Pet Treats Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432197 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Pet Treats Market Size

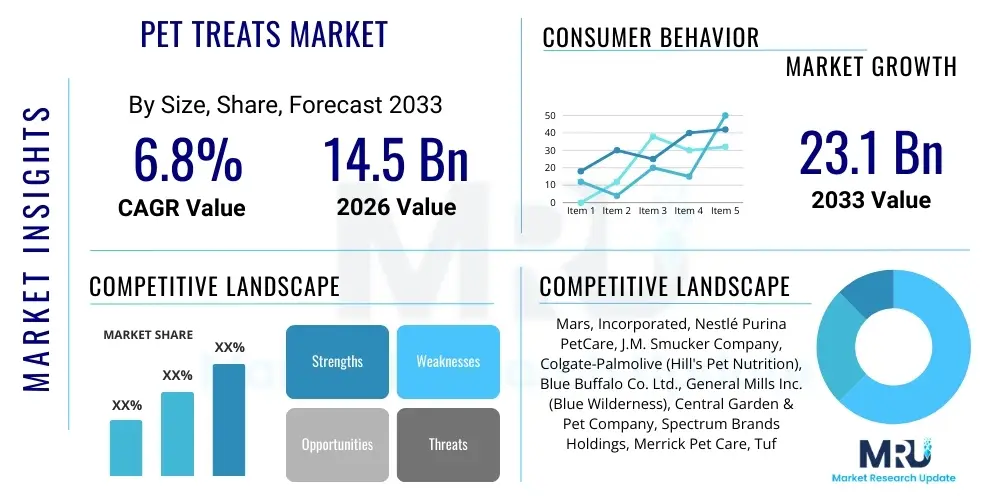

The Pet Treats Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $14.5 Billion in 2026 and is projected to reach $23.1 Billion by the end of the forecast period in 2033. This substantial expansion is primarily driven by the increasing humanization of pets, leading owners to prioritize premium, functional, and health-oriented snack options that mimic human dietary trends such as natural ingredients and specialized nutritional profiles. The shift towards preventive pet healthcare, where treats serve as vehicles for supplements like glucosamine or probiotics, further fuels this robust market valuation increase across key global regions.

Pet Treats Market introduction

The Pet Treats Market encompasses a wide variety of consumable products designed to supplement the nutritional needs and enhance the well-being of companion animals, primarily dogs and cats. These products range from basic biscuits and chews used for behavioral training and rewarding to highly specialized dental treats and functional supplements aimed at addressing specific health concerns like joint mobility, digestive health, or anxiety reduction. The core product description involves confectionery and savory items formulated specifically for palatability and safety for pets, moving increasingly away from artificial additives toward natural, recognizable, and human-grade ingredients. Major applications include behavior reinforcement, nutritional supplementation, dental hygiene maintenance, and fostering the bond between the pet and the owner, cementing their role as essential components of modern pet care routines.

The primary benefits associated with market expansion stem from the emotional attachment consumers have to their pets, resulting in a willingness to pay a premium for perceived quality and efficacy. Pet treats serve as an accessible entry point for pet owners to experiment with functional ingredients without changing the main diet, facilitating market segmentation and innovation. Driving factors include sustained growth in pet ownership globally, particularly in emerging economies, coupled with significant growth in disposable income among pet owners in mature markets like North America and Western Europe. Furthermore, intense product innovation focused on niche dietary needs, such as grain-free, limited ingredient, or high-protein options, broadens the consumer base and encourages frequent purchasing cycles, sustaining overall market momentum.

Moreover, the retail landscape has been significantly influenced by the proliferation of e-commerce platforms, offering consumers unparalleled access to specialized and international brands, thereby accelerating market fragmentation and competitive intensity. Digital marketing strategies leverage consumer interest in pet health and personalized nutrition, driving demand for transparency regarding sourcing and manufacturing processes. The integration of sustainability and ethical sourcing practices into brand messaging, such as the use of insect protein or sustainably sourced fish, also positions treat manufacturers favorably among environmentally conscious pet owners, ensuring long-term relevance and market penetration across diverse demographic groups.

Pet Treats Market Executive Summary

The global Pet Treats Market is experiencing transformative growth, characterized by strong business trends centered around premiumization and functional ingredient integration. Key trends include the rapid shift towards products mirroring human wellness trends, such as supplements delivered via treats (e.g., CBD, probiotics, antioxidants), and a persistent consumer demand for ingredient transparency, leading manufacturers to adopt clean label practices. Strategic investments are concentrated in manufacturing technologies that allow for novel textures (e.g., freeze-dried, puffed, jerky) and complex formulation delivery, enhancing both palatability and efficacy. Competition is intensifying, marked by frequent mergers and acquisitions where large corporations seek to integrate smaller, innovative natural and organic brands to quickly expand their specialized portfolio and capture emerging market segments focused on high-value, niche consumers.

Regionally, North America maintains its dominance due to high per capita pet expenditure, a robust culture of pet humanization, and early adoption of premium health-focused treats. However, the Asia Pacific (APAC) region, driven by countries like China and India, represents the fastest-growing market, propelled by urbanization, rising middle-class disposable incomes, and increasing Western influence on pet care practices. European markets exhibit a mature but stable growth trajectory, prioritizing regulatory compliance regarding ingredient safety and sustainability, with significant demand for ethically sourced and environmentally friendly packaging solutions. These regional dynamics necessitate tailored market entry strategies that account for varying regulatory environments and deeply entrenched consumer preferences regarding pet dietary norms.

Segment trends highlight the overwhelming consumer preference for dog treats, which command the largest market share, although the cat treats segment is demonstrating accelerated growth driven by innovation in texture and flavor profiles aimed at highly discerning feline palates. Functional treats, particularly those focused on dental health and joint support, are the fastest-growing application category, reflecting the aging pet population and the proactive approach owners are taking toward managing chronic conditions. The distribution landscape is evolving rapidly, with the online channel registering the highest growth rate, challenging traditional pet specialty stores but simultaneously creating omni-channel opportunities for brands that effectively integrate digital presence with in-store experience, ultimately catering to consumer convenience and immediate product availability needs.

AI Impact Analysis on Pet Treats Market

Common user questions regarding AI's influence on the Pet Treats Market typically revolve around personalized nutrition recommendations, optimization of supply chains, ensuring quality and safety, and the development of novel product formulations. Users frequently inquire about how AI models can analyze vast datasets of pet health metrics (derived from wearables or veterinary records) to suggest specific treat compositions tailored to individual pet needs, addressing dietary sensitivities or chronic conditions more effectively. Furthermore, significant interest lies in AI's role in predictive analytics for ingredient sourcing, inventory management, and anticipating consumer demand fluctuations, especially for highly perishable or seasonal product lines. The synthesis of these concerns indicates that the market views AI primarily as a tool for hyper-personalization, operational efficiency improvements, and rigorous quality control within complex manufacturing environments, aiming to elevate product standards and consumer trust.

- AI-driven predictive demand forecasting minimizes inventory waste and optimizes the production schedules for seasonal or limited-edition treat lines.

- Personalized pet nutrition algorithms utilize machine learning to recommend specific treat formulations based on a pet's age, breed, weight, activity level, and existing medical history.

- Automated quality control systems employing computer vision detect physical defects or inconsistencies in treats during the manufacturing process, ensuring stringent food safety standards.

- AI analyzes consumer feedback and sentiment across digital platforms, rapidly identifying emerging flavor preferences or functional ingredient demands, accelerating R&D cycles.

- Optimization of raw material sourcing and logistics through AI modeling, reducing transportation costs and enhancing supply chain resilience, especially for unique or globally sourced ingredients.

DRO & Impact Forces Of Pet Treats Market

The Pet Treats Market is fundamentally shaped by several interconnected Drivers, Restraints, and Opportunities (DRO), all subject to significant Impact Forces stemming from socioeconomic and technological changes. Key drivers include the pervasive trend of pet humanization, treating pets as integral family members, which directly correlates with higher spending on premium goods. Furthermore, the increasing awareness regarding functional ingredients that support pet longevity and wellness acts as a crucial driver. Restraints often manifest as rising raw material costs, particularly for high-quality proteins and specialized supplements, coupled with stringent regulatory hurdles concerning pet food safety and labeling claims across different regions. Opportunities are primarily centered on innovation in novel protein sources (e.g., insect-based, cell-based meat), expanding into therapeutic or medicated treat segments, and leveraging e-commerce for direct-to-consumer (D2C) sales models to enhance brand engagement and market reach.

Impact forces significantly amplify or mitigate these DRO elements. Socioeconomic forces, such as global economic stability and demographic shifts (e.g., smaller household sizes prioritizing pet companionship), directly influence consumer purchasing power and willingness to invest in premium treats. Technological forces, particularly advancements in food extrusion, freeze-drying techniques, and sophisticated packaging that extends shelf life and maintains ingredient integrity, drive product differentiation and market viability. Regulatory impact forces, such specifically relating to novel food approvals and health claim substantiation, dictate market entry barriers and required investment in scientific validation, influencing the speed at which innovative products can be introduced to the mass market. The cumulative effect of these forces ensures a dynamic, competitive environment prioritizing safety, quality, and functional efficacy.

The overall impact of these factors results in a market structure where sustainability and transparency are non-negotiable consumer expectations. Brands that successfully integrate ethical sourcing, environmentally friendly packaging, and demonstrable health benefits into their product offerings are poised for sustained growth. Conversely, companies struggling with supply chain volatility or failing to adapt to evolving clean-label requirements face significant erosion of consumer trust and market share. The continuous pursuit of functional benefits, moving treats beyond mere indulgence to tools for proactive health management, represents the central strategic challenge and opportunity for stakeholders operating within this highly consumer-centric industry.

Segmentation Analysis

The Pet Treats Market is extensively segmented based on Pet Type, Form, Ingredient Type, Function, and Distribution Channel, reflecting the diverse needs of pet owners and the high degree of specialization within the industry. This detailed segmentation allows manufacturers to target specific demographic and health-related niches, facilitating tailored product development and marketing strategies. The analysis of these segments is critical for understanding market dynamics, identifying high-growth areas, and strategically allocating resources toward categories where consumer spending and premiumization trends are most pronounced. Given the distinct physiological and behavioral differences between pet species, segmentation ensures that products are optimally formulated and positioned for maximum effectiveness and consumer appeal, particularly within the competitive functional treats category.

- Pet Type: Dogs, Cats, Small Animals (e.g., Rabbits, Hamsters), Birds, Reptiles

- Form: Chews (Rawhide, Edible), Biscuits/Cookies, Dental Treats, Soft/Semi-Moist, Freeze-Dried/Air-Dried, Jerky, Liquid/Gels

- Ingredient: Natural/Organic, Grain-Free, Limited Ingredient Diets (LID), Synthetic/Conventional, Plant-Based, Meat-Based (Poultry, Beef, Fish)

- Function: Training/Behavioral Rewards, Dental Care, Wellness/Health Support (Joint, Digestive, Skin & Coat), Calming/Anxiety Reduction, Nutritional Supplements

- Distribution Channel: Pet Specialty Stores, Supermarkets/Hypermarkets, Online Retail (E-commerce), Veterinary Clinics, Mass Merchandisers

Value Chain Analysis For Pet Treats Market

The value chain for the Pet Treats Market begins with the Upstream Analysis, which encompasses the sourcing and procurement of raw materials. This stage is highly critical and complex, requiring robust supplier management due to the rising consumer demand for human-grade, traceable, and specialized ingredients such as certified organic produce, novel proteins, and pharmaceutical-grade supplements (e.g., Glucosamine, Omega-3 fatty acids, CBD). Key activities include agricultural production, commodity processing, and laboratory testing to ensure ingredient safety and quality compliance before they enter the manufacturing phase. Volatility in commodity prices and the need for rigorous quality assurance protocols heavily influence operational costs and product margins at this initial stage of the value creation process.

The Midstream component involves manufacturing and processing, where raw ingredients are transformed into finished treat products using various technologies like extrusion, baking, freeze-drying, and injection molding. This stage requires significant capital investment in specialized equipment to maintain food safety standards, particularly HACCP (Hazard Analysis and Critical Control Points) and GMP (Good Manufacturing Practices). Product formulation innovation, focusing on texture, shelf stability, and nutritional density, is paramount here. Following manufacturing, the Downstream Analysis centers on distribution and retail. Distribution channels are highly fragmented, involving both Direct and Indirect pathways. Direct distribution includes D2C e-commerce sales and proprietary retail stores, offering maximum control over branding and pricing. Indirect channels involve wholesalers, large mass merchandisers, pet specialty chains, and veterinary clinics, each demanding specific packaging and logistical requirements.

The selection and management of the distribution channel are crucial determinants of market penetration and profitability. Veterinary clinics, for example, often serve as influential channels for functional and therapeutic treats, lending credibility to the product through professional endorsement. Conversely, online retail provides broad geographic reach and access to highly specialized consumer segments, driving growth particularly for innovative smaller brands. Efficient logistics, temperature control for certain ingredients, and strategic warehousing are essential to maintaining product quality until it reaches the end consumer, emphasizing the need for sophisticated supply chain management that balances cost efficiency with adherence to stringent quality and safety mandates throughout the entire value chain.

Pet Treats Market Potential Customers

The primary End-Users or Buyers of pet treats are categorized into three main groups: Household Pet Owners, Commercial Pet Care Facilities, and Veterinary Professionals. Household Pet Owners represent the largest and most varied customer base, driven primarily by emotional connection and the desire to enhance the pet's quality of life. Within this group, customers are segmented by purchasing behavior—ranging from budget-conscious buyers seeking basic training rewards to affluent, health-conscious owners demanding premium, functional, and ethically sourced human-grade products. This segment is highly responsive to clean labeling, specific health claims (like anxiety relief or digestive aid), and packaging aesthetics, signifying the humanization trend’s profound influence on purchasing decisions and product loyalty within the consumer market.

Commercial Pet Care Facilities, including professional dog trainers, groomers, boarding kennels, and specialized pet daycare centers, form a significant B2B customer segment. These facilities purchase treats in bulk, often prioritizing cost-effectiveness, consistency, and high palatability suitable for diverse breeds and training environments. Their purchasing criteria often hinge on regulatory compliance, product safety guarantees, and bulk packaging options that minimize environmental waste. The relationship quality and reliable supply chain logistics are critical factors for securing long-term contracts with these commercial entities, requiring specific industrial-grade packaging and formulation capabilities from manufacturers seeking to tap into this institutional demand stream.

Veterinary Professionals and specialty veterinary clinics constitute a specialized, high-value customer segment. Veterinarians frequently recommend specific therapeutic or medicated treats as part of a prescribed dietary regimen for managing conditions such as obesity, dental disease, or specific allergies. Purchases within this channel are driven by clinical efficacy, scientific backing, and formulation credibility. Manufacturers targeting this segment must invest heavily in clinical trials and gain professional endorsement, utilizing treats as a complementary tool to traditional pharmaceutical interventions. This segment is crucial for validating the efficacy of functional ingredients, often setting benchmarks for premium quality that eventually trickle down to the broader retail market, influencing general consumer perception and acceptance of new product concepts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $14.5 Billion |

| Market Forecast in 2033 | $23.1 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mars, Incorporated, Nestlé Purina PetCare, J.M. Smucker Company, Colgate-Palmolive (Hill's Pet Nutrition), Blue Buffalo Co. Ltd., General Mills Inc. (Blue Wilderness), Central Garden & Pet Company, Spectrum Brands Holdings, Merrick Pet Care, Tuffy's Pet Foods (Nutrisource), Petmate, WellPet LLC, Dechra Pharmaceuticals PLC, Trouw Nutrition, Lortscher Agri Service Inc., Ainsworth Pet Nutrition, Sunshine Mills, Pedigree Petfoods, Kong Company, Zuke's Pet Nutrition. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pet Treats Market Key Technology Landscape

The manufacturing of pet treats increasingly relies on advanced food processing technologies to meet rigorous quality standards, enhance nutritional delivery, and ensure palatability while maintaining cost efficiency. Key technological advancements include sophisticated extrusion systems that allow for precise control over density, texture, and nutritional inclusion, enabling the mass production of consistent kibble-like treats or complex multi-layered structures. Furthermore, the rapid growth of premium segments has accelerated the adoption of gentle processing techniques such as Freeze-Drying and Air-Drying. Freeze-drying, in particular, preserves the maximum nutritional integrity and flavor of raw ingredients, addressing the demand for minimally processed, high-meat-content treats that appeal directly to the humanization trend and command a significantly higher price point in the market.

Beyond core processing, innovation in formulation chemistry and ingredient encapsulation techniques is critical, especially for functional treats. Microencapsulation technology is employed to shield sensitive ingredients, such as probiotics, vitamins, or certain fatty acids, from degradation during manufacturing and storage, ensuring they remain biologically active until consumption. This is crucial for efficacy claims related to joint support or digestive health. Furthermore, advancements in automation and robotics within packaging lines have significantly improved operational throughput and reduced contamination risks. Smart packaging solutions, incorporating modified atmosphere packaging (MAP) or specialized oxygen barriers, extend the shelf life of semi-moist and natural treats that are susceptible to spoilage, reducing waste and maintaining product freshness for the consumer.

The digital transformation of the industry is also being driven by technologies like blockchain for ingredient traceability and quality assurance. As consumers demand greater transparency regarding sourcing, integrating blockchain technology allows manufacturers to provide verifiable records of raw material provenance, from farm to finished product. This technological application is essential for building consumer trust, particularly in markets demanding human-grade standards. Lastly, the integration of Artificial Intelligence (AI) and Machine Learning (ML) into R&D processes aids in simulating the impact of various ingredient combinations on palatability and texture, drastically cutting down the time and cost associated with new product development and ensuring optimal consumer acceptance before market launch, thereby solidifying the technological reliance across the entire product lifecycle.

Regional Highlights

- North America (United States, Canada, Mexico): Dominates the global market, characterized by the highest per capita spending on pets and strong adoption of premium, functional, and specialty treats (e.g., CBD-infused calming treats, dental chews). The market is mature but highly innovative, with significant growth driven by e-commerce penetration and strong consumer demand for locally sourced and environmentally sustainable products. The U.S. remains the epicenter for pet treat innovation and functional ingredient introduction.

- Europe (Germany, UK, France, Italy, Spain): Represents a substantial market with a strong focus on regulatory compliance, natural ingredients, and ethical sourcing. The demand for organic and grain-free options is particularly high. The UK and Germany are leading consumers, showing a preference for high-quality, scientifically backed nutritional treats, often purchased through specialized pet retailers and veterinary channels emphasizing quality assurance.

- Asia Pacific (APAC) (China, Japan, India, South Korea): Fastest-growing regional market, fueled by increasing urbanization, rising disposable incomes, and the Westernization of pet care practices. China and Japan are leading the adoption of packaged treats, with Japanese consumers favoring highly specific, smaller-format treats tailored to small dog breeds. India and Southeast Asia show immense future potential driven by the expanding middle class’s willingness to spend on imported and premium brands.

- Latin America (Brazil, Argentina): Exhibits emerging market characteristics with growing pet ownership rates. The treat market here is developing rapidly, moving away from conventional table scraps toward commercially manufactured, affordable treats. Brazil is the regional leader, displaying growing consumer interest in basic training treats and dental hygiene products, albeit sensitive to local economic fluctuations.

- Middle East and Africa (MEA): Smallest regional market but shows promise, especially in the UAE and Saudi Arabia, driven by expatriate populations and growing exposure to international pet care standards. Demand is highly concentrated in urban centers, favoring imported, shelf-stable, and premium brands, often distributed through specialty stores and online platforms catering to higher-income brackets seeking quality assurance and international brands.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pet Treats Market.- Mars, Incorporated

- Nestlé Purina PetCare

- The J.M. Smucker Company

- Colgate-Palmolive (Hill's Pet Nutrition)

- Blue Buffalo Co. Ltd. (General Mills)

- Central Garden & Pet Company

- Spectrum Brands Holdings Inc.

- Merrick Pet Care

- WellPet LLC

- Dechra Pharmaceuticals PLC

- Lortscher Agri Service Inc.

- Ainsworth Pet Nutrition

- Sunshine Mills Inc.

- Pedigree Petfoods

- Kong Company

- Zuke's Pet Nutrition

- Earthborn Holistic

- C.H. Guenther & Son, Inc.

- Stella & Chewy's

- Petmatrix LLC

Frequently Asked Questions

Analyze common user questions about the Pet Treats market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary growth driver for the Pet Treats Market?

The primary growth driver is the escalating trend of pet humanization, where owners treat pets as family members, leading to increased spending on premium, functional, and health-focused treats that align with human wellness trends, thereby boosting market valuation and driving demand for high-quality ingredients and specialized formulations.

Which segment is showing the fastest growth rate in the Pet Treats Market?

The functional treats segment, particularly those focused on dental care, joint support, and digestive health, is exhibiting the fastest growth rate. This acceleration is driven by the aging pet population and the proactive approach of owners using treats as a convenient vehicle for administering necessary supplements and preventive health components.

How is e-commerce affecting the distribution of pet treats?

E-commerce is revolutionizing distribution by providing consumers with broader access to niche, specialized, and international treat brands, bypassing traditional brick-and-mortar stores. This channel facilitates rapid market entry for innovative D2C brands and supports targeted marketing strategies based on precise consumer data, contributing significantly to overall market volume growth.

What are the main regulatory challenges faced by manufacturers?

Manufacturers face significant regulatory challenges primarily related to substantiating health claims and ensuring ingredient traceability, particularly for functional ingredients like CBD or novel proteins. Strict regulatory bodies mandate accurate labeling, specific testing, and adherence to defined food safety standards, increasing compliance costs and impacting product development timelines across different global jurisdictions.

What role do novel ingredients, such as insect protein, play in the market?

Novel ingredients, notably insect protein, represent a key opportunity driven by sustainability concerns and the need for alternative protein sources. These ingredients offer high nutritional value, lower environmental impact compared to traditional livestock, and address consumer demand for sustainable and allergen-friendly treat options, positioning them as a growing niche within premium and specialized pet nutrition portfolios.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager