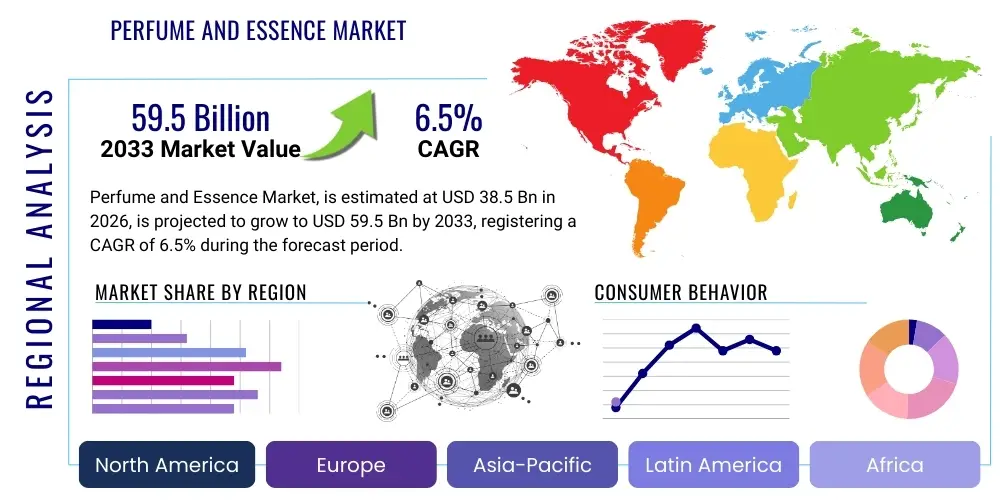

Perfume and Essence Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435161 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Perfume and Essence Market Size

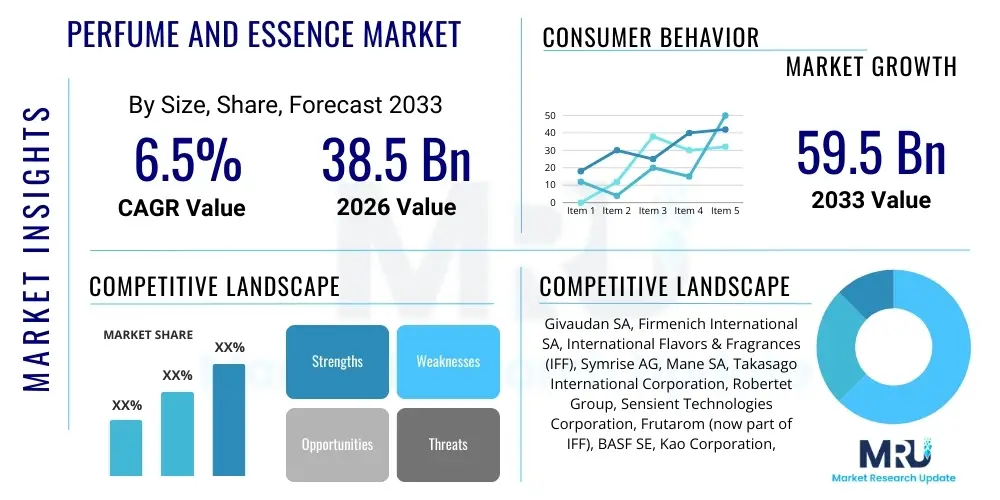

The Perfume and Essence Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $38.5 Billion in 2026 and is projected to reach $59.5 Billion by the end of the forecast period in 2033.

Perfume and Essence Market introduction

The Perfume and Essence Market encompasses the global production, distribution, and sale of fine fragrances, essential oils, aroma chemicals, and functional fragrances used across personal care, home care, and industrial applications. This sophisticated industry leverages intricate blending techniques and advanced chemistry to create unique olfactory experiences that drive consumer purchases based on emotion, identity, and wellness trends. The primary products range from high-concentration Eau de Parfum (EDP) and traditional essential oils to complex aroma compounds utilized in soaps, detergents, and air fresheners, catering to both luxury segments and mass-market demand globally. Essential oils, derived naturally, form a critical sub-segment driven by burgeoning consumer preference for clean label and organic ingredients, particularly in aromatherapy and natural cosmetic formulations. The market's intrinsic value lies not only in the tangible product but also in the brand storytelling, exclusivity, and psychological benefits associated with scent, fueling sustained growth even amidst economic fluctuations.

Major applications of perfumes and essences are predominantly observed in the personal grooming sector, including body sprays, deodorants, and fine fragrances, serving as core elements of daily consumer routines. Beyond personal use, the market has significant penetration in household products, where essences are crucial for masking chemical odors and imparting pleasant scents to cleaning agents, fabric softeners, and air care devices. The demand is highly diversified geographically, with mature markets focusing on niche and artisanal offerings, while emerging economies see rapid expansion in mass-market fragrances driven by increasing disposable incomes and urbanization. Key benefits driving market expansion include the proven psychological effects of certain aromas on mood enhancement, stress reduction, and brand recall, making scent an indispensable tool for both consumers and product manufacturers.

Driving factors for sustained market growth include accelerated innovation in fragrance encapsulation technologies, which extend scent longevity, and the digital transformation of the retail landscape, enabling personalized recommendations and direct-to-consumer (DTC) engagement. Furthermore, increased focus on sustainability and ethical sourcing has mandated shifts in raw material procurement, pushing manufacturers towards synthetic biology solutions and traceable natural ingredients. The market remains intensely competitive, characterized by rapid trend cycles, reliance on seasonal launches, and powerful marketing campaigns led by celebrity endorsements and designer collaborations, all contributing to the high growth trajectory projected for the forecast period.

Perfume and Essence Market Executive Summary

The Perfume and Essence Market is characterized by robust business trends centered on sustainability, customization, and omnichannel distribution. Regional market dynamics demonstrate a clear bifurcation: while North America and Europe maintain dominance in terms of high-value niche and luxury segments, the Asia Pacific (APAC) region stands out as the primary growth engine, fueled by rapid expansion in middle-class populations, increased spending on personal care products, and rising demand for oriental and fresh fragrance profiles. A significant operational trend involves the integration of AI and machine learning tools, which are being deployed to predict localized scent preferences, optimize R&D cycles for novel aroma creation, and enhance supply chain agility in response to fast-changing consumer tastes. This technological assimilation is fundamentally altering the competitive landscape, rewarding companies capable of synthesizing data-driven insights with traditional perfumery expertise.

Segment trends indicate strong performance across naturally derived essential oils and functional fragrances, the latter being fragrances designed not just for aesthetics but also to deliver specific benefits like sleep enhancement or energy boosting. The distribution channel shift towards e-commerce platforms is undeniable, offering brands unparalleled access to global consumer bases and facilitating the rise of smaller, independent, artisanal fragrance houses that bypass traditional retail hurdles. However, established players are countering this by investing heavily in their digital infrastructure and creating immersive online experiences. Furthermore, the trend toward 'clean beauty' has placed significant pressure on formulators to eliminate controversial ingredients, accelerating the adoption of bio-based alternatives and environmentally friendly packaging solutions, thus reshaping the definition of premiumization in the modern context.

Overall, the market’s trajectory is highly positive, supported by resilient consumer spending on emotional well-being products and the continued strategic consolidation among global flavor and fragrance houses aiming to secure supply lines and broaden their technological portfolios. Challenges remain, particularly concerning the volatile pricing of key natural raw materials like jasmine, sandalwood, and patchouli, compounded by the increasing scrutiny from global regulatory bodies regarding allergen labeling and chemical restrictions. To mitigate these risks, leading market participants are heavily investing in internal biosynthesis capabilities and advanced synthetic alternatives, ensuring consistency and cost stability, positioning the industry for diversified and sustainable growth through 2033.

AI Impact Analysis on Perfume and Essence Market

User queries regarding the impact of Artificial Intelligence (AI) on the Perfume and Essence Market frequently revolve around personalized scent creation, supply chain transparency, and the potential disruption of traditional perfumery roles. Key themes indicate strong user expectation that AI will automate trend forecasting, allowing companies to launch products that perfectly align with hyper-localized consumer preferences, thereby reducing market failure rates. Concerns are often raised about the commoditization of fragrance creation and whether AI-driven formulation can truly replicate the subjective artistry and emotional resonance traditionally associated with human Master Perfumers. Simultaneously, users are highly interested in how machine learning algorithms are enhancing quality control, optimizing ingredient mixing ratios, and predicting the performance and stability of complex fragrance compounds under varying environmental conditions, suggesting a focus on efficiency and scientific rigor driven by advanced computing.

AI’s most immediate impact is visible in the R&D phase, where algorithms analyze vast datasets comprising historical sales, ingredient compatibility, chemical structure, and consumer feedback (including social media sentiment) to identify white spaces in the market and suggest novel combinations of aroma chemicals. This capability accelerates the innovation cycle, allowing brands to respond to micro-trends rapidly. Furthermore, AI-powered predictive maintenance and inventory management systems are being integrated into manufacturing facilities, optimizing production schedules, minimizing waste associated with perishable natural ingredients, and ensuring compliance with 'just-in-time' inventory models essential for handling the complexity of thousands of unique SKUs typical in this market. The implementation of generative AI models is now facilitating the rapid prototyping of fragrance concepts, significantly lowering the upfront cost and time investment required for new product development, which traditionally involved extensive manual experimentation.

The long-term influence of AI is projected to revolutionize the consumer experience through hyper-personalization. Retailers are deploying AI-driven virtual try-on and recommendation engines that utilize consumer profiles, environmental factors (like climate), and even physiological data to suggest bespoke fragrances, shifting the industry from mass production to individual batch formulation. This shift towards 'Fragrance-as-a-Service' is underpinned by AI's ability to manage complex formulation libraries and production sequencing. Despite initial skepticism, AI is increasingly viewed not as a replacement for human creativity but as a powerful tool that augments the perfumer's ability to explore complex chemical spaces and ensures scalability and consistency in high-volume, customized production, thus serving as a critical competitive differentiator in the digital economy.

- AI-driven trend forecasting minimizes market risk and accelerates new product conceptualization.

- Machine learning algorithms optimize the blending and manufacturing processes, enhancing batch consistency and quality control.

- Generative AI assists in creating novel aroma chemical combinations and predicting scent stability.

- Personalized scent recommendation engines improve customer experience and drive customized product sales (hyper-personalization).

- AI optimizes supply chain management, improving traceability of natural ingredients and reducing waste.

- Chatbots and virtual assistants offer immediate, expert guidance on fragrance selection and usage.

DRO & Impact Forces Of Perfume and Essence Market

The Perfume and Essence Market is fundamentally driven by rising consumer demand for premium, personalized, and functional fragrances, coupled with the rapid expansion of personal care and home care industries in developing economies. Key restraints include the inherent volatility in raw material pricing, particularly for globally sourced natural ingredients which are subject to climatic and geopolitical instability, alongside increasingly stringent regulatory frameworks concerning allergens and restricted chemicals, notably in the European Union (EU REACH). Opportunities abound through the technological adoption of synthetic biology for sustainable ingredient creation, the untapped potential of emerging markets in Africa and Latin America, and the flourishing demand for mood-enhancing and wellness-focused fragrance products. These forces collectively dictate the market dynamics, influencing R&D investment, supply chain strategies, and consumer engagement models, thereby creating a high-impact environment where innovation and regulatory compliance are paramount for sustained market leadership.

The primary driving force is the profound shift in consumer perception, viewing fragrance not merely as a luxury item but as an essential element of self-care and personal identity. This shift is particularly evident among Millennial and Gen Z consumers who prioritize unique, niche, and ethically sourced products, propelling the growth of artisanal brands and ingredient transparency initiatives. However, this growth trajectory is constantly challenged by restraints such as the lengthy and capital-intensive approval process for novel aroma chemicals, necessary due to safety and toxicity concerns. Furthermore, the reliance on complex, global supply chains exposes manufacturers to risks related to pandemics, shipping disruptions, and political instability in major sourcing regions. Overcoming these restraints necessitates strategic diversification of sourcing and increased investment in vertical integration to gain control over critical inputs.

Impact forces currently shaping the competitive landscape are dominated by technological advancements, specifically green chemistry and biotechnology. The development of synthetic biological pathways allows for the creation of nature-identical molecules without relying on scarce or environmentally damaging natural resources, offering a compelling opportunity to achieve both sustainability and cost stability. The market's structural evolution is also influenced by increasing merger and acquisition activity, as large flavor and fragrance (F&F) houses consolidate expertise and regional footprints. Successful market players are those that can effectively navigate the opportunities presented by digital commerce and hyper-personalization while mitigating the twin restraints of regulatory complexity and raw material price fluctuation, ultimately demonstrating agility and commitment to ethical sourcing practices.

Segmentation Analysis

The Perfume and Essence Market segmentation is complex, reflecting the diverse application landscape and varying consumer preferences across global regions. Segmentation is typically analyzed based on Product Type (Fine Fragrances, Essential Oils, Aroma Chemicals), Application (Personal Care, Home Care, Cosmetics), End-User (Men, Women, Unisex), and Distribution Channel (Offline Retail, Online Retail). Fine fragrances, often categorized further by concentration (Eau de Parfum, Eau de Toilette, etc.), command the highest premium due to their artistic complexity and branding, remaining a cornerstone of the luxury sector. Meanwhile, essential oils and aroma chemicals form the indispensable backbone of the mass-market and industrial applications, where cost efficiency and consistent aroma profiles are prioritized. The market structure is highly dependent on regional cultural nuances, with Middle Eastern markets showing a preference for heavy, opulent Oud and amber scents, while Asian markets favor lighter, fresher, and more subtle olfactory experiences.

Analysis by Application highlights the crucial role of functional fragrances, particularly in the Home Care segment, where essences mask the often-harsh odors of cleaning chemicals and contribute to consumer perception of cleanliness and hygiene. The Personal Care segment is further driven by innovative delivery systems, such as microencapsulation, which ensure long-lasting scent performance in challenging matrices like lotions and shampoos. In terms of end-users, the Unisex segment is experiencing significant growth, aligning with broader societal trends towards fluid identity and personalized expression, prompting brands to launch gender-neutral collections that emphasize ingredients and artistry over traditional gender marketing. This shift is challenging legacy marketing frameworks and requiring companies to adopt more inclusive and ingredient-focused narratives to appeal to modern consumers.

The Distribution Channel segmentation is undergoing the most dynamic change, characterized by the aggressive proliferation of e-commerce. While department stores and specialized beauty retailers (Offline Retail) still provide the crucial physical touchpoint for sampling and expert consultation, Online Retail offers unmatched convenience, selection, and the capacity for smaller niche brands to gain visibility without major retail overheads. The online channel has excelled in leveraging digital marketing, including influencer collaborations and user-generated content, to drive product awareness. Companies are actively pursuing omnichannel strategies that integrate physical and digital experiences, such as augmented reality fragrance consultation tools, to overcome the inherent challenge of selling a sensory product online, ensuring seamless customer engagement across all purchasing avenues.

- By Product Type:

- Fine Fragrances (Eau de Parfum, Eau de Toilette, Eau de Cologne)

- Essential Oils (Lavender, Peppermint, Citrus, Tea Tree)

- Aroma Chemicals (Synthetics and Isolates)

- By Application:

- Personal Care (Deodorants, Soaps, Shampoos)

- Home Care (Air Fresheners, Detergents, Candles)

- Cosmetics and Toiletries

- Aromatherapy

- By End-User:

- Men

- Women

- Unisex/Gender-Neutral

- By Distribution Channel:

- Offline Retail (Specialty Stores, Supermarkets, Department Stores)

- Online Retail (E-commerce Platforms, Brand Websites)

Value Chain Analysis For Perfume and Essence Market

The Value Chain of the Perfume and Essence Market is intricate, commencing with the highly sensitive upstream processes of raw material sourcing and synthesis. Upstream analysis involves the cultivation, harvesting, and extraction of natural ingredients—such as flowers, woods, and resins—which is resource-intensive and often geographically localized, making it susceptible to climate change and geopolitical risks. Simultaneously, the upstream segment includes the sophisticated chemical synthesis of aroma chemicals and isolates, requiring specialized chemical engineering expertise and large-scale manufacturing plants. The subsequent midstream activities involve the crucial steps of formulation, blending, and compounding, where Master Perfumers utilize their technical and artistic skill to combine hundreds of ingredients according to proprietary formulations, ensuring safety, stability, and olfactory appeal, before packaging and quality control measures are implemented. This manufacturing phase is critical for determining the final product's quality and cost structure.

The downstream analysis focuses on the journey of the finished product to the end consumer, involving marketing, branding, and distribution. The distribution channel is bifurcated into direct and indirect routes. Direct distribution channels include brand-owned boutiques and dedicated e-commerce websites, allowing companies maximum control over brand narrative, pricing, and customer data. Indirect distribution relies heavily on global and regional partners, including mass merchandisers, specialty beauty stores (Sephora, Ulta), and third-party online marketplaces (Amazon, Tmall). Effective brand management and compelling storytelling are essential downstream activities, as consumer purchase decisions in this highly experiential market are heavily influenced by emotional factors, luxury perception, and perceived exclusivity, requiring significant investment in high-impact advertising campaigns and influencer outreach.

The dynamic interplay between direct and indirect distribution channels is reshaping market access. While indirect channels provide broad market reach and volume sales, the direct model offers higher profit margins and allows brands to gather granular customer feedback necessary for personalized product development. Successful value chain integration minimizes waste and ensures ethical sourcing transparency, which is increasingly demanded by consumers. Manufacturers are focusing on achieving full traceability from farm to bottle, utilizing blockchain technology in some cases, to validate sustainability claims. Optimization across all stages—from sustainable sourcing in the upstream to effective digital engagement in the downstream—is vital for maintaining a competitive edge in a market where differentiation relies equally on product quality and ethical production practices.

Perfume and Essence Market Potential Customers

The Perfume and Essence Market caters to a wide spectrum of potential customers, broadly categorized into B2C end-users (individual consumers) and B2B industrial buyers. The primary B2C market includes diverse demographics defined by age, income, and lifestyle, with a significant focus on luxury consumers who seek high-end, limited-edition fine fragrances, prioritizing craftsmanship and brand heritage. Emerging consumer segments, particularly Millennials and Gen Z, represent a major growth driver, characterized by their preference for personalized, sustainable, and transparently sourced products, driving demand for indie brands and functional fragrances that align with holistic wellness trends. These younger buyers are highly influenced by digital media and often seek scents that serve as tools for self-expression and identity exploration, favoring complex, unisex, and unique scent profiles over traditional mainstream offerings. Geographical location also segments consumers, with distinct regional preferences dictating the type of fragrance—e.g., preference for oriental or spicy notes in the Middle East versus clean, aquatic notes in East Asia.

The B2B customer segment comprises large-scale manufacturers across the Fast-Moving Consumer Goods (FMCG) industry, including companies specializing in home care (laundry detergents, cleaners), personal hygiene (soaps, shampoos, body washes), and cosmetics (creams, makeup bases). These industrial buyers rely on essence manufacturers to supply consistent, stable, and cost-effective aroma chemicals and fragrance compounds that integrate seamlessly into their base formulations, serving the functional purpose of improving product acceptability and masking undesirable chemical odors. Crucially, B2B procurement decisions are heavily influenced by regulatory compliance (e.g., IFRA standards), supply security, and the ability of the essence supplier to innovate in terms of sustainable or allergen-free compounds. The relationship here is strategic, often involving long-term supply contracts and joint R&D efforts to develop unique signature scents for major product lines.

A smaller but rapidly growing customer category includes specialty buyers such as independent candle makers, artisanal soap manufacturers, and aromatherapy clinics. These customers, though lower volume, often demand highly specialized, high-quality essential oils and pure isolates, prioritizing organic certification and therapeutic benefits. Understanding the purchasing drivers of each potential customer group—from the emotional pull required for fine fragrance sales to the technical specifications necessary for B2B industrial applications—is essential for market segmentation and targeted content strategy. The future customer profile is increasingly discerning, demanding not just a pleasant scent but a product aligned with ethical values, detailed ingredient information, and a personalized sensory experience, compelling sellers to offer comprehensive product narratives and robust compliance documentation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $38.5 Billion |

| Market Forecast in 2033 | $59.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Givaudan SA, Firmenich International SA, International Flavors & Fragrances (IFF), Symrise AG, Mane SA, Takasago International Corporation, Robertet Group, Sensient Technologies Corporation, Frutarom (now part of IFF), BASF SE, Kao Corporation, Estee Lauder Companies, L'Oréal S.A., Coty Inc., Chanel, Dior (LVMH), Hermès International, Shiseido Company, Pvt. Ltd., Ajmal Perfumes, Eurofragance. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Perfume and Essence Market Key Technology Landscape

The technological landscape of the Perfume and Essence Market is being fundamentally reshaped by innovations aimed at sustainability, longevity, and novel aroma creation. One of the most disruptive technologies is synthetic biology, which utilizes genetic engineering to program microorganisms (like yeast or bacteria) to produce high-value aroma molecules traditionally extracted from rare or environmentally sensitive plant sources, such as sandalwood or rose oil. This approach ensures consistent quality, scalable production regardless of harvest yield, and significantly reduces the environmental footprint associated with cultivation and extraction. Furthermore, advancements in Green Chemistry techniques, including supercritical CO2 extraction and solvent-free distillation, are gaining prominence as they yield purer essential oils with better preserved olfactory profiles, avoiding the use of harsh chemical solvents often restricted by regulatory bodies, aligning perfectly with the clean label movement in consumer goods.

Another crucial technological frontier is microencapsulation, a core development for enhancing fragrance performance, particularly in functional applications like laundry detergents and fabric softeners. Microencapsulation involves embedding fragrance oil within tiny polymer shells that protect the scent from degradation due to heat, light, or interaction with base chemicals, releasing the aroma only upon friction or controlled dissolution, guaranteeing long-lasting scent release. This technology is vital for differentiating functional fragrances in highly competitive consumer markets. Parallel to this, advances in analytical chemistry, specifically high-resolution gas chromatography-mass spectrometry (GC-MS) coupled with high-throughput screening, allow researchers to rapidly analyze complex natural extracts and identify trace molecules responsible for unique scent characteristics, aiding both in natural material authentication and the creation of highly accurate synthetic reconstructions, combating counterfeit products and ensuring raw material integrity.

Finally, the integration of Artificial Intelligence and proprietary computational modeling platforms is accelerating the formulation process. These platforms utilize machine learning to predict how specific molecules will interact in a blend, estimate shelf stability, and gauge potential allergen risk, drastically reducing the trial-and-error phase traditionally required by perfumers. These digital tools enable the rapid screening of millions of possible combinations, leading to the discovery of entirely new, commercially viable odorant molecules. The interplay between AI-driven prediction, sustainable synthetic biology, and advanced delivery systems like microencapsulation establishes the technological pillars necessary for innovation and achieving cost efficiencies in the modern essence market, reinforcing the industry's shift towards science-backed artistry.

Regional Highlights

The global Perfume and Essence Market exhibits distinct consumption patterns and growth drivers across major geographical regions: North America, Europe, Asia Pacific (APAC), Latin America, and Middle East & Africa (MEA). Europe traditionally holds significant market share, driven by its rich heritage in fine fragrance creation (France, Italy) and stringent quality standards (EU regulations). However, the APAC region is forecast to demonstrate the highest CAGR due to demographic shifts, urbanization, and the exponential growth of the middle-class population, driving demand for both premium and mass-market products.

- North America: This region is characterized by high consumer spending power and a rapid adoption of lifestyle trends, leading to strong demand for niche, artisanal, and wellness-focused essential oils. The market is highly saturated but remains dynamic, driven by technological integration in retail (AI personalization) and a pronounced focus on clean label ingredients. Innovation centers are robust, with significant R&D investment in synthetic biology solutions to secure sustainable ingredients. Consumers here are highly responsive to celebrity endorsements and digital marketing strategies. The US market dominates regional consumption, emphasizing functional scents used in high-quality home fragrance products and premium unisex perfumes. The regulatory environment, while less centralized than the EU, increasingly focuses on ingredient transparency and disclosure.

- Europe: As the historic center of perfumery, Europe retains a leading position in the fine fragrance segment, underpinned by powerful luxury houses. The market is mature, characterized by high consumer knowledge and preference for quality, long-lasting scents. Regulatory compliance, primarily driven by the European Union’s REACH regulation and strict IFRA standards, presents a significant operational constraint but also drives innovation in safer, allergen-free formulations. Sustainability and ethical sourcing are not just trends but mandatory requirements for market participation, compelling brands to adopt circular economy practices. Germany and France are key consumers, alongside the UK, where bespoke fragrance experiences and refill schemes are gaining traction.

- Asia Pacific (APAC): APAC is the engine of future market growth, fueled by vast populations in China and India, rapidly rising disposable incomes, and increasing Westernization of beauty standards. Consumption is shifting towards sophisticated scents, moving away from simple traditional products. China represents the largest growth opportunity, focusing on subtle, fresh, and often floral-aquatic notes preferred by local consumers, particularly Generation Z. E-commerce penetration is exceptionally high, facilitating direct access for international brands. Key growth segments include functional fragrances integrated into high-end skincare and mass-market essential oils for aromatherapy and stress reduction, reflecting a growing focus on mental wellness.

- Latin America: This region presents promising growth, particularly Brazil and Mexico, due to a strong cultural affinity for fragrances and personal grooming. Brazil is traditionally one of the world's largest consumers of fragrances by volume. The market is characterized by frequent purchases of larger format products, high demand for mass-market and mid-range fragrances, and a preference for intense, long-lasting scent profiles that suit warm climates. Local players hold strong market positions, but international companies are increasingly entering through strategic partnerships and localized product launches. Economic stability and currency fluctuations remain key factors affecting consumer purchasing power in this region.

- Middle East and Africa (MEA): The MEA region is synonymous with high-value, luxury fragrance consumption, dominated by the traditional use of Oud, Amber, and heavy, resinous notes. The Gulf Cooperation Council (GCC) countries, especially Saudi Arabia and the UAE, are major global buyers of premium, bespoke, and artisanal fragrances, often utilizing layered scenting traditions. Cultural practices drive exceptionally high per capita consumption, supporting a thriving market for concentrated perfume oils (Attars) and high-end fine fragrances. The African sub-region, particularly South Africa and Nigeria, offers emerging market potential, driven by rising consumer awareness and increasing distribution access to branded international products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Perfume and Essence Market.- Givaudan SA

- Firmenich International SA

- International Flavors & Fragrances (IFF)

- Symrise AG

- Mane SA

- Takasago International Corporation

- Robertet Group

- Sensient Technologies Corporation

- BASF SE

- Kao Corporation

- Estee Lauder Companies

- L'Oréal S.A.

- Coty Inc.

- Chanel

- Dior (LVMH)

- Hermès International

- Shiseido Company, Pvt. Ltd.

- Ajmal Perfumes

- Eurofragance

- ScentAir Technologies, LLC

Frequently Asked Questions

Analyze common user questions about the Perfume and Essence market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards sustainable sourcing in the Perfume and Essence Market?

The shift is primarily driven by rigorous consumer demand, especially from Millennial and Gen Z demographics, for ingredient transparency, ethical labor practices, and reduced environmental impact. Regulatory pressures (e.g., EU restrictions on certain natural extracts) and the commercial viability of synthetic biology alternatives also mandate sustainable and traceable supply chains.

How is microencapsulation technology impacting the functional fragrance segment?

Microencapsulation is a crucial enabler for functional fragrances by significantly extending the scent longevity in products like detergents and fabric softeners. It protects volatile aroma compounds from degradation, ensuring controlled release upon friction or temperature change, which translates directly into superior consumer experience and product differentiation.

Which regions are expected to exhibit the highest growth rate (CAGR) in the coming decade?

The Asia Pacific (APAC) region, specifically China and India, is projected to demonstrate the highest Compound Annual Growth Rate (CAGR). This acceleration is attributed to rapidly increasing urbanization, the expansion of the middle class, and rising disposable incomes driving discretionary spending on personal care and luxury goods.

What role does Artificial Intelligence play in modern fragrance development?

AI plays a transformative role by analyzing vast chemical and consumer data to predict trends, optimize ingredient formulation for stability and safety, and accelerate the discovery of novel aroma molecules. It assists perfumers by providing data-driven insights, leading to more targeted and efficient product launches.

What are the primary restraints affecting the profitability of the Perfume and Essence Market?

The key restraints include high volatility and price instability of essential natural raw materials due to climate change and geopolitical factors. Additionally, stringent global regulatory frameworks (like IFRA and EU REACH) impose high compliance costs and limit the use of certain cost-effective aroma chemicals, challenging profit margins.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager