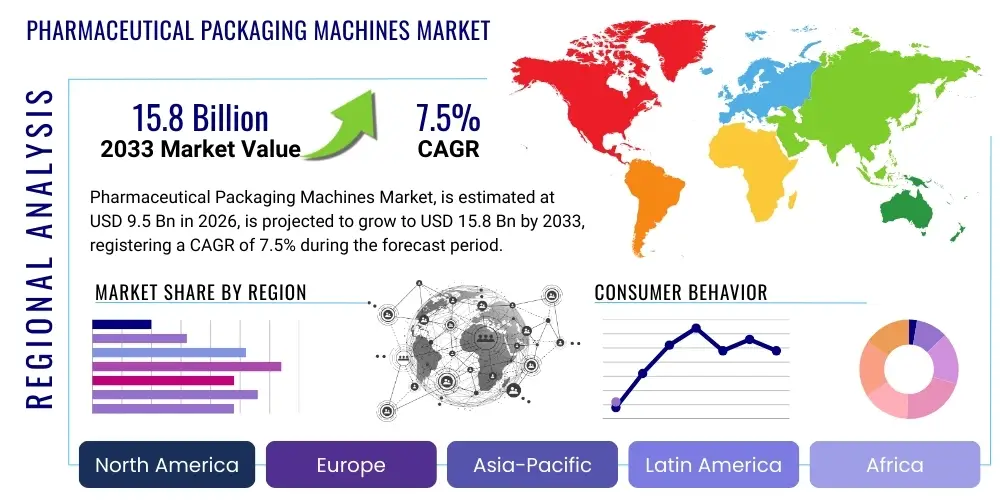

Pharmaceutical Packaging Machines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437982 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Pharmaceutical Packaging Machines Market Size

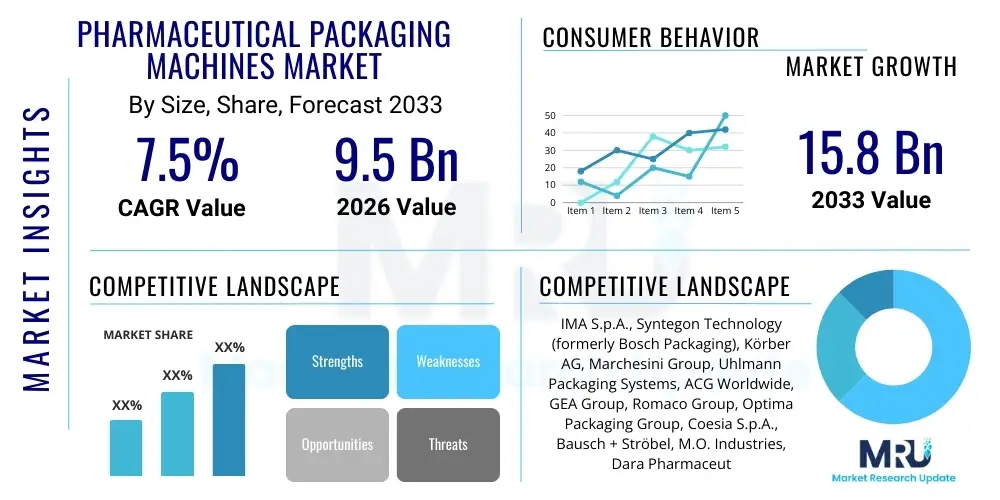

The Pharmaceutical Packaging Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 9.5 Billion in 2026 and is projected to reach USD 15.8 Billion by the end of the forecast period in 2033.

Pharmaceutical Packaging Machines Market introduction

The Pharmaceutical Packaging Machines Market encompasses sophisticated equipment designed for the secure, compliant, and efficient containment and protection of pharmaceutical products, including solids, liquids, and sterile injectables. These machines perform critical functions such as blister packaging, strip packaging, bottle filling, vial and ampoule processing, and advanced secondary packaging operations like cartoning and labeling. The core product description involves highly automated, precise machinery built to meet stringent regulatory standards imposed by bodies like the FDA and EMA, requiring validation, serialization capabilities, and resistance to contamination. Major applications span across primary, secondary, and tertiary packaging stages, ensuring product integrity and supply chain traceability. The primary benefits include increased production speed, enhanced product safety through sterile environments, reduced human error, and compliance with evolving global track-and-trace mandates. Driving factors include the global expansion of generic drug manufacturing, the rising demand for sophisticated biologicals requiring complex cold chain packaging, and continuous technological advancements in automation and robotics designed to maximize operational throughput and minimize material waste while adhering to Good Manufacturing Practices (GMP).

Pharmaceutical Packaging Machines Market Executive Summary

The Pharmaceutical Packaging Machines Market is experiencing robust expansion driven by critical business trends focused on digitization, sustainability, and heightened regulatory scrutiny concerning product safety and anti-counterfeiting measures. Key business trends include the shift towards integrated, end-to-end packaging lines featuring predictive maintenance and IoT capabilities, allowing manufacturers to achieve higher Overall Equipment Effectiveness (OEE). Segment trends highlight significant growth in aseptic packaging machinery due to the surging pipeline of biologics and biosimilars, alongside the continuous innovation in primary packaging, specifically fast changeover blister and sachet machines optimized for flexible manufacturing. Regionally, the Asia Pacific (APAC) market is poised for the fastest growth, propelled by massive investments in local pharmaceutical manufacturing capabilities in India and China, aiming to serve large domestic and export markets. North America and Europe maintain dominance in adopting advanced, high-speed automated systems, particularly those integrating Artificial Intelligence (AI) for quality control and defect detection. The overall market trajectory emphasizes efficiency, compliance, and flexible machinery that can rapidly adapt to diverse drug formats and serialization requirements across global supply chains, reinforcing the necessity for advanced packaging solutions.

AI Impact Analysis on Pharmaceutical Packaging Machines Market

User queries regarding the impact of Artificial Intelligence (AI) and Machine Learning (ML) on the Pharmaceutical Packaging Machines Market typically revolve around operational efficiency gains, error reduction in quality control, predictive maintenance capabilities, and the seamless integration of packaging data into enterprise resource planning (ERP) systems. Common concerns focus on the cost of implementing AI-driven vision systems, the need for specialized IT infrastructure and personnel, and how AI can ensure compliance with evolving global serialization standards while maintaining data security. Users are keenly interested in how AI algorithms can interpret complex sensor data to anticipate mechanical failures, thereby minimizing downtime—a critical factor in high-volume production environments. Expectations are high for AI to revolutionize quality inspection, moving beyond simple image comparison to sophisticated anomaly detection that catches microscopic defects or incorrect labeling at line speeds previously unattainable by conventional systems. Consequently, the key themes summarize into enhanced precision, proactive equipment management, and superior compliance through intelligent data utilization across the packaging lifecycle, fundamentally transforming operational paradigms from reactive to predictive.

The integration of AI algorithms into pharmaceutical packaging lines marks a profound technological shift, moving from static automation to intelligent, adaptive manufacturing processes. This sophisticated application of machine learning extends across the entire packaging workflow, significantly enhancing throughput and ensuring compliance integrity. For example, AI-powered vision systems, utilizing deep learning networks, are now capable of analyzing high-resolution images of packaged products, labels, and blisters in real-time. This level of analysis far surpasses the capabilities of traditional human or rule-based inspection systems, enabling the immediate identification of minute defects such as misaligned text, minor seal compromises, or particle contamination within vials, thereby drastically reducing the risk of product recalls and protecting patient safety. Such precision is paramount in sterile environments where error tolerance is virtually zero, driving the adoption of high-cost, high-value AI components.

Furthermore, AI is fundamentally changing equipment maintenance strategies by enabling true predictive maintenance rather than scheduled or reactive approaches. Machine learning models analyze vast streams of operational data—including vibration patterns, temperature fluctuations, motor performance metrics, and energy consumption—to establish baselines and identify subtle anomalies indicative of impending mechanical failure. By alerting maintenance teams hours or even days before a component breakdown occurs, AI minimizes unplanned downtime, which is extremely costly in pharmaceutical production. This predictive capability significantly boosts Overall Equipment Effectiveness (OEE), optimizing resource allocation and extending the lifespan of complex, expensive machinery. The market is thus seeing a premium placed on packaging machines offering native integration with cloud-based AI platforms for continuous monitoring and optimization, making the machines smarter and inherently more reliable throughout their operational tenure.

- AI-driven Quality Control: Utilizes deep learning vision systems for real-time, high-speed detection of micro-defects in labeling, printing, and sealing processes.

- Predictive Maintenance: Analyzes sensor data (vibration, temperature, current) to forecast equipment failure, dramatically reducing unplanned downtime and improving OEE.

- Optimized Serialization: AI enhances the efficiency and accuracy of unit-level serialization and aggregation processes, ensuring global compliance (e.g., DSCSA, FMD).

- Throughput Optimization: ML algorithms dynamically adjust machine parameters (e.g., speed, temperature) based on real-time feedback loops to maximize production rates while maintaining quality standards.

- Supply Chain Visibility: Facilitates the seamless integration of packaging data with supply chain management systems, improving traceability and anti-counterfeiting efforts.

- Reduced Material Waste: Intelligent systems minimize material consumption (film, foil, carton) by optimizing material flow and handling, contributing to sustainability goals.

DRO & Impact Forces Of Pharmaceutical Packaging Machines Market

The Pharmaceutical Packaging Machines Market is influenced by a dynamic interplay of factors that both accelerate and constrain growth, forming strong impact forces shaping investment decisions and technological development. Drivers primarily include the booming global generic and biosimilar drug markets, which necessitate high-volume, cost-efficient packaging solutions, and the strict mandate for serialization and track-and-trace capabilities globally, compelling pharmaceutical manufacturers to upgrade their machinery. Simultaneously, the increasing prevalence of chronic diseases and the subsequent rise in specialized medication pipelines, such as injectables and personalized medicines, drive demand for specialized, high-precision aseptic filling and packaging equipment. Conversely, Restraints are significant, notably the extremely high initial capital investment required for automated, compliant packaging lines, which poses a barrier to entry for smaller manufacturers or those in developing economies. Furthermore, the stringent regulatory environment and the time-consuming validation processes necessary for new equipment introduce complexity and delays, constraining rapid market expansion. Opportunities exist primarily in the rapid digitalization and integration of packaging lines, focusing on Industry 4.0 concepts like IoT and remote diagnostics, and the growing demand for sustainable packaging solutions, pushing machinery providers to innovate with eco-friendly materials and designs. These forces collectively dictate the market direction, favoring solution providers who can offer high-compliance, flexible, and technologically advanced systems that offer superior long-term cost of ownership, while successfully navigating regulatory bottlenecks.

Segmentation Analysis

The Pharmaceutical Packaging Machines Market is comprehensively segmented based on Type, Product, and End-User, reflecting the diverse requirements of the global pharmaceutical and biopharmaceutical industries. The market segmentation provides a granular view of demand patterns, highlighting areas of high growth such as aseptic and primary packaging machinery. Segmentation by Type distinguishes between primary packaging machines (e.g., blistering, strip, vial filling), which directly contact the drug product, and secondary packaging machines (e.g., cartoning, labeling, inspection), which prepare the product for distribution. The Product segmentation focuses on the specific drug format being packaged, with significant revenue derived from Blister Packaging Machines and specialized equipment for Vials and Ampoules, crucial for the expanding sterile injectable market. End-User segmentation reveals that Pharmaceutical Manufacturing companies remain the largest buyers, while Contract Packaging Organizations (CPOs) are rapidly increasing their market share due to the trend of outsourcing complex packaging operations, demanding highly flexible, multi-format machinery capable of rapid changeovers between client products. This detailed segmentation aids stakeholders in identifying core markets and tailoring their technological offerings to specific industry needs.

- By Type:

- Primary Packaging Machinery

- Secondary Packaging Machinery

- Tertiary Packaging Machinery

- By Product:

- Blister Packaging Machines

- Strip Packaging Machines

- Liquid Filling and Sealing Machines (Bottles, Vials, Ampoules)

- Powder Filling Machines (Dose, Sachet)

- Cartoning Machines

- Labeling Machines

- Wrapping Machines

- Case Packing & Palletizing Machines

- By End-User:

- Pharmaceutical and Biotechnology Companies

- Contract Packaging Organizations (CPOs)

- Nutraceutical and Generics Manufacturers

Value Chain Analysis For Pharmaceutical Packaging Machines Market

The Value Chain of the Pharmaceutical Packaging Machines Market begins with sophisticated upstream activities involving raw material suppliers, including high-grade steel, specialized alloys, and advanced electronic components, which must meet precise manufacturing tolerances and sterility standards. The core manufacturing stage involves machine design, precision engineering, and software development, where Original Equipment Manufacturers (OEMs) focus heavily on integrating compliance features (like validation documentation, serialization readiness, and GMP adherence) into their machinery. Distribution channels are complex, often involving a mix of direct sales teams for large, custom projects and specialized regional distributors providing localized support, installation, and after-sales maintenance services crucial for high-uptime operations. Downstream, the value chain extends to pharmaceutical companies and CPOs, who utilize the equipment to package their products efficiently. A critical aspect of the current value chain is the dominance of indirect services, particularly software updates, validation support, and long-term maintenance contracts, which constitute a significant and growing revenue stream for OEMs, ensuring the continued compliance and operational effectiveness of the installed base. The quality and compliance of components and the efficiency of the after-sales support significantly impact the overall customer perceived value and operational longevity of the packaging lines.

Pharmaceutical Packaging Machines Market Potential Customers

The primary consumers and key buyers in the Pharmaceutical Packaging Machines Market are institutions that require highly regulated and high-volume packaging capabilities to handle sensitive drug products. The largest segment of potential customers remains established Pharmaceutical and Biopharmaceutical Companies, including global innovators and large generic manufacturers, who continuously invest in upgrading and expanding their packaging lines to handle new drug formats (especially parenteral and aseptic products) and comply with evolving traceability mandates. A rapidly expanding customer base consists of Contract Packaging Organizations (CPOs) and Contract Manufacturing Organizations (CMOs). As pharmaceutical companies increasingly outsource non-core activities, CPOs require flexible, high-speed machines capable of handling small-to-medium batch sizes across multiple formats, often investing heavily in multi-product, quick-changeover lines. Finally, Nutraceutical and Large-Scale Generics Manufacturers, particularly those operating in emerging economies, represent a significant volume-driven customer segment, requiring robust, cost-effective machines optimized for mass production of tablets and capsules, prioritizing efficiency and low cost of ownership over bespoke high-end features, driving demand for scalable, proven packaging technologies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 9.5 Billion |

| Market Forecast in 2033 | USD 15.8 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IMA S.p.A., Syntegon Technology (formerly Bosch Packaging), Körber AG, Marchesini Group, Uhlmann Packaging Systems, ACG Worldwide, GEA Group, Romaco Group, Optima Packaging Group, Coesia S.p.A., Bausch + Ströbel, M.O. Industries, Dara Pharmaceutical, MG2 S.r.l., Accutek Packaging Equipment. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pharmaceutical Packaging Machines Market Key Technology Landscape

The technological landscape of the Pharmaceutical Packaging Machines Market is characterized by a relentless drive towards integration, precision, and intelligence, deeply rooted in the principles of Industry 4.0. Core technologies center on high-speed servo-driven mechanisms and robotics, replacing older mechanical systems to ensure greater precision, faster changeovers, and significantly higher operational speeds while minimizing material waste. Servo motors allow for precise control over individual packaging components, which is critical for handling delicate drug forms like biologics or for achieving perfect synchronization during complex blister forming and sealing processes. Furthermore, advanced vision inspection systems leveraging high-resolution cameras and machine learning algorithms have become standard, essential for verifying unit dose quality, detecting minuscule particulate matter, and ensuring 100% accurate code reading for regulatory compliance. The widespread adoption of modular machine design allows pharmaceutical companies to rapidly reconfigure production lines to accommodate various drug formats and batch sizes without extensive engineering downtime, boosting manufacturing flexibility. This integration of modular hardware with intelligent software is the defining feature of modern pharmaceutical packaging technology.

A major focus area within the technology landscape is Aseptic Packaging Technology, driven by the expanding market for sterile injectables, vaccines, and highly sensitive biopharmaceuticals. This requires machinery featuring advanced isolator and Restricted Access Barrier System (RABS) technology to maintain grade A environments during filling and sealing operations. Key advancements here include VHP (Vaporized Hydrogen Peroxide) decontamination capabilities and single-use technologies (SUTs) integrated into the filling modules to reduce cross-contamination risks and minimize cleaning validation efforts. The complexity of these systems demands highly sophisticated control architectures, often utilizing Programmable Logic Controllers (PLCs) and Supervisory Control and Data Acquisition (SCADA) systems that ensure comprehensive data logging and adherence to 21 CFR Part 11 requirements, providing an auditable trail for every packaged unit.

Finally, the evolution of serialization and aggregation technologies remains central to innovation, directly responding to global legislative mandates. Modern packaging lines incorporate high-resolution inkjet printing or laser marking systems, coupled with integrated cameras, to apply unique identifiers (e.g., 2D matrix codes) at various packaging levels—vial, carton, bundle, and case. The technological challenge lies in ensuring these systems operate reliably at extreme line speeds without compromising print quality or verification accuracy. Software platforms that seamlessly manage the vast amounts of serialization data (Level 1 to Level 5) and communicate with national tracking databases are essential, pushing equipment vendors to offer robust, integrated software solutions that are scalable and compliant across diverse international markets, fundamentally changing the definition of a complete packaging machine solution.

Regional Highlights

The global Pharmaceutical Packaging Machines Market exhibits significant regional variations in growth drivers, technological maturity, and regulatory demands, making localized strategies essential for global OEMs. North America and Europe represent the largest markets in terms of value, characterized by high investment in advanced automation, aseptic technology, and sophisticated serialization systems. These regions are early adopters of Industry 4.0 concepts, driven by stringent regulatory frameworks (FDA, EMA) and a high concentration of pharmaceutical R&D, focusing on biologics and complex drug delivery systems which necessitate specialized, high-precision packaging. The mature infrastructure and focus on labor optimization incentivize investments in fully integrated, high-speed lines featuring robotics and AI-powered quality inspection.

Asia Pacific (APAC) is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is primarily fueled by the burgeoning generic drug manufacturing hubs in India and China, coupled with increasing disposable incomes leading to higher local healthcare spending. Governments in APAC are prioritizing the establishment of domestic manufacturing capabilities, driving massive demand for cost-effective, high-volume machinery, particularly for blister, strip, and solid dosage packaging. While initial adoption may prioritize proven, reliable systems, there is a clear and accelerating trend towards implementing serialization readiness and automated quality control to meet export standards to regulated markets, indicating a rapid technological catch-up phase.

Latin America and the Middle East & Africa (MEA) currently hold smaller but rapidly developing market shares. Growth in these regions is heavily influenced by foreign direct investment and government initiatives aimed at reducing reliance on imported pharmaceuticals. The need for primary packaging machines, such as basic filling and labeling equipment, is robust as local production ramps up. Regulatory standards are slowly converging toward global norms, gradually forcing local manufacturers to seek more compliant and automated machinery. These regions offer significant long-term growth potential, particularly for OEMs offering flexible, modular systems that can scale with a manufacturer's evolving production volume and complexity.

- North America: Dominant market share driven by advanced automation, high demand for aseptic filling machines (due to biologics growth), and early adoption of AI for quality control and predictive maintenance, underpinned by strict FDA mandates.

- Europe: Strong market value supported by stringent EU GMP guidelines and mandatory serialization (EU FMD), fostering demand for complex, integrated packaging lines and innovative sustainable material handling capabilities.

- Asia Pacific (APAC): Highest growth trajectory, powered by large-scale production of generics and vaccines in China and India, increasing healthcare expenditure, and substantial government investments in domestic manufacturing infrastructure.

- Latin America (LATAM): Moderate growth supported by local pharmaceutical expansion and investments aimed at regulatory compliance harmonization, focusing on reliable, mid-range automation solutions.

- Middle East & Africa (MEA): Emerging market driven by pharmaceutical self-sufficiency goals (e.g., Saudi Arabia, UAE) and increasing need for basic to intermediate-level packaging automation to replace manual processes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pharmaceutical Packaging Machines Market.- IMA S.p.A.

- Syntegon Technology (formerly Bosch Packaging Technology)

- Körber AG

- Marchesini Group

- Uhlmann Packaging Systems LP

- ACG Worldwide

- GEA Group Aktiengesellschaft

- Romaco Group

- Optima Packaging Group GmbH

- Coesia S.p.A.

- Bausch + Ströbel Maschinenfabrik Ilshofen GmbH + Co. KG

- M.O. Industries S.p.A.

- Dara Pharmaceutical Packaging

- MG2 S.r.l.

- Accutek Packaging Equipment Companies, Inc.

- Harro Höfliger Verpackungsmaschinen GmbH

- Tampco, Inc.

- KHS GmbH

- Sejong Pharmatech

- Multivac Group

Frequently Asked Questions

Analyze common user questions about the Pharmaceutical Packaging Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What technological factors are driving the demand for aseptic packaging machinery?

The primary driver is the rapid growth in the global pipeline for biopharmaceuticals, vaccines, and sterile injectables, which require strict isolation technology (RABS or isolators) during filling to maintain product sterility and meet stringent regulatory requirements (e.g., contamination control and validation standards). Advancements in VHP decontamination and single-use system integration are crucial factors.

How are serialization mandates impacting machine investment decisions globally?

Global serialization mandates (such as the US DSCSA and EU FMD) necessitate significant capital expenditure on upgrading existing packaging lines or purchasing new machines equipped with integrated serialization, aggregation, and verification capabilities. Manufacturers prioritize machines with robust software platforms for data management and high-speed, reliable printing/vision systems to ensure compliance and traceability across the supply chain.

Which geographical region offers the highest growth potential for OEMs in this market?

Asia Pacific (APAC), particularly driven by India and China, offers the highest growth potential. This is due to massive government and private sector investment in expanding domestic pharmaceutical manufacturing capacity, catering to large domestic populations, and increasing demand for cost-effective packaging solutions for generic drugs and vaccines, accelerating the shift from manual to automated processes.

What role does Industry 4.0 play in modern pharmaceutical packaging operations?

Industry 4.0 principles, including the Internet of Things (IoT), AI, and Big Data analytics, enable smarter packaging lines. They facilitate predictive maintenance, remote diagnostics, real-time performance monitoring (OEE), and dynamic adjustments to operational parameters, leading to minimized downtime, higher production quality, and better integration with enterprise-level planning systems.

What is the key challenge pharmaceutical manufacturers face when adopting new packaging machines?

The key challenge is managing the extremely high initial capital cost combined with the extensive regulatory validation and qualification process (IQ/OQ/PQ) required for new equipment. The need for precise documentation and demonstrating absolute compliance with GMP standards often leads to prolonged implementation timelines and requires specialized technical personnel for successful integration and launch.

What is the definition of Primary Packaging Machinery in this context?

Primary Packaging Machinery refers to equipment that performs tasks directly related to containing the pharmaceutical product, such as blister forming and sealing, vial filling and capping, or strip packaging. Since these machines are in direct contact with the drug, they are subject to the highest standards of sterilization, hygiene, and validation (GMP).

How is sustainability affecting the design and materials used in packaging machines?

Sustainability is compelling OEMs to design machines that can handle new eco-friendly materials like monomaterials, recycled plastics, and paper-based foils without compromising speed or seal integrity. Machine design focuses on reducing energy consumption, minimizing material scrap rates, and accommodating lighter-weight packaging formats to lower overall environmental impact while maintaining product protection.

What is the primary advantage of utilizing servo technology over traditional mechanical drives?

Servo technology offers precise, independent control over multiple machine axes, leading to faster changeover times, greater flexibility in handling different product formats and sizes, and superior accuracy in indexing and positioning, which is critical for high-speed filling and precision blistering processes.

Who are the major end-users driving demand for highly flexible, modular packaging systems?

Contract Packaging Organizations (CPOs) and large Contract Manufacturing Organizations (CMOs) are the primary drivers for flexible, modular systems. They require equipment capable of rapid changeovers between different customer products, varying batch sizes, and diverse primary and secondary packaging formats to maximize operational agility and capacity utilization.

What is the importance of Level 5 data management in pharmaceutical packaging?

Level 5 data management refers to the secure, cloud-based exchange of serialization data between the manufacturer and regulatory bodies or supply chain partners. It is crucial for anti-counterfeiting efforts, enabling global traceability, and ensuring seamless compliance with diverse international track-and-trace legislations by providing an authoritative record of every unit packaged.

Describe the key functionality of a Cartoning Machine in secondary packaging.

A Cartoning Machine takes filled and sealed primary packages (like blister packs, vials, or bottles) and automatically inserts them into cardboard boxes or cartons. Its functionality includes leaflet insertion, code verification, lot number printing, and closing the carton via tucking or gluing, preparing the product for the next stage of aggregation.

Why is the need for validation documentation critical in this market?

Validation documentation (Installation Qualification, Operational Qualification, Performance Qualification - IQ/OQ/PQ) is mandatory as per GMP guidelines. It provides documented evidence that the packaging machine operates consistently according to specifications, ensuring product quality and safety, and is a prerequisite for regulatory approval to use the equipment for commercial drug production.

What are the typical components of an advanced Blister Packaging Machine?

An advanced Blister Packaging Machine typically includes a forming station (using thermoforming or cold forming), a product feeding unit (often utilizing robotics), a sealing station (heat and pressure), a coding/printing unit (for batch information), and an inspection system (vision camera) before final cutting and stacking.

How is the rise of personalized medicine influencing packaging technology?

Personalized medicine requires packaging solutions that can handle extremely small batch sizes and often unique, unit-dose requirements. This is driving demand for flexible, scalable micro-dose filling equipment and serialization systems that can uniquely track individual patient treatments with precision and integrity, demanding high levels of automation.

What is the core difference between RABS and Isolator technology in aseptic packaging?

Restricted Access Barrier Systems (RABS) offer a high level of contamination control with physical barriers, but require human intervention via glove ports. Isolator technology offers a superior, closed barrier system that maintains an entirely sealed, positive-pressure sterile environment, often utilizing VHP decontamination, minimizing human interaction and significantly lowering contamination risk for the most sensitive products.

What is the main restraint related to skilled labor in this market?

The complexity of modern, highly automated packaging lines integrating robotics, AI vision systems, and specialized software requires a highly skilled workforce for operation, maintenance, and programming. The shortage of personnel trained in these specialized Industry 4.0 skills represents a significant operational restraint, particularly in emerging markets.

How do leading OEMs ensure customer compliance with evolving global standards?

Leading OEMs proactively ensure compliance by designing machines with integrated serialization readiness, providing comprehensive IQ/OQ/PQ documentation packages, offering continuous software updates for regulatory changes, and delivering specialized training and support to validate the equipment lifecycle according to regional regulatory requirements.

What is the future outlook for the tertiary packaging segment?

The tertiary packaging segment (case packing and palletizing) is expected to see increased automation and robotic integration. The focus will be on improving aggregation efficiency for serialization compliance and incorporating automated guided vehicles (AGVs) or autonomous mobile robots (AMRs) for seamless material handling between the packaging line and the warehouse.

Define Overall Equipment Effectiveness (OEE) in the context of packaging machines.

OEE is a key performance indicator (KPI) measuring the efficiency of a packaging line, calculated by multiplying Availability, Performance, and Quality. For pharmaceutical packaging, maximizing OEE is critical, and AI-driven predictive maintenance and minimized quality defects are primary methods used to optimize this metric.

How are Contract Packaging Organizations (CPOs) influencing technology requirements?

CPOs demand flexible, high-speed, multi-format machinery with fast changeover features to handle diverse client products and specifications efficiently. Their need for agility drives OEMs to invest in modular designs and simplified HMI (Human-Machine Interface) systems that reduce setup time and error rates across varied production runs.

What constitutes the Upstream Analysis in the Value Chain of this market?

Upstream analysis focuses on the procurement and sourcing of high-precision raw materials and specialized components, including pharmaceutical-grade stainless steel, high-performance electronics, servo motors, and advanced sensor technology, ensuring all inputs meet the rigorous compliance standards necessary for building GMP-compliant machinery.

Why is data integrity a critical concern for packaging line software?

Data integrity is vital because the software tracks batch records, quality inspection results, and mandatory serialization data. Any failure to maintain accurate, secure, and auditable records (often mandated by 21 CFR Part 11) can lead to severe regulatory consequences, including product rejection or inability to trace packaged goods.

What is the market relevance of vial and ampoule filling machines?

Vial and ampoule filling machines are highly relevant due to the continuous expansion of the parenteral drug market, including advanced biologics and highly potent oncology treatments. These machines require advanced aseptic handling and high precision to ensure accurate dosing and prevent contamination in sterile liquid filling processes.

In which segment is the application of robotics most prevalent?

Robotics is highly prevalent in the secondary and tertiary packaging segments, particularly in complex applications like high-speed cartoning, specialized product feeding into primary packs, case packing, and fully automated palletizing, optimizing handling efficiency and reducing manual contamination risks.

How do currency fluctuations affect the Pharmaceutical Packaging Machines Market?

Since packaging machinery is often high-value, high-cost capital equipment primarily manufactured in Europe and North America and sold globally, strong fluctuations in major currencies (like the Euro or USD) can significantly impact the final purchase cost for buyers in emerging markets, potentially leading to delayed investment decisions or shifts towards local manufacturers.

What is the primary function of a Case Packing Machine?

A Case Packing Machine takes aggregated secondary packages (cartons or bundles) and efficiently arranges and places them into shipping containers or corrugated cases. In modern lines, this process includes the crucial step of applying and verifying the tertiary level serialization codes required for supply chain logistics.

Explain the driving factor related to chronic diseases in this market.

The increasing global prevalence of chronic diseases (like diabetes, cardiovascular conditions) leads to higher production volumes of maintenance medications, requiring efficient mass-production packaging machinery. Furthermore, complex treatments often require specialized packaging, such as auto-injectors or specialized blister formats, driving technological innovation in specific machine types.

What are the concerns regarding cybersecurity for connected packaging lines?

As packaging machines become part of the Industrial IoT (IIoT), the primary cybersecurity concern is protecting sensitive operational data and ensuring that the control systems are impervious to malicious attacks that could compromise production quality, data integrity (serialization data), or lead to physical machine damage or downtime.

How important is after-sales service and support for packaging machine OEMs?

After-sales service is extremely important, representing a critical competitive differentiator. Pharmaceutical manufacturers require rapid, qualified support for validation, maintenance, spare parts, and remote diagnostics to ensure high uptime and long-term compliance, making the service contract an integral part of the total cost of ownership (TCO).

What is the definition of a Sachet/Stick Pack Filling Machine?

A Sachet or Stick Pack Filling Machine is designed to package single doses of powders, granules, or liquids into small, flexible pouches. These machines are favored for over-the-counter medications, nutraceuticals, and specific prescription drugs, prioritizing high throughput and precise dosing control in a compact format.

How is the market addressing the demand for environmentally sustainable packaging solutions?

The market addresses sustainability by focusing on machine flexibility to handle thinner films, recyclable materials, and lighter-weight cartons. OEMs are also incorporating features like reduced energy consumption during operation and designing equipment that minimizes product and material waste during the packaging process.

What distinguishes Secondary Packaging Machinery from Primary Packaging?

Secondary packaging machinery deals with aggregating, labeling, and protecting the primary-packaged unit, preparing it for distribution. Examples include cartoning, bundling, and applying security seals, operations that do not involve direct contact with the medicinal product itself.

What types of pharmaceutical products primarily drive the Blister Packaging segment?

The Blister Packaging segment is primarily driven by solid dosage forms, including tablets, capsules, and soft gels, due to the high protection, convenient unit-dosing, and enhanced patient compliance provided by blister formats, making it essential for over-the-counter and prescription oral medications.

Explain the concept of 'quick changeover' and its value.

Quick changeover refers to the machine’s ability to transition rapidly and efficiently from packaging one product format or batch size to another. Its value lies in reducing downtime and increasing line flexibility, which is crucial for manufacturers or CPOs handling multiple Stock Keeping Units (SKUs) or frequent small-batch production runs.

What is the major difference in machine specifications needed for generics versus high-value biologics?

Generics packaging emphasizes high throughput, robustness, and cost efficiency, focusing on bulk solid dosage machines. Biologics packaging requires high-precision, low-speed, specialized aseptic equipment (vial/syringe fillers) integrating RABS or Isolator technology, prioritizing sterility, minimal product loss, and stringent contamination control above sheer volume.

What impact does China’s domestic manufacturing growth have on the global market?

China's push for domestic pharmaceutical self-sufficiency and the expansion of its generics export market fuels massive local demand for packaging machines, driving high-volume sales. This growth encourages global OEMs to establish local manufacturing or service facilities while simultaneously fostering competition from capable domestic Chinese machine builders.

How is predictive maintenance implemented using advanced technology?

Predictive maintenance uses IoT sensors to collect continuous data on machine health (vibration, temperature, current). Machine Learning algorithms analyze this data in real-time to detect subtle deviations from normal operation, providing accurate forecasts of potential component failure, allowing maintenance to be scheduled proactively before a breakdown occurs.

What is the role of SCADA systems in managing a packaging line?

Supervisory Control and Data Acquisition (SCADA) systems monitor and control entire packaging processes remotely. They collect data from PLCs and sensors, provide a centralized human-machine interface (HMI), generate historical records for compliance purposes, and ensure operational oversight and consistency across complex, integrated lines.

Why is the need for highly precise dosing equipment increasing?

The increasing use of highly potent and specialized active pharmaceutical ingredients (APIs), particularly in oncology and personalized medicine, mandates highly precise dosing equipment (micro-dosing). Equipment must minimize drug waste and ensure therapeutic efficacy and patient safety through exceptionally accurate filling mechanisms.

How does the geopolitical landscape affect supply chain risk for packaging machinery?

Geopolitical tensions can introduce supply chain volatility, impacting the cost and availability of critical components (e.g., specialized electronics, metals). Manufacturers must manage this risk by diversifying their sourcing strategies and investing in inventory buffers for high-demand, long-lead-time machine parts to ensure production continuity.

What differentiates a Labeling Machine used in pharmaceuticals?

Pharmaceutical labeling machines are distinguished by their need for extremely high accuracy, reliable print verification systems (checking codes and text), and the ability to handle security features (tamper-evident seals). They must integrate seamlessly with serialization systems to apply and verify unique identification codes on vials and cartons at high speeds.

What are the implications of the growth of nutraceuticals on the packaging market?

The nutraceutical market drives demand for packaging machines that prioritize high-volume production, versatility in handling various ingredient forms (powders, tablets), and cost efficiency. While compliance is less stringent than pharmaceuticals, the need for efficiency, product differentiation, and reliable sealing remains high, often leveraging existing pharmaceutical packaging technology.

How do machine vendors utilize modular design?

Modular design involves building packaging lines from standardized, interchangeable units. This allows customers to easily scale production capacity, replace obsolete sections, or reconfigure the line layout to accommodate new products or packaging formats with minimal interruption and lower long-term investment risk.

What is the primary constraint related to high initial capital investment?

The high initial capital investment required for automated, compliant, high-speed packaging lines often represents a significant barrier, especially for smaller or emerging pharmaceutical manufacturers, leading them to delay upgrades or opt for older, less efficient second-hand equipment, thereby limiting rapid modernization across the industry.

Why is temperature control crucial in Blister Packaging Machines?

Precise temperature control is crucial in blister packaging, especially during the forming (thermoforming) and sealing stages. Inconsistent temperatures can compromise the seal integrity, potentially exposing the drug to moisture or oxygen, leading to product degradation, and failing regulatory quality checks.

What is the benefit of integrating specialized robotics into the product feeding system?

Specialized robotics in product feeding (pick-and-place) increase efficiency, improve accuracy in placement (e.g., placing odd-shaped devices), reduce potential physical damage to delicate products, and minimize human contact, which is vital for maintaining high levels of hygiene and reducing cross-contamination risk on the line.

Describe the current trend regarding machine footprint in production facilities.

The current trend fav

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Pharmaceutical Packaging Machines Market Size Report By Type (Primary Packaging Machine, Secondary Packaging Machine, Labeling and Serialization Machine), By Application (Liquids Packaging, Solids Packaging, Semi-Solids Packaging, Other Products Packaging), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Pharmaceutical Packaging Machines Market Statistics 2025 Analysis By Application (Liquids Packaging, Solids Packaging, Semi-Solids Packaging), By Type (Primary Packaging Machine, Secondary Packaging Machine, Labeling and Serialization Machine), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager