Pet Deworming Drugs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435654 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Pet Deworming Drugs Market Size

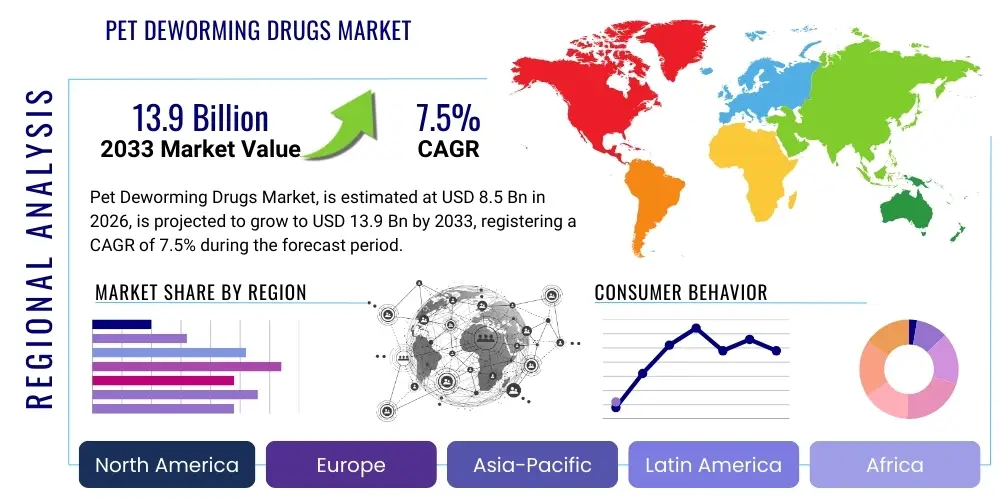

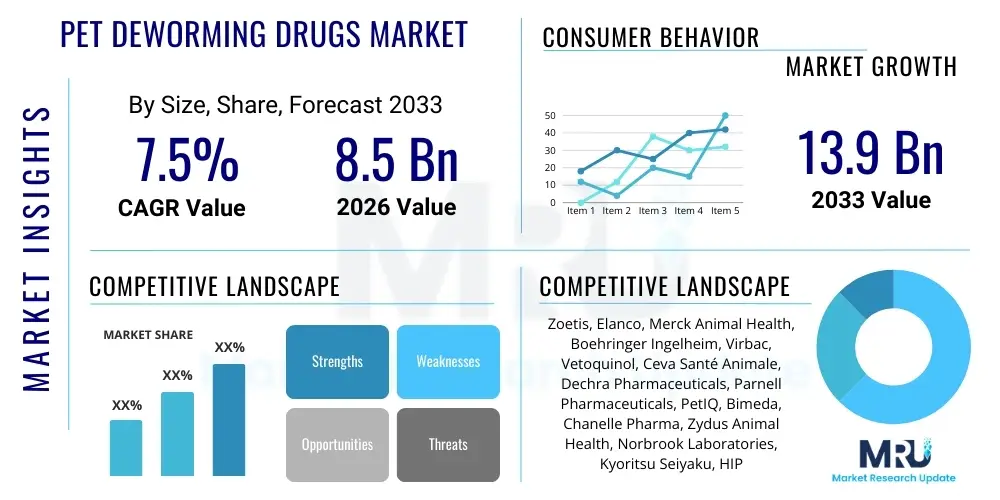

The Pet Deworming Drugs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 13.9 Billion by the end of the forecast period in 2033.

Pet Deworming Drugs Market introduction

The Pet Deworming Drugs Market encompasses pharmaceutical products designed to prevent and treat parasitic infections, primarily helminthes (worms) such as roundworms, hookworms, whipworms, and tapeworms, in companion animals, predominantly dogs and cats. These products are crucial for maintaining pet health, preventing zoonotic transmission to humans, and ensuring overall animal welfare. The market includes a variety of formulations, including tablets, chewables, spot-ons, and injectables, tailored for different administration routes and parasite spectrums. The growing awareness among pet owners regarding preventative healthcare, coupled with the increasing trend of pet humanization, significantly contributes to the consistent demand for effective deworming solutions across developed and emerging economies.

Product description within this sector is highly focused on broad-spectrum efficacy and ease of administration. Modern deworming drugs often combine multiple active ingredients (e.g., milbemycin oxime, praziquantel, fenbendazole) to target both internal and external parasites simultaneously, offering convenience to pet owners. Major applications span routine preventative care, treatment protocols for diagnosed infestations, and veterinary public health initiatives aimed at minimizing the spread of parasites. The continuous innovation in drug delivery systems, particularly the introduction of highly palatable chewable forms, has dramatically improved compliance rates, which is a key driver for market expansion.

The primary benefits of these drugs include improved pet quality of life, prevention of severe gastrointestinal and systemic diseases caused by parasites, and safeguarding human health by controlling zoonotic risks. Driving factors include the sustained rise in global pet ownership, particularly in urban areas, increased expenditure on veterinary care fueled by higher disposable incomes, and stricter regulatory guidelines mandating preventative parasite control protocols by veterinary professional organizations. Furthermore, the rising incidence of drug resistance in certain parasitic species necessitates continuous research and development into novel compounds, ensuring a dynamic and growing market landscape.

Pet Deworming Drugs Market Executive Summary

The Pet Deworming Drugs Market is characterized by robust growth, driven primarily by the global shift towards preventative veterinary medicine and the increasing acceptance of pets as family members, leading to higher spending on specialized healthcare. Key business trends include strategic collaborations between pharmaceutical manufacturers and veterinary clinic networks, the acceleration of product differentiation through combination therapies (dewormers plus flea/tick prevention), and intense investment in R&D to combat emerging drug resistance, particularly in hookworms and heartworms. Major players are focusing on expanding their portfolios with user-friendly, broad-spectrum products that simplify the complex dosing schedules often required for comprehensive parasite control. Furthermore, telemedicine and digital veterinary services are enhancing awareness and accessibility, indirectly boosting product uptake.

Regionally, North America and Europe maintain dominance, attributed to high rates of pet insurance penetration, established veterinary infrastructure, and substantial pet populations coupled with high disposable incomes allocated to pet care. However, the Asia Pacific (APAC) region is demonstrating the fastest growth trajectory, propelled by the rapid urbanization in countries like China and India, resulting in burgeoning middle-class populations acquiring pets and simultaneously adopting Western standards of preventative veterinary care. In contrast, while penetration remains lower in Latin America and the Middle East and Africa (MEA), these regions present significant untapped potential, contingent upon improving economic stability and veterinary regulatory frameworks.

Segment-wise, the oral segment, particularly chewable tablets, holds the largest market share due to superior compliance and palatability, though the topical spot-on segment remains highly popular for its dual action against internal and external parasites. Based on animal type, the canine segment is substantially larger, reflecting the higher global population of dogs and their inherent susceptibility to various parasitic infections, although the feline segment is exhibiting strong growth due to increasing efforts to normalize feline preventative care. The shift from over-the-counter (OTC) sales toward prescription-only (Rx) drugs, driven by veterinary guidance emphasizing tailored treatment plans, is also a notable market trend affecting distribution channel dynamics.

AI Impact Analysis on Pet Deworming Drugs Market

Analysis of common user questions related to AI's impact on the Pet Deworming Drugs Market reveals key themes centered on diagnostic accuracy, personalized treatment, and supply chain optimization. Users frequently inquire about AI's potential to revolutionize fecal analysis and parasite identification, moving beyond traditional microscopy to faster, more accurate automated systems. There is significant interest in how AI algorithms could predict regional parasite outbreaks based on environmental and epidemiological data, allowing for preemptive medication distribution and stock management. Furthermore, questions arise concerning the use of AI in drug discovery, specifically accelerating the identification of novel anthelmintic compounds to overcome resistance challenges, and optimizing clinical trial design for new formulations, minimizing costs and time-to-market. The prevailing expectation is that AI will streamline diagnostic pathways and enable highly personalized deworming schedules, moving away from standardized quarterly dosing.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is beginning to transform several aspects of the Pet Deworming Drugs Market, primarily by enhancing diagnostic capabilities and improving drug research efficiencies. AI-powered image recognition tools are increasingly being deployed in veterinary laboratories to automate the analysis of fecal samples, rapidly identifying parasite eggs and larvae with greater accuracy than human technicians, thereby reducing diagnostic turnaround times. This precision ensures that pets receive the correct spectrum of deworming treatment faster, minimizing the duration of infestation and reducing environmental contamination risks. Moreover, the enhanced data collection facilitated by AI contributes to better epidemiological mapping of parasitic infections, allowing pharmaceutical companies to target marketing and distribution efforts more effectively in high-risk zones.

In the realm of drug development, AI plays a crucial role in predicting the efficacy and toxicity profiles of potential new anthelmintic compounds, dramatically accelerating the pre-clinical phase. ML models analyze vast chemical libraries and genomic data of parasites to identify resistance mechanisms and potential vulnerabilities, streamlining the discovery process. Beyond R&D, AI algorithms are being applied in veterinary practice management systems to analyze individual pet risk factors—including geographic location, lifestyle, and medical history—to recommend optimized, personalized deworming protocols rather than standardized protocols. This move towards personalized preventative medicine, driven by AI insights, promises higher compliance rates and more effective parasite control, ultimately driving demand for premium, targeted drug formulations.

- AI-driven automated fecal diagnostics increase accuracy and speed of parasite identification.

- Machine learning algorithms accelerate drug discovery and optimize clinical trial design for new anthelmintics.

- AI-based epidemiological modeling predicts regional parasite outbreaks, aiding inventory and distribution optimization.

- Personalized dosing and treatment recommendations based on pet-specific risk factors enhance veterinary compliance.

- Advanced supply chain analytics utilizing AI optimize inventory levels and reduce waste of parasiticides.

- Genomic analysis via AI helps identify and target emerging drug resistance mechanisms in helminthes.

DRO & Impact Forces Of Pet Deworming Drugs Market

The Pet Deworming Drugs Market is dynamically shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the impact forces that dictate market trajectory. Key drivers include the overwhelming trend of pet humanization globally, where owners are increasingly willing to spend premium amounts on preventative healthcare to ensure their companions' longevity and quality of life. Simultaneously, the growing understanding among the general public and veterinary professionals regarding the critical zoonotic risks associated with untreated pet parasitic infections strongly mandates regular deworming, thereby sustaining demand. However, the market faces significant restraints, most notably the emergence of drug resistance in common parasites, which necessitates constant and costly R&D efforts. Regulatory hurdles for new drug approvals and the potential for off-label use of cheaper, non-veterinary specific products in some developing regions also impede uniform market growth.

Opportunities in the sector are abundant, primarily centered on technological advancements. The development of novel, long-acting injectable formulations that reduce the burden of frequent oral dosing represents a major opportunity for compliance improvement. Furthermore, expanding market penetration in emerging economies, coupled with public-private partnerships aimed at educating pet owners on preventative care, offers substantial untapped revenue potential. The shift toward combination products that address both endoparasites and ectoparasites in a single, convenient dose represents a highly lucrative avenue for manufacturers. Addressing the specific needs of the rapidly growing exotic and small animal pet segments also provides niche market opportunities for specialized formulations.

The impact forces are largely positive and accelerating market expansion. The high-impact driver of increasing pet healthcare expenditure consistently overshadows the moderate impact of current drug resistance issues, pushing market valuation upwards. The development pipeline remains robust, with major pharmaceutical companies continually investing in next-generation molecules designed to bypass existing resistance mechanisms. Furthermore, global regulatory bodies are increasingly aligning standards for veterinary medicines, which, while initially complex, ultimately facilitates faster market access for proven, innovative drugs. The strongest force shaping the future market remains the consumer demand for safer, highly effective, and easy-to-administer preventative treatments, fueling innovation across dosage forms and active ingredient combinations.

Segmentation Analysis

The Pet Deworming Drugs Market is systematically segmented across several critical dimensions, including product type, animal type, distribution channel, and administration route, which allows for granular analysis of market dynamics and targeted strategic planning. Product type segmentation distinguishes between broad-spectrum drugs, which target multiple parasite classes (e.g., nematodes and cestodes), and narrow-spectrum drugs, which focus on specific infestations. Animal type differentiation highlights the dominant market share held by canine deworming products compared to feline and other companion animal segments. These segmentations are crucial as they reflect differing biological needs, common parasitic risks, and consumer preferences regarding drug administration.

Segmentation by administration route is particularly vital, encompassing oral (tablets, liquids, chewables), topical (spot-ons), and injectable methods. Oral forms, especially the highly palatable chewables, command the largest share due to ease of use and high pet owner compliance. Conversely, topical solutions, favored for their convenience and often combined with external parasite control, are gaining traction. The distribution channel segmentation—analyzing sales through veterinary clinics, retail pharmacies, and e-commerce platforms—is experiencing rapid change, with e-commerce witnessing the fastest growth due to convenience and often competitive pricing, challenging the traditional dominance of veterinary channels.

This multi-dimensional segmentation is essential for understanding market structure and competitive positioning. For instance, companies dominating the canine oral chewable segment through veterinary prescription often focus on achieving excellent palatability and broad-spectrum efficacy, justifying premium pricing. In contrast, those focusing on the feline topical segment prioritize non-irritating formulations and combination treatments. The trend toward preventative rather than reactive treatment further drives the growth of premium segments across all administration routes, reflecting a market moving towards sustained, high-value consumer engagement.

- By Administration Route: Oral (Tablets, Chewables, Liquids), Topical (Spot-ons), Injectables.

- By Product Type: Broad-Spectrum Dewormers, Narrow-Spectrum Dewormers.

- By Parasite Type: Nematodes (Roundworms, Hookworms, Whipworms), Cestodes (Tapeworms), Mixed Infections.

- By Animal Type: Canine (Dogs), Feline (Cats), Other Companion Animals (Rabbits, Ferrets, etc.).

- By Distribution Channel: Veterinary Clinics & Pharmacies, Retail Stores (Pet Stores, Mass Merchants), E-commerce/Online Pharmacies.

- By End-User: Veterinary Hospitals, Clinics, Home Care.

Value Chain Analysis For Pet Deworming Drugs Market

The value chain for the Pet Deworming Drugs Market commences with extensive upstream activities involving raw material procurement, which includes sourcing active pharmaceutical ingredients (APIs) and excipients. This phase is highly regulated, demanding stringent quality control measures for synthesized chemical compounds. API manufacturing is often concentrated among specialized chemical and pharmaceutical providers, who must adhere to Good Manufacturing Practices (GMP). Research and development constitute a critical upstream segment, focusing on identifying new molecular entities, optimizing formulation stability, and conducting pre-clinical and extensive clinical trials to prove efficacy and safety against target parasites, a process that is highly capital and time intensive due to regulatory requirements.

The central segment of the value chain involves primary manufacturing, formulation, and packaging. Drug manufacturers transform the APIs into various dosage forms (e.g., chewables, spot-ons) and package them for sale. Distribution channels represent a crucial downstream element, ensuring the product reaches the end consumer efficiently. Direct distribution often involves pharmaceutical companies supplying directly to large veterinary corporate groups or national distributors. Indirect distribution utilizes wholesalers, who then supply smaller independent veterinary clinics, retail pharmacies, and, increasingly, dedicated online veterinary pharmacies. The final downstream link is the veterinary professional, who diagnoses the need and prescribes the appropriate treatment, or the retail/e-commerce platforms selling OTC products.

The profitability across the value chain varies significantly; R&D and specialized API manufacturing generally involve high fixed costs but potential for high returns on patented innovations. Veterinary clinics capture value through professional consultation and dispensing fees. The increasing dominance of e-commerce has led to margin pressure on traditional distributors and retail channels but enhances consumer access and market reach. Effective supply chain management, particularly managing cold chain requirements for certain vaccines and maintaining inventory across various regions, is essential for minimizing costs and ensuring product integrity, emphasizing the need for robust logistical partnerships.

Pet Deworming Drugs Market Potential Customers

The primary potential customers and end-users of pet deworming drugs are broadly categorized into four groups: pet owners utilizing preventative treatments, veterinary hospitals and clinics purchasing for direct dispensing, animal shelters and rescue organizations, and specialized animal breeding facilities. Individual pet owners constitute the largest volume of consumers, driven by the desire to maintain the health of their companion animals and protect their families from zoonotic infections. Their purchase decisions are heavily influenced by veterinary recommendations, product convenience (e.g., palatability, ease of application), and price point, leading to strong demand for premium, palatable, broad-spectrum, monthly-dosed products.

Veterinary hospitals and independent clinics act as crucial gatekeepers, purchasing drugs in bulk from manufacturers or distributors for in-house dispensing. They serve as the most trusted source of information and product acquisition for prescription-only dewormers, focusing on clinical efficacy, safety profile, and comprehensive coverage against regional parasitic threats. Their purchasing power is significant, and they often favor products offering attractive professional discounts and educational support from pharmaceutical representatives. This segment increasingly requires digital integration solutions for inventory management and automated refill reminders to enhance client compliance.

Animal shelters and rescue organizations represent a high-volume, cost-sensitive segment, requiring robust, effective, and often subsidized deworming programs to manage large populations of animals, many of whom arrive with pre-existing heavy parasitic burdens. Their focus is on ensuring rapid treatment and preventing mass outbreaks. Finally, specialized breeders require precise deworming protocols for pregnant and lactating animals and young puppies/kittens to prevent vertical transmission, demanding highly specific and safe formulations tailored to sensitive developmental stages. Targeting these diverse customer segments requires differentiated product strategies, pricing models, and distribution approaches, ranging from high-touch veterinary detailing to efficient, large-scale e-commerce fulfillment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 13.9 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zoetis, Elanco, Merck Animal Health, Boehringer Ingelheim, Virbac, Vetoquinol, Ceva Santé Animale, Dechra Pharmaceuticals, Parnell Pharmaceuticals, PetIQ, Bimeda, Chanelle Pharma, Zydus Animal Health, Norbrook Laboratories, Kyoritsu Seiyaku, HIPRA, Krka, Ltd., Vétoquinol SA, Neogen Corporation, Heska Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pet Deworming Drugs Market Key Technology Landscape

The technological landscape of the Pet Deworming Drugs Market is continually evolving, driven by the need for enhanced efficacy, improved ease of administration, and the ability to counteract parasitic resistance. A primary technological focus lies in advanced formulation science, particularly the development of highly palatable matrices for oral chewable medications. These formulations often utilize specialized masking agents and texture modifiers to ensure pets readily consume the full dose, directly impacting treatment compliance, which is a major determinant of therapeutic success. Furthermore, advanced polymer chemistry is being deployed to create sophisticated controlled-release mechanisms for injectable or transdermal delivery systems, aiming for sustained parasitic protection over extended periods (e.g., three to six months).

Another significant area of technological advancement involves the synthesis of novel active ingredients derived from combinatorial chemistry and high-throughput screening. With established molecules facing increasing resistance pressure, R&D departments are investing heavily in discovering new chemical classes with unique modes of action against target parasites like hookworms and heartworms. This includes exploring natural products and optimizing existing macrocyclic lactones and benzimidazoles through chemical modifications to improve bioavailability and effectiveness. The successful technological innovation in this area directly translates into premium market positioning and competitive advantage.

Beyond the drug molecule itself, diagnostic technology plays a supportive yet critical role. The adoption of polymerase chain reaction (PCR) assays for precise species-level identification of parasites, coupled with high-resolution microscopy and automated digital imaging systems, provides veterinarians with rapid and accurate diagnostic capabilities. This diagnostic precision ensures that the specific deworming drug is correctly matched to the infestation, reducing the unnecessary use of broad-spectrum products and slowing the development of widespread resistance. The intersection of these diagnostic and formulation technologies is critical for advancing the overall efficacy and responsible use of deworming agents in clinical practice.

Regional Highlights

- North America: This region commands the largest market share, characterized by high rates of pet ownership, substantial disposable income allocated to pet healthcare, and a mature regulatory environment that favors preventative medicine. The market is driven by sophisticated distribution networks, robust pet insurance penetration, and a strong preference for combination products that simplify year-round parasite control. The U.S. and Canada are leaders in adopting premium prescription products, particularly highly palatable broad-spectrum chewables recommended by veterinarians, reflecting high consumer compliance rates and focus on zoonotic prevention.

- Europe: Representing the second-largest market, Europe exhibits stable growth influenced by stringent animal welfare standards and established preventative care protocols, particularly in the Western European countries (Germany, UK, France). The market is slightly more fragmented, with strong competition between multinational giants and regional European pharmaceutical companies. Key trends include the steady shift towards prescription-only dewormers and a focus on topical spot-on applications due to established preference and ease of application, alongside addressing regional-specific parasitic threats like the fox tapeworm.

- Asia Pacific (APAC): Forecasted to be the fastest-growing region, APAC’s expansion is fueled by rising urbanization, rapid economic growth, and the subsequent surge in pet ownership among the expanding middle class in countries like China, India, and Japan. While the market is highly heterogeneous, with significant price sensitivity in emerging sub-regions, awareness of preventative care is increasing sharply. Market growth is contingent upon the formalization of veterinary practices, improving drug registration processes, and effective education campaigns targeting new pet owners, leading to strong potential for both OTC and lower-cost prescription alternatives.

- Latin America (LATAM): Growth in LATAM is driven by increasing investment in veterinary infrastructure, particularly in Brazil and Mexico. The market faces challenges related to economic volatility and accessibility of premium products, leading to a strong prevalence of generic and lower-cost alternatives. However, the high incidence of parasitic infections due to climatic conditions and often loose stray animal populations mandates frequent deworming, creating sustained, albeit price-sensitive, demand across the region.

- Middle East and Africa (MEA): This region is the smallest but shows localized growth opportunities, especially in the GCC countries (UAE, Saudi Arabia) where high disposable incomes support premium pet care and imported veterinary standards. The market is generally constrained by limited penetration of formal veterinary services and lower pet population density in many sub-regions. Focus remains on basic preventative health measures and establishing effective distribution pipelines for necessary veterinary pharmaceuticals.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pet Deworming Drugs Market.- Zoetis

- Elanco Animal Health

- Merck Animal Health

- Boehringer Ingelheim Animal Health

- Virbac

- Vetoquinol SA

- Ceva Santé Animale

- Dechra Pharmaceuticals PLC

- Parnell Pharmaceuticals

- PetIQ, Inc.

- Bimeda Holdings

- Chanelle Pharma

- Zydus Animal Health

- Norbrook Laboratories

- Kyoritsu Seiyaku

- Krka, Ltd.

- HIPRA Animal Health

- Neogen Corporation

- Heska Corporation

- Jurox Pty Ltd

Frequently Asked Questions

Analyze common user questions about the Pet Deworming Drugs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Pet Deworming Drugs Market?

Market growth is primarily driven by the increasing global trend of pet humanization, leading to higher consumer expenditure on preventative health, greater awareness of zoonotic diseases (parasite transmission to humans), and continuous innovation in broad-spectrum, palatable drug formulations that improve pet owner compliance.

Which administration route dominates the pet deworming drugs market?

The oral route, specifically in the form of highly palatable chewable tablets, currently dominates the market share. Chewables offer superior convenience, ensuring pets receive the full dose, which significantly improves treatment compliance compared to traditional tablets or liquids, though topical spot-ons remain highly popular for combination therapy.

How does drug resistance affect the Pet Deworming Drugs industry?

Drug resistance is a significant restraint requiring pharmaceutical companies to invest heavily in research and development to discover novel active ingredients and new chemical classes. It drives the demand for specialized diagnostic testing and necessitates veterinary guidance on rotational deworming strategies to maintain treatment efficacy.

Is the Asia Pacific (APAC) region a key growth area for pet parasiticides?

Yes, APAC is the fastest-growing regional market, propelled by rapid urbanization, increasing disposable incomes in countries like China and India, and a rising awareness among new pet owners about the importance of preventative veterinary healthcare, creating substantial demand for both prescription and OTC products.

What role do combination products play in the current market landscape?

Combination products, which simultaneously treat internal parasites (worms) and external parasites (fleas and ticks), are crucial market differentiators. They simplify the complex preventative regimen for pet owners, leading to higher compliance, increased product value, and a strong competitive advantage for manufacturers offering these comprehensive, single-dose solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager