Perovskite Solar Cells Module Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433904 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Perovskite Solar Cells Module Market Size

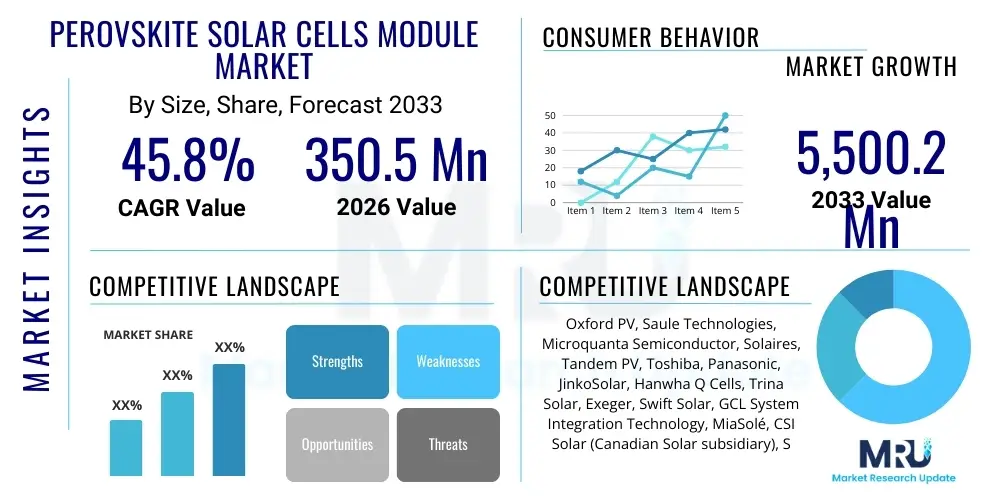

The Perovskite Solar Cells Module Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 45.8% between 2026 and 2033. The market is estimated at USD 350.5 Million in 2026 and is projected to reach USD 5,500.2 Million by the end of the forecast period in 2033.

Perovskite Solar Cells Module Market introduction

The Perovskite Solar Cells Module Market encompasses the development, manufacturing, and commercialization of photovoltaic devices utilizing perovskite structured compounds as the primary light-harvesting layer. Perovskites, generally hybrid organic-inorganic lead or tin halide materials, offer unprecedented advantages over traditional silicon, notably their exceptional potential for high power conversion efficiency (PCE) achieved through low-cost, solution-processing techniques such as roll-to-roll printing or coating. This emerging technology is rapidly transitioning from laboratory research to pilot production, promising a revolution in the solar energy sector by drastically reducing material consumption and manufacturing complexity, thereby lowering the Levelized Cost of Electricity (LCOE).

Perovskite solar cell modules are characterized by their lightweight nature, inherent flexibility, and strong performance under diffuse light conditions, making them ideal for a wide array of specialized applications beyond conventional solar farms. Major applications include integration into building materials (BIPV), powering portable electronic devices, enhancing efficiency in tandem solar configurations, and providing power solutions for aerospace and drone technology. The thin-film nature of these modules facilitates integration into unconventional surfaces, unlocking new market segments previously inaccessible to rigid silicon panels. The product description emphasizes high efficiencies (approaching or exceeding 30% in tandem architectures), tunable bandgaps for optimized light absorption, and a simplified manufacturing footprint.

Driving factors fueling this market include stringent global decarbonization mandates, substantial increases in government and private R&D funding aimed at energy transition technologies, and the compelling cost-reduction potential offered by solution processing methods. The primary benefit remains the promise of delivering highly efficient, extremely low-cost solar electricity quickly and scalably. However, long-term commercial viability hinges critically on overcoming material instability issues related to moisture, heat, and UV exposure, which are the current focal points of research and engineering efforts across the industry.

Perovskite Solar Cells Module Market Executive Summary

The Perovskite Solar Cells Module Market is poised for exponential growth driven by technological breakthroughs in stability and the successful scale-up of manufacturing processes. Business trends indicate a shift toward strategic partnerships between perovskite innovators and established silicon solar manufacturers, primarily focusing on commercializing high-efficiency tandem cell architectures. Significant venture capital and strategic investments are pouring into pilot lines and demonstration projects, signaling strong market confidence in resolving the remaining durability challenges. Furthermore, the market is witnessing robust patent filing activity, particularly focused on encapsulation techniques, defect passivation, and lead mitigation strategies, establishing a dynamic competitive landscape centered around intellectual property superiority and manufacturing yield optimization.

Regionally, Asia Pacific (APAC), particularly China and South Korea, is projected to dominate production capacity due to existing robust photovoltaic supply chains and aggressive national renewable energy targets. Europe, driven by stringent energy efficiency regulations and strong R&D ecosystems (especially in the UK, Germany, and Switzerland), leads in advanced perovskite research, encapsulation technology, and niche BIPV applications. North America is emerging as a critical region for deployment and innovation in tandem technology and space-based applications, supported by favorable government policies and large private sector research initiatives.

Segment trends highlight the rapidly increasing importance of the Tandem Solar Cells segment, which leverages perovskites' high efficiency potential to boost the performance of incumbent silicon technology, representing the shortest path to widespread commercial adoption. Simultaneously, the Flexible Perovskite segment is gaining traction, driven by demand from the Consumer Electronics and Building Integrated Photovoltaics (BIPV) sectors, which value lightweight and aesthetic integration over traditional rigid panels. The industrial application segment, focusing on utility-scale deployment, remains highly sensitive to cost and long-term reliability metrics, driving the demand for robust encapsulation solutions and certified lifetime data.

AI Impact Analysis on Perovskite Solar Cells Module Market

User questions related to the impact of Artificial Intelligence (AI) frequently center on how machine learning accelerates materials discovery, optimizes manufacturing processes, and predicts long-term device performance and stability. Common concerns revolve around the ethical deployment of AI in material selection and whether AI can definitively solve the inherent instability problems faster than traditional scientific methods. Users are highly interested in AI’s capability to screen millions of potential perovskite compositions and dopants virtually, thereby drastically reducing laboratory time. The consensus expectation is that AI will be transformative, moving the industry past empirical trial-and-error toward highly predictive, data-driven design and quality control, ensuring commercial modules meet stringent durability standards necessary for 25-year warranties.

- AI accelerates the discovery of novel, stable perovskite compositions and interfaces through high-throughput virtual screening and predictive modeling, significantly reducing R&D cycles.

- Machine learning algorithms optimize manufacturing parameters (e.g., coating speed, annealing temperature, solvent composition) in solution-processing techniques like roll-to-roll printing, improving yield and uniformity.

- AI-driven sensor data analysis enables real-time quality control during production, identifying defects at the nanoscale and ensuring consistent module quality for commercialization.

- Predictive maintenance and degradation modeling use AI to forecast the long-term operational lifespan and performance stability of installed perovskite modules under various environmental stressors (heat, humidity, UV).

- Generative AI assists in designing specialized encapsulation materials and device architectures optimized for moisture and oxygen exclusion, directly addressing the key hurdle of long-term reliability.

DRO & Impact Forces Of Perovskite Solar Cells Module Market

The market dynamics are defined by the immense potential of perovskites (Drivers) counterbalanced by significant material science and commercialization hurdles (Restraints), while favorable policy landscapes and application niches create clear avenues for expansion (Opportunities). The primary driving forces include the unparalleled potential for high efficiency coupled with low manufacturing costs, positioning perovskites to undercut conventional silicon solar panels on LCOE once stability is assured. Restraints are predominantly centered on the lack of standardized long-term reliability data, the persistence of lead toxicity concerns in some formulations (though alternatives are emerging), and the requirement for substantial capital investment to transition from lab-scale prototypes to certified, gigawatt-scale manufacturing facilities. Opportunities lie specifically in the rapid commercialization of tandem cells, leveraging the existing silicon infrastructure, and penetrating emerging markets such as BIPV and portable electronics that require lightweight, flexible power solutions. These factors create strong internal competitive pressures and external regulatory challenges that collectively shape the market’s trajectory.

The impact forces currently exerting the most influence are the rapidly decreasing cost of key precursors and improved scaling techniques, which are making pilot production economically feasible. However, the most critical impact force remains governmental regulation and certification standards. Regulatory bodies require decades of proven stability, and until industry leaders can demonstrate reliable operation under real-world conditions for 10-15 years, widespread utility-scale adoption will be constrained. The push towards lead-free perovskite variants, driven by public perception and environmental regulations, also serves as a significant force, compelling research efforts toward tin-based or bismuth-based compounds, albeit often at the expense of initial efficiency.

Furthermore, the competitive dynamic between dedicated perovskite startups and established PV giants who are integrating perovskite research internally acts as a powerful market impact force. Startups typically innovate rapidly in composition and architecture, while large corporations provide the necessary engineering expertise and supply chain credibility required for mass production. This collaboration-competition model is accelerating the market maturity, turning scientific findings into commercially viable products. The speed at which large-scale, high-throughput encapsulation methods are perfected will ultimately determine the rate of market penetration against established PV technologies.

Segmentation Analysis

The Perovskite Solar Cells Module Market is broadly segmented based on how the technology is implemented (Product Type), its intended final use (Application), and the ultimate consumer type (End Use). This segmentation reflects the versatility of perovskite materials, which can be adapted to various formats ranging from rigid, high-efficiency tandem cells to flexible, aesthetic films. The segmentation analysis is crucial for understanding specific growth pockets, as market drivers and restraints vary significantly between the high-value BIPV segment which prioritizes aesthetics and flexibility, and the utility-scale segment which demands maximum durability and lowest cost per watt.

The most lucrative segment currently centers around Tandem Solar Cells, as this configuration offers the clearest path to exceeding the theoretical limits of silicon efficiency (Shockley-Queisser limit) and leverages existing manufacturing infrastructure, thus reducing commercialization risks. Conversely, the market for Flexible Perovskite Solar Cells, while smaller in volume today, promises high-margin growth in niche applications like smart textiles and integrated electronics due to unique form-factor advantages. Understanding these distinct segment characteristics allows stakeholders to tailor their product development and market entry strategies efficiently.

- Product Type: Flexible Perovskite Solar Cells, Rigid Perovskite Solar Cells, Tandem Solar Cells (Perovskite-Silicon, Perovskite-Perovskite).

- Application: Building Integrated Photovoltaics (BIPV), Consumer Electronics, Utility-Scale Solar Farms, Portable Power Devices, Space Applications, Automotive Solar Integration.

- End Use: Residential, Commercial, Industrial, Utility.

Value Chain Analysis For Perovskite Solar Cells Module Market

The value chain for the Perovskite Solar Cells Module Market begins with the highly specialized upstream analysis involving the sourcing and purification of precursor materials, primarily lead halides, organic cations, and specialized solvents. This phase is characterized by stringent quality control requirements, as the purity of these materials directly dictates the efficiency and stability of the final perovskite film. Key suppliers in the upstream segment are typically fine chemical manufacturers and specialty material producers who provide research-grade and industrial-grade precursors. Due to the rapid evolution of perovskite chemistry, the relationships between precursor suppliers and cell manufacturers are currently characterized by intensive collaboration to scale custom material production while maintaining purity and cost efficiency, ensuring a stable and traceable supply of highly specific chemical compounds.

The core manufacturing stage involves module fabrication, including thin-film deposition (e.g., solution processing, evaporation), encapsulation, and final module assembly. This stage demands sophisticated equipment, especially for roll-to-roll or high-throughput coating systems, and highly specialized expertise in minimizing moisture and oxygen exposure during processing. Direct distribution channels are prominent in the early market phase, particularly for BIPV and high-value niche applications, where manufacturers work directly with system integrators or specialized contractors to ensure proper installation and customized product fit. Indirect channels, involving standard solar distributors and utility procurement contracts, are anticipated to grow significantly once the technology achieves mass production and standardized reliability certifications, leveraging established photovoltaic distribution networks for wider market reach.

Downstream activities focus on system integration, installation, and long-term operations and maintenance (O&M). Unlike traditional solar, the O&M phase for perovskite modules will initially require greater scrutiny due to ongoing concerns regarding long-term degradation mechanisms. Potential customers include utility companies investing in next-generation solar farms, major construction firms adopting BIPV solutions, and consumer electronics manufacturers seeking flexible, high-power charging solutions. The value chain is currently highly fragmented and research-intensive, with significant intellectual property control residing in the fabrication stage. As the market matures, consolidation among material suppliers and the establishment of robust, standardized assembly and installation procedures will be critical for achieving economies of scale and widespread market acceptance.

Perovskite Solar Cells Module Market Potential Customers

The potential customers for Perovskite Solar Cells Module technology span across multiple high-growth and niche sectors, reflecting the product’s versatility in terms of efficiency, weight, and form factor. Utility companies represent a massive potential customer base, particularly for tandem silicon-perovskite modules, as they prioritize achieving the lowest possible Levelized Cost of Electricity (LCOE) through efficiency gains and low capital expenditure. Their buying decisions are governed by established long-term performance warranties and regulatory compliance, making them early adopters only when reliability metrics are fully proven and bankable.

The Building Integrated Photovoltaics (BIPV) sector, encompassing architects, large construction firms, and commercial property developers, forms another crucial customer segment. These buyers value aesthetic integration, flexibility, and lightweight characteristics, allowing solar generation to be seamlessly incorporated into facades, roofing materials, and windows. For BIPV applications, perovskite’s ability to be manufactured semi-transparently or in custom colors provides a distinct competitive edge over traditional opaque silicon panels, catering to the growing demand for visually appealing, energy-generating infrastructure.

Additionally, manufacturers of Consumer Electronics (wearables, IoT sensors, portable chargers) and specialized aerospace/defense contractors are high-value niche customers. For these segments, the high power-to-weight ratio and flexibility of perovskite cells are paramount. Drones, remote sensing equipment, and military portable power solutions require energy sources that are significantly lighter and more adaptable than current alternatives, positioning perovskites as a premium component in these high-tech markets where high efficiency justifies the current premium pricing associated with early-stage, specialized manufacturing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Million |

| Market Forecast in 2033 | USD 5,500.2 Million |

| Growth Rate | 45.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Oxford PV, Saule Technologies, Microquanta Semiconductor, Solaires, Tandem PV, Toshiba, Panasonic, JinkoSolar, Hanwha Q Cells, Trina Solar, Exeger, Swift Solar, GCL System Integration Technology, MiaSolé, CSI Solar (Canadian Solar subsidiary), SunDrive, Solliance, EPFL spin-offs, Helioce, Energy Materials Corporation, Ossiarc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Perovskite Solar Cells Module Market Key Technology Landscape

The core technology landscape in the Perovskite Solar Cells Module market revolves around thin-film deposition methods designed for high throughput and scalability, paired with innovative material engineering to enhance stability. The dominant deposition technologies currently under intense commercial development include solution processing techniques such as slot-die coating and blade coating, which are inherently compatible with roll-to-roll manufacturing, enabling ultra-low-cost, high-speed production. Vacuum deposition methods, such as thermal evaporation, are also employed, particularly for ensuring highly uniform layers essential for high-efficiency tandem cell interfaces. The choice of deposition technique often depends on the specific end product: solution processing favors flexible and low-cost applications, while vacuum methods are sometimes preferred for high-performance, rigid tandem cells where precise interface control is critical.

A secondary, but increasingly vital, technological area is encapsulation and stabilization. This involves the development of specialized barrier films, polymer composites, and interface engineering techniques (like adding passivation layers or doping) to protect the moisture-sensitive perovskite layer from environmental degradation. Breakthroughs in this area, specifically highly effective moisture barriers that maintain transparency and flexibility, are critical determinants of commercial viability. Manufacturers are heavily investing in robust hermetic sealing technologies that can sustain module integrity over a 25-year lifetime, matching the expected industry standard for silicon PV. Furthermore, technological advancements in scaling up the module size while maintaining uniformity and efficiency are paramount; techniques addressing variations in large-area film deposition are key competitive differentiators.

The technological landscape is also characterized by intense research into tandem architectures, where perovskite acts as a wide-bandgap top cell absorbing high-energy photons, while a silicon or CIGS bottom cell captures lower-energy photons. This approach requires sophisticated interface technology to electrically connect the two sub-cells efficiently without incurring optical or resistive losses. The development of transparent conductive electrodes (TCEs) that are flexible, highly conductive, and stable under processing conditions is another critical technological hurdle. Innovations in materials science, particularly in substituting or mitigating lead content (e.g., using tin-based perovskites or employing lead scavenging layers), are also reshaping the technological focus due to long-term regulatory and environmental pressures.

Regional Highlights

- Asia Pacific (APAC): APAC is the global manufacturing hub for photovoltaic technology and is expected to lead the deployment and mass production of perovskite modules, particularly in China and South Korea. China's established supply chain infrastructure, coupled with immense governmental support for renewable energy technology, positions it as the primary scaling region. South Korea and Japan focus intensely on high-end applications like BIPV and specialized flexible electronics, leveraging advanced materials research and precision manufacturing capabilities.

- Europe: Europe is the core innovation driver, specializing in fundamental research, advanced stability solutions, and the initial commercialization of BIPV products. Countries like the UK (Oxford PV), Germany, and Switzerland host major research institutions and startups focused on solving the stability and lifetime challenges. European regulations, emphasizing building sustainability and green energy standards, create a high-value, early-adoption market for aesthetically integrated solar solutions.

- North America: North America, particularly the United States, demonstrates high demand for high-efficiency tandem cells and applications in the defense and aerospace sectors due to large R&D budgets and a focus on maximizing energy density. Significant private venture capital and public funding from organizations like the Department of Energy are accelerating domestic manufacturing capacity, focusing on high-performance materials and advanced manufacturing automation.

- Latin America, Middle East, and Africa (LAMEA): These regions represent long-term growth opportunities driven by increasing energy access demands and high solar irradiance levels. Adoption will initially be slower, dependent on demonstrated long-term module reliability and the transfer of low-cost manufacturing expertise from APAC. High utility-scale solar demand, particularly in the Middle East, suggests these regions will become major consumption markets once certification hurdles are cleared.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Perovskite Solar Cells Module Market.- Oxford PV

- Saule Technologies

- Microquanta Semiconductor

- Solaires

- Tandem PV

- Toshiba

- Panasonic

- JinkoSolar

- Hanwha Q Cells

- Trina Solar

- Exeger

- Swift Solar

- GCL System Integration Technology

- MiaSolé

- CSI Solar (Canadian Solar subsidiary)

- SunDrive

- Solliance

- EPFL spin-offs

- Helioce

- Energy Materials Corporation

- Ossiarc

Frequently Asked Questions

Analyze common user questions about the Perovskite Solar Cells Module market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary challenge hindering the widespread commercial adoption of perovskite solar cells?

The primary challenge is long-term stability and reliability. Perovskite materials are highly sensitive to moisture, oxygen, and heat, which leads to rapid degradation. Industry focus is intensely dedicated to developing robust, cost-effective encapsulation techniques that can guarantee a 25-year operational lifespan comparable to traditional silicon modules.

How do perovskite tandem cells differ from and improve upon standard silicon PV technology?

Perovskite tandem cells involve stacking a perovskite top cell onto a traditional silicon bottom cell. This configuration allows the system to absorb a wider spectrum of sunlight, significantly boosting the overall power conversion efficiency (PCE) above the theoretical limits of silicon alone, offering a path toward highly efficient and cost-effective solar energy generation.

Are perovskite solar cells truly lower cost than silicon cells, and what drives this cost advantage?

Yes, the potential manufacturing cost is significantly lower. The cost advantage stems from the use of solution-processing techniques (like printing or coating) at low temperatures, which require less energy and material input compared to the high-temperature, capital-intensive ingot slicing and vacuum deposition processes required for silicon solar cell production.

What role does the Building Integrated Photovoltaics (BIPV) segment play in the perovskite market?

BIPV is a crucial early-adoption market for perovskites because their lightweight, flexible, and potentially semi-transparent nature allows for seamless aesthetic integration into building materials such as windows, facades, and curved roofs, opening up new opportunities for solar generation where rigid panels are impractical.

Is the use of lead in perovskite solar cells a major environmental or regulatory concern?

Yes, the use of lead remains a significant environmental and regulatory concern, prompting intensive research into low-toxicity alternatives like tin-based perovskites or robust encapsulation and lead scavenging layers to minimize any potential leakage. Regulatory approval and public acceptance are often contingent upon effectively mitigating this toxicity risk.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager