Perfume and Fragrance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438140 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Perfume and Fragrance Market Size

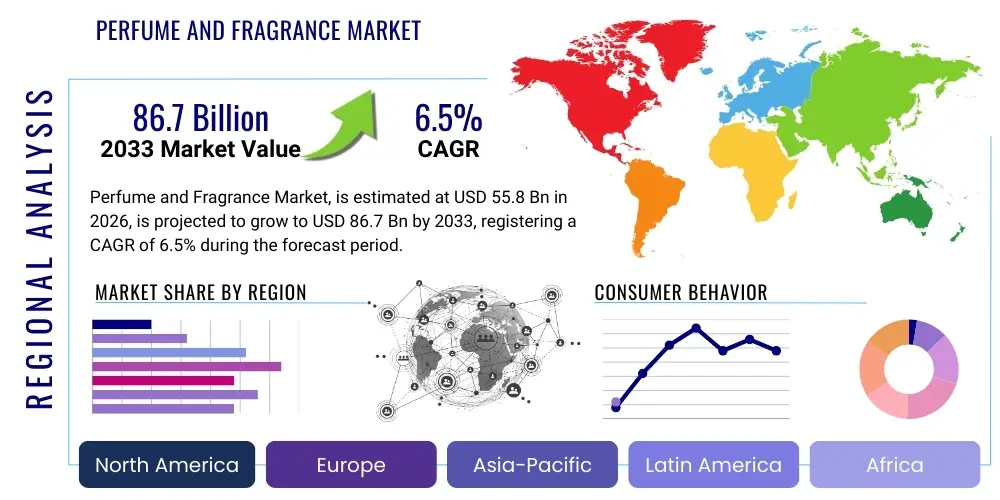

The Perfume and Fragrance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $55.8 Billion in 2026 and is projected to reach $86.7 Billion by the end of the forecast period in 2033.

Perfume and Fragrance Market introduction

The global Perfume and Fragrance Market encompasses a broad spectrum of products, including Eau de Parfum (EDP), Eau de Toilette (EDT), Eau de Cologne (EDC), and body mists, primarily categorized by fragrance concentration and longevity. These products utilize complex formulations derived from natural extracts, essential oils, and synthetic aroma compounds, targeting consumers across all demographics seeking personal expression, enhanced self-confidence, and sensory pleasure. The market is characterized by high brand loyalty, significant investment in marketing, and rapid innovation driven by shifting consumer preferences towards specialized, niche, and sustainable offerings. This ecosystem includes mass-market brands, premium luxury houses, and artisanal producers, all competing intensely for shelf space and consumer attention in both physical retail and burgeoning e-commerce channels. The product lifecycle in this industry is relatively short for trend-driven launches, necessitating continuous R&D and strategic supply chain management to maintain relevance.

Major applications of perfumes and fragrances extend beyond personal grooming to encompass aromatherapy, luxury gifting, and integration into personal care items, thus driving volume sales. The inherent benefits derived from these products, such as mood enhancement, stress reduction, and the establishment of a distinctive personal brand, are fundamental demand drivers. The psychological impact of scent profiles—from fresh and invigorating to warm and comforting—plays a critical role in consumer decision-making. Moreover, the segmentation of products based on gender (masculine, feminine, and increasingly, gender-neutral) and concentration levels allows manufacturers to precisely target distinct consumer needs and price points, reinforcing market stability and expansion.

Key driving factors accelerating market growth include increasing disposable income in emerging economies, the rising influence of social media and celebrity endorsements which dictate fast-moving fragrance trends, and a cultural shift towards self-care and holistic wellness. Furthermore, technological advancements in ingredient sourcing, such as sustainable biotechnology for creating rare or endangered scents synthetically, are reducing environmental impact while ensuring supply consistency. The urbanization trend, coupled with consumers' desire for premium, experiential retail environments, further solidifies the market’s upward trajectory, making it one of the most dynamic sectors within the broader personal luxury goods industry.

Perfume and Fragrance Market Executive Summary

The Perfume and Fragrance Market is experiencing a pivotal transformation driven by profound shifts in consumer values, technological integration, and geographical diversification. Current business trends indicate a strong move toward hyper-personalization, with consumers demanding bespoke fragrance solutions and transparency regarding ingredient origins, particularly concerning sustainability and ethical sourcing. The digital revolution has fundamentally altered the go-to-market strategy, emphasizing direct-to-consumer (D2C) channels, immersive virtual try-on experiences, and data-driven inventory management. Companies are heavily investing in blockchain technology to verify the authenticity and traceability of high-value raw materials, thereby combating the persistent issue of counterfeiting and building stronger consumer trust. Furthermore, strategic mergers and acquisitions remain robust, as large conglomerates seek to absorb innovative, niche, and cruelty-free brands to quickly capture specialized market segments and diversify their portfolios.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, primarily fueled by rapid urbanization, rising middle-class affluence in China and India, and the growing adoption of Western grooming standards. While North America and Europe remain mature markets, they are driving the demand for clean label, natural, and artisanal fragrances, with a strong emphasis on refillable and eco-friendly packaging solutions to minimize ecological footprint. The Middle East and Africa (MEA) continue to dominate the consumption of traditional, oil-based, and highly concentrated Oud fragrances, with local cultural preferences dictating high-volume luxury purchases, often driven by gifting traditions and social status signaling. Market participants are tailoring regional product lines specifically to address these unique cultural and climatic demands, understanding that a one-size-fits-all approach is no longer effective in a globalized industry.

Segmentation trends indicate significant expansion in the gender-neutral fragrance category, which appeals to younger, more fluid consumer identities, challenging traditional binary marketing frameworks. Product type analysis shows premium Eau de Parfum formulations gaining market share over lighter concentrations due to consumer demand for greater longevity and perceived value. The rise of functional fragrances, which incorporate ingredients designed to offer specific cognitive or emotional benefits (e.g., improved sleep or focus), represents a cutting-edge segment trend. Distribution trends confirm the dominance of specialized beauty retailers and online platforms, although prestige department stores continue to serve as critical hubs for experiential browsing and high-touch customer service, vital for high-end luxury purchasing decisions.

AI Impact Analysis on Perfume and Fragrance Market

Analysis of common user questions regarding AI's impact on the Perfume and Fragrance Market reveals central themes revolving around customization, speed of innovation, and predictive analytics. Users frequently inquire about the feasibility and precision of AI-driven scent creation (e.g., "Can AI create a unique fragrance based on my personality data?"), and the practical implementation of virtual sampling technologies. There is significant concern about how AI will influence the role of human perfumers, with users questioning whether traditional artistry will be replaced by algorithms. Key expectations include personalized product recommendations generated through analyzing purchase history and social media sentiment, faster identification of emerging trend patterns (predictive forecasting), and optimization of supply chain logistics to reduce waste and delivery times. Furthermore, consumers are keen to understand how AI tools can enhance the online purchasing experience, bridging the sensory gap inherent in digital commerce, ensuring that the technology enhances, rather than diminishes, the luxury experience.

AI is fundamentally transforming the R&D phase by analyzing millions of data points, including chemical structures, odor profiles, and global consumer reviews, enabling the rapid design of novel molecular combinations. Algorithms can predict ingredient synergies, optimize stability, and reduce the time taken to bring a new formulation to market from years to months. This capability not only accelerates product development but also assists perfumers in navigating the vast chemical space efficiently, freeing them to focus on artistic refinement rather than iterative testing. Companies are leveraging machine learning to model consumer perception, allowing them to formulate fragrances that target specific emotional responses or demographic preferences with unprecedented accuracy, leading to more successful and localized product launches globally.

In the marketing and sales domain, AI-powered tools are revolutionizing customer interaction and personalization. Chatbots and virtual assistants offer guided fragrance discovery by asking preference-based questions and cross-referencing answers with a vast database of existing products. Predictive models anticipate seasonal and regional shifts in demand, enabling optimized inventory planning and minimizing stockouts or excess inventory, thereby increasing overall profitability. The use of augmented reality (AR) apps, often integrated with AI recognition capabilities, allows consumers to virtually visualize the aesthetic of a product or even simulate the scent experience through advanced haptic feedback technologies, greatly enhancing the conversion rate for online perfume sales.

- AI-driven personalized fragrance formulation based on biometric and demographic data.

- Predictive trend analysis forecasting future scent profiles and ingredient popularity.

- Optimization of complex chemical synthesis processes and raw material sourcing via machine learning.

- Enhanced supply chain efficiency, inventory management, and demand forecasting.

- Development of immersive Augmented Reality (AR) and Virtual Reality (VR) tools for digital scent sampling.

- Fraud detection and brand protection through AI-powered tracking of product authenticity across distribution channels.

- Automated customer service (chatbots) providing hyper-relevant product recommendations and purchase support.

DRO & Impact Forces Of Perfume and Fragrance Market

The Perfume and Fragrance Market is shaped by a powerful interplay of dynamic forces, encapsulated by Drivers, Restraints, and Opportunities (DRO). Key drivers include the escalating demand for premium and niche fragrances, spurred by increasing consumer purchasing power globally, particularly in emerging Asian markets where luxury consumption is rapidly standardizing. The strong cultural significance of gifting high-end perfumes also maintains consistent demand, while the pervasive influence of social media and beauty influencers rapidly disseminates new trends, creating instant demand spikes. The emphasis on clean beauty and natural ingredients is another significant driver, pushing manufacturers toward sustainable and transparent practices.

However, the market faces several restraining forces. The persistent threat of counterfeiting and unauthorized gray market activities severely impacts brand reputation and erodes legitimate profit margins, necessitating constant investment in security and anti-fraud technologies. Regulatory complexities regarding the use of certain chemicals and ingredients, particularly in the EU and North America, impose high compliance costs and force ongoing reformulation efforts. Furthermore, the volatility in the pricing and availability of natural raw materials, such as rare floral extracts or exotic wood oils, creates supply chain instability and pressure on manufacturing costs, requiring diversified sourcing strategies and technological alternatives like synthetic biology.

Opportunities for growth are vast, centered largely on technological integration and market expansion. The development of functional fragrances that offer tangible wellness benefits (e.g., sleep, mood regulation) presents a novel product category for differentiation. Geographical expansion into untapped Tier 2 and Tier 3 cities in APAC and Latin America offers significant revenue potential. Most importantly, the rapid adoption of D2C e-commerce models, coupled with AI-driven personalization tools, allows brands to connect directly with consumers, gather actionable data, and build lifelong loyalty. Sustainability initiatives, including the shift to refillable bottles and biodegradable packaging, also represent a major opportunity for brands to gain competitive advantage and appeal to environmentally conscious consumers.

Segmentation Analysis

The global Perfume and Fragrance Market is meticulously segmented based on product type, concentration, distribution channel, gender, and geographical region, reflecting the diverse landscape of consumer preferences and purchasing behaviors worldwide. Analyzing these segments is critical for manufacturers to tailor their product development, pricing strategies, and marketing campaigns accurately. The market shows a distinct premiumization trend, with consumers consistently opting for higher concentration levels like Eau de Parfum due to perceived better value and longevity. Geographic segmentation is vital, as cultural olfactory preferences differ dramatically—for instance, heavy spice and Oud notes dominate in the Middle East, while lighter, floral, and aquatic scents are often preferred in East Asia.

By product type, the market is categorized into Perfumes (high concentration), Deodorants, and others (body mists, aromatherapy oils). The Perfume segment holds the largest revenue share, driven by luxury gifting and self-indulgence trends. The distribution channel segmentation confirms the ongoing shift toward digital platforms, which offer convenience and access to global brands, although specialized beauty retailers remain crucial for the high-touch, sensory experience necessary for initial luxury fragrance trials. Understanding the intersection of gender and product type reveals the growing strength of the unisex or gender-neutral category, which resonates strongly with Gen Z and millennial consumers who prioritize individuality over traditional norms.

The segmentation based on price point—mass, premium, and luxury/niche—is increasingly important. While mass-market fragrances capitalize on volume and affordability, the premium and niche segments drive margin growth. Niche perfumery, characterized by unique ingredients, limited production, and artistic narratives, is capturing an expanding consumer base looking for exclusivity and sophisticated sensory experiences, often leveraging sustainable and transparent supply chains as a core differentiator. This layered segmentation provides a detailed map of consumer demand and future investment opportunities.

- By Product Type:

- Parfum (Extrait de Parfum)

- Eau de Parfum (EDP)

- Eau de Toilette (EDT)

- Eau de Cologne (EDC)

- Body Mists and Deodorants

- By End-User Gender:

- Male

- Female

- Unisex/Gender-Neutral

- By Distribution Channel:

- Specialty Retail Stores (e.g., Sephora, Ulta)

- Online Retail (E-commerce platforms and D2C brand websites)

- Hypermarkets/Supermarkets

- Department Stores and Duty-Free Outlets

- By Price Point:

- Mass Market

- Premium

- Niche/Artisanal

Value Chain Analysis For Perfume and Fragrance Market

The value chain for the Perfume and Fragrance Market is intricate, spanning from the highly specialized sourcing of raw materials (upstream) to complex global distribution networks (downstream). Upstream analysis involves the cultivation, harvesting, and extraction of natural ingredients (e.g., jasmine, patchouli, ambergris substitutes) alongside the industrial synthesis of aroma chemicals. This stage is characterized by high technological dependence, regulatory compliance requirements, and vulnerability to climatic conditions affecting natural yields. Key players in this phase include specialized chemical companies and essential oil producers who often partner directly with fragrance houses to ensure the quality and consistency of high-grade raw components, requiring rigorous quality control and traceability protocols, increasingly managed through digital ledger technologies like blockchain.

The midstream process focuses on formulation and manufacturing. Fragrance houses, employing master perfumers, blend these raw materials into complex concentrates. This process requires significant R&D investment and intellectual property protection for proprietary formulas. The concentrate is then mixed, aged, and filled into packaging components. Downstream activities involve global distribution, marketing, and sales. The distribution channel is diversified, employing both direct and indirect routes. Direct sales include branded flagship stores and the increasingly vital D2C e-commerce websites, allowing brands maximum control over pricing, consumer data, and brand narrative. Indirect channels include wholesale distribution through department stores, specialty beauty retailers, and travel retail (duty-free), which leverage established physical presence and high-foot-traffic locations.

The distribution network relies heavily on efficient global logistics due to the temperature sensitivity of many products and the high value of the inventory, demanding secure and swift transportation. The role of specialized beauty retailers (indirect channel) is crucial as they provide the crucial ‘try-before-you-buy’ experience and expert consultation, mitigating the high-risk nature of fragrance purchases. Conversely, online channels (direct and indirect) are optimized for convenience and range, utilizing advanced imagery and description techniques to compensate for the lack of physical sampling. The efficient integration of these channels—omnichannel strategy—is paramount for maximizing market reach and ensuring a seamless customer journey from digital discovery to physical purchase or delivery.

Perfume and Fragrance Market Potential Customers

Potential customers for the Perfume and Fragrance Market are exceptionally broad, encompassing virtually all age groups, genders, and socio-economic classes, though purchasing drivers and product preferences vary significantly across these demographic boundaries. The core consumer segment is the middle-to-high income adult population (25–55 years old) in developed regions (North America, Europe), who view fragrance as a daily necessity, a form of personal expression, and a luxury item for social signaling. Within this group, customers are often segmented by their loyalty to specific fragrance categories—designer, celebrity, or niche/artisan—with a growing preference for products offering transparent sourcing and sustainable attributes. These established consumers often drive repeat business and seek complex, long-lasting scent profiles.

A second, rapidly growing segment comprises younger consumers (Gen Z and Millennials, 16–30 years old), particularly those emerging into the middle class in APAC and Latin America. These customers are highly influenced by digital trends, celebrity endorsements, and social media platforms (TikTok, Instagram). They prioritize experimentation, affordability (driving demand for EDT and body mists), and gender-neutral options. Their purchasing decisions are often tied to fast-fashion cycles and the desire to possess a diverse 'scent wardrobe' for different occasions and moods. This group is also highly receptive to personalized digital marketing efforts and online shopping experiences, focusing on convenience and product novelty over traditional brand heritage.

Finally, the high-net-worth individual (HNWI) segment forms the basis for the ultra-luxury market, demanding exclusive, bespoke, or limited-edition Extrait de Parfum products. These customers value rarity, premium craftsmanship in packaging (e.g., crystal bottles, hand finishing), and direct, personalized service, often purchasing through high-end department stores or direct from luxury brand boutiques. Furthermore, large corporate buyers constitute potential B2B customers, purchasing fragrances for amenity kits (hotels, airlines) or private label branding, contributing a stable, albeit less visible, revenue stream to the overall market ecosystem. Effective marketing requires targeted strategies addressing the specific emotional drivers—status, self-expression, or experimentation—unique to each consumer cluster.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $55.8 Billion |

| Market Forecast in 2033 | $86.7 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | L'Oréal S.A., Coty Inc., Estée Lauder Companies Inc., Shiseido Co., Ltd., Puig S.L., Givaudan SA, Firmenich International SA, International Flavors & Fragrances (IFF), Chanel S.A., LVMH Moët Hennessy Louis Vuitton SE, Hermès International, Revlon, Interparfums, Kering, Procter & Gamble (P&G), Natura & Co., Rituals, Amouage, Creed, Jo Malone (Estée Lauder). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Perfume and Fragrance Market Key Technology Landscape

The Perfume and Fragrance Market is increasingly reliant on advanced technological adoption across the entire value chain, moving far beyond traditional artisanal methods. A critical area is scent reproduction and novelty: headspace technology is widely used to capture the scent profile of living flowers or environments without harvesting, allowing for the creation of precise, highly realistic fragrance accords. Furthermore, synthetic biology and green chemistry are paramount, enabling the sustainable production of rare or endangered natural molecules at industrial scale, significantly mitigating environmental impact and ensuring supply security against climate change variables. Specialized analytical instruments, such as Gas Chromatography-Mass Spectrometry (GC-MS), are essential for quality control, verifying the purity of raw materials, and reverse-engineering competitors' formulations, driving continuous innovation and market competitiveness.

Digital technologies are revolutionizing the consumer interface and supply logistics. The rise of Augmented Reality (AR) and Virtual Reality (VR) platforms is providing initial attempts at simulating the complex olfactory experience in a digital environment, often coupled with AI-driven preference mapping to guide product discovery. E-commerce platforms utilize sophisticated data analytics and machine learning algorithms for personalized marketing, targeted advertising, and highly accurate demand forecasting, which minimizes inventory waste. In the supply chain, blockchain technology is emerging as a powerful tool for ensuring end-to-end traceability and authenticity, crucial for protecting high-value luxury fragrances against counterfeiting and guaranteeing ethical sourcing compliance, thereby enhancing consumer trust in premium products.

Manufacturing efficiency is also being boosted by automation and IoT integration. Robotics are utilized in precise filling and packaging processes to maintain hygiene and reduce human error, especially critical for luxury goods requiring pristine presentation. Sustainable packaging technology involves developing lighter, refillable, or biodegradable materials, moving away from heavy glass and unsustainable plastics. Finally, functional ingredient technology, which incorporates elements that interact with neuroscience (e.g., enhancing mood or relaxation), is pushing the boundaries of what fragrances can achieve, transforming them from mere aesthetic products into functional wellness tools, supported by clinical studies and novel ingredient encapsulation technologies for controlled release.

Regional Highlights

The global Perfume and Fragrance Market exhibits significant regional variations in growth dynamics, consumer preferences, and market maturity, necessitating localized marketing and product strategies. North America and Europe remain the largest markets in terms of revenue, characterized by high consumer spending on prestige and niche brands, and a strong preference for sustainable and clean formulations. These regions are the primary drivers of the gender-neutral and artisanal fragrance movements, with significant market growth spurred by online retail penetration and sophisticated, experience-driven physical retail spaces. Regulatory shifts regarding ingredient safety and transparency are also predominantly led by these mature markets, setting global standards for ethical production.

Asia Pacific (APAC) is projected to be the fastest-growing region throughout the forecast period, driven by the expansion of the middle class, rapid urbanization, and increasing Western cultural influence on personal grooming habits, particularly in China, India, and Southeast Asia. Consumers in APAC, especially younger demographics, show high enthusiasm for high-end designer fragrances, viewing them as status symbols. However, regional specificities are crucial: East Asian markets often favor lighter, subtly scented products (EDT, body mists) compared to the heavier concentrations popular in Western markets. E-commerce is the preferred distribution channel in many parts of APAC due to dense populations and digital proficiency.

The Middle East and Africa (MEA) holds immense significance due to its cultural appreciation for intense, oil-based, and traditional scents, primarily centered on Oud, musk, and heavy florals. The consumption rate of luxury and ultra-niche fragrances per capita is among the highest globally, fueled by cultural practices like gifting during festivals and high disposable incomes in Gulf Cooperation Council (GCC) countries. Latin America (LATAM), while experiencing economic volatility, presents opportunities in mass and affordable premium segments, with Brazil and Mexico serving as key hubs. Consumption is generally high, driven by a strong focus on personal hygiene and large family sizes, often utilizing direct sales methods (e.g., network marketing) for distribution in localized markets.

- North America: Dominant market for premium and niche fragrance segments; strong focus on clean beauty, transparency, and D2C strategies.

- Europe: Hub for luxury heritage brands and artisanal perfumery; stringent regulations drive innovation in sustainable packaging and ingredient sourcing.

- Asia Pacific (APAC): Highest growth trajectory; increasing luxury demand in China and India; preference for lighter scents in East Asia; rapid e-commerce adoption.

- Middle East & Africa (MEA): High consumption of Oud and concentrated oil-based fragrances; significant luxury spending driven by cultural importance and status.

- Latin America (LATAM): High volume market driven by personal care focus; robust direct selling channels; key growth areas in affordable premium products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Perfume and Fragrance Market.- L'Oréal S.A.

- Coty Inc.

- Estée Lauder Companies Inc.

- Shiseido Co., Ltd.

- Puig S.L.

- Givaudan SA

- Firmenich International SA (now part of DSM-Firmenich)

- International Flavors & Fragrances (IFF)

- Chanel S.A.

- LVMH Moët Hennessy Louis Vuitton SE

- Hermès International

- Revlon

- Interparfums

- Kering

- Procter & Gamble (P&G)

- Natura & Co.

- Rituals Cosmetics

- Amouage

- Creed

- Jo Malone (Estée Lauder)

Frequently Asked Questions

Analyze common user questions about the Perfume and Fragrance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary growth driver for the global Perfume and Fragrance Market?

The primary growth driver is the rising disposable income and increasing consumer expenditure on luxury and personal grooming products, particularly in fast-developing economies such as China and India. Additionally, the growing consumer demand for personalized and niche fragrances significantly accelerates market expansion.

Which distribution channel is expected to dominate the fragrance market in the next five years?

Online retail (e-commerce and D2C brand websites) is projected to experience the fastest growth and potentially dominate the market due to its convenience, wide product variety, and enhanced digital tools like AI-driven personalization and virtual sampling, overcoming the limitations of physical retail.

How is sustainability impacting fragrance formulation and packaging?

Sustainability is driving a major shift towards clean label ingredients, ethical sourcing, and increased transparency regarding raw material origins. Packaging innovations focus on refillable bottles, recycled materials, and biodegradable components to minimize environmental footprint, appealing directly to eco-conscious consumers.

What role does Artificial Intelligence (AI) play in modern perfumery?

AI is used extensively in R&D to analyze vast chemical data, predict successful scent combinations, and accelerate formulation time. It is also crucial in marketing for hyper-personalization, recommending products based on consumer behavior, and optimizing supply chain logistics and demand forecasting.

Why are gender-neutral fragrances becoming increasingly popular?

Gender-neutral fragrances appeal strongly to younger generations (Gen Z) who reject traditional marketing binaries and value individuality and self-expression. This segment focuses on unique, complex scent profiles rather than adherence to traditional masculine or feminine categorizations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager