Pet Doors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434259 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Pet Doors Market Size

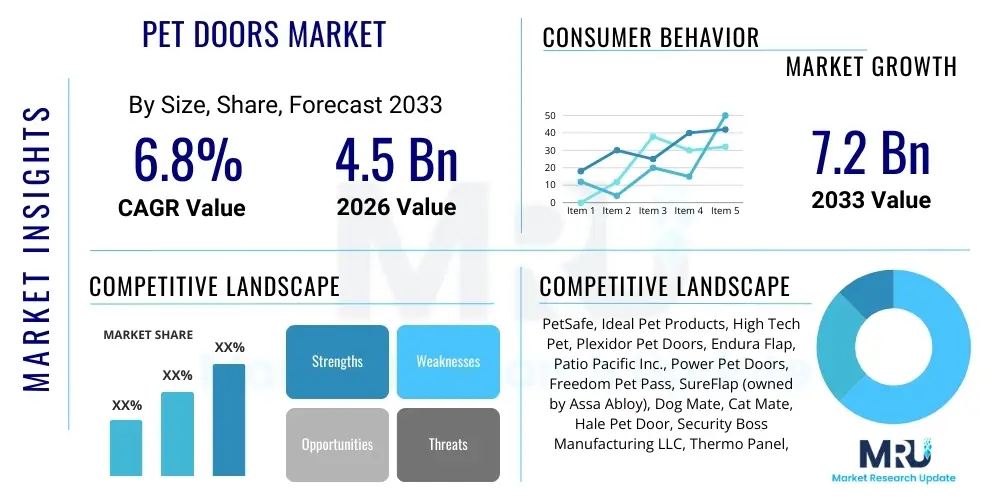

The Pet Doors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $4.5 Billion in 2026 and is projected to reach $7.2 Billion by the end of the forecast period in 2033.

Pet Doors Market introduction

The Pet Doors Market encompasses the design, manufacturing, and distribution of specialized access points allowing domesticated animals, primarily dogs and cats, to move independently between indoor and outdoor environments, or between different rooms within a dwelling. These products range from basic flap-style doors installed in traditional entry doors or walls to highly sophisticated, electronically activated, and smart-enabled systems. The core product category addresses convenience for pet owners by eliminating the need for constant human assistance in granting pet access, thereby contributing significantly to both pet autonomy and owner satisfaction. Key factors driving market proliferation include rising pet ownership rates globally, increased spending on pet comfort and technology, and the growing trend of integrating smart home features into pet care infrastructure.

Product descriptions within this sector highlight varying degrees of insulation, security, and durability. Traditional pet doors utilize plastic or aluminum frames with flexible vinyl or plastic flaps, focusing primarily on basic functionality and cost-effectiveness. However, the modern market increasingly favors premium options such as heavy-duty aluminum frames, energy-efficient double-flap designs, and weather-resistant seals, especially in regions experiencing extreme climatic conditions. Major applications include installation in exterior household doors (wood, metal, sliding glass), walls, and patio door panels, catering to diverse architectural requirements. The continuous innovation in materials focuses on enhancing weather resistance and structural integrity to prevent unauthorized entry by wildlife or intruders, positioning pet doors not merely as accessories but as integral components of home security and energy management.

The primary benefits of utilizing pet doors revolve around improving household convenience and enhancing pet quality of life. For owners, this eliminates the constant interruption of work or leisure activities to open doors, supporting smoother daily routines. For pets, unrestricted access reduces stress associated with confinement and allows for timely outdoor relief, contributing to better behavioral health. Driving factors for market expansion are multi-faceted, involving urbanization leading to smaller living spaces where efficiency is paramount, the humanization of pets leading to greater investment in high-end pet products, and technological advancements such as microchip-activated systems that provide personalized access control, thereby boosting security and energy efficiency, further cementing the product's value proposition in modern households.

Pet Doors Market Executive Summary

The Pet Doors Market is characterized by robust growth, propelled by strong underlying business trends emphasizing smart technology integration and premium product offerings. Business trends indicate a shift towards technologically advanced solutions, particularly microchip and RFID-enabled doors, which address owner concerns regarding security, unwanted animal entry, and climate control. Manufacturers are heavily investing in design patents related to energy efficiency, integrating magnetic sealing systems and insulating materials to meet the rising demand for green building products. Furthermore, the expansion of e-commerce channels has significantly broadened the distribution reach, making specialized and custom-sized pet doors accessible to a global consumer base, contributing to increased revenue per unit due to premium feature adoption.

Regionally, North America and Europe remain the largest contributors to market revenue, driven by high disposable incomes, deeply ingrained pet-owning cultures, and stringent home energy efficiency standards which necessitate insulated pet door solutions. The Asia Pacific (APAC) region, however, is emerging as the fastest-growing market segment. This accelerated growth in APAC is attributed to rapid urbanization, rising middle-class disposable incomes, and the Westernization of lifestyles leading to increased domestic pet adoption rates, particularly in countries like China and India. Regional trends also show diverse product preference; while North America focuses on large dog door solutions, Europe shows high demand for wall-mounted, energy-efficient cat doors suited for tighter urban dwelling specifications, necessitating localized product portfolios by key market participants.

Segment trends highlight the dominance of electronic and smart pet doors in value terms, despite manual doors maintaining the highest volume share due to their affordability. By size, medium to large pet doors account for the majority of the market share, reflecting the popularity of medium-to-large breed dogs as pets. The material segment demonstrates a consistent shift from plastic towards durable, weather-resistant materials like aluminum and heavy-duty polycarbonate, emphasizing longevity and security. The distribution segment is witnessing a digital transformation, with online retail platforms capturing increasing market share over traditional brick-and-mortar pet stores and hardware chains, owing to the ease of product comparison, detailed installation guides, and direct-to-consumer shipping capabilities for bulky items.

AI Impact Analysis on Pet Doors Market

Common user inquiries regarding AI's impact on the Pet Doors Market often center on enhanced security mechanisms, predictive maintenance capabilities, and the seamless integration of pet access control into broader smart home ecosystems. Users frequently ask if AI can differentiate between the household pet and foreign animals (e.g., raccoons or neighborhood cats) even without relying solely on microchip identification, suggesting a strong interest in visual recognition technologies. There is also significant curiosity about how AI algorithms can learn pet habits, such as typical exit and entry times, to optimize door locking schedules and minimize energy loss during peak weather conditions. Concerns often revolve around data privacy related to pet tracking and the cost associated with adopting these advanced smart door systems, alongside the reliability of AI-driven sensors in varying environmental conditions.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally shifting the Pet Doors Market from a mechanical accessory to a sophisticated, networked device. AI enables the next generation of pet doors to incorporate advanced facial recognition or gait analysis systems, moving beyond basic RFID tags to provide highly secure, customized access. This capability addresses the primary consumer concern of preventing unauthorized access by stray animals or small pests. Furthermore, ML algorithms are crucial in developing predictive failure models for moving components (such as motorized flaps or locking mechanisms), alerting owners to potential maintenance needs before a functional breakdown occurs, thereby enhancing product reliability and owner satisfaction.

The future application of AI in this sector focuses on holistic pet management. AI-powered software can interface the pet door with other smart home devices, such as climate control systems or integrated security cameras. For instance, the system could automatically adjust the thermostat when the pet enters or exits, or trigger a recording if the door detects an unrecognized animal attempting entry. This capability elevates the pet door from a simple convenience device to a critical component of household automation and safety, justifying the higher investment for technologically inclined consumers and creating new premium tiers within the market structure.

- AI-enhanced visual recognition for precise pet identification and unauthorized animal exclusion.

- Machine Learning algorithms optimize energy efficiency by predicting and controlling opening/closing schedules based on learned pet behavior patterns.

- Integration with smart home hubs (e.g., Alexa, Google Home) for voice-activated locking and remote monitoring capabilities.

- Predictive maintenance alerts generated by analyzing sensor data on motor wear and flap stress.

- Development of sophisticated access logs and real-time behavioral data analytics for pet owners.

- AI algorithms utilized in personalized marketing and product recommendation based on pet breed and size via e-commerce platforms.

DRO & Impact Forces Of Pet Doors Market

The dynamics of the Pet Doors Market are strongly influenced by a combination of positive growth drivers and necessary mitigating restraints, balanced by substantial technological opportunities, all converging to create significant impact forces. A primary driver is the accelerating humanization of pets, wherein owners view pets as family members and are increasingly willing to invest in products that enhance their well-being and freedom, leading to high adoption rates of premium, high-tech pet access solutions. This trend is amplified by the expansion of the global smart home market, where pet doors are naturally integrated into comprehensive household automation systems. Concurrently, security and energy efficiency remain significant restraints; consumers often perceive traditional pet doors as vulnerabilities regarding home insulation and intrusion risks, demanding robust, high-cost electronic solutions that can restrict market access for price-sensitive segments. Opportunities are mainly concentrated in developing economies and in the untapped potential of customizable, modular pet doors tailored for rental properties or temporary installations, which mitigate the permanent alteration requirement of traditional installation methods.

Key drivers center on convenience and technological innovation. The busy lifestyle of modern pet owners necessitates automated solutions to manage pet access efficiently without constant manual intervention. This demand fuels the market for microchip-activated and sensor-based doors, which offer controlled access, mitigating the security restraint associated with open entry points. Furthermore, the increased awareness regarding sustainable living practices contributes to the demand for highly insulated, energy-saving pet doors, particularly in regions with extreme climate variability, where utility savings offset the higher initial purchase price. The growing elderly population, seeking less physically demanding pet care solutions, also represents a notable driver, favoring easy-to-use, often automated, systems that enhance accessibility and reduce the need for constant bending or monitoring.

Restraints primarily revolve around installation complexity, cost, and structural alteration. Installing a traditional pet door often requires cutting into existing doors or walls, a process consumers in rental properties or those lacking DIY skills are reluctant to undertake. This restraint drives demand for temporary or non-invasive solutions like patio panel inserts, which, while easier to install, often carry higher price points or durability compromises. Moreover, the high initial cost of advanced smart pet doors, which provide the necessary security and energy efficiency features, can deter mass market adoption. Regulatory hurdles related to energy efficiency standards in construction might also impose additional design and testing costs on manufacturers. Opportunities lie in standardizing modular components for easier installation, developing hybrid power solutions for electronic doors (solar/battery), and expanding into commercial applications, such as veterinary clinics or pet-friendly office spaces, requiring high-throughput, secure pet access control.

- Drivers:

- Rising global pet ownership and the humanization of pets.

- Increasing adoption of smart home technology and automation systems.

- Demand for high-security, microchip-activated pet doors to prevent pest intrusion.

- Focus on energy efficiency driving demand for better insulated and sealed products.

- Restraints:

- High cost associated with advanced electronic and customized installation solutions.

- Reluctance of homeowners and renters to permanently alter doors or walls.

- Perceived security risks and vulnerability associated with traditional, non-locking pet doors.

- Complexity of installation requiring specialized tools or professional services.

- Opportunities:

- Development of modular, non-invasive installation systems for temporary use (e.g., rental markets).

- Expansion into the commercial sector (pet hotels, clinics, offices).

- Integration of advanced biometric security features like fingerprint or facial recognition.

- Penetration of emerging markets through localized, cost-effective product variants.

- Impact Forces:

- Strong positive correlation between consumer disposable income and adoption of electronic pet door systems.

- Technological advancements accelerate product obsolescence, requiring continuous innovation in sensor and material science.

- Fluctuations in commodity prices (aluminum, plastics) directly impact manufacturing costs and final retail pricing.

- Regulatory push for increased home energy efficiency elevates the barrier to entry for lower-quality, poorly insulated products.

Segmentation Analysis

The Pet Doors Market is rigorously segmented based on product type, size, material, installation location, mode of operation, and distribution channel, providing a granular view of consumer preferences and market dynamics. Understanding these segments is critical for manufacturers aiming to tailor their product offerings and marketing strategies effectively. The core segmentation by mode of operation—Manual vs. Electronic/Smart—defines the competitive landscape, with electronic segments attracting premium pricing and higher margins due to the incorporation of features like microchip readers, timers, and advanced security locks. Meanwhile, segmentation by size (small, medium, large, extra-large) remains fundamental, directly correlating with the pet demographics (dogs vs. cats, and specific breed sizes) prevalent in different geographical areas, influencing inventory management and production volumes across the supply chain.

Further analysis of installation location segmentation reveals distinct consumer behaviors. Wall-mounted pet doors, while requiring more intensive installation, are highly favored in cold climates as they offer superior insulation by avoiding placement in thinner, less insulated entry doors. In contrast, door-mounted units remain the most common and accessible entry point due to their relative ease of installation and lower material requirements. The material segmentation is witnessing a critical shift; while low-cost plastic dominates the volume segment, the growing demand for durable, secure, and aesthetic solutions is bolstering the adoption of metal-framed doors (aluminum or steel), particularly for large dog doors where structural strength and resistance to rough usage are paramount. These material choices directly influence product lifespan, pricing, and environmental credentials, crucial factors for modern consumers.

The segmentation by distribution channel highlights the accelerating importance of digital platforms. Online retail provides unparalleled access to niche products, such as customized or very large pet doors, and offers extensive consumer reviews and detailed installation videos, significantly influencing purchase decisions. While traditional brick-and-mortar pet specialty stores and big-box hardware retailers still serve consumers seeking immediate purchases or in-person consultation, the convenience, price competitiveness, and extensive range offered by e-commerce platforms ensure its continued dominance in revenue growth. This segmentation dictates marketing spend allocation, favoring digital marketing and partnerships with major online retailers to maximize market exposure and conversion rates, essential strategies for both established brands and emerging competitors.

- By Mode of Operation:

- Manual Pet Doors (Basic Flap, Traditional)

- Electronic Pet Doors (Microchip/RFID Activated, Sensor-Activated, Timer Controlled)

- By Installation Location:

- Door Mounted

- Wall Mounted

- Sliding Glass/Patio Panel Inserts

- Window Units

- By Pet Size:

- Small (Cats/Small Dogs)

- Medium

- Large

- Extra-Large/Giant

- By Material:

- Plastic/Vinyl

- Aluminum/Metal

- Wood (Frame Only)

- By Distribution Channel:

- Online Retail (E-commerce Platforms, Company Websites)

- Offline Retail (Specialty Pet Stores, Hardware Stores, Mass Merchants)

Value Chain Analysis For Pet Doors Market

The Value Chain for the Pet Doors Market commences with upstream activities involving raw material procurement, specifically focusing on durable plastics (polycarbonate, PVC), metals (aluminum for frames), and specialized insulating materials for high-end models. Upstream analysis involves establishing stable supply contracts for consistent material quality, essential for maintaining product durability and meeting safety standards. Key activities in this stage include material engineering to enhance weather resistance and security features. Due to the high dependency on plastic and metal commodities, effective supply chain risk management and hedging against price volatility are critical determinants of profitability for manufacturers.

Midstream activities involve core manufacturing, assembly, and quality assurance. This stage is dominated by specialized fabrication processes, including molding for plastic components, extrusion and forming for aluminum frames, and integrating complex electronic components (sensors, RFID readers, microcontrollers) for smart doors. Vertical integration is a competitive advantage, allowing companies to control the quality of both mechanical parts and embedded software. The introduction of lean manufacturing techniques is crucial to reduce waste and optimize production cycles, particularly for customized or proprietary designs that require high precision and complex sealing mechanisms to achieve optimal energy efficiency ratings.

Downstream analysis focuses on distribution and after-sales service. The distribution channel is bifurcated into direct channels (manufacturer websites) and indirect channels (e-commerce giants, hardware stores, specialty pet retailers). Direct channels offer better margin control and customer data, while indirect channels provide wider market reach. Effective downstream logistics, especially handling large or custom-sized units, are essential. After-sales support, including providing comprehensive installation guides, technical support for electronic doors, and warranty fulfillment, significantly influences customer satisfaction and brand loyalty in this market, particularly given the DIY nature of installation often associated with the product category.

Pet Doors Market Potential Customers

The primary customer base for the Pet Doors Market consists of homeowners, particularly those with fenced yards or secure outdoor spaces, seeking solutions to enhance pet freedom and reduce owner responsibility for access control. This segment often favors permanent, high-quality installations (wall or door mounted) and is increasingly adopting advanced electronic solutions to maintain home security and minimize energy loss. These buyers typically prioritize durability, security features such as microchip activation, and excellent insulation over the lowest price point, representing the highest value segment of the market.

A rapidly growing segment comprises renters and apartment dwellers who require temporary or non-invasive solutions. This customer group is primarily interested in patio panel inserts or temporary window units that do not require permanent modification of the leased property. For this segment, ease of installation, portability, and damage-free removal are the most critical purchase criteria. While often budget-conscious, this group shows willingness to pay a premium for specialized, temporary products that meet stringent lease agreement terms. The focus is often on smaller pet sizes, predominantly cats and small to medium dogs suitable for urban living environments.

Secondary but crucial customers include businesses in the pet services industry, such as veterinary clinics, pet boarding facilities, and specialized pet training centers. These commercial buyers require industrial-grade, highly durable pet doors capable of withstanding heavy usage and meeting specific regulatory requirements for animal welfare and safety. Their purchasing decisions are driven by high throughput capacity, robust security features, ease of cleaning, and long-term operational reliability, often necessitating custom sizing and heavy-duty materials designed for continuous commercial application rather than residential use.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | PetSafe, Ideal Pet Products, High Tech Pet, Plexidor Pet Doors, Endura Flap, Patio Pacific Inc., Power Pet Doors, Freedom Pet Pass, SureFlap (owned by Assa Abloy), Dog Mate, Cat Mate, Hale Pet Door, Security Boss Manufacturing LLC, Thermo Panel, Carlson Pet Products, SportDOG Brand, Staywell, Gun Dog House Door, K&H Pet Products, Dremel Pet. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pet Doors Market Key Technology Landscape

The technological landscape of the Pet Doors Market is rapidly evolving, moving beyond simple mechanical flaps towards highly integrated electronic and sensor-based systems. The most critical technological advancement is the widespread adoption of Radio-Frequency Identification (RFID) and microchip technology, allowing the pet door to recognize a specific pet's implanted microchip or attached collar tag. This technology is fundamental to enhancing security, ensuring only authorized pets can gain access, effectively blocking stray animals and minimizing intrusion risks. Furthermore, these smart doors often utilize magnetic sensors and sophisticated motor mechanisms to ensure swift, tight sealing after pet passage, directly addressing consumer demand for superior insulation and energy conservation, crucial technological pillars supporting the premium segment growth.

Another significant technological focus lies in improving the insulation performance and structural integrity of the doors. Modern pet door designs incorporate advanced weather sealing, often involving multiple layers of flexible vinyl or rigid polycarbonate flaps, coupled with high-strength magnetic closures to create an air-tight seal, minimizing thermal transfer. Materials science plays a key role, with manufacturers utilizing energy-efficient insulating cores within wall-mounted models and low-emissivity glass in patio panel inserts to comply with strict residential building codes, particularly in regions prone to extreme weather conditions. The engineering challenge involves creating a balance between a highly insulating seal and ensuring the door remains easily operable by the pet without excessive force, optimizing the biomechanical interface.

Connectivity and integration form the third pillar of the technological landscape. High-end pet doors are increasingly equipped with Wi-Fi and Bluetooth capabilities, allowing remote control via smartphone applications. This connectivity provides real-time monitoring of pet activity, control over locking mechanisms, and the ability to set customized schedules or access profiles. Furthermore, the integration with broader smart home ecosystems (e.g., Apple HomeKit, Zigbee standards) facilitates seamless interaction with other household devices, such as automatically activating pet cameras when the pet exits or adjusting interior lighting. Future technological developments are anticipated to include enhanced battery backup systems, solar charging capabilities for remote installations, and AI-driven visual analytics for access control verification, solidifying the market's trajectory toward full digital automation.

Regional Highlights

- North America: North America, comprising the United States and Canada, represents the largest and most mature market for pet doors globally, characterized by high pet ownership rates and substantial discretionary spending on pet products. The region exhibits a strong preference for large and extra-large electronic pet doors, reflecting the popularity of larger dog breeds and the emphasis on home security and energy efficiency. The U.S. market is highly competitive, driven by innovation in smart technology integration and robust e-commerce penetration. The demand here is frequently for heavy-duty, weather-resistant materials designed to handle the variable climates, leading to high adoption of insulated wall-mounted units and complex electronic access systems. Regulatory environment focusing on residential energy standards further accelerates the adoption of premium, well-sealed products, maintaining the region's revenue leadership.

- Europe: Europe holds the second-largest share, with significant contributions from the UK, Germany, and France. The European market is distinct due to a higher concentration of smaller urban dwellings and a considerable cat population, resulting in a robust demand for small to medium-sized cat flaps and highly efficient, aesthetically integrated door and window installations. Energy efficiency is a primary driver across the EU, with consumers prioritizing features that comply with strict thermal insulation directives. The market shows a strong preference for discreet, subtle designs and high-quality materials. Scandinavia, in particular, demonstrates high adoption of premium, triple-sealed doors due to severe cold weather conditions, while Western European markets drive the adoption of sophisticated microchip-activated systems for enhanced neighborhood control and security.

- Asia Pacific (APAC): The APAC region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is fueled by rising urbanization, increasing disposable incomes, and the shift towards Western-style pet keeping, particularly in China, Japan, and Australia. While the base market size is smaller than in the West, the growth trajectory is steep. Early adoption is focused on affordability and basic convenience, but markets like Japan and Australia show high affinity for technology, driving demand for compact, smart, and integrated electronic cat doors suitable for smaller homes and high-density living. Local manufacturers are rapidly emerging, often focusing on competitive pricing and quick adaptation to regional housing specifics, such as thin aluminum door frames common in Asian construction.

- Latin America (LATAM): The LATAM market is in an emerging phase, characterized by moderate growth and a focus on cost-effective manual solutions. Brazil and Mexico are the largest contributors, driven by a growing middle class and increasing residential construction activities. The demand centers around standard-sized pet doors made from durable plastic that can withstand high temperatures and humidity. Electronic door adoption is currently lower, primarily limited to high-income urban areas. Market penetration is significantly reliant on localized distribution networks and price sensitivity remains a major factor, necessitating manufacturers to offer robust, functional products at accessible price points, utilizing cost-optimized materials and simplified installation processes.

- Middle East and Africa (MEA): The MEA market is the smallest but exhibits potential in affluent urban centers within the GCC countries (UAE, Saudi Arabia). Market growth is slow, constrained by varied regional cultural norms regarding domestic animals and sometimes challenging climate conditions requiring specialized thermal solutions. Demand in the UAE tends to favor high-end, customized, and highly insulated electronic pet doors, often integrated into luxury villas and expatriate housing, where security and protection against extreme heat or sand ingress are paramount. The African segment remains highly niche, largely focused on basic plastic flap doors distributed through limited retail channels, though urbanization is expected to marginally increase demand over the forecast period, specifically targeting small to medium pet sizes prevalent in city environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pet Doors Market.- PetSafe

- Ideal Pet Products

- High Tech Pet

- Plexidor Pet Doors

- Endura Flap

- Patio Pacific Inc.

- Power Pet Doors

- Freedom Pet Pass

- SureFlap (Assa Abloy)

- Dog Mate

- Cat Mate

- Hale Pet Door

- Security Boss Manufacturing LLC

- Thermo Panel

- Carlson Pet Products

- SportDOG Brand

- Staywell

- Gun Dog House Door

- K&H Pet Products

- Dremel Pet

Frequently Asked Questions

Analyze common user questions about the Pet Doors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between electronic and manual pet doors?

Electronic pet doors use technologies like RFID, microchips, or sensors to grant access only to registered pets, significantly enhancing security and preventing stray animals from entering. Manual doors rely on simple flaps and are generally cheaper but offer no access control and may compromise home insulation.

How can pet doors contribute to home energy efficiency?

Modern pet doors, particularly high-end models, incorporate specialized features such as insulated double flaps, magnetic seals, and weather stripping to minimize air leaks and thermal transfer. Wall-mounted units often offer better insulation than traditional door inserts, resulting in measurable energy savings over time.

What factors should be considered when choosing the appropriate size of a pet door?

The pet door size must accommodate the pet's width and height comfortably. It is essential to measure the pet's shoulder height and chest width to ensure smooth passage. Choosing a door slightly larger than the pet's measurement prevents scraping or discomfort, which is crucial for maximizing long-term usage and preventing door damage.

Are smart pet doors compatible with all types of pets, regardless of microchip standard?

Most modern electronic pet doors are designed to read standard 9-digit, 10-digit, and 15-digit microchips (FDX-B ISO 11784/11785), ensuring compatibility with almost all global pet microchip standards. Manufacturers usually confirm compliance with ISO standards, though older or non-standard chips might require a compatible RFID collar tag.

What are the most durable materials used in high-quality pet door construction?

High-quality pet doors primarily utilize heavy-duty aluminum frames for structural strength and resistance to warping. Flaps are often made from durable, flexible vinyl or UV-resistant polycarbonate, sometimes employing dual-flap systems for enhanced weather resistance and longevity, especially in large, high-traffic applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager