PET Training Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435049 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

PET Training Services Market Size

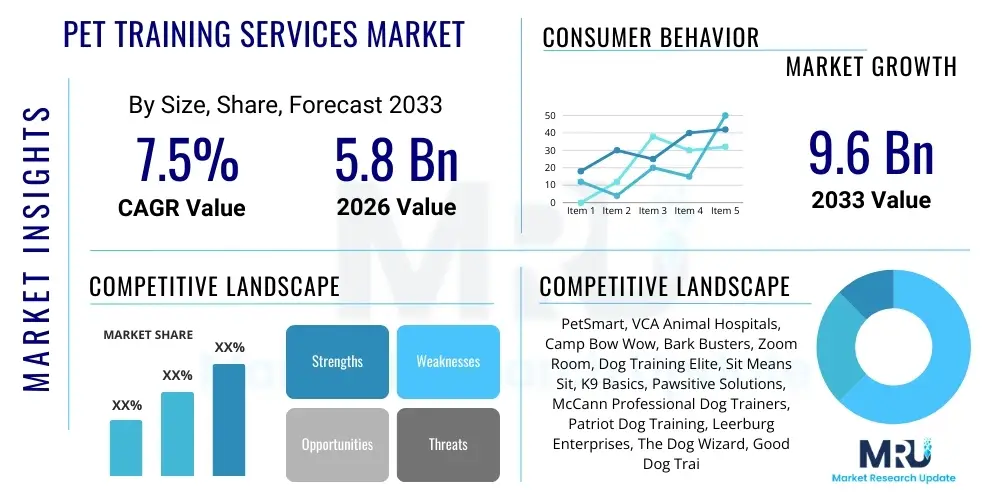

The PET Training Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $5.8 Billion in 2026 and is projected to reach $9.6 Billion by the end of the forecast period in 2033.

PET Training Services Market introduction

The PET Training Services Market encompasses professional instruction and behavioral conditioning programs designed to improve the relationship between pets and their owners, focusing primarily on dogs and, increasingly, cats. These services range from fundamental obedience classes necessary for public safety and domestic harmony to specialized behavioral modification addressing complex issues like aggression, separation anxiety, or specific skill development for service animals. The market is fundamentally driven by the escalating trend of pet humanization, where owners are increasingly willing to invest substantial resources into the health, well-being, and behavioral stability of their companion animals, viewing them as integral family members. This cultural shift elevates pet training from a discretionary expense to a necessary investment for integrating pets into modern, often dense, urban environments.

The core product offerings within this industry include group classes, private one-on-one sessions, board-and-train programs, and a rapidly expanding array of virtual and hybrid training solutions utilizing digital platforms. Major applications span socialization, basic command compliance, advanced agility training, and addressing specific psychological conditions. The primary benefits include enhanced pet safety, reduced euthanasia rates linked to behavioral problems, improved quality of life for the pet, and profound stress reduction for owners. Key driving factors include the massive increase in pet adoption rates globally, spurred partly by pandemic-era lockdowns, rising disposable incomes in key regions, and widespread recognition, supported by veterinary professionals, that training is essential for responsible pet ownership.

Furthermore, regulatory bodies in many jurisdictions are beginning to acknowledge the importance of trained pets, particularly in rental housing and public access areas, further solidifying demand for certified training services. The introduction of specialized training niches, such as canine fitness and therapy dog preparation, continues to diversify the revenue streams for market players. Technological integration, including the use of tracking devices and specialized behavioral assessment software, is also revolutionizing service delivery, making training more data-driven and accessible to a broader consumer base, especially those in remote or less populated areas.

PET Training Services Market Executive Summary

The PET Training Services Market is experiencing robust growth, primarily fueled by shifting consumer attitudes towards pet care, viewing it as a critical component of wellness rather than merely maintenance. Business trends indicate a strong move toward franchise models and national chains, which benefit from standardized curricula, centralized branding, and large-scale marketing capabilities, alongside the rapid proliferation of PetTech platforms offering subscription-based virtual training. There is notable vertical integration occurring, where veterinary clinics and large pet retailers are incorporating training services to capture a larger share of the holistic pet care expenditure, creating competitive pressures for independent trainers.

Regional trends show North America maintaining market leadership due to high household penetration of pets and high consumer expenditure on premium services. Europe follows, characterized by strong consumer emphasis on welfare standards and regulatory frameworks often requiring proof of training for certain breeds. Asia Pacific is identified as the fastest-growing region, driven by explosive growth in pet ownership, particularly in emerging economies like China and India, where Western pet care practices are rapidly being adopted. Urbanization across all regions necessitates behavior modification training as pets adapt to smaller living spaces and increased sensory stimulation.

Segment trends highlight the dominance of dog training, though the cat training segment, especially focused on litter box issues and destructive scratching, is gaining traction supported by new research. Delivery Mode segmentation shows a permanent shift toward hybrid models, where initial in-person assessments are combined with continuous virtual support and digital homework assignments, offering flexibility and higher engagement rates. The Behavior Modification segment is commanding higher price points and requires advanced professional expertise, driving demand for specialized certifications and continuous professional development within the training industry. Investment in specialized niche services, such as fear-free training methodologies and positive reinforcement techniques, is dominating service innovation.

AI Impact Analysis on PET Training Services Market

User inquiries regarding AI's influence in the PET Training Services Market primarily center on two critical areas: the automation of basic obedience instruction and the potential for AI tools to diagnose complex behavioral issues remotely. Users frequently ask if AI-powered applications, such as real-time video analysis or sophisticated behavior tracking wearables, can provide cheaper and more convenient alternatives to traditional trainers, effectively reducing the need for expensive in-person sessions. Additionally, there is significant interest concerning the ability of AI to personalize training curricula based on individual pet data (breed, age, personality metrics), optimizing learning speed and retention. Consumers are balancing the desire for convenience and data-driven insights against the necessity of the human element—the subtle cues and empathetic connection only a professional trainer can provide during critical socialization or intense behavior modification tasks.

The market is responding to these expectations by integrating AI tools primarily as supportive technologies rather than replacements for human expertise. For instance, sophisticated machine learning algorithms are being utilized to analyze video footage submitted by owners, providing objective assessments of pet stress levels, body language, and execution of commands. This allows trainers to offer highly precise, personalized feedback, minimizing the guesswork involved in remote consultations. Furthermore, AI is crucial in managing the vast amounts of data generated by connected pet wearables, alerting owners and trainers to statistically significant deviations in sleep patterns, activity levels, or vocalizations that might signal underlying behavioral or health issues requiring professional intervention. This diagnostic precision enhances the effectiveness and value proposition of human trainers.

However, concerns remain regarding the limitations of AI in replicating the critical aspects of physical handling, precise timing required for effective positive reinforcement, and addressing multi-factorial behavioral problems rooted in environmental contexts or owner-pet dynamics. AI is excellent at pattern recognition but currently lacks the nuanced decision-making capability and emotional intelligence needed for high-stakes behavior modification. Consequently, the impact of AI is transforming the role of the trainer from a primary instructor to a data interpreter and high-level behavioral consultant, leveraging technology to scale their reach and enhance service quality, thereby maintaining the high-value role of certified human professionals within the training ecosystem. AI adoption is expected to increase operational efficiency, particularly in scheduling, client management, and foundational training program delivery.

- AI-driven real-time behavior analysis via home monitoring systems provides objective data for trainers.

- Personalized curriculum generation using machine learning models optimizes training efficacy based on breed and behavioral profiles.

- Chatbots and conversational AI handle initial client triage and offer 24/7 basic obedience guidance and FAQ support.

- Integration of pet wearables with AI algorithms detects subtle shifts in health or anxiety metrics, enabling proactive intervention.

- Virtual Reality (VR) simulations, powered by AI, train owners in handling complex scenarios before interacting physically with the pet.

- Automated scheduling and billing systems improve the operational efficiency of large training organizations and franchises.

- AI facilitates global scaling of specialized training content via adaptive learning management systems (LMS).

DRO & Impact Forces Of PET Training Services Market

The PET Training Services Market is characterized by strong fundamental drivers counterbalanced by significant operational restraints, leading to highly specific growth opportunities influenced by powerful market impact forces. The dominant driver is the continued humanization of pets, translating directly into increased expenditure per animal and a heightened prioritization of behavioral health, alongside the rapid growth in global pet ownership, particularly post-2020. Conversely, the market faces restraints stemming from high service costs, which can limit access for lower-income households, and a pervasive lack of regulatory standardization and unified certification across different geographies, creating consumer confusion and distrust regarding trainer qualifications. Opportunities are abundant in the integration of specialized technology, such as telehealth platforms and gamified learning apps, and in expanding into niche services, including training for emotional support animals, specialized detection work, and geriatric pet care, which command premium pricing and require specialized expertise. These factors collectively determine the market's growth trajectory and competitive dynamics.

Impact forces currently shaping the market include demographic shifts, specifically the Millennial and Gen Z generations' preference for high-quality, ethically sourced pet services, which favors positive reinforcement and fear-free training methodologies. Economic elasticity plays a role; while training is considered essential, macroeconomic downturns can affect discretionary spending on advanced or specialized courses, shifting demand towards more affordable group classes or virtual options. Regulatory environments are emerging as a key force, particularly in regions like Europe, where breed-specific legislation and mandatory behavioral assessments are becoming more common, directly compelling owners to seek professional training. Furthermore, the powerful impact of social media and online communities disseminates training information rapidly, both accurate and inaccurate, increasing consumer awareness but also demanding higher levels of professional validation and transparency from training providers.

The structural forces affecting the competitive intensity include the relatively low barriers to entry for individual trainers, which keeps competition high at the local level, contrasted by the high capital requirements and certification expertise necessary to establish scalable, branded franchise operations. Buyer bargaining power is moderate; while consumers have many choices, specialized, highly reputable trainers maintain pricing power due to their unique expertise and proven track records, which are highly valued in behavior modification scenarios. Supplier power (veterinarians, equipment providers) is generally low, except where partnerships with veterinary practices act as a primary referral source, significantly influencing client acquisition for trainers. Overall, the market remains driven by intangible factors—trust, reputation, and perceived expertise—making brand differentiation and ethical practice paramount for long-term success and premium pricing justification.

- Drivers: Increased pet ownership and adoptions; growing recognition of behavioral training benefits by veterinary professionals; rising disposable incomes allocated to premium pet care; regulatory pushes for mandatory training in certain areas.

- Restraints: High cost of specialized, one-on-one training sessions; fragmentation and inconsistency in trainer certification and accreditation standards; time constraints faced by pet owners impacting participation in multi-week programs; potential cultural resistance to certain training methodologies.

- Opportunities: Expansion of online and hybrid training models utilizing interactive technology; specialized training for service animals and therapy pets; integration of training services into corporate wellness or employee benefit packages; developing specialized curriculum for popular "designer" breeds with unique behavioral needs.

- Impact Forces: Technological disruption from AI and PetTech; shifts in ethical consumption favoring positive reinforcement; strong referral relationships with veterinary and pet shelter networks; evolving municipal laws governing pet access and behavior in urban settings.

Segmentation Analysis

The PET Training Services Market is strategically segmented based on factors including the type of training provided, the delivery mode utilized, the animal type targeted, and the age group of the pet. This multifaceted segmentation allows market players to tailor services precisely to distinct consumer needs and willingness-to-pay segments. The primary delineation exists between foundational obedience training, which targets mass-market adoption and often utilizes group class settings, and highly specialized behavior modification, which addresses clinical issues and commands premium pricing in private consultation formats. Understanding these segments is crucial for resource allocation, pricing strategy, and developing targeted marketing campaigns, as the needs of a new puppy owner seeking socialization differ drastically from an owner dealing with severe canine aggression.

Segmentation by delivery mode has become particularly dynamic following global shifts favoring remote services. In-person services still hold significant perceived value, especially for initial assessments and practical handling experience, but the Virtual/Online segment, utilizing live video consultations, pre-recorded modules, and digital homework submissions, offers unparalleled scalability and geographical reach. Hybrid models are emerging as the preferred method, combining the best elements of both, optimizing cost-efficiency for trainers while maintaining high client engagement. Animal Type segmentation is historically dominated by dogs (Canine), but significant growth in the Feline segment reflects a growing understanding of cat behavior and the need for professional intervention for common issues like inappropriate elimination or inter-cat aggression, creating new revenue streams.

Further analysis of the age group segment reveals that Puppy/Kitten training is a high-volume, early-entry segment crucial for securing long-term client loyalty, focusing heavily on early socialization and basic manners. In contrast, the Adult/Senior pet segment typically drives demand for advanced skill training (e.g., competitive sports, complex tasks) or behavior modification required due to age-related changes or accumulated behavioral issues. Successful market penetration necessitates continuous product innovation tailored to the specific cognitive and physical requirements of each life stage, ensuring services remain relevant throughout the pet's lifespan and maximizing customer lifetime value (CLV).

- By Type: Obedience Training, Behavior Modification, Socialization Classes, Agility and Sports Training, Specialized/Service Animal Training.

- By Delivery Mode: In-Person (Private Sessions, Group Classes, Board-and-Train), Virtual/Online (Live Consultations, Pre-recorded Courses, Subscription Apps), Hybrid Model.

- By Animal Type: Dogs (Canine), Cats (Feline), Others (Exotic Pets, Birds).

- By Age Group: Puppy/Kitten, Adolescent, Adult, Senior.

Value Chain Analysis For PET Training Services Market

The value chain for the PET Training Services Market begins with upstream activities focused heavily on knowledge generation, curriculum development, and human capital investment. Key upstream stakeholders include academic institutions developing ethology and behavioral science research, professional certification bodies (e.g., Certification Council for Professional Dog Trainers - CCPDT), and curriculum providers who license training methodologies. The quality of the input—the scientific backing of the training methods and the certification level of the trainers—directly dictates the perceived value and premium pricing potential downstream. Investment in continuous professional development and adherence to ethical training standards (e.g., fear-free accreditation) are critical upstream inputs that differentiate top-tier market participants from local, uncertified competitors.

Midstream activities involve the actual delivery of the service, encompassing physical infrastructure (training facilities, daycare centers, specialized equipment) and digital infrastructure (LMS platforms, scheduling software, telehealth capabilities). This is where value addition is maximized through personalized instruction, client coaching, and service customization. The integration of technology in the midstream allows for scalability—a single trainer can service a far greater number of clients globally through virtual platforms than through traditional physical classes. Operational efficiency in scheduling and client progress tracking is paramount in this phase to maintain profitability, especially for high-volume group classes and franchise operations.

Downstream activities focus on reaching and serving the end-user—the pet owner. Distribution channels are predominantly direct, involving trainers delivering services directly to clients through in-person facilities or virtual conferencing. However, indirect channels, mainly through crucial referral networks, significantly influence market reach. These indirect channels include veterinary clinics recommending behavioral specialists, local pet retailers hosting introductory classes, and animal shelters requiring post-adoption training compliance. Effective downstream success hinges on high client satisfaction, leading to positive word-of-mouth referrals, which are the most powerful and cost-effective form of marketing in this service-based industry. Maintaining robust post-training support and follow-up consultation services enhances long-term client retention and maximizes the lifetime value of each customer.

PET Training Services Market Potential Customers

The primary potential customers and end-users of PET Training Services are diverse but can be broadly categorized into several key demographics, reflecting varied needs and willingness to pay. The largest segment comprises New Pet Owners, typically those who have recently adopted a puppy or rescue animal and require foundational socialization and obedience training to integrate the pet successfully into their household and community. This group seeks accessible, entry-level classes and clear, structured guidance, often prioritizing convenience and immediate results. They represent a high-volume segment crucial for pipeline generation for many training businesses.

A second major segment consists of owners dealing with Clinical Behavioral Issues, such as severe anxiety, aggression towards humans or other animals, or destructive separation distress. These clients are highly motivated, are typically referred by veterinarians, and seek specialized expertise and credentials (e.g., Certified Applied Animal Behaviorists, Veterinary Behaviorists). This segment is characterized by low price sensitivity and high demand for customized, intensive, and long-duration private consulting packages. They are critical for generating high-margin revenue and establishing reputation in complex areas of the market.

Other significant customer groups include Working Pet Owners (seeking services like detection dog training, service animal preparation, or competitive sports training such as agility or flyball), who require highly specialized, advanced skill-building programs. Lastly, the Institutional and Corporate segment includes animal shelters, rescue organizations, police/military K9 units, and property management companies who contract training services for staff education, animal assessment, or tenant compliance purposes. Targeting these varied groups requires specialized marketing materials, distinct pricing models, and specific trainer certifications aligned with the end-user’s unique functional requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.8 Billion |

| Market Forecast in 2033 | $9.6 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | PetSmart, VCA Animal Hospitals, Camp Bow Wow, Bark Busters, Zoom Room, Dog Training Elite, Sit Means Sit, K9 Basics, Pawsitive Solutions, McCann Professional Dog Trainers, Patriot Dog Training, Leerburg Enterprises, The Dog Wizard, Good Dog Training, Courteous Canine, Karen Pryor Clicker Training, The Company of Animals (Halti), Ian Dunbar's Training Academy, Premier Pet Products (Busy Buddy), Puppy Manners |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PET Training Services Market Key Technology Landscape

The technological landscape in the PET Training Services Market is rapidly evolving, moving beyond simple website listings to integrated digital ecosystems designed to enhance both the effectiveness and accessibility of training. A major development is the proliferation of Learning Management Systems (LMS) specifically tailored for pet owners, enabling trainers to distribute video modules, track client homework completion, and provide asynchronous feedback. This shift supports the scalability of hybrid models, where foundational learning is done digitally, reserving valuable in-person time for complex application and troubleshooting. Furthermore, professional trainers are increasingly adopting Customer Relationship Management (CRM) tools integrated with scheduling and billing platforms, allowing for highly efficient client management and personalized communication strategies, which is essential for managing repeat business and referral programs.

Another crucial technological advancement involves the use of specialized PetTech hardware and software, fundamentally altering how behavioral data is collected and analyzed. Wearable technology, such as smart collars and harnesses equipped with gyroscopes and acoustic sensors, monitors physiological indicators (heart rate, respiration) and behavioral metrics (barks, activity levels, sleep quality) relevant to anxiety and stress. Integrating this data with machine learning algorithms allows trainers to move from subjective observation to data-driven behavioral assessment. This technology provides objective evidence of training efficacy and helps identify environmental triggers that may be overlooked during remote or even in-person sessions, significantly enhancing diagnostic accuracy in behavior modification cases.

The ongoing development of telehealth platforms is key, particularly for veterinary behaviorists and specialized trainers who offer services across vast geographical areas. Secure video conferencing capabilities, often supplemented by AI tools for real-time video analysis of pet body language, ensure high-quality consultations can be delivered remotely. Investment in augmented reality (AR) and virtual reality (VR) is beginning to emerge, particularly for owner training, allowing clients to practice specific handling techniques or exposure therapies in a controlled, simulated environment before attempting them in real-world scenarios. This technological integration not only enhances service delivery but also provides strong justification for premium pricing in the increasingly competitive high-end training market.

Regional Highlights

North America

North America, particularly the United States, commands the largest share of the global PET Training Services Market, driven by exceptionally high rates of pet humanization and substantial discretionary income allocated to pet wellness. The market here is mature and highly segmented, dominated by large national franchise chains and big-box pet retailers (such as PetSmart and Petco) offering standardized group classes, which act as a key entry point for new pet owners. The region is characterized by early and aggressive adoption of PetTech, with strong investment in startups focusing on behavior tracking, virtual training, and subscription-based educational content. Regulatory standards, while varying by state and municipality, are generally favorable, often requiring proof of training for certain insurance policies or housing situations. Demand for specialized services, including service dog training and advanced behavior modification, is particularly strong, fueling growth in the high-end private consultation sector.

The competitive landscape in North America is marked by intense rivalry between nationwide franchises offering scalability and local, independent certified behaviorists offering niche expertise and personalized attention. Post-pandemic trends have solidified the demand for hybrid training models, where owners seek the convenience of digital support combined with the practical application learned during occasional in-person sessions. Consumer expectations are high, demanding not only efficacy but also adherence to ethical, positive reinforcement methodologies. This region’s high market value is sustained by continuous professional certification requirements and a deep cultural acceptance of pets as integral family members, justifying premium expenditure on behavioral health.

Furthermore, the North American market benefits significantly from robust referral pathways established with the veterinary community. Veterinarians frequently refer complex behavioral cases to certified trainers and behaviorists, creating a steady stream of high-value clients. Investment trends show venture capital increasingly targeting platforms that consolidate scheduling, payment, and learning modules for independent trainers, aiming to professionalize and standardize the service delivery across the fragmented independent sector. Growth is projected to remain steady, focusing on specialization, technological integration, and geographical expansion of successful franchise models into currently underserved metropolitan areas.

Europe

Europe represents the second-largest market, characterized by diverse regulatory environments and a strong emphasis on animal welfare standards, often influencing the permissible training methodologies. Countries like Germany, the UK, and the Netherlands lead in market maturity, driven by proactive governmental measures and high animal welfare consciousness among consumers. Specific regulations often mandate certain training levels or licenses for owning particular breeds (e.g., "dangerous" breeds), creating a non-discretionary driver for professional training services. The market generally favors ethically sound, positive reinforcement-based training, with fear-free certifications highly valued by the consumer base.

The European market structure is often more fragmented than North America, with strong regional or national brands dominating, rather than massive continental franchises. Independent, highly-certified trainers specializing in behavior modification and ethology often hold significant market influence, particularly in Northern and Western Europe. Pricing can be slightly higher than the global average due to rigorous certification processes and higher labor costs in key economic areas. The demand for virtual and hybrid training is growing rapidly, bridging geographical distances and addressing the challenges posed by varied language requirements across the continent, enabling trainers to serve wider, multilingual client bases effectively.

Innovation in Europe often centers on scientific rigor and long-term behavioral sustainability. There is strong collaboration between university researchers, veterinary schools, and training organizations to establish and promote evidence-based practices. Eastern Europe represents an emerging sub-region with accelerated growth, fueled by rising disposable incomes and rapid adoption of Western European pet care standards. Future growth in Europe will be contingent on harmonizing regulatory standards related to animal training and successful adaptation of digital platforms to meet stringent European data privacy regulations (GDPR).

Asia Pacific (APAC)

The Asia Pacific region is forecast to exhibit the fastest growth rate globally, driven by an explosive rise in pet ownership and increasing urbanization, particularly across China, India, and Southeast Asian nations. Historically, organized pet training was less prevalent in many APAC countries compared to Western counterparts, but rapid modernization, rising middle-class disposable incomes, and the influx of Western pet care standards are transforming consumer behavior. Urbanization necessitates formal training as pets live in smaller apartments and navigate crowded public spaces, driving high demand for basic obedience and socialization classes.

The market in APAC is still nascent but rapidly adopting technology to overcome infrastructural challenges. Virtual training and mobile applications are essential tools for reaching the vast, geographically dispersed consumer base, particularly in large markets like China and India, where localized content and language support are crucial for market success. South Korea and Japan represent mature sub-markets within APAC, characterized by high expenditure on premium, highly specialized services, including pet manners and complex behavior protocols designed for high-density living environments.

Competition often involves a mix of local entrepreneurs adapting Western franchise models and domestic players focused on affordability and accessibility. Challenges include varying consumer awareness levels regarding the benefits of professional training versus traditional, often punitive, methods, and a relative lack of standardized local certification bodies, requiring reliance on international credentials. Long-term growth will be sustained by increased public education campaigns regarding ethical pet management, greater investment in certified local trainers, and expansion of veterinary-trainer referral networks.

Latin America and Middle East & Africa (LAMEA)

The LAMEA regions offer significant potential, though they currently contribute smaller shares to the global market. Growth is primarily concentrated in urban centers and high-income demographics in countries such as Brazil, Mexico, South Africa, and the UAE. Latin America is driven by rapid growth in pet ownership and increasing consumer awareness regarding pet health, though economic volatility can impact discretionary spending on specialized services. The market generally features smaller, independent service providers, with a high reliance on word-of-mouth marketing and localized community trust.

In the Middle East, particularly the Gulf Cooperation Council (GCC) countries, high disposable incomes support premium and luxury pet services, including specialized, high-security training for personal protection dogs and elite obedience programs. Market growth here is slower but focused on high-value, exclusive service offerings. Africa remains highly fragmented, with formal training markets limited mostly to major metropolitan areas and serving specific demographic niches.

Across LAMEA, opportunities exist in deploying culturally sensitive virtual training platforms that overcome logistical and cost barriers associated with in-person services. Investment is crucial in developing local certification programs and establishing strong professional partnerships to elevate the perceived value and trustworthiness of professional pet training services within these emerging economic landscapes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PET Training Services Market.- PetSmart

- VCA Animal Hospitals

- Camp Bow Wow

- Bark Busters

- Zoom Room

- Dog Training Elite

- Sit Means Sit

- K9 Basics

- Pawsitive Solutions

- McCann Professional Dog Trainers

- Patriot Dog Training

- Leerburg Enterprises

- The Dog Wizard

- Good Dog Training

- Courteous Canine

- Karen Pryor Clicker Training

- The Company of Animals (Halti)

- Ian Dunbar's Training Academy

- Premier Pet Products (Busy Buddy)

- Puppy Manners

Frequently Asked Questions

Analyze common user questions about the PET Training Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving growth in the PET Training Services Market?

The major driver is the accelerating trend of pet humanization globally, coupled with a significant increase in pet ownership rates. Owners are increasingly prioritizing behavioral wellness and spending more on professional training to ensure their pets are well-adjusted members of the family and community.

How is technology impacting the delivery modes of pet training services?

Technology is shifting the market towards hybrid models. Virtual platforms (telehealth, customized LMS) allow trainers to offer scalable, convenient online consultations and pre-recorded modules, complementing essential in-person sessions necessary for hands-on application and complex behavior modification.

Which segmentation dominates the PET Training Services Market in terms of revenue?

The Dog Training (Canine) segment, followed by the Behavior Modification training type, consistently generates the highest revenue. Behavior modification services addressing serious issues like aggression or anxiety command the highest professional fees and require the most specialized expertise.

Is there a recognized standard certification for professional pet trainers?

While there is no single global government-mandated standard, organizations like the Certification Council for Professional Dog Trainers (CCPDT) and the International Association of Animal Behavior Consultants (IAABC) provide recognized, rigorous professional certifications highly valued by both consumers and veterinary professionals globally.

What role does Artificial Intelligence play in modern pet training?

AI primarily acts as a supportive diagnostic and data analysis tool. It integrates with wearable sensors and video monitoring systems to provide objective behavioral metrics and personalized curriculum suggestions, enhancing the precision and efficiency of human trainers rather than replacing them.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager