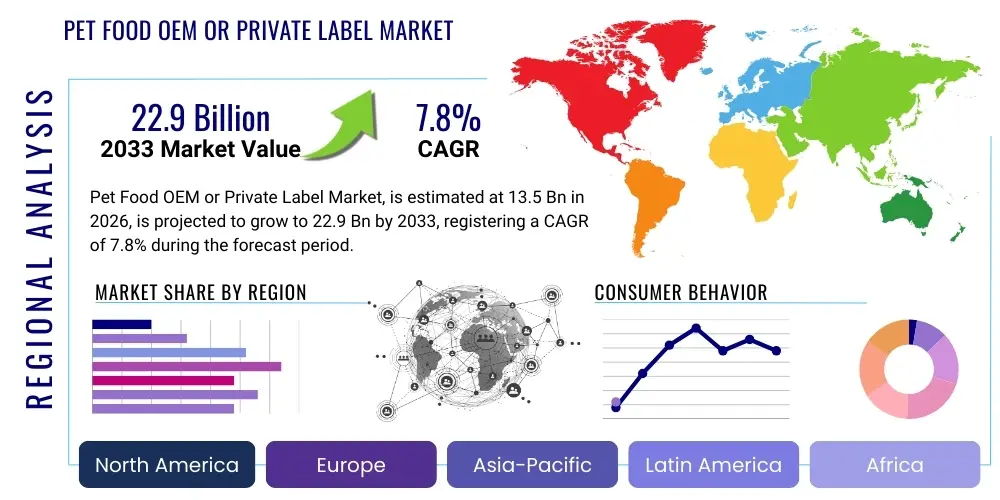

Pet Food OEM or Private Label Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439446 | Date : Jan, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Pet Food OEM or Private Label Market Size

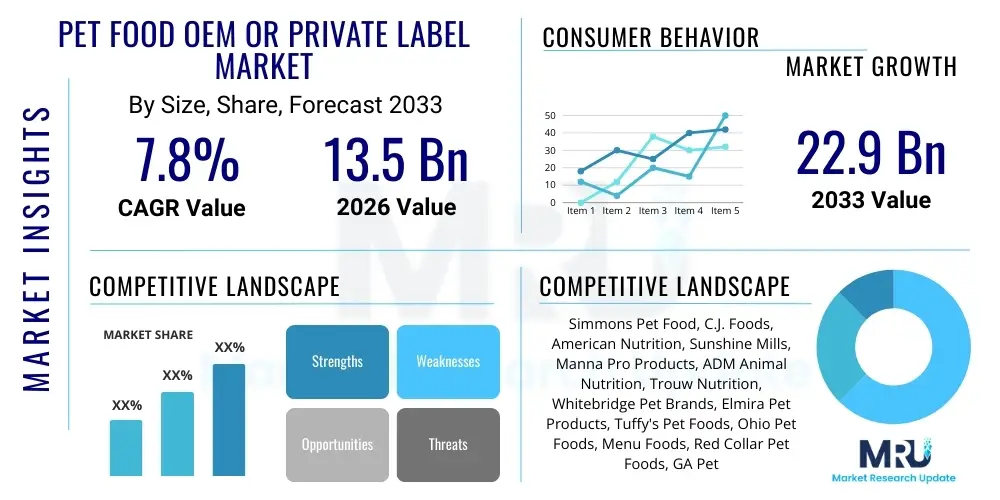

The Pet Food OEM or Private Label Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 13.5 Billion in 2026 and is projected to reach USD 22.9 Billion by the end of the forecast period in 2033.

Pet Food OEM or Private Label Market introduction

The Pet Food OEM (Original Equipment Manufacturer) or Private Label market encompasses the manufacturing of pet food products by a third-party producer for sale under another company's brand. This business model allows retailers, e-commerce platforms, veterinary clinics, and even established pet brands to offer a diverse range of pet food products without incurring the significant capital expenditure associated with setting up their own manufacturing facilities. These products span various categories, including dry kibble, wet food, treats, raw food, and specialized diets, catering to different animal types such as dogs, cats, birds, and small animals. The primary advantage lies in leveraging the manufacturer's expertise, infrastructure, and economies of scale.

The pet food private label market is characterized by its flexibility and customization options, enabling brands to differentiate their offerings through unique formulations, packaging designs, and ingredient profiles. Major applications include supermarket private brands, pet specialty store own brands, online subscription services, and veterinarian-recommended diets. Benefits for businesses include lower entry barriers, reduced operational costs, faster time-to-market, and greater control over product branding and pricing strategies. This approach fosters innovation by allowing brands to experiment with niche markets and specific dietary trends without large-scale investment risks.

Driving factors for this market's growth are multifaceted. A significant trend is the increasing humanization of pets, leading pet owners to seek high-quality, nutritious, and specialized food options that mirror human dietary preferences. This includes demand for natural, organic, grain-free, and limited-ingredient diets. The expansion of e-commerce and direct-to-consumer (D2C) models further fuels the market, as these brands often rely on private label manufacturers to scale their product lines efficiently. Additionally, retailers are increasingly investing in their private label portfolios to capture higher profit margins and build customer loyalty, contributing substantially to the market's robust expansion.

Pet Food OEM or Private Label Market Executive Summary

The Pet Food OEM or Private Label market is experiencing dynamic shifts, driven by evolving consumer preferences and technological advancements. Key business trends include a move towards ingredient transparency, sustainable sourcing, and personalized nutrition, prompting manufacturers to invest in advanced formulation capabilities and robust supply chain management. Consolidation among smaller private label manufacturers by larger entities is also a notable trend, aiming to achieve greater scale and broader market reach. Furthermore, the market is witnessing an uptick in strategic partnerships between brands and OEM manufacturers to co-develop innovative products, accelerating time-to-market for specialized pet food lines.

Regionally, North America and Europe continue to be mature markets, characterized by a strong demand for premium, health-oriented, and ethically sourced pet food. These regions are at the forefront of adopting novel ingredients and sustainable packaging solutions within their private label offerings. The Asia Pacific region, however, represents the fastest-growing market, propelled by increasing pet ownership rates, rising disposable incomes, and the Westernization of pet care practices, particularly in countries like China, India, and Southeast Asian nations. Latin America and the Middle East & Africa are emerging markets with significant untapped potential, as pet humanization trends begin to take root, creating new opportunities for private label expansion.

Segmentation trends highlight a strong demand for products catering to specific dietary needs and life stages, such as senior, puppy/kitten, weight management, and allergy-sensitive formulations. Dry pet food remains the largest segment due to convenience and cost-effectiveness, but wet food and treats are gaining traction due driven by perceived palatability and supplementary benefits. The distribution channel landscape is also evolving, with online retail witnessing exponential growth, offering a powerful platform for private label brands to reach a wider audience. Ingredient-wise, natural, organic, and limited-ingredient diets are commanding premium prices, reflecting consumer willingness to pay more for perceived health benefits, thereby influencing OEM production strategies significantly.

AI Impact Analysis on Pet Food OEM or Private Label Market

Users frequently inquire about AI's potential to revolutionize product development, supply chain efficiency, and personalization within the Pet Food OEM or Private Label market. Key themes revolve around how AI can enhance the speed and accuracy of new product formulation, optimize ingredient sourcing for cost-effectiveness and sustainability, and enable highly tailored dietary recommendations for individual pets. Concerns often touch upon data privacy, the ethical implications of AI-driven personalization, and the initial investment required for AI implementation. Expectations are high for AI to deliver greater precision in manufacturing, improve quality control, and create more responsive supply chains, ultimately leading to superior, safer, and more cost-effective private label pet food options.

- AI-driven personalized nutrition recommendations based on pet profiles, breed, age, and health data.

- Optimized ingredient sourcing and supply chain management through predictive analytics for demand forecasting and logistics.

- Accelerated new product formulation and R&D by simulating ingredient interactions and nutritional profiles.

- Enhanced quality control and food safety through real-time monitoring and anomaly detection in manufacturing processes.

- Automated manufacturing processes and machinery maintenance using machine learning for efficiency and reduced downtime.

- Targeted marketing and sales strategies for private label brands through analysis of consumer purchasing patterns and preferences.

- Improved sustainability efforts by optimizing resource usage and reducing waste in production cycles.

DRO & Impact Forces Of Pet Food OEM or Private Label Market

The Pet Food OEM or Private Label market is propelled by significant drivers such as the burgeoning trend of pet humanization, where pets are increasingly viewed as family members, leading to a demand for high-quality, human-grade, and specialized food options. The cost-effectiveness and flexibility offered by OEM and private label models allow retailers and emerging brands to quickly enter the market and cater to these evolving consumer demands without substantial initial investment in manufacturing infrastructure. Furthermore, the rapid expansion of e-commerce platforms and direct-to-consumer businesses creates new avenues for private label brands to reach a wider audience, facilitating market penetration and growth. The focus on ingredient transparency, natural ingredients, and functional foods further fuels this market as consumers seek specific health benefits for their pets.

However, the market also faces considerable restraints, including stringent regulatory complexities and varying food safety standards across different regions, which can pose challenges for manufacturers operating internationally or producing for diverse markets. Maintaining consistent quality control and ensuring traceability of ingredients across a complex supply chain is another significant hurdle for private label manufacturers. Intense competition from well-established national brands, coupled with volatility in raw material prices and potential supply chain disruptions, can impact profit margins and production stability. The need for continuous innovation to keep pace with changing consumer preferences and dietary trends also places pressure on OEM providers to frequently update formulations and manufacturing processes.

Opportunities within this market are abundant, particularly in the realm of personalized nutrition, leveraging data analytics and AI to create bespoke pet food formulations tailored to individual pet needs. The growing demand for sustainable and ethically sourced ingredients presents a chance for manufacturers to differentiate their offerings and appeal to environmentally conscious consumers. Expansion into niche markets, such as specialized diets for exotic pets, senior pets, or those with specific health conditions, offers significant growth potential. Moreover, the increasing adoption of functional ingredients, probiotics, and nutraceuticals in pet food provides fertile ground for product innovation and market diversification for private label brands. The ability to quickly adapt to these emerging trends will be key to unlocking future market value.

The impact forces influencing the Pet Food OEM or Private Label market are shaped by the competitive landscape and stakeholder dynamics. The bargaining power of buyers, primarily retailers and brand owners, is significant as they often dictate terms, specifications, and pricing, seeking cost-effective solutions while demanding high quality and customization. Conversely, the bargaining power of suppliers, especially for unique or premium ingredients, can impact manufacturing costs and product availability. The threat of new entrants is moderate; while manufacturing is capital-intensive, the private label model lowers the barrier for new brands, intensifying competition. The threat of substitutes, largely from established national brands or home-cooked pet food, remains constant, pushing private label manufacturers to innovate. Finally, competitive rivalry among OEM producers is high, leading to continuous efforts in cost reduction, quality improvement, and service differentiation.

Segmentation Analysis

The Pet Food OEM or Private Label market is comprehensively segmented to address the diverse needs of pets and their owners, reflecting the complexity and specialization within the industry. These segmentations allow for a granular understanding of market dynamics, consumer preferences, and growth opportunities across various product types, animal categories, ingredient compositions, and distribution channels. Analyzing these segments is crucial for manufacturers and brand owners to tailor their strategies, optimize product portfolios, and effectively target specific consumer demographics. Each segment presents unique challenges and opportunities, requiring specialized expertise in formulation, sourcing, and marketing.

- By Product Type

- Dry Pet Food (Kibble)

- Wet Pet Food (Canned, Pouches)

- Pet Treats and Chews

- Raw and Freeze-Dried Pet Food

- Veterinary Diets/Therapeutic Food

- By Animal Type

- Dog Food

- Cat Food

- Bird Food

- Fish Food

- Small Animal Food (e.g., rabbits, hamsters)

- By Ingredient Type

- Natural and Organic

- Grain-Free

- Limited Ingredient Diets (LID)

- High-Protein

- Vegetarian/Vegan

- Conventional

- By Distribution Channel

- Offline Retail

- Supermarkets and Hypermarkets

- Pet Specialty Stores

- Veterinary Clinics

- Independent Retailers

- Online Retail

- E-commerce Platforms

- Direct-to-Consumer (D2C) Websites

- Subscription Boxes

- Offline Retail

Value Chain Analysis For Pet Food OEM or Private Label Market

The value chain for the Pet Food OEM or Private Label market begins with the upstream activities of raw material sourcing. This critical initial stage involves acquiring a diverse range of ingredients such as meat proteins (chicken, beef, fish), grains (corn, rice, wheat), vegetables, fruits, vitamins, minerals, and specialized additives. Relationships with reliable and quality-assured suppliers are paramount, often involving long-term contracts and stringent quality checks to ensure compliance with safety standards and brand specifications. Transparency and traceability in sourcing are increasingly vital, driven by consumer demand for ethical and sustainable ingredients. Any disruption or quality issue at this stage can have significant downstream impacts on production and brand reputation.

Moving downstream, the core of the value chain lies in the manufacturing process carried out by OEM or private label producers. This stage encompasses formulation development, ingredient mixing, cooking (extrusion for kibble, canning for wet food), drying, coating, and packaging. Advanced manufacturing facilities with specialized machinery are essential for producing a wide variety of pet food formats while maintaining consistent quality and adherence to specific brand recipes. Quality control and assurance are embedded throughout this process, from raw material inspection to final product testing, ensuring that products meet nutritional claims and safety regulations. Packaging design and execution are also critical, serving both functional (preservation, protection) and marketing (brand identity, consumer appeal) purposes. Efficient production schedules and capacity management are key to meeting diverse client demands.

The final stage of the value chain involves distribution channels, linking manufactured products to the end-users. This includes both direct and indirect distribution methods. Direct channels involve manufacturers selling directly to brand owners or large retailers who then manage their own logistics to stores or consumers. Indirect channels typically involve wholesalers, distributors, or logistics providers who store and transport finished products to various retail outlets, including supermarkets, hypermarkets, pet specialty stores, veterinary clinics, and increasingly, e-commerce warehouses. The efficiency of these distribution networks, including inventory management, transportation, and warehousing, is crucial for timely delivery and market penetration. E-commerce has significantly expanded the reach of private label brands, creating new logistical challenges and opportunities for optimized supply chain solutions.

Pet Food OEM or Private Label Market Potential Customers

Potential customers for Pet Food OEM or Private Label manufacturers are diverse and span various business models within the pet care industry. A primary customer segment includes large retail chains, such as supermarkets, hypermarkets, and mass merchandisers, who seek to develop their own private label brands to offer cost-effective alternatives to national brands, enhance customer loyalty, and capture higher profit margins. These retailers often require a broad range of products across different pet food categories and are looking for manufacturers with significant production capacity and capabilities to handle complex supply chain demands. The ability to customize formulations and packaging to fit specific brand guidelines is a key differentiator for OEM providers targeting this segment.

Another significant customer base comprises pet specialty stores and independent retailers who aim to differentiate themselves from larger competitors by offering exclusive, high-quality private label products that cater to niche markets or specific customer preferences. These customers often prioritize unique formulations, premium ingredients, and strong brand storytelling to resonate with their discerning clientele. E-commerce platforms, including online-only pet stores and subscription box services, represent a rapidly growing customer segment. These digital-first brands often rely entirely on OEM manufacturers to produce their entire product line, valuing flexibility, scalability, and the ability to adapt quickly to online trends and consumer feedback, all without the overhead of physical manufacturing.

Furthermore, veterinary clinics and animal hospitals increasingly seek private label therapeutic diets or specialized nutritional products to complement their professional services and offer tailored health solutions directly to their patients. These customers prioritize scientific backing, specific health benefits, and strict quality control. Lastly, emerging pet food startups and even established pet food brands looking to expand their product lines into new categories or test new market segments without committing to internal manufacturing investments are also key potential customers. For these businesses, the private label model offers a low-risk, high-flexibility pathway to innovation and market expansion, leveraging the manufacturer's expertise and infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 13.5 Billion |

| Market Forecast in 2033 | USD 22.9 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Simmons Pet Food, C.J. Foods, American Nutrition, Sunshine Mills, Manna Pro Products, ADM Animal Nutrition, Trouw Nutrition, Whitebridge Pet Brands, Elmira Pet Products, Tuffy's Pet Foods, Ohio Pet Foods, Menu Foods, Red Collar Pet Foods, GA Pet Food Partners, Natures Menu |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pet Food OEM or Private Label Market Key Technology Landscape

The Pet Food OEM or Private Label market is increasingly reliant on advanced technologies to meet consumer demands for quality, safety, and specialized nutrition, while also enhancing operational efficiency. In the realm of formulation and product development, sophisticated nutritional software and AI-powered algorithms are utilized to precisely balance ingredient profiles, optimize nutrient density, and predict the palatability and digestibility of new pet food recipes. This technology allows for rapid prototyping of diverse diets, from grain-free to therapeutic formulas, reducing the time and cost associated with traditional R&D. Furthermore, laboratory information management systems (LIMS) are crucial for managing ingredient specifications and finished product testing data, ensuring strict adherence to nutritional claims and regulatory standards.

Within manufacturing, automation and smart factory solutions are transforming production lines. Advanced extrusion technologies are employed for dry kibble production, offering greater control over size, density, and nutritional integrity. Aseptic processing and sophisticated canning technologies are vital for wet food production, ensuring product sterility and extended shelf life without compromising nutritional value. The integration of Internet of Things (IoT) sensors throughout the manufacturing process enables real-time monitoring of temperature, pressure, and ingredient flow, allowing for immediate adjustments and predictive maintenance, thereby minimizing downtime and improving overall yield. Robotics are increasingly used for repetitive tasks such as packaging and palletizing, boosting efficiency and reducing labor costs while improving safety.

Beyond production, technology plays a pivotal role in supply chain management and quality assurance. Blockchain technology is emerging as a critical tool for ensuring end-to-end traceability of ingredients, providing transparency from farm to bowl, which is highly valued by modern pet owners. Enterprise Resource Planning (ERP) systems integrate various business processes, from procurement and manufacturing to sales and distribution, offering a holistic view of operations and enabling better decision-making. Advanced analytical tools and machine learning are also applied to demand forecasting, inventory optimization, and logistics planning, helping OEM manufacturers respond more agilely to market fluctuations and client needs. These technological adoptions are key enablers for private label manufacturers to deliver high-quality, safe, and innovative products consistently and efficiently.

Regional Highlights

- North America: This region represents a mature and highly developed market for Pet Food OEM or Private Label, driven by high rates of pet ownership, significant disposable incomes, and a strong trend of pet humanization. Consumers in North America prioritize premiumization, demanding natural, organic, grain-free, and functional pet food options. The presence of major retailers with strong private label strategies and a robust e-commerce infrastructure further fuels growth. Innovation in novel ingredients and sustainable packaging is also a key characteristic of this market.

- Europe: Similar to North America, Europe is a well-established market with a high demand for high-quality pet food. Strict regulatory frameworks regarding pet food safety and nutrition influence manufacturing practices. The European market shows a strong inclination towards sustainability, ethical sourcing, and specialized diets for specific breeds or health conditions. Germany, the UK, and France are leading countries, demonstrating significant private label penetration across various retail channels.

- Asia Pacific (APAC): The APAC region is the fastest-growing market, primarily due to increasing pet adoption rates, rising disposable incomes, and the burgeoning middle class in countries like China, India, Japan, and Australia. The Westernization of pet care practices and a growing awareness of pet health and nutrition are driving the demand for diverse pet food options. OEM and private label manufacturers are capitalizing on this growth by offering tailored products for regional preferences and expanding their distribution networks, particularly through online channels.

- Latin America: This region is an emerging market for Pet Food OEM or Private Label, characterized by increasing urbanization and a gradual shift towards pet humanization. Countries such as Brazil, Mexico, and Argentina are witnessing a rise in pet ownership and a growing interest in commercially prepared pet food over homemade alternatives. While price sensitivity remains a factor, there is a developing demand for more nutritious and specialized options, creating opportunities for private label brands to offer value-for-money products.

- Middle East and Africa (MEA): The MEA region is a nascent market with significant untapped potential. Growth is primarily driven by increasing pet ownership in urban centers and a rising awareness of pet health and welfare. While traditional retail still dominates, the expansion of modern trade and e-commerce platforms is slowly opening new avenues for private label pet food. Economic diversification and increasing consumer sophistication in some countries are creating a fertile ground for market expansion, albeit from a lower base.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pet Food OEM or Private Label Market.- Simmons Pet Food

- C.J. Foods

- American Nutrition

- Sunshine Mills

- Manna Pro Products

- ADM Animal Nutrition

- Trouw Nutrition

- Whitebridge Pet Brands

- Elmira Pet Products

- Tuffy's Pet Foods

- Ohio Pet Foods

- Menu Foods

- Red Collar Pet Foods

- GA Pet Food Partners

- Natures Menu

Frequently Asked Questions

Analyze common user questions about the Pet Food OEM or Private Label market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Pet Food OEM or Private Label manufacturing?

Pet Food OEM (Original Equipment Manufacturer) or Private Label refers to the production of pet food by a third-party manufacturer that is then sold under a brand owner's label or a retailer's own brand. It allows businesses to offer customized pet food products without owning manufacturing facilities.

What are the main benefits of choosing private label pet food?

The key benefits include lower initial investment, faster time-to-market, greater control over branding and pricing, customization options for formulations and packaging, and leveraging the manufacturer's expertise and economies of scale. It allows for brand differentiation and caters to specific market niches.

Is private label pet food as safe and high-quality as national brands?

Yes, reputable private label manufacturers adhere to stringent quality control standards, often matching or exceeding those of national brands. They follow regulatory guidelines (e.g., AAFCO, FEDIAF) and perform extensive testing to ensure product safety, nutritional integrity, and consistent quality, using similar high-quality ingredients.

How do private label manufacturers ensure product customization?

Private label manufacturers offer extensive customization through their R&D and formulation teams. They work closely with brand owners to develop unique recipes, select specific ingredients, design distinctive packaging, and meet dietary requirements (e.g., grain-free, organic), ensuring the final product aligns perfectly with the brand's vision.

What role does e-commerce play in the growth of private label pet food?

E-commerce is a significant driver, providing a direct-to-consumer channel for private label brands to reach a wider audience efficiently. Online platforms facilitate easier market entry for new brands, enable data-driven personalization, and support subscription models, all of which are highly conducive to the private label business model.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager