PET Sheet Extrusion Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432562 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

PET Sheet Extrusion Equipment Market Size

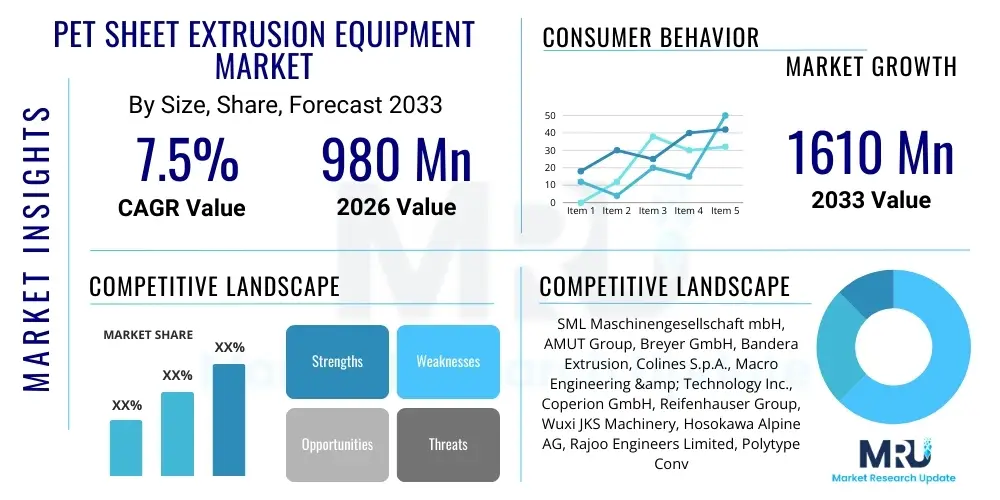

The PET Sheet Extrusion Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 980 Million in 2026 and is projected to reach USD 1610 Million by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by escalating global demand for sustainable and high-clarity packaging materials, particularly within the food and beverage industry, coupled with significant technological advancements aimed at enhancing efficiency and integrating recycling capabilities directly into the extrusion process. The shift toward lightweight and easily recyclable packaging solutions further solidifies the market's upward momentum.

PET Sheet Extrusion Equipment Market introduction

The PET Sheet Extrusion Equipment Market encompasses the specialized machinery and integrated production lines used for converting polyethylene terephthalate (PET) resin, both virgin and recycled (rPET), into thin, uniform sheets. These sheets are essential intermediate products, predominantly used for thermoforming applications such as food containers, blister packs, and clamshells. The core technology involves feeding raw PET pellets into an extruder, melting the material, filtering out impurities, degassing volatile components, and finally, using a precise calender stack to form the sheet to the specified thickness and width before winding. Modern equipment prioritizes energy efficiency, high output rates, and the ability to process high percentages of rPET without compromising final product quality, addressing global mandates for circular economy practices.

Key applications driving the market include the packaging sector, particularly in the food and medical industries where barrier properties, clarity, and safety are paramount. PET sheets are favored due to their excellent mechanical strength, transparency, and inherent barrier characteristics against oxygen and moisture, which significantly extend the shelf life of perishable goods. The rise of e-commerce, which necessitates durable and lightweight protective packaging, has further amplified the demand for high-quality PET sheets. Manufacturers are increasingly focused on developing tandem extrusion lines and utilizing advanced drying and crystallization technologies, such as infrared (IR) crystallization, to optimize material preparation and reduce thermal degradation during processing, thereby ensuring superior sheet quality and maximizing throughput.

The primary benefits offered by contemporary PET sheet extrusion equipment include enhanced production efficiency, reduced energy consumption compared to older models, and improved gauge control, which minimizes material waste and operational costs. Furthermore, the integration of super-clean technology, often meeting stringent FDA and European Food Safety Authority (EFSA) standards, allows for the safe processing of food-grade rPET, which is a major driver of sustainable manufacturing adoption. Driving factors for the market expansion include the stringent regulatory environment in developed economies promoting plastic circularity, growing consumer preference for transparent packaging, and continuous investment by major packaging converters in high-capacity, automated production lines capable of 24/7 operation to meet fluctuating market demands effectively.

PET Sheet Extrusion Equipment Market Executive Summary

The PET Sheet Extrusion Equipment Market is characterized by intense focus on operational efficiency and sustainable integration, with major business trends revolving around the adoption of high-speed, co-extrusion lines capable of producing multi-layer sheets for enhanced barrier protection. Strategic mergers and acquisitions among equipment manufacturers are common, aimed at consolidating technological expertise, particularly concerning downstream equipment like winders and automatic thickness gauges, which are critical for quality control. Equipment suppliers are transitioning from offering standalone machines to providing complete, integrated turnkey solutions that minimize installation time and optimize process compatibility, thereby offering higher value to large-scale packaging enterprises seeking immediate return on investment.

Regionally, the Asia Pacific (APAC) continues its dominance, fueled by the rapid expansion of its packaging industry, particularly in China and India, where growing middle-class populations necessitate increased consumption of packaged foods and consumer goods. North America and Europe, while mature markets, exhibit robust demand driven less by volume growth and more by technological sophistication. These regions are prioritizing equipment capable of handling high percentages of post-consumer recycled (PCR) PET, complying with strict regulatory mandates such as the EU’s Single-Use Plastics Directive. This focus is accelerating the adoption of complex degassing systems and advanced filtration technologies unique to processing waste streams, positioning these regions as leaders in sustainable extrusion technology adoption.

Segment trends reveal a pronounced shift toward high-capacity extrusion lines (those exceeding 2000 kg/hour output) to leverage economies of scale and minimize per-unit processing costs. The twin-screw extruder segment is experiencing particularly high growth due to its superior capability in processing raw PET materials that have not been thoroughly dried, or for handling rPET flakes directly, simplifying the upstream process. Application-wise, the thermoforming segment remains the largest consumer, but demand from specialized applications like photovoltaic back sheets and medical device packaging is growing, necessitating precision equipment capable of extremely tight gauge tolerances and sterile manufacturing environments, thereby driving innovation in cooling and calendering systems.

AI Impact Analysis on PET Sheet Extrusion Equipment Market

User inquiries regarding AI's impact on PET Sheet Extrusion Equipment frequently center on how AI can enhance predictive maintenance capabilities, optimize energy consumption in high-heat processes, and ensure stringent quality control without manual intervention. Common concerns include the complexity and cost of integrating sophisticated machine learning models into existing legacy equipment, data privacy issues associated with transmitting proprietary production data to cloud-based analytical platforms, and the necessary specialized training required for operators to manage these intelligent systems effectively. However, the overarching expectation is that AI integration will fundamentally transform extrusion operations by minimizing downtime, reducing material scrap rates through real-time adjustment, and achieving unparalleled levels of product consistency, thus cementing its role as a mandatory feature in next-generation extrusion machinery.

AI algorithms are fundamentally changing how extrusion parameters are managed. Traditionally, line speed, melt temperature, and calender gaps were adjusted based on historical data or operator experience. AI systems now use real-time sensor data from melt pumps, thickness gauges, and cooling units to predict potential defects (e.g., uneven crystallization, surface imperfections) milliseconds before they occur. This prescriptive analytics capability allows the system to automatically adjust screw speed or melt pressure, maintaining optimal operating points under varying material input quality (which is common when using rPET). This proactive approach drastically cuts down on material waste and ensures consistent sheet quality across long production runs, providing a tangible competitive advantage to early adopters.

Beyond process control, AI enhances operational efficiency through sophisticated energy management and predictive failure detection. Extrusion lines are massive energy consumers, particularly the heating zones and vacuum systems. AI models can learn the specific thermal characteristics of different polymer grades and ambient conditions, optimizing heater output schedules to maintain thermal stability with minimal power consumption. Furthermore, by analyzing vibrational and thermal signatures from critical mechanical components, AI can predict the remaining useful life (RUL) of components like gearbox bearings or feed screws. This capability shifts maintenance strategies from time-based or reactive approaches to true predictive maintenance, minimizing unscheduled downtime which, in high-volume production, translates directly into significant cost savings and improved overall equipment effectiveness (OEE).

- AI-driven predictive maintenance reduces unscheduled downtime by forecasting component failure based on vibration and temperature analysis.

- Real-time quality control (QC) via machine vision systems minimizes scrap material by instantly detecting and classifying surface and internal sheet defects.

- Optimization of energy consumption through intelligent thermal management of heating zones and auxiliary equipment.

- Algorithmic process parameter adjustment stabilizes melt pressure and flow rate, compensating automatically for variations in recycled material quality (rPET).

- Enhanced supply chain visibility by using AI to predict raw material inventory needs and optimize delivery logistics based on production schedules.

- Improved recipe management allowing quick, precise changes between different sheet specifications with minimal adjustment time and material waste.

DRO & Impact Forces Of PET Sheet Extrusion Equipment Market

The PET Sheet Extrusion Equipment Market is powerfully influenced by a dynamic interplay of Drivers (D), Restraints (R), Opportunities (O), and structural Impact Forces. Key drivers include the global mandate for sustainable packaging, spurred by governmental regulations requiring minimum recycled content in products, coupled with the rapid growth of the thermoforming industry, particularly in emerging economies where packaged food consumption is escalating. Simultaneously, significant restraints hinder growth, primarily the substantial initial capital expenditure required for high-capacity, sophisticated extrusion lines, which presents a high barrier to entry for smaller or new manufacturing entities. Furthermore, the volatility and rising cost of virgin PET resin, which is linked to petroleum price fluctuations, can compress profit margins for processors, slowing down investment cycles for new machinery. Market opportunities are expansive, centered on the development of equipment specialized in handling bio-based PET (bio-PET) and other complex multi-layer structures, and penetrating untapped markets in Africa and Latin America where packaging infrastructure is rapidly maturing. These opportunities incentivize continuous research and development efforts among leading equipment OEMs.

Impact forces stemming from technological advancement and environmental pressure dictate the pace and direction of the market. The high impact force of sustainability dictates that equipment must integrate superior de-contamination and melt filtration systems to reliably process 100% rPET flakes back into food-grade sheets. Equipment that fails to meet this circularity requirement is quickly becoming obsolete, forcing major manufacturers to prioritize advanced vacuum degassing technology. Another significant impact force is the competition from alternative polymers, such as polypropylene (PP) and polylactic acid (PLA). While PET remains dominant due to its clarity and barrier properties, manufacturers must continuously improve efficiency and reduce the total cost of ownership (TCO) to maintain market competitiveness against cheaper alternatives, driving forces for innovation in high-speed calender units and optimized cooling systems.

The regulatory impact force is particularly strong in the European Union and North America, where legislation concerning food contact materials and waste reduction is strict. This forces equipment manufacturers to not only build certified 'super-clean' systems but also to provide comprehensive documentation verifying the material’s journey and purity, increasing complexity but simultaneously creating a niche for highly specialized, premium equipment. The underlying economic force remains robust demand driven by demographic shifts, especially urbanization, which inherently increases reliance on processed and packaged goods. Overall, while capital cost and raw material volatility remain persistent restraints, the overwhelming impact of regulatory drivers and sustainability opportunities ensures a forward trajectory for the PET sheet extrusion equipment sector, focusing investments on automation and material circularity.

Segmentation Analysis

The PET Sheet Extrusion Equipment market is comprehensively segmented across several crucial dimensions, primarily based on the type of extruder technology employed, the output capacity of the line, and the end-use application of the resulting PET sheet. Segmentation by equipment type, distinguishing between single-screw and twin-screw extruders, is vital as it dictates the processing capabilities, particularly concerning the type and quality of the raw material feedstock (virgin vs. recycled, dried vs. undried). Twin-screw extruders are rapidly gaining traction due to their ability to directly process rPET flakes without intensive pre-drying, offering significant operational cost savings and simplification for companies focused on circular production models. This technological shift is a major factor influencing purchasing decisions among large converters seeking maximum throughput and material flexibility.

Segmentation by output capacity (low, medium, and high) reflects the diversity of market players, ranging from smaller, regional packaging converters utilizing lines under 1000 kg/h, to massive, multinational corporations deploying high-capacity lines exceeding 2500 kg/h. The high-capacity segment is experiencing the fastest growth, driven by economies of scale and the centralization of packaging production in highly efficient mega-factories. These high-output systems demand highly robust downstream equipment, including advanced multi-roll calender stacks and automatic turret winding systems, to manage the increased speed and volume without sacrificing the critical gauge accuracy of the finished sheet. The investment in high-capacity lines signifies confidence in sustained global demand for PET packaging.

Application segmentation confirms the dominance of the packaging sector, encompassing food and beverage packaging, pharmaceuticals, and blister packs for consumer goods. The food packaging segment, particularly thermoformed containers for prepared meals and fresh produce, accounts for the largest market share due to regulatory requirements for clear, safe, and hygienic materials. However, non-packaging applications, such as printing sheets, construction materials, and specialized electrical films, represent a growing niche demanding unique equipment features like specialized surface treatments and extremely precise thickness control. This diversified demand ensures that equipment manufacturers must offer customizable line solutions tailored to various industry specifications, moving beyond standard packaging setups.

- By Type:

- Single-Screw Extrusion Line

- Twin-Screw Extrusion Line (Co-rotating, Counter-rotating)

- By Output Capacity:

- Low Capacity (< 1000 kg/h)

- Medium Capacity (1000 – 2000 kg/h)

- High Capacity (> 2000 kg/h)

- By Application:

- Packaging (Food & Beverage, Medical & Pharmaceutical, Consumer Goods)

- Non-Packaging (Printing Films, Construction, Electrical Insulation)

Value Chain Analysis For PET Sheet Extrusion Equipment Market

The value chain for the PET Sheet Extrusion Equipment Market is intricate, starting with upstream activities involving the sourcing and refinement of raw materials and specialized components. Upstream providers include petrochemical companies supplying virgin PET resin (monomers), rPET flake processors, and specialized component manufacturers supplying high-precision gearboxes, motors, heating elements, and sophisticated sensor technology necessary for advanced control systems. The profitability of the midstream segment, which consists of the original equipment manufacturers (OEMs), is heavily reliant on maintaining stable and competitive relationships with these component suppliers, particularly those providing proprietary elements like advanced calender rolls and melt filtration screens. Efficient upstream logistics are critical, as delays or quality inconsistencies in components directly impact the high-precision assembly process of the extrusion lines, leading to potential delivery delays for end-users.

The core midstream activity involves the design, manufacturing, assembly, and testing of the complete extrusion line, including the extruder, melt pump, screen changer, calender stack, haul-off unit, and winding system. OEMs often distinguish themselves through technological innovation, such as developing proprietary degassing systems or integrating energy recovery modules. Distribution channels for this high-value, heavy machinery are primarily direct, involving the OEM’s dedicated sales and engineering teams interacting directly with the large packaging converters (the downstream customers). This direct model facilitates tailored customization, installation support, and long-term service contracts, which are crucial revenue streams for OEMs. Indirect channels, typically involving specialized local agents or distributors, are more common in smaller, geographically fragmented markets, providing necessary localized technical support and market penetration that large international OEMs may lack internally.

Downstream activities are dominated by the packaging converters and end-users who utilize the PET sheets. Converters use thermoforming, vacuum forming, or cutting processes to turn the sheets into final products (e.g., cups, trays, blister packaging). The demand generated by these downstream users, particularly major global food and beverage companies, dictates the capacity and technological requirements passed back up the chain to the equipment manufacturers. This segment requires high-quality, uniform PET sheets with precise thickness control. Therefore, the success of the equipment market is intrinsically linked to the regulatory and consumer trends affecting the final packaging market, particularly the shift toward maximizing recycled content. A streamlined value chain, focusing on minimizing friction between material suppliers, equipment providers, and converters, is essential for rapidly responding to market changes and ensuring the continuous adoption of circular economy models.

PET Sheet Extrusion Equipment Market Potential Customers

The primary potential customers for PET Sheet Extrusion Equipment are large-scale packaging converters who specialize in high-volume thermoforming operations. These enterprises require robust, reliable, and high-output machinery capable of running 24/7 with minimal downtime to fulfill major contracts with global fast-moving consumer goods (FMCG) and food processing companies. Key drivers for these customers include the total cost of ownership (TCO), operational efficiency metrics (such as OEE), and the ability of the equipment to handle diverse material inputs, especially varying percentages of rPET. Investment decisions are typically strategic, focusing on equipment longevity and the availability of sophisticated service and maintenance contracts provided directly by the OEM to ensure maximized uptime and minimal production interruption.

Another significant customer segment comprises specialized rigid packaging manufacturers serving the medical and pharmaceutical sectors. These customers have distinct requirements that prioritize sterility, extreme material purity, and unparalleled gauge accuracy, often necessitating cleanroom compatibility and certification for food contact or sterile environments. Their purchasing criteria place a higher emphasis on technological features, such as advanced melt filtration systems and automated inline inspection technology, over merely maximizing output capacity. The bespoke nature of their requirements often leads to closer collaboration with OEMs to develop customized extrusion lines that meet specific regulatory body mandates, driving demand for premium, high-specification equipment rather than standard, off-the-shelf models.

Emerging markets and new entrants into the packaging industry also represent a growing customer base. In regions like Southeast Asia and parts of Latin America, localized converters are investing in medium-capacity lines to meet rapidly escalating domestic demand for packaged goods driven by demographic changes and expanding urbanization. While these customers may initially prioritize cost-effectiveness and ease of operation, their long-term growth strategies often require scaling up to high-capacity lines that can process rPET efficiently. Equipment manufacturers targeting this segment must offer flexible, modular systems that can be easily upgraded and expanded as the customer’s business matures and technological requirements evolve, fostering long-term relationships through accessible financing options and comprehensive operator training programs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 980 Million |

| Market Forecast in 2033 | USD 1610 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SML Maschinengesellschaft mbH, AMUT Group, Breyer GmbH, Bandera Extrusion, Colines S.p.A., Macro Engineering & Technology Inc., Coperion GmbH, Reifenhauser Group, Wuxi JKS Machinery, Hosokawa Alpine AG, Rajoo Engineers Limited, Polytype Converting, Kiefel GmbH, Battenfeld-Cincinnati, Davis-Standard LLC, Parkinson Technologies Inc., Jinming Machinery, Zhejiang Jwell Machinery Co. Ltd., EREMA Group, and Tomra Systems ASA (Indirect technology provider). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PET Sheet Extrusion Equipment Market Key Technology Landscape

The contemporary technological landscape of the PET Sheet Extrusion Equipment market is defined by a relentless pursuit of efficiency, precision, and sustainability, leading to the rapid adoption of specialized processes aimed at handling recycled materials. The most critical technological shift involves the development of super-clean, FDA-approved extrusion lines designed specifically for processing 100% post-consumer PET (rPET). This necessitates highly efficient vacuum degassing systems, often integrated with twin-screw technology, which remove volatile impurities and moisture before the material reaches the melt pump. Furthermore, advanced melt filtration systems, such as continuous backflush screen changers with optimized mesh sizes, are essential to eliminate contaminants like paper, metal, and foreign polymers that are frequently found in recycled flakes, thereby ensuring the final sheet meets stringent food-grade standards and maintains optical clarity comparable to virgin PET.

Precision and throughput advancements are driving innovation in downstream equipment, particularly the calender stacks and automatic gauging systems. Modern high-speed calender units utilize sophisticated temperature control mechanisms and hydro-pneumatic gap adjustment to maintain extremely tight gauge tolerances (thickness uniformity) even at speeds exceeding 100 meters per minute. This precision minimizes material overage (giveaway) and ensures optimal performance during the subsequent thermoforming process. Complementing this, high-resolution, non-contact measuring systems, often using nuclear or infrared technology, provide instantaneous, continuous feedback to the line’s central control unit. This real-time data is critical for closed-loop control, allowing immediate, automatic adjustments to line parameters via proportional-integral-derivative (PID) controllers, thereby maximizing yield and reducing reliance on manual operator intervention.

Furthermore, the focus on integration and automation through Industry 4.0 principles is standardizing the market. Equipment now features comprehensive supervisory control and data acquisition (SCADA) systems, utilizing industrial IoT sensors to gather performance data across every component—from the crystallizer and dryer to the winder. This connectivity supports remote diagnostics, facilitates predictive maintenance schedules, and enables sophisticated energy monitoring to reduce operational costs. The increasing use of gravimetric dosing systems also ensures highly accurate blending of virgin resin, rPET, colorants, and additives, providing consistent material feeding regardless of input material density variations. This technological evolution ensures that modern PET extrusion lines are not just faster, but fundamentally smarter, more sustainable, and economically superior over their lifecycle.

Regional Highlights

- Asia Pacific (APAC): APAC represents the dominant region in terms of both market size and growth rate, primarily driven by China, India, and Southeast Asian nations. The explosion of the consumer goods and processed food markets, coupled with rapid urbanization and the expansion of the e-commerce sector, necessitates massive investments in packaging infrastructure. Equipment demand in APAC focuses heavily on high-capacity lines to achieve economies of scale, although there is a growing trend, particularly in developed areas like Japan and South Korea, toward high-precision machinery specializing in complex multi-layer barrier sheets and advanced rPET processing to address localized waste management challenges. Government initiatives supporting domestic manufacturing and foreign direct investment in large-scale plastic conversion plants further fuel this regional market expansion, making it a critical hub for global equipment suppliers.

- Europe: Europe is characterized by technological maturity and a profound emphasis on the circular economy, making it a key market for high-specification rPET extrusion equipment. Regulatory pressures, especially the mandatory inclusion of recycled content in new packaging materials, drive demand for specialized twin-screw extruders and certified super-clean technology that meets strict EFSA food-contact guidelines. Countries like Germany and Italy, home to major packaging machinery manufacturers, lead the adoption of advanced automation, energy-efficient designs, and integration of AI for quality control. While volume growth is moderate, the high average selling price (ASP) of sophisticated, customized equipment ensures that Europe remains a highly valuable and quality-focused market segment for OEMs.

- North America: The North American market (primarily the US and Canada) is characterized by a strong focus on automation, output consistency, and reducing labor dependency. High labor costs incentivize packaging converters to invest in fully automated lines that require minimal operator supervision, leading to high adoption rates of advanced winding systems and integrated material handling solutions. Sustainability initiatives, driven by corporate commitments from major CPG (Consumer Packaged Goods) companies rather than solely governmental mandates, are increasing the demand for equipment capable of handling consistent high levels of rPET. Furthermore, the burgeoning demand for specialized medical and pharmaceutical packaging also drives investment in highly precise extrusion systems that adhere to rigorous FDA standards for material traceability and process validation.

- Latin America (LATAM): LATAM is considered an emerging market with significant growth potential, led by Brazil and Mexico. Demand here is transitioning from basic, low-to-medium capacity machinery toward more efficient, modern lines as local packaging converters aim to serve both domestic and export markets with competitive pricing and quality. The market is often price-sensitive, but the rising awareness of plastic waste management is beginning to introduce demand for rPET processing capabilities. Investment decisions are frequently influenced by favorable trade policies and the ability of OEMs to provide comprehensive installation, training, and financing solutions tailored to regional economic conditions.

- Middle East and Africa (MEA): The MEA region, while diverse, is primarily driven by expansion in the food and beverage industry, particularly in the Gulf Cooperation Council (GCC) states and South Africa. Investments are often concentrated in large, centralized packaging facilities serving rapidly growing populations. Initial purchases may favor cost-effective, reliable equipment; however, as sustainability concerns grow, particularly in the UAE and Saudi Arabia, there is an increasing, albeit nascent, interest in adopting modern extrusion lines that incorporate basic recycling capabilities and energy-saving features to align with national long-term economic diversification visions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PET Sheet Extrusion Equipment Market.- SML Maschinengesellschaft mbH

- AMUT Group

- Breyer GmbH

- Bandera Extrusion

- Colines S.p.A.

- Macro Engineering & Technology Inc.

- Coperion GmbH

- Reifenhauser Group

- Wuxi JKS Machinery

- Hosokawa Alpine AG

- Rajoo Engineers Limited

- Polytype Converting

- Kiefel GmbH

- Battenfeld-Cincinnati

- Davis-Standard LLC

- Parkinson Technologies Inc.

- Jinming Machinery

- Zhejiang Jwell Machinery Co. Ltd.

- EREMA Group

- Tomra Systems ASA

Frequently Asked Questions

Analyze common user questions about the PET Sheet Extrusion Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technological shift defining new PET sheet extrusion equipment?

The primary technological shift is the integration of high-efficiency, super-clean twin-screw extrusion systems that allow for the direct processing of 100% post-consumer recycled PET (rPET) flakes into food-grade sheets. This shift emphasizes advanced vacuum degassing and melt filtration to meet stringent regulatory requirements for plastic circularity and safety.

How does the use of rPET impact the selection of extrusion equipment?

Processing rPET requires specialized equipment features, including advanced crystallization and drying systems to handle moisture variability, and robust continuous screen changers to filter out contaminants. Twin-screw extruders are increasingly preferred for rPET due to their superior capability in handling materials with lower intrinsic viscosity and volatile impurities without extensive pre-treatment.

Which geographical region exhibits the highest demand for PET sheet extrusion lines?

The Asia Pacific (APAC) region currently exhibits the highest demand, driven by rapid industrialization, burgeoning population growth, and escalating consumption of packaged food and beverages, necessitating continuous investment in high-capacity, economically viable extrusion machinery, primarily in China and India.

What role does AI or Industry 4.0 play in modern PET sheet production?

AI and Industry 4.0 facilitate predictive maintenance, reducing costly downtime by forecasting equipment failure based on sensor data. They also optimize process parameters (temperature, pressure, speed) in real-time, using closed-loop control to ensure optimal material utilization, energy efficiency, and high product consistency, crucial for advanced gauge control.

What are the key restraint factors influencing market growth?

The most significant restraint factors are the substantial initial capital investment required to purchase and install high-capacity, sophisticated extrusion lines, which limits market access for smaller players. Additionally, the market remains vulnerable to the volatility of raw material prices (virgin PET resin), impacting converters' profit margins and delaying investment decisions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager