Pharmaceutical Grade Bentonite Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437231 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Pharmaceutical Grade Bentonite Market Size

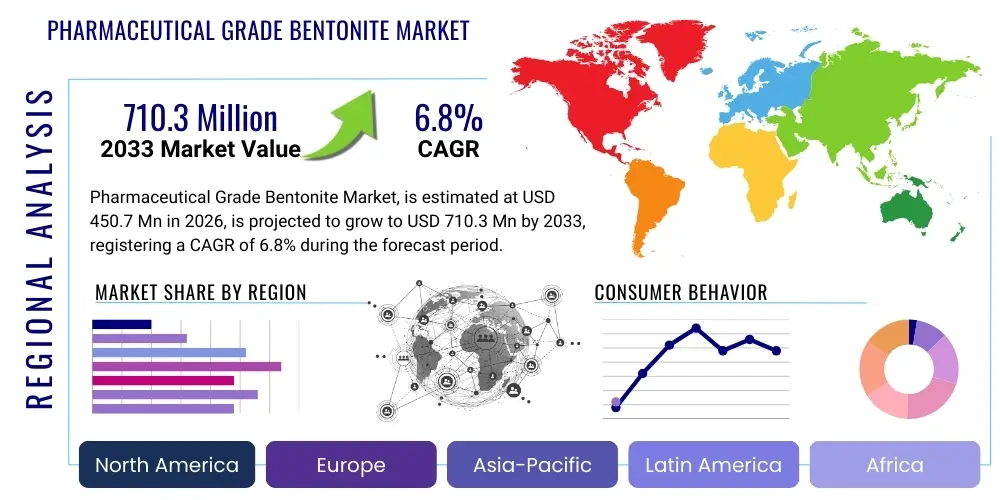

The Pharmaceutical Grade Bentonite Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450.7 Million in 2026 and is projected to reach USD 710.3 Million by the end of the forecast period in 2033.

Pharmaceutical Grade Bentonite Market introduction

The global Pharmaceutical Grade Bentonite Market encompasses the supply, distribution, and consumption of highly refined bentonite clay, a phyllosilicate mineral predominantly composed of the smectite group, specifically montmorillonite, which is chemically characterized by a high cation exchange capacity and unique layered crystalline structure. This specific mineralogical composition imparts exceptional colloidal, rheological, and adsorption characteristics, making it an indispensable raw material within the pharmaceutical and allied healthcare industries. To be certified as pharmaceutical grade, the material must strictly conform to globally recognized monographs such as the United States Pharmacopeia (USP), European Pharmacopoeia (EP), and British Pharmacopoeia (BP). This compliance ensures extremely low levels of heavy metals—including critical elements like lead, arsenic, and mercury—and mandates rigorous control over microbial contamination, thereby safeguarding patient health and maintaining formulation integrity. The versatility of bentonite allows it to function effectively in numerous roles, ranging from a mechanical stabilizer to a specific adsorbent in sophisticated drug delivery systems, driving consistent demand across diverse therapeutic areas.

In terms of practical application within drug manufacturing, pharmaceutical bentonite serves several vital functions across different dosage formats. For oral liquid formulations, its primary utility is derived from its thixotropic property; when agitated, the viscosity temporarily decreases, allowing easy administration, but upon standing, the viscosity recovers rapidly, which effectively prevents the sedimentation of insoluble Active Pharmaceutical Ingredients (APIs) or other insoluble components, ensuring dose uniformity throughout the product shelf life. In solid dosage forms, bentonite acts as a superior binder to improve the mechanical strength of tablets and as a disintegrant to facilitate the rapid breakdown and dissolution of the tablet mass upon ingestion, aiding in drug release kinetics. Furthermore, in specialized topical dermatological preparations, including lotions and creams, bentonite provides essential structural body, emulsion stabilization, and acts as a delivery matrix for active substances. The sustained growth of the geriatric population, which often requires easily administered liquid medications, further amplifies the demand for high-quality suspending agents like pharmaceutical bentonite, reinforcing its critical role in formulation stability and patient adherence.

The intrinsic benefits driving market adoption include its inert nature, which minimizes potential chemical interaction with sensitive APIs, and its natural origin, which appeals to manufacturers catering to the burgeoning natural and clean-label excipient trends in the nutraceutical and dietary supplement sectors that adhere to pharmaceutical production standards. Key driving factors propelling market expansion include the exponential growth in global generic drug manufacturing, which constantly seeks reliable and cost-efficient excipients, and the increasing focus on advanced controlled-release drug delivery systems where modified bentonites play a crucial role in regulating dissolution kinetics. The requirement for consistency in material performance across all global manufacturing sites necessitates supplier expertise in advanced processing technologies such as micronization and surface activation, ensuring the delivered product meets exacting quality standards regardless of the source of the raw clay deposit. Regulatory mandates for excipient traceability and quality consistency across international borders further cement the strategic importance of certified pharmaceutical grade bentonite suppliers.

Pharmaceutical Grade Bentonite Market Executive Summary

The Pharmaceutical Grade Bentonite Market trajectory is marked by aggressive investment in quality assurance protocols and strategic capacity expansion, particularly in regions experiencing a surge in pharmaceutical outsourcing. Analyzing key business trends reveals a significant movement towards backward integration, where major excipient suppliers are acquiring or establishing control over high-quality bentonite mines. This strategy is essential for ensuring supply chain resilience, mitigating raw material price volatility, and, most importantly, guaranteeing the source purity and traceability mandated by international pharmaceutical regulatory bodies. Furthermore, intellectual property development is focusing on specialty bentonite grades engineered through chemical modification or advanced physical treatment (e.g., thermal or acid activation) to optimize performance for specific APIs or novel administration routes, moving away from basic commodity supply and towards highly specialized functional excipient provision, commanding premium pricing and higher margins in niche therapeutic segments.

Regionally, the market displays a pronounced bifurcation in growth dynamics. Developed regions like North America and Western Europe remain crucial high-value markets, characterized by stable demand for premium, customized bentonite grades used in innovative drug development and specialized topical treatments. The market dynamic here is focused on technological leadership and regulatory expertise, often demanding specific particle size distributions and validated sterilization processes. In sharp contrast, the Asia Pacific (APAC) region, spearheaded by manufacturing powerhouses like China and India, exhibits the highest volume growth due to government support for domestic pharmaceutical manufacturing and its established position as the world's leading supplier of generics. This regional trend drives intense competition among suppliers to offer volume-based, cost-competitive products that still maintain full compliance with stringent USP/EP standards, necessitating massive operational scale and efficiency.

Segmental trends underscore the dominance of Sodium Bentonite due to its superior rheological profile, vital for liquid stability, capturing the largest market share by type. Application-wise, the excipient category, encompassing binders and suspending agents, remains the foundational revenue driver, reflecting its ubiquitous nature in solid and liquid formulations. However, the fastest growth is observed in the specialized adsorbent segment, driven by the increasing integration of bentonite into medical devices and advanced detoxifying formulations targeting gastrointestinal health. End-user analysis highlights the interdependence between high-volume generic manufacturers, which dictate overall market size, and the smaller, yet highly lucrative, nutraceutical and cosmetic pharmaceutical sectors, which drive innovation in high-purity processing and clean-label certification. Successful market participants must therefore maintain a dual strategy: maximizing efficiency for the commodity generic segment while simultaneously developing specialized, high-performance derivatives for complex, high-value applications.

AI Impact Analysis on Pharmaceutical Grade Bentonite Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into the Pharmaceutical Grade Bentonite value chain is fundamentally reshaping processes related to quality control, resource optimization, and formulation development, addressing key user concerns about consistency and risk. A primary area of analytical focus involves leveraging computer vision systems powered by AI for geological surveys and mineral identification during the upstream mining phase. By analyzing high-resolution satellite imagery, remote sensing data, and geophysical information, AI algorithms can predict the location and quality of high-purity montmorillonite deposits with far greater accuracy than traditional methods, drastically reducing exploration costs and ensuring that only the highest quality raw material enters the pharmaceutical refinement pipeline. Furthermore, in the raw material processing stage, sophisticated AI systems monitor and adjust critical parameters such as moisture content, particle size distribution, and hydration kinetics in real-time within the processing plant, achieving unparalleled lot-to-lot consistency that is nearly impossible to maintain through conventional, manual control mechanisms.

In the mid-stream refinement process, AI models are crucial for tackling one of the industry's most critical constraints: heavy metal contamination. Advanced ML classifiers analyze data from high-throughput analytical instruments (like Inductively Coupled Plasma Mass Spectrometry - ICP-MS, and X-ray Fluorescence - XRF) to identify and predict the presence of trace impurities in different ore batches based on mineralogical fingerprints. Based on these predictions, the system can autonomously optimize the washing, acid activation, or ion-exchange purification parameters, ensuring that the final purified bentonite consistently adheres to the ultra-low heavy metal thresholds mandated by global Pharmacopoeias. This proactive and predictive quality assurance minimizes costly batch rejection rates, significantly enhancing operational efficiency and lowering the overall cost of compliance, which is a major concern for manufacturers dealing with naturally variable raw materials like bentonite.

Downstream, AI provides unparalleled benefits in formulation science and product stability prediction. Machine learning algorithms are now utilized to model and predict the complex physicochemical interactions between various APIs and the structural layers of bentonite, particularly concerning drug release profiles, shelf-life, and formulation stability under varying environmental stressors. For instance, AI can simulate the thixotropic recovery time of a bentonite suspension under different shear conditions or predict the long-term sedimentation rate based on ambient temperature fluctuations, rapidly optimizing the necessary excipient concentration for maximum shelf stability before clinical trials begin. This predictive capability significantly reduces the need for lengthy, expensive, empirical experimentation, accelerating the time-to-market for new drug products and cementing AI's role as a transformative technology in developing and optimizing complex bentonite-based drug delivery systems. The adoption of AI is thus becoming a competitive necessity for suppliers aiming to be recognized as high-technology partners rather than mere raw material providers.

- Enhanced predictive modeling for drug formulation stability and shelf life, optimizing suspension viscosity and sedimentation rates based on AI simulations.

- AI-driven optimization of mining and purification processes for superior material consistency, leading to reduced impurity variance and minimized non-compliance risks.

- Automated quality control systems using machine vision for real-time monitoring of particle size, morphology, and color consistency during micronization.

- Streamlined regulatory documentation and automated generation of compliant Certificates of Analysis (CoA) through sophisticated database linkage and NLP tools.

- Predictive maintenance programs reducing critical equipment downtime in specialized micronization and sterilization plants, enhancing supply reliability.

- Accelerated discovery and development of novel chemical surface modification techniques via machine learning simulations of molecular binding efficiencies.

- Improved global supply chain traceability, inventory management, and risk assessment using integrated AI platforms across geographically dispersed logistics networks.

- Optimized resource utilization during purification (minimizing consumption of water, acids, and energy) leading to reduced operational costs and improved environmental sustainability metrics.

DRO & Impact Forces Of Pharmaceutical Grade Bentonite Market

The dynamics of the Pharmaceutical Grade Bentonite Market are molded by compelling Drivers (D), significant Restraints (R), exploitable Opportunities (O), and pervasive Impact Forces (IF). A key driver is the global health imperative to expand access to generic and essential medicines, particularly in developing economies, necessitating high volumes of reliable, certified excipients. The shift towards natural mineral-based ingredients in pharmaceutical and nutraceutical products further supports consumption, capitalizing on bentonite’s intrinsic safety profile, biocompatibility, and lower cost compared to synthetic polymers. This demand is amplified by the continuous need for stabilizing agents in increasing volumes of liquid and semi-solid formulations used for pediatric and geriatric patient populations. However, this market faces serious restraints, chief among them being the inherent geological variability of natural clay deposits, which makes achieving the stringent, consistent purity required by Pharmacopoeias challenging and capital-intensive. The required high investment in analytical testing, advanced processing refinement, and environmental remediation acts as a substantial cost burden and regulatory barrier to market entry, restricting competition primarily to large, established multinational corporations with deep geological and technical expertise, thereby limiting supply options.

The opportunities within the sector are primarily focused on technological advancement, material specialization, and geographic diversification. The development and commercialization of chemically modified bentonites—such as organo-clays or highly acid-activated variants designed for enhanced compatibility with specific classes of APIs, especially those with poor solubility—offer high-margin growth avenues. These specialty products are critical in novel drug delivery applications like transdermal patches, targeted drug carriers, and complex encapsulation systems. Furthermore, addressing the supply chain risk through strategic geographical diversification of mining operations and investing in sustainable, environmentally friendly processing technologies presents opportunities for suppliers to differentiate themselves in a market increasingly focused on corporate social responsibility and green chemistry initiatives. Impact forces stemming from innovation include the rapid adoption of Process Analytical Technology (PAT) to monitor and control purification and micronization processes in real-time, drastically reducing lot-to-lot variability and enhancing the reliability of the final product, which is a non-negotiable requirement from pharmaceutical buyers globally.

Geopolitical instability, trade protectionism, and climate change effects represent major external impact forces, as high-quality bentonite deposits are often geographically concentrated (e.g., in the US, Greece, Turkey, and China). Disruptions in mining operations due to regulatory changes, extreme weather events, or international shipping routes can severely compromise the global supply of critical excipients, leading to price spikes and manufacturing bottlenecks for pharmaceutical companies reliant on just-in-time inventory. The regulatory environment also acts as a forceful constraint; harmonized but ever-evolving global standards, particularly those concerning the allowable limits for heavy metals and residual solvents, necessitate ongoing, expensive upgrades to manufacturing infrastructure and continuous validation studies. Successfully navigating these impact forces requires suppliers to maintain redundant production capabilities across different geographical zones, invest heavily in specialized regulatory affairs expertise, and secure long-term contracts with geographically diversified mining partners to ensure supply continuity and mitigate market volatility, thereby stabilizing the overall market structure.

Segmentation Analysis

The segmentation of the Pharmaceutical Grade Bentonite Market offers critical insights into product usage, customer profiles, and technical requirements across the global pharmaceutical industry. The market segmentation by type—primarily Sodium Bentonite, Calcium Bentonite, and Potassium Bentonite—is foundational, reflecting distinct chemical structures and resulting performance characteristics. Sodium bentonite is prized for its high volume expansion, superior hydration rate, and high viscosity when mixed with water, making it the preferred choice for stabilizing pharmaceutical suspensions, and consequently dominates the market revenue share. Conversely, Calcium Bentonite exhibits lower swelling but higher adsorbent capacity for specific non-polar organic molecules, finding niche application as an anti-caking agent, clarifying agent, or detoxifying component in certain gastrointestinal preparations. Understanding this differential functionality is essential for targeted product development, specialized formulation strategies, and effective market positioning.

Segmentation by application clearly illustrates the market's dependency on the excipient function, which includes roles as a binder, disintegrant, and diluent in tablets, capsulses, and granules, driving the bulk of the sales volume. This stable excipient segment is characterized by high volume and fierce price competition. However, the rapidly expanding adsorbent segment, where bentonite is used in anti-diarrheal medications, gastrointestinal detoxifiers, and medical dressings, is demonstrating superior growth due to the mineral's highly effective toxin-binding capacity and safety profile. The stringent purity requirements for these internal applications demand the absolute highest levels of purity and specialized certifications, often commanding higher unit prices. Furthermore, the segmentation by end-user—including Branded Pharmaceutical Companies, Generic Drug Manufacturers, and CMOs—delineates buyer priorities, with generics manufacturers focusing heavily on cost-to-performance ratio and reliable volume supply, while branded pharma prioritize bespoke specifications, unique performance characteristics, and collaborative R&D for novel drug formulations, necessitating differentiated supplier engagement models.

The granularity provided by these segmentations allows key industry players to execute precision strategies. For example, a company specializing in acid-activated calcium bentonite would strategically target the nutraceutical and medical device end-user segment due to the specific heavy metal adsorption requirements of those products, while a producer of ultra-micronized sodium bentonite would focus intensely on high-volume generic drug CMOs in the APAC region for suspension stabilization. Crucially, the pharmaceutical grade segmentation (USP, EP, BP, JP) cuts across all other criteria, acting as a mandatory baseline quality requirement that underscores the perpetual importance of stringent quality control over simple cost metrics. Future market expansion will be significantly shaped by the ability of suppliers to innovate within the high-growth niche applications, such as specialized excipients for veterinary drugs and complex pediatric liquid formulations, ensuring material integrity and efficacy for highly regulated end-products worldwide.

- By Type:

- Sodium Bentonite (High swelling capacity, dominant in suspension stabilization and gelling)

- Calcium Bentonite (High adsorption capacity, utilized in clarifying, detoxification, and specific cosmetic pharmaceuticals)

- Potassium Bentonite (Specialized applications, lower market share)

- By Application:

- Excipient (Binder, Disintegrant, Filler, Flow Aid for solid dosage forms, largest volume segment)

- Suspending and Gelling Agent (Critical for liquid formulations and topical gels, leveraging thixotropic properties)

- Adsorbent (Used in antidiarrheal and detoxifying medications, capturing heavy metals and toxins)

- Emulsifier and Stabilizer (For complex topical creams and lotions)

- Thickener (Rheology modification for semi-solids)

- By End-User:

- Branded Pharmaceutical Companies (Demand customization and technical collaboration)

- Generic Drug Manufacturers (Focus on compliance, volume, and cost efficiency)

- Contract Manufacturing Organizations (CMOs) (Intermediary high-volume users requiring broad certified compliance across multiple clients)

- Nutraceutical and Dietary Supplement Manufacturers (Demand for natural, pharmaceutical-grade minerals with high purity)

- Veterinary Pharmaceuticals (Specialized oral and topical applications for animal health)

- By Grade:

- USP Grade (United States Pharmacopeia)

- EP Grade (European Pharmacopoeia)

- BP Grade (British Pharmacopoeia)

- JP Grade (Japanese Pharmacopoeia)

Value Chain Analysis For Pharmaceutical Grade Bentonite Market

The intricate value chain of the Pharmaceutical Grade Bentonite Market begins with upstream activities focused heavily on geological surveying, precise mining techniques, and initial processing—stages where consistency and quality selection are paramount. Raw bentonite ore, often sourced from highly concentrated, high-purity deposits globally, undergoes initial beneficiation, involving crushing, drying, and coarse classification. This initial quality screening is crucial because the presence of unwanted accessory minerals like quartz, iron oxides, or crystalline silica must be minimized immediately, as their presence drastically reduces the suitability and increases the difficulty and cost of downstream pharmaceutical purification. Leading companies invest heavily in optimizing these upstream logistics, often through backward integration or securing exclusive mining rights, to ensure a stable, high-quality feed material, thereby dictating cost structure and mitigating primary quality risks early in the chain. Geopolitical stability and local environmental regulations of the mining location significantly influence supply risk and operational expenditure at this foundational stage.

The midstream constitutes the core value-addition segment, involving sophisticated chemical and physical processing essential for achieving pharmaceutical compliance and desired performance characteristics. This stage includes optimized acid activation to modify surface charge and properties, selective sedimentation and washing cycles to remove soluble impurities and excess salts, and most importantly, ultra-micronization and milling using advanced jet mills to achieve the exact particle size distribution (PSD) and specific surface area required for various pharmaceutical applications. Following this refinement, the material undergoes advanced analytical chemistry verification using highly sensitive instruments like ICP-MS to confirm heavy metal limits are below Pharmacopoeial thresholds. Final processing steps often involve specialized, validated sterilization techniques (e.g., certified cleanroom packing, gamma irradiation, or heat sterilization) to meet strict microbial count regulations. This rigorous purification process distinguishes certified pharmaceutical suppliers from industrial ones and commands the significant price premium associated with the final certified grade product. Manufacturing expertise, robust validation studies, and strict adherence to global GMP protocols are the key competitive leverage points in this capital-intensive stage.

The downstream activities involve distribution, regulatory compliance, and final consumption. The distribution channel is highly controlled and characterized by complexity due to the need for maintained quality documentation and traceability. Direct channels are utilized for large, multinational pharmaceutical manufacturers under long-term quality agreements, allowing for robust audit trails and streamlined technical support. This direct relationship is essential for managing critical quality changes (Change Control). Indirect distribution utilizes specialized excipient distributors who possess the necessary expertise to maintain pharmaceutical warehousing conditions (temperature, humidity control), manage customs compliance, and provide local regulatory support to smaller pharmaceutical or nutraceutical companies across fragmented regional markets. End-users (e.g., CMOs and drug manufacturers) assess suppliers based not just on competitive pricing, but primarily on the reliability of the supply chain, the completeness of regulatory documentation (CoAs, DMFs, validation data), and the capacity for high-volume, consistent delivery, highlighting that robust logistics and expert regulatory affairs management are indispensable elements of the final value proposition in the pharmaceutical excipient market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.7 Million |

| Market Forecast in 2033 | USD 710.3 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mineral Technologies Inc., Imerys S.A., Clariant AG, Ashapura Minechem Ltd., Amcol International (A part of Minerals Technologies), Laviosa Chimica Mineraria S.p.A., Hojat Mining Industries Group, Kunimine Industries Co. Ltd., CETCO (A part of Minerals Technologies), Wyo-Ben Inc., Alfa Chemical Co. Ltd., G & W Mineral Resources, Volclay International, Gujarat Industrial Minerals Co., LKAB Minerals AB, Bayer AG (as a major end-user/integrated producer), BASF SE (through excipient division), Merck KGaA, Dorian Industrial Minerals, Akzo Nobel N.V. (related chemicals) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pharmaceutical Grade Bentonite Market Key Technology Landscape

The technological evolution within the pharmaceutical grade bentonite market is centered on achieving enhanced functional performance metrics, particularly material stability and regulatory compliance, signifying a transition from simple refinement towards complex particle engineering and surface chemistry modification. One of the most critical technological areas is the advanced implementation of micronization techniques, such as air-jet milling and high-pressure homogenization, to achieve precise, narrow particle size distributions (PSD) often in the nanometer range. This nano-level processing significantly increases the specific surface area, which is directly correlated with improved binding efficiency in tablets and superior colloidal properties crucial for maximizing drug adsorption capacity and ensuring long-term physical stability in liquid formulations. Suppliers are also adopting sophisticated laser diffraction and dynamic light scattering (DLS) technologies for accurate, real-time particle size analysis, feeding data back into Process Analytical Technology (PAT) systems to maintain consistent quality output and reduce batch variability, a core regulatory concern.

Purity enhancement technologies represent the highest capital investment area due to the rigorous regulatory landscape. Because bentonite is a naturally occurring mineral, the removal of trace heavy metals (like lead and arsenic) and crystalline silica requires complex, validated chemical separation processes. This includes optimized, proprietary acid-washing procedures, which selectively dissolve metal oxides without compromising the crucial structural integrity of the montmorillonite layers, followed by multi-stage ultrafiltration and dialysis systems to remove processing residues. Furthermore, achieving microbial compliance, particularly for sterile or semi-sterile products (like injectable suspensions or ophthalmic preparations), necessitates the use of validated sterilization technologies. Gamma irradiation remains a widely accepted method, though new non-thermal plasma sterilization techniques are being explored to minimize potential heat-induced structural changes in the clay, thereby preserving its intrinsic rheological properties crucial for formulation success and longevity.

Innovation is also highly concentrated in surface modification and functionalization, which allows bentonite to be precisely tailored for specific API characteristics and drug delivery needs. Technologies like organo-clay synthesis involve chemically treating the bentonite surface with specific organic cations (e.g., quaternary ammonium compounds) to intentionally transform the naturally hydrophilic clay into an organophilic (oil-loving) material. This technological leap allows the bentonite to interact effectively with lipophilic APIs or be integrated into lipid-based excipients, significantly enhancing solubility, bioavailability, and controlled release kinetics in specialized topical, transdermal, and sustained-release oral systems. Successful implementation of these advanced modification technologies requires deep proprietary chemical synthesis knowledge, rigorous safety testing, and continuous quality control at every step, creating a strong competitive moat for technologically leading suppliers and significantly raising the barrier for generic entrants in the specialty excipient segment, which commands the highest growth potential.

Regional Highlights

- North America (USA, Canada, Mexico)

- Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of Asia Pacific)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (GCC Countries, South Africa, Rest of MEA)

North America commands a premium position in the Pharmaceutical Grade Bentonite Market, characterized by high barriers to entry related to quality control, stringent regulatory scrutiny, and sophisticated documentation requirements, particularly in the United States. This region houses the headquarters and primary R&D facilities of several global pharmaceutical innovators and large-scale Contract Manufacturing Organizations (CMOs), driving demand for the most technologically advanced and highly certified grades of bentonite, often requiring triple compliance (USP, EP, JP). The strong emphasis on innovative drug delivery systems, coupled with high healthcare expenditure, ensures robust pricing power for suppliers who can guarantee superior batch consistency and comprehensive regulatory support. Furthermore, the robust presence of a highly regulated nutraceutical sector, particularly focused on digestive health and detoxification supplements, further stimulates demand for natural, ultra-pure mineral excipients adhering to pharmaceutical production standards.

The Asia Pacific (APAC) region is indisputably the high-growth frontier, projected to exhibit the highest CAGR, fueled by massive domestic demand for essential medicines and the region's increasing role as the global manufacturing center for Active Pharmaceutical Ingredients and finished generic drugs. Countries like India and China are witnessing extensive investment in new pharmaceutical manufacturing infrastructure, leading to surging consumption of high-volume, cost-effective excipients. While price sensitivity in APAC markets is generally higher than in North America or Europe, the rapid adoption of internationally harmonized standards (e.g., ICH guidelines) means that local manufacturers are rapidly upgrading their quality requirements, shifting demand towards certified USP/EP bentonite grades. This dynamic necessitates that global suppliers establish localized processing and efficient distribution networks within APAC to manage logistics cost-effectively and remain competitive while simultaneously guaranteeing certified quality and compliance documentation.

Europe represents a sophisticated, mature market emphasizing innovation in specialty applications, particularly in advanced dermatology, complex semi-solid dosage forms, and bio-pharmaceuticals. The market is concentrated in Western European nations (Germany, France, UK), which are global leaders in formulation science and medical device development. The demand here is fundamentally shaped by strict environmental regulations regarding mining and processing, alongside the European Pharmacopoeia’s demanding specifications for excipient characterization and batch stability. Suppliers successfully navigating the European market often differentiate themselves through certified sustainable sourcing practices, providing expert technical service, and offering bentonite grades precisely tailored for complex stability challenges in sensitive biologic formulations. Latin America and MEA are accelerating regions; growth is driven by government efforts to establish self-sufficiency in medicine supply and improving public health initiatives, increasing the need for reliably imported or locally sourced excipients as regulatory convergence towards international quality standards progresses, driving steady, long-term market expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pharmaceutical Grade Bentonite Market.- Mineral Technologies Inc. (A major integrated player controlling mining and processing, offering high-purity grades)

- Imerys S.A. (Global leader in specialty minerals, strong focus on excipients and performance additives)

- Clariant AG (Focus on functional excipients and specialty chemicals solutions)

- Ashapura Minechem Ltd. (Significant presence in Asian raw material supply and processing)

- Amcol International (A part of Minerals Technologies, specialized bentonite derivatives and organo-clays)

- Laviosa Chimica Mineraria S.p.A. (Leading European specialty clay supplier with advanced processing)

- Hojat Mining Industries Group (Regional focus on Middle Eastern and Asian market supply)

- Kunimine Industries Co. Ltd. (Key Japanese player with strong focus on high-quality J-grade standards)

- CETCO (A part of Minerals Technologies, known for high-grade, certified bentonite products)

- Wyo-Ben Inc. (Focused on high-quality US bentonite reserves and processing)

- Alfa Chemical Co. Ltd. (Chemical and specialty materials supplier for Asia)

- G & W Mineral Resources (Specializing in refined, certified mineral products)

- Volclay International (Global supplier of bentonite and related products for various industries)

- Gujarat Industrial Minerals Co. (Strong Indian market presence and supply chain)

- LKAB Minerals AB (Scandinavian supplier focusing on sustainable sourcing and high-purity applications)

- Bayer AG (Large pharmaceutical end-user, influencing excipient quality standards and consumption)

- BASF SE (Through excipient division, competing with functional fillers and binders)

- Merck KGaA (Provider of high-purity laboratory chemicals and formulation materials)

- Dorian Industrial Minerals (Specialized mining and advanced processing operations)

- Akzo Nobel N.V. (Indirectly through chemical additives used in processing)

Frequently Asked Questions

Analyze common user questions about the Pharmaceutical Grade Bentonite market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of bentonite in pharmaceutical formulations, specifically regarding suspensions?

Pharmaceutical grade bentonite primarily serves as a multi-functional excipient, acting as a highly effective suspending agent due to its thixotropic properties. This allows liquid suspensions to become fluid when shaken (enabling easy administration) but regain high viscosity quickly upon standing, effectively preventing sedimentation of Active Pharmaceutical Ingredients (APIs) and ensuring uniform dose delivery throughout the product's shelf life.

How is pharmaceutical grade bentonite differentiated from industrial bentonite and what standards must it meet?

The distinction lies in stringent purity and safety standards. Pharmaceutical grade bentonite (e.g., USP, EP, BP grade) must undergo extensive purification and validation processes, including sterilization, to minimize heavy metal content (like lead and arsenic), crystalline silica, and microbial load, ensuring safety and efficacy for human consumption or topical use, unlike industrial grades.

Which type of bentonite is the largest contributor to market revenue and why is it preferred?

Sodium Bentonite is generally the preferred type and the largest revenue contributor for high-performance pharmaceutical applications, particularly in stabilizing high-volume liquid suspensions and topical gels, owing to its superior swelling capacity, higher cation exchange capability, and ideal rheological performance profile compared to Calcium Bentonite.

What key technological developments are driving innovation in bentonite quality and performance?

Key technological advancements include ultra-fine micronization and nano-particle engineering to optimize surface area and particle size distribution, coupled with advanced chemical surface modification techniques (e.g., organo-clays) to tailor the material for specific API interactions, enhanced bioavailability, and integration into complex sustained-release drug delivery systems.

What major regulatory challenge impacts the global supply of pharmaceutical bentonite?

The central regulatory challenge is the consistent adherence to global Pharmacopoeial limits for inherent impurities, notably heavy metals, which requires suppliers to implement continuous, high-cost analytical testing (ICP-MS/XRF) and invest heavily in validated purification processes to mitigate the natural geological variability of the raw clay source across all production batches.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager