Pharmaceutical Packaging Machinery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432563 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Pharmaceutical Packaging Machinery Market Size

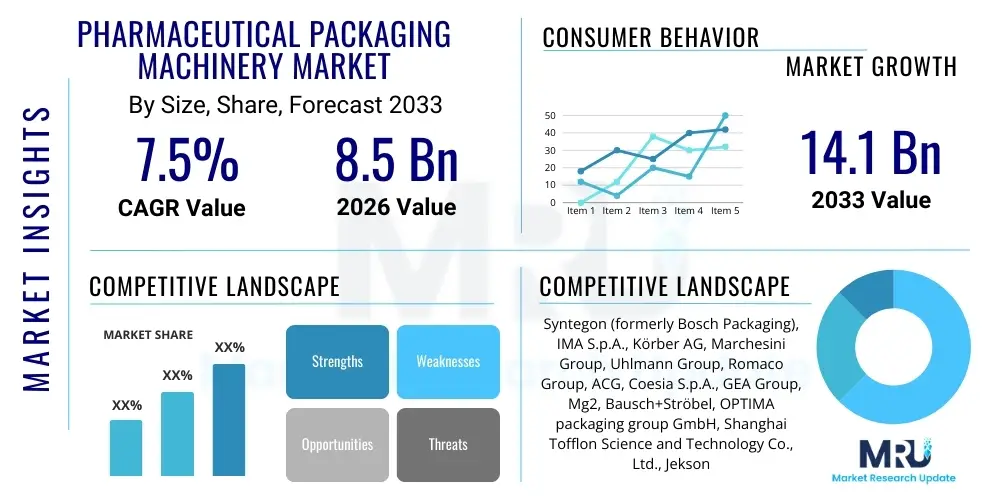

The Pharmaceutical Packaging Machinery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 14.1 Billion by the end of the forecast period in 2033.

Pharmaceutical Packaging Machinery Market introduction

The Pharmaceutical Packaging Machinery Market encompasses a range of specialized equipment designed for the secure, compliant, and efficient packaging of pharmaceutical products, including solids (tablets, capsules), liquids, injectables, and biologics. These machines perform critical functions such as blister packaging, strip packaging, filling, capping, labeling, cartoning, and serialization. The primary objective of pharmaceutical packaging machinery is to ensure product integrity, sterility, and patient safety while meeting stringent global regulatory requirements imposed by bodies like the FDA and EMA. The sophisticated nature of drug development, coupled with the necessity for high-speed, contamination-free operations, drives the continuous evolution of this market towards advanced automation and precision engineering. This machinery is vital for preventing counterfeiting, ensuring accurate dosing, and extending product shelf life.

The product description spans across various machinery types, categorized broadly into primary, secondary, and tertiary packaging systems. Primary packaging machines, such as blister formers and vial fillers, handle direct contact with the medication. Secondary packaging involves cartoning and bundling, enhancing consumer appeal and protective layers. Tertiary packaging, including palletizing and stretch wrapping systems, prepares the packaged drugs for logistics and distribution. Major applications of this machinery are pervasive throughout the pharmaceutical manufacturing lifecycle, including over-the-counter (OTC) drugs, prescription medications, generic pharmaceuticals, and increasingly, complex biologic products that require specialized cold-chain packaging solutions.

Key benefits derived from adopting advanced pharmaceutical packaging machinery include enhanced operational efficiency, reduced human error, maximized throughput, and strict adherence to Good Manufacturing Practices (GMPs). The driving factors propelling market growth are significant and multifaceted. They include the global increase in pharmaceutical R&D spending, particularly in personalized medicine, the surging demand for generic drugs due to cost pressures, and the mandatory global adoption of track-and-trace systems (serialization) to combat drug counterfeiting. Furthermore, the rising geriatric population worldwide, which necessitates greater consumption of medications, contributes substantially to the increasing production volumes requiring high-speed packaging solutions.

Pharmaceutical Packaging Machinery Market Executive Summary

The global Pharmaceutical Packaging Machinery Market is characterized by robust growth, primarily fueled by technological advancements in automation, robotics, and the pressing need for compliance with global serialization mandates. Business trends indicate a strong shift towards flexible packaging formats, enabling manufacturers to handle diverse batch sizes and product types (solids, liquids, and viscous biologics) on integrated lines. Key vendors are focusing intensely on developing smart machinery equipped with sensors and interconnected systems, facilitating real-hand monitoring and predictive maintenance (Industry 4.0). Mergers and acquisitions remain a core strategy for expanding technological portfolios, particularly in specialized areas like aseptic filling and high-containment packaging required for potent compounds, aiming for integrated supply chain solutions and improved operational expenditure efficiencies across the pharmaceutical manufacturing ecosystem.

Regional trends demonstrate that North America and Europe currently hold the largest market share, attributed to stringent regulatory frameworks, high adoption rates of advanced machinery, and the presence of major pharmaceutical innovators. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This explosive growth in APAC is driven by rapid industrialization, expanding domestic pharmaceutical production in countries like China and India (often focused on generics and vaccines), and significant investment by Contract Manufacturing Organizations (CMOs) seeking to upgrade their infrastructure to meet international quality standards. The Middle East and Africa (MEA) and Latin America are also showing promising growth, albeit from a smaller base, spurred by healthcare infrastructure improvements and foreign direct investment in local drug manufacturing capabilities.

Segment trends highlight the dominance of primary packaging machinery, specifically blister packaging equipment, owing to its cost-effectiveness, tamper-proof nature, and widespread application for oral solid dosage forms. However, the fastest-growing segment is anticipated to be specialized machinery for sterile injectables (vials, ampoules, pre-filled syringes), reflecting the pharmaceutical industry's pivot toward complex biologics and vaccine production. Regarding automation levels, fully automatic machinery continues to gain traction over semi-automatic and manual systems, driven by the imperative to minimize contamination risks and maximize output speed and accuracy. The cartoning and labeling segment is also experiencing high demand, directly linked to serialization mandates that require sophisticated coding, verification, and aggregation capabilities.

AI Impact Analysis on Pharmaceutical Packaging Machinery Market

User inquiries regarding AI's influence in pharmaceutical packaging predominantly revolve around themes of quality control, predictive maintenance, and optimized line efficiency. Common questions address how AI can eliminate human inspection errors, the capabilities of machine learning algorithms in forecasting equipment failure, and the integration of smart vision systems for real-time compliance checks. Users are particularly concerned about ensuring zero-defect packaging, maximizing uptime, and reducing the operational costs associated with complex, high-speed lines. The consensus expectation is that AI will transcend traditional automation by providing cognitive capabilities, shifting packaging operations from reactive maintenance and quality assurance to proactive, intelligent manufacturing environments.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the design and operation of pharmaceutical packaging machinery. AI-powered vision systems are replacing conventional optical sorters, offering unprecedented accuracy and speed in defect detection, color verification, and label integrity checks, crucial for meeting rigorous regulatory standards. By analyzing massive datasets collected from sensors on packaging lines—including vibration, temperature, and pressure—ML algorithms can establish baseline performance profiles. This allows for the identification of subtle deviations that precede mechanical failure, enabling predictive maintenance schedules and significantly minimizing unplanned downtime, a critical factor in high-volume production environments.

Furthermore, AI plays a pivotal role in optimizing production scheduling and material flow management within packaging facilities. Sophisticated algorithms can dynamically adjust machinery speeds and resource allocation based on real-time factors like raw material availability, labor constraints, and external demand forecasts. This level of optimization ensures maximum throughput efficiency and reduces waste associated with overproduction or incorrect packaging specifications. The long-term impact of AI is expected to lead to fully autonomous, self-adjusting packaging lines that can recalibrate for different product formats instantly, dramatically enhancing the flexibility and agility required by the evolving landscape of personalized medicine and smaller batch sizes.

- AI-Powered Vision Systems: Enhances quality control for blister checks, label placement, and serialization code verification, reducing false rejects and human error.

- Predictive Maintenance (PdM): Machine Learning algorithms analyze sensor data (vibration, temperature) to forecast equipment failures, increasing uptime and extending machinery lifespan.

- Automated Anomaly Detection: Identifies subtle deviations in packaging consistency or material handling that manual inspection might miss, ensuring absolute product integrity.

- Optimized Production Scheduling: AI algorithms dynamically manage batch sequencing, resource allocation, and line speed based on real-time operational constraints.

- Enhanced Data Integrity and Compliance: Supports track-and-trace systems by instantaneously processing and validating vast serialization data, crucial for regulatory adherence.

- Robotics and Cobots Integration: AI facilitates precise path planning and safe interaction between human operators and collaborative robots (cobots) used for heavy lifting and repetitive tasks like cartoning and palletizing.

DRO & Impact Forces Of Pharmaceutical Packaging Machinery Market

The Pharmaceutical Packaging Machinery Market is subject to powerful forces, dominated by mandatory global regulatory shifts toward serialization and track-and-trace systems, which necessitate significant capital investment in advanced machinery capable of high-speed coding and verification. This regulatory pressure acts as the primary driver, compelling manufacturers worldwide to modernize their equipment base. Simultaneously, the burgeoning global demand for generic pharmaceuticals and complex biologics, requiring specialized and high-precision aseptic filling, sustains market expansion. These drivers are tempered by significant restraints, namely the substantial initial cost of fully automated, integrated systems, which poses a barrier to entry for smaller manufacturers, and the ongoing challenge of integrating disparate legacy systems with modern, smart packaging lines.

Opportunities in this sector are highly correlated with technological innovation and emerging market development. The push toward Industry 4.0 principles, including the adoption of the Industrial Internet of Things (IIoT) and advanced robotics, provides lucrative avenues for specialized equipment providers offering integrated, data-driven solutions. Furthermore, the shift towards personalized medicine often entails smaller, specialized batch runs, driving demand for flexible machinery capable of rapid changeovers. Geographically, untapped potential lies within developing nations in the Asia Pacific and Latin America, where local pharmaceutical production is accelerating, requiring robust, scalable packaging infrastructure, often supported by international manufacturing partners and Contract Manufacturing Organizations (CMOs).

Impact forces shape the competitive dynamics and operational landscape of the industry. Porter's Five Forces analysis suggests that the bargaining power of buyers (large pharmaceutical companies) is moderate to high, as they often require customized, long-term maintenance contracts and highly specific machinery configurations. However, the bargaining power of suppliers (of components like sensors, robotics, and software) is also increasing due to the complexity and specialization of modern packaging equipment. The threat of new entrants is low due to the high capital requirement, intellectual property protection, and the necessity for proven regulatory compliance track records. Substitute threats are negligible, as physical packaging remains mandatory for drug safety, ensuring sustained demand for the specialized machinery required to produce it.

Segmentation Analysis

The Pharmaceutical Packaging Machinery market is intricately segmented based on machinery type, product packaged, and end-user, reflecting the diverse requirements of pharmaceutical manufacturing. Segmentation by type—Primary, Secondary, and Tertiary—delineates the stage of the packaging process, with primary machinery being the most crucial due to its direct contact with the drug product and stringent hygienic requirements. Primary packaging machinery dominates revenue share, driven by the critical need for barrier protection, dosing accuracy, and sterile conditions, especially for injectables and liquid formulations. The growth in specialized drug delivery systems, such as auto-injectors and pulmonary devices, also necessitates bespoke primary packaging equipment.

Analyzing the market by product type highlights the sustained dominance of the Blister Packaging segment, which is favored globally for its cost-efficiency, visual appeal, and high security for solid dose pharmaceuticals (tablets and capsules). However, the Filling & Capping segment, encompassing machinery for vials, ampoules, and syringes, is experiencing the fastest expansion. This accelerated growth is directly correlated with the global increase in R&D and manufacturing of complex biologic drugs, vaccines, and sterile injectables, all of which require extremely precise, high-speed aseptic processing capabilities. Equipment in this segment must adhere to Grade A and B cleanroom standards, driving innovation toward isolator technology and restricted access barrier systems (RABS).

From an end-user perspective, Pharmaceutical Companies represent the largest consumer base, utilizing machinery for proprietary drug manufacturing across their internal production facilities. Nonetheless, Contract Manufacturing Organizations (CMOs) are the fastest-growing end-user segment. CMOs often invest heavily in highly flexible and versatile packaging lines to service multiple clients and handle rapid changeovers between diverse product formats and batch sizes. Their rapid capacity expansion and continuous technological upgrades to meet stringent global client requirements, including sophisticated serialization implementation, solidify their role as a major growth catalyst in the packaging machinery market, fostering demand for robust, integrated solutions.

- By Type:

- Primary Packaging Machinery

- Secondary Packaging Machinery

- Tertiary Packaging Machinery

- By Product:

- Blister Packaging Machinery

- Strip Packaging Machinery

- Filling & Capping Machinery (Vials, Ampoules, Syringes)

- Labeling & Cartoning Machinery

- Wrapping and Bundling Machinery

- Cleaning and Sterilization Machinery

- Others (Inspection and Serialization Systems)

- By End-User:

- Pharmaceutical Companies

- Contract Manufacturing Organizations (CMOs)

- Research Laboratories and Biopharmaceutical Companies

- By Automation Level:

- Automatic

- Semi-Automatic

- Manual

Value Chain Analysis For Pharmaceutical Packaging Machinery Market

The value chain for pharmaceutical packaging machinery begins upstream with the suppliers of specialized components, including robotics, industrial sensors, sophisticated control software (PLCs), high-grade stainless steel, and specialized machine tooling. These suppliers often dictate the technological ceiling of the final machinery. Integration complexity is high in this stage, as machinery manufacturers must secure reliable sources for specialized, high-precision components that comply with hygienic design standards and ensure operational longevity. Successful manufacturers maintain deep, collaborative relationships with specialized component vendors to facilitate the integration of cutting-edge technologies like advanced servo drives, vision systems, and IIoT communication protocols into their equipment designs, ensuring continuous innovation and quality assurance in a highly regulated environment.

Midstream, the value chain involves the core processes of machinery design, manufacturing, assembly, and rigorous testing. Leading Original Equipment Manufacturers (OEMs) focus heavily on R&D to develop machinery that offers high speed, rapid format changeover capabilities, and strict compliance with serialization requirements (e.g., incorporating highly accurate printing, verification, and aggregation systems). Significant value addition occurs through software integration, enabling seamless control, data capture, and connectivity necessary for Industry 4.0 adoption. The testing phase is critical, often involving extensive Factory Acceptance Tests (FAT) and Site Acceptance Tests (SAT) to ensure the machinery operates flawlessly under pharmaceutical manufacturing conditions and meets all necessary validation protocols (e.g., IQ/OQ/PQ).

Downstream analysis focuses on distribution, installation, and after-sales service. Direct distribution channels are prevalent for complex, high-value machinery, allowing OEMs to provide specialized consultancy and customized installation services to pharmaceutical clients and CMOs. Indirect channels, involving agents or regional distributors, are more common in emerging markets to facilitate localized sales and support. Crucially, post-sale services, including preventative maintenance contracts, spare parts supply, and software updates (especially for serialization and data management), represent a significant revenue stream and a core competitive differentiator. Effective service minimizes client downtime, which is paramount in continuous pharmaceutical production, thereby solidifying long-term customer loyalty and repeat business. The final stage involves the end-users—pharmaceutical companies and CMOs—who depend on these distribution and support networks to ensure operational efficiency.

Pharmaceutical Packaging Machinery Market Potential Customers

The primary and largest category of potential customers for pharmaceutical packaging machinery comprises integrated Pharmaceutical Companies, including both multinational organizations and large regional players. These companies require vast fleets of machinery for both proprietary drug manufacturing and the production of established medicines. Their purchasing decisions are driven by the need for high-throughput, customized solutions that integrate seamlessly with their entire production ecosystem, including upstream manufacturing processes (API production) and downstream logistics. They demand the highest standards of quality, validation documentation, and long-term service contracts to minimize supply chain risks and ensure continuous compliance with strict regulatory requirements across different geographic markets where their products are sold.

The second fastest-growing customer segment consists of Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs). CMOs represent a dynamic and expanding customer base, distinguished by their requirement for high flexibility and versatility. Since CMOs handle a diverse range of products for multiple clients—from small clinical trial batches to large-scale commercial runs—they prioritize machinery capable of rapid format changeovers, specialized handling of potent or cytotoxic compounds (requiring high containment packaging), and advanced serialization capabilities that adhere to various global mandates simultaneously. Their investment strategy is typically focused on state-of-the-art, modular equipment that offers operational agility and maximizes utilization across various contract types, ensuring their competitiveness in the outsourced manufacturing sector.

A third, specialized customer segment includes Biopharmaceutical Companies, Research Laboratories, and compounding pharmacies. Biopharma customers, in particular, drive demand for specialized aseptic filling and capping machinery optimized for complex injectable drug formats, such as pre-filled syringes and lyophilized products. Their needs are often centered around small-to-medium batch sizes requiring ultra-high precision, minimal product loss, and stringent contamination control via isolator or Restricted Access Barrier System (RABS) technology. Research laboratories utilize smaller, often semi-automatic, machinery for pilot runs and stability testing packaging. As the complexity of modern medicine increases, the specialized requirements of biopharmaceutical producers continue to be a significant driver of high-end machinery development and sales.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 14.1 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Syntegon (formerly Bosch Packaging), IMA S.p.A., Körber AG, Marchesini Group, Uhlmann Group, Romaco Group, ACG, Coesia S.p.A., GEA Group, Mg2, Bausch+Ströbel, OPTIMA packaging group GmbH, Shanghai Tofflon Science and Technology Co., Ltd., Jekson Vision, KHS Group, Mpac Group plc, Vanguard Pharmaceutical Machinery, Inc., Sepha Ltd., Dara Pharmaceutical Equipment, Hamer Packaging Technology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pharmaceutical Packaging Machinery Market Key Technology Landscape

The technological landscape of the Pharmaceutical Packaging Machinery market is rapidly evolving, driven primarily by the pursuit of higher precision, increased throughput, and unwavering regulatory compliance. One of the most significant technological trends is the widespread integration of advanced serialization and aggregation systems. These systems utilize high-resolution printing technology (like thermal inkjet or laser), sophisticated vision inspection cameras, and specialized software to apply unique, verifiable codes to every unit package, bundle, case, and pallet. This is essential for meeting mandates such as the EU Falsified Medicines Directive (FMD) and the U.S. Drug Supply Chain Security Act (DSCSA), transforming packaging lines into critical data-generating hubs rather than mere assembly points.

Another dominant technological shift is the adoption of Industry 4.0 principles, leveraging the Industrial Internet of Things (IIoT) to connect all operational machinery components. This connectivity enables real-time data collection, remote diagnostics, and condition monitoring. Modern packaging machinery is equipped with hundreds of sensors that feed data into centralized Manufacturing Execution Systems (MES). This integration allows for sophisticated predictive maintenance schedules, automated troubleshooting, and overall equipment effectiveness (OEE) optimization. The goal is to move beyond mere automation to create truly smart, self-optimizing packaging lines that minimize human intervention and maximize yield with minimum risk of contamination or error.

Furthermore, specialized packaging technologies are seeing massive investment, particularly in aseptic processing and high-containment solutions. The growth of biologic drugs necessitates specialized machinery featuring isolators or Restricted Access Barrier Systems (RABS) to maintain Grade A cleanroom conditions during critical filling and capping processes. This equipment minimizes human contact and environmental contamination, ensuring the sterility of sensitive injectable products. Concurrently, the rise of powerful and potentially hazardous compounds requires machinery designed with high containment features (e.g., negative pressure systems and specialized cleaning protocols) to protect operators and prevent cross-contamination, pushing the boundaries of machine design towards hermetically sealed and automated handling solutions for advanced pharmaceutical products.

Regional Highlights

The global Pharmaceutical Packaging Machinery market exhibits distinct regional dynamics, influenced by varying regulatory stringencies, manufacturing maturity, and healthcare spending profiles.

- North America (NA): Dominates the market value share, characterized by high adoption rates of advanced, fully automated, and sophisticated packaging equipment. The region's market growth is driven by stringent FDA regulations, massive pharmaceutical R&D investment, and the early and extensive implementation of serialization mandates across the supply chain. The U.S. remains the core driver, focusing heavily on high-speed filling for injectables and specialized primary packaging for complex biologics.

- Europe: Represents the second-largest market, primarily driven by the robust presence of large multinational pharmaceutical companies and high compliance requirements under the Falsified Medicines Directive (FMD). European manufacturers are leaders in developing highly flexible, modular machinery designed for rapid changeovers and high OEE, catering to both domestic and export markets. Countries like Germany and Italy are major hubs for packaging machinery innovation and manufacturing.

- Asia Pacific (APAC): Projected to be the fastest-growing regional market globally due to exponential growth in pharmaceutical manufacturing in India and China (largely generic and biosimilar production). This growth is fueled by expanding healthcare access, growing patient populations, and significant infrastructure investment. While cost sensitivity remains a factor, the need to meet international quality and serialization standards is pushing manufacturers toward adopting modern, automated Western-style machinery rapidly, often facilitated by CMO investments.

- Latin America (LATAM): Exhibits stable growth, influenced by regional efforts to expand local drug production and reduce reliance on imports. Key markets like Brazil and Mexico are upgrading their packaging infrastructure, leading to increased demand for semi-automatic and mid-level automatic machinery, alongside compliance-focused labeling and cartoning equipment.

- Middle East and Africa (MEA): Emerging market with promising long-term growth, primarily concentrated in countries with established pharmaceutical bases (e.g., Saudi Arabia, UAE, South Africa). Market demand focuses on imported, automated equipment to establish foundational manufacturing capabilities and ensure drug security and traceability, often supported by government initiatives to localize pharmaceutical production.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pharmaceutical Packaging Machinery Market.- Syntegon Technology GmbH (formerly Bosch Packaging Technology)

- IMA S.p.A.

- Körber AG (through its subsidiary, Körber Pharma)

- Marchesini Group S.p.A.

- Uhlmann Group

- Romaco Group

- ACG (Associated Capsules Group)

- Coesia S.p.A.

- GEA Group Aktiengesellschaft

- Mg2 S.r.l.

- Bausch+Ströbel Maschinenfabrik Ilshofen GmbH + Co. KG

- OPTIMA packaging group GmbH

- Shanghai Tofflon Science and Technology Co., Ltd.

- Dara Pharmaceutical Equipment

- Jekson Vision

- KHS Group

- Mpac Group plc

- Vanguard Pharmaceutical Machinery, Inc.

- Sepha Ltd.

- Antares Vision S.p.A. (Focusing on inspection and serialization)

Frequently Asked Questions

Analyze common user questions about the Pharmaceutical Packaging Machinery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Pharmaceutical Packaging Machinery Market?

The market growth is primarily driven by the mandatory global implementation of serialization and track-and-trace regulations, increased production of generic drugs and complex biologics, and the critical need to minimize human error and contamination risks through advanced automation and robotics.

How is Industry 4.0 influencing pharmaceutical packaging lines?

Industry 4.0 enables the integration of IIoT (Industrial Internet of Things), AI-driven predictive maintenance, and real-time data analytics into packaging machinery. This drastically improves Overall Equipment Effectiveness (OEE), facilitates remote diagnostics, and optimizes production schedules for greater flexibility.

Which segment of the packaging machinery market is experiencing the fastest growth?

The Filling and Capping machinery segment, particularly those specialized for aseptic processing of vials, ampoules, and pre-filled syringes, is witnessing the fastest growth due to the surging global demand and investment in complex biologic drugs and vaccine manufacturing.

What role do Contract Manufacturing Organizations (CMOs) play in the market?

CMOs are major customers driving demand for highly flexible, modular, and versatile packaging machinery capable of rapid changeovers. Their strategic investment in state-of-the-art equipment ensures they meet diverse client needs and comply with stringent international packaging standards, accelerating market adoption of new technologies.

What is the main restraint impacting the market adoption of new machinery?

The main restraint is the high initial capital investment required for purchasing fully automated, sophisticated, and validated packaging lines. This cost barrier, coupled with the complexity of integrating new digital machinery with existing legacy systems, often slows down the modernization process for smaller manufacturers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager