Pet Accessories Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437738 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Pet Accessories Market Size

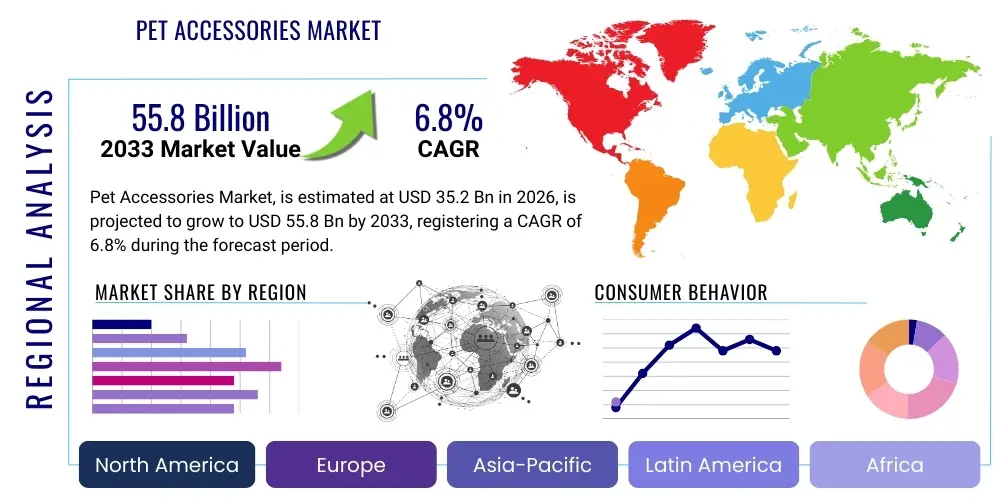

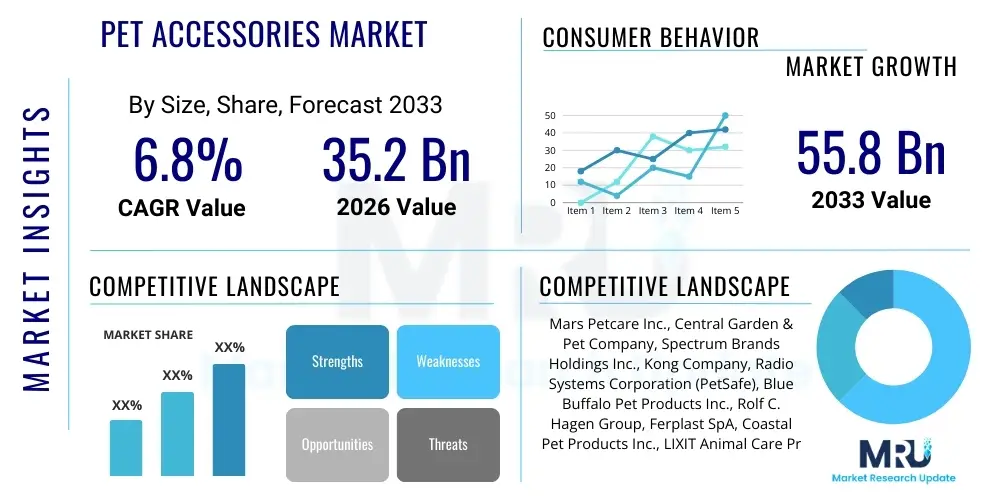

The Pet Accessories Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 35.2 Billion in 2026 and is projected to reach USD 55.8 Billion by the end of the forecast period in 2033.

Pet Accessories Market introduction

The Pet Accessories Market represents a dynamic and highly resilient segment within the broader pet care industry, fundamentally defined by the manufacturing and distribution of non-edible products intended to improve the quality of life, management, and interaction with domestic companion animals. This comprehensive category spans foundational necessities such as robust containment solutions, including advanced carriers and specialized crates, and extends into sophisticated technological integrations like behavior monitoring wearables and automated climate-controlled habitats. A key defining characteristic is the continuous evolution towards premiumization, driven by affluent consumer segments demanding human-grade quality, often incorporating features found in high-end consumer goods, such as memory foam orthopedic bedding or precision-engineered stainless steel feeding systems. The market’s intrinsic linkage to discretionary consumer spending is counterbalanced by the emotional necessity associated with pet ownership, ensuring steady demand even when other luxury sectors face retraction. The ecosystem supports extensive product differentiation, catering meticulously to breed-specific requirements—for example, specialized cooling vests for thick-coated breeds in warm climates, or low-impact joint supports for geriatric pets, illustrating the depth of market segmentation and the technical complexity involved in product design and material selection across the supply chain.

Product diversity is a hallmark of the Pet Accessories Market, reflecting the specialized requirements of different animal species and breeds. The core utility of these products addresses major pet owner concerns: safety, health, hygiene, and mental stimulation. In terms of safety, the market has seen massive advancements, moving from basic reflective collars to complex GPS and cellular-enabled tracking devices integrated with geofencing capabilities, providing owners with enhanced security and peace of mind when pets are unsupervised or prone to wandering. For health management, accessories now include slow-feeding bowls designed to prevent bloat, specialized dental care kits, and therapeutic apparel like anxiety wraps or recovery suits, reducing reliance on conventional medical treatments for minor issues. The sheer volume of SKU proliferation reflects the industry's response to modern lifestyle demands, catering to needs ranging from specialized travel accessories conforming to increasingly stringent airline regulations to aesthetically pleasing pet furniture designed to blend seamlessly with contemporary home décor. The market is also heavily influenced by regulatory standards, particularly in regions like the European Union and North America, where stringent chemical safety and durability testing protocols govern the sale of materials that come into contact with animals, ensuring consumer trust and minimizing product liability risks for reputable manufacturers.

The primary driving factors sustaining market growth include the robust humanization of pets trend, where owners are willing to allocate significant disposable income towards premium pet care products that mirror human-grade quality and design. Technological advancements, such as the integration of GPS tracking, health monitoring sensors, and automated feeding systems into accessories, enhance convenience and pet safety, appealing strongly to tech-savvy consumers. The expansion of accessible distribution channels, particularly through global e-commerce platforms and specialized pet retail chains, facilitates product availability across diverse geographic regions. Benefits derived from utilizing quality accessories include improved pet health outcomes (e.g., orthopedic beds, slow feeders), enhanced safety during outdoor activities (e.g., reflective vests, secure harnesses), and strengthened human-animal bonds through interactive play and training. This alignment of social trends, technological capability, and proven utility guarantees the market's trajectory remains strongly positive, attracting continuous investment in research and development and strategic market expansion across emerging economies where pet adoption rates are still accelerating.

Pet Accessories Market Executive Summary

The Pet Accessories Market is undergoing significant evolution, characterized by pronounced business trends favoring direct-to-consumer (DTC) models and heightened corporate focus on sustainable and ethically sourced materials. Strategic mergers and acquisitions remain pivotal, as established conglomerates aim to quickly absorb disruptive startups specializing in highly technical niches, such as microchip-enabled feeders or behaviorally specialized toy systems, allowing for rapid portfolio diversification and intellectual property capture. A critical emerging business trend is the mastery of the Direct-to-Consumer (DTC) sales model, offering brands unprecedented opportunities to manage customer feedback loops directly, enabling swift product iterations and fostering deeply loyal customer communities through personalized communication and targeted marketing campaigns. Manufacturers are placing a premium on supply chain resilience, often diversifying sourcing geographically and investing in vertical integration to mitigate risks associated with fluctuating material costs and global shipping bottlenecks, recognizing that product availability and timely delivery are non-negotiable competitive factors in the high-velocity e-commerce environment.

Regional dynamics highlight a bifurcation in market maturity and growth profiles. The mature markets of North America and Western Europe, while possessing the largest cumulative market value, drive growth primarily through value enhancement—the substitution of standard accessories with high-end, technologically superior, or branded designer alternatives. These regions exhibit sophisticated regulatory environments that favor safety-certified, locally manufactured or ethically imported goods, creating high barriers to entry for low-quality generic providers. Conversely, the Asia Pacific (APAC) region, driven by explosive growth in urbanization and middle-class expansion in countries like China, India, and Southeast Asia, represents the primary volume growth engine. APAC's market development is characterized by rapid retail infrastructure expansion, the proliferation of large-scale pet exhibition centers, and the swift adoption of both domestic and imported accessory brands, indicating a significant untapped potential for mass-market penetration and brand establishment. Successfully navigating the APAC market requires localized product adaptation, particularly concerning design aesthetics and suitability for climate conditions prevalent in the dense metropolitan areas.

Analysis of segment trends demonstrates a clear trajectory away from standardized, multi-purpose items toward specialized, solution-oriented accessories. The apparel and fashion segment, previously considered a luxury outlier, has normalized and is now a significant driver, spanning functional weather gear (e.g., cooling jackets, waterproof parkas) to designer clothing, supported by social media visibility and influencer culture. Crucially, the segment comprising pet health and wellness accessories, including specialized orthopedic supports, anxiety-reducing pheromone diffusers, and clinically tested behavioral aids, is expanding at an above-average pace, benefiting from the willingness of aging pet populations to require long-term care solutions. This emphasis on specialized niche products allows manufacturers to command higher price points and establish stronger brand differentiation, ensuring that investment priorities align with contemporary sociological shifts and consumer welfare concerns, moving away from purely aesthetic or functional competition towards value-added utility.

AI Impact Analysis on Pet Accessories Market

The influence of Artificial Intelligence (AI) on the Pet Accessories Market is transitioning from theoretical application to fundamental operational restructuring, addressing key areas from design optimization to enhanced consumer interaction. Common stakeholder questions center on how machine learning algorithms can interpret the vast, continuous stream of data generated by smart accessories—such as activity logs, feeding patterns, and physiological markers—to produce genuinely individualized recommendations that surpass traditional demographic segmentation. Manufacturers are specifically interested in leveraging generative AI tools to rapidly iterate through thousands of potential accessory designs (e.g., optimizing the stress points on a harness or the grip efficacy of a chew toy) before committing to expensive physical prototyping, thereby dramatically accelerating the time-to-market for novel products. Furthermore, there is significant emphasis on using AI in predictive logistics, anticipating seasonal fluctuations in demand (e.g., peak demand for cooling mats in Southern regions or heavy-duty snow boots in Northern areas) with higher accuracy than traditional forecasting models, leading to leaner inventory management and improved capital efficiency across global distribution networks.

In the realm of product enhancement, AI integration elevates accessories from simple physical tools to intelligent monitoring systems. For instance, advanced smart collars equipped with miniaturized biosensors and integrated AI processors can utilize deep learning models trained on extensive datasets of healthy and distressed pet behavior. This allows the accessory to identify subtle, non-obvious deviations in movement, vocalization, or heart rate that could signal the onset of illness, stress, or injury long before a human owner recognizes the symptoms. This transition positions accessories as critical preventative health endpoints, significantly increasing their intrinsic value and justifying premium pricing tiers. The effectiveness of these AI-powered devices relies heavily on the quality and volume of training data, prompting strategic partnerships between technology developers and veterinary research institutions to validate algorithmic accuracy and build specialized, pet-specific behavioral models, thereby reinforcing market trust in these sophisticated new product categories.

Beyond the product itself, AI significantly refines the customer journey and personalization at scale. E-commerce platforms employ sophisticated AI recommendation engines that analyze not only the pet's profile details provided by the owner but also contextual factors such as climate data, local product reviews, and integration capabilities with existing smart home technology. If a customer purchases an automated feeder, the AI can immediately recommend compatible battery backup systems, specialized storage containers, and accessories suitable for cleaning the feeding mechanism, optimizing the entire product ecosystem for the user. Moreover, AI-driven conversational interfaces are becoming standard in customer support, providing instant, specialized technical troubleshooting for complex smart devices, reducing the need for costly human intervention, and ensuring 24/7 technical support. This comprehensive utilization of AI throughout the value chain—from design and manufacturing efficiency to predictive health monitoring and optimized retail interaction—is the single most transformative force currently shaping the competitive landscape of the Pet Accessories Market, favoring technologically adept, data-centric organizations.

- AI drives hyper-personalized accessory recommendations based on individual pet data (breed, age, activity, specific health metrics collected from sensors).

- Predictive analytics optimize inventory management and reduce supply chain lead times for high-demand seasonal items, minimizing storage costs.

- Machine learning enhances smart pet accessories (e.g., feeders, collars) to provide advanced behavioral and health monitoring, detecting early signs of distress or illness.

- Generative AI assists product designers in rapid prototyping and optimizing material usage and ergonomic functionality of new accessories.

- Automated customer service using AI chatbots assists owners with product selection, technical troubleshooting of complex smart devices, and order fulfillment queries, improving operational efficiency.

DRO & Impact Forces Of Pet Accessories Market

The foundational strength of the Pet Accessories Market lies in the powerful synergy of demographic and economic drivers. The most pervasive driver is the humanization trend, which manifests economically as inelastic demand for premium products, meaning consumers are less likely to trade down on quality even during economic downturns when the purchase is perceived as directly benefiting their pet's welfare. This is compounded by rising global pet ownership rates, particularly in densely populated urban areas across Asia and Latin America, creating a massive influx of first-time accessory buyers. Specific market expansion drivers include the growing geriatric pet population, necessitating specialized accessories like ramps, orthopedic support vests, and temperature-regulating bedding, which command significantly higher price points due to their specialized engineering and medical relevance. Furthermore, intense social media sharing and normalization of pet products, often driven by professional pet influencers, rapidly accelerates demand for trendy, fashionable, and aesthetically integrated items, driving short product lifecycle trends in categories like apparel and travel gear, ensuring constant consumer renewal and replacement cycles.

Notwithstanding the robust growth drivers, the market faces structural constraints and formidable obstacles. One major restraint is the significant market fragmentation, which facilitates the proliferation of counterfeit or low-quality goods, often sourced cheaply and sold through unauthorized online channels. These products frequently fail safety standards, undermining consumer trust and forcing reputable brands to invest heavily in anti-counterfeiting measures and consumer education regarding material safety (e.g., avoiding toxic dyes or unsafe small parts in toys). Pricing sensitivity remains a challenge in mass-market segments, where cost efficiency in manufacturing often dictates market dominance, potentially compromising the feasibility of premium sustainable material use. Additionally, regulatory hurdles regarding the import and sale of electronic accessories, particularly related to frequency spectrum allocation and data privacy standards for smart devices, create compliance complexity, particularly for companies operating across multiple international jurisdictions that require specialized product variations and certifications.

Opportunities for strategic advantage are concentrated heavily within the intersection of wellness, sustainability, and digital convenience. A major untapped opportunity exists in expanding the B2B segment, specifically creating and marketing industrial-grade accessories for the rapidly growing professional pet service sector—including specialized handling equipment for large veterinary hospitals, advanced training aids for dog daycares, and durable, easy-to-sanitize furniture for luxury boarding facilities. The overarching impact forces shaping the competitive arena are the continued shift toward Direct-to-Consumer (DTC) engagement and the increasing expectation of product intelligence. Market leaders will be those who successfully leverage data analytics from connected accessories to create personalized, proactive service offerings (e.g., automatic reorder suggestions for worn-out toys based on usage data or alerts for potential vet visits). Ultimately, maintaining high-velocity product innovation aligned with demonstrable health benefits and ethical sourcing will determine profitability and market positioning over the long-term forecast period.

Segmentation Analysis

Segmentation analysis is critical for navigating the complexity of the Pet Accessories Market, as it dictates manufacturing specialization, channel strategy, and targeted marketing efforts. The segmentation by Pet Type remains the most fundamental axis, with Dogs and Cats accounting for the overwhelming majority of market revenue due to their sheer population size and the extensive variety of accessories required across their lifespan, encompassing everything from basic restraint systems to specialized post-operative care items. However, the smaller pet categories, including exotic birds, reptiles, and specialized aquariums, represent high-value, albeit niche, segments. Owners in these segments are often highly dedicated enthusiasts willing to pay premium prices for highly specific habitat accessories, temperature control systems, and unique enrichment toys designed specifically to mimic natural environments, underscoring the necessity for specialized product lines that cater to these distinct biological and behavioral needs.

Segmentation by Product Type reveals distinct growth dynamics. While traditional, non-electronic items such as collars, leashes, and bowls constitute high-volume, stable revenue streams, the high-growth trajectories are clearly located within the technology-enabled categories. Smart Pet Accessories, including automated feeders with integrated scales, high-definition pet monitoring cameras, and GPS tracking collars utilizing low-power wide-area network (LPWAN) protocols, are expanding rapidly. This growth is a direct reflection of owner anxiety concerning pet welfare when absent, combined with decreasing component costs for sensors and connectivity modules. Furthermore, the Apparel and Clothing segment is diversifying, transitioning from purely aesthetic items to functional gear, such as specialized high-visibility vests for safety or therapeutic garments designed to reduce anxiety through mild compression, thereby increasing the segment's utilitarian appeal and driving consistent consumer purchases based on seasonal and functional requirements.

The analysis of Distribution Channels underscores the market's ongoing digital transformation. E-commerce platforms, including massive online marketplaces and specialized pet-centric retailer sites, provide unparalleled breadth of choice, competitive pricing, and user-generated product reviews, establishing them as the dominant sales avenue, particularly for standardized or highly researched technical products. Traditional brick-and-mortar outlets, including specialty pet stores and veterinary clinics, continue to maintain importance for experiential purchases—such as fitting complex harnesses, sampling specialized pet foods (often cross-sold with accessories), or providing expert consultation on expensive items like heavy-duty crates or large-scale aquariums. Successfully competing requires an Omnichannel strategy, leveraging the physical presence for high-touch service and the digital platform for efficient fulfillment, data collection, and personalized product recommendations, optimizing the supply chain to effectively service both the immediate retail pull and scheduled recurring subscription needs.

- Pet Type: Dogs, Cats, Small Animals, Fish, Birds, Others.

- Product Type: Collars, Leashes & Harnesses, Toys, Apparel, Beds & Blankets, Carriers & Crates, Grooming Products, Smart Pet Accessories (Feeders, Trackers), Bowls & Feeders, Others.

- Material: Nylon, Leather, Plastic/Polymer, Metal, Rubber, Natural/Eco-friendly Materials.

- Distribution Channel: Offline (Specialty Stores, Mass Retailers, Veterinary Clinics), Online (E-commerce Portals, Company Websites, Subscription Services).

Value Chain Analysis For Pet Accessories Market

The upstream segment of the Pet Accessories value chain is characterized by a high reliance on specialized material procurement, demanding meticulous attention to both cost control and strict quality assurance, especially concerning pet safety. Raw materials sourcing involves securing bulk contracts for high-performance textiles (e.g., military-grade webbing, weather-resistant polyester), advanced polymers (e.g., BPA-free, food-grade plastics for feeders), and electronic components (microchips, sensors, GPS modules) required for smart products. A critical factor in this phase is the validation of supplier compliance with international chemical safety standards, specifically ensuring the absence of heavy metals or toxic phthalates in materials that pets frequently mouth or wear for extended periods. Strategic leverage in the upstream segment often stems from long-term agreements with specialized material innovators, granting exclusive access to proprietary materials, such as antimicrobial coatings for bedding or advanced shock-absorbing plastics for carriers, providing manufacturers with a distinct technological advantage over competitors reliant on commodity inputs.

Midstream operations encompass design, advanced manufacturing, and rigorous quality control protocols. Modern accessory design heavily utilizes Computer-Aided Design (CAD) and simulation software to optimize product ergonomics, particularly for orthopedic supports and harness systems, ensuring maximum comfort and minimum risk of chafing or injury. Manufacturing processes are varied; basic items like plastic bowls are produced via high-volume injection molding, while intricate smart devices require complex electronic assembly and software integration, often outsourced to specialized EMS (Electronic Manufacturing Services) providers in Asia. Maintaining high quality control (QC) is paramount; products like leashes and harnesses are subjected to stringent pull-strength testing, while electronics undergo prolonged functional testing under various environmental conditions. The increasing demand for customization and personalization, facilitated by flexible manufacturing techniques like additive manufacturing (3D printing), allows for highly specialized, small-batch production runs catering to bespoke customer orders, thus capturing premium market segments that prioritize individualized fit and aesthetic.

The downstream flow involves market penetration, brand promotion, and the intricate management of multi-channel distribution. Distribution effectiveness is judged by speed, accuracy, and reach. Direct sales through proprietary e-commerce platforms offer the highest margin and direct customer data access, facilitating powerful feedback loops crucial for service refinement and product iteration. Indirect distribution relies on partnerships with mega-retailers (e.g., Walmart, Target) for mass-market reach and specialized pet chains (e.g., Petco, PetSmart) for expert consultation and display of premium items. Logistics complexity is exacerbated by the diverse size and weight of accessories, requiring sophisticated warehouse management systems (WMS) capable of optimizing storage and fulfillment for everything from lightweight apparel to oversized crates. The successful integration of digital platforms with physical inventory ensures efficient flow and minimizes stockouts, a critical element for satisfying the highly time-sensitive demands of modern pet owners who rely on instant accessibility and swift delivery for necessary replacement items.

Pet Accessories Market Potential Customers

The principal customer base for the Pet Accessories Market is segmented into high-involvement pet parents, driven by emotional attachment and a strong desire for premiumization, and utilitarian consumers, focused on basic functionality and cost-effectiveness. The high-involvement segment, dominated by Millennials and Gen Z, exhibits purchasing patterns focused on innovation, brand ethicality, and the aesthetic integration of pet gear into their personal lifestyles. These consumers are the primary adopters of smart accessories, designer apparel, and specialized health-focused products. They are highly responsive to content marketing that emphasizes the pet's well-being and are active users of online forums and social media for product discovery and peer validation, making digital influence a vital component of customer acquisition strategy, requiring sophisticated data analysis to track evolving social trends.

A second major customer group includes specialized institutions and businesses, such as veterinary clinics, professional groomers, animal shelters, and pet boarding facilities. These B2B customers prioritize industrial-grade durability, ease of sanitation, and specialized functionality. For instance, veterinary clinics are significant buyers of specific medical accessories, specialized restraints, recovery collars, and therapeutic bedding. Groomers require professional-grade clippers, tables, and specialized dryers designed for heavy-duty, continuous use. While they represent a smaller volume of individual transactions compared to consumer purchases, B2B buyers often purchase in large bulk quantities and prioritize long-term vendor relationships built on reliability and quality certification.

Ultimately, the key strategic customer group driving market profitability is the high-spending, premium segment of pet owners who actively seek out niche, specialized, and high-tech accessories. These customers are motivated by safety, health outcomes, and a strong emotional connection, translating into inelastic demand for high-quality goods, regardless of price fluctuations. Manufacturers must focus their marketing efforts on establishing brand narratives that emphasize superior materials, technological superiority, and ethical sourcing to capture this valuable demographic. Understanding the psychological drivers—the desire to provide the absolute best care and security for the pet—is crucial for successful engagement with the market’s highest-value customers, requiring targeted digital campaigns and strong expert endorsements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.2 Billion |

| Market Forecast in 2033 | USD 55.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mars Petcare Inc., Central Garden & Pet Company, Spectrum Brands Holdings Inc., Kong Company, Radio Systems Corporation (PetSafe), Blue Buffalo Pet Products Inc., Rolf C. Hagen Group, Ferplast SpA, Coastal Pet Products Inc., LIXIT Animal Care Products, PetMate, Doog Inc., Worldwise Inc., Ethical Products Inc., West Paw Design, Nylabone, Zoon, Sleepypod, Hurtta, Kurgo, ZippyPaws, Trixie Pet Products. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pet Accessories Market Key Technology Landscape

The core technological evolution in the Pet Accessories Market is defined by the pervasive integration of the Internet of Things (IoT) framework, which transforms static products into connected data sources. This involves embedding sophisticated micro-electromechanical systems (MEMS) sensors—such as accelerometers, gyroscopes, and temperature monitors—into seemingly simple items like collars and harnesses. These sensors continuously collect vast amounts of physiological and behavioral data, which are then transmitted via low-power communication standards (e.g., Bluetooth Low Energy or specialized cellular networks like NB-IoT) to cloud platforms for complex analysis. The technological challenge lies in optimizing energy efficiency to ensure long battery life while maintaining high data sampling rates and ensuring the entire system is ruggedized to withstand rigorous physical activity, dirt, and moisture, thereby demanding high-specification component selection and specialized encapsulation techniques in manufacturing.

Beyond connectivity, material science represents a crucial technological frontier. Innovations include the development of self-cleaning and antimicrobial textile technologies (utilizing silver ions or specialized non-leaching chemical treatments) for bedding and apparel, significantly improving hygiene and reducing odor. In the orthopedic segment, advanced viscoelastic polymers, often marketed as pet memory foam, are engineered to provide superior joint support and pressure distribution for older or injured animals. For toys and feeding equipment, the technological focus is on enhancing durability and safety through the use of non-toxic, highly resilient polymers and composites, designed to withstand aggressive chewing while remaining chemically inert and safe for ingestion of small, non-sharp particles, addressing major consumer concerns regarding product longevity and chemical safety standards compliance.

Furthermore, automation and robotics technology are increasingly defining the functionality of high-end hygiene and feeding accessories. This includes robotic litter boxes that employ sophisticated weight and motion sensors, combined with mechanical waste removal systems, to offer hands-free waste management solutions. Automated feeders utilize precision dispensing mechanisms integrated with smartphone apps, allowing owners to manage multiple scheduled feedings with exact portion control, often incorporating integrated scales and dietary tracking software. The implementation of user-friendly Graphical User Interfaces (GUIs) and robust firmware updates are essential for these devices, ensuring smooth operation and adaptability to evolving software standards. The successful deployment of these automation technologies demands seamless software-hardware integration and rigorous cybersecurity measures to protect user data and ensure the continuous, reliable operation of these critical, life-sustaining pet management tools.

Regional Highlights

The regional dynamics of the Pet Accessories Market reflect varied levels of economic development, pet ownership penetration, and cultural attitudes toward animal care expenditure.

- North America: Dominant market share due to high consumer spending power and high rate of pet humanization. The US market drives innovation in smart accessories, specialized health-focused products, and premium orthopedic and dietary gear. Robust distribution networks and high e-commerce penetration characterize this region.

- Europe: High maturity, second largest revenue generator. Western Europe (UK, Germany, France) shows strong demand for ethical, sustainable, and EU regulatory compliant products. Growth is fueled by sophisticated consumer demand for high-end design and eco-friendly materials, particularly in apparel and travel accessories.

- Asia Pacific (APAC): Fastest-growing region, driven by exponential growth in urban pet adoption in China, Japan, and South Korea. Rising disposable income is fueling a rapid shift from traditional, basic accessories to modern, technologically advanced products. Local manufacturing prowess makes this a key global supply and innovation hub.

- Latin America (LATAM): Emerging growth region, characterized by increasing retail modernization and improving economic stability. Demand is currently focused on essential and mid-range accessories, with Brazil leading the region in pet population and market opportunity, especially for flea/tick accessories and basic training gear.

- Middle East and Africa (MEA): Represents the smallest but highly potential market. Growth is localized in affluent urban centers (e.g., UAE, Saudi Arabia, South Africa) where high-income consumers import luxury and high-tech pet products, often mirroring Western premium trends, although religious and climatic factors influence product type demand (e.g., specialized cooling mats).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pet Accessories Market.- Mars Petcare Inc. (Strategic investor in digital pet ecosystems)

- Central Garden & Pet Company (Broad portfolio across grooming and habitat)

- Spectrum Brands Holdings Inc. (Focus on aquatics and small animal accessories)

- Kong Company (Dominant in durable chew and interactive toys)

- Radio Systems Corporation (PetSafe) (Leader in containment and training electronics)

- Blue Buffalo Pet Products Inc. (Expanding accessory lines alongside premium food)

- Rolf C. Hagen Group (Global reach with diverse pet supply offerings)

- Ferplast SpA (European leader in cages, carriers, and habitat solutions)

- Coastal Pet Products Inc. (Specializes in collars, leashes, and harnesses)

- LIXIT Animal Care Products (Focus on specialized hydration and feeding solutions)

- PetMate (Major manufacturer of crates, kennels, and travel accessories)

- Doog Inc. (Known for innovative walking and waste management gear)

- Worldwise Inc. (Emphasis on eco-friendly and sustainable pet products)

- Ethical Products Inc. (Strong presence in toys and hygiene accessories)

- West Paw Design (Specialized in eco-friendly, durable Zogoflex toys)

- Nylabone (Leader in edible and non-edible chew items)

- Zoon (UK-based brand focusing on contemporary pet furniture and decor)

- Sleepypod (Designer and producer of high-safety crash-tested pet carriers)

- Hurtta (Finnish company specializing in performance dog apparel for extreme weather)

- Kurgo (Focus on safety and comfort for traveling pets in vehicles)

Frequently Asked Questions

Analyze common user questions about the Pet Accessories market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Pet Accessories Market?

The primary driver is the widespread humanization of pets, where owners treat companion animals as family members, leading to increased willingness to purchase premium, high-quality, and technologically advanced accessories for comfort, safety, and health monitoring.

Which pet accessory segment is experiencing the fastest growth rate?

The Smart Pet Accessories segment, including GPS trackers, automated feeders, and remote monitoring cameras, is exhibiting the highest growth due to technological integration and owner demand for real-time pet safety and wellness data, often leveraging IoT technology.

How is sustainability impacting product development in pet accessories?

Sustainability is a crucial factor, driving manufacturers to adopt materials such as recycled ocean plastics, biodegradable fibers, and ethically sourced textiles, appealing to the growing consumer segment that prioritizes environmental responsibility and non-toxic safety for their pets.

Where do potential customers primarily purchase pet accessories?

While specialty pet stores remain important for consultative purchases, the majority of volume sales are rapidly shifting to online channels, including major e-commerce platforms and brand-specific Direct-to-Consumer (DTC) websites, driven by convenience and competitive pricing.

What role does Artificial Intelligence play in modern pet accessories?

AI is used for hyper-personalization, recommending accessories based on specific pet profiles, and is embedded in smart devices to provide predictive health insights, behavioral pattern analysis, and optimize automated functions like precise feeding schedules and anxiety detection.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager