Personal Accident and Health Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433438 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Personal Accident and Health Insurance Market Size

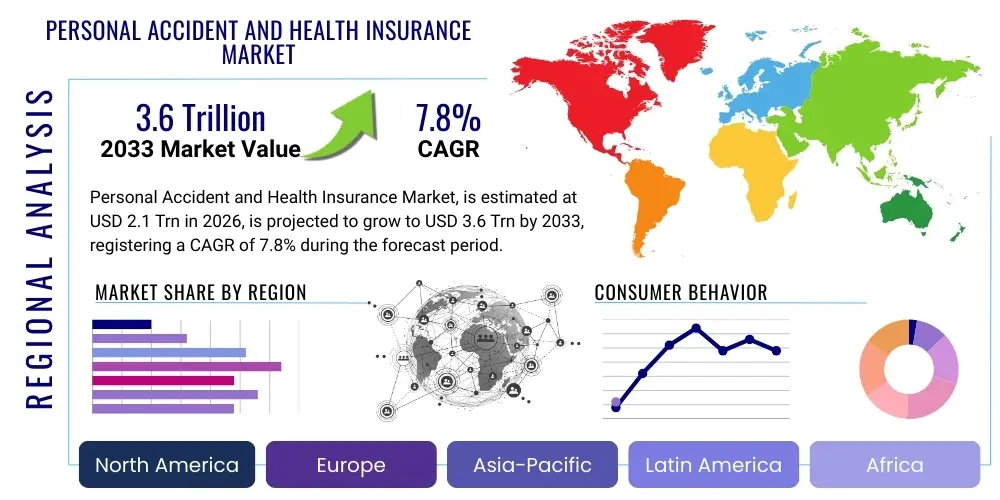

The Personal Accident and Health Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 2.1 Trillion in 2026 and is projected to reach USD 3.6 Trillion by the end of the forecast period in 2033.

Personal Accident and Health Insurance Market introduction

The Personal Accident and Health Insurance market encompasses various insurance products designed to provide financial protection against unexpected medical expenses, disability, or death resulting from accidents or illness. This crucial segment of the financial services industry addresses the fundamental need for economic security against unforeseen health-related catastrophes, spanning traditional indemnity plans, managed care organizations (HMOs/PPOs), critical illness policies, and specialized personal accident coverage. The core product provides payouts for hospitalization, surgical procedures, and loss of income due to temporary or permanent disabilities, transferring significant risk from the individual to the insurer.

Major applications for these insurance products are observed across both individual and group segments. Individual policies cater to self-employed persons, retirees, and those seeking supplementary coverage, while group policies are predominantly utilized by employers to provide comprehensive employee benefits packages. The rising cost of healthcare globally, coupled with increasing consumer awareness regarding lifestyle diseases and the limitations of public healthcare systems, serves as a paramount driving factor for market expansion. Furthermore, regulatory mandates in several emerging economies promoting mandatory health coverage are significantly broadening the market penetration.

The primary benefits of these insurance services include comprehensive financial safeguarding, access to advanced healthcare facilities, and peace of mind. Driving factors include demographic shifts such as an aging global population requiring extensive medical care, technological advancements enabling personalized risk assessment and claim processing, and macroeconomic stability that supports consumer expenditure on discretionary financial services like insurance. The market is also heavily influenced by innovation in product design, moving toward integrated health and wellness platforms that incentivize preventative behavior, thereby shifting the industry focus from merely paying claims to proactively managing member health.

Personal Accident and Health Insurance Market Executive Summary

The global Personal Accident and Health Insurance market is experiencing robust expansion driven by converging business trends, focused segment growth, and critical regional developments. Key business trends indicate a significant shift toward digitalization, where insurers are leveraging advanced analytics and artificial intelligence to enhance underwriting accuracy, expedite claims settlements, and offer highly customized policy plans. Partnerships between traditional carriers and InsurTech startups are accelerating this transformation, focusing particularly on improving the customer journey from policy purchase to service interaction, resulting in greater operational efficiency and reduced fraud exposure.

Segment trends highlight the exceptional growth potential in specialized coverage areas, particularly critical illness insurance and supplemental accident policies, which address coverage gaps left by standard health plans. Furthermore, the rising popularity of wellness-linked insurance models, often bundled with wearables and health apps, is reshaping product dynamics, encouraging policyholders to maintain healthier lifestyles in exchange for lower premiums. The shift in employment structures, including the gig economy, is also fueling demand for flexible, modular insurance solutions tailored for non-traditional workers who lack employer-sponsored benefits.

Regionally, the Asia Pacific (APAC) market is projected to be the fastest-growing area, propelled by rapidly increasing middle-class populations, improving economic stability, and government initiatives aimed at expanding insurance coverage accessibility. North America and Europe remain mature markets characterized by stringent regulatory environments and a focus on integrating digital health services (Telehealth) with insurance offerings. Overall, the market remains highly competitive, necessitating continuous investment in technology and innovative distribution channels, such as bancassurance and direct-to-consumer digital platforms, to maintain market share and capitalize on burgeoning consumer demand for financial resilience.

AI Impact Analysis on Personal Accident and Health Insurance Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Personal Accident and Health Insurance market generally center on the fairness of pricing, the speed of claims processing, and concerns over data privacy. Users frequently ask how AI-driven algorithms determine their individual risk profile, whether these algorithms might introduce biases based on demographic data, and if predictive analytics could lead to the denial of coverage for high-risk individuals. Furthermore, policyholders are keenly interested in the potential for AI-powered chatbots and virtual assistants to provide instant, 24/7 customer support and simplify complex policy documentation. The overarching expectation is that AI should lower administrative costs, leading to more affordable premiums, but without compromising ethical data handling or introducing unfair discriminatory practices in underwriting.

The deployment of AI and machine learning models is fundamentally transforming core insurance functions, moving beyond simple automation to sophisticated risk prediction. In underwriting, AI analyzes vast datasets, including electronic health records and behavioral data, to model risk with far greater precision than traditional actuarial methods, allowing for granular pricing and highly personalized products. For claims management, AI systems can instantly verify eligibility, detect fraudulent patterns through anomaly identification, and automate straight-through processing for simple claims, drastically reducing turnaround times. This operational efficiency is critical for maintaining customer satisfaction and reducing the expense ratio for insurers.

However, the ethical implications of AI remain a critical area of focus. Insurers must navigate the regulatory landscape concerning data protection and algorithmic transparency. Ensuring that AI models are explainable (XAI) and free from inherited biases is paramount to maintaining consumer trust and adhering to fair practices legislation. As AI increasingly manages policyholder interactions through digital channels, the quality and empathy of automated service must be continuously refined to ensure a positive brand experience, balancing efficiency gains with the necessity of human oversight for complex or sensitive cases.

- Enhanced personalized underwriting and risk segmentation using machine learning.

- Rapid and automated claims processing through predictive fraud detection and smart contract execution.

- Implementation of AI-powered virtual assistants for 24/7 customer service and policy inquiries (Chatbots).

- Development of behavioral economic models linking wearable device data to dynamic pricing adjustments.

- Improved solvency and capital management through sophisticated predictive modeling of potential loss ratios.

- Challenges related to regulatory compliance, algorithmic bias, and stringent data privacy requirements (e.g., GDPR, HIPAA).

DRO & Impact Forces Of Personal Accident and Health Insurance Market

The dynamics of the Personal Accident and Health Insurance market are governed by a complex interplay of internal and external forces summarized as Drivers, Restraints, and Opportunities (DRO). Key drivers include the pervasive trend of escalating global healthcare costs, which compels individuals and corporations alike to seek robust financial protection mechanisms. Simultaneously, rapid urbanization and associated changes in lifestyle have led to a higher incidence of non-communicable and lifestyle-related diseases, increasing the demand for comprehensive health coverage. Regulatory environments in several countries are also serving as powerful drivers by mandating minimum levels of health insurance coverage, thereby expanding the potential customer base dramatically.

Conversely, significant restraints hinder market growth. High premium costs, often perceived as unaffordable by lower-income segments, present a major barrier to entry, particularly in developing economies where disposable income remains constrained. Furthermore, the inherent complexity and lack of transparency in policy wording and claims processes often lead to consumer distrust and poor adoption rates. Regulatory fragmentation across different geographies necessitates complex operational adjustments for international carriers, adding to administrative burdens and operational costs. The slow pace of digitalization and reliance on legacy IT systems in specific regional insurance sectors also acts as a drag on market efficiency and innovation.

The primary opportunities for market stakeholders lie in leveraging technological advancements, particularly InsurTech. The proliferation of connected devices (IoT), mobile health applications, and telemedicine platforms offers insurers novel ways to engage customers, manage risk proactively through preventative measures, and reduce claims costs. Expanding product offerings to address specialized risks, such as mental health coverage and tailored solutions for the aging population (long-term care), represents fertile ground for growth. Moreover, developing simplified, bite-sized insurance products distributed through digital ecosystems (embedded insurance) allows carriers to tap into previously underserved demographics and significantly lower customer acquisition costs, amplifying the market’s positive impact forces.

Segmentation Analysis

The Personal Accident and Health Insurance market is primarily segmented based on coverage type, policy type, end-user, distribution channel, and geographical region. Understanding these segmentations is critical for market participants to tailor their strategies and product offerings effectively. Segmentation by coverage type differentiates between standard health insurance (covering medical and hospitalization expenses), personal accident insurance (focusing on accidental death and disability), critical illness plans (providing a lump sum upon diagnosis of specified conditions), and indemnity vs. managed care products. This differentiation allows insurers to target specific risk appetites and financial capabilities within the consumer base.

Policy type segmentation separates individual policies, purchased directly by consumers, from group policies, typically provided by employers or associations. The rapid growth of the gig economy and small and medium-sized enterprises (SMEs) is driving significant innovation in group policy design, demanding flexible and scalable solutions. The end-user segment distinguishes between institutional purchasers (corporate entities, government bodies) and individual consumers, with B2B partnerships becoming increasingly important for mass market penetration.

Furthermore, segmentation by distribution channel—including agents/brokers, direct sales, banks (bancassurance), and online aggregators—reflects the evolution of customer preferences and access points. Digital channels are witnessing the highest growth rate due to convenience and cost-efficiency. This detailed market structure ensures that product development and marketing efforts are aligned with specific consumer needs and regulatory environments across diverse demographic and economic landscapes.

- Coverage Type: Health Insurance, Personal Accident Insurance, Critical Illness Insurance, Long-Term Care Insurance, Disability Income Insurance.

- Policy Type: Individual Policy, Group Policy, Corporate Plans, Specialized Family Floater Plans.

- End-User: Individuals, Group (Corporate/Government Employees), Seniors, Small and Medium Enterprises (SMEs).

- Distribution Channel: Agents/Brokers, Bancassurance, Direct Sales (Online/Offline), Aggregators/E-Commerce Platforms.

Value Chain Analysis For Personal Accident and Health Insurance Market

The value chain for the Personal Accident and Health Insurance market starts with upstream activities involving product development and risk modeling. This stage requires extensive data acquisition, actuarial science, and predictive analytics to determine policy design, premium pricing, and reserving strategies. Key upstream partners include reinsurers, who mitigate catastrophic risk exposure for primary carriers, and specialized InsurTech companies providing advanced analytics tools for accurate risk assessment and personalized product creation. The efficiency of this stage directly dictates the profitability and competitiveness of the subsequent policy offerings.

The middle segment of the value chain focuses on policy issuance, sales, and distribution. Distribution channels are highly diversified, encompassing direct sales (online portals, call centers), traditional intermediaries (agents and brokers), and strategic partnerships such as bancassurance, where policies are sold through bank networks. Effective distribution requires robust Customer Relationship Management (CRM) systems and compliance monitoring to ensure adherence to financial regulations. The quality of sales operations, including clear communication of policy terms, significantly influences customer satisfaction and retention rates.

Downstream activities center on post-sales service, including policy administration, claims processing, and customer support. This is the most crucial interaction point where the insured realizes the value of their coverage. Technology is rapidly optimizing this stage, utilizing AI for automated claims verification and payment, and advanced data analytics for fraud detection. The efficiency of the claims process and the resolution of disputes are fundamental to building long-term customer trust and maintaining the insurer's reputation. Direct and indirect distribution channels coexist, but the trend leans toward hybrid models that integrate digital convenience with personalized advisory services for complex financial products.

Personal Accident and Health Insurance Market Potential Customers

The potential customer base for Personal Accident and Health Insurance is extraordinarily broad, spanning nearly all demographic and economic segments due to the universal nature of health risk. Primary end-users include individual consumers seeking basic or supplemental coverage, especially those who are self-employed, working in the gig economy, or retired and relying solely on government-provided schemes that may have coverage gaps. These buyers prioritize affordability, clear policy terms, and rapid claim disbursement, often utilizing online comparison tools and direct distribution channels for purchase simplicity.

A second major segment comprises corporate entities and Small and Medium Enterprises (SMEs) purchasing group policies as part of employee welfare and retention strategies. For these organizational buyers, factors such as comprehensive coverage options, flexible plan designs to accommodate diverse employee needs, and efficient group administration services are critical. The demand for specialized riders, such as mental health benefits or corporate wellness programs integrated into the insurance offering, is rapidly increasing in this segment.

Furthermore, governmental bodies and large institutional organizations constitute a stable customer segment, typically requiring large-scale, customized health schemes for public sector employees, veterans, or subsidized population groups. Specialized niches, such as international travelers requiring travel health insurance, expatriates needing robust global coverage, and high-net-worth individuals seeking premium, concierge-level medical services, also represent valuable potential customers. The increasing global awareness of health risks and the desire for financial stability underpin the continuous expansion of this diverse end-user landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Trillion |

| Market Forecast in 2033 | USD 3.6 Trillion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | UnitedHealth Group, Anthem Inc., Cigna Corporation, Humana Inc., Allianz SE, AXA SA, Ping An Insurance (Group) Company of China, Zurich Insurance Group, Generali Group, Prudential Financial, Kaiser Permanente, Aetna (CVS Health), AIG, Munich Re, Swiss Re, Tokio Marine Holdings, Manulife Financial, HDFC ERGO General Insurance, Bupa, Blue Cross Blue Shield. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Personal Accident and Health Insurance Market Key Technology Landscape

The technological landscape of the Personal Accident and Health Insurance market is defined by rapid integration of digital solutions aimed at enhancing operational efficiency, improving customer engagement, and refining risk assessment capabilities. Core to this transformation is the adoption of advanced data analytics and Big Data platforms, which allow insurers to process massive volumes of structured and unstructured data—including claims history, EMRs (Electronic Medical Records), and demographic information—to create precise actuarial models. This precision enables usage-based insurance (UBI) and dynamic pricing, moving away from static risk pools to individualized coverage plans based on real-time behavior and health indicators.

A second critical technological advancement is the rise of InsurTech and the use of Artificial Intelligence (AI) and Machine Learning (ML). AI algorithms are employed extensively in fraud detection during the claims lifecycle, reducing losses and minimizing turnaround time. Furthermore, technologies such as blockchain are being explored for creating secure, transparent, and immutable records of policy contracts and medical data, facilitating the execution of smart contracts for automatic claims payment upon verified triggers. The use of Robotic Process Automation (RPA) handles repetitive administrative tasks, such as policy renewals and data entry, freeing human resources for complex problem-solving and personalized customer interaction.

Finally, the proliferation of the Internet of Things (IoT), especially wearable technology and connected health devices, represents a paradigm shift toward preventative insurance. Insurers are actively integrating data from these devices into their wellness programs, offering policyholders financial incentives (e.g., premium discounts, loyalty points) for maintaining active and healthy lifestyles. Telemedicine platforms have also gained prominence, particularly post-pandemic, offering remote consultations and monitoring services that reduce healthcare costs and improve accessibility, creating a symbiotic relationship between health service provision and insurance risk management.

Regional Highlights

Regional dynamics within the Personal Accident and Health Insurance market reflect diverse economic maturity, regulatory landscapes, and healthcare system structures.

- North America: Dominates the global market in terms of market value, characterized by a highly privatized healthcare system, sophisticated product offerings, and high consumer spending power. The market is driven by complex regulatory compliance (like HIPAA and the Affordable Care Act), intense competition among major carriers, and early adoption of InsurTech solutions, particularly in claims adjudication and personalized wellness programs.

- Europe: A mature market defined by a mix of public and private healthcare models. Growth is steady, fueled by increasing awareness of coverage gaps in state-funded systems and mandatory accident insurance in several countries. Digital transformation is key, but regulatory requirements, especially GDPR concerning data handling, impose significant operational constraints on cross-border insurers.

- Asia Pacific (APAC): Expected to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid economic development, expanding middle classes, and low historical insurance penetration rates. Countries like China and India are major growth engines, driven by government initiatives to universalize health coverage, rising disposable incomes, and the swift adoption of mobile-first insurance distribution models (e-commerce platforms and super-apps).

- Latin America: Characterized by fragmented healthcare systems and rising economic volatility. Market growth is primarily concentrated in urban centers, focusing on addressing the lack of adequate public sector coverage through affordable, basic health and accident products. Bancassurance remains a critical distribution channel in countries like Brazil and Mexico.

- Middle East and Africa (MEA): Growth is primarily concentrated in the Gulf Cooperation Council (GCC) states due to mandatory employee health insurance requirements for expatriate and local workers. Digitalization efforts are accelerating, but the market is heavily influenced by oil revenues and regional geopolitical stability. The African continent presents immense untapped potential, reliant on microinsurance models and mobile payment technology for mass market access.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Personal Accident and Health Insurance Market.- UnitedHealth Group

- Anthem Inc.

- Cigna Corporation

- Humana Inc.

- Allianz SE

- AXA SA

- Ping An Insurance (Group) Company of China

- Zurich Insurance Group

- Generali Group

- Prudential Financial

- Kaiser Permanente

- Aetna (CVS Health)

- AIG

- Munich Re

- Swiss Re

- Tokio Marine Holdings

- Manulife Financial

- HDFC ERGO General Insurance

- Bupa

- Blue Cross Blue Shield

Frequently Asked Questions

Analyze common user questions about the Personal Accident and Health Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Personal Accident and Health Insurance market?

The primary drivers include the exponential increase in global healthcare expenditure, demographic shifts toward an aging population, mandatory governmental regulations enforcing insurance coverage, and widespread adoption of digital technologies that streamline product delivery and improve service accessibility. Consumer demand for financial protection against lifestyle diseases and inadequate public health services also plays a critical role.

How is digital transformation affecting the cost and accessibility of personal health insurance policies?

Digital transformation significantly lowers administrative and operating costs for insurers through automation (RPA and AI), which can translate into more competitive premiums for consumers. Furthermore, online aggregators and direct-to-consumer platforms have dramatically increased market accessibility, particularly for younger demographics and those in remote areas, simplifying the comparison and purchasing process.

What role does Artificial Intelligence play in personal accident claims processing?

AI plays a crucial role in modern claims processing by enabling immediate eligibility checks, automating straight-through processing for simple claims, and employing sophisticated machine learning models to identify and flag potential fraudulent activities with high accuracy. This reduces the time-to-settlement and minimizes manual intervention, significantly improving efficiency and reducing the insurer's loss ratio.

Which geographical region holds the greatest growth potential in the Personal Accident and Health Insurance market?

The Asia Pacific (APAC) region, particularly emerging economies like China, India, and Southeast Asia, holds the highest growth potential. This is driven by rapid economic expansion, increasing disposable incomes, government initiatives to expand health coverage, and a large, untapped population base shifting toward formalized insurance products.

What are the main differences between Personal Accident Insurance and standard Health Insurance?

Standard Health Insurance primarily covers medical expenses, hospitalization, and treatments related to both illness and injury. Personal Accident Insurance, conversely, is typically designed to provide a lump-sum payment or defined benefit solely in the event of accidental injury, disability, or death, often compensating for loss of income rather than covering diverse medical treatments.

What is bancassurance and why is it important in this market?

Bancassurance is the partnership between a bank and an insurance company, allowing the insurer to sell products to the bank's client base. It is a vital distribution channel, especially in Europe and Latin America, as it leverages the bank's extensive customer trust, established infrastructure, and large distribution network, lowering customer acquisition costs and increasing insurance penetration.

How do wearable devices and IoT impact health insurance pricing?

Wearable devices and IoT enable dynamic risk assessment by collecting real-time behavioral data (e.g., activity levels, heart rate). Insurers use this data in wellness programs to offer personalized, usage-based insurance models where policyholders who exhibit healthier behaviors receive premium discounts or rewards, shifting the focus from claims payment to preventative health management.

What regulatory challenges face global health insurance providers?

Global providers face challenges related to jurisdictional differences in mandatory coverage rules, capital reserve requirements, and stringent data protection laws (such as GDPR and country-specific data localization mandates). Navigating these disparate regulations requires complex compliance frameworks and significant investment in adaptive technology infrastructure.

What is critical illness insurance and who is the target customer?

Critical illness insurance provides a single, lump-sum payout upon the diagnosis of a predefined serious illness (like cancer, heart attack, or stroke). The target customer is typically an individual concerned about high out-of-pocket costs and loss of income associated with catastrophic health events, seeking coverage supplementary to their standard health policy.

How does the gig economy influence demand for personal accident and health insurance?

The rise of the gig economy means a growing workforce lacks traditional employer-sponsored health benefits, driving demand for flexible, modular, and affordable individual or short-term policies. Insurers are developing specialized products tailored to the intermittent and highly variable income streams characteristic of independent contractors.

What are the key concerns regarding algorithmic bias in AI underwriting?

Key concerns revolve around the potential for AI models to perpetuate or amplify existing societal biases if the training data is skewed, potentially leading to unfair pricing or denial of coverage based on protected characteristics like ethnicity or geography, necessitating stringent ethical oversight and algorithmic transparency.

What role does reinsurance play in the Personal Accident and Health Insurance market?

Reinsurance plays a vital role by allowing primary insurers to transfer high-risk exposure, particularly against catastrophic events (e.g., major pandemics or mass accidents), ensuring the insurer's financial stability and capacity to underwrite substantial policy volumes without undue solvency risk.

Why is Long-Term Care (LTC) insurance becoming increasingly relevant?

LTC insurance is gaining relevance due to the sustained increase in global life expectancy and the rising costs of non-medical support services (such as nursing home care or home health aides) required by the elderly. It addresses a significant gap in coverage often not met by standard health insurance or government programs.

How are insurance companies utilizing blockchain technology?

Insurers are exploring blockchain for enhanced data security, improved transparency in shared medical records (with patient consent), and automating the claims lifecycle through smart contracts. Blockchain minimizes disputes and increases the speed and trust associated with cross-party transactions, particularly in complex claim scenarios.

What is the significance of the shift from indemnity plans to managed care organizations (MCOs)?

The shift signifies a transition toward proactive cost management. MCOs (like HMOs and PPOs) utilize networks of providers and emphasize preventative care and utilization review to control healthcare costs, contrasting with indemnity plans, which traditionally reimbursed policyholders after treatment without controlling service usage or pricing.

What are the major distribution challenges in rural and developing markets?

Major challenges include low insurance literacy, lack of banking infrastructure, unreliable digital connectivity, and difficulty in assessing risk accurately due to limited reliable data. These markets require simplified microinsurance products distributed through mobile money platforms and local community agents.

How does mental health coverage fit into the current insurance landscape?

Mental health coverage is rapidly integrating into standard policy offerings, driven by increased societal awareness and parity legislation mandating equitable coverage for physical and mental illnesses. Insurers are responding by including telehealth services and specialized mental health support networks within their plans.

What are the primary determinants of premium pricing for individual health policies?

Premium pricing is primarily determined by age, geographic location, health status (subject to regulatory limitations), coverage level selected, utilization history, and the overall administrative costs and expected loss ratio calculated by the insurer's actuarial models.

What is the concept of embedded insurance in this market?

Embedded insurance involves integrating coverage seamlessly into the purchase of a related product or service (e.g., travel insurance bought during a flight booking). In health and accident, this often means offering small, event-specific coverage instantly through non-traditional platforms, significantly expanding point-of-sale opportunities.

What is the expected long-term impact of macroeconomic inflation on the health insurance sector?

Sustained macroeconomic inflation increases the cost of medical services, labor, and supplies, leading to higher medical loss ratios for insurers. Consequently, this pressure forces carriers to raise premiums, potentially reducing affordability and adoption rates unless operational efficiencies are significantly improved through technology.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager