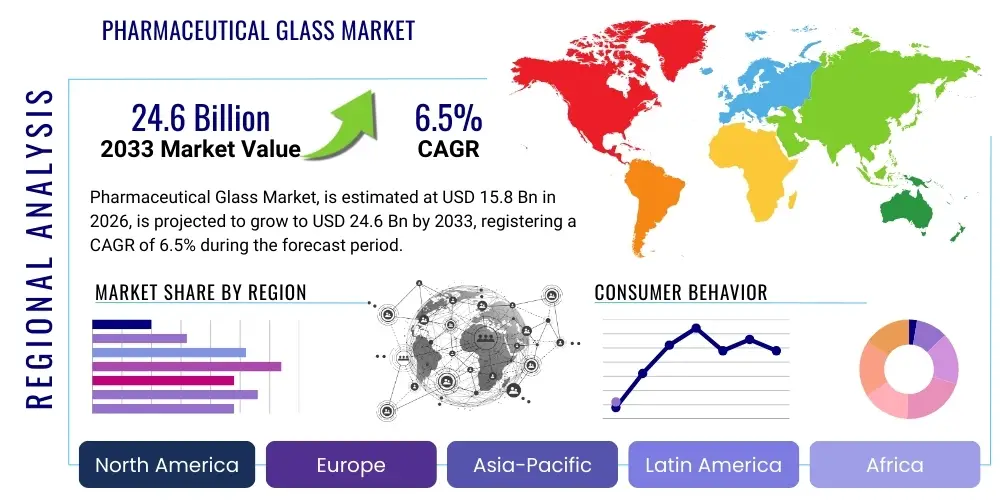

Pharmaceutical Glass Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437336 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Pharmaceutical Glass Market Size

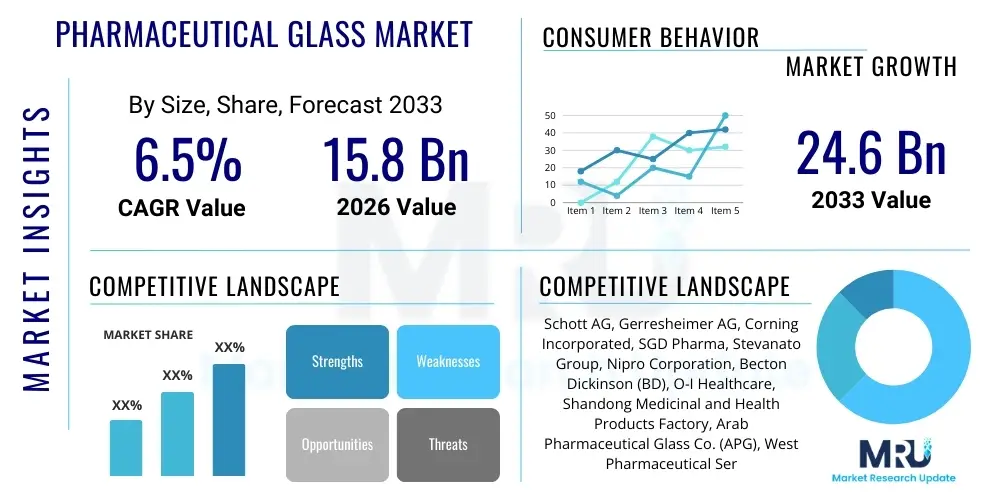

The Pharmaceutical Glass Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 15.8 Billion in 2026 and is projected to reach USD 24.6 Billion by the end of the forecast period in 2033.

Pharmaceutical Glass Market introduction

The Pharmaceutical Glass Market encompasses the manufacturing and distribution of specialized glass containers designed for storing, packaging, and delivering various pharmaceutical products, including injectable drugs, vaccines, biologicals, and oral solid dose medications. These glass containers, primarily categorized into Type I (borosilicate), Type II (treated soda-lime), and Type III (soda-lime), are essential due to their critical chemical inertness, barrier properties, and thermal shock resistance, ensuring drug integrity and stability throughout their shelf life. The high-purity composition of pharmaceutical glass minimizes leaching, degradation, and contamination risks, which is paramount in maintaining patient safety and meeting stringent global regulatory standards set by bodies like the FDA and EMA. The fundamental product description revolves around vials, ampoules, cartridges, and syringes, each tailored to specific delivery methods and drug formulations.

Major applications of pharmaceutical glass span across the entire drug manufacturing lifecycle, predominantly serving high-value biological drugs, personalized medicines, and sensitive small-molecule pharmaceuticals. The inherent benefits, such as transparency for visual inspection, excellent moisture barrier properties, and compatibility with high-speed filling lines, solidify glass as the material of choice, particularly for parenteral packaging where sterility and non-reactivity are non-negotiable requirements. Recent innovations focus on improving hydrolytic resistance and reducing tungsten inclusion or delamination risks, driving continuous improvement in product quality standards to support complex new drug entities.

The primary driving factor for market expansion is the global surge in chronic diseases, necessitating increased production of injectable medications and vaccines. Furthermore, the rapid growth in the biologics and biosimilars sectors—which rely heavily on Type I borosilicate glass for stability—significantly boosts demand for high-quality packaging solutions. Technological advancements in glass manufacturing, enabling precision molding and enhanced internal coating (e-coating) to further protect sensitive medications, also propel market growth. Regulatory pressure to minimize drug-container interaction further mandates the use of premium, certified glass packaging, underpinning the market's robust trajectory.

Pharmaceutical Glass Market Executive Summary

The Pharmaceutical Glass Market is defined by consistent demand stabilization, heavily influenced by the biotech boom and stringent quality control regulations. Current business trends indicate a strategic shift among leading manufacturers towards vertical integration and specialization in high-performance Type I borosilicate glass, especially for pre-filled syringes (PFS) and cartridges used in self-administration devices. Key players are investing heavily in advanced inspection systems (such as Artificial Vision Systems) to ensure zero-defect packaging, a critical requirement for high-cost biological drugs. Consolidation and strategic partnerships between glass manufacturers and large pharmaceutical companies (CMOs and CDMOs) are becoming common, aimed at standardizing quality protocols and securing supply chains against potential disruptions. Sustainability is also emerging as a key trend, with increasing interest in lightweight glass solutions and closed-loop recycling programs, although maintaining integrity remains the paramount priority.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, driven by expanding domestic pharmaceutical production in India and China, coupled with rising healthcare expenditures and increasing adoption of Western-standard packaging technologies. North America and Europe maintain dominance in terms of value, primarily due to the established presence of major biopharma companies and extremely strict regulatory environments requiring premium Type I glass for the bulk of their injectable portfolios. These mature markets are focusing on automation in handling and processing, minimizing human intervention to further reduce contamination risk during filling and finishing processes, thereby driving demand for advanced, high-precision packaging formats like molded vials and integrated closure systems. The Middle East and Africa (MEA) are showing moderate growth, linked to increasing localization of drug manufacturing capabilities and infrastructure development.

Segmentation trends confirm that the Vial segment holds the largest market share by volume, driven by mass vaccination programs and standard injectable drug storage. However, the Pre-Filled Syringes (PFS) segment is demonstrating the highest CAGR, reflecting the industry shift toward user-friendly, high-precision drug delivery systems for chronic conditions like diabetes and autoimmune diseases. By glass type, Type I borosilicate glass continues to dominate the revenue share due to its superior chemical resistance and necessity for high-pH or highly sensitive drug formulations, effectively displacing Type II and Type III glass in critical applications. End-user analysis reveals that pharmaceutical and biotechnological companies remain the primary customers, although specialized compounding pharmacies and contract packaging organizations are also becoming increasingly significant demand centers, requiring flexible and customized batch sizes.

AI Impact Analysis on Pharmaceutical Glass Market

Analysis of common user questions regarding the intersection of Artificial Intelligence (AI) and the Pharmaceutical Glass Market reveals primary concerns centered on quality control, manufacturing efficiency, and predictive supply chain management. Users frequently ask: "How can AI reduce cosmetic and functional defects in glass manufacturing?" and "Will AI integration increase the speed of production lines without compromising the high-purity requirements?" Key expectations revolve around using machine learning for real-time defect detection, optimizing furnace operations for energy efficiency and consistency, and forecasting demand volatility for specialty glass types (like Type I) based on pipeline drug development announcements. The overarching theme is the deployment of AI to achieve 'zero-defect' goals and enhance operational resilience in a highly regulated environment, balancing cost reduction with uncompromising quality assurance essential for patient safety. Users are also keen on understanding AI's role in traceability and serialization compliance within the complex global supply chain of pharmaceutical packaging.

- AI facilitates real-time defect detection through high-resolution image analysis during the forming and post-annealing stages, drastically reducing manual inspection errors.

- Machine learning algorithms optimize melting furnace parameters (temperature, composition input) to ensure hydrolytic resistance consistency and minimize batch variations.

- Predictive maintenance schedules for high-speed forming machines minimize unplanned downtime, directly boosting production throughput and supply chain reliability.

- AI enhances supply chain visibility and demand forecasting, predicting surges in specific packaging formats (e.g., PFS for new vaccines) based on clinical trial outcomes and regulatory approvals.

- Generative AI models assist in designing specialized container geometries to improve drug stability or compatibility with autoinjector devices, optimizing physical performance.

DRO & Impact Forces Of Pharmaceutical Glass Market

The Pharmaceutical Glass Market is profoundly shaped by a combination of strong internal drivers, external regulatory restraints, and emerging growth opportunities, all channeled through significant impact forces that determine market equilibrium. The principal driver is the relentless innovation in the biopharmaceutical sector, particularly the surge in parenteral drug development, which necessitates primary packaging with the highest chemical inertia—Type I borosilicate glass. This demand is further amplified by the global expansion of injectable delivery systems (PFS and cartridges) that require precise dimensional accuracy and superior resistance to breakage, supporting safer and more convenient drug administration. Concurrently, increasing global health awareness and the preparation for potential pandemic scenarios necessitate robust manufacturing capacity for glass vials and ampoules.

Conversely, significant restraints challenge market expansion, primarily revolving around the high capital investment required for establishing and maintaining Type I glass manufacturing facilities, which demand specialized infrastructure and high energy input. The inherent risk of glass breakage and delamination, although rare, remains a major industry concern, demanding constant vigilance and costly quality control measures. Furthermore, regulatory hurdles are complex; strict adherence to pharmacopeial standards (USP, EP, JP) and the lengthy validation process required for any change in packaging material or supplier often slows down adoption rates for new glass technologies. Competition from alternative packaging materials, such as high-performance plastics (COC/COP), while limited, poses a niche restraint, particularly in applications where extreme lightness or shatter resistance is prioritized.

Opportunities for growth are concentrated in emerging fields, including the adoption of advanced barrier technologies like internal siliconization and polymer coatings on glass surfaces, which further minimize drug-container interaction and reduce protein aggregation risks. The rapid expansion of contract development and manufacturing organizations (CDMOs) in APAC creates new demand centers for high-volume, standardized glass packaging. Furthermore, the push towards digitalization and IoT integration within manufacturing processes presents opportunities to optimize production yield and reduce energy costs, addressing the sustainability challenge. The major impact forces are the intensity of regulatory oversight, which acts as a powerful barrier to entry, and the supplier concentration, which gives established glass manufacturers significant pricing power and control over specialized high-ppurity glass supply.

Segmentation Analysis

The Pharmaceutical Glass Market segmentation provides a detailed structural breakdown based on material type, product format, and end-user application, offering clarity on market dynamics and strategic focus areas. The classification by glass type—Type I, Type II, and Type III—is crucial as it directly correlates with the sensitivity and route of administration of the packaged drug; Type I borosilicate remains the benchmark for most high-value biologicals and injectable products due to its superior chemical stability. Product format segmentation distinguishes between containers designed for single-dose administration (ampoules, PFS) and multi-dose packaging (vials, bottles), revealing shifts in delivery trends favoring convenience and safety. End-user classification helps identify primary demand drivers across different segments of the healthcare value chain, dominated by pharmaceutical and biotech firms requiring validated high-volume supplies.

- By Glass Type:

- Type I (Neutral Borosilicate Glass)

- Type II (Treated Soda-Lime Glass)

- Type III (Soda-Lime Glass)

- By Product Type:

- Vials (Molded and Tubular)

- Ampoules

- Cartridges

- Pre-filled Syringes (PFS)

- Bottles and Jars (e.g., Tablet Containers)

- By Application:

- Injectable Drugs and Biologics (Parenteral)

- Non-Injectable Drugs (Oral, Nasal, Topical)

- Vaccines

- Blood Products

- By End-User:

- Pharmaceutical and Biotechnology Companies

- Contract Manufacturing Organizations (CMOs/CDMOs)

- Research Laboratories and Compounding Pharmacies

Value Chain Analysis For Pharmaceutical Glass Market

The value chain for the Pharmaceutical Glass Market is characterized by highly specialized upstream processes and complex regulatory requirements in the downstream distribution. Upstream analysis begins with the sourcing of primary raw materials, predominantly high-purity silica sand, boron oxide (for Type I glass), soda ash, and limestone. This stage involves meticulous quality checks to ensure minimal heavy metal contamination, which could compromise the final glass product's integrity. The subsequent manufacturing process involves high-temperature melting, drawing (for tubular glass), and precise forming (for molded glass), requiring sophisticated energy management and continuous quality control. The technical expertise required at the melting and forming stages makes the upstream segment capital-intensive and concentrated among a few global specialists.

Midstream activities focus on secondary processing and high-precision finishing. This includes processes like annealing (stress relief), internal surface treatment (e.g., ammonium sulfate treatment for Type II or siliconization), and meticulous inspection using automated vision systems to detect minute defects such as cracks, scratches, or delamination potential. Finished products, such as vials, ampoules, or syringe barrels, are then washed, sterilized, and often packaged in cleanroom environments before being transferred to the drug manufacturers. The integration of advanced coating technologies to enhance barrier properties and reduce friction is becoming a crucial component of value addition at this stage, moving beyond standard packaging toward integrated drug delivery solutions.

The downstream segment involves the distribution channel, which is highly regulated and tailored to the needs of the pharmaceutical sector. Direct distribution models, where glass manufacturers supply major pharmaceutical companies under long-term quality agreements, dominate the high-value Type I segment, ensuring supply chain integrity and traceability. Indirect distribution often involves specialized medical packaging distributors or agents, particularly serving smaller biotech firms or compounding pharmacies. Regulatory compliance, including providing full documentation for validation (e.g., Extractables and Leachables studies), is essential for successful downstream movement. The final link is the integration of these containers into the drug manufacturer's high-speed filling lines, requiring tight dimensional tolerances and compatibility with automated stoppers and closures, emphasizing the collaborative nature of the final distribution and application stage.

Pharmaceutical Glass Market Potential Customers

The primary end-users and potential customers of pharmaceutical glass are the global pharmaceutical and biotechnology companies. These organizations represent the core demand base, requiring large volumes of high-quality glass packaging for their commercial drug production, ranging from over-the-counter medications to cutting-edge biologic therapies. These customers prioritize supplier reliability, global logistical capabilities, and, most importantly, compliance with stringent regulatory requirements, demanding detailed documentation on material composition and manufacturing quality protocols. The complexity of packaging sensitive drugs, such as monoclonal antibodies or gene therapies, means these customers are overwhelmingly reliant on Type I borosilicate glass and advanced formats like pre-filled syringes and cartridges.

A rapidly expanding customer base includes Contract Development and Manufacturing Organizations (CDMOs) and Contract Packaging Organizations (CPOs). As pharmaceutical companies increasingly outsource manufacturing and filling processes, CDMOs and CPOs become significant bulk buyers of pharmaceutical glass. These entities require flexibility in order size, speed of delivery, and technical support to handle diverse client requirements, spanning multiple drug types and regulatory markets. Their strategic importance lies in bridging the gap between glass manufacturing specialization and the final sterile filling process, acting as critical intermediaries in the supply chain. These customers are often keen adopters of standardized, high-volume products to optimize their operational throughput.

Further potential customers encompass research laboratories, academic institutions, specialized blood banks, and compounding pharmacies. While their volume demand is smaller compared to major drug manufacturers, their requirements often involve highly specialized or customized glass packaging for clinical trials, diagnostic reagents, or personalized medicine preparations. For example, compounding pharmacies require smaller batches of specialized vials or bottles that must meet the same stringent quality standards as mass-produced packaging. The demand from the vaccine sector, particularly in response to global health crises, creates episodic, extremely high-volume demand spikes for standard glass vials and ampoules, making governments and public health organizations indirect, yet critical, potential customers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.8 Billion |

| Market Forecast in 2033 | USD 24.6 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schott AG, Gerresheimer AG, Corning Incorporated, SGD Pharma, Stevanato Group, Nipro Corporation, Becton Dickinson (BD), O-I Healthcare, Shandong Medicinal and Health Products Factory, Arab Pharmaceutical Glass Co. (APG), West Pharmaceutical Services, Piramal Glass, Nuova Ompi (Stevanato Group), Shandong Yaohui Pharmaceutical Glass, Jiangsu Shuangfeng Glass Product Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pharmaceutical Glass Market Key Technology Landscape

The technological landscape of the Pharmaceutical Glass Market is centered around ensuring superior chemical stability, dimensional accuracy, and sterility, moving packaging from a simple container to an integrated component of drug delivery. A fundamental technology is the specialized high-temperature melting and forming of Type I neutral borosilicate glass, which requires precise control over raw material composition and furnace atmosphere to minimize potential issues like tungsten residue or blister formation, critical quality defects that can lead to product recalls. Advancements in tubing technology, such as the implementation of advanced vertical drawing methods (Vello or Danner processes), allow for highly uniform wall thicknesses and improved strength, crucial for the structural integrity of thin-walled vials and syringe barrels intended for use in autoinjector devices.

A major area of innovation is in surface modification and internal coating technologies designed to enhance the protective capabilities of the glass. Techniques such as internal siliconization are standard for improving drug interaction and facilitating plunger movement in syringes. More advanced technologies include specialized chemical vapor deposition (CVD) or plasma enhanced chemical vapor deposition (PECVD) methods to apply ultra-thin, highly protective barrier layers, such often based on silica oxide or carbon, directly onto the interior surface of the container. These coatings dramatically reduce ion leaching and chemical reactivity, making the container suitable even for the most sensitive protein-based biologics and preventing potential delamination, a severe form of degradation where microscopic glass flakes separate from the container wall, thereby significantly impacting drug quality and patient safety. Such technologies are particularly vital for high-pH formulations and sensitive large molecules.

Furthermore, automation and digitization define the quality control landscape. High-speed, high-resolution camera systems utilizing complex machine vision algorithms (often AI-enhanced) are now standard for inspecting every unit for cosmetic and dimensional faults far beyond human capability. In the assembly stage, especially for pre-filled syringes and cartridges, high-precision washing, sterilization (using processes like depyrogenation), and high-speed assembly equipment ensure aseptic conditions are maintained throughout the finishing process. The integration of serialization and traceability systems, utilizing specialized laser marking or advanced ink technologies, is also a mandatory technological requirement, driven by global mandates to combat counterfeiting and enhance supply chain transparency from the glass manufacturer to the final patient delivery point.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to exhibit the highest growth rate, driven by massive investments in domestic pharmaceutical manufacturing capabilities, particularly in China and India. These countries are not only serving their enormous internal markets but are also increasingly becoming global hubs for generic and biosimilar drug production. The focus is shifting rapidly from Type III and Type II glass toward international standard Type I borosilicate glass, catalyzed by regulatory harmonization efforts and rising quality expectations. Japan and South Korea remain key innovators, focusing on high-end specialized formats like pre-filled syringes for advanced biotechnology products. The region's large population base and expanding access to healthcare infrastructure necessitate sustained high-volume production of primary packaging materials, often leading to partnerships between local drug manufacturers and global glass specialists to ensure quality supply.

- North America: North America holds the largest revenue share in the global market, underpinned by the substantial presence of major pharmaceutical and biotechnology companies and a highly mature drug development pipeline. The market is defined by an uncompromising focus on premium packaging, predominantly Type I glass, for expensive biologics, personalized medicines, and new injectable therapies. Demand is particularly strong for high-value formats like pre-filled syringes and high-precision cartridges used in advanced delivery devices (e.g., insulin pens and autoinjectors). Regulatory stringency, enforced by the FDA, mandates the highest possible quality standards, driving continuous innovation in delamination prevention, barrier technology, and highly accurate dimensional specifications for container geometry.

- Europe: Europe is a mature market, serving as a critical global manufacturing base for high-quality pharmaceuticals and vaccines. Germany, Switzerland, and France are hubs for glass manufacturing excellence and advanced drug filling operations. The market is characterized by strict adherence to European Pharmacopoeia (EP) standards and a strong emphasis on sustainability, leading to demand for lightweight glass solutions and optimized manufacturing processes to reduce the carbon footprint. High growth is observed in the niche market for advanced parenteral packaging used in sophisticated therapies, including oncology and chronic disease management. Furthermore, Europe is often at the forefront of implementing new global serialization standards, requiring manufacturers to rapidly adopt compatible packaging and labeling technologies.

- Latin America (LATAM): The LATAM market is characterized by moderate but steady growth, influenced primarily by improvements in local healthcare spending and the expansion of generic drug manufacturing in Brazil and Mexico. While Type II and Type III glass still see significant use for lower-sensitivity medications, there is a clear upward trend in the adoption of Type I borosilicate glass, driven by increasing government procurement of vaccines and the entry of international biopharmaceutical companies demanding global-standard packaging solutions. Challenges include fragmented regulatory environments and the need for improved supply chain infrastructure, which often necessitates local manufacturing investment by major global glass suppliers.

- Middle East and Africa (MEA): MEA is the smallest market but shows substantial promise due to government initiatives aimed at reducing reliance on imported drugs and establishing local pharmaceutical production hubs, notably in Saudi Arabia and the UAE. This localization effort creates nascent demand for standardized glass packaging, initially focusing on essential medicines and vaccines. Quality standards are rapidly evolving, moving towards international benchmarks, which translates into opportunities for suppliers of high-quality Type I vials and ampoules. Market growth is heavily contingent upon infrastructural development and stability across the diverse regional economies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pharmaceutical Glass Market.- Schott AG

- Gerresheimer AG

- Corning Incorporated

- Stevanato Group

- Nipro Corporation

- SGD Pharma

- Becton Dickinson (BD)

- West Pharmaceutical Services

- O-I Healthcare

- Piramal Glass

- Arab Pharmaceutical Glass Co. (APG)

- Shandong Medicinal and Health Products Factory

- Jiangsu Shuangfeng Glass Product Co. Ltd.

- Hindustan National Glass & Industries Ltd.

- Hebei Xingyao Glass Group

- Dwyer Vials and Supplies

- Stölzle Glass Group

- AptarGroup, Inc.

- Datwyler Holding Inc.

- Klaro Group

Frequently Asked Questions

Analyze common user questions about the Pharmaceutical Glass market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Type I, Type II, and Type III pharmaceutical glass?

Type I (Borosilicate) glass is considered the gold standard due to its superior chemical inertness and resistance to thermal shock, making it ideal for highly sensitive injectable drugs and biologics. Type II is treated soda-lime glass, which has had its inner surface de-alkalized for improved chemical resistance, suitable for some acidic and neutral parenteral preparations. Type III is untreated soda-lime glass, generally used for non-aqueous or dry powder formulations like oral tablets, where direct chemical contact is less critical.

Why are Pre-Filled Syringes (PFS) a major growth driver in the pharmaceutical glass market?

PFS are driving growth because they offer enhanced patient safety, convenience for self-administration (especially for chronic diseases like diabetes and arthritis), and reduced risk of dosing errors compared to traditional vial-and-syringe systems. For drug manufacturers, PFS minimize drug waste and simplify the sterile filling process, making them the preferred packaging format for high-value injectable therapies and sophisticated biologics, demanding high-precision Type I glass barrels.

What is delamination risk, and how are glass manufacturers mitigating this issue?

Delamination refers to the leaching of microscopic glass flakes from the internal surface of the container into the drug solution, potentially causing serious quality issues and patient harm. Manufacturers mitigate this risk primarily through highly controlled Type I borosilicate glass formulations, optimizing furnace parameters to eliminate defect sites, and employing advanced internal barrier coatings (e.g., specialized siliconization or chemically inert oxide layers) to protect the glass surface from aggressive drug formulations, particularly high-pH solutions.

How do global regulations (FDA, EMA) influence the Pharmaceutical Glass Market?

Global regulations heavily influence the market by setting mandatory quality standards for chemical stability (hydrolytic resistance), dimensional tolerance, and sterility. Compliance with USP, EP, and JP pharmacopeial standards is non-negotiable. Regulatory pressure continuously drives manufacturers to invest in advanced quality assurance, robust documentation (validation packages), and materials testing (Extractables and Leachables studies), thereby favoring established suppliers capable of ensuring zero-defect, highly stable glass packaging, especially for injectable drugs.

Which regional market is exhibiting the fastest growth in pharmaceutical glass adoption?

The Asia Pacific (APAC) region is demonstrating the fastest growth rate. This accelerated expansion is attributed to massive infrastructure investments in domestic pharmaceutical manufacturing across countries like China and India, increased prevalence of chronic diseases requiring modern drug therapies, and a growing regional shift towards adopting international quality standards, driving up the demand for premium Type I borosilicate packaging materials across the entire drug production spectrum.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager