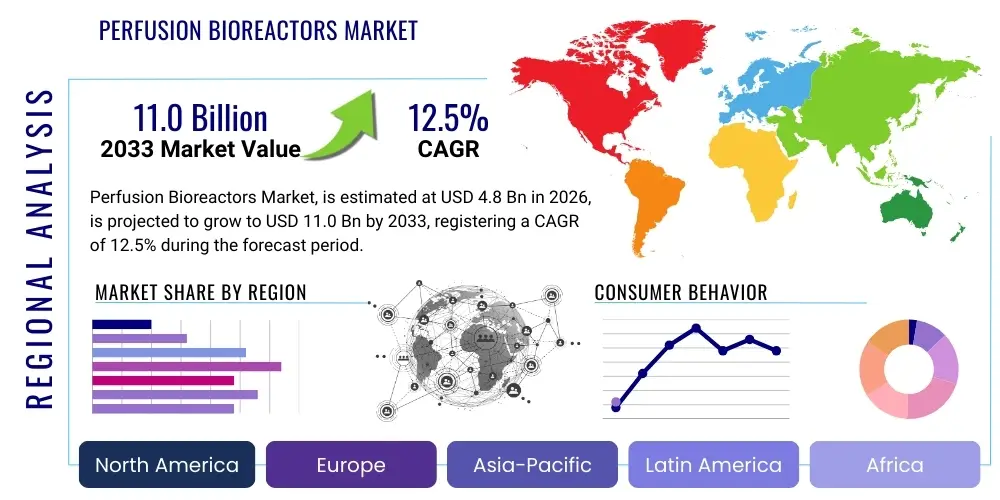

Perfusion Bioreactors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437422 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Perfusion Bioreactors Market Size

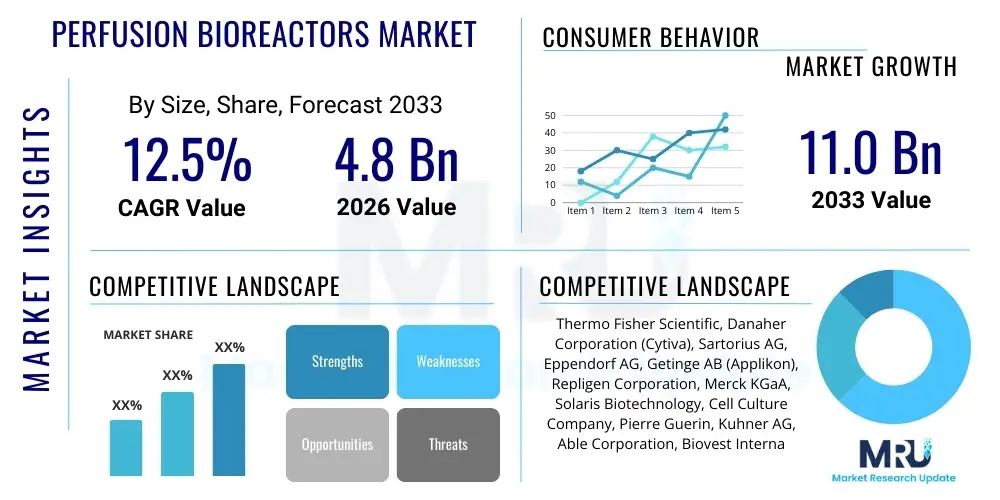

The Perfusion Bioreactors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 11.0 Billion by the end of the forecast period in 2033.

Perfusion Bioreactors Market introduction

Perfusion bioreactors represent a critical technology within the biopharmaceutical manufacturing landscape, enabling the continuous feeding of nutrients and removal of spent medium, thereby sustaining high cell viability and achieving significantly increased cell densities compared to traditional batch or fed-batch systems. This technology is foundational for intensifying upstream bioprocessing, particularly in the production of monoclonal antibodies (mAbs), recombinant proteins, and advanced therapies like cell and gene therapies. The core benefit lies in maintaining a stable, optimized cellular environment over extended periods, leading to higher volumetric productivity and reduced physical footprint requirements in manufacturing facilities. The necessity for reliable, high-yield biomanufacturing solutions drives the adoption of these sophisticated systems across global pharmaceutical and biotechnology sectors.

The primary applications of perfusion bioreactors span large-scale commercial production and research and development activities. In commercial settings, they are indispensable for continuous biomanufacturing, allowing manufacturers to streamline processes, reduce costs associated with frequent harvesting, and ensure consistent product quality. Beyond traditional protein therapeutics, perfusion systems are increasingly vital for scaling up production of viral vectors required for gene therapy, where maintaining stable, high-density mammalian or insect cell cultures is paramount. This expansion into advanced therapy medicinal products (ATMPs) signifies a major growth vector for the market, requiring specialized perfusion devices capable of handling shear-sensitive cell lines and complex media exchange strategies.

Driving factors for this market include the global surge in demand for biologics, particularly biosimilars and novel mAb therapeutics, coupled with a strong industry push towards process intensification (PI) and continuous manufacturing (CM) paradigms mandated by regulatory bodies like the FDA and EMA. Perfusion bioreactors offer substantial economic benefits, including reduced capital expenditure (CapEx) through smaller equipment size and lower operating expenditure (OpEx) due to enhanced material utilization. Furthermore, technological innovations in cell retention devices—such as tangential flow filtration (TFF), acoustic separators, and alternating tangential flow (ATF) systems—have significantly improved the reliability and scalability of perfusion operations, overcoming historical challenges related to fouling and cell viability.

Perfusion Bioreactors Market Executive Summary

The global Perfusion Bioreactors Market is experiencing robust expansion, fundamentally driven by the pharmaceutical industry’s transition toward continuous processing to enhance manufacturing efficiency and responsiveness. Current business trends indicate a strong preference for single-use, disposable perfusion systems, which mitigate cross-contamination risks and significantly reduce turnaround times compared to stainless steel counterparts. Strategic alliances and mergers between bioreactor manufacturers and bioprocess technology providers are common, aimed at developing fully integrated, automated continuous bioprocessing platforms. The market is also witnessing increased investment in flexible, modular facilities designed specifically to accommodate continuous manufacturing setups, reinforcing the shift away from legacy batch processing infrastructures.

Segment trends reveal that the use of Alternating Tangential Flow (ATF) systems remains dominant due to their gentleness on fragile cells and proven ability to achieve extremely high cell densities. However, emerging technologies, particularly intensified continuous centrifugation and advanced acoustic separation methods, are gaining traction, especially in specialized cell culture applications like exosome production and cell therapy manufacturing. By volume, the market for 100L to 500L perfusion bioreactors is the fastest-growing segment, reflecting the sweet spot for intensified clinical and early commercial production where high titers are prioritized without necessitating massive bioreactor scale-up, often facilitating a 'N-1' seed train strategy.

Regionally, North America maintains the largest market share, benefiting from a high concentration of leading biopharmaceutical companies, extensive R&D spending, and supportive regulatory frameworks promoting continuous manufacturing adoption. Nevertheless, the Asia Pacific (APAC) region is projected to exhibit the highest CAGR during the forecast period, fueled by rapid growth in the Chinese and Indian biopharma sectors, increasing government investment in domestic biologics production capabilities, and the establishment of new contract development and manufacturing organizations (CDMOs) focused on efficiency. Europe continues to be a crucial market, particularly due to early adoption of continuous bioprocessing technologies driven by established biotechnology clusters in countries such as Germany, Switzerland, and Ireland.

AI Impact Analysis on Perfusion Bioreactors Market

User inquiries regarding AI's influence on the Perfusion Bioreactors Market predominantly revolve around achieving process optimization, predictive maintenance, and enhanced quality control. Users seek information on how AI algorithms can interpret complex, multivariate data streams generated by continuous perfusion systems (e.g., cell density, glucose concentration, waste product accumulation, flow rates) to dynamically adjust operational parameters in real-time. Key themes include the implementation of Digital Twins for simulating and optimizing bioprocess performance before physical deployment, the use of Machine Learning (ML) to predict potential system fouling or cell stress events, and the ultimate expectation that AI integration will significantly reduce batch-to-batch variability and accelerate regulatory approval processes for continuous manufacturing facilities.

- AI facilitates real-time monitoring and predictive analytics of bioreactor critical process parameters (CPPs), ensuring optimal cellular environment.

- Machine Learning models enhance yield forecasting and enable dynamic, automated control adjustments of feed rates and bleed volume based on cell metabolism.

- Implementation of Digital Twins allows for complex bioprocess simulation and optimization, reducing physical experimentation time and cost.

- AI-driven image analysis improves monitoring of cell morphology and viability within the high-density environment characteristic of perfusion culture.

- Predictive maintenance schedules for pumps, sensors, and cell retention devices are generated by AI, minimizing unplanned downtime and equipment failure risk.

- Advanced statistical process control (SPC) using AI ensures superior product quality consistency in continuous biomanufacturing workflows.

DRO & Impact Forces Of Perfusion Bioreactors Market

The market dynamics for perfusion bioreactors are shaped by a powerful confluence of drivers, constraints, and inherent opportunities. The primary driver is the demonstrable cost reduction and productivity enhancement achieved through process intensification, which is rapidly becoming the industry standard for high-volume biologics production. Coupled with this is the accelerating demand for high-titer monoclonal antibodies and the complexity inherent in manufacturing novel cell and gene therapies, which often mandate perfusion techniques. However, the market faces significant restraints, notably the high initial capital investment required for implementing sophisticated continuous manufacturing facilities and the stringent regulatory hurdles associated with transitioning from established batch processes to novel continuous workflows, which necessitate comprehensive process understanding and robust validation data.

Significant opportunities arise from the increasing adoption of disposable/single-use perfusion systems, which streamline operations and offer flexibility to CDMOs, thereby democratizing access to continuous manufacturing technologies. Furthermore, the expansion of the biosimilars market globally provides a massive opportunity, as manufacturers seek highly efficient, low-cost production methods to compete effectively. The impact forces are characterized by high substitution threat from advanced fed-batch technologies that have achieved very high titers (e.g., N-stage intensified fed-batch), balanced against the strong bargaining power of large biopharma buyers who demand integrated, scalable solutions. Technological innovation, particularly in integrated sensor technology and miniaturization, acts as a pivotal force driving market evolution.

The shift towards localized, decentralized manufacturing models, often involving smaller-scale, intensified continuous bioreactors, presents a structural opportunity. This model is particularly relevant for specialized therapies where personalized or regional production is economically advantageous. Overcoming the knowledge gap and ensuring workforce training in continuous bioprocessing remain critical challenges that industry leaders must address to fully realize the market’s potential. Ultimately, the relentless pressure on biopharma companies to improve time-to-market and reduce the cost of goods sold (COGS) ensures that the development and adoption of high-performance perfusion systems will continue unabated, defining the trajectory of upstream biomanufacturing.

Segmentation Analysis

The Perfusion Bioreactors Market is comprehensively segmented based on various technical and commercial parameters, allowing for detailed strategic analysis. Key segmentation criteria include the specific technology used for cell retention (which is the technical heart of any perfusion system), the scale or volume of the bioreactor, the material used in construction (stainless steel versus single-use disposables), and the specific type of application (R&D, clinical, or commercial production). Understanding these segments is crucial as different end-users have distinct needs; for instance, academia often prefers smaller, stainless steel bench-top units, while commercial manufacturers prioritize large-scale, single-use ATF systems for maximum productivity and flexibility.

The volume segmentation, particularly focusing on systems above 500 liters, reflects the shift towards truly large-scale continuous production, challenging the traditional necessity for massive 10,000L batch reactors. The dominance of single-use consumables is transforming the supply chain, creating specific demands for high-quality, pre-sterilized bags and associated flow paths engineered for extended, continuous operation. Furthermore, the segmentation by end-user highlights the increasing importance of CDMOs as major procurers of perfusion technology, leveraging their specialized expertise to offer intensified manufacturing solutions to numerous biopharma clients globally, thereby fueling market growth through centralized adoption hubs.

- By Retention Technology: Alternating Tangential Flow (ATF), Tangential Flow Filtration (TFF), Centrifugation, Acoustic Separation, Gravity Settling.

- By Type of Material: Stainless Steel Bioreactors, Single-Use Bioreactors (SUBs).

- By Volume: Benchtop Scale (<10L), Pilot Scale (10L – 100L), Commercial Scale (100L – 500L), Large Commercial Scale (>500L).

- By Application: Monoclonal Antibody Production, Vaccines Production, Recombinant Protein Production, Cell and Gene Therapy Manufacturing.

- By End User: Pharmaceutical and Biotechnology Companies, Contract Development and Manufacturing Organizations (CDMOs), Academic and Research Institutes.

Value Chain Analysis For Perfusion Bioreactors Market

The value chain for the Perfusion Bioreactors Market begins upstream with raw material suppliers, predominantly focusing on specialized polymers for single-use bags, high-grade stainless steel for traditional systems, and advanced sensor components. Upstream activities also include the development and manufacturing of critical ancillary components, such as high-precision pumps (peristaltic or diaphragm), specialized filtration membranes, and complex automated control systems. The quality and reliability of these components are paramount, especially given the extended operational periods and high cell densities involved in perfusion culture, requiring material stability and robustness under continuous stress. Innovation in membrane pore size and fouling resistance drives competitive advantage at this stage.

The core manufacturing stage involves the assembly, integration, and sterilization of the complete bioreactor system, encompassing the vessel (stainless steel or single-use), the retention device (e.g., ATF or TFF systems), and the sophisticated control software. Distribution channels are typically a mix of direct sales forces utilized by major established players and specialized indirect distributors or channel partners, particularly in emerging markets where localized technical support is necessary. The direct channel allows for deep customer engagement and customization, which is often required for high-capital equipment like large perfusion systems, while indirect channels facilitate broader market penetration and efficient logistics for consumables.

Downstream activities center on the end-users—biopharmaceutical companies and CDMOs—who utilize the perfusion bioreactors for the actual production of biologics. This phase includes process development, optimization, scaling, and eventual commercial manufacturing. Support services, including validation, ongoing technical support, maintenance, and training in continuous bioprocessing, form a critical part of the value proposition, ensuring high system uptime and compliance with regulatory requirements. The feedback loop from downstream users back to manufacturers regarding system performance, scalability, and ease of cleaning or disposal constantly drives incremental improvements in bioreactor design and automation capabilities.

Perfusion Bioreactors Market Potential Customers

The primary consumers and end-users of perfusion bioreactors are organizations deeply vested in the large-scale, cost-effective, and accelerated production of complex biological molecules and advanced therapies. Global pharmaceutical and major biotechnology corporations constitute the largest customer base, particularly those focused on developing and manufacturing blockbuster monoclonal antibodies and biosimilars, where continuous processing offers significant economic advantages by lowering COGS. These companies seek fully integrated, compliant systems capable of operating reliably for months.

Contract Development and Manufacturing Organizations (CDMOs) represent the fastest-growing customer segment. CDMOs leverage perfusion technology as a competitive differentiator, offering specialized, intensified production services to clients ranging from virtual biotechs to large pharma needing overflow capacity. Their buying decisions are heavily influenced by system flexibility, rapid turnover capabilities (facilitated by single-use technology), and proven track records in high-density perfusion culture, which are essential for servicing multiple clients and diverse product portfolios efficiently.

Academic institutions and government-funded research laboratories also constitute important customers, albeit typically for smaller, benchtop or pilot-scale systems. They utilize perfusion bioreactors primarily for process understanding, cell line development, optimization studies, and early-stage drug discovery. Furthermore, emerging companies focused on novel therapeutics, such as engineered cell lines for personalized medicine or next-generation vaccines, increasingly adopt perfusion systems due to the inherent scalability and control necessary for these highly complex, often volume-sensitive products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 11.0 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Danaher Corporation (Cytiva), Sartorius AG, Eppendorf AG, Getinge AB (Applikon), Repligen Corporation, Merck KGaA, Solaris Biotechnology, Cell Culture Company, Pierre Guerin, Kuhner AG, Able Corporation, Biovest International, Infors HT, Esco Group, ZETA Group, Bionet, Shanghai Bailun Biotechnology, Hanmi Science (Hanmi Pharm), Corning Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Perfusion Bioreactors Market Key Technology Landscape

The technological landscape of the Perfusion Bioreactors Market is characterized by intense competition among various cell retention methodologies, each striving for maximum efficiency, scalability, and minimal shear stress on cultured cells. The most prevalent technology remains Alternating Tangential Flow (ATF), favored for its gentle, low-shear operation achieved through diaphragm pumping that cycles media across a hollow fiber membrane, thereby minimizing membrane fouling and maintaining exceptional cell viability even at densities exceeding 100 million cells/mL. Parallel to ATF, Tangential Flow Filtration (TFF) systems are widely used, particularly in applications where cost or footprint is a major consideration, although TFF typically requires more sophisticated control over transmembrane pressure to prevent fouling at extremely high densities.

Emerging technologies are continuously challenging the ATF/TFF dominance. Acoustic separation, utilizing ultrasonic waves to gently separate cells from the medium without requiring physical membranes, represents a significant advancement for highly shear-sensitive cultures, such as those used in gene therapy vector production. This membrane-less approach fundamentally addresses the persistent issues of membrane fouling, cleaning validation (in stainless steel systems), and consumable costs associated with hollow fibers. Furthermore, advancements in integrated sensing and control systems—incorporating sophisticated spectroscopic probes (e.g., Raman or near-infrared) and multivariate data analysis—are crucial, moving perfusion operations toward truly autonomous control.

A key disruptive trend is the integration of these technologies into single-use platforms. Single-use perfusion bioreactor systems, incorporating disposable manifolds, bioreactor bags, and integrated single-use retention devices, simplify validation, reduce facility dependence on Clean-in-Place (CIP) and Steam-in-Place (SIP) infrastructure, and greatly accelerate batch turnaround times. This shift towards disposables not only impacts the manufacturing hardware but also necessitates continued innovation in robust, leachables/extractables-free polymer science capable of withstanding prolonged contact with biological media at production scales up to 1,000 liters, thereby establishing a critical link between material science and bioprocess engineering success.

The convergence of advanced computational fluid dynamics (CFD) modeling with physical bioreactor design is also refining system performance, particularly concerning mixing efficiency and gas transfer kinetics within high-density cultures. CFD simulations allow manufacturers to optimize impeller geometry and sparger design, mitigating potential localized stresses or suboptimal nutrient distribution, which are magnified in high-volume, continuous systems. This theoretical optimization is vital for transferring perfusion processes smoothly from pilot scale to commercial scale (scale-up). Moreover, the development of continuous cell separation technologies, specifically continuous centrifugation systems adapted for bioprocessing, offers an alternative for high throughput harvest following the perfusion stage, further enhancing end-to-end continuous flow.

Finally, the proliferation of modular and containerized continuous manufacturing facilities is driven directly by perfusion technology. These facilities leverage the small footprint and high productivity of perfusion systems, allowing biomanufacturers to establish geographically decentralized or "point-of-care" production sites. This necessitates bioreactor systems that are not only high-performing but also robust, portable, and easily integrated into automated, compact, Grade C or D environments, pushing technology providers to develop highly integrated, skid-mounted perfusion units that minimize external connections and complexity. This holistic approach, merging technology and facility design, defines the future direction of biomanufacturing infrastructure.

Regional Highlights

Regional dynamics play a significant role in the adoption and growth trajectory of the Perfusion Bioreactors Market, reflecting differences in regulatory environments, R&D intensity, and local manufacturing capacity. North America, specifically the United States, commands the largest share due to its pioneering role in biopharmaceutical innovation and the presence of major global market players and regulatory leadership in promoting advanced manufacturing techniques. The high concentration of biotech startups and venture capital funding fuels continuous investment in novel bioprocess technologies, ensuring early and widespread adoption of the latest perfusion systems, particularly in the critical domain of cell and gene therapy manufacturing.

Europe represents the second-largest market, characterized by strong biotechnology clusters in countries like Germany, the UK, and Switzerland. Regulatory bodies like the European Medicines Agency (EMA) are actively engaged in supporting continuous manufacturing initiatives, providing a favorable ecosystem for deployment. European manufacturers often exhibit a balanced adoption strategy, maintaining significant stainless steel capacity while simultaneously investing in sophisticated single-use perfusion setups, reflecting a diverse historical installed base coupled with a drive towards modernization and sustainability in bioproduction processes.

Asia Pacific (APAC) is slated to be the fastest-growing region, driven primarily by accelerating biopharmaceutical output in China, India, and South Korea. Government initiatives aimed at establishing self-sufficient domestic biologics production, coupled with massive infrastructure investments by local CDMOs, are creating substantial demand for process intensification tools like perfusion bioreactors. This region shows a strong preference for single-use systems to quickly establish flexible capacity without the heavy initial CapEx and validation burdens associated with large stainless steel facilities, positioning APAC as a crucial future market for high-volume consumables.

- North America (NA): Market leader due to extensive R&D spending, robust regulatory support for continuous manufacturing, and dominance in cell and gene therapy development.

- Europe: Strong uptake driven by established biopharma industry, supportive EMA policies, and early adoption of hybrid (stainless steel and single-use) continuous systems in nations like Ireland and Germany.

- Asia Pacific (APAC): Highest projected CAGR, propelled by rapid growth in China and India's biopharma sectors, infrastructure expansion, and heavy investment by domestic CDMOs utilizing single-use perfusion systems.

- Latin America (LATAM): Emerging market focused primarily on vaccine and biosimilar production, with increasing adoption of pilot-scale perfusion systems to improve efficiency and reduce dependence on imports.

- Middle East and Africa (MEA): Limited but growing market, driven by governmental efforts in specific countries (e.g., Israel, UAE) to establish local pharmaceutical manufacturing capabilities and reduce reliance on global supply chains.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Perfusion Bioreactors Market.- Thermo Fisher Scientific Inc.

- Danaher Corporation (Cytiva)

- Sartorius AG

- Repligen Corporation

- Eppendorf AG

- Merck KGaA

- Getinge AB (Applikon Biotechnology)

- Solaris Biotechnology S.r.l.

- Kuhner AG

- Infors HT

- Pierre Guerin

- Able Corporation

- Biovest International, Inc.

- Shanghai Bailun Biotechnology Co., Ltd.

- Corning Incorporated

- Esco Group

- ZETA Group

- Bionet

- Hanmi Science (Hanmi Pharm)

- Cell Culture Company

Frequently Asked Questions

Analyze common user questions about the Perfusion Bioreactors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using perfusion bioreactors over traditional fed-batch systems?

Perfusion bioreactors enable continuous feeding and waste removal, resulting in significantly higher viable cell densities (VCD) and substantially increased volumetric productivity, which ultimately reduces the manufacturing footprint and cost of goods sold (COGS) for biologics.

Which cell retention technology is currently the most widely adopted in commercial perfusion processes?

Alternating Tangential Flow (ATF) systems are the most commonly adopted retention technology due to their low-shear operating mechanism, reliability in achieving high VCDs, and efficiency in minimizing membrane fouling across various cell lines.

How does the shift to single-use perfusion systems impact manufacturing flexibility?

Single-use systems dramatically increase manufacturing flexibility by eliminating the need for time-consuming cleaning and sterilization (CIP/SIP) procedures, reducing cross-contamination risks, and allowing for rapid turnaround and simplified facility design, beneficial for multi-product facilities like CDMOs.

What key challenges must be overcome for widespread adoption of perfusion technology?

Key challenges include the high initial capital investment required for continuous manufacturing infrastructure, the complexity and cost of regulatory validation for continuous processes, and the necessity for specialized operator training in sophisticated bioprocess control.

What is the role of perfusion bioreactors in the manufacturing of cell and gene therapies?

Perfusion bioreactors are crucial for cell and gene therapy manufacturing as they provide a highly controlled, stable environment necessary for the long-term culture of sensitive cell lines and for producing high titers of viral vectors, minimizing product degradation and maximizing yield.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager