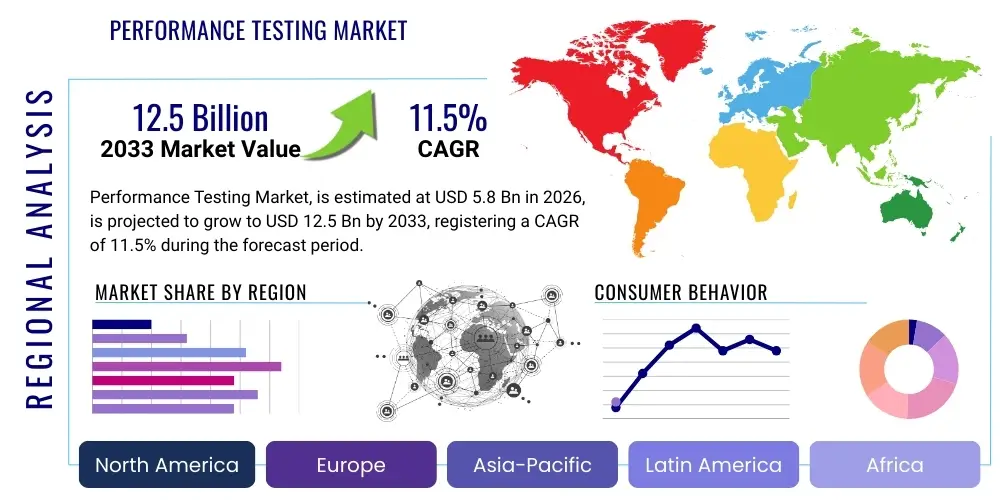

Performance Testing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436834 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Performance Testing Market Size

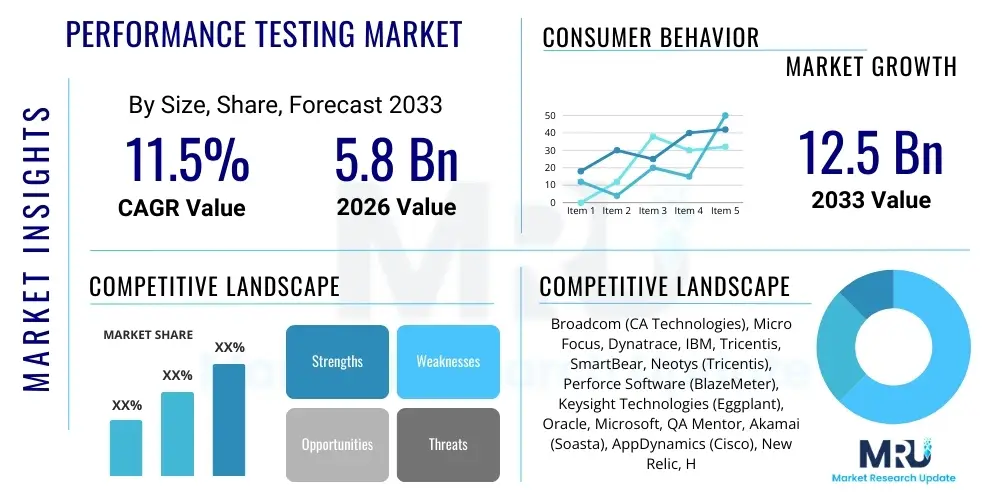

The Performance Testing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $5.8 Billion in 2026 and is projected to reach $12.5 Billion by the end of the forecast period in 2033.

Performance Testing Market introduction

The Performance Testing Market encompasses software quality assurance activities dedicated to determining the speed, responsiveness, scalability, stability, and resource usage of an application, system, or infrastructure. This field has witnessed substantial expansion driven by the global acceleration of digital transformation initiatives across virtually all industry verticals. Modern software architectures, characterized by distributed microservices, reliance on cloud-native technologies, and the necessity for continuous integration/continuous deployment (CI/CD) pipelines, mandate rigorous performance validation to ensure optimal user experience (UX) and business continuity. Key product offerings include advanced load testing tools, application performance monitoring (APM) solutions, and specialized performance engineering services that help organizations preemptively identify bottlenecks and system degradation under expected and extreme loads.

Major applications of performance testing span critical sectors such as banking and financial services (handling peak transaction volumes), e-commerce (managing holiday sales spikes), and telecommunications (ensuring low latency for 5G and IoT applications). The core benefit derived from robust performance testing is the mitigation of risks associated with system failures, which can lead to significant financial losses, reputational damage, and customer churn. Furthermore, performance optimization translates directly into improved infrastructure efficiency, reducing operational costs associated with over-provisioning hardware or cloud resources. The increased reliance on globally accessible, always-on digital services makes sustained high performance a non-negotiable requirement for market competitiveness.

Driving factors propelling this market include the pervasive adoption of DevOps methodologies, which integrate testing earlier and continuously throughout the software development lifecycle (Shift-Left testing). The proliferation of mobile applications and the accompanying demand for instant responsiveness are also significant contributors. Moreover, the complexity introduced by hybrid cloud environments and the integration of third-party APIs necessitates comprehensive testing strategies that simulate real-world traffic scenarios accurately. Regulatory compliance requirements in heavily regulated industries, such as healthcare and finance, often mandate proof of system resilience and stability, further solidifying the indispensable role of dedicated performance testing solutions and services.

Performance Testing Market Executive Summary

The global Performance Testing Market is experiencing robust growth fueled by mandatory digital resilience requirements and the widespread transition to Agile and DevOps frameworks. Business trends indicate a strong movement toward specialized performance engineering services that integrate advanced monitoring and predictive analytics, moving beyond mere reactive load testing. Enterprises are increasingly investing in sophisticated, cloud-based testing platforms that offer elastic resource provisioning and simulated environments reflecting actual production settings, thus addressing the limitations of traditional, on-premises testing infrastructure. Furthermore, there is a pronounced focus on specialized testing areas, including API performance testing and service virtualization, critical for complex microservices architectures.

Regionally, North America maintains the largest market share due to the early adoption of advanced cloud technologies, the presence of major technology vendors, and high expenditure on software development and quality assurance in the BFSI and IT sectors. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, driven by accelerated digital transformation in emerging economies, massive consumer internet penetration, and significant governmental investment in digital infrastructure. Europe remains a key region, primarily influenced by stringent data protection regulations (like GDPR) which necessitate systems that are both compliant and highly performant under pressure. Market strategies across all regions are emphasizing integrated solutions combining performance testing with security and continuous observability.

Segment trends reveal that the Services component dominates the market revenue, as complex performance issues often require specialized expertise, consulting, and managed services for effective remediation and performance optimization. Within testing types, load testing remains foundational, but endurance and scalability testing are gaining rapid prominence, reflecting the need to validate long-term stability and capacity growth. The shift towards cloud-deployed testing tools is accelerating significantly, offering scalability and reduced total cost of ownership (TCO) compared to traditional licensing models. Vertically, BFSI and IT & Telecom sectors are the primary consumers, although the retail and e-commerce sector shows high cyclical demand for peak performance readiness, driving specific market innovation.

AI Impact Analysis on Performance Testing Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Performance Testing Market primarily revolve around automation capabilities, predictive analytics, and the reduction of manual effort. Common questions center on how AI can autonomously generate realistic load scenarios, optimize test parameters based on production data, and, crucially, accelerate root cause analysis (RCA) by correlating performance deviations with code changes or infrastructure events. There is significant interest in understanding AI's role in shifting performance testing further left—embedding it into the development process—and transforming performance engineering from a reactive bottleneck identification task into a proactive optimization discipline. Users are keenly looking for solutions that leverage AI/ML to predict potential performance degradation before it impacts end-users, moving towards AIOps capabilities within the testing lifecycle.

The integration of AI/ML algorithms is fundamentally redefining the efficiency and accuracy of performance testing processes. AI models are trained on historical performance data, log files, and production metrics to develop sophisticated baselines and identify anomalies that human analysts might miss. This predictive capability allows engineering teams to allocate resources more efficiently, focusing remediation efforts on the most likely points of failure. Furthermore, AI tools are capable of dynamically adjusting test loads in real-time based on system responses, creating more realistic and complex simulation scenarios than static scripting allows, ensuring comprehensive coverage of potential failure modes and boundary conditions.

AI's influence extends deeply into test data management and test automation scripting. Machine learning models can analyze production traffic patterns and automatically generate synthetic test data sets that accurately mirror real customer behavior, overcoming data privacy challenges and ensuring test fidelity. The adoption of AI-driven platforms reduces the reliance on specialized performance engineers for initial setup and execution, democratizing the process and enabling faster feedback loops in a continuous delivery environment. This technological leap addresses the industry shortage of specialized performance expertise by automating repetitive and data-intensive tasks, thereby elevating the role of human testers to focus on complex optimization and strategic performance architecture design.

- AI enables predictive identification of performance bottlenecks prior to deployment.

- Machine learning optimizes load generation parameters for realistic simulation scenarios.

- Automated root cause analysis (RCA) accelerates defect identification and resolution.

- AI assists in generating synthetic, representative test data based on production patterns.

- Integration of AIOps capabilities streamlines performance monitoring and alerting post-release.

- Reduces manual scripting effort, facilitating true continuous performance testing within CI/CD pipelines.

DRO & Impact Forces Of Performance Testing Market

The Performance Testing Market is powerfully shaped by several interconnected drivers, restraints, and opportunities that dictate its trajectory and intensity. A primary driver is the overwhelming imperative for flawless digital customer experiences, where latency and downtime are intolerable, pushing organizations to prioritize application stability and speed. This is intrinsically linked to the explosive growth in cloud migration, as companies need specialized tools to validate the performance and cost-efficiency of workloads running on dynamic, elastic cloud infrastructure. Simultaneously, the pervasive adoption of DevOps and microservices architectures mandates continuous, automated performance validation, making performance testing a non-negotiable step rather than a late-stage gate.

However, the market faces significant restraints that temper its growth. The most critical is the scarcity of highly skilled performance engineers capable of managing complex, distributed testing environments and interpreting sophisticated analytical data. Performance testing tools, particularly those leveraging AI and cloud infrastructure simulation, often entail high initial licensing and operational costs, posing a barrier to entry for Small and Medium-sized Enterprises (SMEs). Furthermore, integrating performance testing seamlessly into fast-paced CI/CD pipelines requires substantial organizational change management and cultural alignment, which many enterprises struggle to implement effectively, leading to fragmented or superficial testing efforts.

Opportunities for market expansion are abundant, particularly driven by technological evolution. The rise of 5G and the Internet of Things (IoT) presents a massive demand for testing the performance of low-latency networks and the scalability of massive device concurrency, opening new specialized testing niches. The increasing maturity of AIOps platforms offers a significant opportunity for vendors to provide integrated solutions that bridge the gap between pre-production testing and real-time production monitoring. Furthermore, the market is ripe for growth in hybrid performance testing models, combining on-premises robustness with the flexibility and scale of cloud-based resources, catering to organizations with stringent regulatory requirements regarding data residency and security.

Segmentation Analysis

The Performance Testing Market is comprehensively segmented across several dimensions, providing granularity necessary for precise market analysis and strategic decision-making. These segmentations are critical for understanding how different market components contribute to overall revenue and which specific areas are undergoing the most rapid technological evolution and adoption. The segmentation by component differentiates between the tangible tools and platforms—which often feature complex proprietary algorithms for load generation and reporting—and the critical services segment, which includes consulting, implementation, and managed performance engineering outsourcing, typically constituting a higher revenue share due to the specialized expertise required.

Further analysis by deployment model highlights the fundamental shift from traditional on-premises solutions, preferred by highly regulated industries for data control, toward cloud-based platforms. Cloud deployment offers unparalleled benefits in terms of elasticity, enabling testers to simulate massive, global load spikes without maintaining expensive, idle internal infrastructure. The segmentation by testing type is crucial, distinguishing between foundational activities like load testing (measuring performance under expected load) and advanced activities like stress testing (determining system breaking points) and scalability testing (measuring capacity limits), which are increasingly important for modern, high-growth applications.

Finally, the segmentation by industry vertical underscores the differential adoption rates and specific performance requirements across economic sectors. BFSI requires extreme transaction integrity and zero downtime; IT and Telecom demand ultra-low latency and high concurrent user handling; while Retail and E-commerce face dramatic, unpredictable peak loads requiring scalable, elastic testing solutions. Analyzing these segments provides vendors with strategic insights into tailoring their performance testing offerings to meet the specific compliance, capacity, and technological demands unique to each industry.

- Component:

- Tools/Platform (Software licenses, Subscription models)

- Services (Consulting, Implementation, Managed Services, Support and Maintenance)

- Deployment Model:

- On-Premise

- Cloud (SaaS/Subscription-based)

- Hybrid

- Testing Type:

- Load Testing

- Stress Testing

- Volume Testing

- Endurance Testing (Soak Testing)

- Spike Testing

- Scalability Testing

- Industry Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- IT and Telecommunication

- Retail and E-commerce

- Healthcare and Life Sciences

- Manufacturing

- Government and Public Sector

- Media and Entertainment

Value Chain Analysis For Performance Testing Market

The Value Chain for the Performance Testing Market begins with the upstream activities centered on core technology development and infrastructure provision. This stage involves the creation of sophisticated testing frameworks, synthetic load generators, scripting languages, and advanced monitoring agents by specialized tool vendors and open-source communities. Key upstream players include cloud providers (like AWS, Azure, Google Cloud) who offer the elastic infrastructure necessary for large-scale load generation, and software developers who build the core algorithms for analysis and reporting. The competitive advantage at this stage rests on innovation in AI/ML integration for predictive testing and the ability to support emerging protocols and distributed architectures (e.g., Kafka, microservices communication patterns).

Midstream activities focus on the delivery, customization, and implementation of performance testing solutions. This critical phase involves specialized consulting firms, system integrators, and managed service providers who deploy, configure, and operate the testing tools on behalf of end-users. These firms provide crucial expertise in test strategy formulation, script maintenance, performance bottleneck identification, and remediation recommendations. The distribution channel is bifurcated: direct sales channels handle large enterprise contracts and custom service agreements, while indirect channels utilize technology partners, resellers, and marketplaces (especially for SaaS products) to reach smaller organizations and specific geographical regions, ensuring broader market penetration and scalable delivery.

Downstream activities involve the final consumption and feedback loop, where end-users (enterprises in BFSI, IT, Retail, etc.) execute the performance tests and leverage the insights generated for application optimization and capacity planning. The efficiency of the downstream process relies heavily on the quality of reporting and the integration of testing results into existing DevOps toolchains (e.g., Jira, Jenkins). Effective collaboration between development teams, QA teams, and infrastructure operations is paramount. Feedback from production performance monitoring is often fed back upstream to improve testing scenarios, closing the loop and driving continuous refinement of both the application and the testing methodology.

Performance Testing Market Potential Customers

Potential customers for performance testing solutions are virtually any organization that develops or relies heavily on software applications where speed, stability, and scale directly impact revenue, reputation, or compliance obligations. The primary end-users fall into large enterprises across high-volume transaction sectors like BFSI and E-commerce, where a single minute of downtime or slow response during peak hours can translate into millions in lost sales and severe reputational damage. These large organizations require highly sophisticated, enterprise-grade tools capable of simulating geographically distributed users and complex multi-application workflows, demanding comprehensive scalability and stress testing solutions.

Beyond the high-transaction sectors, potential buyers include technology companies (IT and Telecom) that are constantly updating their services and require stringent validation of system resilience before deployment. Telecom operators, in particular, need to ensure their infrastructure can handle massive, sudden spikes in network traffic associated with major events or new service launches, requiring specialized testing of network function virtualization (NFV) and 5G core systems. Furthermore, organizations undergoing major digital transformations, such as transitioning monolith applications to cloud-native microservices, constitute a critical customer base, as these architectural shifts introduce new performance risks that must be proactively mitigated.

A rapidly growing segment of potential customers includes SMEs and startups operating within the SaaS or high-growth tech space. While they may lack the budget for extensive custom deployments, they are increasingly adopting cloud-based, pay-as-you-go performance testing services (PaaS/SaaS models) to ensure their rapidly scaling applications can handle anticipated growth without compromising user experience. Regulatory compliance in industries like Healthcare (HIPAA, ensuring system availability) and Government (critical national infrastructure) also drives demand, compelling these entities to acquire performance validation capabilities to meet mandates for system reliability and operational uptime.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.8 Billion |

| Market Forecast in 2033 | $12.5 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Broadcom (CA Technologies), Micro Focus, Dynatrace, IBM, Tricentis, SmartBear, Neotys (Tricentis), Perforce Software (BlazeMeter), Keysight Technologies (Eggplant), Oracle, Microsoft, QA Mentor, Akamai (Soasta), AppDynamics (Cisco), New Relic, HPE, Apica, Load Impact, Splunk, Cigniti Technologies |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Performance Testing Market Key Technology Landscape

The technological landscape of the Performance Testing Market is characterized by innovation centered on automation, integration, and realism. Traditional client-server testing tools are being rapidly supplanted by cloud-native platforms that offer massive, distributed load generation capabilities, overcoming the limitations of internal hardware resources. Key technologies include advanced protocols support (such as HTTP/2, WebSocket, and various proprietary messaging queues), crucial for testing modern APIs and microservices. The shift towards open-source technologies, notably including tools like JMeter and Gatling, necessitates vendors to provide enterprise-grade wrappers and enhanced reporting features around these community-driven solutions, offering both flexibility and robustness.

Service virtualization is a critical technology component, allowing testers to simulate the performance behavior of external or unavailable dependencies (e.g., third-party APIs, legacy systems) without incurring costs or delays. This enables continuous performance testing even when the full environment is not yet stable or accessible. Furthermore, the convergence of Application Performance Monitoring (APM) tools with performance testing tools is essential. Modern solutions provide integrated observability, allowing performance engineers to drill down immediately from high-level transaction failures into specific code lines or infrastructure metrics (CPU, memory, disk I/O) causing the degradation, drastically cutting down diagnosis time and promoting the 'Performance Engineering' mindset.

The most transformative technology currently influencing the market is the application of Artificial Intelligence and Machine Learning (AI/ML). AI models are leveraged for sophisticated tasks such as automated test script generation, dynamic test data provisioning, and intelligent anomaly detection that differentiates between genuine performance issues and standard system fluctuations. The incorporation of AI/ML aids in scaling performance tests to handle the complexities introduced by transient cloud functions and serverless architectures. Finally, containerization technologies (Docker, Kubernetes) are integral, allowing testing environments to be rapidly spun up and torn down, ensuring environment parity between development, testing, and production for accurate results.

Regional Highlights

The Performance Testing Market demonstrates varied maturity levels and growth dynamics across key geographical regions, influencing global strategic investments and market activity.

- North America: Dominates the global market, largely driven by the high concentration of major technology firms, early and aggressive adoption of cloud and DevOps methodologies, and significant enterprise IT spending in the BFSI and IT sectors. The mature digital infrastructure and stringent quality requirements for customer-facing applications sustain high demand for advanced, AI-enabled performance engineering services and complex cloud testing solutions.

- Europe: Represents a substantial market share, characterized by high regulatory requirements (GDPR, financial services compliance) that necessitate robust system resilience testing. Western European nations, particularly the UK, Germany, and France, lead in adoption. The region is seeing growth fueled by industry automation and the need to validate the stability of cross-border digital services.

- Asia Pacific (APAC): Projected to be the fastest-growing region during the forecast period. This rapid expansion is attributed to large-scale digital initiatives in countries like India, China, and Southeast Asian nations, coupled with massive growth in mobile and internet users. Investment in IT infrastructure and the imperative to scale applications for huge populations drive demand for cost-effective, high-volume performance testing tools.

- Latin America (LATAM): Exhibits moderate growth, primarily centered in larger economies like Brazil and Mexico. Market growth here is spurred by the modernization of legacy IT systems, increased adoption of e-commerce, and rising mobile banking penetration, necessitating investment in performance validation infrastructure.

- Middle East and Africa (MEA): Shows emerging potential, particularly in the Gulf Cooperation Council (GCC) countries, driven by ambitious smart city projects, significant governmental digitization efforts, and heavy investment in the telecommunications and financial sectors. Cloud adoption is accelerating, directly translating to increased demand for cloud performance testing solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Performance Testing Market.- Broadcom (CA Technologies)

- Micro Focus

- Dynatrace

- IBM

- Tricentis

- SmartBear

- Neotys (Tricentis)

- Perforce Software (BlazeMeter)

- Keysight Technologies (Eggplant)

- Oracle

- Microsoft

- QA Mentor

- Akamai (Soasta)

- AppDynamics (Cisco)

- New Relic

- HPE

- Apica

- Load Impact

- Splunk

- Cigniti Technologies

Frequently Asked Questions

Analyze common user questions about the Performance Testing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the key differentiator between load testing and stress testing?

Load testing assesses system performance under expected, normal user traffic to ensure stability and meet service level agreements (SLAs). Stress testing, conversely, pushes the system beyond its operational limits to determine the breaking point, identify failure modes, and evaluate recovery processes.

How is the Performance Testing Market addressing the shift to microservices architecture?

The market is addressing microservices by focusing on API performance testing, service virtualization (to simulate dependencies), and distributed tracing tools integrated within performance testing platforms, ensuring end-to-end transaction visibility across complex, multi-service environments.

Why is performance testing essential in a DevOps environment?

Performance testing is crucial in DevOps because it enables continuous feedback. By integrating automated performance checks early (Shift-Left), teams can identify and fix bottlenecks rapidly before they escalate, supporting the goals of speed, continuous delivery, and high quality.

What role does Artificial Intelligence (AI) play in modern performance testing?

AI optimizes performance testing by automating test script maintenance, generating realistic test data based on production patterns, and utilizing machine learning for predictive anomaly detection and faster, intelligent root cause analysis (RCA).

Which deployment model is experiencing the highest growth in the Performance Testing Market?

Cloud-based deployment models (SaaS/PaaS) are experiencing the highest growth. Cloud solutions offer elastic scaling for massive load generation, reduce reliance on capital expenditure for infrastructure, and facilitate collaboration across globally distributed testing teams.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Web Performance Testing Market Statistics 2025 Analysis By Application (SMEs, Large Enterprises, Government Organizations), By Type (Cloud Based, On-Premise), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Performance Testing Tools Market Statistics 2025 Analysis By Application (Large Enterprise, SMBs), By Type (Cloud, SaaS, Web, On Premise), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Performance Testing Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Load Testing, Stress Testing), By Application (Web App, Mobile App), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Performance Testing Software Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (API Testing, Load Testing, Web Testing), By Application (SME (Small and Medium Enterprises), Large Enterprise), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager