Perm Fixing Agent Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434719 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Perm Fixing Agent Market Size

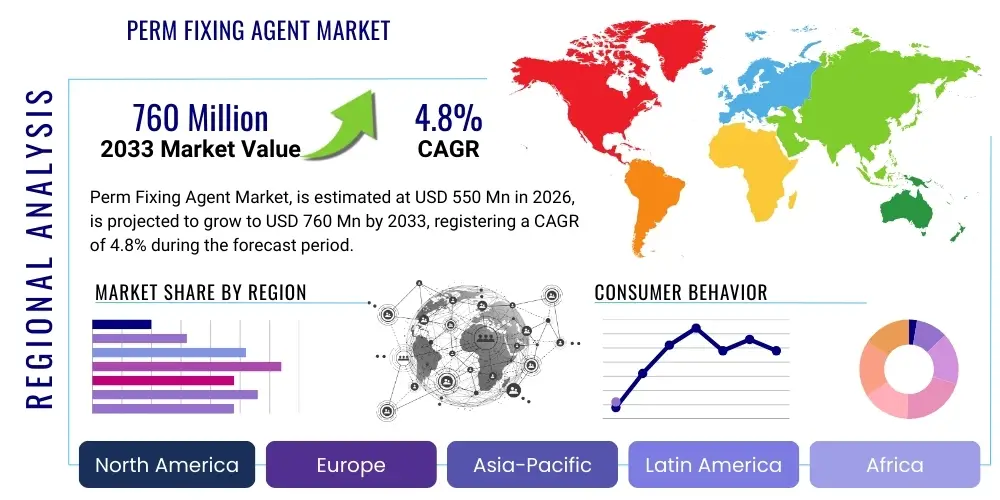

The Perm Fixing Agent Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 760 Million by the end of the forecast period in 2033. This growth is primarily driven by the resurgence of vintage hairstyles, increasing consumer demand for long-lasting hair treatments, and continuous innovation in formulation chemistry aimed at minimizing hair damage while maximizing style retention. The shift towards milder, safer fixing agents, such as non-toxic bromate-based solutions and specialized polymer systems, is broadening the application base beyond traditional chemical perms to include hybrid styling and texture modification services.

Perm Fixing Agent Market introduction

Perm fixing agents, critical components in hair waving and perming processes, are chemical solutions applied after the waving agent to neutralize the hair structure and lock the new curl pattern permanently. These agents, primarily categorized as oxidizers like hydrogen peroxide or sodium bromate, function by reforming the disulfide bonds within the hair keratin, thereby setting the desired shape. The market encompasses a range of products tailored for professional salon use and retail consumer applications, varying significantly in concentration, pH level, and integrated conditioning components. Major applications include permanent waving, body waves, and specialty texturizing treatments in both developed and emerging economies. The market is fundamentally driven by high consumer spending on professional beauty services, the persistent trend of personalized hair styling, and the demonstrable benefits of perm fixing agents in achieving durable, defined textural changes that necessitate low daily maintenance compared to heat styling.

Perm Fixing Agent Market Executive Summary

The Perm Fixing Agent Market demonstrates robust expansion, fueled by structural business trends focusing on sustainable and low-damage formulations, specifically incorporating keratin complexes and botanical extracts to enhance hair health during the chemical process. Regional trends indicate that Asia Pacific (APAC) remains the dominant consumer base due to strong cultural acceptance of elaborate hair treatments and rapid salon modernization, while North America and Europe prioritize premium, cruelty-free, and ethically sourced ingredient profiles. Segment trends highlight significant growth in the professional salon segment, driven by advanced training and the introduction of specialized fixing systems designed for different hair types (e.g., color-treated, fine, or coarse hair). Furthermore, the retail segment is benefiting from user-friendly, at-home perm kits targeting younger demographics seeking temporary or semi-permanent texture modifications, thereby increasing overall market penetration and revenue streams across diverse socioeconomic groups.

AI Impact Analysis on Perm Fixing Agent Market

User queries regarding AI's influence typically revolve around how artificial intelligence can optimize inventory management in salons, predict emerging style trends that dictate demand for fixing agents, and, most importantly, personalize chemical formulations based on individual hair profiles analyzed via machine vision or diagnostic apps. Consumers are interested in predictive modeling to avoid chemical over-processing, which traditionally leads to hair damage. The underlying expectation is that AI will enhance product efficacy, reduce waste by optimizing application parameters, and eventually lead to automated or semi-automated diagnostics within smart mirrors or handheld devices used by professional stylists, ensuring precise selection and dosage of the fixing agent for maximum results and safety. This shift emphasizes efficiency, customization, and predictive safety in chemical hair treatments.

- AI-driven supply chain optimization reduces inventory holding costs for specialized fixing agents and ensures timely delivery to salons.

- Predictive analytics based on social media trends and regional climate data help manufacturers forecast demand for specific perm styles, influencing production cycles.

- AI-powered diagnostic tools assess hair porosity, existing damage, and chemical history, recommending the exact concentration and processing time for fixing agents.

- Machine learning algorithms assist R&D by simulating chemical interactions, accelerating the development of safer, more effective fixing agent formulations.

- Chatbots and virtual assistants provide professional stylists with instant troubleshooting guidance related to fixing agent application and unexpected chemical reactions.

DRO & Impact Forces Of Perm Fixing Agent Market

The Perm Fixing Agent Market is significantly driven by the robust demand for professional, long-lasting hair texturizing services and continuous R&D focusing on mild, damage-reducing formulations, positioning safety and performance as core consumer expectations. Restraints primarily involve stringent regulatory hurdles regarding chemical safety, particularly concerning ingredients like sodium bromate in certain regions, coupled with the ongoing consumer education challenge related to the potential for chemical damage if products are misused at home. Opportunities lie in the expansion of high-end, customizable perm systems targeting specific demographic groups (e.g., men's grooming, ethnic hair care) and capitalizing on the demand for hybrid treatments that combine perming with conditioning. The key impact forces include intense competition driving down product differentiation solely based on price, the powerful influence of social media trends rapidly popularizing new perm styles, and shifting global regulatory environments that necessitate frequent product reformulation and retesting to maintain market access and consumer trust in product safety.

Segmentation Analysis

The Perm Fixing Agent Market is meticulously segmented based on the chemical composition of the active agent, its intended application channel, and the specific hair type targeted. Understanding these segmentations is crucial for manufacturers to tailor their product offerings, focusing R&D on high-growth niches such as mild, alkaline-free fixatives or specialized formulas compatible with color-treated hair. The primary segmentation by product type—oxidizing agents versus conditioning neutralizers—determines the chemical profile and overall treatment effect, while segmentation by end-user (professional vs. consumer) defines packaging, volume requirements, and accompanying instructions, directly influencing market distribution strategies and pricing architectures globally.

- By Product Type

- Bromates (Sodium Bromate, Potassium Bromate)

- Peroxides (Hydrogen Peroxide)

- Polymer-based Neutralizers

- Thio-based Fixatives (Less common, but used in certain specialty systems)

- By End-User

- Professional Salon Use

- At-Home Consumer Use (DIY Kits)

- By Application

- Cold Perming

- Digital Perming (Heat Assisted)

- Specialty Texturizing

- By Distribution Channel

- Professional Beauty Supply Stores

- E-commerce Platforms

- Retail Drug Stores and Supermarkets

- Direct Sales to Salons

Value Chain Analysis For Perm Fixing Agent Market

The value chain for the Perm Fixing Agent Market commences with the upstream sourcing of key chemical raw materials, notably specialized oxidizing agents like sodium bromate and hydrogen peroxide, along with conditioning polymers, emulsifiers, and fragrances. This initial stage is characterized by stringent quality control and dependence on chemical manufacturers that adhere to cosmetic-grade purity standards. The middle stage involves specialized formulation and manufacturing, where blending, quality testing, and packaging occur. Differentiation at this stage often relies on proprietary stabilizing technologies and the incorporation of premium conditioning ingredients, such as botanical extracts or hydrolyzed proteins, which mitigate the drying effects inherent in the chemical fixing process.

The downstream segment encompasses distribution and marketing, where products move from manufacturing facilities to various sales channels. For professional use products, distribution relies heavily on specialized beauty supply wholesalers and direct sales forces that maintain strong relationships with high-volume salon chains. These channels provide necessary training and technical support to stylists, which is critical given the complexity of chemical treatments. Conversely, consumer-grade kits are predominantly channeled through high-volume retail, supermarkets, and increasingly, high-traffic e-commerce platforms, requiring substantial investment in consumer-friendly packaging and clear, instructional documentation.

Direct distribution often provides higher margins and tighter control over brand messaging, typically utilized by premium brands targeting elite professional salons. Indirect channels, though offering broader market reach, introduce complexity through multiple intermediaries, potentially diluting brand image or increasing logistical overhead. The ultimate value delivery is achieved when the fixing agent successfully delivers the promised long-lasting, uniform curl pattern without causing unacceptable levels of hair damage, necessitating robust clinical testing and clear communication throughout the distribution network to maintain consumer and professional confidence in product performance.

Perm Fixing Agent Market Potential Customers

The primary customer base for perm fixing agents is broadly divided into two distinct groups: professional hair salons and the end consumer utilizing at-home kits. Professional salons, including independent stylists, national chains, and high-end spas, represent the largest and most valuable segment, characterized by high-volume purchases of specialized, concentrated formulations. These professional customers require comprehensive product knowledge, bulk packaging options, and reliability, as the fixing agent's performance directly impacts the reputation and service quality of the salon. Their purchasing decisions are heavily influenced by technical efficacy, safety certifications, and manufacturer support in addressing complex hair chemistry challenges.

The second major group, individual consumers, primarily purchases DIY perm kits through retail and online channels. This segment is characterized by price sensitivity, ease-of-use requirements, and a preference for all-in-one solutions that minimize the need for specialized tools or expertise. While their usage frequency is lower than professional clients, the sheer size of the consumer base drives demand for highly standardized, safe-to-use formulas with integrated conditioning steps. Furthermore, niche customers such as theatrical studios and cosmetology schools also form a smaller but significant customer segment, demanding products suitable for training and highly specific performance needs.

Emerging potential customer groups include mobile stylists and specialized texture modification clinics, particularly those focusing on complex ethnic hair types that require customized fixing processes due to unique disulfide bond structures. Manufacturers are increasingly recognizing the need to develop product lines specifically addressing the chemistry and conditioning needs of diverse hair textures, moving beyond standardized "one-size-fits-all" approaches. The evolution of personalized beauty regimens, supported by consumer data and technological diagnostics, means that future customers will demand hyper-specific fixing agents tailored down to the individual strand level, driving innovation in micro-dosage packaging and customized formulation blending services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 760 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | L'Oréal S.A., Henkel AG & Co. KGaA, Kao Corporation, Shiseido Company, Limited, The Procter & Gamble Company, Wella Company, Zotos International Inc., HOYU Co., Ltd., Unilever PLC, Giesse Cosmetics, Milbon Co., Ltd., Schwarzkopf Professional (Henkel), Estée Lauder Companies Inc., Coty Inc., Reuzel, Phyto Specific, Aveda (Estée Lauder), Goldwell (Kao), Paimore Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Perm Fixing Agent Market Key Technology Landscape

The technology landscape of the Perm Fixing Agent Market is undergoing a subtle but continuous evolution, moving away from harsh, high-pH chemical systems towards sophisticated, multi-functional formulations designed for optimal hair integrity. A primary technological focus involves enhancing the delivery system of the oxidizing agent. Encapsulation technologies are being explored to ensure gradual, controlled release of the fixative (e.g., bromates or peroxides), which minimizes oxidative stress and heat generation during the fixing process, leading to a smoother cuticle layer and reduced frizz. Furthermore, innovations in polymer chemistry are introducing specialized conditioning polymers that form a protective film around the hair shaft, reinforcing the hair structure simultaneously as the disulfide bonds are reformed.

Another crucial area of technological advancement is the development of next-generation neutralizing agents that work effectively across various perming techniques, including traditional cold perms and newer digital (heat-assisted) perms. Digital perms, which utilize heat to enhance and lock the curl, require fixatives capable of tolerating and synergizing with thermal processes without compromising bond formation or causing thermal damage. Manufacturers are investing in low-pH neutralizers and fixatives enriched with amino acids and lipid complexes, which help restore the hair's natural moisture balance and structural integrity immediately following the intense chemical restructuring phase. This technological integration aims to deliver superior curl longevity coupled with improved shine and softness, directly addressing core consumer pain points.

The push for safer, environmentally friendly ingredients is driving research into bio-based alternatives and non-toxic neutralizers, although traditional chemicals remain dominant due to cost-effectiveness and proven efficacy. Advanced analytical techniques, such as mass spectrometry and electron microscopy, are being increasingly utilized in R&D to precisely map the interaction between the fixing agents and the hair keratin structure at a molecular level. This precise understanding allows formulators to fine-tune the chemical kinetics, ensuring maximum bond reformation efficiency while strictly controlling the potential for over-oxidation, which is a major cause of post-perm damage. The future landscape is expected to feature fixing agents fully integrated into smart systems that monitor application conditions in real-time.

Regional Highlights

The global market for perm fixing agents exhibits significant regional variations in terms of consumption volume, preferred product types, and technological adoption. Asia Pacific (APAC) stands as the undisputed market leader, primarily driven by countries such as South Korea, Japan, and China, where permanent texturizing services are deeply integrated into beauty culture. This region demonstrates high demand for sophisticated digital perm systems and associated specialized heat-setting fixatives. The rapid urbanization, increasing disposable income, and the strong influence of K-beauty trends emphasizing sleek, controlled waves contribute substantially to APAC's dominance. Manufacturers in this region often prioritize innovations that offer high definition and compatibility with frequently color-treated hair, catering to a chemically sophisticated consumer base.

North America and Europe represent mature markets characterized by a strong demand for premium, ethical, and organic-certified fixing agents. Consumers and professional salons in these regions prioritize ingredient transparency, demanding cruelty-free, sulfate-free, and minimal-chemical formulations. While overall consumption volume might be slightly lower than APAC, the Average Selling Price (ASP) of products is significantly higher due to the premium positioning of brands focusing on natural conditioning additives and sustainable packaging. Regulatory stringency, particularly in the European Union (EU), dictates continuous product reformulation to comply with evolving ingredient restrictions, maintaining a highly innovative but regulated market environment.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging as high-growth potential regions. LATAM's market expansion is fueled by a large youth demographic keen on embracing new style trends and a growing professional salon sector seeking high-performance products for coarse and challenging hair textures prevalent in the region. The MEA market, while smaller, is experiencing growth linked to increasing consumer awareness of professional salon services and the gradual replacement of traditional, often damaging, hair straightening methods with modern perming and relaxing alternatives. These regions present substantial opportunities for international manufacturers willing to adapt their marketing and product stability to suit high-humidity and diverse climate conditions.

- Asia Pacific (APAC): Dominant market share due to high consumer acceptance of permanent styling; leadership in digital perm technology and high consumption in South Korea and Japan.

- North America (NA): High ASP market driven by demand for ethical, clean-label, and professional-grade fixing agents; strong focus on DIY kits in the retail sector.

- Europe (EU): Strict regulatory environment necessitates constant reformulation; premium market segment focusing on sustainability, botanical ingredients, and salon exclusivity.

- Latin America (LATAM): Emerging market with rapid growth potential fueled by young consumers and increasing professionalization of salon services targeting diverse hair types.

- Middle East & Africa (MEA): Growth driven by urbanization and rising disposable incomes leading to higher expenditure on professional hair texturizing treatments and imported premium brands.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Perm Fixing Agent Market.- L'Oréal S.A.

- Henkel AG & Co. KGaA

- Kao Corporation

- Shiseido Company, Limited

- The Procter & Gamble Company

- Wella Company

- Zotos International Inc.

- HOYU Co., Ltd.

- Unilever PLC

- Giesse Cosmetics

- Milbon Co., Ltd.

- Schwarzkopf Professional (Henkel)

- Estée Lauder Companies Inc.

- Coty Inc.

- Reuzel

- Phyto Specific

- Aveda (Estée Lauder)

- Goldwell (Kao)

- Paimore Co., Ltd.

- TIGI International (Unilever)

Frequently Asked Questions

Analyze common user questions about the Perm Fixing Agent market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a perm fixing agent?

The primary function of a perm fixing agent, often called a neutralizer, is to rapidly stop the chemical reaction initiated by the waving lotion and reform the disulfide bonds in the hair keratin. This process locks the hair into the new curl or wave pattern, making the texture modification permanent and durable.

How do bromate-based fixing agents compare to peroxide-based fixing agents?

Bromate-based fixatives (e.g., sodium bromate) are generally considered milder and slower acting than peroxide-based fixatives (hydrogen peroxide). Bromates offer a more gradual and controlled fixation process, often resulting in less immediate oxidative stress, although regulatory concerns limit their use in some regions.

Which market segment currently drives the highest demand for perm fixing agents?

The Professional Salon Use segment currently drives the highest demand. Salons purchase concentrated, specialized formulas in bulk, relying on high-performance products to deliver reliable, high-quality texturizing services essential for maintaining their professional reputation and client retention.

Are perm fixing agents safe for use on color-treated hair?

Yes, but compatibility is crucial. Modern perm fixing agents are increasingly formulated to be color-safe, often containing protective polymers and lower pH levels. Professional stylists must select specialized fixatives designed specifically for color-treated or damaged hair to prevent color stripping and excessive breakage.

What major regulatory challenge impacts the Perm Fixing Agent Market?

The key regulatory challenge involves the safety assessment and restriction of certain ingredients, particularly sodium bromate, which is banned in some major markets (like the EU) due to health concerns. This forces manufacturers to invest heavily in R&D for safe, equally effective alternative oxidizing agents to maintain global market compliance.

What is the main driver of innovation in perm fixing agent technology?

The main driver of innovation is the consumer and professional demand for reduced hair damage and enhanced conditioning. Technology focuses on developing slow-release encapsulation systems and incorporating structural components like keratin and amino acids into the fixative to maintain hair health during the chemical restructuring process.

How does the shift to digital perming techniques affect fixative formulation?

Digital perming uses heat, requiring fixative formulations that are stable under elevated temperatures and are optimized to work synergistically with thermal activation. This often means developing fixatives with better heat tolerance and incorporating ingredients that maximize the longevity and definition of heat-set curls.

Why is the Asia Pacific region the leading consumer of perm fixing agents?

The Asia Pacific region leads consumption due to strong cultural trends favoring highly styled and permanent textural hair changes, particularly in countries like South Korea and Japan. High disposable income and rapid adoption of advanced techniques like digital perming also significantly boost market volume.

What role does e-commerce play in the distribution of perm fixing agents?

E-commerce plays a vital role, especially in the At-Home Consumer Use segment, providing broad access to DIY perm kits and specialty products. It also serves as an efficient channel for professional suppliers to distribute low-volume, specialized chemical products directly to independent stylists.

What are the key upstream components in the value chain of this market?

Key upstream components include the procurement of cosmetic-grade chemical raw materials such as oxidizing salts (bromates, peroxides), stabilizing agents, specialized conditioning polymers, and high-purity solvents required for manufacturing the final liquid or cream fixative product.

How do AI analytics benefit the Perm Fixing Agent supply chain?

AI analytics optimize the supply chain by predicting style trend shifts and regional demand fluctuations, allowing manufacturers to adjust inventory levels and production schedules precisely. This minimizes stockouts of high-demand formulas and reduces waste associated with overproduction of slower-moving products.

What is the current estimated CAGR for the Perm Fixing Agent Market?

The market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 4.8% between the years 2026 and 2033, indicating steady growth driven by premiumization and technological advancements in product safety and efficacy.

What is a significant restraint hindering market growth in developed economies?

A significant restraint is the high potential for chemical damage and consumer reluctance due to past negative experiences or concerns about chemical exposure, which necessitates expensive safety testing, strict labeling, and comprehensive professional training to overcome.

How is the market segment of 'Thio-based Fixatives' evolving?

Thio-based fixatives are generally less common today for standard neutralization but are evolving in specialized, two-step systems, often used in specific relaxing or texturizing treatments where a highly structured bond reformation is required, moving toward gentler, lower-odor derivatives.

What customer requirement dictates the high pricing of products in the European market?

The stringent requirement for ingredient transparency, ethical sourcing, sustainable packaging, and compliance with the EU's comprehensive list of restricted substances necessitates higher manufacturing costs, leading to a higher Average Selling Price (ASP) for European consumers and salons.

In the Value Chain, what differentiates direct distribution from indirect distribution?

Direct distribution, usually to professional salons, provides greater margin control and allows manufacturers to directly manage brand messaging and technical education. Indirect distribution, via wholesalers and retailers, offers broader market penetration but may increase complexity and potential brand dilution.

What opportunity exists in targeting specific hair types in the market?

A major opportunity lies in developing hyper-customized perm fixing systems tailored explicitly for complex hair textures, such as fine, coarse, or heavily bleached hair, as well as specific ethnic hair types, which require specialized chemical balances to achieve desired results without damage.

Which technological advancement helps in minimizing oxidative stress during fixation?

Encapsulation technology is a key advancement, enabling the controlled, gradual release of the oxidizing agent. This steady process minimizes the instantaneous chemical shock and excessive oxidative stress on the hair structure, promoting healthier post-perm results.

How do social media trends function as an impact force in this market?

Social media trends rapidly popularize specific perm styles (e.g., specific Korean wave styles), creating sudden spikes in professional service bookings and subsequent demand for the specialized fixing agents required to achieve those exact textural outcomes, forcing rapid inventory adaptation.

What are the estimated market size values for 2026 and 2033?

The market size is estimated at USD 550 Million in the base year 2026 and is projected to reach USD 760 Million by the end of the forecast period in 2033, reflecting consistent growth in the global hair care industry.

What type of training is essential for professional customers using perm fixing agents?

Essential training includes detailed instruction on hair diagnostic techniques, precise product mixing and application methods, correct processing timing based on hair type, and emergency procedures for handling adverse chemical reactions, ensuring client safety and optimal results.

Besides salons, who are the niche potential customers in this market?

Niche potential customers include cosmetology training institutions that require educational quantities of products, specialized theatrical and film studios needing texturizing for wigs and actors, and advanced trichology clinics focused on specialized hair treatments.

How does AI contribute to product development in this sector?

AI assists product development by running complex simulations of chemical interactions with various hair proteins. This accelerates the R&D cycle, allowing chemists to predict the efficacy and safety profile of new formulations without extensive, time-consuming lab testing.

What is the significance of polymer-based neutralizers in modern perm kits?

Polymer-based neutralizers are increasingly significant because they often include conditioning agents that not only neutralize the perm solution but also impart strength and shine, offering a less damaging, two-in-one treatment solution highly valued by both professionals and retail consumers.

Which region shows significant potential for growth in the adoption of professional services?

Latin America (LATAM) shows significant potential for growth due to increasing economic stability, which facilitates higher expenditure on professional grooming services and the subsequent adoption of high-performance perm fixing systems by regional salons.

What is the primary concern for end-users of at-home perm kits?

The primary concern for at-home end-users is misuse, which often results in uneven curls or severe hair damage. Manufacturers address this by providing extremely clear, standardized, and highly simplified instructions, often supported by video tutorials.

How do manufacturers ensure product quality in the mid-stage of the value chain?

Manufacturers ensure product quality through rigorous batch testing, microbial contamination checks, and stability assessments. They verify that the active oxidizing agent remains effective and stable throughout the designated shelf life and under various temperature conditions.

What is the impact of low-pH neutralizers on the hair structure?

Low-pH neutralizers help in effectively closing the hair cuticle quickly after the chemical restructuring. This minimizes damage, locks in moisture, and contributes significantly to the final shine and smooth texture of the permed hair, reducing post-treatment frizz.

Which major company holds a strong portfolio across multiple segmentations?

Companies like L'Oréal and Henkel hold strong positions across multiple segmentations, offering premium products for professional salon use (e.g., Schwarzkopf, L'Oréal Professionnel) and accessible DIY kits for the consumer retail market, leveraging global distribution networks.

What is the core distinction between cold perming and digital perming applications?

Cold perming relies solely on chemical reaction for bond reformation, while digital perming incorporates controlled heat application to accelerate and set the perm structure. Digital perms typically result in looser, more natural-looking waves compared to the tight curls often achieved with cold perms.

How does the demand for conditioning additives affect product pricing?

The inclusion of premium conditioning additives, such as hydrolyzed proteins, botanical extracts, or specialized oils, increases the cost of raw materials and R&D, directly contributing to the higher retail price of premium, low-damage perm fixing agents compared to basic chemical formulations.

What factor is driving the professional salon segment's growth?

The professional salon segment's growth is driven by the increasing complexity of specialized texturizing techniques and the consumer preference for customized, guaranteed results that require professional expertise and high-quality, high-concentration products not available in retail stores.

Why is effective technical support crucial in the downstream distribution process?

Effective technical support is crucial because chemical hair services involve complexity; stylists often need immediate guidance on handling various hair conditions, mixing ratios, and trouble-shooting unexpected chemical results. This support ensures proper product usage and client satisfaction.

What defines the market landscape in terms of competition?

The market landscape is defined by intense competition between multinational giants and specialized chemical manufacturers, with competition focusing heavily on proprietary, damage-minimizing formulation patents, brand loyalty among professional stylists, and distribution efficiency.

How does the packaging of perm fixing agents vary by end-user?

Professional products are typically sold in large, utilitarian bulk bottles or concentrated containers requiring precise measurement, while at-home consumer kits feature smaller, single-use containers with clearly marked, pre-measured components designed for foolproof application.

What is the key benefit of achieving durable, defined textural changes?

The key benefit is reduced daily styling effort for the consumer, as the hair maintains the desired shape through washing and drying cycles, making the investment in a permanent treatment highly attractive from a convenience and maintenance perspective.

Which historical timeframe is covered in the market analysis?

The historical timeframe covered in the market analysis spans from 2019 to 2024, providing a crucial basis for understanding pre-pandemic and post-pandemic market dynamics and trends leading up to the base year.

How significant is the influence of men's grooming trends on this market?

Men's grooming is an increasingly significant niche, with rising demand for subtle body waves or texturizing perms to enhance volume and styling versatility. This drives specific demand for smaller product sizes and specialized fixatives tailored for shorter hair lengths.

What factor contributes to Asia Pacific's high adoption of digital perm systems?

High adoption is driven by consumer preference for the results of digital perms—large, defined, and natural-looking waves. This preference subsequently boosts the market for the heat-tolerant, high-performance fixing agents necessary for these sophisticated techniques.

What strategic move do companies use to mitigate regulatory restraints?

Companies strategically invest in diversifying their formulation portfolio, ensuring they have robust, high-performance alternatives (such as polymer-based systems or specific peroxide derivatives) ready for launch in regions where traditional chemical ingredients face bans or severe restrictions.

How is the market leveraging diagnostic apps in AI integration?

Diagnostic apps use AI to analyze high-resolution images of a client's hair, determining porosity, moisture level, and existing damage. This analysis generates precise recommendations for the stylist regarding the optimal type and strength of the perm fixing agent needed for safe application.

Why are non-toxic bromate solutions gaining traction?

Non-toxic bromate solutions are gaining traction as manufacturers refine their purification processes, offering the controlled efficacy of bromates while addressing health concerns, providing a balanced solution that minimizes damage compared to stronger oxidizers.

What role does the base year 2025 play in the forecast?

The base year 2025 serves as the reference point for calculating the projected Compound Annual Growth Rate (CAGR) and establishing the initial market value from which the forecast period (2026-2033) extrapolates future market performance and revenue projections.

What are the implications of the shift towards permanent texture modifications?

The shift implies consistent demand for perm fixing agents, as these treatments require professional products to maintain the longevity of the style for several months, driving repeat business for both salons and manufacturers of high-quality fixatives.

How does intense competition impact product differentiation in the market?

Intense competition compels companies to differentiate beyond basic price points, focusing on proprietary innovations such as integrated bond-building technology, superior fragrance profiles, or unique dispensing mechanisms to justify premium pricing and capture market share.

What type of products are included under the 'Specialty Texturizing' application segment?

Specialty texturizing includes partial perms, root lifts, specific wave patterns for styling ease, and specialized treatments designed for highly specific hair types or conditions that fall outside standard full-head cold or digital perms.

Why is R&D investment in stabilizing technologies critical for manufacturers?

Investment in stabilizing technologies is critical to ensure the chemical components (the oxidizers) remain potent and non-volatile over their shelf life, especially when combined with conditioning agents, thereby guaranteeing consistent efficacy and safety when the product is used by the end-user.

What market trend supports the growth of retail drug stores as a distribution channel?

The increasing consumer interest in accessible, budget-friendly beauty solutions supports the growth of retail drug stores and supermarkets as channels for distributing user-friendly, all-inclusive DIY at-home perm kits targeting mass market consumers.

What is the main difference in product needs between fine and coarse hair?

Fine hair requires milder, often buffered fixatives that avoid weighing down the delicate strands, while coarse hair typically needs stronger, higher-concentration fixatives to effectively penetrate the tougher cuticle and successfully reform the robust disulfide bonds.

What defines the market opportunity in the Middle East and Africa (MEA)?

The opportunity in MEA is defined by the growing urbanization, resulting in greater access to professional salons, and the shift from traditional hair care methods toward modern, high-quality chemical texturizing services provided by international brands.

How does the value chain address the need for ongoing education for stylists?

The value chain addresses this through the downstream segment, where manufacturers and specialized distributors provide technical seminars, online courses, and direct product support to stylists, ensuring they are proficient in the application and chemistry of complex fixing agents.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager