Pharmaceutical Continuous Manufacturing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432335 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Pharmaceutical Continuous Manufacturing Market Size

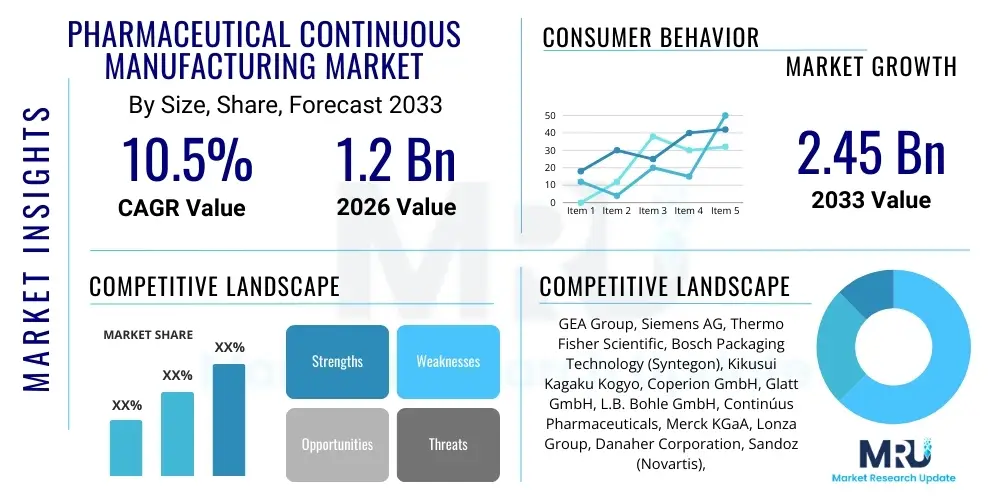

The Pharmaceutical Continuous Manufacturing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $2.45 Billion by the end of the forecast period in 2033.

Pharmaceutical Continuous Manufacturing Market introduction

The Pharmaceutical Continuous Manufacturing (PCM) market involves the systematic integration of various unit operations for drug substance (DS) and drug product (DP) production into a single, uninterrupted process flow, contrasting sharply with traditional batch manufacturing. Continuous manufacturing fundamentally shifts pharmaceutical production from segmented operations to an optimized, end-to-end system, leading to smaller footprints, reduced cycle times, and enhanced consistency. This paradigm shift supports high-quality standards and rapid scalability, making it highly attractive for modern drug development and commercialization. Major applications span across the production of solid oral dosage forms (tablets, capsules), biologics, and specialized sterile products, though adoption is currently dominated by oral solids. The primary benefits include significant cost reduction due to optimized resource utilization, minimization of inventory hold times, and, critically, superior real-time quality assurance facilitated by advanced Process Analytical Technology (PAT). The market is primarily driven by increasing regulatory support from agencies like the FDA, emphasizing quality by design (QbD) principles, and the pharmaceutical industry's need to improve operational efficiency and supply chain resilience in response to global market demands and competitive pressures.

Pharmaceutical Continuous Manufacturing Market Executive Summary

The Pharmaceutical Continuous Manufacturing (PCM) market is experiencing robust growth driven by favorable regulatory environments and intense pressure on pharmaceutical companies to maximize operational efficiency and accelerate time-to-market. Business trends indicate a shift towards integrated, end-to-end solutions, with technology providers focusing heavily on modular and flexible systems capable of handling varied drug formulations. There is a strong movement toward strategic partnerships between large pharma companies and specialized Contract Manufacturing Organizations (CMOs) equipped with continuous platforms, enabling rapid process adoption without massive initial capital expenditure by drug innovators. Regionally, North America maintains market dominance due to early regulatory adoption and the presence of major biopharma headquarters, while the Asia Pacific region is demonstrating the fastest growth trajectory, fueled by increasing investment in advanced manufacturing capabilities, particularly in China and India, aimed at improving domestic drug quality and global competitiveness. Segment trends reveal that continuous oral solid dosage (OSD) manufacturing remains the largest segment, but continuous bioprocessing is emerging as a high-growth area, driven by the increasing complexity of biologic drugs and the demand for personalized medicine requiring highly efficient, flexible small-batch production runs.

AI Impact Analysis on Pharmaceutical Continuous Manufacturing Market

User inquiries concerning the integration of Artificial Intelligence (AI) in Pharmaceutical Continuous Manufacturing (PCM) frequently center on several critical themes: the capability of AI to manage and interpret the massive data streams generated by Process Analytical Technology (PAT) in real-time; the utility of machine learning (ML) models for predictive quality control and autonomous process adjustments; concerns regarding the validation and regulatory acceptance of AI-driven control systems; and the potential for AI to optimize complex process parameters that are intractable using traditional control methods. Users seek definitive insights into how AI accelerates scale-up, minimizes waste, and ensures 'right first time' production runs, transforming continuous lines from merely integrated systems into truly intelligent, self-optimizing factories.

The consensus emerging from industry analysis is that AI is not merely an enhancement but a fundamental requirement for achieving the full potential of PCM. AI algorithms are uniquely suited to handle the high-dimensionality data generated by PAT sensors monitoring critical quality attributes (CQAs) and critical process parameters (CPPs). By applying deep learning and predictive modeling, AI systems can detect subtle deviations in feedstock quality or process drift far earlier than traditional statistical process control (SPC) methods. This predictive capability allows the system to proactively adjust input parameters, such as flow rates or mixing speeds, maintaining the process within the optimal design space (PDS) and drastically reducing the risk of batch failure or material excursion, which is paramount in continuous operations where material flows constantly.

Furthermore, AI facilitates the development and deployment of 'digital twins'—virtual models of the continuous manufacturing line—that allow manufacturers to simulate various operational scenarios, optimize control strategies offline, and rapidly troubleshoot issues before implementing changes in the physical plant. This drastically reduces the experimental cost and time associated with process development and validation. Beyond optimization, AI is transforming workforce efficiency by automating complex decision-making processes, shifting the role of operators from manual monitoring to high-level process supervision and strategic decision-making, thereby accelerating regulatory approval processes through meticulously documented and auditable data trails managed and analyzed by sophisticated AI systems.

- AI enables real-time, predictive maintenance planning, minimizing unplanned downtime in continuous processes.

- Machine learning algorithms optimize complex multi-variable process parameters, enhancing yield and purity consistently.

- Deep learning models interpret high-frequency PAT data for instantaneous quality control and automatic rejection mechanisms.

- AI facilitates the creation and calibration of digital twins, streamlining process scale-up and validation activities.

- Autonomous control systems, driven by AI, allow the manufacturing line to self-adjust to material variability, ensuring Quality by Design (QbD) integrity.

- AI aids in regulatory compliance by providing comprehensive, auditable data lineage and rationale for process changes.

- Natural Language Processing (NLP) speeds up the assimilation and standardization of complex scientific literature and SOPs for continuous operations.

DRO & Impact Forces Of Pharmaceutical Continuous Manufacturing Market

The Pharmaceutical Continuous Manufacturing (PCM) market is propelled by key drivers such as stringent global regulatory mandates encouraging Quality by Design (QbD) principles, the inherent efficiency benefits including reduced operational costs and faster cycle times, and the ability of continuous systems to rapidly scale production up or down in response to fluctuating demand or unforeseen supply chain disruptions. Conversely, the market faces significant restraints, primarily the exceptionally high initial capital investment required for installing new continuous lines or retrofitting existing batch facilities, coupled with the inherent complexity and resistance to change within conservative pharmaceutical organizations that prefer proven batch methodologies. Opportunities abound in the development of specialized continuous systems for complex drug modalities, particularly personalized medicine and highly potent active pharmaceutical ingredients (HPAPIs), and the expansion of expertise and knowledge transfer through Contract Development and Manufacturing Organizations (CDMOs). The primary impact forces driving accelerated adoption include evolving global supply chain security requirements, necessitating robust, localized production capabilities, and the persistent regulatory incentive structure provided by agencies promoting faster approvals for continuously manufactured products, ultimately pushing the industry toward a higher standard of operational excellence and agility.

Segmentation Analysis

The Pharmaceutical Continuous Manufacturing market is broadly segmented based on the type of operation, the application of the technology, and the end-user utilizing the system. The operational segmentation distinguishes between integrated continuous systems, where all unit operations are linked (common for OSD), and semi-continuous or hybrid systems, which might incorporate continuous steps alongside traditional batch processing for specific upstream or downstream needs. Application segmentation highlights the core areas of usage, with oral solid dosage (OSD) forms commanding the largest share due to well-established technology and regulatory frameworks, while the burgeoning field of continuous bioprocessing represents the fastest growing segment. Finally, the market is differentiated by the end-user profile, separating large pharmaceutical and biotechnology companies who invest heavily in proprietary internal systems, from Contract Development and Manufacturing Organizations (CDMOs) who provide continuous manufacturing services on a fee-for-service basis, democratizing access to this advanced technology.

- By Type of Operation:

- End-to-End Integrated Systems

- Hybrid/Semi-Continuous Systems

- By Application:

- Solid Oral Dosage Manufacturing (OSD)

- API (Drug Substance) Synthesis

- Continuous Bioprocessing

- Sterile and Liquid Dose Manufacturing

- By End User:

- Pharmaceutical and Biotechnology Companies

- Contract Manufacturing Organizations (CMOs/CDMOs)

- Academic and Research Institutes

- By Technology:

- Continuous Granulation

- Continuous Direct Compression

- Continuous Blending

- Continuous Drying

- Advanced PAT Systems

Value Chain Analysis For Pharmaceutical Continuous Manufacturing Market

The value chain for Pharmaceutical Continuous Manufacturing (PCM) is characterized by high levels of technological integration and specialized expertise, beginning with the upstream suppliers of critical raw materials and sophisticated equipment. Upstream activities involve the sourcing of specialized excipients, highly standardized APIs, and the design and manufacturing of the continuous processing hardware itself, including highly precise feeders, blenders, twin-screw extruders, and drying systems. Equipment manufacturers play a pivotal role, requiring deep competence in engineering, control software, and regulatory compliance. The quality and consistency of raw materials are exponentially more critical in a continuous environment than in batch, as there are fewer opportunities for intermediate quality checks and adjustments, thereby placing immense pressure on supplier relationships and material qualification protocols.

Midstream activities constitute the core value addition, focusing on process development and implementation, often involving extensive modeling and simulation (digital twins) before plant installation. This stage involves specialized engineering consultants and automation experts who integrate the modular equipment with advanced Process Analytical Technology (PAT) systems and high-level control software. The integration process is complex, requiring seamless data communication between sensors, actuators, and the supervisory control and data acquisition (SCADA) systems, often managed by AI and machine learning platforms. Companies offering full-stack integration services, including software validation and regulatory submission support, capture significant value here.

Downstream elements primarily involve the utilization of the continuous manufacturing output, encompassing secondary packaging, warehousing, distribution, and ultimately, patient delivery. The continuous process inherently simplifies the supply chain by reducing the need for large buffer inventories, speeding up release testing, and allowing for rapid shifts in production volume. Distribution channels are streamlined as products move directly from manufacturing to packaging and shipment. Direct channels are utilized by large pharmaceutical companies managing their own distribution networks, while indirect channels leverage third-party logistics (3PL) providers and wholesalers. CMOs often act as the primary distribution nexus for smaller biotech partners. The efficiency gained in the manufacturing phase translates directly into increased responsiveness and reduced lead times in the final distribution steps, offering a competitive advantage in global market penetration.

Pharmaceutical Continuous Manufacturing Market Potential Customers

The primary potential customers and end-users of Pharmaceutical Continuous Manufacturing technologies are global pharmaceutical and biotechnology companies, ranging from large multinational corporations to specialized, venture-backed biotechs. Large pharmaceutical companies are the largest consumers, motivated by the mandate to rationalize global manufacturing networks, achieve significant cost savings through improved efficiency, and ensure product quality consistency across diverse manufacturing sites. These established players often invest in proprietary, large-scale continuous lines for blockbuster solid oral dose drugs and increasingly for their high-volume sterile injectable portfolios, viewing PCM as a strategic capability essential for long-term competitiveness and regulatory compliance adherence.

Contract Development and Manufacturing Organizations (CDMOs) represent the second most significant customer base and a crucial accelerator for market penetration. CDMOs purchase and implement PCM systems to offer specialized services to their clients, particularly small and mid-sized biotechnology companies that lack the internal capital or expertise to adopt continuous manufacturing independently. By outsourcing to CDMOs equipped with flexible, multi-product continuous lines, biotech firms can rapidly transition from clinical trials to commercial production, benefitting from reduced regulatory timelines and lower capital expenditure. This democratization of access is vital for the growth of the overall market, as it lowers the barrier to entry for innovative drug manufacturers seeking high-quality, efficient production methods.

Furthermore, academic and governmental research institutions, alongside advanced compounding pharmacies, represent smaller but critical niche markets. Research institutions utilize these systems for advanced drug formulation studies, process modeling, and training the next generation of pharmaceutical engineers and scientists, thereby fostering the required expertise base. Advanced compounding pharmacies are beginning to explore smaller, often modular continuous platforms to produce personalized medicines and tailored dose strengths rapidly and reliably, catering to specific patient needs that require highly flexible, low-volume continuous processes, driven by the increasing demand for precision dosing and decentralized manufacturing models.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $2.45 Billion |

| Growth Rate | CAGR 10.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GEA Group, Siemens AG, Thermo Fisher Scientific, Bosch Packaging Technology (Syntegon), Kikusui Kagaku Kogyo, Coperion GmbH, Glatt GmbH, L.B. Bohle GmbH, Continúus Pharmaceuticals, Merck KGaA, Lonza Group, Danaher Corporation, Sandoz (Novartis), Pfizer Inc., Bristol-Myers Squibb, Eli Lilly and Company, GSK plc, Sanofi S.A., Janssen Pharmaceutica (J&J), Fette Compacting |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pharmaceutical Continuous Manufacturing Market Key Technology Landscape

The technological landscape of Pharmaceutical Continuous Manufacturing is fundamentally built upon the integration of advanced hardware and sophisticated software control systems designed for seamless, uninterrupted operation. Central to OSD manufacturing is the deployment of specialized continuous blending and granulation equipment, such as twin-screw wet granulation (TSWG) systems, which offer rapid mixing and solvent addition control, and high-shear continuous mixing systems. These devices must interface precisely with continuous drying technologies, predominantly fluid bed or microwave dryers, designed to achieve specified moisture content rapidly and consistently. For direct compression methods, highly accurate gravimetric feeders and continuous blenders are paramount, ensuring precise material flow and homogeneous mixtures before tablet pressing. The core engineering innovation lies in designing modular and easily cleanable equipment that minimizes downtime and maximizes flexibility for multi-product campaigns.

Crucially, the success of continuous manufacturing hinges entirely on the maturity and integration of Process Analytical Technology (PAT). PAT systems, utilizing techniques such as Near-Infrared (NIR) spectroscopy, Raman spectroscopy, and imaging technologies, provide non-invasive, real-time data on critical quality attributes (CQAs) like blend uniformity, particle size distribution, and concentration. This real-time quality assurance replaces extensive end-of-process testing, significantly reducing release times. The data generated by PAT feeds directly into advanced control systems, which use algorithms—increasingly incorporating AI and machine learning—to maintain the process within the defined operational parameters. These control systems manage everything from feedstock input rate to rejection mechanisms for non-conforming materials, ensuring robust quality control throughout the entire run.

Beyond OSD, the technological focus is expanding significantly into continuous bioprocessing. This involves the use of continuous cell culture systems, perfusion bioreactors, and highly integrated continuous chromatography and filtration steps for downstream purification. These technologies aim to intensify biological production, achieving higher titers and better resource utilization compared to large-volume batch bioreactors. The implementation requires highly sterile, closed-loop systems and specialized sensors to monitor complex biological metrics in real-time. The overall trend is towards modularity, where standardized units can be rapidly assembled and deployed across different sites and therapeutic areas, drastically reducing the time and cost associated with facility construction and validation, moving pharmaceutical production toward highly flexible, facility-less manufacturing concepts.

Regional Highlights

North America, particularly the United States, represents the dominant market for Pharmaceutical Continuous Manufacturing, driven by early and decisive regulatory encouragement from the FDA, which has actively promoted the adoption of advanced manufacturing technologies. The region benefits from a high concentration of major pharmaceutical and biotechnology companies with significant R&D budgets, willing to invest the requisite capital in high-tech continuous lines. Furthermore, the robust ecosystem of equipment suppliers, specialized engineering firms, and CDMOs skilled in continuous technology implementation provides essential infrastructure support. Regulatory incentives, such as priority review and quicker approval pathways for continuously manufactured drugs, have cemented North America's leadership in the commercialization of PCM technology, especially for high-value solid dosage and innovative biopharmaceutical products.

Europe stands as the second-largest market, characterized by strong governmental support for pharmaceutical innovation and quality standards, backed by the European Medicines Agency (EMA). European pharmaceutical giants have been proactive in exploring and integrating continuous processes, often focusing on advanced API synthesis and multi-product facilities to serve diverse national markets efficiently. Countries like Germany, Switzerland, and Ireland are key hubs for specialized equipment manufacturing and high-end pharmaceutical production, driving regional growth. The regional strategy often centers on modernization and automation of existing facilities, rather than exclusive greenfield projects, utilizing hybrid continuous systems to gradually transition from traditional batch processes while maintaining compliance with rigorous EU quality standards and sustainability goals.

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid growth is fueled by aggressive governmental initiatives in countries like China, India, and South Korea, aimed at elevating domestic drug quality to global standards and becoming major exporters of high-quality pharmaceuticals. Increasing healthcare expenditure, coupled with the rising demand for generic and biosimilar drugs, is necessitating mass production efficiencies that PCM inherently provides. Significant investments are being channeled into modernizing existing manufacturing facilities and establishing large-scale continuous plants, often through collaborations or technology transfer agreements with Western firms. While the initial focus was on affordable generic OSD, the region is quickly expanding into complex API and continuous bioprocessing capabilities, making it the most dynamic market globally.

- North America (US and Canada): Market leader due to stringent FDA support, high R&D spending, and early commercial adoption, especially for OSD and complex APIs.

- Europe (Germany, UK, Switzerland): Second largest market, driven by regulatory alignment (EMA), strong engineering capabilities, and high adoption rates for advanced API synthesis and facility modernization projects.

- Asia Pacific (China, India, South Korea): Fastest growing region, fueled by government mandates for quality improvement, booming generic drug demand, and significant foreign investment in new, high-efficiency continuous facilities.

- Latin America (Brazil, Mexico): Emerging market characterized by increasing local manufacturing capacity and efforts to reduce reliance on imports through process optimization, focusing primarily on solid oral dosage forms.

- Middle East and Africa (MEA): Nascent market primarily focused on establishing localized pharmaceutical manufacturing bases; growth is driven by strategic partnerships and technology importation to meet local health security mandates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pharmaceutical Continuous Manufacturing Market.- GEA Group

- Siemens AG

- Thermo Fisher Scientific

- Bosch Packaging Technology (Syntegon)

- Kikusui Kagaku Kogyo

- Coperion GmbH

- Glatt GmbH

- L.B. Bohle GmbH

- Continúus Pharmaceuticals

- Merck KGaA

- Lonza Group

- Danaher Corporation

- Sandoz (Novartis)

- Pfizer Inc.

- Bristol-Myers Squibb

- Eli Lilly and Company

- GSK plc

- Sanofi S.A.

- Janssen Pharmaceutica (J&J)

- Fette Compacting

Frequently Asked Questions

Analyze common user questions about the Pharmaceutical Continuous Manufacturing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of Pharmaceutical Continuous Manufacturing (PCM) over traditional batch methods?

The primary benefit is superior, consistent product quality assurance achieved through real-time monitoring (PAT) and automated control, leading to reduced material waste, faster release times, and significantly lower operational costs due to optimized resource use and smaller facility footprints.

How does the FDA view the regulatory approval process for continuously manufactured drugs?

The FDA strongly supports PCM, offering regulatory incentives and expedited review pathways, particularly for novel drugs and modernization projects. Continuous manufacturing is viewed as aligning closely with Quality by Design (QbD) principles, enabling robust process understanding and consistent drug supply, accelerating market access.

What are the largest technological challenges restraining PCM adoption?

The major challenges include the high initial capital investment required for specialized equipment and integration, the complexity of validating integrated software and control systems (especially AI/ML components), and the difficulty in securing standardized, high-quality input materials required for uninterrupted continuous operation.

Which application segment currently dominates the Pharmaceutical Continuous Manufacturing market?

Solid Oral Dosage (OSD) manufacturing currently dominates the PCM market, as technologies like continuous granulation, blending, and direct compression are mature and have established regulatory acceptance for high-volume solid dose production.

What role do Contract Manufacturing Organizations (CMOs) play in continuous manufacturing market growth?

CMOs are critical market drivers as they democratize access to PCM technology. By investing in multi-product continuous lines, CMOs allow smaller biotech and pharmaceutical firms to utilize advanced manufacturing without the massive initial capital expenditure, speeding up clinical transition and commercial scale-up.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager