Phalaenopsis Orchid Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432995 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Phalaenopsis Orchid Market Size

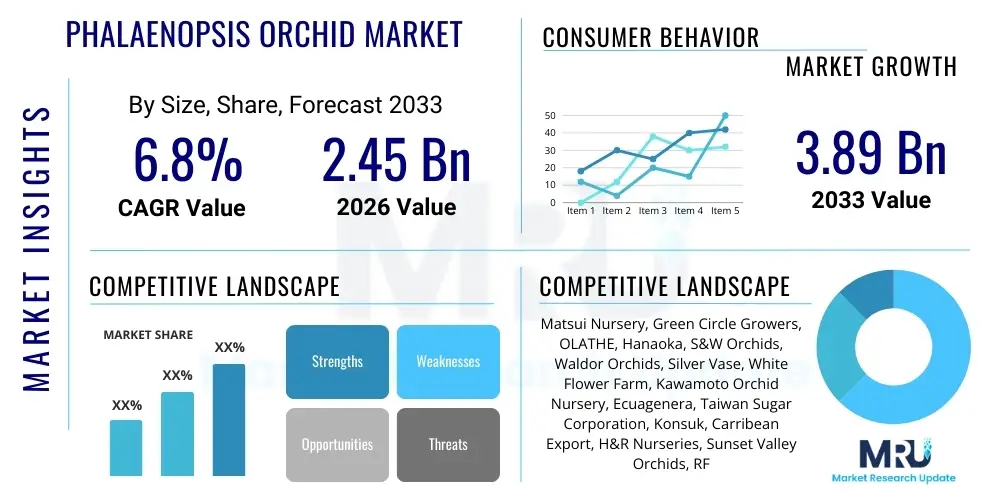

The Phalaenopsis Orchid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 2.45 Billion in 2026 and is projected to reach USD 3.89 Billion by the end of the forecast period in 2033.

Phalaenopsis Orchid Market introduction

The Phalaenopsis orchid, commonly known as the Moth Orchid, stands as the most commercially significant genus within the Orchidaceae family, dominating the potted ornamental plant segment globally. This market is characterized by a strong consumer preference for its long-lasting, vibrant blooms and relatively low maintenance requirements compared to other specialized orchids. The product encompasses various cultivars, including standard hybrids, miniature varieties, and specialized novelty types, catering to diverse consumer aesthetics and space constraints. Its primary appeal lies in its decorative value, making it an essential element in interior landscaping, high-end retail displays, and professional floristry.

Major applications for Phalaenopsis orchids span household decoration, corporate gifting, specialized event adornment, and large-scale commercial landscaping projects, particularly in hotels and office spaces. The market’s resilience is rooted in the continuous development of new color patterns and bloom sizes through advanced breeding techniques, enhancing its attractiveness to repeat buyers and collectors. Furthermore, the shift towards incorporating natural elements into urban living environments has significantly boosted demand for high-quality, readily available flowering houseplants like the Phalaenopsis. These factors collectively establish the Phalaenopsis as a stable and expanding segment within the broader floriculture industry.

Driving factors propelling market expansion include rising disposable incomes in emerging economies, particularly across Asia Pacific, leading to increased spending on discretionary aesthetic purchases. Technological advancements in greenhouse climate control, tissue culture propagation, and integrated pest management (IPM) have drastically improved production efficiency and reduced cultivation cycles, allowing producers to meet escalating demand consistently. The aesthetic appeal, coupled with the proven psychological benefits of integrating ornamental plants into workspaces and homes, continues to serve as a fundamental catalyst for sustained market growth globally. The established supply chain infrastructure, leveraging efficient international logistics, ensures timely delivery of sensitive floral products across continents, further supporting market momentum.

Phalaenopsis Orchid Market Executive Summary

The Phalaenopsis Orchid Market demonstrates robust growth driven primarily by shifting consumer trends towards premium, long-lasting ornamental plants and the increasing popularity of online floral retail. Key business trends indicate a strong focus on automation in large commercial nurseries to mitigate labor costs and enhance crop uniformity. Strategic partnerships between large-scale cultivators and global logistics providers are becoming crucial for maintaining product quality during long-distance shipping. Furthermore, the market is witnessing a consolidation phase, with major players acquiring smaller, specialized breeders to gain access to novel genetic lines and expand regional footprints, thereby optimizing the competitive landscape.

Regional trends highlight Asia Pacific as the dominant growth engine, fueled by established orchid cultivation hubs in Taiwan and Thailand, coupled with booming consumer markets in China and Southeast Asia. Europe remains a mature yet vital market, driven by high per capita spending on decorative plants, particularly in countries like the Netherlands and Germany, which also serve as critical re-export hubs. North America is characterized by increasing domestic production utilizing advanced vertical farming and greenhouse technologies to reduce reliance on imports and improve sustainability metrics, addressing growing consumer demand for locally sourced products.

Segment trends emphasize the rapid adoption of miniature and novelty Phalaenopsis varieties. Miniature orchids appeal to urban dwellers with limited space, while novelty types—featuring unique spotting, color breaks, or petal shapes—cater to a niche but high-value collector base, commanding premium prices. The distribution channel shift shows significant movement toward specialized e-commerce platforms and Direct-to-Consumer (D2C) models, which offer improved customization and freshness guarantee compared to traditional big-box retailers. The application segment sees continued dominance from household decoration, though corporate and gifting applications are exhibiting above-average growth rates, particularly during festive and holiday seasons.

AI Impact Analysis on Phalaenopsis Orchid Market

User inquiries regarding AI's influence in the Phalaenopsis Orchid market center on optimizing cultivation processes, enhancing disease detection, and improving supply chain predictability. Consumers are keen to know if AI can lead to more sustainably grown, genetically superior, and cost-effective orchids. Concerns often revolve around the initial investment required for AI infrastructure and data privacy within proprietary breeding programs. The prevailing expectation is that AI tools, specifically machine vision and predictive analytics, will revolutionize resource management in greenhouses, ensuring optimal temperature, humidity, and nutrient delivery with minimal human intervention, thereby driving overall operational efficiency and consistency in bloom quality.

- AI-Powered Climate Control: Utilizing predictive algorithms to maintain perfect microclimates in greenhouses, optimizing growth cycles and reducing energy consumption.

- Automated Disease and Pest Detection: Deploying machine vision systems to identify early signs of fungal, bacterial, or pest infestations, allowing for precision intervention and reducing chemical usage.

- Yield and Harvest Forecasting: Using deep learning models to accurately predict bloom readiness and volume, crucial for efficient inventory management and market scheduling.

- Optimized Breeding Programs: AI analyzing complex genomic data to accelerate the selection of desirable traits (e.g., color, fragrance, disease resistance) in new hybrids.

- Supply Chain Optimization: Predictive analytics enhancing logistics planning, minimizing transit time losses, and ensuring product freshness upon arrival at retail points.

- Robotics and Automation: Integrating AI-driven robotic systems for delicate tasks like potting, labeling, and quality grading, mitigating labor scarcity challenges.

DRO & Impact Forces Of Phalaenopsis Orchid Market

The dynamics of the Phalaenopsis Orchid market are governed by a complex interplay of internal market demands and external technological and economic shifts. Key drivers include the inherent aesthetic appeal and decorative versatility of the orchids, coupled with ongoing urbanization that increases demand for indoor green spaces. However, the market faces significant restraints, primarily the high capital and operational costs associated with maintaining controlled greenhouse environments, along with the susceptibility of these tropical plants to various pests and climatic volatility. The major opportunity lies in expanding into untapped consumer demographics through novel marketing strategies and leveraging biotechnological advancements for developing stress-tolerant and unique cultivars.

Impact forces shape the competitive landscape and strategic direction of major growers. Technological integration, particularly automation and sensor-based monitoring, is rapidly becoming a non-negotiable factor for profitability, driving economies of scale among large producers. Consumer preference shifts towards sustainable and ethically sourced plants also exert significant force, compelling growers to adopt water-efficient irrigation systems and reduce reliance on synthetic fertilizers and pesticides. Economic forces, such as fluctuating fuel prices and international trade tariffs, impact the highly integrated global supply chain, influencing the final retail price and profitability margins across regions.

The confluence of rising global spending on home decor and the accessibility facilitated by e-commerce platforms acts as a powerful accelerator for market expansion. Nevertheless, the prolonged cultivation cycle—often 18 to 24 months from flask to bloom—poses an inherent constraint on rapid scaling and responsiveness to sudden market surges. Strategic opportunities are being created through the licensing of proprietary genetic material and establishing closed-loop distribution systems that minimize damage and waste, further improving the value proposition for the premium orchid segment.

Segmentation Analysis

The Phalaenopsis Orchid market is critically segmented based on criteria such as type, application, and distribution channel, providing crucial insights into consumer behavior and commercial viability across different product lines. Analyzing these segments helps stakeholders—from breeders to retailers—tailor their strategies to capitalize on high-growth niches, such as the increasing demand for unique genetic variations and the shift towards specialized online sales channels. Understanding the distinct requirements of each end-user category, whether it be a household consumer seeking long-lasting decoration or a commercial client needing large volumes for landscaping, is paramount for optimized production and inventory management.

- By Type:

- Standard Phalaenopsis (Large-flowered hybrids)

- Miniature Phalaenopsis (Compact varieties suitable for small spaces)

- Novelty Phalaenopsis (Unique colors, patterns, or specialized genetic lines)

- By Application:

- Household Decoration (Personal use, interior enhancement)

- Gifts/Presentations (Seasonal events, corporate gifting)

- Commercial Landscaping (Hotels, offices, malls)

- Research/Breeding (Genetic development and study)

- By Distribution Channel:

- Retail Stores (Florists, garden centers)

- Online Platforms (E-commerce, D2C websites)

- Specialized Nurseries (Direct wholesale and retail from grower)

- Supermarkets/Hypermarkets (Mass market retail)

Value Chain Analysis For Phalaenopsis Orchid Market

The value chain for Phalaenopsis orchids is intensive and highly structured, beginning with specialized upstream activities focused on genetic selection and propagation. Upstream analysis involves highly technical processes such as tissue culture propagation (meristemming) in sterile laboratories to ensure the clonal consistency and health of the mother plants. Key upstream players include specialized breeding houses and biotechnology firms that invest heavily in R&D to develop novel, disease-resistant, and high-yielding varieties. The quality of the initial propagules dictates the success and speed of the subsequent growth phase, making this stage critical for market competitiveness and intellectual property protection.

The midstream component encompasses the extensive cultivation and growing phase, typically occurring in highly controlled, computerized greenhouses. This phase demands significant capital investment in climate control, specialized substrates, and nutritional programs over an extended period (18–24 months). Downstream analysis focuses on packaging, logistics, and distribution. Given the delicate nature of the product, efficient, climate-controlled shipping is essential, often involving specialized packaging designed to minimize bloom damage during transit, particularly across international borders.

Distribution channels are multifaceted, blending both direct and indirect routes. Direct distribution involves specialized nurseries or D2C online platforms selling directly to end-consumers or large commercial buyers (hotels, corporations). Indirect distribution relies heavily on mass-market retailers like supermarkets and hypermarkets, as well as specialized floral wholesalers who manage inventory flow between international growers and local florists. The growing prominence of online platforms is streamlining the indirect path by reducing the number of intermediaries, offering consumers fresher products, and providing growers with higher margin opportunities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.45 Billion |

| Market Forecast in 2033 | USD 3.89 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Matsui Nursery, Green Circle Growers, OLATHE, Hanaoka, S&W Orchids, Waldor Orchids, Silver Vase, White Flower Farm, Kawamoto Orchid Nursery, Ecuagenera, Taiwan Sugar Corporation, Konsuk, Carribean Export, H&R Nurseries, Sunset Valley Orchids, RF Orchids, Phalaenopsis Orchids Europe B.V., Orchid Island Growers, Floricultura, SOGO Plant. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Phalaenopsis Orchid Market Potential Customers

The Phalaenopsis Orchid market caters to a broad spectrum of end-users, ranging from individual consumers to large commercial entities, making the identification of distinct buyer segments crucial for targeted marketing. The largest segment remains the general household consumer, who purchases the orchids primarily for interior decoration, seeking long-lasting beauty and ease of care. These buyers often prioritize visual aesthetics, price point, and accessibility, making mass-market retailers and supermarkets their primary purchasing channel. This consumer group drives high volume, though often seeks standard hybrid varieties.

A second major customer segment includes professional buyers such as interior designers, corporate procurement managers, and event planners. These buyers require consistent quality, specific color palettes to match corporate branding or event themes, and large, reliable supply volumes. They predominantly source their products through specialized nurseries and wholesalers who can guarantee scheduled delivery and offer bespoke cultivation arrangements. This segment often purchases high-value, large specimens or customized arrangements for luxury settings like high-end hotels, corporate lobbies, and wedding venues, prioritizing reliability over absolute price minimization.

Finally, there is a specialized segment comprising hobbyists, collectors, and researchers. These customers are highly educated about specific genus requirements and genetics. They seek novelty and rare Phalaenopsis cultivars, often paying significant premiums for unique breeding lines or specific species. They typically transact directly with specialized breeding houses or via highly focused online auction platforms. Targeting this group requires high-precision communication regarding genetic pedigree, cultivation history, and rarity, significantly differing from the mass-market approach.

Phalaenopsis Orchid Market Key Technology Landscape

The operational efficiency and product innovation within the Phalaenopsis Orchid market are heavily reliant on advanced agricultural technologies, particularly those related to controlled environment agriculture (CEA). Key technology involves sophisticated climate control systems that utilize high-precision sensors to monitor and regulate temperature, humidity, CO2 levels, and light intensity (often provided by LED grow lights tailored to the orchid’s spectral needs). This precise control minimizes resource waste and maximizes photosynthetic efficiency, drastically reducing the cultivation period and ensuring year-round, uniform production regardless of external climatic conditions. The move towards fully closed-loop systems is paramount for sustainable production.

Another crucial technological area is biotechnology, underpinning the entire propagation stage. Tissue culture, or micropropagation, remains the standard method for producing thousands of genetically identical, disease-free clones from a single mother plant. Advances in genomics and molecular markers are increasingly being employed in breeding programs to screen for traits such as extended bloom longevity, enhanced disease resistance (especially to bacterial brown spot and fusarium wilt), and novel color expressions. These techniques significantly accelerate the breeding cycle compared to traditional hybridization methods, offering a competitive advantage to firms investing in proprietary genetics.

Furthermore, automation and robotics are transforming the labor-intensive aspects of orchid cultivation. Automated potting machines, precise nutrient delivery systems (fertigation), and specialized internal transport systems within greenhouses minimize the need for manual handling, thereby reducing labor costs and potential damage to the fragile plants. The emerging use of drone imagery and AI-driven monitoring provides large growers with real-time health assessments across vast greenhouse areas, enabling preventive maintenance and targeted interventions, which collectively drive down production losses and enhance overall yield predictability.

Regional Highlights

Regional dynamics play a crucial role in the global Phalaenopsis Orchid market, reflecting variations in consumption patterns, production capabilities, and regulatory environments. Asia Pacific (APAC) dominates the production landscape, primarily led by established, highly efficient cultivation industries in Taiwan, Thailand, and the Netherlands (which serves as a key gateway to global markets). This region benefits from favorable climates for certain growth stages and centuries of floriculture expertise. APAC is also the fastest-growing consumption market, driven by rapidly expanding middle-class populations in China, India, and Southeast Asia, where orchids hold cultural significance as symbols of elegance and prosperity, particularly for gifting during Lunar New Year and other major holidays.

Europe represents a mature market characterized by high consumer spending power and a sophisticated distribution network. The Netherlands acts not only as a major producer but also as the world’s leading hub for floricultural trade, dictating international pricing and innovation trends. European demand focuses heavily on quality, sustainability certifications (e.g., MPS certification), and novel varieties. Germany, the UK, and France are the major consumption countries, with purchasing patterns heavily influenced by seasonal shifts and established retail channels such as large garden centers and florists who emphasize locally grown produce.

North America, led by the United States, is a substantial consumer market increasingly focused on domestic production to minimize logistics costs and improve sustainability. While historically reliant on imports, major growers are adopting massive, high-tech greenhouses to compete with overseas suppliers. The market here is strongly influenced by mass-market retailers (Supermarkets, Big Box Stores), leading to a high demand for standardized, reliable, and competitively priced potted orchids. Latin America and the Middle East & Africa (MEA) currently hold smaller market shares but represent significant long-term opportunities, particularly as tourism infrastructure and luxury retail sectors expand, boosting demand for high-end commercial landscaping and decoration.

- Asia Pacific (APAC): Dominates production and leads in consumption growth; key markets include Taiwan, China, and Japan, focusing on high volume and cultural significance.

- Europe: High-value market focused on quality and sustainability; Netherlands serves as the central trade hub; strong consumer demand in Germany and the UK.

- North America: Significant consumer base driven by mass retail; increasing trend toward sophisticated domestic production using CEA technologies to shorten supply chains.

- Latin America: Emerging regional production centers (e.g., Brazil, Colombia) catering primarily to local and regional export markets; potential growth driven by rising income levels.

- Middle East & Africa (MEA): Niche, high-end market driven by luxury hotels, corporate decoration, and wealthy consumers; reliant mostly on premium imports requiring specialized logistics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Phalaenopsis Orchid Market.- Matsui Nursery

- Green Circle Growers

- OLATHE

- Hanaoka

- S&W Orchids

- Waldor Orchids

- Silver Vase

- White Flower Farm

- Kawamoto Orchid Nursery

- Ecuagenera

- Taiwan Sugar Corporation

- Konsuk

- Carribean Export

- H&R Nurseries

- Sunset Valley Orchids

- RF Orchids

- Phalaenopsis Orchids Europe B.V.

- Orchid Island Growers

- Floricultura

- SOGO Plant

Frequently Asked Questions

Analyze common user questions about the Phalaenopsis Orchid market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current growth forecast for the Phalaenopsis Orchid Market?

The Phalaenopsis Orchid Market is projected to experience stable growth, forecasted at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033, driven by increasing consumer preference for decorative houseplants and expansion in e-commerce floral distribution.

Which segmentation of Phalaenopsis orchids is experiencing the fastest growth?

The Miniature Phalaenopsis and Novelty Phalaenopsis segments are showing the fastest growth rates. Miniatures cater effectively to the space constraints of urban living, while Novelty types attract high-value hobbyists seeking unique genetic color patterns and forms.

How does technological advancement impact the cost of Phalaenopsis production?

Technological advancements, particularly in automated climate control, LED lighting, and robotics, initially require high capital investment. However, these technologies significantly reduce long-term operational costs, improve crop uniformity, minimize labor requirements, and enhance yield predictability, ultimately driving down the per-unit cost of production for large-scale growers.

Which geographic region dominates the global cultivation of Phalaenopsis orchids?

Asia Pacific (APAC), particularly driven by Taiwan and Thailand, remains the leading region for Phalaenopsis orchid cultivation due to highly established specialized farming expertise, efficient propagation techniques, and large-scale greenhouse operations capable of serving global export demand.

What are the primary challenges restraining market expansion for Moth Orchids?

Key market restraints include the long cultivation cycle (18–24 months), which limits rapid response to demand shifts, the high capital and maintenance costs of sophisticated controlled environment agriculture (CEA) required for optimal growth, and the inherent vulnerability of the plants to various fungal and bacterial diseases during transport.

Are Phalaenopsis orchids mainly sold through traditional florists or online platforms?

While traditional florists and garden centers remain vital, the market is rapidly shifting towards online platforms and specialized e-commerce sites. These digital channels offer greater reach, D2C options, and enhanced logistics to ensure product freshness, appealing especially to younger consumer demographics.

What role does sustainability play in current Phalaenopsis market trends?

Sustainability is a major driver, with increasing consumer demand for ethically grown and environmentally responsible products. Growers are responding by implementing water-efficient irrigation, biological pest control, and reducing the use of peat moss, often seeking certifications like MPS to validate their eco-friendly practices.

How significant is the corporate gifting segment within the application analysis?

The corporate gifting segment is highly significant and shows strong seasonal peaks, especially around major holidays and corporate events. Phalaenopsis orchids are favored for their premium appearance and long shelf life, making them preferred corporate gifts over perishable floral arrangements.

How do major growers protect their proprietary orchid genetics?

Major growers primarily use plant breeders' rights (PBR) or plant patents to protect newly developed, proprietary hybrid strains. Additionally, strict control over the tissue culture propagation process and limited licensing agreements help maintain exclusivity and value for unique genetic lines.

What is the expected impact of AI on disease management in orchid cultivation?

AI is expected to drastically improve disease management through machine vision systems that continuously monitor plant health and identify early signs of pathogens or pests long before human inspection. This enables precision application of treatments, significantly reducing overall pesticide and fungicide use.

What is the most crucial step in the Phalaenopsis orchid value chain?

The most crucial step is the upstream propagation stage via tissue culture. Ensuring the production of genetically stable, high-quality, and disease-free propagules (clones) dictates the success, uniformity, and ultimately the market value of the finished flowering plant.

How does currency fluctuation affect international Phalaenopsis trade?

Since the Phalaenopsis market is highly globalized, significant currency fluctuations (particularly involving the Euro and US Dollar) directly impact the profitability of exporters in high-volume regions like Asia and the Netherlands, influencing final consumer prices and procurement strategies globally.

Are there seasonal variations in Phalaenopsis orchid demand?

Yes, demand peaks significantly during major gifting seasons, including Valentine's Day, Mother’s Day, Easter, and especially the Lunar New Year in Asian markets, requiring growers to precisely time their cultivation cycles to maximize output during these crucial windows.

What criteria do commercial buyers use when sourcing orchids for large-scale projects?

Commercial buyers prioritize consistency, volume capacity, precise color matching (to interior design specifications), and logistical reliability. They often require specialized contract growing to ensure scheduled delivery of uniform plants for corporate landscaping or hospitality environments.

Why is Phalaenopsis the most commercially successful orchid genus?

Phalaenopsis is commercially successful due to its long-lasting flowers (often blooming for several months), its wide variety of colors and sizes, its relative ease of care compared to other orchids, and its high rate of successful propagation via modern tissue culture techniques, enabling mass-market accessibility.

What are the main risks associated with cross-border shipping of orchids?

The main risks include temperature and humidity stress leading to bud drop or bloom failure, physical damage during handling, and complex phytosanitary regulations that require extensive documentation and inspection, delaying transit times and increasing costs.

Is the market moving towards vertical farming for Phalaenopsis cultivation?

While true vertical farms are challenging due to the orchid's size requirements, the trend is towards high-tech controlled environment greenhouses. These facilities often utilize multi-tiered growing systems combined with sophisticated LED lighting to maximize spatial efficiency, particularly in land-scarce, high-cost regions.

How important is the Netherlands in the global Phalaenopsis trade?

The Netherlands is critically important, serving as the largest global floriculture trade hub, responsible for a significant portion of production, export, and re-export activities. Its auction systems and integrated logistics networks set international benchmarks for quality and pricing.

What is the typical cultivation duration for a market-ready Phalaenopsis orchid?

The typical commercial cultivation duration, from the flask stage (small plantlet) to a mature flowering plant ready for retail, spans approximately 18 to 24 months, requiring careful staging and environmental manipulation throughout the growth cycle.

How are environmental regulations influencing Phalaenopsis cultivation practices?

Environmental regulations are compelling growers to adopt closed-loop water systems to prevent runoff pollution, adhere to stricter pesticide usage limits, and manage nutrient discharge, thereby raising operational compliance costs but driving overall environmental responsibility within the industry.

What is the market differentiation between standard and novelty Phalaenopsis types?

Standard Phalaenopsis are mass-produced hybrids with consistent, common colors (white, pink) sold at high volume through mass retail. Novelty Phalaenopsis are characterized by unique, rare, or complex color patterns, are produced in lower volumes, and command premium prices primarily targeted at specialized collectors and enthusiasts.

Which segments present the greatest opportunity for new market entrants?

New market entrants can find opportunities in localized, sustainable, and specialized niche markets, particularly those focusing on unique novelty cultivars or leveraging direct-to-consumer digital channels to minimize intermediary costs and ensure product freshness.

What impact do rising energy costs have on Phalaenopsis profitability?

Rising energy costs significantly threaten profitability, as greenhouse cultivation relies heavily on artificial heating, cooling, and lighting (HVAC systems). This is driving major growers to invest in energy-efficient infrastructure, such as thermal screens and sophisticated LED technology, to mitigate operational exposure.

How is genome sequencing contributing to Phalaenopsis breeding?

Genome sequencing is accelerating breeding efforts by allowing scientists to accurately map genes responsible for desirable traits like disease resistance, compact growth habit, or novel coloration. This significantly speeds up the selection process, reducing the time required to bring a new, improved hybrid to market.

What is the primary method used for commercial Phalaenopsis propagation?

The primary commercial method is micropropagation, specifically tissue culture (meristemming). This laboratory technique ensures the rapid production of thousands of genetically uniform, pathogen-free plantlets, essential for maintaining consistency across large commercial batches.

How does the quality grading process affect retail pricing?

Quality grading, which assesses factors like bloom count, flower size, plant height, and leaf health, directly determines the retail price. Premium grades (e.g., those with multiple long spikes and high bloom counts) command significantly higher prices than standard or lower-grade plants sold through mass-market channels.

What is the consumer perception regarding imported versus locally grown Phalaenopsis?

Consumers, particularly in North America and Europe, are increasingly favoring locally grown Phalaenopsis due to perceived freshness, reduced carbon footprint, and support for domestic industries. However, imports often dominate due to established supply chains and lower production costs in major Asian and Dutch centers.

How are social media platforms influencing consumer purchasing decisions for orchids?

Social media platforms are powerful marketing tools, driving demand for aesthetically appealing and unique Phalaenopsis varieties by showcasing them in aspirational home decor settings. Influencer marketing and visual content campaigns significantly boost impulse purchases and brand awareness among younger buyers.

What are the core challenges related to labor management in large orchid nurseries?

Core challenges include securing highly specialized labor for delicate tasks, managing the high costs associated with manual handling and inspection, and coping with seasonal labor peaks. This drives the increasing reliance on automation technologies to stabilize workforce requirements and improve efficiency.

What financial metrics are essential for evaluating the profitability of an orchid growing operation?

Essential financial metrics include Return on Investment (ROI) for greenhouse infrastructure, yield per square meter, Cost of Goods Sold (COGS), labor efficiency (plants handled per hour), and Gross Margin per plant, all measured against the long, fixed cultivation cycle.

How is the packaging technology evolving to protect orchids during transit?

Packaging technology is focusing on robust, specialized inserts and ventilated boxes designed to fix the plant securely, preventing movement and damage to the fragile flower spikes and blooms. The use of specialized insulating materials also helps maintain temperature stability during long-haul shipping.

What role do floriculture auctions play in the Phalaenopsis market pricing?

Floriculture auctions, particularly in the Netherlands, play a central role in transparently establishing daily market prices based on immediate supply and demand dynamics, influencing global commodity pricing for standardized Phalaenopsis varieties traded in high volumes.

Are miniature Phalaenopsis easier to care for than standard varieties?

Miniature Phalaenopsis generally have similar care requirements regarding light and temperature. Their appeal lies in their compact size, making them easier to integrate into smaller urban spaces and requiring less potting material, though they may demand slightly more frequent watering due to smaller pots.

What is the significance of the "flower spike" in Phalaenopsis commerce?

The flower spike is crucial as it determines the potential number and arrangement of blooms. Commercial value increases significantly based on the number of spikes (single, double, or branched) and the length of the spike, which indicates the plant’s maturity and presentation quality.

How does the use of LED lighting benefit orchid growers?

LED lighting allows growers to precisely tailor the light spectrum (photosynthetically active radiation) to the specific needs of the orchid at different growth stages. This optimizes photosynthesis, accelerates growth, and reduces energy consumption compared to traditional high-intensity discharge (HID) lamps.

What consumer groups are driving the demand for novelty Phalaenopsis varieties?

The demand for novelty varieties is driven primarily by specialized collectors, high-end florists seeking unique design elements, and affluent consumers looking for status symbols or rare interior pieces, often characterized by intricate patterns or unique color breaks.

How do trade agreements or tariffs impact the importation of Phalaenopsis?

Trade agreements, such as those within the EU or between major trading blocs, facilitate smoother importation through reduced tariffs and harmonized phytosanitary standards. Conversely, new trade tariffs or restrictions can significantly increase import costs, destabilizing pricing structures and supply routes.

What future trends are anticipated in Phalaenopsis orchid genetics?

Future genetic trends include breeding for increased heat and drought tolerance, developing compact plants suitable for mass consumer markets, and focusing on novel, complex color combinations, including true blue or black pigments, currently achieved through advanced hybridization techniques.

How do Phalaenopsis orchids contribute to the broader ornamental plant market?

Phalaenopsis orchids act as a premium anchor product in the ornamental plant market. Their high perceived value and longevity often attract new consumers to the houseplant category, subsequently driving sales for other decorative flora.

What is the role of digital traceability in the orchid supply chain?

Digital traceability, often implemented via QR codes or RFID tags, allows growers and retailers to track the orchid's journey from propagation flask to retail shelf. This ensures compliance with regulatory standards, validates sustainability claims, and helps manage recalls or quality issues efficiently.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager