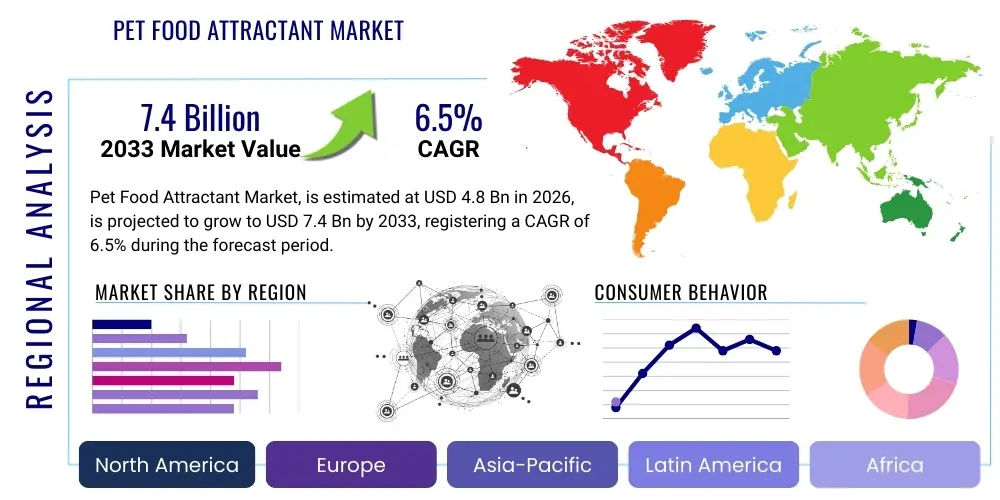

Pet Food Attractant Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437684 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Pet Food Attractant Market Size

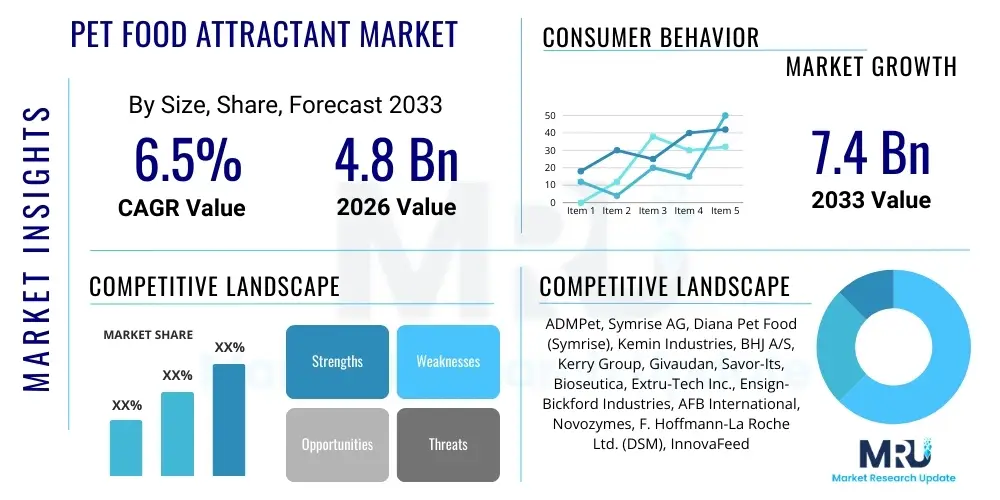

The Pet Food Attractant Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.4 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by increasing consumer focus on pet health and wellness, coupled with the critical need for manufacturers to enhance product acceptance, particularly among finicky eaters such as felines and specialized breeds requiring therapeutic diets. The strategic integration of advanced flavor profiles and texture enhancers is pivotal in achieving this projected valuation, reflecting the maturation of pet nutrition science globally.

Pet Food Attractant Market introduction

The Pet Food Attractant Market encompasses specialized ingredients incorporated into animal nutrition formulations designed to improve the palatability, aroma, and overall consumption experience of commercial pet foods. These attractants, often derived from hydrolyzed proteins, yeast extracts, savory powders, or specialized fats and oils, serve the primary function of masking undesirable flavors in highly fortified or medicinal diets while simultaneously stimulating the pet's olfactory and gustatory senses. The product landscape ranges from liquid enhancers used in wet food manufacturing to powdered coatings applied to kibble, ensuring maximum engagement and reducing food waste associated with rejection.

Major applications of pet food attractants span across various food formats, including dry kibble, semi-moist foods, wet canned products, and nutrient-dense treats and supplements. These ingredients are critical for the successful delivery of essential nutrients, vitamins, and pharmaceuticals, especially in therapeutic or weight-management diets where flavor compromises might otherwise lead to dietary non-compliance. Benefits derived from the use of attractants include improved animal welfare through consistent nutrition intake, enhanced market competitiveness for pet food brands, and optimization of manufacturing processes by providing consistent coating adhesion and flavor stability across batches.

Driving factors for this market include the global increase in pet ownership rates, particularly in emerging economies, coupled with the humanization of pets leading owners to prioritize premium, high-quality, and palatable diets. Furthermore, continuous research and development in animal physiological science, focusing on species-specific sensory preferences—especially the distinct taste receptors and aroma sensitivities of cats versus dogs—propels innovation in developing highly targeted and effective attractant solutions. Regulatory compliance and the push toward natural, clean-label ingredients also dictate product development pathways, favoring bio-derived and safe enhancers over artificial alternatives.

Pet Food Attractant Market Executive Summary

The Pet Food Attractant Market demonstrates significant growth momentum, underpinned by key business trends such as strategic acquisitions focused on expanding flavor technology portfolios and a rising consumer preference for natural ingredient sourcing. Manufacturers are intensely focused on utilizing advanced flavor encapsulation technologies to ensure prolonged stability and release characteristics, addressing the challenges inherent in high-heat extrusion processes typical of dry pet food production. Business strategies revolve around establishing strong partnerships with rendering facilities and biotechnology firms to secure sustainable, high-quality protein hydrolysates and novel yeast extracts, positioning companies to meet escalating demand for premium, highly palatable formulations in the burgeoning super-premium pet food segment.

Regionally, North America and Europe maintain dominance, driven by mature pet markets, high disposable incomes, and stringent quality standards favoring sophisticated attractant solutions, particularly in the premium therapeutic segment. However, the Asia Pacific region, led by China and India, is emerging as the fastest-growing market due to rapid urbanization, increasing middle-class disposable income, and a noticeable shift toward commercial pet food adoption over traditional home-cooked diets. This regional dynamic necessitates localized flavor profiles and ingredient sourcing to align with diverse regulatory landscapes and consumer preferences, particularly for unique pet types prevalent in Asian markets.

Segmentation trends highlight the increasing prominence of palatability enhancers derived from protein hydrolysates, owing to their dual function of providing both superior flavor and nutritional value. The application segment continues to be dominated by dry pet food, given its vast volume consumption, though the fastest growth is observed in the pet treats and specialized supplements sector, where attractants are crucial for masking the taste of functional ingredients like prebiotics, probiotics, and joint supplements. Furthermore, the species-specific focus remains critical, with dedicated research aimed at understanding and catering to the highly sensitive and discerning palates of feline species, driving investment in novel animal-derived and synthesized flavor bases specifically optimized for cats.

AI Impact Analysis on Pet Food Attractant Market

Common user questions regarding AI's impact on the Pet Food Attractant Market frequently center on its role in predictive modeling for consumer preferences, optimization of flavor ingredient ratios, and automated quality control during production. Users inquire about how AI can analyze vast datasets concerning breed-specific dietary intake patterns, ingredient interaction thermodynamics, and real-time sensory data to formulate optimal attractant blends that maximize efficacy and stability. The core concern revolves around the balance between algorithmic efficiency and maintaining the natural integrity of flavor profiles, along with the expected disruption in traditional R&D cycles. Users anticipate that AI will significantly accelerate the discovery of novel, species-specific flavor compounds and streamline regulatory approval processes by predicting ingredient compatibility and safety profiles with higher accuracy than conventional methods.

AI is already beginning to revolutionize the R&D pipeline for pet food attractants by leveraging machine learning algorithms to analyze complex chromatographic data of flavor compounds and correlating these with measured animal acceptance trials. This capability allows researchers to rapidly identify key volatile organic compounds (VOCs) that contribute most effectively to palatability for specific species, cutting down the time required to formulate new generations of enhancers. Furthermore, AI-powered systems are being deployed in manufacturing facilities for real-time process optimization, adjusting spray-drying parameters or coating thicknesses to maintain flavor potency and homogeneity across high-volume production runs, thereby significantly reducing batch variation and enhancing product consistency, which is vital for consumer trust and brand reliability.

The impact of AI extends into the supply chain through predictive analytics for ingredient sourcing, helping companies manage the volatility associated with procuring natural raw materials like animal proteins and yeast extracts. By forecasting yield variability and market price fluctuations, AI minimizes procurement risks. Moreover, sophisticated generative models are being explored to synthesize entirely new flavor molecules that mimic natural sources but offer enhanced stability or reduced cost, paving the way for sustainable and highly effective next-generation attractants. This technological shift demands a specialized skillset within the industry, emphasizing data science alongside traditional animal nutrition expertise, fundamentally altering the competitive landscape for ingredient suppliers.

- AI-driven predictive modeling optimizes species-specific flavor profiles based on large-scale consumption data.

- Machine learning accelerates the discovery of novel flavor compounds and ingredient synergies, shortening R&D cycles.

- Real-time quality control systems powered by AI ensure consistent flavor application and potency during manufacturing.

- Predictive supply chain analytics improve procurement efficiency for volatile natural attractant ingredients.

- Generative AI explores and synthesizes highly stable, cost-effective artificial or bio-mimicking flavor enhancers.

DRO & Impact Forces Of Pet Food Attractant Market

The dynamics of the Pet Food Attractant Market are shaped by a complex interplay of facilitating factors, inherent market limitations, significant untapped opportunities, and overarching external forces that dictate strategic planning and growth trajectories. The primary driver remains the compelling need to improve acceptance rates for specialized or therapeutic diets, where ingredients like high levels of supplements or novel proteins often possess inherently low palatability. Conversely, the market faces restraints related to the high cost associated with developing and procuring high-quality, clean-label attractants, particularly those derived from natural sources, which contrasts with the cost sensitivity prevalent in the economy pet food segment. Opportunities lie in leveraging biotechnological advancements, such as fermentation-derived ingredients and precision animal nutrition, to create sustainable and highly effective solutions.

Impact forces significantly affecting the market include the stringent regulatory environment governing food additives and ingredient traceability, especially in regions like the EU and North America, which necessitates substantial investment in safety testing and documentation. Consumer preferences, manifesting as a powerful social force, demand transparency regarding ingredient origin and processing methods, pushing the industry away from synthetic compounds toward natural, recognizable sources like liver hydrolysates, brewer’s yeast, and vegetable extracts. Economic forces, such as fluctuating commodity prices for protein sources and global trade complexities, introduce volatility in raw material costs, forcing manufacturers to adopt flexible sourcing strategies and explore bio-fermentation alternatives to stabilize production costs for key attractants.

Furthermore, technological forces, specifically the integration of omics technologies (genomics, proteomics, metabolomics) into flavor research, are accelerating the identification of compounds that modulate the animal's feeding behavior, allowing for hyper-targeted product development. Competitive forces are intensifying as major global flavor and fragrance houses enter the pet food space, bringing advanced encapsulation and stabilization technologies that raise the barrier to entry for smaller specialized suppliers. Navigating these forces requires companies to invest heavily in robust R&D, secure diverse supply chains, and communicate transparently with consumers about the functional benefits and sourcing ethics of their attractant ingredients.

Drivers:

- Increasing global pet ownership and the humanization trend demanding palatable, high-quality nutrition.

- Critical necessity to enhance the acceptance of therapeutic, novel protein, and highly fortified diets.

- Advancements in protein hydrolysis and yeast fermentation technologies yielding superior flavor bases.

Restraints:

- High development and production costs associated with premium, natural, clean-label attractants.

- Challenges in maintaining flavor stability and potency through high-temperature extrusion processes.

- Regulatory complexities regarding the classification and approval of new flavor ingredients in different jurisdictions.

Opportunities:

- Focus on species-specific (especially feline) flavor modulation and nutrient delivery systems.

- Expansion into the high-growth market of pet treats and functional supplements requiring strong masking agents.

- Development of sustainable, non-animal derived, fermentation-based attractants (e.g., microbial proteins).

Impact Forces:

- Social Force: Strong consumer demand for clean-label, ethically sourced, and transparently disclosed ingredients.

- Economic Force: Volatility in commodity prices affecting raw material costs for protein-based attractants.

- Technological Force: Integration of AI and omics research for precise flavor compound identification and synthesis.

- Regulatory Force: Increasing scrutiny and stringent compliance requirements for food additives globally.

Segmentation Analysis

The Pet Food Attractant Market is broadly segmented based on ingredient type, the application format of the food, the target animal species, and the source (natural versus synthetic). This segmentation provides a granular view of market dynamics, revealing where innovation is concentrated and where consumer and manufacturer investments are directed. Understanding these segments is crucial for strategic market positioning, as the requirements for an attractant used in high-moisture canned cat food are fundamentally different from those used in low-fat dog kibble, demanding tailored formulations that address specific processing challenges and sensory preferences.

The dominance of the Type segment, particularly Palatability Enhancers, underscores the shift from simple flavoring agents to functional ingredients that actively modulate the pet's ingestion behavior through complex chemical signaling involving smell, taste, and texture. Furthermore, the species segmentation highlights the highly specialized nature of the market, driven by the distinct nutritional and sensory biology of different animals, necessitating research dedicated solely to feline or canine flavor perception. This specialization ensures that products maximize biological efficacy and comply with specific species dietary needs, thereby enhancing overall market value and consumer loyalty to brands employing highly effective, targeted attractants.

Analyzing these segments provides clarity on future market direction, suggesting a significant migration towards highly differentiated, natural-sourced, and application-specific products. The demand for attractants that offer secondary benefits, such as immune support (e.g., yeast extracts rich in beta-glucans) or digestive health (e.g., specialized fats), further blurs the lines between simple attractants and functional food ingredients, fueling market innovation and commanding premium pricing across key segments.

- By Type: Palatability Enhancers, Flavor Agents, Taste Modulators

- By Application: Dry Pet Food, Wet Pet Food, Pet Treats, Others (Supplements, Veterinary Diets)

- By Species: Dogs, Cats, Others (Birds, Small Mammals, Fish)

- By Source: Natural Attractants, Synthetic Attractants

Value Chain Analysis For Pet Food Attractant Market

The value chain for the Pet Food Attractant Market begins with the upstream segment, encompassing the sourcing and processing of core raw materials. This typically involves rendering facilities providing animal by-products (meat, liver, fish) for hydrolysis, specialized fermentation companies producing yeast extracts and microbial proteins, and chemical synthesis labs for specific amino acids and flavor precursors. The quality and sustainability of raw material sourcing are critical at this stage, heavily influencing the final product cost and compliance with clean-label demands. Efficiency in processing, such as advanced enzymatic hydrolysis techniques, directly impacts the sensory intensity and nutritional profile of the resulting attractant base, making technological investment upstream a significant competitive advantage.

The core manufacturing stage involves the specialized refinement and formulation of these raw bases into finished attractants, often requiring complex techniques such as spray drying, liquid blending, and microencapsulation to ensure stability during the pet food production process (e.g., extrusion). Manufacturers must optimize their processes to deliver attractants that remain potent under high heat and long storage periods. Distribution channels, both direct and indirect, then move the attractants to the downstream users. Direct distribution often involves large, integrated pet food manufacturers purchasing directly from ingredient suppliers for maximum control and customization. Indirect channels involve distributors or brokers who supply smaller regional pet food producers, managing inventory and logistics across diverse geographical markets.

The downstream segment centers on the application by pet food manufacturers (the end-users) and finally, the consumption by the pet. Successful downstream integration relies on strong technical support from attractant suppliers, helping manufacturers integrate the product seamlessly into their specific food matrices. The effectiveness of the attractant is ultimately validated by consumer acceptance, as measured by pet consumption rates and repeat purchase behavior. This full value chain emphasizes collaborative innovation, where upstream suppliers work closely with downstream food producers to develop customized solutions that perfectly match the pet food base and the target species' palatability needs.

Pet Food Attractant Market Potential Customers

The primary customers and end-users of pet food attractants are commercial pet food manufacturers, ranging from multinational corporations dominating the mass-market segment to specialized regional producers focusing on niche or boutique products. These manufacturers require attractants to ensure the consumption of their dry kibble, wet canned food, and semi-moist products, mitigating rejection, particularly when incorporating functional but poorly tasting ingredients like specific proteins, fibers, or pharmaceuticals. The customer base can be segmented based on scale, product focus (e.g., therapeutic vs. maintenance), and geographic location, each having unique requirements concerning formulation, stability, and regulatory compliance.

Within this customer group, manufacturers specializing in therapeutic or veterinary diets represent a crucial segment due to their acute need for high-efficacy attractants. These diets are often critical for managing chronic conditions, yet their specialized nutrient composition can severely compromise palatability. Therefore, these customers prioritize performance and stability over marginal cost differences, driving demand for premium, highly concentrated flavor solutions that guarantee compliance with veterinary recommendations. Another rapidly growing customer segment comprises manufacturers of high-value functional treats and supplements, where attractants are essential for masking the strong flavors of ingredients like CBD, probiotics, and joint care compounds, ensuring pets view the functional product as a reward rather than medication.

Finally, emerging market players in regions like APAC represent significant potential growth areas. As these regional manufacturers scale up and increasingly adopt global quality standards, they require reliable, cost-effective attractants to compete with established Western brands. These customers often seek attractants derived from local or regionally favored protein sources, requiring suppliers to adapt their product portfolios and supply chains to meet region-specific flavor preferences and sourcing requirements, confirming the broad and diverse nature of the end-user base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.4 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ADMPet, Symrise AG, Diana Pet Food (Symrise), Kemin Industries, BHJ A/S, Kerry Group, Givaudan, Savor-Its, Bioseutica, Extru-Tech Inc., Ensign-Bickford Industries, AFB International, Novozymes, F. Hoffmann-La Roche Ltd. (DSM), InnovaFeed |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pet Food Attractant Market Key Technology Landscape

The Pet Food Attractant Market is highly reliant on sophisticated chemical and biological technologies to ensure both efficacy and compliance. A central technology is Enzymatic Hydrolysis, used extensively to break down high-protein raw materials (like poultry, pork, or fish by-products) into palatable peptides and amino acids. This process is crucial as it not only enhances the savory (umami) flavor profile but also improves the digestibility of the protein base, creating dual-purpose ingredients that function as both attractants and nutritional components. Optimization of enzymatic cocktails is an area of intense research, focusing on specific proteases to yield peptides known to activate species-specific taste receptors, guaranteeing superior product acceptance, particularly in the notoriously selective feline market.

Another pivotal technological area is Microencapsulation and Coating Technologies. Since dry pet food extrusion involves high temperatures and mechanical stress that can degrade sensitive flavor compounds, microencapsulation protects the volatile attractant components until consumption. Techniques such as spray drying, fluid bed coating, and liposome encapsulation are used to create stable, homogeneous powder or liquid coatings that adhere uniformly to kibble surfaces. These technologies allow for controlled release of aroma and taste compounds upon ingestion, maximizing the sensory impact and preventing flavor fade during storage, a major consumer quality concern.

Furthermore, Fermentation Technology is rapidly emerging as a sustainable and clean-label method for producing high-quality attractants. The controlled fermentation of yeasts (e.g., brewer’s yeast, specific functional strains) and microbial cultures produces nucleotides, amino acids, and volatile sulfur compounds known for their intense savory and meaty flavor profiles. This method reduces reliance on animal-derived proteins, addresses vegan/vegetarian pet food trends, and provides ingredients recognized as natural by consumers. Advanced fermentation processes, often optimized using Artificial Intelligence, allow for precise control over the metabolite profile, ensuring consistency and superior performance compared to traditional extract preparation.

Regional Highlights

The global Pet Food Attractant Market exhibits distinct regional consumption patterns and growth drivers, reflecting varying pet ownership rates, economic development, and regulatory frameworks.

- North America: This region holds the largest market share, driven by a high concentration of premium and super-premium pet food brands, extensive pet humanization trends, and high consumer willingness to pay for specialized diets (e.g., grain-free, therapeutic, limited ingredient). The market here is characterized by demand for natural, traceable, and highly effective attractants, with innovation focusing on clean-label certifications and sustainable sourcing from reputable rendering operations.

- Europe: Similar to North America, Europe represents a mature and significant market, particularly Germany, the UK, and France. Stringent European Union regulations regarding animal by-products (Cat 3 materials) and food additive safety heavily influence product formulation. The region shows strong demand for plant-based and fermentation-derived attractants, aligning with sustainability goals and evolving consumer preferences towards non-animal protein sources in pet diets.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by burgeoning pet populations in urban centers (China, Japan, South Korea) and increasing disposable incomes leading to the adoption of commercial pet food. While price sensitivity remains a factor in developing markets, the shift towards high-quality, imported, and locally produced premium foods is rapid. This market demands attractants that cater to regional pet types (e.g., smaller breeds) and ensure palatability in humid climates, often requiring robust coating solutions.

- Latin America (LATAM): Growth in countries like Brazil and Mexico is supported by increasing professionalization of the local pet food industry. Manufacturers here focus on balancing cost-effectiveness with performance. There is a rising interest in functional attractants that provide nutritional benefits alongside flavor enhancement, helping local brands compete against established global players.

- Middle East and Africa (MEA): This region currently represents the smallest market share but offers nascent opportunities driven by increased luxury pet ownership and reliance on imported, high-quality pet foods. The demand is often centered around specialized attractants for high-end dry kibble, reflecting global premium trends, though localized production remains limited.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pet Food Attractant Market.- ADMPet (Archer Daniels Midland Company)

- Symrise AG

- Diana Pet Food (Symrise Subsidiary)

- Kemin Industries

- BHJ A/S

- Kerry Group

- Givaudan

- Savor-Its (Pala-Tech Laboratories)

- Bioseutica

- Extru-Tech Inc. (Focusing on application equipment)

- Ensign-Bickford Industries (AFB International Parent Company)

- AFB International (A major global attractant specialist)

- Novozymes (Enzyme supplier crucial for hydrolysis)

- F. Hoffmann-La Roche Ltd. (via DSM Nutritional Products)

- InnovaFeed (Sustainable insect-derived protein source)

- Ohly GmbH (Yeast extracts specialist)

- Mane SA

- International Flavors & Fragrances (IFF)

- Beneo GmbH

- Pure Taste Labs

Frequently Asked Questions

Analyze common user questions about the Pet Food Attractant market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a pet food attractant and a flavor agent?

An attractant is a broader category of ingredients designed to increase overall palatability by enhancing both the aroma (olfactory appeal) and the taste (gustatory appeal), often using complex protein hydrolysates or yeast extracts. A flavor agent is typically a simpler ingredient focusing primarily on adding a specific recognizable flavor note, such as a synthetic smoke or cheese essence, though the terms are often used interchangeably in general industry context.

Why are attractants especially critical for feline diets compared to canine diets?

Felines are obligate carnivores with unique, highly sensitive, and selective palates; they lack sweet taste receptors and rely heavily on aroma and savory (umami) compounds, particularly those derived from animal proteins. Attractants are essential in cat food to mask the taste of essential but unpalatable ingredients, ensuring nutritional compliance for this finicky species.

Are natural attractants more effective than synthetic attractants?

Natural attractants, derived from sources like meat hydrolysates, yeast, and natural fats, are often perceived as more effective because they mimic the natural prey diet aromas that pets instinctively recognize and prefer. Consumer preference and clean-label trends strongly favor natural attractants, although synthetic compounds can offer superior stability and cost-effectiveness in specific applications, particularly for highly volatile flavor notes.

How does the extrusion process affect the stability and efficacy of pet food attractants?

The high temperature (up to 180°C) and pressure involved in pet food extrusion can cause significant degradation or volatilization of heat-sensitive flavor compounds. To counteract this, manufacturers use technologies like microencapsulation or apply the attractants externally (topically) after the extrusion and drying process, minimizing heat exposure and maximizing flavor retention on the finished kibble surface.

What role does biotechnology play in the future of pet food attractants?

Biotechnology, particularly precision fermentation, is central to future innovation, enabling the sustainable production of highly concentrated, functional attractants like specific peptides and nucleotides without reliance on traditional animal rendering. This technology promises better consistency, lower cost volatility, and cleaner labels, addressing both sustainability and performance demands simultaneously.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager