Pet Medical Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434882 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Pet Medical Equipment Market Size

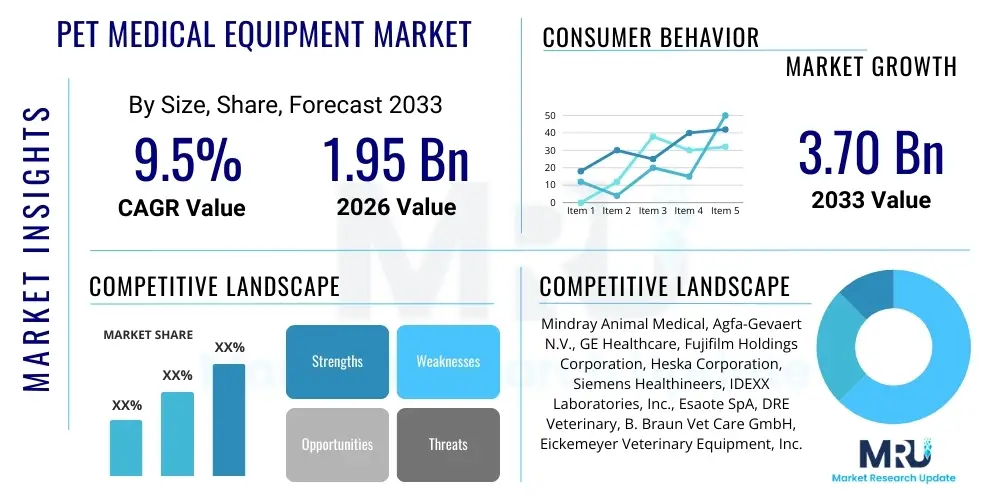

The Pet Medical Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 1.95 Billion in 2026 and is projected to reach USD 3.70 Billion by the end of the forecast period in 2033.

Pet Medical Equipment Market introduction

The Pet Medical Equipment Market encompasses a wide array of devices and instruments used for the diagnosis, monitoring, treatment, and surgery of companion and livestock animals. This sector is characterized by increasing sophistication, mirroring advancements found in human healthcare, driven primarily by the rising prevalence of pet ownership, coupled with the growing humanization trend where pets are considered integral family members. Key products include diagnostic imaging systems (X-ray, ultrasound, MRI), monitoring devices (pulse oximeters, ECGs), surgical tools, and specialized therapy equipment (laser therapy, rehabilitation machines). The integration of advanced veterinary medicine necessitates robust equipment infrastructure, ensuring high-quality clinical outcomes and improving animal welfare across veterinary hospitals, specialized clinics, and research institutions.

Major applications of pet medical equipment span preventative care, critical care, routine check-ups, and complex surgical procedures. The benefits derived from utilizing these advanced tools include earlier and more accurate disease detection, minimized invasiveness during treatment, and enhanced recovery times. For instance, high-resolution ultrasound allows for non-invasive soft tissue examination, while sophisticated anesthesia machines ensure patient safety during prolonged surgeries. The market is also seeing rapid adoption of portable and user-friendly devices, allowing veterinarians to offer specialized services both in clinic settings and during house calls, broadening accessibility to advanced veterinary care.

The primary driving factor for market expansion is the substantial increase in pet healthcare expenditure globally, particularly in developed economies. As disposable incomes rise, pet owners are increasingly willing to invest in costly, life-extending treatments. Furthermore, the rising incidence of zoonotic diseases and chronic conditions such as diabetes, obesity, and cardiac issues in companion animals necessitates continuous demand for sophisticated diagnostic and therapeutic equipment. Regulatory standards concerning animal welfare and the establishment of advanced veterinary specializations further compel clinics to invest in state-of-the-art medical technologies, cementing the positive outlook for market growth.

Pet Medical Equipment Market Executive Summary

The global Pet Medical Equipment Market exhibits robust growth, underpinned by significant business trends centered around technological miniaturization, digitalization, and enhanced portability of diagnostic devices. Strategic partnerships between veterinary equipment manufacturers and specialized veterinary distribution networks are optimizing market reach. Furthermore, consolidation among major veterinary hospital chains is driving bulk purchasing of high-end equipment, favoring manufacturers capable of providing integrated diagnostic solutions and comprehensive service contracts. Investment in research and development remains critical, focusing on adapting human medical technologies for veterinary use, particularly in advanced surgical robotics and personalized imaging modalities. This focus on innovation ensures sustainable competitive advantage and addresses the complex medical needs of an aging pet population.

Regionally, North America maintains market dominance due to high per-capita spending on pets, robust insurance penetration, and the presence of numerous specialized veterinary centers and research universities. However, the Asia Pacific (APAC) region is poised for the fastest growth, fueled by increasing companion animal populations, rising middle-class disposable incomes, and the rapid establishment of modern veterinary infrastructures in countries like China and India. Europe also represents a mature market, driven by stringent animal welfare regulations and a cultural emphasis on pet health, with high adoption rates of advanced monitoring and imaging systems across the European Union. Latin America and the Middle East & Africa (MEA) are emerging, driven by urbanization and subsequent increases in companion animal ownership.

Segment trends indicate that Diagnostic Imaging Equipment holds the largest market share, essential for early detection and complex case management. Within this segment, digital radiography and veterinary specific computed tomography (CT) scanners are experiencing high adoption. Therapeutic and monitoring devices are forecast to show accelerated growth, primarily due to the increasing incidence of chronic illnesses requiring long-term management and intensive care. The Accessories and Consumables segment, though lower value, provides critical recurring revenue streams, driven by the volume of procedures performed globally. Segmentation based on animal type confirms that companion animals, particularly dogs and cats, account for the overwhelming majority of equipment usage, reflecting the investment priority within the veterinary sector.

AI Impact Analysis on Pet Medical Equipment Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Pet Medical Equipment Market often revolve around how AI can enhance diagnostic accuracy, streamline workflow in veterinary clinics, and potentially reduce the reliance on highly specialized human expertise. Users frequently inquire about the integration of AI in interpreting complex imaging scans (such as MRI and CT), automating laboratory diagnostics (like blood smear analysis), and improving patient monitoring for early detection of critical deterioration. Key concerns center on data privacy, the cost of implementing AI infrastructure, validation of AI algorithms for diverse animal species, and ensuring regulatory compliance. Overall user expectations are high, anticipating AI’s role in democratizing advanced veterinary care, making sophisticated diagnostics more accessible and efficient, thus improving overall clinical throughput and patient outcomes.

The integration of AI algorithms into veterinary medical equipment is fundamentally transforming diagnostic capabilities. AI-powered image analysis tools can automatically detect subtle abnormalities in radiographs, ultrasounds, and pathological slides, often surpassing human detection limits and significantly reducing diagnostic variability. This enhanced accuracy accelerates treatment planning and minimizes the chances of misdiagnosis, particularly valuable in busy general practices that handle a broad range of clinical cases. Furthermore, AI contributes to predictive maintenance and operational efficiency of the equipment itself, scheduling necessary servicing based on usage patterns rather than fixed timelines, thereby maximizing uptime for critical devices such as MRI machines and advanced surgical robots.

Beyond diagnostics, AI is crucial in personalized medicine and therapeutic decision-making for pets. Machine learning models utilize vast datasets of patient histories, treatment responses, and genetic information to suggest optimal treatment protocols for conditions like cancer or chronic pain management. In monitoring equipment, AI analyzes real-time physiological data (ECG, blood pressure, respiration) to provide predictive alerts for potential crises, allowing veterinary staff to intervene proactively. This shift towards intelligent monitoring reduces the burden on nursing staff and significantly enhances patient safety during anesthesia and in intensive care units, representing a substantial value addition for sophisticated pet medical equipment.

- AI enhances diagnostic imaging interpretation (radiography, ultrasound) by identifying subtle lesions and improving consistency.

- Predictive analytics in monitoring equipment alerts veterinarians to critical physiological changes before symptoms manifest.

- Machine learning optimizes laboratory diagnostics, automating the analysis of blood counts, urinalysis, and pathological samples.

- AI-driven veterinary telehealth platforms facilitate remote consultation and preliminary symptom assessment based on owner input.

- AI aids in personalized treatment planning by analyzing large clinical datasets for conditions like oncology and orthopedics.

- Optimization of equipment usage and maintenance scheduling through predictive analytics minimizes device downtime.

DRO & Impact Forces Of Pet Medical Equipment Market

The market dynamics are governed by powerful drivers, necessitating rapid technological advancement; significant restraints, often related to cost and accessibility; and considerable opportunities for specialized equipment deployment, with these forces collectively shaping the competitive landscape. Key drivers include the increasing consumer willingness to pay for expensive pet treatments, the expansion of pet insurance coverage reducing the out-of-pocket costs for advanced procedures, and the continuous innovation in human-to-veterinary technology transfer. These factors create a high demand environment, compelling manufacturers to invest heavily in next-generation medical devices tailored for veterinary anatomy and physiology. The growing number of veterinary specialists, such as veterinary cardiologists and oncologists, also drives the requirement for high-precision, specialized instruments.

However, the market faces significant restraints that temper growth. The high initial capital investment required for purchasing and installing sophisticated equipment, such as MRI or CT scanners, often restricts adoption, particularly among smaller independent veterinary practices or clinics in emerging economies. Furthermore, the scarcity of adequately trained veterinary technicians capable of operating and maintaining complex machinery poses an operational challenge. Regulatory hurdles, although less stringent than in human medicine, still require thorough testing and validation, adding to the time-to-market and overall cost of new devices. Economic downturns leading to reduced discretionary spending on pet luxury items can also momentarily slow equipment upgrades.

Opportunities for market growth are abundant, particularly in the development of portable, user-friendly, and cost-effective point-of-care (POC) diagnostic equipment suitable for general practitioners and mobile veterinary units. The rising trend of minimally invasive surgeries (MIS) creates a niche for specialized endoscopic and laparoscopic equipment designed for animals. Furthermore, geographic expansion into rapidly developing regions like Southeast Asia and Eastern Europe, coupled with the focus on telehealth integrated devices that facilitate remote diagnostics and monitoring, represents a significant avenue for market penetration. The overall impact forces exert strong upward pressure on market valuation, prioritizing innovation, accessibility, and precision in all newly released pet medical devices.

Segmentation Analysis

The Pet Medical Equipment Market is rigorously segmented based on product type, application, end-user, and animal type, providing granular insights into demand patterns and adoption rates across the veterinary healthcare landscape. Product segmentation differentiates between diagnostic imaging, therapy/surgery equipment, monitoring devices, and essential consumables, reflecting the varied technological needs of modern clinics. Application analysis highlights the critical areas driving expenditure, such as oncology, orthopedics, and dental care, which typically require specialized, high-value equipment. End-user classification distinguishes demand originating from large veterinary hospitals versus smaller clinics and academic research institutes, illustrating differing budget capacities and technological requirements. Finally, animal type segmentation emphasizes the dominance of companion animals (dogs and cats) over livestock, guiding R&D investment towards prevalent pet diseases.

A detailed segmentation approach is vital for manufacturers to tailor product development and market strategies effectively. For instance, focusing on diagnostic imaging for companion animals reveals a high demand for high-resolution ultrasound and digital X-ray systems, crucial for routine and emergency procedures. Conversely, equipment designed for large animals (livestock) tends to prioritize durability, portability, and cost-effectiveness suitable for farm or ambulatory settings. The complexity and specificity of modern veterinary medicine mandate that suppliers offer a diverse portfolio of equipment that aligns precisely with the specialized requirements of each segment, ensuring both clinical efficacy and financial viability for the purchasing entity. This structured analysis enables stakeholders to identify underserved niches and allocate resources efficiently.

The most rapidly evolving segment pertains to monitoring devices, driven by the need for enhanced patient safety during surgical procedures and improved post-operative care. Products like multi-parameter monitors capable of tracking ECG, SpO2, EtCO2, and invasive blood pressure simultaneously are becoming standard in critical care settings. Additionally, therapeutic equipment, including advanced laser therapy and sophisticated physiotherapy devices for rehabilitation following orthopedic surgery, are seeing increased utilization as pet owners prioritize quality of life and accelerated recovery for their companions. This segment reflects the market's trajectory towards comprehensive, specialized, and quality-of-life-focused veterinary medical services.

- Product Type: Diagnostic Imaging (X-ray, Ultrasound, CT, MRI), Therapeutic Equipment (Anesthesia, Ventilation, Laser Therapy), Monitoring Devices (Pulse Oximeters, ECG, Blood Pressure Monitors), Consumables & Accessories (Surgical Instruments, IV Systems).

- Animal Type: Companion Animals (Dogs, Cats, Others), Livestock Animals (Cattle, Poultry, Swine, Others).

- End User: Veterinary Hospitals, Veterinary Clinics, Academic & Research Institutes, Specialty Veterinary Centers.

- Application: Orthopedics, Oncology, Cardiology, Dental, General Surgery, Diagnostics.

Value Chain Analysis For Pet Medical Equipment Market

The value chain for the Pet Medical Equipment Market begins with upstream activities involving raw material suppliers and component manufacturers, providing specialized metals, plastics, electronic circuits, and sensor technology crucial for medical-grade devices. Research and Development (R&D) is a core upstream activity, where manufacturers focus on intellectual property creation, clinical testing, and regulatory compliance. Efficiency at this stage determines the overall quality and technological edge of the final product. Key challenges upstream include maintaining stringent quality control over specialized components and managing complex supply chains that often span multiple international jurisdictions to ensure component reliability and cost-effectiveness, especially for high-precision diagnostic tools like sensors for blood gas analyzers or high-frequency transducers for ultrasound machines.

Moving through the midstream, the manufacturing and assembly phase is critical, involving the fabrication of the final equipment, stringent quality assurance (QA) testing, and packaging. Direct distribution channels involve manufacturers selling high-value equipment directly to large veterinary hospital chains, government research institutions, and large academic veterinary teaching hospitals. This direct approach often includes installation, training, and long-term service agreements, ensuring a continuous revenue stream from maintenance and repair services. Indirect distribution, conversely, relies heavily on specialized regional veterinary equipment distributors and third-party resellers who manage inventory, logistics, and sales to smaller, independent veterinary clinics and general practitioners who prefer simplified procurement and localized support. These distributors play a crucial role in market penetration across fragmented regional markets.

Downstream activities focus on post-sales support, maintenance, technical calibration, and the provision of consumables and disposable accessories necessary for the continuous operation of the equipment. End-users (veterinary professionals) rely heavily on responsive technical support and training to maximize the utilization and longevity of their significant capital investments. The effectiveness of the service network significantly influences brand loyalty and future purchasing decisions. The value chain emphasizes strong linkages between manufacturers and end-users, where feedback loop mechanisms regarding equipment performance and feature requirements drive future R&D cycles, ensuring the product portfolio remains relevant and competitive in the dynamic veterinary healthcare environment.

Pet Medical Equipment Market Potential Customers

The primary end-users and buyers of pet medical equipment are predominantly professional veterinary organizations that require advanced tools to maintain high standards of animal care and clinical diagnosis. Veterinary hospitals, especially multi-specialty and referral centers, represent the largest customer segment due to their higher patient volumes, extensive service offerings, and greater financial capacity to invest in high-end imaging systems (MRI, CT) and specialized surgical suites. These institutions prioritize integrated systems, reliability, and comprehensive service contracts, seeking solutions that enhance patient throughput and diagnostic accuracy across complex cases, positioning them as high-value, high-volume purchasers.

Independent and small-to-medium-sized veterinary clinics constitute another significant customer base. While these clinics typically have lower budgets compared to large hospitals, they are high-volume purchasers of essential equipment such as digital radiography units, basic anesthesia systems, and portable monitoring devices. Their procurement decisions are often heavily influenced by equipment cost, ease of use, space requirements, and the necessity of immediate ROI. Manufacturers target this segment with cost-effective, durable, and multifunctional devices, often procured indirectly through regional distributors who provide financing and localized support, enabling smaller practices to offer modern diagnostic capabilities.

Academic and research institutions, including veterinary schools and university teaching hospitals, also serve as crucial potential customers. These entities require state-of-the-art equipment not only for advanced clinical training and residency programs but also for preclinical trials and fundamental animal health research. Their demand often focuses on the latest, cutting-edge technology, such as specialized laboratory testing equipment, advanced physiological monitors for research animals, and educational simulators, driving adoption of new technologies before they become mainstream in general practice. Additionally, mobile veterinary units, increasingly popular for rural areas and busy urban settings, represent a growing niche for robust, portable, and battery-operated diagnostic and monitoring tools.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.95 Billion |

| Market Forecast in 2033 | USD 3.70 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mindray Animal Medical, Agfa-Gevaert N.V., GE Healthcare, Fujifilm Holdings Corporation, Heska Corporation, Siemens Healthineers, IDEXX Laboratories, Inc., Esaote SpA, DRE Veterinary, B. Braun Vet Care GmbH, Eickemeyer Veterinary Equipment, Inc., Midmark Corporation, Woodley Equipment Company, Digicare Biomedical Technology, Inc., VETTA Animal Health, SurgiVet (Zoetis), Shenzhen Comen Medical Instruments Co., Ltd., Bionet America, Inc., KRUUSE, Konica Minolta. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pet Medical Equipment Market Key Technology Landscape

The technological landscape of the Pet Medical Equipment Market is characterized by the continuous adaptation and refinement of technologies initially developed for human medicine, ensuring higher precision, safety, and functionality for diverse animal sizes and species. Digital imaging remains a foundational technology, with Veterinary Digital Radiography (DR) systems offering superior image quality and faster processing times compared to traditional film-based X-ray systems. Furthermore, advanced diagnostic modalities like veterinary-specific CT and MRI scanners are becoming more accessible, moving beyond specialized referral centers into large community veterinary hospitals. These systems feature customized software protocols and coil designs optimized for animal anatomy, significantly improving diagnostic yield for complex neurological and orthopedic conditions.

Another pivotal technological advancement is the integration of high-fidelity patient monitoring and life support systems. Modern anesthesia machines incorporate precise vaporizers, ventilator functionality, and comprehensive gas monitoring (EtCO2, O2 concentration) essential for maintaining stable physiological parameters in small and critical patients during surgery. The trend towards minimally invasive surgery (MIS) has driven demand for high-definition veterinary endoscopy and laparoscopy towers, requiring specialized instruments and optics tailored for internal surgical sites in pets. These technologies minimize trauma, reduce recovery times, and improve cosmetic outcomes, appealing strongly to pet owners seeking the highest standard of care.

Point-of-Care (POC) diagnostics represents a rapidly growing segment, utilizing compact, quick-testing devices for blood chemistry, hematology, and infectious disease screening directly within the clinic setting. These technologies, often integrated with cloud-based software, provide immediate results, enabling quicker treatment decisions, particularly in emergency situations. Furthermore, telemedicine and connected equipment (IoT devices) are allowing for remote patient monitoring and consultation, where diagnostic data is transmitted securely to specialists for review. The focus remains on portability, rapid turnaround time, and seamless data integration into electronic veterinary records, streamlining clinic operations and enhancing collaboration among veterinary practitioners.

Regional Highlights

Regional dynamics play a crucial role in the Pet Medical Equipment Market, reflecting differences in economic development, pet ownership rates, and healthcare infrastructure maturity. North America, encompassing the United States and Canada, stands as the market leader. This dominance is attributed to extremely high consumer awareness regarding pet health, substantial disposable income allocated to pet care, and the widespread adoption of pet insurance, which facilitates investment in expensive diagnostic and therapeutic procedures. The U.S. features a highly fragmented but technologically advanced veterinary sector, with a strong presence of large corporate hospital chains and numerous specialized referral centers constantly upgrading equipment. The region is a primary hub for R&D and early adoption of pioneering technologies like veterinary robotics and advanced laser therapy systems.

Europe represents the second-largest market, characterized by stringent animal welfare regulations and a mature veterinary profession, particularly in Western European nations such as Germany, the UK, and France. The European market shows a high penetration of digital imaging solutions and advanced surgical equipment. However, market growth in Europe is steady but often tempered by slower economic growth in certain countries and sometimes cautious adoption of very high-cost technology compared to North America. The trend towards specialized services, particularly in areas like veterinary cardiology and neurology, continues to drive steady demand for high-fidelity monitoring and imaging equipment across the region, supported by well-established veterinary education systems.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This exponential growth is driven by rapid urbanization, significant increases in the companion animal population, and the emerging middle class in populous countries like China, India, South Korea, and Japan. While Japan and Australia possess mature markets similar to those in the West, emerging economies are rapidly establishing modern veterinary infrastructure, leading to large-scale imports and localized manufacturing of essential medical equipment. Increased awareness regarding preventative pet healthcare and rising disposable incomes are the key catalysts encouraging clinics to move from basic equipment to more sophisticated diagnostic tools, though price sensitivity remains a key consideration in purchasing decisions across many developing APAC nations.

Latin America and the Middle East & Africa (MEA) currently hold smaller shares but present compelling growth potential. In Latin America, countries such as Brazil and Mexico are experiencing growth driven by increased pet ownership and the professionalization of veterinary services. The MEA region's growth is often localized in wealthier Gulf Cooperation Council (GCC) countries, where high-standard veterinary clinics cater to affluent pet owners. Challenges in these regions include fluctuating economic stability and logistical hurdles related to importing, installing, and servicing complex medical equipment. However, the foundational establishment of dedicated veterinary colleges and international collaborations are progressively improving the capacity for adopting advanced pet medical technologies.

- North America (Market Leader): High spending on pet healthcare, extensive pet insurance coverage, technological leadership, and large corporate veterinary hospital chains. Focus on advanced imaging (MRI, CT) and specialty surgery equipment.

- Europe (Steady Growth): Mature market driven by strong animal welfare laws, high adoption of digital diagnostics, and established specialization in veterinary medicine. Demand centered on therapeutic and monitoring devices.

- Asia Pacific (Fastest Growth): Driven by urbanization, rising disposable incomes, rapid growth of the companion animal population, and infrastructure development in countries like China and India. High potential for portable and cost-effective solutions.

- Latin America & MEA (Emerging Markets): Growth spurred by professionalization of veterinary services and increased urbanization, requiring essential diagnostic and monitoring equipment, often facing challenges related to import costs and technical support infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pet Medical Equipment Market.- Mindray Animal Medical

- Agfa-Gevaert N.V.

- GE Healthcare

- Fujifilm Holdings Corporation

- Heska Corporation

- Siemens Healthineers

- IDEXX Laboratories, Inc.

- Esaote SpA

- DRE Veterinary

- B. Braun Vet Care GmbH

- Eickemeyer Veterinary Equipment, Inc.

- Midmark Corporation

- Woodley Equipment Company

- Digicare Biomedical Technology, Inc.

- VETTA Animal Health

- SurgiVet (Zoetis)

- Shenzhen Comen Medical Instruments Co., Ltd.

- Bionet America, Inc.

- KRUUSE

- Konica Minolta

Frequently Asked Questions

Analyze common user questions about the Pet Medical Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the substantial growth in the Pet Medical Equipment Market?

The primary driver is the increasing humanization of pets, leading to higher owner willingness to spend on advanced, sophisticated medical care. Other key factors include the expansion of pet insurance coverage, rising incidence of chronic diseases in pets (like diabetes and cancer), and continuous technological convergence of human and veterinary medical devices.

Which product segment holds the largest share in the pet medical equipment industry?

The Diagnostic Imaging segment, encompassing products like digital radiography (DR), veterinary ultrasound, and CT/MRI scanners, consistently holds the largest market share. This dominance is due to the critical role imaging plays in accurate and timely diagnosis for a wide range of veterinary conditions, making it a foundational investment for most high-quality veterinary practices.

How is Artificial Intelligence (AI) currently influencing veterinary medical devices?

AI is primarily enhancing diagnostic precision by automating the interpretation of complex medical images (radiographs, pathology slides) and monitoring physiological data for early warning signs of patient deterioration during surgery or intensive care. This integration improves efficiency, reduces diagnostic variability, and supports proactive clinical decision-making.

What major challenges restrict the widespread adoption of high-end pet medical equipment?

The main challenge is the high initial capital investment required for purchasing equipment like MRI or advanced surgical robotics, which can be prohibitive for smaller, independent clinics. Additionally, the limited availability of veterinary professionals specifically trained to operate and maintain these specialized high-technology devices acts as a significant constraint.

Which regional market is expected to demonstrate the fastest growth rate?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth, fueled by rapid economic development, increasing urbanization, a burgeoning middle class, and the consequential rise in companion animal ownership. Countries such as China, India, and South Korea are actively developing modern veterinary infrastructure, driving high demand for new equipment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager