Pharma & Cosmetics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434956 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Pharma & Cosmetics Market Size

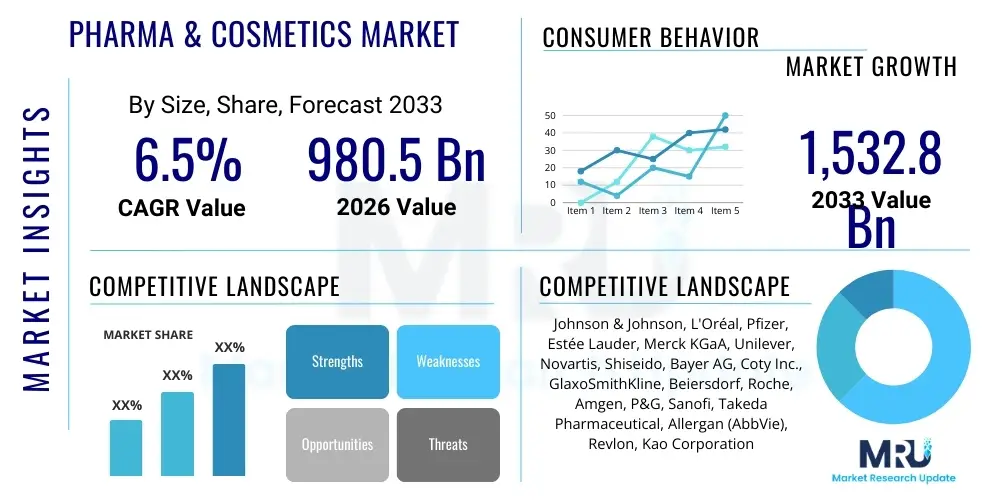

The Pharma & Cosmetics Market, often viewed through the lens of integrated health and aesthetic solutions (cosmeceuticals), is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. This robust growth is fueled by increasing consumer awareness regarding wellness, preventative healthcare, and personalized beauty regimes that often rely on medically substantiated ingredients.

The market is estimated at USD 980.5 Billion in 2026, capturing traditional pharmaceutical sales alongside the burgeoning cosmeceutical sector which requires high-grade research and development typically associated with drug discovery. Regulatory alignment, particularly in the European Union and the United States, is driving manufacturers to uphold pharmaceutical-level standards even in specialized cosmetic lines, thereby increasing overall market valuation and complexity.

The market is projected to reach USD 1,532.8 Billion by the end of the forecast period in 2033. This significant expansion reflects demographic shifts, specifically an aging global population seeking anti-aging solutions and increased disposable income in developing economies, leading to higher spending on both necessary medications and premium appearance-enhancing products that offer measurable clinical efficacy.

Pharma & Cosmetics Market introduction

The Pharma & Cosmetics Market encompasses a broad spectrum of products ranging from highly regulated prescription drugs and over-the-counter pharmaceuticals to specialized cosmetic preparations, often referred to as cosmeceuticals, which bridge the gap between beauty and medicine. This market is characterized by stringent quality control, intensive research and development investments, and high degrees of innovation focused on targeted delivery systems and bio-active ingredients. The convergence of these two industries is accelerating, driven by consumer demand for products offering scientifically proven physiological benefits beyond mere surface appearance, such as dermal repair, cellular regeneration, and optimized skin barrier function.

Major applications span therapeutics, wellness, and aesthetics. Therapeutic applications include dermatological drugs for treating severe skin conditions, while wellness focuses on preventative care and nutritional supplements that impact skin and hair health from within. The aesthetic sector, dominating the cosmetic aspect, utilizes advanced formulations, injectables, and high-performance topical treatments. The increasing globalization of beauty standards and the rapid dissemination of scientific information via digital channels have amplified the market's reach, pushing manufacturers to continuously refine formulations and adhere to evolving international compliance standards. Product descriptions often highlight clinical trial data, pharmaceutical-grade purity, and specific biological mechanisms of action, further blurring the line between drugs and cosmetics.

Key benefits derived from this integrated market include enhanced efficacy through biotechnological advancements, personalized treatment options tailored to individual genetic profiles or microbiome analyses, and improved patient compliance due to aesthetically pleasing delivery formats. Driving factors prominently include technological breakthroughs in drug delivery (e.g., liposomal encapsulation, nano-emulsions), the rise of 'clean' and 'active' beauty concepts, and increasing health consciousness among middle- and high-income demographics globally. Furthermore, the substantial investment in genomics and proteomics allows for the development of highly specific ingredients that target biological aging processes with precision, fostering continuous market dynamism.

Pharma & Cosmetics Market Executive Summary

The Pharma & Cosmetics Market is undergoing profound transformations, marked by rapid cross-industry convergence where pharmaceutical rigor is applied to cosmetic innovation, profoundly affecting business trends. Major pharmaceutical companies are increasingly acquiring or partnering with specialized cosmetic science firms, utilizing their expertise in molecular biology and clinical trials to validate claims for high-end cosmeceuticals. This trend mandates higher expenditure on regulatory compliance and robust intellectual property protection, favoring large entities capable of managing complex global supply chains and diversified product portfolios. Business growth is notably fueled by e-commerce platforms and direct-to-consumer (D2C) models, allowing niche, science-backed brands immediate global market penetration, disrupting traditional retail distribution channels.

Regional trends indicate significant market maturation and growth heterogeneity. North America and Europe remain key revenue centers due to high consumer spending power, stringent regulatory environments fostering trust, and established healthcare infrastructures that support advanced cosmetic procedures and prescribed dermatological solutions. However, the Asia Pacific (APAC) region, particularly China and India, is emerging as the fastest-growing market segment. This growth is driven by expanding middle classes, burgeoning interest in personalized traditional medicine integrated with modern cosmetics, and rapid urbanization leading to increased exposure to environmental stressors, prompting demand for protective and regenerative skin care solutions.

Segment trends highlight the exceptional growth of the cosmeceuticals and functional ingredients segments, such as retinol, hyaluronic acid, peptides, and advanced antioxidants. Within the pharmaceutical application area, specialized dermatology (e.g., biologics for psoriasis, eczema) and injectable aesthetic treatments (dermal fillers, neurotoxins) are showing robust expansion. Furthermore, the distribution landscape is shifting towards medical aesthetics clinics and specialized online pharmacies, reflecting consumer preference for expert consultation and verifiable product authenticity. The market is consolidating around efficacy and safety, prioritizing science-backed claims over purely aesthetic branding.

AI Impact Analysis on Pharma & Cosmetics Market

User inquiries regarding AI's influence in the Pharma & Cosmetics market frequently revolve around its application in personalized product formulation, drug discovery acceleration, supply chain optimization, and consumer experience enhancement. Key themes include the ethical implications of using deep learning for skin diagnostics, the potential for AI-driven clinical trials to speed up ingredient validation, and the shift towards hyper-customized cosmetic recommendations based on genomic or microbiome data. Users are keen to understand how AI minimizes time-to-market for novel drugs and beauty ingredients while maintaining stringent safety standards, reflecting a blend of high expectations for innovation and concerns about data privacy and algorithmic bias in highly personalized regimes.

AI is fundamentally reshaping the R&D pipeline by enabling the rapid screening of millions of molecules for specific biological activities relevant to both therapeutic and cosmetic applications, significantly reducing the cost and duration of preclinical stages. In product development, Machine Learning (ML) models analyze vast datasets encompassing consumer preferences, genetic markers, environmental exposure, and efficacy feedback, allowing companies to formulate highly targeted products, such as personalized anti-aging creams or dosage-specific medications, at scale. Furthermore, AI tools are deployed in quality control and manufacturing, optimizing process parameters to ensure consistency, purity, and adherence to Good Manufacturing Practices (GMP).

Beyond R&D, AI enhances market interaction and sales intelligence. Chatbots and virtual try-on technology powered by AI improve the consumer buying journey, providing diagnostic consultations and personalized recommendations remotely. For the pharmaceutical side, predictive analytics anticipate regulatory bottlenecks and market shortages, improving inventory management and minimizing supply chain disruptions for critical medications. This strategic integration of AI across the value chain positions companies leveraging these technologies for a significant competitive advantage in efficacy, speed, and customization capabilities.

- AI accelerates drug and ingredient discovery by predictive modeling and virtual screening.

- Machine Learning facilitates hyper-personalized product formulation based on genomics and lifestyle data.

- AI-driven diagnostics analyze skin conditions and recommend tailored treatments or cosmetic regimes.

- Predictive analytics optimize supply chain logistics, inventory, and demand forecasting.

- AI enhances clinical trial efficiency by identifying ideal candidates and monitoring real-time data.

- Automated quality control systems reduce manufacturing errors and ensure product consistency.

DRO & Impact Forces Of Pharma & Cosmetics Market

The market is defined by several pivotal forces: Drivers include the accelerating trend of consumer demand for preventative health and personalized wellness products, alongside significant advancements in biotechnology that provide potent, verifiable ingredients. Restraints primarily encompass the extremely high capital investment required for pharmaceutical-grade research and clinical trials, coupled with complex and often divergent international regulatory landscapes that pose significant barriers to global product commercialization. Opportunities are abundant in the integration of digital technologies, particularly in telehealth, remote diagnostics, and the expansion into high-growth emerging economies where market penetration for premium products is still low. These elements collectively shape the strategic landscape, dictating investment priorities and market entry strategies for both established giants and agile startups.

Impact forces stem largely from two critical areas: regulatory policy shifts and rapid demographic changes. Regulatory bodies globally, such as the FDA and EMA, are increasing scrutiny on the safety and efficacy claims of cosmeceuticals, forcing manufacturers to invest heavily in scientific substantiation, effectively elevating the cost of bringing products to market. Simultaneously, the global aging population represents a massive driving force, as older consumers dedicate substantial spending towards anti-aging, regenerative medicine, and chronic condition management, many of which intersect with the dermatological and aesthetic sectors. Economic volatility and geopolitical factors also influence discretionary spending on premium cosmetics, although essential pharmaceuticals remain relatively resilient.

The strategic tension between high efficacy and consumer affordability often defines market dynamics. While consumers are willing to pay a premium for proven results, companies must continuously balance R&D costs with pricing strategies to maintain competitiveness, especially as patents expire and generic competition emerges in pharmaceutical segments, impacting overall profitability. The environmental and sustainability mandate also functions as a powerful, non-financial impact force, compelling companies to reformulate using eco-friendly materials and ethical sourcing, influencing consumer purchasing decisions and corporate branding significantly.

Segmentation Analysis

The Pharma & Cosmetics Market is highly fragmented, segmented primarily based on Product Type, Application, and Distribution Channel, reflecting the diverse pathways through which therapeutic and aesthetic solutions reach the end-user. Product segmentation is crucial, differentiating between traditional pharmaceuticals (prescription and OTC), specialized cosmeceuticals (ingredients with pharmaceutical-level activity), and conventional personal care items. This segmentation helps identify regulatory pathways and competitive landscapes, as pharmaceutical products face stringent clinical trial requirements, while cosmeceuticals navigate complex overlapping regulations.

Application segmentation clarifies the end use, distinguishing between clinical treatments for chronic conditions (Therapeutics), preventative health and general well-being (Wellness), and purely appearance enhancement (Aesthetics). The fastest growth is observed in the convergence of Wellness and Aesthetics, where products promise both external enhancement and internal biological benefits. Understanding these application niches allows companies to tailor marketing messages and distribution strategies, for example, targeting dermatologists for advanced aesthetic solutions and mass retail for general wellness products.

Distribution channel analysis reveals the importance of specialized access points. While retail pharmacies remain vital for OTC and prescription drugs, the rapid expansion of e-commerce platforms has democratized access to specialized cosmeceutical brands globally. Furthermore, the rise of specialized medical spas and aesthetic clinics provides a growing channel for professional-grade and injectable products, necessitating strategic partnerships between manufacturers and certified practitioners to ensure safety and efficacy in administration.

- Product Type:

- Pharmaceuticals (Prescription Drugs, Over-the-Counter Drugs)

- Cosmeceuticals (Active Ingredient-Focused Products)

- Personal Care & Mass Cosmetics

- Application:

- Therapeutics (Dermatology, Anti-Inflammatory)

- Wellness and Preventative Care

- Aesthetics (Anti-Aging, Skin Enhancement)

- Ingredient Type:

- Biologics and Peptides

- Vitamins and Minerals

- Botanical Extracts

- Distribution Channel:

- Retail Pharmacies and Drug Stores

- Online Platforms and E-commerce

- Specialty Stores and Medical Spas

- Direct Sales and Clinics

Value Chain Analysis For Pharma & Cosmetics Market

The value chain for the Pharma & Cosmetics Market is complex, beginning with upstream analysis focused heavily on high-tech R&D, sourcing, and material synthesis. Upstream activities involve extensive clinical and dermatological research to identify novel active pharmaceutical ingredients (APIs) and advanced cosmetic components. Sourcing is critical, requiring validated suppliers for high-purity raw materials, whether synthetic biologics or ethically harvested natural extracts. Compliance with international standards such as ISO certification and GMP is mandatory at this stage, establishing the foundation of quality and safety for all subsequent processes.

Midstream activities involve sophisticated manufacturing, quality control, formulation, and packaging. Due to the sensitive nature of many APIs and cosmeceutical ingredients, manufacturing often requires sterile, controlled environments and highly specialized equipment to ensure stability and efficacy. Packaging plays a dual role: ensuring product integrity (e.g., protecting light-sensitive ingredients) and serving as a critical marketing tool, conveying luxury and scientific credibility. Robust inventory management and adherence to serialization requirements for traceability are essential components of the midstream process, especially for prescription pharmaceuticals.

Downstream analysis focuses on distribution channels, marketing, and sales. Distribution involves both direct and indirect routes. Direct distribution typically includes sales forces engaging healthcare providers (dermatologists, plastic surgeons) and D2C online sales platforms for personalized services. Indirect channels utilize third-party distributors, wholesalers, and mass retail outlets like drugstores and department stores. Marketing strategies are highly differentiated, with pharmaceuticals relying on evidence-based physician promotion, while cosmetics leverage digital media, influencer marketing, and brand storytelling emphasizing clinical efficacy and ethical practices.

Pharma & Cosmetics Market Potential Customers

The potential customer base for the Pharma & Cosmetics Market is broad yet highly segmented, comprising individuals seeking both therapeutic interventions and aesthetic enhancements, alongside healthcare professionals who mediate access to specialized products. End-users fall into distinct groups: the aging population (seeking anti-aging and regenerative treatments), millennials and Gen Z (demanding preventative care, personalized, and 'clean' beauty solutions), and individuals suffering from chronic dermatological conditions (requiring prescription or medically supervised treatments). Geographic location and socioeconomic status heavily influence purchasing power and product sophistication preference.

A crucial category of buyers includes healthcare institutions and practitioners, such as dermatologists, plastic surgeons, medical spas, and compounding pharmacies. These professional buyers purchase products in bulk for in-office procedures, prescriptions, and customized client regimes. Their purchasing decisions are driven by clinical effectiveness, safety profiles, professional endorsements, and the manufacturer's educational support regarding product application and patient outcomes. Manufacturers must maintain high levels of clinical data and professional outreach to serve this segment effectively.

Retail consumers, particularly those prioritizing cosmeceuticals, act as sophisticated buyers who research ingredient efficacy, clinical substantiation, and ethical sourcing before making a purchase. The proliferation of digital information means these buyers are highly informed and demand transparency, often switching brands based on real-world results and perceived value. The rise of personalized medicine buyers, willing to invest significantly in products tailored specifically to their genetic or environmental profile, represents a high-value, fast-growing subset of the potential customer landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 980.5 Billion |

| Market Forecast in 2033 | USD 1,532.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson & Johnson, L'Oréal, Pfizer, Estée Lauder, Merck KGaA, Unilever, Novartis, Shiseido, Bayer AG, Coty Inc., GlaxoSmithKline, Beiersdorf, Roche, Amgen, P&G, Sanofi, Takeda Pharmaceutical, Allergan (AbbVie), Revlon, Kao Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pharma & Cosmetics Market Key Technology Landscape

The technological landscape of the Pharma & Cosmetics market is characterized by innovations aimed at enhancing ingredient efficacy, stability, and targeted delivery. Key enabling technologies include nanotechnology and liposomal encapsulation, which protect sensitive active ingredients from degradation and facilitate deep penetration into the dermal layers, significantly improving bioavailability for both drugs and cosmeceuticals. These microscopic delivery systems are crucial for maximizing the effectiveness of highly potent, often unstable compounds like certain vitamins and peptides, ensuring they reach their specific biological targets with minimized systemic side effects.

Furthermore, advances in biotechnology, specifically in recombinant DNA technology and fermentation processes, are pivotal for the sustainable and scalable production of bio-identical and highly purified active ingredients, such as growth factors, specific proteins, and custom-designed peptides. This allows companies to move away from animal-derived or resource-intensive ingredients while maintaining high biological activity. The adoption of 'omics' technologies—genomics, proteomics, and metabolomics—provides the data necessary for developing personalized medicine and cosmetic products that interact precisely with an individual's unique biological pathways, moving the market from broad solutions to precise interventions.

Digitalization and automation technologies are equally important in modernizing the market's operational aspects. High-throughput screening (HTS) and robotic systems accelerate the testing of thousands of compounds in preclinical stages, dramatically shortening R&D cycles. On the consumer-facing side, advanced diagnostic imaging, virtual reality tools, and sophisticated data analysis platforms provide personalized skin assessments and enable remote consultation services, bridging the gap between expert advice and consumer purchasing decisions, driving the integration of technology throughout the customer journey.

Regional Highlights

Regional dynamics play a significant role in shaping the Pharma & Cosmetics Market, driven by differential regulatory environments, consumer wealth, and cultural priorities regarding health and beauty.

- North America (U.S. and Canada): This region is characterized by high adoption rates of advanced medical aesthetics (injectables, laser treatments) and a robust market for innovative cosmeceuticals backed by clinical data. The strong presence of major pharmaceutical and biotech firms drives significant R&D investment. Regulatory scrutiny is high, particularly through the FDA, fostering consumer trust in product claims. The U.S. remains the single largest revenue contributor.

- Europe (Germany, France, U.K.): Europe leads in sophisticated regulatory frameworks (e.g., EU Cosmetics Regulation), prioritizing product safety and ethical sourcing. France and Germany are major hubs for high-end, clinically focused cosmetic brands and specialized pharmaceuticals. The strong focus on sustainable and 'clean' beauty drives innovation in natural and biotech ingredients.

- Asia Pacific (APAC) (China, Japan, South Korea, India): APAC is the fastest-growing region, fueled by rising disposable incomes, urbanization, and the pervasive influence of K-Beauty and J-Beauty trends which emphasize multi-step routines and preventative skin health. South Korea and Japan are innovation powerhouses in formulation and packaging, while China represents a vast and expanding consumer market for both imported and domestic premium brands.

- Latin America (LATAM) (Brazil, Mexico): LATAM shows strong demand for affordable mass-market cosmetics and personal care, though the professional aesthetic sector, particularly in countries like Brazil, is rapidly expanding due to a culturally strong emphasis on physical appearance and cosmetic procedures. Regulatory harmonization across the region remains a challenge.

- Middle East and Africa (MEA): Growth is primarily concentrated in the Gulf Cooperation Council (GCC) countries, driven by high disposable incomes and a strong preference for luxury and high-efficacy products. Investment in local manufacturing and pharmaceutical production is increasing, aiming to reduce reliance on imports and adhere to local regulatory standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pharma & Cosmetics Market, covering their strategic initiatives, product portfolios, R&D focus, and market positioning. These companies often lead innovation in convergence areas such as cosmeceuticals, advanced dermatology, and personalized health solutions.- Johnson & Johnson

- L'Oréal

- Pfizer

- Estée Lauder

- Merck KGaA

- Unilever

- Novartis

- Shiseido

- Bayer AG

- Coty Inc.

- GlaxoSmithKline

- Beiersdorf

- Roche

- Amgen

- Procter & Gamble (P&G)

- Sanofi

- Takeda Pharmaceutical Company Limited

- Allergan (AbbVie)

- Revlon

- Kao Corporation

Frequently Asked Questions

Analyze common user questions about the Pharma & Cosmetics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor behind the convergence of the Pharma and Cosmetics industries?

The primary driver is consumer demand for products offering clinically proven efficacy and measurable health benefits beyond basic aesthetics, leading to the rise of cosmeceuticals which mandate pharmaceutical-grade research and testing protocols for ingredient validation and safety assurance.

How does AI contribute to personalization in the Pharma & Cosmetics Market?

AI utilizes sophisticated algorithms to analyze large datasets, including genetic predispositions, microbiome data, environmental factors, and consumer feedback, allowing companies to formulate, recommend, and dispense hyper-customized cosmetic treatments and dosage-specific medications efficiently.

Which regulatory challenges most significantly restrain market growth?

The most significant restraint is the complex and disparate international regulatory landscape, which necessitates extremely high investment in clinical trials, scientific substantiation, and regional compliance management for products that bridge the gap between therapeutic drugs and cosmetic preparation.

What role does biotechnology play in developing new products?

Biotechnology is crucial for synthesizing highly pure and potent active ingredients, such as specific peptides, growth factors, and bio-identical compounds, which are utilized for targeted regenerative and anti-aging effects in advanced pharmaceuticals and premium cosmetic formulations.

Where are the highest growth opportunities located geographically?

The highest growth opportunities are concentrated in the Asia Pacific (APAC) region, particularly in markets like China and India, driven by rapidly increasing consumer disposable incomes, high rates of urbanization, and a cultural emphasis on preventative health and appearance enhancement.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager