Perphenazine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431836 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Perphenazine Market Size

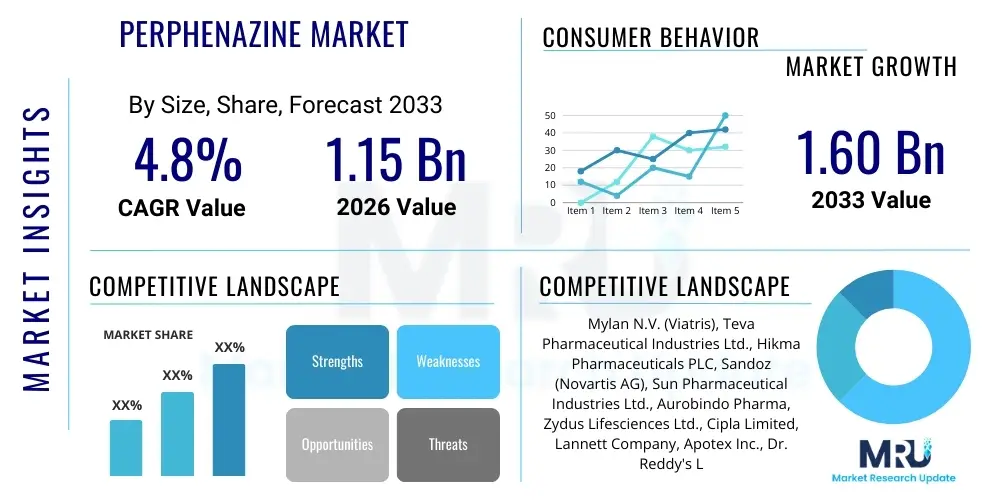

The Perphenazine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $1.15 Billion in 2026 and is projected to reach $1.60 Billion by the end of the forecast period in 2033.

Perphenazine Market introduction

Perphenazine is a potent, high-potency typical (first-generation) antipsychotic drug belonging to the piperazinyl phenothiazine class. Primarily indicated for the management of schizophrenia and other psychotic disorders, it is also highly effective in treating severe nausea and vomiting due to its strong antiemetic properties. As a dopamine receptor antagonist, Perphenazine exerts its therapeutic effects by blocking postsynaptic D2 receptors in the mesolimbic pathway of the brain. The drug’s established efficacy, especially in controlling positive symptoms of psychosis and its cost-effectiveness compared to many second-generation treatments, solidifies its critical role in clinical psychiatric practice globally. Despite the advent of newer drugs, Perphenazine maintains relevance, particularly in institutional settings and specific patient populations where compliance or efficacy with atypical antipsychotics remains challenging.

The market for Perphenazine is fundamentally driven by the escalating global prevalence of chronic mental health conditions, particularly schizophrenia and bipolar disorder, which necessitate long-term pharmacological management. Furthermore, the increasing geriatric population, which often requires treatment for drug-induced or illness-related nausea refractory to standard treatments, also contributes significantly to demand for Perphenazine’s antiemetic applications. Regulatory stability, coupled with high generic availability, ensures broad geographical access, particularly in emerging economies where healthcare budgets prioritize cost-effective essential medicines. Key benefits include established clinical outcomes, diverse dosage forms (oral tablets and injectables), and a predictable safety profile when administered under clinical supervision.

However, market dynamics are shifting, requiring manufacturers to focus on product differentiation through enhanced formulations and improved delivery mechanisms to mitigate known side effects, such as extrapyramidal symptoms (EPS) and tardive dyskinesia. The continued necessity for effective, affordable treatment options ensures that Perphenazine remains a vital component of the global psychopharmaceutical landscape. Current innovation is focused on pharmacokinetic profiling to optimize dosing schedules and minimize adverse effects, thereby enhancing patient adherence and overall quality of life. The stable demand structure, supported by mandatory inclusion in essential medicines lists across numerous jurisdictions, underpins the market's steady growth trajectory over the forecast period.

Perphenazine Market Executive Summary

The Perphenazine market exhibits robust stability characterized by steady demand driven by the persistent global burden of severe mental illnesses and its strong position as an essential antiemetic. Business trends indicate a strong reliance on generic drug manufacturing, leading to intense price competition, particularly in North America and Europe. Key players are strategically investing in vertically integrated supply chains to secure raw material sourcing and maintain cost leadership. Furthermore, there is a minor but growing trend towards developing fixed-dose combination therapies that incorporate Perphenazine to manage co-morbid symptoms more effectively. The market is consolidating around major generic manufacturers proficient in navigating complex regulatory environments for older established drug profiles, ensuring manufacturing compliance and quality control remain paramount.

Regionally, the market presents a dichotomy. Mature markets such as North America and Western Europe are driven primarily by prescription refills, stable pricing dynamics, and stringent regulatory oversight regarding patient safety, slightly constrained by competition from atypical antipsychotics. Conversely, the Asia Pacific (APAC) and Latin America regions are experiencing higher growth rates, fueled by increasing healthcare expenditure, improving access to psychiatric care, and a substantial unmet need for affordable schizophrenia treatments. These developing markets highly value the cost-effectiveness of Perphenazine, leading to rapid volume growth and significant governmental procurement tenders. Investment in localized manufacturing capabilities within these high-growth regions is a strategic imperative for global market leaders seeking to expand their operational footprint and distribution networks.

Segment trends reveal that the tablet dosage form dominates the market due to ease of administration and patient familiarity. However, the injectable segment, comprising both short-acting and long-acting formulations, is projected to see faster growth, particularly for acute patient management in clinical settings and addressing non-adherence issues. The application segmentation confirms the primacy of schizophrenia treatment, although the antiemetic use in oncology and post-operative care represents a significant and stable demand pocket. Technological advancements, though limited in terms of entirely new molecules, are focusing on micronization and advanced coating techniques to improve bioavailability and reduce gastrointestinal irritation, optimizing the therapeutic index within existing formulations.

AI Impact Analysis on Perphenazine Market

User queries regarding AI's impact on the Perphenazine market center predominantly around whether AI-driven drug discovery will replace existing molecules, how AI can optimize diagnosis and patient adherence tracking for schizophrenia, and the potential use of machine learning (ML) in predicting and mitigating severe side effects like tardive dyskinesia associated with first-generation antipsychotics. Users are seeking clarification on whether AI tools are being deployed for personalized dosing strategies to improve the risk-benefit ratio of established drugs like Perphenazine. The core concerns revolve around AI's ability to revolutionize psychiatric treatment pathways, potentially shifting clinical preference away from older drugs, while also recognizing AI’s capacity to enhance the safety monitoring of current treatments, thereby extending their clinical utility. Expectations are high that AI will lead to better stratification of patients who are most likely to benefit from Perphenazine with minimal adverse reactions.

- AI facilitates predictive analytics for patient response and adherence to Perphenazine treatment protocols.

- Machine Learning models assist in personalized dosing regimens, optimizing therapeutic windows and minimizing Extrapyramidal Symptoms (EPS).

- AI aids in rapid clinical trial analysis for new, optimized Perphenazine formulations or fixed-dose combinations.

- Natural Language Processing (NLP) is used for real-time monitoring of patient feedback and pharmacovigilance related to Perphenazine adverse events.

- AI-powered diagnostic tools enhance the early and accurate identification of psychotic disorders, increasing timely prescription initiation.

DRO & Impact Forces Of Perphenazine Market

The Perphenazine market is propelled by the essential need for cost-effective schizophrenia management (Driver) and is constrained by the persistent risk of severe movement disorders (Restraint). The primary opportunity lies in repositioning Perphenazine through advanced drug delivery systems and combination therapies to compete with second-generation antipsychotics. These forces synergistically influence market trajectories: while affordability ensures high volume demand, especially in public healthcare systems, safety concerns necessitate ongoing clinical research and patient monitoring improvements. The established clinical history acts as a dual-impact force, providing regulatory familiarity (accelerating market access) while simultaneously exposing its known adverse effect profile (limiting first-line prescription uptake in some developed markets). This complex interplay of cost, efficacy, and safety dictates the strategic positioning of manufacturers in the global pharmaceutical ecosystem.

Drivers: The increasing global prevalence of psychiatric disorders, particularly schizophrenia, which requires consistent, long-term pharmacological intervention, remains the primary driver. Furthermore, Perphenazine's inclusion on the World Health Organization's (WHO) Model List of Essential Medicines reinforces its necessity and drives governmental procurement worldwide. Its superior cost-effectiveness compared to patented atypical antipsychotics makes it the preferred initial treatment in resource-limited settings and managed care environments focused on budget optimization. The stable efficacy profile, especially for positive symptoms, also ensures continued prescribing habits among seasoned clinicians who are adept at managing its side effect profile.

Restraints: The most significant restraint is the higher incidence of severe, dose-related extrapyramidal symptoms (EPS) and the irreversible risk of tardive dyskinesia compared to newer atypical antipsychotics. This often leads to Perphenazine being reserved as a second- or third-line treatment in developed markets. The intense generic competition results in margin erosion, potentially limiting the financial incentive for manufacturers to invest heavily in formulation innovation or extensive clinical trials. Additionally, the social stigma associated with first-generation antipsychotics can sometimes lead to lower patient compliance and preference for newer therapeutic options perceived as having fewer side effects.

Opportunities: Significant market opportunities exist in formulating long-acting injectable (LAI) versions of Perphenazine, which could drastically improve patient adherence and compliance, a major challenge in chronic psychiatric care. Repositioning the drug for specific refractory symptoms or in combination with other agents to mitigate side effects presents a clinical niche. Moreover, expanding its antiemetic applications into high-value specialized areas, such as chemotherapy-induced nausea and vomiting (CINV) where current treatments are sometimes inadequate, offers substantial revenue potential. Utilizing precision medicine approaches to identify patients genetically predisposed to low side effects could also rejuvenate its market standing.

Segmentation Analysis

The Perphenazine market is comprehensively segmented based on its application, which primarily dictates demand volume, and dosage form, which addresses clinical suitability and patient adherence. Further segmentation by distribution channel reflects the primary routes through which the drug reaches end-users, mainly institutional and retail pharmacies. The dominance of the schizophrenia treatment segment highlights the drug’s central role in managing chronic psychotic disorders, while the increasing focus on the injectable dosage form underscores efforts to improve therapeutic compliance and manage acute exacerbations effectively. Understanding these segments is crucial for manufacturers to tailor production capabilities and for healthcare providers to optimize patient management strategies based on regional availability and cost parameters.

- By Application:

- Schizophrenia and Psychotic Disorders

- Severe Nausea and Vomiting (Antiemetic Use)

- Hiccups and Other Off-label Uses

- By Dosage Form:

- Tablets (Oral)

- Injectables (Solution for Injection)

- By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies and Drug Stores

- Online Pharmacies

Value Chain Analysis For Perphenazine Market

The value chain for the Perphenazine market begins with the procurement and synthesis of highly specific chemical intermediates (upstream analysis). This phase is characterized by strict quality control standards and reliance on specialized chemical synthesis expertise, often concentrated in key manufacturing hubs in Asia. Following this, the synthesis of the active pharmaceutical ingredient (API), Perphenazine, is carried out, requiring high purification standards to ensure clinical safety and efficacy. Cost efficiency in API manufacturing is critical, as the drug is largely generic, making raw material sourcing and conversion efficiency paramount to competitive pricing. Disruptions in the supply of key precursors, often regulated under chemical control laws, pose a persistent risk to upstream stability.

Midstream activities involve formulation development, primarily focusing on tablets and injectables, followed by clinical packaging and quality assurance testing. Given the drug’s mature status, formulation innovation focuses less on bioavailability improvements and more on manufacturing scale-up, cost reduction, and ensuring batch-to-batch consistency. Regulatory approval maintenance for existing formulations is a substantial midstream cost center. The downstream segment encompasses the distribution and commercialization phases. Distribution channels are highly regulated, relying heavily on national centralized drug procurement agencies, hospital pharmacy systems, and large pharmaceutical wholesalers. Direct distribution models are less common, with reliance on indirect channels dominating due to the necessity of licensed and controlled substance handling.

Direct channels, primarily utilized for governmental tenders or specialized institutional supply, offer tighter control over pricing but represent a smaller volume of the overall market. Indirect channels, involving wholesalers and retail pharmacies, facilitate broad market penetration but introduce complexity in inventory management and pricing fluctuations. Effective distribution is crucial for a drug like Perphenazine, which often needs immediate availability in acute care settings. The final stage involves dispensing to the end-user (patients in clinics or hospitals), requiring specialized psychiatric or medical prescription. Overall market profitability is driven by volume rather than high margins, emphasizing the need for efficient logistics and lean manufacturing throughout the entire value chain.

Perphenazine Market Potential Customers

The primary customers for the Perphenazine market are institutions providing psychiatric and acute medical care. These include large state psychiatric hospitals, general hospital inpatient psychiatric wards, and specialized mental health treatment centers. For these institutions, Perphenazine is a staple in their formulary due to its established efficacy in acute psychosis management and its favorable cost profile for long-term institutional care. Procurement decisions in this segment are typically managed through centralized purchasing departments responding to clinician demand and adherence to national essential medicines lists. The focus for institutional buyers is on securing large volumes at competitive tender prices, ensuring continuity of supply for chronic patient populations.

Secondary, yet highly significant, potential customers include retail and specialty pharmacies that cater to ambulatory patients receiving maintenance therapy for schizophrenia or those requiring antiemetic therapy post-discharge. These customers, and indirectly the patients they serve, rely on stable supply chains and generic accessibility. Prescribing psychiatrists, neurologists, and primary care physicians function as critical gatekeepers, determining the volume of prescriptions. This segment is highly sensitive to pricing, insurance coverage, and patient preference concerning side effects, meaning the availability of co-pay assistance or patient support programs can influence prescribing behavior among generic alternatives.

Emerging potential customers include managed care organizations (MCOs) and governmental health systems in developing nations undergoing psychiatric care infrastructure expansion. MCOs, focused on population health management and cost containment, often prioritize first-generation, cost-effective drugs like Perphenazine within their preferred drug lists (PDLs). In developing economies, ministries of health are major purchasers, driven by the imperative to provide foundational, evidence-based treatments to vast, underserved populations. Targeted marketing and supply chain agreements with these centralized procurement bodies represent a significant long-term growth opportunity, particularly in high-volume, low-margin territories across Asia and Africa.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.15 Billion |

| Market Forecast in 2033 | $1.60 Billion |

| Growth Rate | 4.8% ( CAGR ) |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mylan N.V. (Viatris), Teva Pharmaceutical Industries Ltd., Hikma Pharmaceuticals PLC, Sandoz (Novartis AG), Sun Pharmaceutical Industries Ltd., Aurobindo Pharma, Zydus Lifesciences Ltd., Cipla Limited, Lannett Company, Apotex Inc., Dr. Reddy's Laboratories Ltd., Pfizer Inc., Bristol-Myers Squibb Company, Eli Lilly and Company, Merck & Co., Inc., Actavis Generics, Shanghai Pharmaceutical Group Co., Ltd., Sanofi S.A., GSK plc, Takeda Pharmaceutical Company Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Perphenazine Market Key Technology Landscape

While Perphenazine itself is a mature molecule, the surrounding technological landscape focuses heavily on improving its safety profile and patient compliance through advanced formulation technologies. One key area involves the development and refinement of micronization and nano-suspension techniques. These technologies aim to enhance the dissolution rate and bioavailability of the oral tablet form, potentially allowing for lower effective doses and mitigating gastrointestinal side effects. Furthermore, advanced polymer coating techniques are being researched to develop extended-release or delayed-release formulations, which could simplify dosing schedules and provide steadier plasma concentrations, thereby potentially reducing the peak concentration-related incidence of side effects, a common issue with conventional immediate-release formulations.

Another crucial technological development revolves around sophisticated drug delivery systems, particularly long-acting injectables (LAI). While not yet widely commercialized for Perphenazine in all markets, the underlying technology—often utilizing liposomes, microspheres, or in situ gelling systems—is critical for managing non-adherence, a primary challenge in psychiatric care. These LAI formulations provide therapeutic levels of the drug over weeks or months following a single injection. The development effort for Perphenazine LAI would necessitate stabilizing the highly potent molecule within a biocompatible vehicle that allows for controlled, predictable release kinetics, offering a substantial clinical advantage over daily oral dosing, especially for chronic, high-risk patients.

Beyond drug formulation, the technology landscape includes diagnostic and monitoring tools essential for the responsible use of Perphenazine. Pharmacogenomic testing, while not universally integrated, represents a pivotal technology for the future. By analyzing genetic polymorphisms (e.g., CYP2D6 metabolizer status), clinicians can predict individual patient metabolism rates and tailor Perphenazine doses more precisely, minimizing the risk of adverse drug reactions, particularly EPS. Additionally, digital therapeutics and remote monitoring technologies (wearable sensors) are becoming key components in tracking medication adherence and detecting early signs of movement disorders, allowing for prompt dose adjustments or co-medication introduction, thus optimizing the safety and overall clinical utility of this first-generation antipsychotic.

Regional Highlights

Regional dynamics for the Perphenazine market are heavily influenced by regulatory acceptance of first-generation antipsychotics, healthcare spending per capita, and the prevalence of managed care systems prioritizing generic affordability. North America, driven by the US and Canada, represents a high-value market characterized by robust insurance coverage and highly developed healthcare infrastructure. Although newer atypical antipsychotics dominate first-line treatment protocols, Perphenazine maintains a strong presence due to its inclusion in institutional formularies and its cost-effective profile for chronic care. Generic availability is high, leading to significant price competition, and regional growth is steady, driven by prescription volume stability rather than price escalation.

Europe presents a fragmented market, with strong usage in Western Europe (Germany, UK, France) where national health systems often prioritize proven, cost-effective generics. Regulatory bodies like the European Medicines Agency (EMA) ensure strict quality control, reinforcing confidence in the established safety profile. Eastern European countries show higher dependence on typical antipsychotics like Perphenazine due to budgetary constraints and rising incidence rates of schizophrenia coupled with improving access to foundational mental healthcare services. The implementation of centralized tendering processes across various European Union member states often dictates price points and procurement volumes.

Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by large patient populations in India and China, increasing governmental investment in mental health infrastructure, and a surging middle class gaining access to pharmaceutical treatments. The market here is highly price-sensitive, making the affordability of Perphenazine a major competitive advantage. Localized manufacturing expansion is rampant to meet high volume demand. The Middle East and Africa (MEA) and Latin America (LATAM) regions also offer substantial growth potential, driven by unmet medical needs, urbanization leading to increased stress-related disorders, and governmental focus on stocking essential medicines, where Perphenazine plays a crucial role.

- North America: Market stability maintained by managed care organizations prioritizing cost-efficiency; strong generic penetration; high usage in institutional settings.

- Europe: Demand anchored by national health services requiring highly cost-effective treatments; regulatory focus on high-quality generic supply; increasing usage in Eastern Europe.

- Asia Pacific (APAC): Rapid growth driven by large patient pools in China and India; increasing health awareness; strong emphasis on localized, affordable generic manufacturing.

- Latin America (LATAM): Growth spurred by expanding public health coverage and centralized drug purchasing; essential medicine status ensures consistent demand.

- Middle East and Africa (MEA): Emerging market driven by improving healthcare access and infrastructural development; demand focused on foundational, low-cost psychiatric drugs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Perphenazine Market.- Mylan N.V. (Viatris)

- Teva Pharmaceutical Industries Ltd.

- Hikma Pharmaceuticals PLC

- Sandoz (Novartis AG)

- Sun Pharmaceutical Industries Ltd.

- Aurobindo Pharma

- Zydus Lifesciences Ltd.

- Cipla Limited

- Lannett Company

- Apotex Inc.

- Dr. Reddy's Laboratories Ltd.

- Pfizer Inc.

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- Merck & Co., Inc.

- Actavis Generics

- Shanghai Pharmaceutical Group Co., Ltd.

- Sanofi S.A.

- GSK plc

- Takeda Pharmaceutical Company Limited

Frequently Asked Questions

Analyze common user questions about the Perphenazine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the continued demand for Perphenazine?

The primary driver is its exceptional cost-effectiveness relative to newer atypical antipsychotics, coupled with its proven efficacy in managing positive symptoms of schizophrenia and its established role as an essential antiemetic in global healthcare systems.

How is the market for Perphenazine segmented by dosage form?

The market is segmented predominantly into Oral Tablets, which account for the largest share due to ease of use, and Injectables (solutions for injection), which are utilized for acute psychiatric management and improving patient compliance.

What major restraint affects the overall growth potential of the Perphenazine market?

The main restraint is the heightened risk profile associated with long-term use, specifically the development of irreversible movement disorders such as tardive dyskinesia and other dose-related extrapyramidal symptoms (EPS), often favoring newer drugs.

Which geographical region is projected to exhibit the fastest growth in the Perphenazine market?

The Asia Pacific (APAC) region is forecasted to experience the highest growth rate, driven by expanding access to mental healthcare, large underserved patient populations, and governmental prioritization of affordable, essential psychiatric medicines.

What technological advancement holds the most promise for enhancing Perphenazine's clinical utility?

The development of Long-Acting Injectable (LAI) formulations is the most promising advancement, as it directly addresses the critical challenge of patient non-adherence in chronic psychiatric care, offering sustained therapeutic levels over extended periods.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager