Bank

- JPMorgan Chase & Co.

- HSBC Holdings plc

- Citibank, S.A.

- Deutsche Bank AG

- Barclays PLC

- BNP Paribas

- Credit Suisse Group AG (Acquired by UBS Group AG)

- UBS Group AG

- Bank of America Corporation

- Wells Fargo & Company

- Mitsubishi UFJ Financial Group (MUFG)

- Industrial and Commercial Bank of China (ICBC)

- Agricultural Bank of China (ABC)

- China Construction Bank (CCB)

- ICICI Bank

- State Bank of India (SBI)

- Qatar National Bank (QNB)

- Riyad Bank

- Saudi National Bank (SNB)

Frequently Asked Questions

Analyze common user questions about the Performance Bank Guarantee market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between a Performance Bank Guarantee (PBG) and a Letter of Credit (LC)?

A Performance Bank Guarantee assures the beneficiary against non-performance of contractual duties by the applicant (e.g., project delay or quality failure). Conversely, a Letter of Credit assures payment for goods or services rendered, contingent upon the presentation of specific shipping and documentation criteria, fundamentally focusing on payment risk, not performance risk.

How does blockchain technology enhance the security and efficiency of Performance Bank Guarantees?

Blockchain provides an immutable, decentralized ledger for issuing and managing guarantees, eliminating reliance on paper documents susceptible to fraud. It enables faster verification, automated claim processing via smart contracts, and ensures all parties have a single, verifiable source of truth regarding the guarantee status, significantly reducing processing time and operational risk.

What role do international standards like URDG 758 play in the global PBG market?

URDG 758 (Uniform Rules for Demand Guarantees, ICC Publication No. 758) provides a globally accepted set of rules governing demand guarantees. Its adoption ensures contractual consistency, reduces disputes, and facilitates acceptance of guarantees across different jurisdictions and correspondent banks, thus streamlining complex cross-border trade and infrastructure projects.

Which sectors are the primary demand drivers for Performance Bank Guarantees in emerging markets?

In emerging markets, the primary demand drivers are large-scale public and private sector projects within the Construction and Infrastructure sector (e.g., transportation networks, real estate development) and the Energy & Power sector, particularly oil and gas expansion and the rapidly growing renewable energy segment, all requiring robust performance security.

What major regulatory factors restrain the growth of the Performance Bank Guarantee market?

The primary restraint is the regulatory capital requirement, particularly imposed by Basel III frameworks, which dictates that banks must allocate significant capital against contingent liabilities, making PBGs a capital-intensive service. This regulatory burden increases the cost of issuance and limits the volume of guarantees a bank can comfortably issue.

The Performance Bank Guarantee Market is experiencing a paradigm shift influenced heavily by regulatory pressures and technological innovation, demanding that financial institutions adopt sophisticated digital platforms to maintain competitiveness. The integration of risk assessment models derived from AI and the deployment of standardized, blockchain-enabled solutions are becoming prerequisites for operating efficiently within the global trade finance ecosystem. Market participants must continuously evaluate their compliance frameworks against evolving international trade norms and regional capital adequacy regulations, ensuring their guarantee portfolios are optimized for both profitability and systemic resilience. The long-term growth trajectory remains positive, underscored by the fundamental need for performance assurance in a global economy characterized by increasingly complex and capital-intensive contractual commitments.

In the context of evolving geopolitical dynamics, the market must also account for heightened country risk and counterparty risk in cross-border transactions, often requiring more structured and politically sensitive guarantees. Financial institutions specializing in specific geographic corridors or high-risk sectors are capitalizing on their expertise to price risks accurately, distinguishing themselves from universal banks operating on standardized pricing models. This specialization further drives segmentation within the PBG market, allowing for tailored risk mitigation solutions that address niche requirements, such as political force majeure or sovereign default risk related to government procurement contracts. The continued diversification of guarantee types, moving beyond pure performance assurances to include warranty, maintenance, and advance payment guarantees, also broadens the market scope and applicability across the full spectrum of project lifecycles.

Moreover, the environmental, social, and governance (ESG) factors are beginning to influence PBG issuance, particularly in the construction and energy sectors. Banks are increasingly scrutinizing the underlying contracts to assess adherence to sustainability benchmarks, and in some cases, linking guarantee fees or availability to the applicant’s ESG performance score. This emerging trend signals a shift toward responsible banking and sustainable trade finance, adding another layer of complexity to the underwriting process but also creating new market opportunities for 'green guarantees' that facilitate sustainable development projects globally. This evolution ensures that the PBG market remains aligned with broader global economic and environmental objectives.

The competitive landscape remains dominated by large multinational banks with extensive correspondent networks, which possess the necessary capital buffers and global reach to underwrite major international projects. However, regional and specialized banks are gaining ground by focusing on localized market knowledge and rapid digital service delivery, particularly targeting small-to-medium enterprises (SMEs) that struggle with the high collateral requirements and slow processing times of global institutions. The future competitive dynamics will likely revolve around the speed of digital issuance and the effectiveness of integrated risk data platforms, favoring those institutions that successfully marry robust underwriting discipline with seamless client-facing technology. Collaborations between traditional banks and specialized fintech companies focused solely on trade finance digitalization are also reshaping the competitive structure, creating hybrid models that leverage the financial strength of banks and the agility of technology firms.

The operational resilience of the PBG market is also critical, particularly concerning disaster recovery and business continuity planning. Given the instrument’s role in safeguarding crucial infrastructure projects, the capacity of issuing banks to manage claims and amendments reliably, even during periods of systemic disruption (e.g., pandemics, major cyber incidents), is paramount. This necessitates significant investment in redundant IT infrastructure and highly secured data storage solutions. Furthermore, the legal and regulatory clarity regarding the validity and enforceability of digital, cross-border guarantees requires ongoing harmonization efforts by bodies like the International Chamber of Commerce (ICC) to fully realize the benefits of technological adoption and ensure uniform legal recognition globally.

The structural transformation of the global economy, moving toward greater reliance on complex global supply chains and outsourced manufacturing, guarantees the sustained relevance of PBGs. Whether it is ensuring the quality of components provided by an overseas supplier or guaranteeing the timely execution of a sophisticated IT service contract, the need for a robust, third-party assurance mechanism remains fundamental. This sustained demand, coupled with the ongoing technological advancements that promise to make the instrument more accessible and efficient, positions the Performance Bank Guarantee Market for consistent and substantial growth throughout the forecast period. Strategic planning by market participants must prioritize digital integration and deep sectoral expertise to capture the highest growth potential.

The detailed segmentation analysis reveals that the largest-value guarantees typically fall within the Energy and Infrastructure segments, reflecting the immense capital requirements and potential liability associated with these projects. For instance, guarantees related to offshore wind farm construction or large oil pipeline projects often run into hundreds of millions of dollars, necessitating participation from syndicated banking groups to distribute risk effectively. In contrast, guarantees issued for manufacturing or small trade contracts, while individually smaller, contribute significantly to the overall volume of transactions processed, driving the need for automated, high-throughput processing systems. Understanding these volume versus value dynamics is crucial for banks setting their capital planning and risk exposure limits.

Geographical expansion remains a key strategic lever. While established markets offer stable fee income, the highest growth rates are projected in regions like Southeast Asia and Sub-Saharan Africa, where rapid infrastructure rollout is being financed by international development funds and private equity. Banks entering these regions must navigate complex local legal systems and often require local partnerships to underwrite political and regulatory risks effectively. The issuance of guarantees backed by multilateral development banks (MDBs) is a common strategy in these environments, providing an additional layer of credit enhancement and risk mitigation that encourages private sector participation. This focus on blended finance and risk-sharing models is increasingly central to market development in frontier economies.

The competitive differentiation among major players is increasingly moving beyond pricing to encompass service delivery and specialized risk knowledge. Banks that can offer integrated trade finance suites—combining PBGs with letters of credit, supply chain finance, and factoring services—provide comprehensive solutions that lock in corporate clients. Furthermore, tailored advisory services regarding contractual risk structure and guarantee wording are becoming highly valued, especially for bespoke project finance deals. This consultative approach elevates the relationship between the bank and the corporate client, transforming the PBG from a simple commodity instrument into a strategic financial partnership tool, thereby enhancing customer retention and yielding higher-margin business.

The inherent risk management challenges posed by PBGs, especially unconditional demand guarantees, necessitate exceptionally robust internal control frameworks. Banks must have clear, defensible procedures for investigating claims and managing counterparty default scenarios. The shift to digital guarantees, while offering speed, also increases reliance on the security and integrity of the digital platform, requiring continuous investment in cyber defense and verification protocols to prevent digital impersonation or manipulation of guarantee terms. Regulatory oversight bodies are focusing intensely on banks' digital resilience and their ability to ensure continuous, secure transaction processing, further highlighting the criticality of technology in the current market environment.

Finally, the market's trajectory is inextricably linked to global macroeconomic stability. Economic downturns or prolonged periods of high interest rates typically increase the likelihood of contractor defaults, leading to a surge in PBG claims. Conversely, periods of robust economic growth spur large-scale project initiation, driving up the volume and value of guarantees issued. Market participants must therefore adopt cyclical forecasting models to anticipate demand fluctuations and adjust their liquidity and capital reserves accordingly. The ability to dynamically hedge currency risks associated with cross-border guarantees further enhances a bank's resilience and competitive standing in the volatile global marketplace, ensuring sustainable growth across various economic cycles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager