Personal Finance App Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432415 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Personal Finance App Market Size

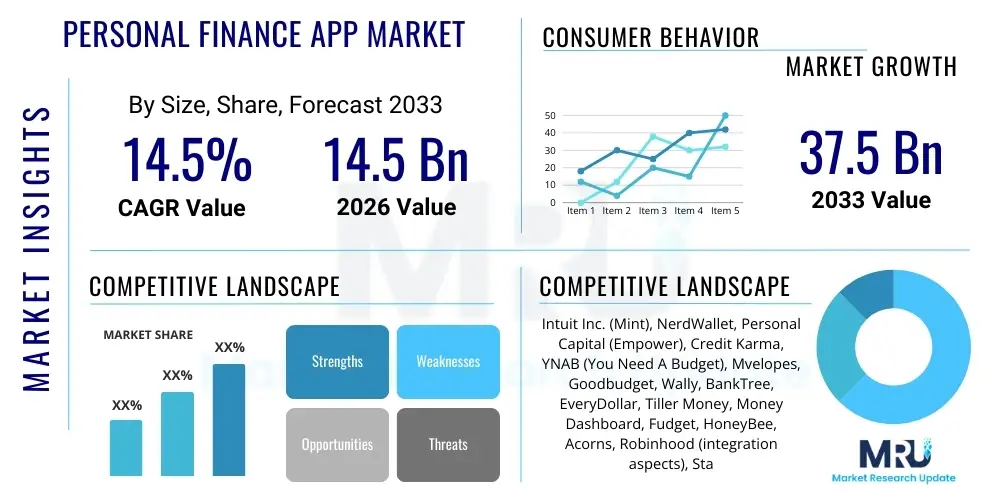

The Personal Finance App Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at USD 14.5 Billion in 2026 and is projected to reach USD 37.5 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by increasing digital literacy globally, the widespread adoption of smartphones, and a growing consumer need for automated, real-time financial management solutions that provide clarity and control over spending and savings habits in an increasingly complex economic environment.

The acceleration of digital transformation within the financial sector, coupled with supportive regulatory frameworks like Open Banking initiatives in various jurisdictions, has significantly lowered the barriers to entry for new Personal Finance App developers. These platforms are transitioning from simple transaction tracking tools to comprehensive financial ecosystems that incorporate budgeting, micro-investing, debt management, and customized financial advice. The integration capabilities with traditional banking systems and third-party financial services are defining the competitive landscape and driving market expansion across demographic groups previously underserved by conventional financial institutions.

Furthermore, the shift in consumer behavior, particularly among younger generations who prioritize instant, mobile-first solutions, is a crucial determinant of market expansion. The value proposition of these applications—offering transparency, convenience, and educational resources—is particularly appealing in emerging economies where financial inclusion efforts are gaining momentum. The necessity for individuals to manage volatility stemming from global economic uncertainty has solidified the role of personal finance apps as essential tools rather than mere conveniences, ensuring sustained high growth rates throughout the forecast period.

Personal Finance App Market introduction

The Personal Finance App Market encompasses software applications designed to assist individuals in managing their money, tracking expenses, planning budgets, monitoring investments, and analyzing overall financial health. These products range from basic expense trackers to sophisticated platforms incorporating advanced investment advisory services and debt optimization strategies. Major applications include automated transaction categorization, goal-based savings, bill reminders, credit score monitoring, and integration with banking and brokerage accounts via secure APIs. The proliferation of these tools is fundamentally changing how consumers interact with their finances, moving away from manual record-keeping towards automated, real-time financial oversight.

The primary benefits driving the widespread adoption of Personal Finance Apps include enhanced financial literacy, improved budgeting discipline, identification of wasteful spending patterns, and significant time savings associated with automated financial reconciliation. These applications empower users by providing visual, digestible insights into complex financial data, thereby reducing financial anxiety and facilitating proactive decision-making regarding debt repayment and retirement planning. Moreover, the inherent convenience of having consolidated financial data accessible instantly on a mobile device meets the demands of modern, fast-paced lifestyles, making financial management seamless and integrated into daily routines.

Key driving factors propelling this market include the global surge in smartphone penetration, particularly in developing regions, making digital finance accessible to a larger population base. The supportive regulatory environment encouraging Open Banking and data sharing is essential, allowing third-party apps secure access to necessary financial data to provide value-added services. Additionally, the increasing complexity of personal investment options and the need for individuals to navigate inflation and fluctuating interest rates have heightened the demand for tools that offer predictive modeling and customized financial guidance, solidifying the market's long-term growth prospects.

Personal Finance App Market Executive Summary

The Personal Finance App Market is experiencing robust expansion driven by shifting business models towards premium subscription services and the widespread adoption of Artificial Intelligence (AI) for hyper-personalization. Key business trends indicate a consolidation phase, where established fintech entities and large traditional banks are acquiring innovative startups to integrate advanced features like robo-advisory and predictive cash flow analysis into their offerings. The monetization strategy is increasingly focused on value-added features such as tax preparation tools and personalized insurance recommendations, moving beyond basic expense tracking to holistic wealth management platforms. Partnerships with employers for employee financial wellness programs also represent a significant new revenue stream, diversifying the market's commercial landscape.

Regionally, North America remains the largest and most mature market, characterized by high competition, advanced regulatory frameworks, and significant consumer trust in digital financial services. However, Asia Pacific (APAC) is projected to exhibit the fastest growth, primarily fueled by the massive, rapidly digitizing population bases in China, India, and Southeast Asia, where mobile-first financial solutions are addressing historical gaps in banking infrastructure. Europe is characterized by strict adherence to GDPR and PSD2 regulations, which, while promoting innovation in Open Banking, necessitate significant investment in data security and compliance, influencing the types of services that can be offered across the fragmented regional market.

Segmentation trends highlight the dominance of mobile-based platforms, offering superior user experience and accessibility. Within application types, the Investment Management segment is witnessing the most rapid evolution, propelled by gamification and fractional share investing features appealing to younger investors. The subscription-based model is overshadowing the freemium model, as consumers increasingly perceive value in paying for enhanced data security, ad-free experiences, and sophisticated analytical tools, affirming a willingness to invest in personalized financial intelligence that leads to tangible savings or optimized investment returns.

AI Impact Analysis on Personal Finance App Market

Common user questions regarding AI’s impact on Personal Finance Apps center predominantly on data security, the accuracy of automated advice, and the degree of personalization achievable without intrusive data collection. Users frequently inquire whether AI-driven budgeting tools can adapt to highly irregular income patterns, how robo-advisors powered by machine learning handle market volatility compared to human advisors, and what specific measures are in place to prevent deepfake or sophisticated phishing attacks exploiting personalized financial data. The overarching concern is balancing the efficiency and predictive power offered by AI with maintaining stringent privacy standards and ensuring that automated advice truly serves the user’s best financial interest rather than the platform’s monetization goals.

The integration of AI, particularly Machine Learning (ML) algorithms, is fundamentally transforming the value proposition of personal finance applications by moving beyond simple historical reporting to predictive and prescriptive guidance. AI algorithms analyze vast amounts of transactional data, credit history, and external economic indicators in real time to generate highly accurate cash flow forecasts, alert users to potential overdrafts days in advance, and suggest personalized saving opportunities based on behavioral economics principles. This shift towards proactive financial management is enhancing user engagement and driving the perceived utility of these applications, thereby reducing churn and increasing reliance on the platform for critical financial decisions.

Furthermore, AI is crucial for automating complex tasks that traditionally required significant user effort or professional consultation. This includes automated tax preparation by classifying complex income streams, optimizing debt repayment strategies by analyzing interest rates and balances across multiple accounts, and dynamically rebalancing investment portfolios based on predefined risk tolerance and changing market conditions. The ability of AI to detect fraudulent transactions and anomalies instantly is also bolstering trust in these digital platforms, positioning them as superior alternatives to manual or static financial management methods, and setting a new benchmark for financial software functionality.

- AI-driven Hyper-Personalization: Custom budgeting recommendations based on learned spending habits and future financial goals.

- Robo-Advisory Services: Automated, algorithm-driven investment management and portfolio rebalancing utilizing ML.

- Fraud Detection and Security: Real-time identification of anomalous transactions and behavioral biometrics for enhanced security.

- Predictive Cash Flow Analysis: Forecasting future account balances and alerting users to potential shortages or surplus funds.

- Natural Language Processing (NLP): Enabling conversational interfaces (chatbots) for users to query financial data easily.

- Automated Debt Optimization: Algorithms suggesting optimal strategies for high-interest debt repayment across various loans and credit cards.

- Financial Literacy Enhancement: Providing AI-curated educational content tailored to the user's current financial profile and knowledge gaps.

DRO & Impact Forces Of Personal Finance App Market

The market is primarily driven by the escalating demand for financial autonomy and the need for simplified money management tools amidst increasing economic volatility (Drivers). However, growth is heavily constrained by significant challenges related to data privacy, stringent global regulatory compliance (GDPR, CCPA), and consumer reluctance to share sensitive financial information with third-party applications (Restraints). Opportunities lie in leveraging embedded finance to seamlessly integrate financial planning tools into non-financial platforms, and expanding into niche markets such as specialized tools for gig economy workers or cross-border remittance management (Opportunity). These factors interact through pervasive Impact Forces such as technological innovation demanding continuous feature updates, and the critical need to build consumer trust in data handling practices, which fundamentally dictates market penetration and adoption rates globally.

Key drivers include the dramatic rise in the cost of living globally, compelling individuals to seek precise expense tracking and budget adherence. The low entry barriers for accessing investment markets, facilitated by apps offering fractional shares and commission-free trading, attracts a large segment of novice investors who require personalized guidance. Furthermore, the regulatory push toward Open Banking mandates in regions like Europe and Australia has provided secure pathways for data aggregation, which is the foundational capability of most advanced personal finance apps. This regulatory support acts as a catalyst, streamlining the development process and enhancing interoperability within the financial ecosystem, speeding up feature deployment and market adoption.

Significant restraints involve the heterogeneity of global banking standards and the complexity of achieving unified data synchronization across disparate financial institutions, which often leads to poor data quality or connectivity failures. The lack of standardized data security protocols among smaller market entrants also poses a systemic risk, undermining consumer confidence in the entire ecosystem. Moreover, competitive pressure from incumbent banks that are rapidly developing their own integrated mobile solutions, leveraging their established customer base and high trust levels, limits the market share expansion capabilities of pure-play fintech applications. Addressing user concerns about the misuse of financial behavior data for targeted marketing remains a core obstacle to mass adoption.

Segmentation Analysis

The Personal Finance App Market is comprehensively segmented based on various technical and functional criteria, allowing for granular analysis of demand patterns and competitive strategies across different user demographics and operational environments. Key segmentation includes classification by platform type (Mobile-based and Web-based), deployment model (Cloud and On-premise), and application type, which differentiates functionalities such as budgeting, investment tracking, and wealth management. Further dissection occurs based on the end-user profile, separating individual consumers from small businesses or professionals requiring integrated financial oversight tools. Understanding these segments is crucial for strategic positioning, allowing developers to target specific pain points and deliver highly tailored software solutions that maximize user retention and monetization potential.

The segmentation by application reveals a dynamic shift: while basic Budgeting and Expense Tracking remain fundamental entry points, segments related to Advanced Investment Monitoring and Debt Management are demonstrating the fastest growth rates. This indicates a maturing user base that initially sought financial awareness and now requires sophisticated tools for active wealth creation and liability optimization. The mobile-based segment dominates the market share due to its superior convenience and real-time access capabilities, essential for instant transaction classification and on-the-go financial checking, making it the primary focus for feature innovation and user interface development across all regional markets.

The deployment model segmentation emphasizes the rapid displacement of traditional on-premise solutions by cloud-based platforms. Cloud deployment offers scalability, continuous updates, superior security infrastructure provided by large cloud service providers, and cost-efficiency for both developers and users. This model facilitates the seamless integration required for Open Banking APIs and enables sophisticated data analytics necessary for AI-driven recommendations. This operational flexibility is paramount in a market characterized by rapid technological iteration and a need for instantaneous data synchronization across multiple devices and financial accounts.

- By Platform Type:

- Mobile-based Applications (Dominant segment due to accessibility)

- Web-based Applications (Often used for deeper analysis and reporting)

- By Deployment Model:

- Cloud-based (Preferred model, offering scalability and real-time data)

- On-premise (Limited, primarily for institutions requiring proprietary control)

- By Application:

- Budgeting and Expense Tracking

- Investment Management and Portfolio Tracking (Fastest Growing)

- Debt Management and Credit Monitoring

- Savings and Goal Planning

- Tax Preparation and Filing Tools

- Financial Education and Literacy Tools

- By End User:

- Individual Consumers

- Small Businesses and Freelancers (Integrated professional and personal finance)

- By Revenue Model:

- Subscription-based (Premium features, dominant)

- Freemium (Basic features free, monetization via ads or upgrades)

- Affiliate Revenue (Product recommendations)

Value Chain Analysis For Personal Finance App Market

The value chain for the Personal Finance App Market commences with the Upstream Analysis, which involves the development of core software infrastructure, encompassing robust API integration modules (often relying on Open Banking standards), advanced data analytics engines (ML/AI development), and sophisticated cybersecurity frameworks. Key upstream activities include securing partnerships with data providers, cloud service providers (AWS, Azure, Google Cloud), and specialized data aggregation services (e.g., Plaid, Yodlee). This stage is critical as the accuracy, speed, and security of data aggregation directly determine the app's functionality and user trust, requiring significant investment in R&D and specialized fintech engineering talent.

The Midstream component focuses on the actual processing, customization, and delivery of the application to the end-user. This involves user interface (UI) and user experience (UX) design, ensuring intuitive navigation and clear financial visualizations, and continuous feature updates based on market feedback and regulatory changes. The Distribution Channel is bifurcated into Direct and Indirect methods. Direct distribution involves proprietary websites or direct partnerships with financial institutions. Indirect distribution, which dominates the consumer market, relies heavily on major mobile app stores (Apple App Store, Google Play Store), which act as critical gateways, dictating visibility, pricing policies, and installation volume through their strict guidelines and ranking algorithms.

The Downstream Analysis involves post-acquisition activities centered around customer engagement, retention, and monetization. This includes providing personalized customer support, managing data compliance and privacy requirements, and leveraging user behavior insights to cross-sell or upsell premium features (e.g., robo-advisory upgrades or tax consulting services). The effectiveness of the downstream segment is measured by user retention rates and the Lifetime Value (LTV) of the customer, often enhanced by features such as integrated financial marketplaces where users can compare insurance, loans, or credit card offers, generating affiliate revenue and completing the full service loop within the app ecosystem.

Personal Finance App Market Potential Customers

The potential customer base for Personal Finance Apps is broad and segmented, ranging from digital-native Millennials and Gen Z who prioritize mobile-first solutions to older generations seeking simplified retirement planning tools. The core target demographic consists of individuals aged 25 to 45 who are actively managing fluctuating income, debt (mortgages, student loans), and beginning investment portfolios, and who seek automated tools to maximize savings efficiency and achieve financial goals faster. These users value convenience, real-time data synchronization, and tools that offer a consolidated view of their complex financial lives across multiple banking and investment providers, making them ideal targets for subscription-based premium services.

A rapidly expanding segment comprises the financially underserved or those seeking to improve their financial literacy. This group often includes individuals with low to moderate income who require rigorous, easily digestible budgeting tools to break cycles of debt and manage month-to-month cash flow instability. For this segment, basic, free-to-use expense tracking features and educational modules are essential entry points, with monetization often achieved through affiliate marketing or value-added services like credit monitoring or short-term loan facilitation, provided ethically and transparently to avoid predatory practices.

Furthermore, specialized platforms are increasingly targeting High-Net-Worth Individuals (HNWIs) and business professionals who require apps capable of handling complex financial scenarios, including international asset tracking, real estate investments, and integrated personal/business expense separation. These customers are willing to pay high subscription fees for advanced security features, direct integration with private wealth managers, and bespoke tax optimization tools. The market is also finding traction among freelancers and gig economy workers who need robust tools for invoicing, tax estimation, and managing variable income streams, representing a distinct and growing professional end-user segment critical for future market expansion.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 14.5 Billion |

| Market Forecast in 2033 | USD 37.5 Billion |

| Growth Rate | 14.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Intuit Inc. (Mint), NerdWallet, Personal Capital (Empower), Credit Karma, YNAB (You Need A Budget), Mvelopes, Goodbudget, Wally, BankTree, EveryDollar, Tiller Money, Money Dashboard, Fudget, HoneyBee, Acorns, Robinhood (integration aspects), Stash, Revolut, N26, Chime. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Personal Finance App Market Key Technology Landscape

The technology landscape underpinning the Personal Finance App Market is characterized by a reliance on highly secure, interoperable, and scalable digital infrastructure. Open Banking APIs (Application Programming Interfaces) are foundational, enabling secure and consented third-party access to financial data across different banking institutions, which is necessary for data aggregation and providing a unified financial dashboard. These APIs must adhere to stringent security standards, such as OAuth 2.0 and specific regional protocols like PSD2 in Europe, ensuring both compliance and robust encryption. The rapid evolution of these standards dictates the pace of new feature development and the complexity of maintaining real-time data feeds, demanding continuous integration and delivery pipelines (CI/CD) to manage updates seamlessly.

Cloud computing infrastructure, primarily utilizing microservices architecture on platforms like AWS, Microsoft Azure, and Google Cloud, is central to managing the massive volumes of sensitive transactional data generated daily. This allows for horizontal scalability, critical during peak usage periods, and provides sophisticated tooling for data warehousing and analytics. Furthermore, advanced cryptographic techniques, including end-to-end encryption for data both in transit and at rest, are mandatory to build and maintain user trust in the security of their financial records. The transition towards decentralized identity solutions and potentially limited use of distributed ledger technology (blockchain) is being explored to enhance data provenance and security layers, although adoption remains preliminary outside of specific cross-border payment functionalities.

Crucially, the technological differentiation is increasingly provided by proprietary Artificial Intelligence (AI) and Machine Learning (ML) algorithms. These technologies process aggregated data to perform sophisticated functions like behavioral scoring, predictive budgeting, and automated investment advice. ML models require extensive, clean data sets and powerful processing capabilities to deliver accurate, personalized insights. Furthermore, the use of behavioral economics principles embedded within the app design, often facilitated by technology, encourages positive user habits through gamification, notification scheduling, and intuitive visualization techniques, transforming raw data into actionable financial intelligence and driving long-term user retention.

Regional Highlights

- North America (US and Canada): This region dominates the global market, characterized by high disposable income, mature digital banking infrastructure, and significant penetration rates for established players like Intuit (Mint) and Empower (Personal Capital). The US market benefits from competitive innovation in niche areas such as student loan management and credit score improvement, driven by high consumer debt levels. Regulatory innovation, while sometimes fragmented, generally supports fintech growth. The primary regional trend is the migration of users from free, ad-supported models to robust, subscription-based financial planning platforms that offer integrated tax and investment services.

- Europe (Germany, UK, France): Growth is primarily dictated by the implementation and continued refinement of the Payment Services Directive 2 (PSD2), which mandated Open Banking and fueled significant competition and innovation in data aggregation. The UK is a fintech powerhouse, with strong adoption of budget tracking apps like Money Dashboard and Revolut's integrated financial services. However, market fragmentation due to diverse languages and national banking regulations means app developers must invest heavily in localization and specific country compliance, making cross-border scaling more complex than in North America.

- Asia Pacific (APAC) (China, India, Japan, Southeast Asia): Projected as the fastest-growing region, driven by the enormous, rapidly digitizing population and the high mobile-first commerce adoption, particularly in India and Southeast Asia. The region is marked by a large unbanked or underbanked population, making personal finance apps essential tools for initial financial inclusion. Key drivers include government initiatives promoting digital payments (e.g., UPI in India) and the rise of super-apps (WeChat, Grab) that integrate payment, lending, and basic financial management, often leveraging low-cost data access and local language support to penetrate rural markets quickly.

- Latin America (LATAM) (Brazil, Mexico): Characterized by high economic volatility and fluctuating inflation, leading to significant consumer demand for robust expense tracking and savings protection tools. The regulatory environment is evolving, with Brazil leading efforts in implementing Open Banking frameworks (Open Finance). The market potential is high, but challenges include lower credit card penetration, requiring apps to adapt to cash-based economies, and ensuring high levels of data security amidst varying local consumer protection laws. Mobile usage is extremely high, driving platform preference.

- Middle East and Africa (MEA): This region is highly diverse, with Gulf Cooperation Council (GCC) countries showing strong investment in high-end wealth management apps targeting high-net-worth segments and leveraging advanced blockchain security. In Africa, particularly sub-Saharan countries, the market is dominated by mobile money solutions (like M-Pesa), where personal finance apps focus on integrating these digital wallets with traditional banking services. Growth is spurred by young, digitally savvy populations but is hampered by infrastructure limitations and fragmented regulatory oversight in many smaller nations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Personal Finance App Market.- Intuit Inc. (Mint)

- Empower Personal Capital

- NerdWallet

- Credit Karma

- You Need A Budget (YNAB)

- Mvelopes

- Goodbudget

- Wally

- BankTree Software

- EveryDollar

- Tiller Money

- Money Dashboard

- Fudget

- HoneyBee

- Acorns Grow Inc.

- Stash Financial, Inc.

- Revolut Ltd. (Integrated services)

- Chime (Integrated banking and finance app)

- Monzo Bank Ltd. (Integrated banking and finance app)

- Albert Corporation

Frequently Asked Questions

Analyze common user questions about the Personal Finance App market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Personal Finance App Market?

The Personal Finance App Market is projected to grow at a robust Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033, driven primarily by increasing demand for automated budgeting and investment tools worldwide.

How is AI fundamentally changing personal finance applications?

AI is transforming apps by enabling predictive cash flow forecasting, providing highly customized budgeting recommendations, powering robo-advisory services for investment, and significantly enhancing fraud detection capabilities through real-time data analysis.

Which region currently leads the Personal Finance App Market?

North America currently holds the largest market share due to its mature fintech ecosystem, high consumer trust in digital financial services, and significant competition leading to continuous innovation and feature enhancement.

What are the primary restraints affecting market growth?

The main restraints include significant consumer concerns regarding data privacy and security of sensitive financial information, coupled with the complexity of adhering to the highly fragmented and evolving global financial regulatory mandates such as GDPR and CCPA.

What is the dominant revenue model used by leading personal finance apps?

The subscription-based model is increasingly dominant, as it allows companies to offer premium features like advanced portfolio analysis, tax optimization tools, and dedicated customer support, moving beyond the revenue limitations of the older freemium model.

What are the key technological enablers in this market?

Key technological enablers include secure Open Banking APIs for data aggregation, scalable cloud computing infrastructure, and sophisticated Machine Learning (ML) algorithms necessary for delivering personalized, predictive financial insights and enhancing overall user experience.

Who are the primary end-users driving demand for these applications?

The primary drivers of demand are Millennials and Gen Z who prefer mobile-first solutions for managing debt and initiating investments, alongside individuals seeking financial literacy and automated tools to navigate complex economic conditions and improve savings discipline.

Is the market moving towards specialized or holistic financial platforms?

The market is trending towards holistic financial platforms, where apps integrate various functions—from budgeting and credit monitoring to investment and tax planning—to provide users with a single, comprehensive view and management tool for their entire financial lifecycle, thereby increasing customer lifetime value.

How important are data visualization and user experience (UX) in app success?

Data visualization and UX are critical for success, as they simplify complex financial data into digestible formats, helping users quickly understand spending patterns and progress towards financial goals, which directly impacts user engagement and long-term retention rates.

What opportunities exist in the emerging markets like Asia Pacific?

Asia Pacific offers major opportunities driven by high mobile penetration, a large unbanked population requiring basic financial inclusion tools, and the rapid adoption of digital payment systems, enabling massive scale for localized financial management applications.

What is the role of Open Banking regulations in market expansion?

Open Banking regulations are vital as they mandate secure data sharing protocols, allowing third-party apps to reliably aggregate data from different financial institutions, which is the foundational capability necessary for personal finance apps to function effectively and provide consolidated oversight.

Are traditional banks competing effectively with fintech apps?

Traditional banks are increasingly competitive by integrating similar robust personal finance management features directly into their proprietary mobile banking applications, leveraging their existing high customer trust and extensive user bases to challenge pure-play fintech firms.

How do personal finance apps address behavioral finance?

Apps utilize principles of behavioral finance through features like gamification, timely nudges, personalized spending alerts, and goal-setting visualization to encourage users to adopt positive financial habits and mitigate detrimental impulsive spending or saving behaviors.

Which application segment is showing the fastest growth?

The Investment Management and Portfolio Tracking segment is exhibiting the fastest growth, fueled by the accessibility of micro-investing, fractional shares, and the rising demand for automated, low-cost robo-advisory services among novice investors.

What role does cybersecurity play beyond standard encryption?

Cybersecurity extends beyond standard encryption to include behavioral biometrics, real-time anomaly detection using ML models to flag unusual transactions, and continuous monitoring of API security to prevent unauthorized data access, maintaining essential user confidence.

What is the significance of the shift from Web-based to Mobile-based platforms?

The shift signifies consumer preference for real-time, on-the-go financial access. Mobile platforms offer better user experience, immediate transaction classification capabilities, and higher engagement, making them the dominant and primary platform for new feature deployment.

How do apps monetize besides subscriptions?

Alternative monetization methods include affiliate marketing (recommending insurance, credit cards, or loan products), charging small fees for advanced services like tax filing, and data licensing (anonymized and aggregated data) for market trend analysis, though subscriptions remain key.

What is the impact of global economic inflation on app usage?

High global inflation significantly increases demand for personal finance apps, as consumers become more vigilant about managing tight budgets, tracking rising costs, and seeking tools that provide clear financial projections to cope with reduced purchasing power.

What is the key challenge in scaling apps internationally?

The key challenge is the regulatory complexity and fragmentation across national boundaries, which necessitates extensive localization efforts, adherence to distinct data protection laws, and integration with hundreds of unique local banking standards and payment infrastructures.

How do personal finance apps support financial inclusion?

They support financial inclusion by providing accessible, low-cost entry points for financial management to unbanked or underbanked populations, particularly in emerging markets, allowing them to track income, budget effectively, and access basic credit or savings tools without needing a traditional bank account.

What specific challenges do apps face with irregular income users?

Apps face challenges in accurately predicting cash flow and creating reliable budgets for users with irregular or seasonal income (like freelancers or gig workers). Advanced AI models are necessary to accurately analyze variable deposits and create flexible, adaptive financial plans.

What is a key downstream activity in the market value chain?

A key downstream activity is maximizing customer retention through continuous personalized support and targeted feature rollout, leveraging user data insights to increase the Customer Lifetime Value (LTV) through upselling premium, high-value financial services.

How is the concept of 'embedded finance' relevant to this market?

Embedded finance allows personal finance features (like budgeting alerts or expense tracking) to be seamlessly integrated into non-financial platforms (e.g., e-commerce sites or productivity software), broadening the reach and contextualizing financial management within daily consumer activities.

What makes the Middle East and Africa (MEA) market unique?

The MEA market is unique due to the strong presence of mobile money ecosystems in some parts, requiring financial apps to prioritize integration with these wallets, while GCC countries focus on high-security, specialized wealth management solutions targeting affluent expatriate and local populations.

How are companies using partnerships to expand their offerings?

Companies form strategic partnerships with employers to offer financial wellness programs, partner with tax preparation services for integrated filing, and collaborate with traditional banks to offer co-branded or white-labeled digital financial management tools, expanding both feature sets and user acquisition channels.

What role does the cloud deployment model play in market growth?

Cloud deployment is critical because it offers the essential scalability, cost-efficiency, and robust security needed to handle real-time data aggregation across numerous accounts, facilitating rapid deployment of updates and supporting complex AI computations necessary for predictive advice.

What are the typical components of the upstream value chain?

The upstream value chain primarily involves securing crucial inputs such as data aggregation technology (via partners like Plaid), developing core ML/AI frameworks, and procuring high-level cloud computing resources necessary to process and secure sensitive user financial data.

How does the fragmentation of the European market impact strategy?

Market fragmentation necessitates significant investment in localization, language support, and adaptation to specific national banking protocols. Developers must ensure compliance with diverse national data protection and consumer laws, often limiting the immediate scalability of a single product across the continent.

Beyond budgeting, what is a crucial, high-value application type?

Debt Management and Optimization is a high-value application, utilizing algorithms to analyze various debt instruments (credit cards, loans) and recommend the mathematically optimal repayment schedule, saving users significant interest over time and justifying premium subscription fees.

How do personal finance apps contribute to financial wellness?

These apps contribute to financial wellness by providing transparency into spending habits, reducing financial stress through automated organization, and offering educational content and tools that empower users to make informed long-term decisions about saving, investing, and retirement planning.

What is the estimated market size of Personal Finance Apps by 2033?

The market is projected to reach an estimated value of USD 37.5 Billion by the end of the forecast period in 2033, reflecting substantial anticipated growth driven by digital adoption and sophisticated technology integration.

What competitive advantage do pure-play fintech firms hold over traditional banks?

Fintech firms often hold an advantage in terms of agility, superior user interface (UX) design, speed of feature deployment, and a focused ability to leverage cutting-edge technologies like AI without the legacy system constraints faced by large, incumbent financial institutions.

How significant is the role of gamification in user retention?

Gamification techniques, such as earning badges for savings milestones or using progress bars for debt repayment, are highly significant as they enhance user engagement, make financial management less tedious, and encourage the consistent interaction necessary for successful long-term financial planning.

What is the primary factor driving rapid growth in the Asia Pacific region?

The primary factor is the widespread adoption of smartphones and the significant push for financial inclusion through mobile-first digital solutions in massive, rapidly developing economies like India and Southeast Asia, bypassing traditional, often inefficient banking infrastructures.

How is blockchain technology being considered in the market?

While not universally adopted, blockchain technology is being explored primarily for enhancing data security and immutability, ensuring better data provenance, and potentially streamlining cross-border payments, adding a layer of transparency and trust in specific high-value transactions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager