Pet Eye Care Products Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432268 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Pet Eye Care Products Market Size

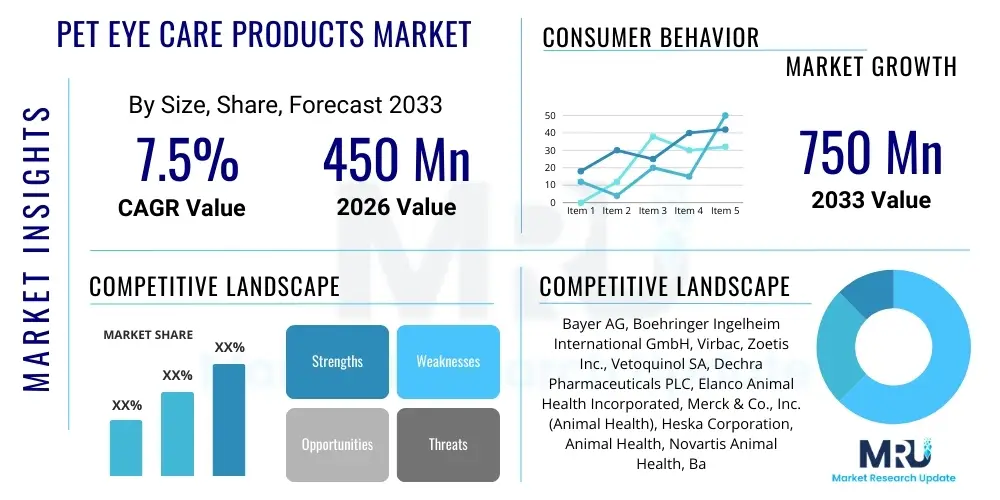

The Pet Eye Care Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 750 Million by the end of the forecast period in 2033. This robust growth trajectory is underpinned by increasing awareness regarding companion animal health, advancements in veterinary ophthalmology, and the growing trend of pet humanization across developed and emerging economies. The rising prevalence of common ocular conditions, such as cataracts, glaucoma, conjunctivitis, and dry eye syndrome, particularly in geriatric pet populations, necessitates continuous demand for specialized prophylactic and therapeutic eye care solutions. Furthermore, improved diagnostic capabilities in veterinary settings contribute significantly to early detection and subsequent product adoption, driving market expansion.

Pet Eye Care Products Market introduction

The Pet Eye Care Products Market encompasses a diverse array of pharmaceuticals, nutraceuticals, and medical devices designed specifically for the maintenance, diagnosis, and treatment of ophthalmic conditions in companion animals, primarily dogs and cats. These products range from basic cleaning solutions, lubricating drops, and tear stain removers to prescription medications like antibiotics, anti-inflammatories, and glaucoma treatments. The primary objective of these specialized products is to preserve visual acuity, alleviate discomfort, and manage chronic or acute ocular diseases that significantly impact the quality of life for pets. As pets live longer due to better nutrition and healthcare, the incidence of age-related eye conditions escalates, positioning eye care products as essential components of preventative and corrective veterinary services globally.

Key market drivers include the increasing expenditure on veterinary services, driven by the strong emotional bond between owners and their pets, commonly referred to as the pet humanization trend. This trend translates directly into a willingness among owners to invest in premium and specialized healthcare products, including those focused on delicate areas like ocular health. Moreover, ongoing research and development efforts by pharmaceutical companies are introducing novel drug delivery systems, such as sustained-release formulations and advanced biotechnological therapies, which offer better efficacy and compliance compared to traditional methods. These innovations expand the scope of treatable conditions, encouraging greater adoption rates among veterinary practitioners and specialty clinics.

Major applications of pet eye care products extend across routine preventative care, management of infectious diseases, surgical aftercare, and chronic disease management. Benefits derived from using these specialized products include reduced risk of secondary infections, improved comfort for the animal, prevention of irreversible vision loss, and successful management of chronic diseases like diabetes-related cataracts. The continuous influx of effective, safe, and easily administered products is crucial for supporting both general practice veterinarians and board-certified veterinary ophthalmologists in providing high standards of care, thereby sustaining the upward momentum of the market.

Pet Eye Care Products Market Executive Summary

The global Pet Eye Care Products Market is characterized by robust business trends, primarily centered around innovation in drug formulation, strategic partnerships between veterinary pharmaceutical giants and specialized biotechnology firms, and expansion into rapidly growing regions like the Asia Pacific. A significant trend involves the development of preventative and wellness-focused products, such as specialized diets or supplements containing essential fatty acids and antioxidants, targeting ocular health maintenance rather than just disease treatment. Furthermore, the market is experiencing consolidation, with leading players actively acquiring smaller, niche companies possessing proprietary technologies or unique product lines, aiming to broaden their therapeutic portfolios and distribution networks globally, thus enhancing competitive positioning.

Regional trends indicate North America currently holding the dominant market share, driven by exceptionally high rates of pet ownership, sophisticated veterinary infrastructure, high disposable incomes, and the strong prevalence of pet insurance coverage which facilitates access to expensive specialized treatments. However, the Asia Pacific region is forecast to exhibit the fastest growth over the projection period. This rapid expansion is attributed to demographic shifts, particularly the increasing penetration of Western lifestyle preferences, rising urbanization leading to higher adoption of companion animals, and improving economic conditions that allow greater discretionary spending on pet healthcare. Europe maintains a strong presence, characterized by stringent regulations ensuring product quality and a high level of consumer education regarding pet wellness.

Segment trends reveal that the pharmaceutical segment, including antibiotic and anti-inflammatory drops, remains the largest revenue generator due to the high incidence of bacterial and allergic conjunctivitis. Conversely, the nutraceutical and supplements segment is projected to grow at the highest CAGR, reflecting the growing consumer preference for proactive and natural solutions for age-related macular degeneration and dry eye syndrome prevention. Distribution channels show a continued strong reliance on veterinary clinics and hospitals for prescription-based medicines, while online pharmacies and specialized pet stores are rapidly gaining traction, particularly for over-the-counter (OTC) maintenance products and supplements, driven by convenience and competitive pricing dynamics.

AI Impact Analysis on Pet Eye Care Products Market

User questions regarding the impact of Artificial Intelligence (AI) in the Pet Eye Care Products Market frequently center on its role in diagnostics, personalized treatment protocols, and efficiency improvements in veterinary practice. Consumers and industry professionals alike are keenly interested in whether AI can enhance the accuracy of detecting subtle ocular changes, such as early signs of glaucoma or diabetic retinopathy, often missed in conventional examinations. Key concerns also revolve around the cost implications of implementing sophisticated AI-driven imaging analysis tools (like fundus cameras integrated with AI algorithms) and the feasibility of integrating these technologies into standard veterinary clinics versus specialty hospitals. Users also seek information on how AI might accelerate the R&D process for novel ophthalmic drugs and improve supply chain predictability for essential eye care products.

The immediate and tangible impact of AI is primarily visible in diagnostic imaging. Machine learning algorithms are being trained on vast datasets of pet retinal scans and anterior segment images to automatically identify pathologies with remarkable speed and accuracy. This significantly aids veterinarians, especially those in general practice who may not have specialized ophthalmology training, ensuring earlier and more precise diagnosis of conditions like cataracts, corneal ulcers, and retinal detachments. By automating the preliminary analysis of complex images, AI reduces the burden on veterinary professionals, allowing them to focus on clinical decision-making and direct patient care, thereby potentially improving patient outcomes and standardizing diagnostic quality across different practices.

Furthermore, AI plays a crucial role in optimizing the development and distribution side of the market. In pharmaceutical R&D, AI models are used to predict the efficacy and toxicity of new drug candidates for ocular delivery, potentially accelerating the time-to-market for novel treatments. Within the supply chain, predictive analytics powered by AI helps manufacturers anticipate regional demand fluctuations based on seasonal pet illnesses (e.g., allergy-related conjunctivitis) or disease outbreaks, optimizing inventory management and reducing shortages of critical eye medications. This integration of AI across the value chain promises increased efficiency, reduced operational costs, and ultimately, better accessibility of specialized pet eye care products for consumers.

- AI-enhanced diagnostic imaging for early disease detection (e.g., glaucoma, retinopathy).

- Personalized treatment planning based on individual pet genetic and clinical data.

- Accelerated pharmaceutical R&D through computational modeling of drug efficacy.

- Optimized inventory management and supply chain logistics using predictive analytics.

- Development of smart telehealth platforms for remote ophthalmology consultations.

DRO & Impact Forces Of Pet Eye Care Products Market

The trajectory of the Pet Eye Care Products Market is shaped significantly by a confluence of accelerating drivers, necessary restraints, and emerging opportunities, all interacting to generate powerful market impact forces. Key drivers include the global increase in pet ownership and humanization, resulting in heightened consumer willingness to spend on premium pet healthcare, coupled with the rising incidence of age-related ophthalmic disorders in an expanding geriatric pet population. Restraints typically involve the high cost associated with specialized veterinary ophthalmology treatments and advanced pharmaceuticals, which can limit adoption in price-sensitive markets, alongside stringent regulatory requirements for new veterinary drug approvals that slow down product innovation cycles. Opportunities are abundant in the development of novel drug delivery systems, expansion into emerging economies with underserved veterinary needs, and integrating digital tools like telemedicine for remote eye monitoring, which collectively summarize the core impact forces driving strategic investment and innovation in the sector.

Detailed analysis of the drivers reveals that the growing prevalence of chronic diseases in companion animals, such as canine diabetes leading to cataracts, is a major sustained impetus for market growth. Furthermore, enhanced consumer education through veterinary associations and accessible online resources has amplified awareness regarding the importance of routine eye examinations, moving market activity from reactive treatment to proactive prevention. This focus on prevention is fueling the demand for non-prescription products like daily lubricating drops and tear stain solutions. The continuous expansion of global veterinary infrastructure, particularly the specialization within ophthalmology units in large animal hospitals, also ensures that complex eye conditions can be managed effectively, thereby boosting the utilization of specialized products.

While the market is propelled forward by demand, substantial restraints exist, primarily revolving around economic barriers and regulatory hurdles. The specialized nature of ophthalmic products often translates into higher manufacturing and retailing costs, posing a barrier to entry for smaller practices and affordability issues for a segment of pet owners without insurance. Additionally, veterinary pharmaceuticals face rigorous regulatory scrutiny across major jurisdictions (FDA, EMA), requiring extensive clinical trials that delay market access for innovative treatments. Successfully navigating these restraints involves developing cost-effective, generic alternatives where possible, and strategically focusing on over-the-counter wellness products which typically face fewer regulatory barriers, allowing for quicker market penetration and wider consumer access.

The strongest impact forces stem from the convergence of technological advancements and unmet clinical needs. Opportunities lie in developing targeted treatments for previously challenging conditions like refractory corneal ulcers or specific retinal degenerations. Furthermore, the integration of companion diagnostics—tools that help veterinarians identify the specific subtype of ocular inflammation or infection before prescribing medication—ensures targeted therapy, minimizing antibiotic resistance and improving therapeutic outcomes. Utilizing sustainable and eco-friendly packaging for eye care products also presents a critical opportunity to appeal to the environmentally conscious pet owner demographic, enhancing brand loyalty and social responsibility within the competitive landscape.

Segmentation Analysis

The Pet Eye Care Products Market is segmented across several critical dimensions, including product type, animal type, application, and distribution channel, providing a granular view of market dynamics and revenue generation streams. Product type segmentation distinguishes between therapeutic products, such as prescription drugs (anti-infectives, anti-inflammatories, glaucoma agents), and non-therapeutic products, which include diagnostic tools, cleaning solutions, and nutritional supplements. This segmentation is crucial as it reflects the varying regulatory requirements, price points, and consumer purchasing patterns associated with different categories of eye care. The analysis highlights that while therapeutic products command higher value due to clinical necessity, non-therapeutic products drive volume sales through preventative and routine care adoption.

Animal type segmentation primarily focuses on dogs and cats, which represent the vast majority of companion animals requiring specialized eye care. Dogs, being susceptible to conditions like progressive retinal atrophy (PRA), dry eye (KCS), and breed-specific glaucoma, constitute the larger and more lucrative segment. However, the feline segment, though smaller, is growing steadily, driven by increasing awareness of conditions like Feline Herpes Virus (FHV)-related corneal disease and chronic conjunctivitis. Specialized product formulations tailored to the unique physiological and behavioral characteristics of each species—such as palatable oral supplements for cats or specific tear stain remover formulations for white-coated dog breeds—are key growth catalysts within this dimension.

Further segmentation by application (e.g., diagnosis, treatment, and preventive care) and distribution channel allows companies to tailor their marketing and sales strategies effectively. Treatment applications dominate in terms of revenue due to the high cost of chronic disease management and post-surgical rehabilitation. However, preventive care is the fastest-growing application area, aligning with the shift toward proactive health management and premium pet wellness. The distribution channel breakdown clearly shows the ongoing importance of veterinary channels for high-value prescription sales, while the burgeoning e-commerce channel caters primarily to the convenient purchase of lower-cost, over-the-counter maintenance products and supplements, reflecting changing consumer shopping habits.

- Product Type:

- Pharmaceuticals (Antibiotics, Anti-inflammatories, Glaucoma Agents, Antivirals)

- Ophthalmic Diagnostics (Stains, Schirmer Tear Test Strips)

- Supplements and Nutraceuticals

- Cleaning and Maintenance Solutions (Tear Stain Removers, Saline Flushes)

- Animal Type:

- Dogs

- Cats

- Other Companion Animals (Horses, Rabbits)

- Application:

- Treatment (Acute and Chronic Diseases)

- Preventive Care and Wellness

- Surgical Aftercare

- Diagnosis and Screening

- Distribution Channel:

- Veterinary Hospitals and Clinics

- Retail Pharmacies and Pet Stores (Online and Offline)

- E-commerce Platforms

Value Chain Analysis For Pet Eye Care Products Market

The value chain for the Pet Eye Care Products Market is complex, spanning from the procurement of highly specialized raw materials and active pharmaceutical ingredients (APIs) to the final dispensing to pet owners, predominantly through veterinary channels. The upstream activities involve extensive research and development (R&D) focused on novel ophthalmologic formulations suitable for veterinary use, often borrowing methodologies and API technology from the human ophthalmology sector. Raw material procurement demands stringent quality control, especially for APIs used in sterile ophthalmic solutions, necessitating strong relationships with specialized chemical and pharmaceutical component suppliers. Given the delicate nature of ocular treatments, manufacturing processes must adhere to Good Manufacturing Practice (GMP) standards, focusing heavily on sterility and precision in formulation, representing a high-cost component of the upstream phase.

Midstream activities primarily encompass the manufacturing, packaging, and regulatory approval processes. Achieving veterinary marketing authorization for eye drops, gels, or ointments requires substantial investment in clinical efficacy and safety trials tailored for specific animal species. Once approved, the distribution channel management becomes critical. Direct distribution involves manufacturers supplying large veterinary hospital groups or specialized ophthalmology centers. Indirect distribution relies heavily on regional veterinary wholesalers and distributors who manage logistics, warehousing, and delivery to individual veterinary clinics, retail chains, and increasingly, specialized online veterinary pharmacies. The efficacy of the cold chain management is particularly important for biological products or certain temperature-sensitive pharmaceuticals within the eye care portfolio.

Downstream activities focus on reaching the end-user, primarily pet owners. Veterinary professionals—including general practitioners and board-certified ophthalmologists—act as the essential gatekeepers for therapeutic products, influencing over 90% of prescription sales due to their diagnostic expertise. For over-the-counter (OTC) products like cleaning solutions and supplements, pet specialty retailers and e-commerce platforms serve as crucial sales points, offering convenience and broader access. The crucial element in the downstream segment is the provision of educational resources and training by manufacturers to veterinarians to ensure correct diagnosis and appropriate product recommendation, thereby closing the loop of the value chain and ensuring positive therapeutic outcomes for companion animals.

Pet Eye Care Products Market Potential Customers

The core customer base for the Pet Eye Care Products Market consists primarily of three distinct groups: veterinary professionals, direct pet owners, and specialized animal research institutions. Veterinary professionals, encompassing general practitioners, specialized ophthalmologists, and veterinary technicians, are the most influential buyers and prescribers of therapeutic eye care products. They require reliable, effective, and evidence-based pharmaceuticals and diagnostic tools to manage acute infections, chronic diseases like glaucoma, and post-operative recovery. Manufacturers focus significant resources on marketing, education, and clinical evidence presentation to this group, as their recommendation is pivotal for prescription product uptake and inventory purchasing decisions at the clinic level.

Pet owners represent the ultimate end-users and are the primary consumers of over-the-counter (OTC) products, including tear stain removers, routine cleaning solutions, and nutritional supplements aimed at ocular health maintenance. Driven by increasing pet humanization and a heightened desire for preventive wellness, this segment is highly influenced by convenience, perceived safety, and product reputation (often vetted through online reviews or social media). Marketing efforts directed toward pet owners emphasize ease of administration, natural ingredients, and the long-term health benefits of proactive eye care, with purchases often channeled through online marketplaces and large pet specialty retail outlets, shifting away from exclusive veterinary distribution for non-prescription items.

Specialized animal research institutions, universities conducting veterinary trials, and large-scale animal shelters constitute a smaller but important segment. These organizations often require bulk quantities of standard eye care solutions, diagnostic stains, and sometimes, novel investigational products for controlled studies or large-scale population health management. Their purchasing decisions are driven by cost-effectiveness, high-volume capacity, and technical support documentation. Serving this segment often involves establishing long-term institutional contracts and providing tailored packaging and delivery logistics that meet strict institutional protocols and budgeting requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 750 Million |

| Growth Rate | CAGR 7.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bayer AG, Boehringer Ingelheim International GmbH, Virbac, Zoetis Inc., Vetoquinol SA, Dechra Pharmaceuticals PLC, Elanco Animal Health Incorporated, Merck & Co., Inc. (Animal Health), Heska Corporation, Animal Health, Novartis Animal Health, Bausch + Lomb (Veterinary Division), Scope Opthalmics, Ceva Santé Animale, Akorn Animal Health, Alcon Veterinary Division |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pet Eye Care Products Market Key Technology Landscape

The technology landscape within the Pet Eye Care Products Market is rapidly evolving, driven by the transfer of sophisticated techniques from human ophthalmology and specialized veterinary R&D efforts. A crucial technological focus is on enhancing drug bioavailability and compliance through novel drug delivery systems. Traditional liquid drops often have poor retention time on the ocular surface. Consequently, advanced formulations such as thermosensitive gels, sustained-release implants, and liposomal suspensions are emerging. These technologies minimize the required frequency of application, significantly improving owner compliance and ensuring a consistent therapeutic concentration of the active ingredient, which is particularly beneficial for managing chronic conditions like canine glaucoma or dry eye syndrome (KCS).

Diagnostic technology plays an equally vital role, with key advancements focused on making detailed ophthalmic examinations more accessible and less invasive. Technologies such as high-resolution optical coherence tomography (OCT) adapted for veterinary use allow for non-invasive, cross-sectional imaging of the retina and optic nerve head, crucial for early detection of blinding diseases. Furthermore, portable and user-friendly diagnostic tools, including digital tonometers for intraocular pressure measurement and specialized cameras for fundus photography, are increasingly being adopted by general practitioners, moving advanced diagnostics beyond the specialized clinic setting. The integration of these digital tools with cloud-based data analysis facilitates comparison and monitoring over time.

Finally, the growing adoption of digital health platforms and telemedicine is transforming how eye care is delivered and monitored. Tele-ophthalmology allows veterinary specialists to review images and diagnostic data remotely, providing expert consultation to clinics in underserved or remote areas. Technology is also critical in the development of sophisticated nutraceuticals, where microencapsulation techniques are used to protect sensitive ingredients like Omega-3 fatty acids and antioxidants from oxidation, ensuring maximum potency when consumed by the pet. These technological advancements collectively contribute to better diagnostic capabilities, improved therapeutic efficacy, and streamlined patient management, sustaining market innovation.

Regional Highlights

- North America: North America, particularly the United States, commands the largest share of the Pet Eye Care Products Market. This dominance is attributed to several factors including the highest per capita expenditure on pet healthcare globally, exceptionally high pet humanization rates, and the robust presence of advanced veterinary specialization. The U.S. market benefits from extensive pet insurance penetration, which encourages owners to pursue high-cost, specialized treatments for ophthalmic conditions such as cataract surgery and glaucoma management. Furthermore, leading pharmaceutical companies have their primary R&D and manufacturing bases in this region, facilitating rapid commercialization of innovative products.

- Europe: Europe represents a mature and stable market, characterized by strict animal welfare regulations and a high level of consumer awareness regarding preventative pet health. Western European countries, including the UK, Germany, and France, are major contributors, driven by a large elderly pet population susceptible to chronic eye diseases. The market here shows a strong demand for high-quality, regulated pharmaceutical products and a growing preference for natural and organic supplements for eye health, aligning with broader European consumer trends favoring natural pet wellness.

- Asia Pacific (APAC): The APAC region is projected to experience the fastest growth during the forecast period. This accelerated expansion is fueled by rising disposable incomes, rapid urbanization leading to increased companion animal adoption, and the gradual improvement and modernization of veterinary infrastructure, particularly in countries like China, India, and South Korea. While the initial market penetration focused on basic cleaning solutions, there is a clear and accelerating shift toward specialized therapeutic products as veterinary expertise and consumer willingness to pay for premium care increases across the region.

- Latin America: The Latin American market is emerging, with growth driven by increasing pet ownership and an expanding middle class. While the market is currently price-sensitive, leading to a strong demand for generic and cost-effective eye care solutions, increased foreign investment in veterinary clinics is slowly introducing specialized products and diagnostic tools. Brazil and Mexico are the dominant markets, focusing on basic treatments for common infections and preventative care.

- Middle East and Africa (MEA): The MEA region remains a relatively nascent market but shows promising growth, primarily concentrated in urban centers within the UAE and South Africa, which possess relatively high levels of economic stability and advanced veterinary services. The market demand is highly segmented, driven by specialized needs in affluent areas and basic needs in developing nations. The import reliance for specialized pharmaceutical products is high across most MEA countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pet Eye Care Products Market.- Bayer AG

- Boehringer Ingelheim International GmbH

- Virbac

- Zoetis Inc.

- Vetoquinol SA

- Dechra Pharmaceuticals PLC

- Elanco Animal Health Incorporated

- Merck & Co., Inc. (Animal Health)

- Heska Corporation

- Animal Health

- Novartis Animal Health

- Bausch + Lomb (Veterinary Division)

- Scope Opthalmics

- Ceva Santé Animale

- Akorn Animal Health

- Alcon Veterinary Division

- Bio-Groom

- Nutri-Vet

- Miracle Care

- I-Med Animal Health

Frequently Asked Questions

Analyze common user questions about the Pet Eye Care Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary factors are driving the growth of the Pet Eye Care Products Market?

The market growth is fundamentally driven by the global trend of pet humanization, which translates into increased spending on advanced veterinary healthcare, combined with the rising prevalence of age-related ophthalmic diseases such as cataracts and glaucoma in the growing geriatric pet population. Technological advancements in diagnostic tools and the introduction of novel, effective drug delivery systems also significantly contribute to market expansion.

Which product segment holds the largest share in the market, and why?

The Pharmaceuticals segment, encompassing prescription medications like antibiotics, anti-inflammatories, and glaucoma treatments, currently holds the largest market share. This dominance is due to the necessity and high cost of managing chronic and acute infectious ophthalmic diseases in pets, which strictly require veterinary intervention and specialized, regulated therapeutic agents for successful treatment.

How is the role of technology influencing pet eye care diagnostics and treatment?

Technology is significantly influencing pet eye care by integrating advanced human ophthalmic tools, such as veterinary-adapted Optical Coherence Tomography (OCT) and specialized digital tonometers, for precise, early diagnosis. Furthermore, AI is beginning to assist in image analysis. Treatment is being improved through sustained-release drug delivery systems, enhancing efficacy and owner compliance by reducing application frequency.

Which geographical region is anticipated to exhibit the fastest growth rate?

The Asia Pacific (APAC) region is projected to experience the fastest compound annual growth rate (CAGR). This acceleration is directly linked to increasing disposable incomes, rapid urbanization leading to higher pet adoption rates, and substantial governmental and private investment in developing modern veterinary infrastructure and specialized healthcare services across major economies in the region.

What are the main distribution channels for Pet Eye Care Products, and what is the current trend?

The primary distribution channels are Veterinary Clinics/Hospitals and Retail/E-commerce platforms. Veterinary clinics remain critical for prescription-based pharmaceuticals and diagnostic products. However, the current trend shows rapid growth in the E-commerce channel for convenient purchase of over-the-counter maintenance solutions, supplements, and routine care items due to competitive pricing and ease of access for pet owners.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager