Pet Virus Testing Card Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437099 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Pet Virus Testing Card Market Size

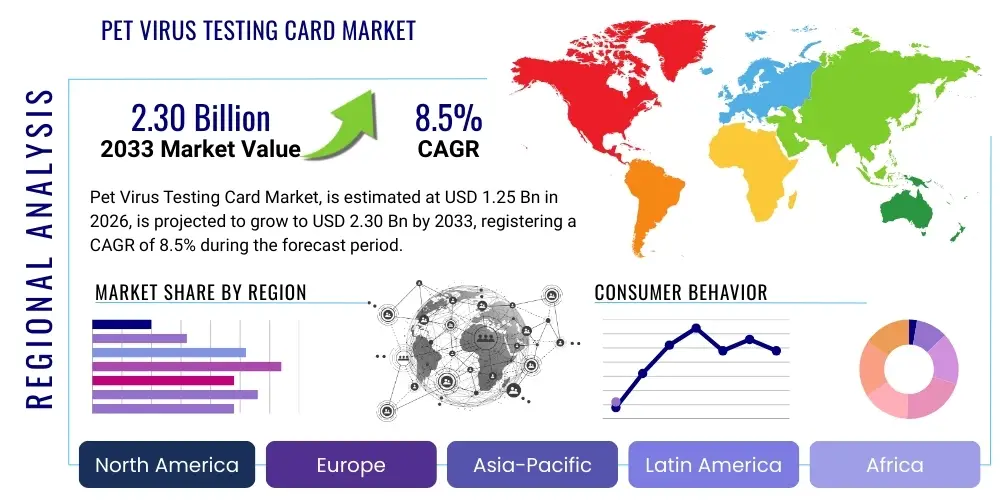

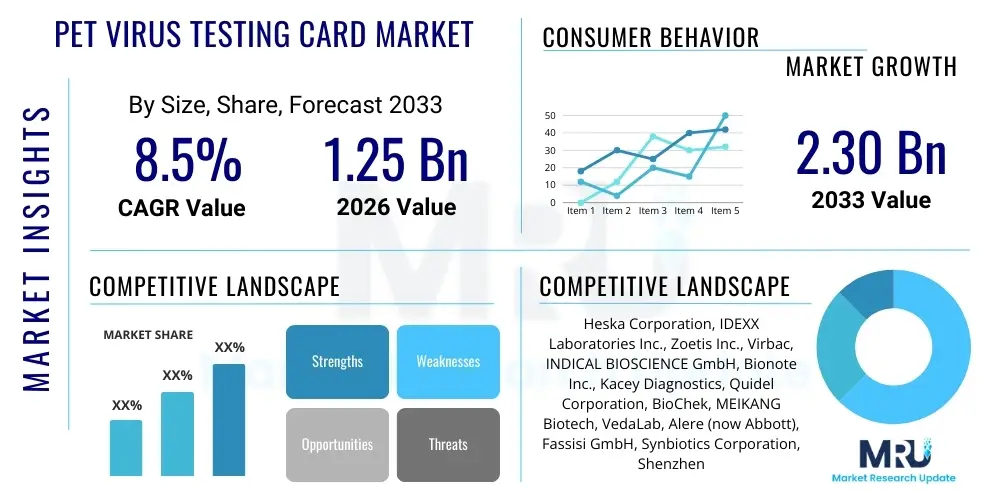

The Pet Virus Testing Card Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 2.30 Billion by the end of the forecast period in 2033.

Pet Virus Testing Card Market introduction

The Pet Virus Testing Card Market encompasses rapid diagnostic tests (RDTs), primarily based on the Lateral Flow Immunoassay (LFIA) technique, designed for the swift, qualitative detection of specific viral antigens or antibodies in companion animals. These cards provide veterinarians and pet owners with quick, accessible screening tools for highly contagious diseases such as Canine Parvovirus (CPV), Feline Leukemia Virus (FeLV), Feline Immunodeficiency Virus (FIV), and Canine Distemper Virus (CDV), among others. The core product is a point-of-care (PoC) device, minimizing the need for complex laboratory equipment and reducing turnaround time, which is crucial for early intervention and minimizing outbreak spread in shelters or clinical settings.

Major applications of these testing cards include routine wellness checks, screening of new animals in shelters or breeding facilities, diagnosis of acute disease symptoms, and monitoring the effectiveness of vaccination programs. The rapid nature of these tests allows for immediate isolation protocols to be initiated, significantly improving biosecurity and patient outcomes. Furthermore, the simplicity of the test procedure makes it viable for use in remote areas or by personnel with limited laboratory training, extending diagnostic reach beyond metropolitan veterinary hospitals. The market growth is inherently linked to the global expansion of pet ownership and the increasing awareness among pet owners regarding preventative veterinary healthcare.

Key benefits driving market adoption include the high speed of results (typically 5 to 15 minutes), cost-effectiveness compared to molecular diagnostics (PCR), and portability. The driving factors primarily revolve around the escalating incidence of infectious pet diseases globally, the heightened human-animal bond leading to increased expenditure on pet health, and technological advancements focusing on improving the sensitivity and multiplexing capabilities of LFIA cards. These factors collectively position the testing card market as a critical component of modern veterinary diagnostic infrastructure, facilitating efficient disease management and population health control.

Pet Virus Testing Card Market Executive Summary

The Pet Virus Testing Card Market is undergoing robust expansion, characterized by increasing demand for point-of-care diagnostics driven by rising pet populations and higher rates of companion animal disease incidence. Business trends show a strong shift towards the development of multiplex testing cards that can simultaneously detect multiple pathogens from a single sample, enhancing efficiency in clinical settings. Furthermore, partnerships between diagnostic manufacturers and large veterinary corporate groups are accelerating product distribution and adoption. Investment is particularly flowing into improving reagent stability and refining reading mechanisms to minimize human error, thus bridging the sensitivity gap between RDTs and gold-standard laboratory methods. The overall market trajectory indicates sustained growth, supported by the foundational need for quick quarantine decisions in infectious disease management.

Regional trends indicate North America and Europe currently dominate the market due to established veterinary infrastructure, high discretionary spending on pet health, and stringent regulatory frameworks promoting disease surveillance. However, the Asia Pacific region is projected to register the fastest CAGR, primarily fueled by rapid urbanization, a surge in middle-class disposable income, and the burgeoning trend of responsible pet ownership in countries like China and India. This regional shift is attracting global players to localize manufacturing and distribution networks to cater to these expanding patient bases. Regulatory environments, particularly in the APAC region, are gradually aligning with Western standards, further legitimizing and driving the use of certified diagnostic tools.

Segment trends highlight the dominance of the Canine segment, given the higher prevalence and recognition of canine viruses like Parvovirus and Distemper. However, the Feline segment is experiencing accelerated growth, driven by focused research into feline-specific pathogens such as FIP (Feline Infectious Peritonitis). By technology, the Lateral Flow Immunoassay (LFIA) segment maintains the largest market share due to its proven reliability and simplicity, but new entrants focusing on microfluidics and integrated optical reader systems are poised to disrupt the status quo by offering enhanced quantitative measurement capabilities. In terms of end-users, veterinary clinics and hospitals remain the primary consumers, but the rapid proliferation of animal shelters and rescue organizations presents a high-growth niche for bulk purchases of rapid screening cards.

AI Impact Analysis on Pet Virus Testing Card Market

Common user questions regarding AI's influence often center on whether AI can improve the accuracy of human-interpreted rapid tests, how it might integrate RDT results into large-scale veterinary data systems, and whether it can assist in outbreak prediction. Based on this analysis, the key themes summarize that AI is expected to revolutionize the interpretation phase of pet virus testing cards, moving them beyond purely subjective human visual readings. Users anticipate AI-powered mobile applications or integrated optical readers that can provide objective, quantitative results by analyzing the intensity of the test line, thereby standardizing diagnostics across various clinical environments. Furthermore, AI systems are seen as essential tools for aggregating results from decentralized testing locations to create real-time epidemiological maps, allowing veterinary public health bodies to predict and mitigate viral outbreaks in large pet populations or specific geographic clusters more effectively. The integration of AI tools promises to transform rapid testing from a quick qualitative screening method into a more sophisticated, data-driven diagnostic asset.

- AI integration through mobile image recognition (computer vision) ensures standardized and objective result interpretation, reducing inter-user variability.

- Predictive analytics algorithms utilize aggregated RDT data to forecast localized disease outbreaks (e.g., Parvovirus seasonality), aiding preventative resource allocation.

- Telehealth platforms leverage AI to guide pet owners or remote clinic staff in performing tests correctly and transmitting validated results to consulting veterinarians.

- AI-driven data synthesis connects individual patient RDT results with electronic health records (EHRs), streamlining record-keeping and longitudinal patient management.

- Optimization of R&D processes using machine learning to identify optimal antibody/antigen pairings, potentially leading to the development of higher-sensitivity testing platforms.

DRO & Impact Forces Of Pet Virus Testing Card Market

The Pet Virus Testing Card Market expansion is fundamentally propelled by the increasing global emphasis on preventative veterinary medicine and the rising emotional and financial investment in companion animals, translating into higher demand for prompt diagnostics. This dynamic is moderated by technical limitations inherent in rapid testing technologies, particularly concerning sensitivity and the risk of false negatives when compared to laboratory PCR methods. Opportunities abound in developing multiplex cards that can screen for numerous endemic and emerging pathogens simultaneously, and in expanding market penetration into emerging economies where rapid, cost-effective diagnostics are highly valued due to infrastructural constraints. The interplay of these forces dictates a robust but strategically nuanced growth trajectory, favoring innovations that enhance accuracy and usability in diverse settings.

Drivers: A primary driver is the accelerating frequency of pet travel and global animal movement, which increases the risk of transboundary disease transmission, demanding quick screening tools. Furthermore, heightened public awareness regarding zoonotic diseases and the 'One Health' approach encourages broader veterinary surveillance, placing rapid tests at the forefront of initial diagnostic screening. Economically, the low per-test cost compared to full laboratory panels makes these cards attractive for routine screening and mass testing campaigns, especially in animal shelters where throughput efficiency is crucial. Increased government and non-profit organization investment in animal welfare programs worldwide also significantly contributes to the demand volume.

Restraints: Significant restraints include the inherent trade-off between speed and accuracy; the sensitivity and specificity of LFIA tests can be insufficient to detect early or low-titer infections, leading to the necessity for confirmatory lab tests. Regulatory hurdles and slow approval processes in certain regions for new diagnostic assays can also impede market entry and innovation uptake. Additionally, the prevalence of counterfeit or poorly manufactured testing kits in unregulated markets poses a risk to both patient care and the reputation of legitimate products, necessitating continuous quality control and educational efforts among end-users. User reliance on subjective visual interpretation remains a technical barrier, although this is being addressed through digital reading systems.

Opportunities: The greatest opportunities lie in the development of next-generation rapid diagnostic tests (NG-RDTs) incorporating advanced materials science, such as quantum dots or magnetic nanoparticles, to significantly boost detection limits and provide semi-quantitative results. Expanding the application scope to include exotic pets and livestock pathogens offers diversification potential. Furthermore, integrating RDTs with blockchain technology for secure, tamper-proof result tracking and decentralized disease surveillance presents a unique opportunity for market modernization, especially crucial for tracking vaccination status and disease incidence across veterinary networks. Developing comprehensive training programs for veterinary technicians on the standardized use and interpretation of these cards in resource-limited settings will unlock significant untapped demand.

Impact Forces: The high impact of the growing global pet population provides strong, sustained market momentum (Driver). Conversely, the persistent threat of litigation due to misdiagnosis resulting from the limitations of rapid technology maintains a medium-to-high restrictive pressure (Restraint). The emergence of user-friendly digital readers for result interpretation acts as a powerful enabling force, transforming RDTs into more reliable tools (Opportunity realization). The collective impact forces indicate a market environment conducive to innovation, particularly in areas that enhance test performance and connectivity, while simultaneously demanding strict quality control to manage the inherent diagnostic compromises associated with rapid, field-deployable technologies. Regulatory harmonization across major markets also acts as a key accelerating force for global trade.

Segmentation Analysis

The Pet Virus Testing Card Market is meticulously segmented based on the type of animal tested, the specific viral pathogen targeted, the underlying technology used for detection, and the primary end-user facility. This segmentation provides a granular view of market dynamics, highlighting areas of high growth and technological maturity. The Canine segment leads due to the high volume of dog ownership globally and established screening protocols for common diseases like Parvovirus and Canine Distemper. However, the Feline segment is rapidly gaining traction as diagnostic awareness for viruses like Feline Infectious Peritonitis (FIP) increases. Technological segmentation underscores the market's dependence on the Lateral Flow Immunoassay (LFIA) format, while simultaneously pointing toward emerging sophisticated platforms.

By Technology, the market distinguishes between standard LFIA, which is qualitative and relies on visual reading, and advanced technologies such as fluorescence immunochromatography (FIC) or devices integrated with digital readers. These advanced methods offer improved precision and the ability to quantify pathogen loads, appealing strongly to high-throughput veterinary reference laboratories and specialized clinics seeking enhanced diagnostic sensitivity. The end-user classification clearly defines the demand centers, with veterinary clinics and hospitals dominating consumption due to their role as primary care providers for diagnostic screening, followed by animal shelters which require economical and rapid tests for managing large, transient populations susceptible to infectious outbreaks.

Understanding these segments allows market participants to tailor their product offerings and marketing strategies effectively. For instance, manufacturers targeting the Feline segment must focus on developing highly specific tests for emerging feline retroviruses, while those targeting the Veterinary Clinic segment prioritize product reliability, ease of storage, and integration with existing electronic health record systems. This differentiated approach is vital for capturing market share in this increasingly competitive diagnostic space, ensuring that the specific needs of various animal species and clinical settings are adequately met by the rapid testing solutions offered.

- By Animal Type:

- Canine

- Feline

- Others (e.g., Avian, Bovine, Equine)

- By Technology:

- Lateral Flow Immunoassay (LFIA)

- Fluorescence Immunoassay (FIA)

- Others (e.g., Microfluidics-based RDTs)

- By Target Pathogen:

- Parvovirus

- Distemper Virus

- Feline Leukemia Virus (FeLV)

- Feline Immunodeficiency Virus (FIV)

- Others (e.g., Coronavirus, Rotavirus)

- By End User:

- Veterinary Clinics and Hospitals

- Animal Shelters and Rescue Organizations

- Veterinary Reference Laboratories

- By Distribution Channel:

- Direct Sales

- Distributors and Third-Party Suppliers

- Online Retail

Value Chain Analysis For Pet Virus Testing Card Market

The value chain for the Pet Virus Testing Card Market begins with upstream activities involving the sourcing and refinement of biological components, primarily monoclonal and polyclonal antibodies, antigens, and highly purified membrane materials (such as nitrocellulose). Specialized suppliers focus on achieving the necessary sensitivity and stability for the binding elements that form the core detection mechanism of the testing card. Manufacturing involves sophisticated processes for reagent conjugation, membrane dispensing, strip cutting, and final card assembly under stringent cleanroom conditions. Quality control is paramount at this stage to ensure batch-to-batch consistency and regulatory compliance, particularly concerning sensitivity thresholds and shelf-life stability.

Midstream activities primarily focus on logistics, packaging, and regulatory clearance. Because these products are sensitive to temperature and humidity, the distribution channel requires a robust cold chain or temperature-controlled warehousing, even for room-temperature stable tests. Direct and indirect distribution channels are utilized, with large manufacturers often using direct sales teams for key accounts (major veterinary hospitals or corporate chains) to ensure technical support and high service levels. Indirect distribution, leveraging specialized veterinary wholesalers and regional distributors, is essential for reaching smaller, independent clinics and penetrating geographically challenging or highly fragmented markets.

Downstream analysis centers on the end-users: veterinary professionals, laboratory technicians, and shelter personnel who purchase and administer the tests. The effectiveness of the value chain is measured by the speed of delivery, the availability of technical training, and the seamless integration of these diagnostic tools into the clinical workflow. The increasing preference for online ordering and e-commerce platforms is transforming the downstream market, facilitating easier access for small clinics, while strong partnerships between manufacturers and veterinary organizations remain critical for driving large-volume institutional purchases and adoption of new product iterations.

Pet Virus Testing Card Market Potential Customers

Potential customers for Pet Virus Testing Cards are primarily entities responsible for the health, welfare, and infectious disease management of companion animals. The largest segment of end-users consists of Veterinary Clinics and Hospitals, ranging from small, independent practices providing general care to large, specialized veterinary referral centers equipped with high-volume diagnostic needs. These facilities utilize testing cards for immediate, in-house screening of symptomatic animals, especially in emergency situations where rapid diagnosis is critical for treatment planning and triage.

The second major customer group includes Animal Shelters, Rescue Organizations, and Humane Societies. These entities manage large populations of animals with unknown health histories, requiring mandatory, rapid, and cost-effective screening upon intake to prevent outbreaks of highly contagious viruses like Parvovirus or Panleukopenia. The economic constraints and high volume of testing required in this setting make rapid testing cards an indispensable tool for immediate biosecurity measures. Furthermore, these organizations often partner with manufacturers for subsidized or donated kits, reflecting the public health dimension of the market.

Additional potential customers include specialized groups such as professional dog and cat breeders who require regular screening to ensure the health certification of breeding stock and litters, pet stores involved in animal sales, and certain mobile veterinary services that rely heavily on portable point-of-care diagnostics. Veterinary Reference Laboratories also use these cards for initial, rapid confirmation tests before proceeding with more expensive molecular diagnostics, effectively leveraging RDTs in a tiered diagnostic approach. Finally, government agencies involved in animal health surveillance and public health initiatives represent a latent high-volume purchaser, particularly during widespread disease monitoring campaigns.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 2.30 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Heska Corporation, IDEXX Laboratories Inc., Zoetis Inc., Virbac, INDICAL BIOSCIENCE GmbH, Bionote Inc., Kacey Diagnostics, Quidel Corporation, BioChek, MEIKANG Biotech, VedaLab, Alere (now Abbott), Fassisi GmbH, Synbiotics Corporation, Shenzhen Kingnor Technology Co., Ltd., Shanghai Chemtron Biotech Co., Ltd., Bio-X Diagnostics, Creative Diagnostics, VMRD Inc., and SkySen Biotech. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pet Virus Testing Card Market Key Technology Landscape

The technological landscape of the Pet Virus Testing Card Market is predominantly defined by the Lateral Flow Immunoassay (LFIA), recognized for its cost-effectiveness and rapid results. LFIA relies on the interaction of target analytes (viral antigens or antibodies) in a liquid sample with specific immobilized reagents on a porous membrane. Despite its widespread adoption, standard LFIA often suffers from relatively lower sensitivity compared to molecular techniques, necessitating the development of enhancements. Current technological innovation is heavily focused on improving the limit of detection (LoD) through enhanced conjugation chemistries, such as utilizing gold nanoparticles with tighter size distribution and optimizing membrane pore size for better flow dynamics and signal capture.

A significant technological shift involves the transition from qualitative visual interpretation to semi-quantitative or quantitative digital reading systems. This incorporates advanced methodologies like Fluorescence Immunoassay (FIA) or integrated optical readers equipped with Charge-Coupled Device (CCD) sensors. FIA utilizes fluorescent labels instead of traditional gold nanoparticles, providing a much stronger signal that can be accurately measured by a dedicated reader, thus substantially improving sensitivity and enabling the quantification of viral load or antibody titer. These digital systems eliminate human subjectivity, provide an objective record of the test result, and facilitate seamless data integration with centralized patient management systems, addressing a critical restraint of the traditional RDT format.

Emerging technologies include microfluidics-based platforms that integrate sample preparation, reaction, and detection onto a small chip, offering higher throughput and reduced sample volume requirements while minimizing the potential for contamination. Furthermore, multiplexing—the ability to detect several different viral targets simultaneously on one card—is a major focus area, crucial for differential diagnosis in animals presenting with generalized symptoms. Successful adoption of these quantitative and multiplex technologies will redefine the utility of the testing card, moving it from a simple screening tool to a robust diagnostic instrument capable of supporting complex clinical decision-making. Continuous material science research into novel bioreceptors and stable dried reagents also ensures the longevity and reliability required for field use.

Regional Highlights

- North America: This region maintains market leadership due to high per-capita spending on pet healthcare, widespread adoption of advanced veterinary diagnostics, and the presence of major industry players (e.g., IDEXX, Zoetis). The region benefits from established veterinary infrastructure and a strong regulatory focus on managing contagious pet diseases, driving consistent demand for rapid screening tools in clinics and corporate veterinary chains.

- Europe: Characterized by mature markets in Western Europe (Germany, UK, France), where strict animal welfare regulations and high pet ownership penetration fuel consistent demand. Emphasis is placed on preventative health programs and rapid outbreak containment, particularly in farm animals and companion animals moving across borders, creating strong opportunities for multiplex and high-quality RDTs.

- Asia Pacific (APAC): Positioned as the fastest-growing market, driven by urbanization, rising disposable income, and a fundamental shift towards nuclear families increasing pet adoption. Emerging economies like China and India are experiencing massive growth in the number of organized veterinary facilities and animal shelters, demanding cost-effective, high-volume testing solutions to manage endemic viral threats.

- Latin America (LATAM): Growth is steady but challenged by economic volatility and varying levels of veterinary infrastructure development. Brazil and Mexico are key markets due to large companion animal populations. The primary demand driver here is the need for affordable, accessible diagnostics for highly prevalent diseases like Canine Parvovirus, often favoring traditional LFIA technologies.

- Middle East and Africa (MEA): This region represents a relatively smaller, yet rapidly developing market. Growth is localized, concentrating in urban centers with expatriate communities and burgeoning awareness of pet health. The primary need is for robust, temperature-stable diagnostics suitable for environments with unreliable power supply or extreme climatic conditions, driving innovation in reagent stabilization.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pet Virus Testing Card Market.- Heska Corporation

- IDEXX Laboratories Inc.

- Zoetis Inc.

- Virbac

- INDICAL BIOSCIENCE GmbH

- Bionote Inc.

- Kacey Diagnostics

- Quidel Corporation

- BioChek

- MEIKANG Biotech

- VedaLab

- Alere (now Abbott)

- Fassisi GmbH

- Synbiotics Corporation

- Shenzhen Kingnor Technology Co., Ltd.

- Shanghai Chemtron Biotech Co., Ltd.

- Bio-X Diagnostics

- Creative Diagnostics

- VMRD Inc.

- SkySen Biotech

Frequently Asked Questions

Analyze common user questions about the Pet Virus Testing Card market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technological difference between traditional rapid testing cards and next-generation RDTs in pet diagnostics?

Traditional Pet Virus Testing Cards utilize the Lateral Flow Immunoassay (LFIA) with visible gold nanoparticles, offering qualitative (yes/no) results based on subjective visual interpretation. Next-generation RDTs often incorporate Fluorescence Immunoassay (FIA) or digital readers to provide objective, semi-quantitative results, significantly boosting sensitivity and reducing human error through standardized signal measurement.

How are Pet Virus Testing Cards impacting veterinary workflows and disease management in animal shelters?

Testing cards fundamentally accelerate veterinary workflows by delivering actionable diagnostic results within minutes, essential for rapid triage and isolation of potentially infectious animals. In animal shelters, this speed is critical for immediate biosecurity protocols, preventing massive viral outbreaks (like Parvovirus or Panleukopenia) among high-density, vulnerable populations, ensuring better population health management.

What are the main limitations of using Pet Virus Testing Cards compared to laboratory PCR testing?

The main limitations are lower analytical sensitivity and specificity, particularly in early-stage or low-titer infections, which can lead to false negative results. Unlike Polymerase Chain Reaction (PCR), which detects the virus's genetic material and is highly sensitive and quantitative, RDTs detect proteins or antibodies and are often qualitative or semi-quantitative, necessitating confirmatory PCR testing in critical or ambiguous cases.

Which geographical region is expected to show the highest growth rate, and what factors drive this expansion?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This expansion is driven by surging urbanization, the rapidly expanding middle class leading to increased pet ownership, improving veterinary infrastructure, and a growing consumer awareness regarding proactive and preventative companion animal healthcare spending.

How is the concept of multiplex testing cards influencing the Pet Virus Testing Card Market?

Multiplex testing cards, which detect multiple pathogens simultaneously from a single sample, are driving innovation by enhancing diagnostic efficiency. This capability is crucial for differential diagnosis when an animal presents with non-specific, acute symptoms, allowing veterinarians to quickly rule out co-infections and select appropriate treatments, thereby reducing time and overall diagnostic costs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager