Pharmaceutical Capsule Filling Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434086 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Pharmaceutical Capsule Filling Machine Market Size

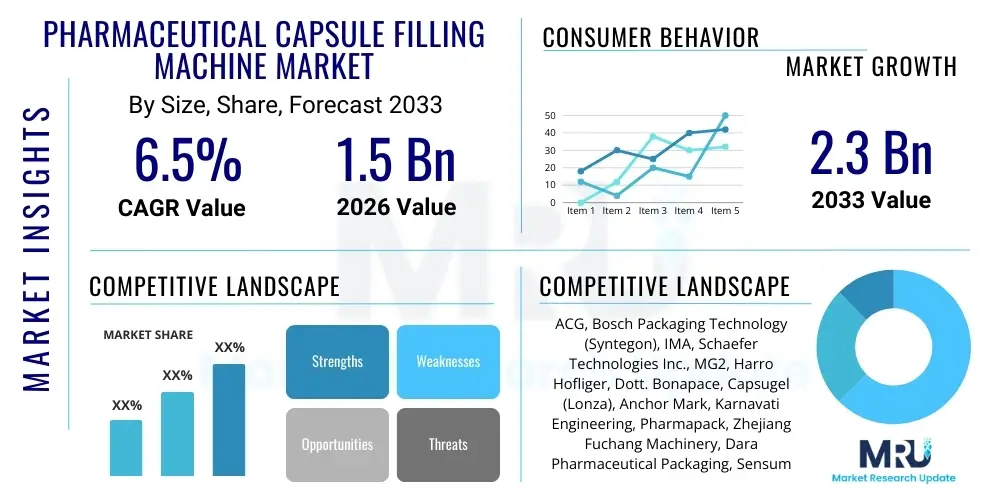

The Pharmaceutical Capsule Filling Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.3 Billion by the end of the forecast period in 2033.

Pharmaceutical Capsule Filling Machine Market introduction

The Pharmaceutical Capsule Filling Machine Market encompasses equipment essential for precisely and efficiently filling hard or soft gelatin capsules with various dosage forms, including powders, pellets, granules, liquids, and combination fills. These sophisticated machines are crucial components of solid dosage manufacturing lines, ensuring dosage accuracy, consistency, and high throughput necessary for mass production under strict regulatory compliance frameworks. The increasing global demand for pharmaceuticals, especially complex generics and over-the-counter (OTC) products encapsulated in unit dose formats, is fundamentally driving the adoption of advanced capsule filling technology across both established and emerging pharmaceutical hubs.

Capsule filling equipment is categorized primarily by operation speed—manual, semi-automatic, and fully automatic—and by filling mechanism, such as tamping pin, dosing disc, or vacuum-based systems. These machines offer several inherent benefits over tablet compression, including improved bioavailability for certain formulations, better taste masking, and ease of personalization in clinical trial settings. Applications span prescription drugs, dietary supplements, and specialized veterinary medicines, demanding flexible machinery capable of handling diverse excipients and active pharmaceutical ingredients (APIs) while minimizing product loss.

Major driving factors influencing market expansion include the rapid proliferation of contract manufacturing organizations (CMOs) seeking high-speed, flexible equipment, stringent regulatory requirements mandating precise dosing and traceability, and continuous technological advancements focused on integrating predictive maintenance and automation. Furthermore, the growing trend toward personalized medicine and the rise of novel dosage forms requiring specialized liquid or combination filling capabilities are propelling pharmaceutical manufacturers to invest in state-of-the-art capsule filling systems to maintain competitive efficiency and regulatory adherence.

Pharmaceutical Capsule Filling Machine Market Executive Summary

The Pharmaceutical Capsule Filling Machine Market is undergoing a significant transformation characterized by a strong shift toward fully automated, high-precision systems integrated with Industry 4.0 principles. Business trends indicate increased consolidation among leading equipment manufacturers, focusing on offering end-to-end solutions that incorporate advanced quality control measures, such as inline weight checking (IWC) and statistical process control (SPC). Key players are prioritizing the development of modular machinery designed for quick changeovers between different capsule sizes and formulation types, addressing the growing market need for flexible production schedules demanded by personalized medicine and smaller batch requirements in specialized treatments.

Regionally, the Asia Pacific (APAC) market is poised for the most rapid growth, fueled by massive investments in pharmaceutical manufacturing infrastructure in China and India, driven by their roles as global suppliers of generic drugs and vaccines. North America and Europe, while mature, maintain their dominance in terms of technological adoption, particularly concerning the implementation of sophisticated software for predictive analytics and advanced robotics in machine handling. Latin America and the Middle East & Africa (MEA) are emerging as significant markets due to improving healthcare expenditure and the establishment of local production facilities aiming for self-sufficiency in essential medicines, creating consistent demand for reliable, mid-range automated equipment.

Segment trends highlight the fully automatic machine category as the most dominant and fastest-growing segment, primarily driven by the imperative of maximizing throughput and minimizing human error in large-scale operations. Within filling technologies, the tamping pin and dosing disc systems remain prevalent for powder and granule filling due to their reliability and efficiency. However, there is a distinct upward trend in demand for liquid and pellet filling capabilities, reflecting the pharmaceutical industry's focus on formulating poorly soluble APIs that require advanced delivery systems such as self-emulsifying drug delivery systems (SEDDS) or multiparticulate systems encapsulated within hard capsules.

AI Impact Analysis on Pharmaceutical Capsule Filling Machine Market

User inquiries regarding the integration of Artificial Intelligence (AI) in capsule filling often center on three critical themes: enhancing predictive maintenance schedules, optimizing complex dosing processes for novel formulations, and ensuring unparalleled quality assurance through real-time data analysis. Users are highly interested in how AI can transition maintenance from reactive to predictive, thereby minimizing costly downtime and improving overall equipment effectiveness (OEE). There is also significant curiosity about AI’s capability to manage the minute adjustments required for filling heterogeneous materials, such as combination fills or highly cohesive powders, where traditional controls might struggle to maintain strict weight uniformity.

The pervasive expectation is that AI algorithms will revolutionize quality control by analyzing continuous data streams from inline inspection systems, detecting anomalies that human operators or standard statistical methods might miss. This includes leveraging machine vision for high-speed capsule defect identification (e.g., body/cap separation, dents, foreign objects) and using deep learning models to correlate machine parameters (e.g., humidity, feeder speed, tamping force) with final product quality, allowing for autonomous, fine-grained process adjustments. Furthermore, pharmaceutical manufacturers view AI as a vital tool for achieving greater regulatory compliance and traceability by creating immutable digital records of every production run, validated by AI-driven anomaly detection systems.

Ultimately, the impact of AI is anticipated to lead to smart, self-optimizing capsule filling lines. By deploying AI and machine learning (ML), manufacturers can achieve higher first-pass yield, significantly reduce material waste associated with start-up and deviation management, and accelerate product scale-up times by rapidly determining optimal processing windows. This shift moves the industry away from reliance on empirical testing toward data-driven, closed-loop manufacturing environments, fostering a paradigm of continuous improvement in solid dosage production efficiency and reliability.

- AI-powered Predictive Maintenance: Forecasting equipment failure based on sensor data, reducing unplanned downtime by up to 30%.

- Real-time Process Optimization: Utilizing ML algorithms to dynamically adjust filling parameters (e.g., tamping pressure, powder depth) to maintain precise dosage uniformity.

- Enhanced Quality Control (QC): Implementing machine vision systems paired with deep learning for high-speed, automated defect detection and rejection.

- Advanced Traceability: Creating comprehensive digital twins of the filling process to ensure audit readiness and compliance with GMP standards.

- Reduced Formulation Waste: Optimizing machine setup and transition processes, particularly for high-value or highly potent APIs, minimizing material loss.

- Autonomous Calibration: Self-adjusting machine settings based on real-time environmental factors (temperature, humidity) affecting powder flow characteristics.

DRO & Impact Forces Of Pharmaceutical Capsule Filling Machine Market

The Pharmaceutical Capsule Filling Machine Market is influenced by a complex interplay of growth drivers, structural restraints, and emerging opportunities, collectively defining the strategic landscape. The primary driver is the escalating global prevalence of chronic diseases, necessitating continuous and high-volume production of affordable generic medications, many of which utilize the capsule dosage format due to its stability and ease of formulation. Concurrently, the increasing focus on advanced dosage delivery, particularly the encapsulation of high-potency active pharmaceutical ingredients (HPAPIs) and specialized liquid fills, requires equipment with higher containment levels and superior precision, compelling manufacturers to upgrade existing machinery or invest in new, technologically advanced units.

Conversely, significant restraints hinder market growth, most notably the high initial capital investment required for purchasing fully automatic, high-speed capsule filling lines, particularly for small and medium-sized pharmaceutical enterprises (SMEs) and CMOs in developing regions. Furthermore, the stringent and constantly evolving regulatory landscape across major jurisdictions (e.g., FDA, EMA) demands continuous validation, specialized containment features for complex substances, and strict adherence to data integrity protocols (e.g., 21 CFR Part 11). These regulatory hurdles increase operational complexity and raise the total cost of ownership, slowing down the rate of widespread adoption of cutting-edge technology.

Opportunities for market expansion are largely centered around geographical expansion into rapidly industrializing regions and technological diversification. The rising demand for specialized nutraceutical and dietary supplements, which often prefer capsule formats, presents a lucrative niche for machine manufacturers offering flexible, medium-speed systems. Moreover, the industry shift towards continuous manufacturing methodologies, moving away from traditional batch processing, creates substantial opportunities for developing fully integrated, modular capsule filling machines designed specifically for continuous operation, offering smaller footprints and enhanced supply chain responsiveness.

Segmentation Analysis

The Pharmaceutical Capsule Filling Machine Market is comprehensively segmented based on the operational mechanism, level of automation, type of capsule filled, and the end-user industry, providing a granular view of market dynamics and specialized demand pockets. Understanding these segments is crucial for manufacturers to tailor their product offerings, whether focusing on high-speed automatic tamping machines for generic drug producers or specialized semi-automatic liquid fillers for compounding pharmacies and small batch clinical trials. The evolution within these segments reflects the broader industry movement towards high throughput, improved precision, and increased flexibility in handling diverse pharmaceutical formulations, ensuring compliance and efficiency across the production spectrum.

- By Type:

- Automatic Capsule Filling Machines

- Semi-Automatic Capsule Filling Machines

- Manual Capsule Filling Machines

- By Operation Principle:

- Tamping Pin Technology

- Dosing Disc Technology

- Vacuum Filling Technology

- Auger Filling Technology

- By Capsule Size:

- Size 000, 00, 0, 1, 2, 3, 4, 5

- By Filling Material:

- Powder/Granule Filling

- Pellet/Bead Filling

- Liquid/Semi-Solid Filling

- Combination Filling

- By End User:

- Pharmaceutical & Biotechnology Companies

- Nutraceutical & Dietary Supplement Companies

- Contract Manufacturing Organizations (CMOs)

- Academic & Research Institutes

Value Chain Analysis For Pharmaceutical Capsule Filling Machine Market

The value chain for the Pharmaceutical Capsule Filling Machine Market begins with the upstream suppliers providing critical raw materials and components, predominantly precision-engineered metals (like stainless steel for GMP compliance), highly specialized electronic components, and advanced automation and control systems (PLCs, sensors, and servomotors). These component suppliers must adhere to stringent material quality standards, as the machinery operates within regulated pharmaceutical environments, demanding high durability, corrosion resistance, and sterile capabilities. The quality and availability of these upstream components directly influence the final machine cost, lead time, and operational lifespan, making robust supplier relationships essential for key equipment manufacturers.

The midstream involves the core activities of the Original Equipment Manufacturers (OEMs). This stage encompasses sophisticated research and development (R&D) focusing on mechanical innovations, automation software integration, and compliance engineering, followed by meticulous manufacturing, assembly, and rigorous factory acceptance testing (FAT). OEMs often invest heavily in patents related to precise dosing mechanisms and enhanced containment features, serving as critical differentiators. After manufacturing, the distribution channel plays a vital role; this includes direct sales teams for major pharmaceutical clients requiring complex customization, and a network of specialized local distributors and agents (indirect channel) who provide localized sales, installation, validation, and crucial after-sales support, particularly in highly regulated or geographically dispersed markets.

Downstream analysis focuses on the end-users—pharmaceutical companies, CMOs, and nutraceutical manufacturers—who utilize the equipment for mass production. This stage is dominated by operational maintenance, validation (IQ/OQ/PQ), and continuous technical support provided by the OEMs or certified third-party service providers. The feedback loop from downstream operations, relating to machine efficiency, changeover times, and reliability under production stress, heavily informs the OEMs' R&D priorities. Effective after-sales service, including spare parts availability and prompt technical assistance, is a major factor influencing purchasing decisions and long-term customer loyalty in this highly specialized capital goods market.

Pharmaceutical Capsule Filling Machine Market Potential Customers

Potential customers for Pharmaceutical Capsule Filling Machines represent a concentrated group of entities operating within highly regulated life science sectors, characterized by a need for precision, scalability, and strict adherence to Good Manufacturing Practices (GMP). The primary buyers are large multinational Pharmaceutical and Biotechnology Companies, which require high-speed, fully automatic machines with integrated inspection systems to meet global demand for blockbuster drugs and mass-produced generics. These customers prioritize machine reliability (OEE), advanced data integrity features, and rapid throughput capabilities, often demanding customized solutions for handling specialized or high-potency APIs (HPAPIs).

The second major consumer segment consists of Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs). These organizations represent a rapidly growing customer base, driven by the pharmaceutical industry’s increasing trend toward outsourcing production. CMOs require exceptionally flexible machinery capable of managing quick changeovers between diverse batch sizes, various capsule types (hard/soft), and a wide range of formulations (powders, pellets, liquids) for multiple clients. Their purchasing decisions are heavily influenced by equipment versatility and the total cost of ownership (TCO) over a lifespan of high utilization across different projects.

Furthermore, Nutraceutical and Dietary Supplement Companies form a robust and expanding customer base, specifically seeking semi-automatic or moderately high-speed automatic machines tailored for filling vitamins, herbal extracts, and nutritional blends. While regulatory requirements might be less stringent than for prescription drugs, these customers still demand accuracy and hygiene. Additionally, smaller compounding pharmacies and academic/research institutes purchase manual or semi-automatic desktop models for specialized batch production, research purposes, and clinical trial material preparation, valuing ease of use, lower throughput, and precision for small-scale operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.3 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ACG, Bosch Packaging Technology (Syntegon), IMA, Schaefer Technologies Inc., MG2, Harro Hofliger, Dott. Bonapace, Capsugel (Lonza), Anchor Mark, Karnavati Engineering, Pharmapack, Zhejiang Fuchang Machinery, Dara Pharmaceutical Packaging, Sensum, Torpac, Key International, Shanghai Jianfa, NJP Pharma, Changsung Softgel System, Sejong Pharmatech. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pharmaceutical Capsule Filling Machine Market Key Technology Landscape

The technological landscape of the Pharmaceutical Capsule Filling Machine Market is rapidly evolving, driven by the dual imperatives of maximizing efficiency and meeting the challenges posed by new, complex drug formulations. A core technological development is the shift from mechanical indexing systems to servo motor-driven systems, which offer significantly greater control over machine speed, indexing precision, and reduced noise levels, thereby enhancing overall operational reliability and minimizing wear and tear. Furthermore, modern machines integrate advanced sensors and sophisticated Programmable Logic Controllers (PLCs) to monitor key process parameters like powder flow rate, humidity, and weight in real-time, facilitating rapid intervention and ensuring sustained quality output even at high operating speeds exceeding 150,000 capsules per hour.

Precision dosing technology remains a critical focus area, specifically the refinement of tamping pin and dosing disc systems to handle poor-flowing, cohesive, or highly potent powders with superior weight accuracy. Innovations in vacuum-based and auger filling systems are gaining traction for handling micro-dosing and specialized materials that are difficult to dose accurately using conventional methods. A particularly salient technological trend is the proliferation of specialized liquid and semi-solid filling modules. These modules require complex temperature control and often employ piston pumps or positive displacement systems to ensure volumetric accuracy for sensitive formulations like oils, suspensions, or hot melts, significantly broadening the capability of hard capsules as a drug delivery system beyond traditional solids.

Finally, the landscape is defined by the integration of Industry 4.0 elements, including enhanced connectivity and data analytics. This includes integrating machines with Manufacturing Execution Systems (MES) and Enterprise Resource Planning (ERP) software for seamless production planning and inventory management. Crucially, the deployment of sophisticated In-Process Control (IPC) systems, such as 100% checkweighing units (utilizing micro-balances for individual capsule weighing), allows for immediate rejection of out-of-specification products and provides the rich dataset necessary for advanced statistical process control (SPC) and AI-driven process optimization, setting a new standard for quality assurance in solid dosage manufacturing.

Regional Highlights

The global Pharmaceutical Capsule Filling Machine Market exhibits distinct regional dynamics, influenced by local regulatory environments, manufacturing capacity, and healthcare investment levels. North America, particularly the United States, remains a dominant market in terms of technology adoption and investment value. This region is characterized by high operational standards, a strong presence of major pharmaceutical innovators, and rigorous regulatory oversight, driving demand for fully automatic, high-specification equipment featuring advanced containment systems (for HPAPIs) and integrated data integrity solutions. High labor costs also push manufacturers toward maximizing automation, prioritizing machines with high OEE and minimal operator intervention.

Europe represents another mature and substantial market, driven by powerful pharmaceutical manufacturing hubs in Germany, Switzerland, and Italy. European demand focuses heavily on flexible manufacturing solutions, given the necessity for quick changeovers to accommodate diverse product portfolios and the trend toward smaller, more specialized batch sizes for targeted therapies. The rigorous EU GMP standards necessitate that equipment vendors offer exceptional documentation, validation support, and machinery designed for easy cleaning and sterilization, supporting the region's focus on quality and environmental sustainability in manufacturing processes.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This growth is predominantly fueled by the rapid expansion of generic drug manufacturing in India and China, coupled with increased government focus on establishing local pharmaceutical self-sufficiency in Southeast Asian nations. While price sensitivity remains a factor, the enormous production scale requirements drive demand for both reliable semi-automatic machines (for smaller, local players) and ultra-high-speed automatic machines (for large, export-focused manufacturers). Increasing investment in local R&D and manufacturing capacity positions APAC as the primary engine for volume demand globally.

Latin America (LATAM) and the Middle East & Africa (MEA) constitute growing, albeit smaller, markets. LATAM's growth is supported by expanding healthcare access and increasing foreign direct investment in manufacturing facilities, particularly in Brazil and Mexico. Demand here is often balanced between cost-effectiveness and moderate automation levels (semi-automatic to mid-speed automatic systems). MEA’s market growth is tied to government initiatives aimed at reducing reliance on imported pharmaceuticals, driving investments in new greenfield manufacturing plants, especially in the GCC countries and South Africa. These regions show significant potential for growth as regulatory infrastructures mature and local pharmaceutical consumption rises.

- North America: Market leader in technology adoption, driven by stringent regulatory compliance (FDA) and high labor costs necessitating maximum automation. Focus on high-containment systems for HPAPIs.

- Europe: High demand for flexible, modular equipment to support complex, small-batch manufacturing and adherence to demanding EU GMP standards. Strong focus on integration of predictive maintenance.

- Asia Pacific (APAC): Fastest-growing region, fueled by massive generic drug production in India and China. Volume demand across all machine types, from basic semi-automatic to advanced high-speed systems.

- Latin America (LATAM): Emerging market characterized by increasing healthcare investments. Demand centered on cost-effective, reliable semi-automatic and mid-range automatic machinery.

- Middle East & Africa (MEA): Growth driven by governmental strategies promoting local pharmaceutical manufacturing self-sufficiency and establishing new production facilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pharmaceutical Capsule Filling Machine Market.- ACG

- Bosch Packaging Technology (Syntegon)

- IMA S.p.A.

- Schaefer Technologies Inc.

- MG2 S.r.l.

- Harro Hofliger Verpackungsmaschinen GmbH

- Dott. Bonapace & Co. Srl

- Capsugel (Lonza)

- Anchor Mark Pvt. Ltd.

- Karnavati Engineering Ltd.

- Pharmapack Co., Ltd.

- Zhejiang Fuchang Machinery Co., Ltd.

- Dara Pharmaceutical Packaging

- Sensum LLC

- Torpac Inc.

- Key International, Inc.

- Shanghai Jianfa Packaging Equipment Co., Ltd.

- NJP Pharma Machinery

- Changsung Softgel System Inc.

- Sejong Pharmatech

Frequently Asked Questions

Analyze common user questions about the Pharmaceutical Capsule Filling Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key differences between tamping pin and dosing disc capsule filling technologies?

Tamping pin technology relies on compression (tamping) pins to form a slug of powder which is then ejected into the capsule body; it is excellent for high-speed, high-volume filling and typically ensures high weight consistency for free-flowing powders. Dosing disc technology, conversely, uses volumetric dosing pockets on a rotating disc to deliver the dose. Tamping pins offer greater flexibility for handling various powder characteristics, including moderately difficult formulations, making it the industry standard for automated systems.

How does automation level (manual, semi-automatic, automatic) impact pharmaceutical manufacturing?

Automation level fundamentally determines throughput, labor reliance, and precision. Manual machines are used for small batches, compounding, or R&D due to low cost but high labor intensity. Semi-automatic machines offer medium throughput, balancing capital cost with efficiency, suitable for CMOs and mid-sized firms. Fully automatic machines are essential for mass production, minimizing human error, maximizing speed (over 100,000 capsules/hour), and integrating advanced features like 100% checkweighing and AI-driven predictive maintenance for optimal OEE.

What role do checkweighing systems play in modern capsule filling machines?

Checkweighing systems, particularly the modern 100% inline checkweighers (IWC), are critical for regulatory compliance and quality assurance. They measure the weight of every individual filled capsule at high speed, immediately rejecting out-of-specification units. This ensures strict dosage uniformity, minimizes batch variation, and provides the real-time data necessary for statistical process control (SPC) and feedback loops to optimize the filling process, which is mandated by global GMP standards.

What are the primary challenges in filling liquid and semi-solid formulations into hard capsules?

The main challenges involve maintaining accurate volumetric dosing and controlling temperature. Liquid formulations often require specialized equipment, such as heated tanks and precise volumetric piston pumps, to maintain the material's flow characteristics and ensure seal integrity after filling. Stability and leak prevention are paramount, necessitating specialized banding or sealing processes post-filling to prevent migration and degradation of the encapsulated material, especially for highly hygroscopic or heat-sensitive ingredients.

How is Industry 4.0 influencing the design and functionality of new capsule filling equipment?

Industry 4.0 integrates smart technologies like IoT sensors, machine learning, and cloud computing into capsule filling operations. This influence manifests in modular designs that communicate seamlessly with MES, enhanced remote diagnostics, and AI-powered self-adjustment capabilities to optimize efficiency and minimize downtime. This results in 'smart factories' where filling equipment proactively reports maintenance needs, optimizes changeover times, and ensures robust data integrity (21 CFR Part 11 compliance) automatically.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager