Pharmaceutical & Biotechnology Environmental Monitoring Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431818 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Pharmaceutical & Biotechnology Environmental Monitoring Market Size

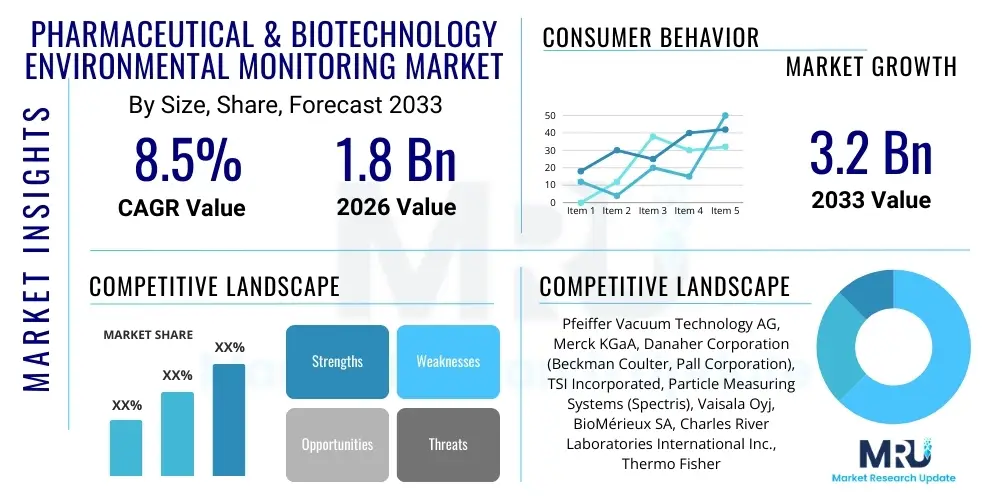

The Pharmaceutical & Biotechnology Environmental Monitoring Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.2 Billion by the end of the forecast period in 2033.

Pharmaceutical & Biotechnology Environmental Monitoring Market introduction

The Pharmaceutical & Biotechnology Environmental Monitoring Market encompasses the specialized equipment, consumables, and services required to continuously assess and control critical environmental parameters within controlled manufacturing environments, such as cleanrooms, laboratories, and storage facilities. This monitoring is fundamental for maintaining Good Manufacturing Practice (GMP) compliance, ensuring product sterility, and guaranteeing patient safety, particularly in the production of sterile drug products, vaccines, and advanced biologic therapies. Key monitoring applications include airborne particulate counting, viable (microbial) air sampling, surface and personnel monitoring, temperature and humidity mapping, and differential pressure tracking across classified areas.

The complexity and high value of modern biopharmaceuticals, coupled with stringent regulatory guidelines enforced by agencies like the FDA, EMA, and WHO, drive the necessity for robust environmental monitoring systems. These systems have evolved from manual sampling methods to highly automated, integrated solutions utilizing real-time sensor technology and centralized data management platforms. The primary goal is not only detecting deviations but also providing predictive analytics to prevent contamination events before they compromise product quality or necessitate costly batch rejection. These advancements are crucial in mitigating risks associated with cross-contamination and ensuring product integrity throughout the manufacturing lifecycle.

Major applications of environmental monitoring tools are heavily concentrated in aseptic processing areas, formulation and filling lines, and quality control laboratories. The market benefits significantly from the expansion of the global biologics sector, increased investments in sterile injectables, and the growing demand for Contract Manufacturing Organizations (CMOs) specializing in high-standard contamination control. Driving factors include the increasing incidence of regulatory audits focusing on data integrity, the shift toward continuous manufacturing processes requiring dynamic monitoring, and technological innovations offering greater sensitivity and faster result turnaround times for microbial detection.

Pharmaceutical & Biotechnology Environmental Monitoring Market Executive Summary

The Pharmaceutical & Biotechnology Environmental Monitoring Market demonstrates robust expansion driven primarily by critical regulatory pressures and the rapid global proliferation of advanced therapeutic modalities, notably monoclonal antibodies, cell and gene therapies, and mRNA vaccines, which demand ultra-stringent contamination control. Business trends indicate a strong shift towards fully automated, integrated monitoring systems that leverage IoT connectivity and cloud-based data storage, moving away from decentralized, manual logging methods. This digitalization enhances data integrity (a major regulatory focus) and facilitates real-time decision-making, significantly reducing potential time-to-market delays caused by quality exceptions. Furthermore, service providers offering validation, calibration, and data analysis support are seeing increasing demand as manufacturers seek to outsource non-core environmental quality functions.

Regionally, North America and Europe maintain dominance, characterized by highly established regulatory frameworks, high levels of pharmaceutical R&D spending, and early adoption of novel monitoring technologies, particularly within large pharmaceutical corporations and specialized biotechnology hubs. However, the Asia Pacific region, led by China and India, is registering the highest growth trajectory due to massive government investments in local pharmaceutical manufacturing capabilities, expansion of global CMO footprints, and rapidly maturing regulatory landscapes demanding adherence to international quality standards. The market growth in APAC is further fueled by the need to upgrade legacy facilities to meet modern GMP requirements, driving sales for both hardware and software solutions.

Segmentation trends highlight the dominance of the consumables segment, including microbial culture media, filters, and specialized sampling accessories, driven by their recurrent purchase cycle essential for continuous monitoring protocols. The largest growth is anticipated in the software and services segment, reflecting the industry's need for advanced analytics platforms, Laboratory Information Management Systems (LIMS) integration, and validation services necessary to handle the large volumes of real-time data generated by automated systems. Technology-wise, real-time viable particle counters and rapid microbial detection systems are gaining traction as they significantly reduce the lengthy incubation periods traditionally associated with contamination confirmation, accelerating product release processes.

AI Impact Analysis on Pharmaceutical & Biotechnology Environmental Monitoring Market

Common user questions regarding AI's influence in environmental monitoring center on its ability to predict contamination events, automate root cause analysis (RCA), and enhance data integrity validation within regulated settings. Users frequently inquire about how AI models can process continuous streams of data from disparate sensors—such as particle counters, temperature logs, and pressure sensors—to identify subtle, nascent anomalies that precede critical failure points. There is significant interest in using Machine Learning (ML) algorithms for pattern recognition in complex cleanroom environments, specifically concerning identifying non-standard operational shifts or equipment degradation that might lead to microbial excursions. Concerns often revolve around the validation of AI systems under strict GMP regulations, the interpretability of algorithmic decisions (Explainable AI or XAI), and the potential for AI-driven automation to reduce human error in critical data handling and trend analysis, positioning AI as a transformative tool for proactive quality assurance.

AI's primary impact involves shifting environmental quality control from reactive intervention to proactive risk management. By employing sophisticated deep learning algorithms trained on historical monitoring data, including production schedules, personnel movements, and maintenance records, manufacturers can establish highly precise baseline operating parameters. When sensor data deviates from these AI-defined norms, the system triggers alerts, often hours or days before a human analyst might identify a statistically significant adverse trend. This capability significantly reduces the window of exposure to potential contamination and minimizes the risk associated with batch failures. Furthermore, AI automates the generation of complex trend analysis reports required for regulatory submissions, streamlining the quality assurance workload.

The integration of AI also optimizes resource allocation within the monitoring program. For instance, predictive models can prioritize which cleanroom zones or equipment require more frequent physical sampling based on their predicted risk scores derived from real-time operational data. This targeted approach ensures that expensive human resources and consumables are deployed where the contamination risk is highest, thereby increasing the efficiency and cost-effectiveness of the overall monitoring strategy. Validation of these AI systems, however, remains a key challenge, requiring robust documentation to prove that the algorithmic decisions consistently comply with regulatory expectations regarding data accuracy and quality control standards.

- AI enables predictive modeling to forecast potential contamination events based on multivariate sensor data inputs, reducing reliance on retrospective analysis.

- Machine Learning algorithms automate the identification of subtle data anomalies and deviations in environmental parameters, improving trend analysis complexity and speed.

- AI enhances data integrity and compliance by automatically flagging inconsistencies in sensor readings or logging procedures, thereby strengthening GMP documentation.

- Automation of root cause analysis (RCA) through AI tools minimizes the time required to isolate the source of microbial excursions or particulate spikes.

- Optimization of sampling frequency and location based on real-time, AI-calculated risk scores for specific manufacturing zones.

DRO & Impact Forces Of Pharmaceutical & Biotechnology Environmental Monitoring Market

The market dynamics are defined by a strong confluence of regulatory mandates (Drivers), significant capital investment and validation hurdles (Restraints), and the rise of advanced therapies necessitating specialized clean environments (Opportunities), all shaping the competitive intensity of the Impact Forces. The stringent global focus on preventing recalls, especially for sterile injectables and biologics, creates non-negotiable demand for high-fidelity monitoring solutions. Conversely, the high initial cost of implementing fully automated, validated systems, coupled with the need for specialized IT and validation expertise, acts as a brake on adoption, particularly for smaller biotechnology startups and mid-sized CMOs in developing regions. These opposing forces dictate market penetration rates and influence the adoption strategy, pushing vendors towards offering subscription-based or modular solutions to ease entry barriers.

The core Drivers include the escalating number of infectious disease outbreaks and subsequent rapid growth in vaccine manufacturing, which mandates exceptional environmental control, and the global convergence towards harmonized quality standards (e.g., ISO, ICH Q9) requiring continuous monitoring documentation. Restraints encompass the complexity of validating new software solutions under GMP Annex 1 guidelines, the resistance to replacing legacy systems due to high switching costs, and the ongoing challenge of managing massive volumes of data generated by continuous monitoring networks while maintaining data integrity. Furthermore, skilled labor shortages required to manage and maintain advanced analytical equipment pose operational bottlenecks for end-users.

Significant Opportunities arise from the rapidly expanding market for cell and gene therapies (ATMPs), which are produced in highly controlled, often segregated cleanrooms, requiring ultra-precise monitoring of both non-viable and viable particulates in small, isolated environments. The transition to single-use systems in bioprocessing also drives demand for specialized, non-invasive monitoring tools. Impact forces, such as the threat of new entrants offering SaaS monitoring platforms and the bargaining power of major pharmaceutical buyers demanding integrated solutions, compel existing market players to continually innovate, focusing on reducing detection times, improving sensor durability, and simplifying data integration with existing manufacturing execution systems (MES) and LIMS.

Segmentation Analysis

The Pharmaceutical & Biotechnology Environmental Monitoring market is comprehensively segmented based on the type of product utilized, the nature of the sampling method, the specific application area within the facility, and the end-user profile. The product segmentation is critical as it delineates between essential hardware (monitoring instruments), necessary consumables (media, reagents), and complex software/services required for data interpretation and compliance. Sampling type differentiates between the traditional, growth-dependent viable monitoring (microbial) and the immediate, physical measurement of non-viable particulates and environmental physics (temperature, pressure), each serving distinct regulatory requirements for quality control.

Analysis by application focuses on the specific zones within the manufacturing environment where monitoring is deployed. Cleanroom monitoring represents the largest segment, demanding continuous, high-sensitivity instrumentation for classified areas (Grade A, B, C, D). Other crucial applications include controlled storage area monitoring and specialized utility monitoring (e.g., purified water systems, clean steam). End-user analysis reveals that pharmaceutical and biotechnology companies, being the primary beneficiaries and regulated entities, account for the majority of the market share, followed closely by outsourced operations handled by Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs).

- By Product:

- Monitoring Instruments

- Non-Viable Particle Counters

- Viable Air Samplers (Active and Passive)

- Real-Time Viable Monitoring Systems

- Temperature and Humidity Monitoring Devices

- Pressure Differential Monitors

- Consumables

- Culture Media and Plates

- Filters and Membranes

- Reagents and Swabs

- Software and Services

- Environmental Monitoring Software (EMS)

- Data Acquisition and Management Systems

- Validation, Calibration, and Maintenance Services

- Monitoring Instruments

- By Sampling Type:

- Viable Monitoring (Microbial)

- Non-Viable Monitoring (Physical)

- By Application:

- Cleanroom Monitoring

- Controlled Storage Area Monitoring

- Utility Monitoring (Water and Gas Systems)

- By End User:

- Pharmaceutical Companies

- Biotechnology Companies

- Contract Manufacturing Organizations (CMOs) and CROs

- Academic and Research Institutes

Value Chain Analysis For Pharmaceutical & Biotechnology Environmental Monitoring Market

The value chain for environmental monitoring systems is highly structured, beginning with upstream raw material suppliers and ending with downstream services supporting pharmaceutical manufacturing clients. Upstream activities involve the sourcing of specialized components, including high-precision sensors (e.g., optical sensors for particle counting, thermistors for temperature), sophisticated electronics, and specialized biological media preparation materials. Key players at this stage focus on optimizing material quality and ensuring supply chain robustness, crucial for maintaining instrument calibration and consumable consistency, both of which are regulated heavily.

Midstream activities involve the design, manufacturing, and integration of the final monitoring instruments and software platforms. This stage is characterized by high R&D intensity, focusing on developing systems that comply with evolving regulatory standards like EU GMP Annex 1 for continuous monitoring and data integrity requirements (21 CFR Part 11). Manufacturers differentiate themselves through product accuracy, system integration capabilities (compatibility with LIMS/MES), and the development of proprietary software algorithms for alarm management and reporting. Distribution channels are typically a mix of direct sales teams, especially for large, complex cleanroom projects requiring extensive custom installation, and specialized indirect distributors who provide localized support, technical expertise, and quicker access to consumables and standardized replacement parts.

Downstream operations are centered on the end-users and the critical support services. Direct sales channels are frequently employed for highly specialized or customized monitoring systems sold to Tier 1 pharmaceutical companies, allowing for closer collaboration during installation and validation. Indirect channels, often involving local distributors or accredited service partners, manage the recurring revenue stream derived from consumable sales (e.g., petri plates, sampling fluids) and mandatory annual calibration and validation services. Potential customers rely heavily on vendors not just for the equipment but also for ongoing support to ensure the system remains validated and compliant throughout its operational lifecycle, creating a significant reliance on high-quality post-sales technical service offerings.

Pharmaceutical & Biotechnology Environmental Monitoring Market Potential Customers

The primary cohort of potential customers for pharmaceutical and biotechnology environmental monitoring solutions consists of entities directly involved in the sterile and non-sterile production of pharmaceuticals, biologics, and medical devices. This includes major multinational pharmaceutical corporations that operate extensive global manufacturing networks requiring standardized, interconnected monitoring systems for high-volume drug production. These companies are driven by the need for enterprise-level data management and harmonization across multiple sites to satisfy global regulatory demands and internal quality standards, investing heavily in automated, continuous monitoring infrastructure.

A rapidly growing segment of potential customers includes specialized biotechnology firms and startups focused on developing advanced therapies such as cell and gene therapies (ATMPs). These entities often operate smaller, highly complex cleanroom environments where contamination control is paramount due to the autologous or highly sensitive nature of the products. Their buying decisions are focused on ultra-sensitive monitoring technology, often favoring rapid microbial detection systems and smaller, modular monitoring solutions that can be easily validated for bespoke manufacturing processes. They frequently rely on vendors for comprehensive validation services due to limited in-house quality assurance expertise.

Furthermore, Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs) represent significant potential customers. As pharmaceutical companies increasingly outsource production, CMOs must demonstrate exceptionally high standards of environmental control to secure contracts from multiple global clients. Their demand focuses on flexible, highly configurable monitoring systems capable of handling frequent product changeovers while maintaining continuous regulatory compliance, often requiring advanced software platforms for efficient batch record review and audit preparedness. Academic and government research laboratories also constitute a smaller, yet consistent, customer base, particularly those involved in federally funded drug discovery or vaccine development requiring GLP/GMP compliance in their pilot facilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.2 Billion |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pfeiffer Vacuum Technology AG, Merck KGaA, Danaher Corporation (Beckman Coulter, Pall Corporation), TSI Incorporated, Particle Measuring Systems (Spectris), Vaisala Oyj, BioMérieux SA, Charles River Laboratories International Inc., Thermo Fisher Scientific Inc., Romer Labs (DSM), Lighthouse Worldwide Solutions Inc., Setra Systems Inc., Testo SE & Co. KGaA, Esco Group, Chemchek Instruments Inc., Mettler-Toledo International Inc., Novatek International, ProCleanroom, Veltek Associates Inc., Federal Sterilizer (Steris) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pharmaceutical & Biotechnology Environmental Monitoring Market Key Technology Landscape

The current technology landscape in environmental monitoring is defined by a shift from manual, intermittent sampling toward highly integrated, continuous monitoring systems leveraging Industry 4.0 principles. The core of this transformation involves sophisticated sensor technologies, specifically high-sensitivity laser particle counters that provide real-time data on non-viable particulates, crucial for maintaining cleanroom classifications (e.g., ISO Class 5/Grade A). Furthermore, the introduction of real-time viable particle counters (RTVPCs) utilizing laser-induced fluorescence (LIF) technology is paramount, offering immediate detection of biological particles without the required two-to-seven-day incubation period of traditional microbial methods, drastically reducing quality assurance hold times and accelerating potential intervention.

Connectivity and data management represent another critical technological pillar. Modern environmental monitoring systems (EMS) are increasingly IoT-enabled, featuring wireless communication protocols and cloud-based data storage architecture. This connectivity allows for centralized data acquisition from hundreds of sensors across large facilities, ensuring data integrity is maintained through secure, time-stamped, and auditable records compliant with FDA 21 CFR Part 11. The software component has matured significantly, offering advanced visualization dashboards, automated deviation reporting, and integrated validation tools to simplify the complex task of regulatory documentation and periodic review required by GMP Annex 1.

Beyond standard particle and temperature monitoring, advanced technologies include automated surface and personnel monitoring techniques, often employing rapid swab analysis kits or automated plate handling systems to minimize human intervention and potential cross-contamination during sampling. Innovations in air sampling focus on directional sampling probes and isokinetic probes designed for accurate integration into restricted access barrier systems (RABS) and isolators. The convergence of these hardware and software advancements facilitates predictive maintenance, allowing facilities managers to identify failing sensors or environmental control systems (HVAC) before they lead to regulatory non-compliance or product loss, embodying the goal of continuous process verification.

Regional Highlights

The global Pharmaceutical & Biotechnology Environmental Monitoring Market exhibits distinct regional adoption patterns influenced by regulatory maturity, R&D intensity, and manufacturing capacity.

- North America: Dominates the market share due to the stringent enforcement of FDA regulations, the presence of major biopharmaceutical companies, and high investment in advanced sterile manufacturing technologies, particularly for biologics and ATMPs. The region is a leader in adopting continuous monitoring systems and implementing AI/ML-driven analytics platforms for risk management.

- Europe: Represents the second-largest market, characterized by strict compliance with EU GMP Annex 1 revisions, which emphasize Quality Risk Management (QRM) and continuous process validation. Germany, Switzerland, and Ireland are key hubs, focusing heavily on technology upgrades to harmonize monitoring practices across pharmaceutical supply chains, driving demand for validated software and services.

- Asia Pacific (APAC): Expected to be the fastest-growing region, fueled by massive government initiatives to expand local drug manufacturing, particularly in China and India. Rapid urbanization, increasing healthcare expenditure, and the influx of foreign pharmaceutical investment necessitate the modernization of monitoring infrastructure to meet international quality standards. The demand is high for cost-effective, yet reliable, sensor technology and integrated system solutions.

- Latin America: Market growth is moderate, often driven by subsidiaries of global pharmaceutical giants and increasing demand for localized vaccine production. Regulatory environments are maturing, prompting incremental investment in certified monitoring equipment, although budget constraints often favor basic or semi-automated systems over fully continuous enterprise solutions.

- Middle East and Africa (MEA): This region is nascent but showing potential, primarily concentrated in countries like Israel (strong biotech base) and Saudi Arabia/UAE (investments in local pharmaceutical production). Growth is tied to government diversification strategies and efforts to establish regional manufacturing security, leading to targeted investment in compliant cleanroom environments and essential monitoring tools.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pharmaceutical & Biotechnology Environmental Monitoring Market.- Pfeiffer Vacuum Technology AG

- Danaher Corporation (via Beckman Coulter and Pall Corporation)

- TSI Incorporated

- Particle Measuring Systems (A Spectris company)

- Vaisala Oyj

- BioMérieux SA

- Charles River Laboratories International Inc.

- Thermo Fisher Scientific Inc.

- Lighthouse Worldwide Solutions Inc.

- Setra Systems Inc.

- Testo SE & Co. KGaA

- Novatek International

- Validair Monitoring Solutions Ltd.

- Mesa Laboratories Inc.

- Veltek Associates Inc.

- Bürkert Fluid Control Systems

- RMB Electro-Tech

- Esco Group

- Solara Analytical Labs

- Kaye (Amphenol Advanced Sensors)

Frequently Asked Questions

Analyze common user questions about the Pharmaceutical & Biotechnology Environmental Monitoring market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for investment in Pharmaceutical Environmental Monitoring systems?

The primary driver is stringent global regulatory compliance, particularly related to aseptic processing defined by agencies like the FDA (21 CFR Parts 210/211) and EMA (EU GMP Annex 1). These regulations mandate continuous monitoring of critical parameters—such as non-viable particulates and microbial loads—to ensure product sterility and prevent costly batch rejections or recalls, making compliance non-negotiable for market access and patient safety.

How are advancements in viable (microbial) monitoring impacting the industry?

The industry is rapidly adopting Real-Time Viable Particle Counters (RTVPCs) which use technologies like Laser-Induced Fluorescence (LIF) to detect airborne microbial particles instantly. This advancement significantly reduces the traditional lag time associated with agar plate incubation (2–7 days), enabling immediate intervention upon contamination detection, thereby dramatically accelerating quality control decision-making and product release cycles.

What role does digitalization play in meeting data integrity requirements for environmental monitoring?

Digitalization, powered by IoT and Environmental Monitoring Software (EMS), ensures robust data integrity by providing automated, secure, and auditable data logs that comply with 21 CFR Part 11. Centralized, connected systems eliminate manual transcription errors, offer time-stamped records, and facilitate easy trend analysis and rapid report generation, which are critical components for regulatory audits and maintaining a validated state.

Which geographical region exhibits the fastest growth potential for Environmental Monitoring solutions?

The Asia Pacific (APAC) region, specifically countries like China and India, is poised for the fastest growth. This is attributed to massive governmental and private investments aimed at expanding local pharmaceutical manufacturing capacity, modernizing existing facilities to meet international GMP standards, and catering to the surging global demand for generic drugs and vaccines manufactured under stringent environmental controls.

What are the key differences between viable and non-viable monitoring in cleanrooms?

Non-viable monitoring involves counting physical airborne particles (like dust or fibers) to confirm the cleanroom’s physical classification (e.g., ISO Grade), offering immediate results. Viable monitoring, conversely, involves sampling air or surfaces to culture and quantify living microorganisms, assessing the biological risk to the product. Both are essential, but the trend is toward integrating faster, real-time technology for both viable and non-viable assessments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager