Pharmaceutical Wholesale & Distribution Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432937 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Pharmaceutical Wholesale & Distribution Market Size

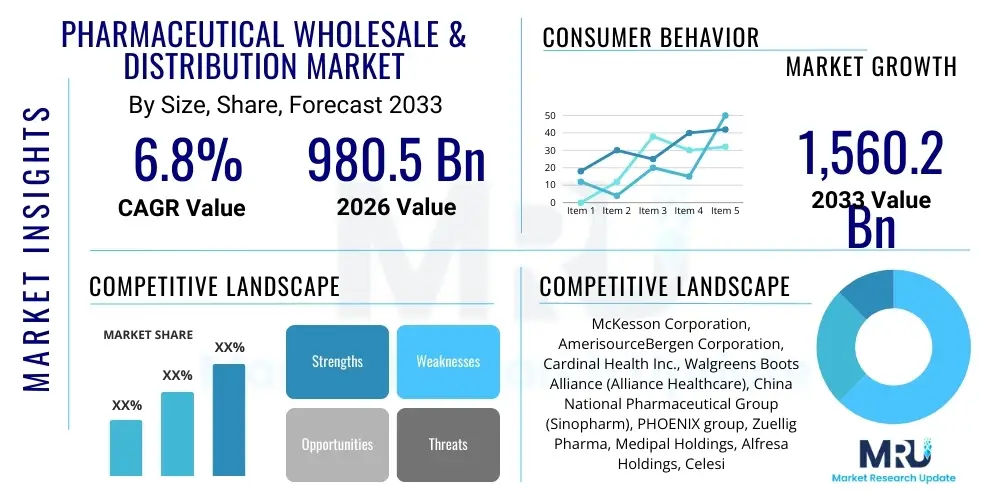

The Pharmaceutical Wholesale & Distribution Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 980.5 Billion in 2026 and is projected to reach USD 1,560.2 Billion by the end of the forecast period in 2033.

Pharmaceutical Wholesale & Distribution Market introduction

The Pharmaceutical Wholesale & Distribution Market encompasses the complex logistics and intermediary activities essential for moving finished drug products, medical supplies, and biologicals from manufacturers to dispensing entities such as hospitals, pharmacies, clinics, and government health organizations. The market is defined by stringent regulatory requirements, the necessity for cold chain management, and high-volume, low-margin operations. Major applications include hospital supply management, retail pharmacy inventory replenishment, and specialized distribution of high-cost biopharmaceuticals. The core benefits derived from this market structure are enhanced supply chain resilience, standardized inventory management, and broad geographic access to critical medications. Driving factors include the increasing global prevalence of chronic diseases, expansion of healthcare infrastructure in emerging economies, and technological advancements in supply chain visibility and security. The market acts as the backbone of the global healthcare ecosystem, ensuring timely and secure delivery of vital products, thereby directly influencing patient outcomes and public health stability.

Pharmaceutical Wholesale & Distribution Market Executive Summary

The Pharmaceutical Wholesale & Distribution sector is experiencing significant transformation driven by evolving global healthcare policies, digital integration, and consolidation among major players. Business trends indicate a strong focus on margin optimization through advanced automation, particularly in warehousing and last-mile delivery, alongside diversification into value-added services like inventory financing and patient assistance programs. Regionally, North America maintains market dominance due to high healthcare expenditure and established infrastructure, although the Asia Pacific region is demonstrating the highest growth trajectory, fueled by expanding universal healthcare coverage and rising demand for generics. Segment trends highlight the increasing importance of specialty pharmaceuticals, which demand sophisticated cold chain logistics and specialized handling, pushing distributors to invest heavily in advanced infrastructure compliant with global standards like Good Distribution Practices (GDP). Furthermore, the shift towards direct-to-patient models, though nascent, is impacting traditional wholesale channels, necessitating flexible and hybrid distribution strategies focused on enhanced data security and traceability across the entire supply chain lifecycle.

AI Impact Analysis on Pharmaceutical Wholesale & Distribution Market

User queries regarding AI’s influence on pharmaceutical distribution primarily revolve around how artificial intelligence can optimize historically manual or predictive processes. Key themes include AI’s role in demand forecasting accuracy, minimizing spoilage (especially for cold chain products), enhancing supply chain transparency via predictive risk analysis, and automating compliance reporting. Concerns often focus on the initial capital investment required for AI infrastructure, data privacy issues concerning sensitive distribution metrics, and the potential displacement of human labor in warehousing and logistics management. Users are highly expectant of AI delivering superior inventory efficiency, providing real-time vulnerability detection for counterfeit drugs, and enabling dynamic route optimization that significantly reduces operational costs and delivery times across complex regional networks.

- Enhanced Demand Forecasting: AI algorithms analyze historical sales, seasonal trends, and epidemiological data to predict drug demand with significantly higher accuracy, minimizing stock-outs and excess inventory.

- Optimized Logistics and Route Planning: Machine learning models calculate optimal delivery routes in real-time, factoring in traffic, weather, and delivery windows, reducing fuel consumption and operational expenditure.

- Improved Cold Chain Monitoring: AI systems continuously monitor temperature fluctuations, identifying potential risks to temperature-sensitive pharmaceuticals preemptively and triggering immediate corrective actions.

- Automation of Warehouse Operations: Robotics and AI-driven sorting systems accelerate picking, packing, and sorting processes, increasing throughput and accuracy while reducing labor costs.

- Counterfeit Detection and Traceability: AI analyzes serialization data patterns and anomalies across the supply chain, bolstering efforts against illicit drug distribution and ensuring regulatory compliance.

- Predictive Maintenance: AI monitors the performance of critical distribution infrastructure (trucks, refrigeration units) to predict equipment failure, ensuring uninterrupted supply chain operations.

DRO & Impact Forces Of Pharmaceutical Wholesale & Distribution Market

The dynamics of the Pharmaceutical Wholesale & Distribution Market are governed by powerful interconnected forces encompassing legislative mandates, economic pressures, and technological acceleration. Key drivers include the global aging population and the associated rise in chronic disease management requiring continuous drug supply, coupled with the increasing volume of high-value specialty drugs demanding precise handling. Restraints largely center on stringent regulatory pricing pressures from governments and payers, the requirement for massive capital investment in advanced cold chain infrastructure, and the inherent complexity of navigating diverse international regulatory landscapes. Opportunities emerge through expansion into underserved emerging markets, offering sophisticated value-added services beyond mere distribution (such as data analytics for manufacturers), and the integration of blockchain technology to enhance supply chain security. These forces collectively shape the market's direction, emphasizing the need for distributors to maintain high efficiency, comply rigorously with global GDP standards, and strategically adapt to deflationary pricing environments while simultaneously investing in specialized logistics capabilities required by modern pharmaceutical pipelines. The central impact force remains the necessity to provide uninterrupted, secure, and compliant access to life-saving medicines across all geographic territories.

Segmentation Analysis

The Pharmaceutical Wholesale & Distribution Market is primarily segmented based on product type, distribution channel, and geography, reflecting the heterogeneity of pharmaceutical products and the diverse methods of reaching end-users. Product segmentation typically divides the market into branded drugs, generic drugs, and over-the-counter (OTC) medicines, each presenting distinct margins, volume characteristics, and handling requirements. Distribution channels are critical, distinguishing between retail pharmacy distribution, hospital distribution, and mail-order/e-commerce pharmacy distribution, which dictate the necessary logistical infrastructure and technology required. Understanding these segments is crucial for distributors aiming to optimize their service portfolio and capitalize on high-growth areas, such as the rapidly expanding specialty drug and generic pharmaceuticals markets, while maintaining efficiency in traditional, high-volume segments like OTC products.

- By Product Type:

- Branded Drugs

- Generic Drugs

- Over-the-Counter (OTC) Medicines

- Specialty Pharmaceuticals

- Biologics

- By Distribution Channel:

- Retail Pharmacy Distribution

- Hospital Distribution

- Mail-Order/E-commerce Pharmacy Distribution

- Clinic and Physicians' Office Distribution

- Governmental and Public Health Facilities

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Pharmaceutical Wholesale & Distribution Market

The pharmaceutical distribution value chain begins with upstream activities dominated by large pharmaceutical manufacturers, contract manufacturing organizations (CMOs), and suppliers of active pharmaceutical ingredients (APIs). The upstream segment is characterized by intense R&D activities, rigorous clinical trials, and strict adherence to Good Manufacturing Practices (GMP). Wholesalers act as the crucial link, purchasing in bulk from manufacturers, managing inventory, and breaking down large shipments into smaller, manageable quantities suitable for end-users. This intermediary function requires significant capital investment in secure, temperature-controlled warehousing and advanced inventory tracking systems, making scale and operational efficiency paramount to profitability.

The core function of the wholesaler involves meticulous logistics and inventory management. This includes warehousing, order fulfillment, transportation management, and compliance with national and international drug traceability laws, such as the Drug Supply Chain Security Act (DSCSA) in the U.S. and similar measures in Europe. A key component of the wholesaler’s added value is managing the complex financial relationships between manufacturers (who often offer chargebacks and rebates) and the downstream entities. Effective management of these financial flows and inventory levels determines the wholesaler's competitiveness and ability to maintain tight profit margins in a highly regulated environment.

Downstream analysis focuses on the final dispensing points, primarily retail pharmacies, large hospital systems, and governmental health organizations. The distribution channel is bifurcated into direct and indirect methods. Direct distribution, although less common for general pharmaceuticals, often involves manufacturers supplying high-cost specialty drugs directly to highly specialized clinics or infusion centers. Indirect distribution, the dominant model, utilizes the three-tier system (manufacturer to wholesaler to dispenser). The shift towards integrated delivery networks (IDNs) and specialized mail-order pharmacies is reshaping the downstream segment, requiring wholesalers to adapt their fulfillment models to cater to high-frequency, smaller-volume orders and specialized patient delivery requirements, further stressing the need for robust IT integration and efficient last-mile delivery.

Pharmaceutical Wholesale & Distribution Market Potential Customers

Potential customers, or end-users, in the Pharmaceutical Wholesale & Distribution Market are highly diversified institutions that form the final tier of the healthcare delivery system. The largest customer segment remains traditional retail pharmacies, both independent and large chain stores, which require frequent replenishment of high-volume generic drugs, branded medications, and OTC products. These pharmacies rely heavily on wholesalers for quick turnaround times, comprehensive inventory breadth, and effective credit terms to manage their day-to-day operations and serve the general public. Wholesalers must offer sophisticated inventory technology that integrates seamlessly with pharmacy management systems to ensure efficient ordering and stock rotation, a critical factor in maintaining product freshness and avoiding expiration.

Hospitals and integrated healthcare networks (IHNs) represent another major customer segment, characterized by demand for large volumes of specialized pharmaceuticals, surgical supplies, and medications required for in-patient care. Unlike retail pharmacies, hospitals often require just-in-time delivery models and specialized logistics for high-cost, acute-care drugs, including those requiring ultra-cold storage. Wholesalers catering to this segment must demonstrate robust operational stability, detailed handling protocols for controlled substances, and the capacity to manage complex formularies and procurement processes dictated by hospital group purchasing organizations (GPOs). The complexity of hospital orders and the necessity of uninterrupted supply make this a segment demanding high levels of service expertise and reliability.

Furthermore, specialized end-users, including long-term care facilities, specialized clinics (e.g., oncology or rheumatology centers), and government agencies (such as Veterans Affairs or public health departments), constitute growing customer bases. Long-term care facilities require specialized packaging and medication management services, often necessitating unit-dose dispensing facilitated by the wholesaler. Clinics demand punctual delivery of specialty injectables and infusion therapies, often requiring direct patient support services integrated into the distribution model. Government and non-governmental organizations (NGOs) often require large-scale disaster relief or immunization campaign logistics, demanding wholesalers capable of rapid, secure, and broad geographic deployment, often under non-standard delivery conditions, emphasizing the breadth of logistical capability required across the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 980.5 Billion |

| Market Forecast in 2033 | USD 1,560.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | McKesson Corporation, AmerisourceBergen Corporation, Cardinal Health Inc., Walgreens Boots Alliance (Alliance Healthcare), China National Pharmaceutical Group (Sinopharm), PHOENIX group, Zuellig Pharma, Medipal Holdings, Alfresa Holdings, Celesio AG (McKesson Europe), Owens & Minor, Morris & Dickson Co. LLC, H. D. Smith (AmerisourceBergen), Nippon Rikagaku Kogyo Co., Ltd., Dubai Healthcare City (DHCC), Mawdsley Brooks & Co. Ltd., Anda Distribution (Teva), Grupo Coppel, Imperial Health Sciences, and Adcock Ingram. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pharmaceutical Wholesale & Distribution Market Key Technology Landscape

The technological evolution in pharmaceutical distribution is centered around optimizing efficiency, enhancing security, and ensuring strict regulatory compliance, moving the industry far beyond simple transportation logistics. Enterprise Resource Planning (ERP) systems customized for the pharmaceutical supply chain are foundational, integrating inventory management, financial processing, and procurement across vast networks. These systems must handle complex chargeback calculations and rebate processing specific to the drug industry. Furthermore, advanced Warehouse Management Systems (WMS) incorporating automation, such as robotic picking systems and automated guided vehicles (AGVs), are crucial for reducing human error and accelerating order fulfillment, especially in the high-volume generic drug segment. The increasing requirement for serialization and traceability mandates the use of specialized software and hardware to read, record, and transmit data for every drug unit throughout its journey, directly addressing counterfeit concerns.

Cold chain management technologies represent a significant area of expenditure and innovation, vital for the expanding biologics and vaccine segments. This includes the deployment of Internet of Things (IoT) sensors for continuous, real-time temperature and humidity monitoring within storage facilities and transport vehicles. Data collected by these sensors is integrated into centralized dashboards, allowing distributors to proactively intervene if temperature excursions occur, thus protecting high-value products and ensuring GDP compliance. The adoption of cloud-based platforms facilitates better data sharing among manufacturers, distributors, and regulators, creating a more transparent and responsive supply chain ecosystem capable of rapid adjustments during unforeseen supply disruptions or public health emergencies.

The nascent but highly influential technology of Blockchain is gaining traction, particularly in pilot programs aimed at creating immutable, shared ledgers for drug provenance and ownership transfer records. Blockchain offers a superior level of security and transparency compared to current serialization databases, potentially streamlining regulatory audits and enhancing consumer trust by guaranteeing product authenticity from the point of manufacture to the patient. Moreover, Artificial Intelligence (AI) and Machine Learning (ML) algorithms are being deployed for predictive analytics, optimizing everything from inventory placement based on hyper-local demand data to sophisticated fraud detection protocols. This suite of technologies—from foundational ERP and WMS to cutting-edge AI and Blockchain—is fundamentally transforming operational models, pushing distributors towards becoming sophisticated data managers and compliance assurance experts, rather than just logistical service providers.

Regional Highlights

- North America: Market leader driven by high healthcare expenditure, established three-tier distribution structure, and sophisticated demand for specialty drugs requiring advanced cold chain capabilities.

- Europe: Highly fragmented market characterized by diverse national regulatory environments and a strong presence of wholesale pharmacy groups integrated with retail operations; strong focus on GDP compliance across the EU.

- Asia Pacific (APAC): Fastest-growing region, fueled by rising disposable incomes, rapid urbanization, expansion of universal health coverage in key countries like China and India, and increasing foreign investment in logistics infrastructure.

- Latin America (LATAM): Market characterized by logistical challenges, varying economic stability, and increasing efforts toward improving pharmaceutical security and combating drug diversion through stricter regulatory frameworks.

- Middle East and Africa (MEA): Significant investment in healthcare infrastructure, particularly in the GCC states, driving demand for advanced distribution services; high dependency on imported pharmaceuticals necessitates robust, secure international logistics.

North America, specifically the United States, commands the largest share of the global pharmaceutical wholesale and distribution market. This dominance is primarily attributed to the substantial volume of pharmaceutical products moving through the supply chain, the high prices of innovative branded drugs, and the highly consolidated nature of the distribution sector, dominated by the 'Big Three' wholesalers. The mature regulatory environment, while complex, necessitates high standards of service and technology adoption. Consolidation has allowed these large distributors to achieve significant economies of scale, leading to efficient but powerful intermediary positions within the healthcare ecosystem. The regional focus is heavily shifting towards managing the complexity of specialty pharmaceutical distribution, which demands precise handling, often point-of-care delivery coordination, and rigorous adherence to manufacturer limited distribution programs.

The Asia Pacific region is forecast to exhibit the most rapid growth throughout the projection period. This growth stems from massive unmet healthcare needs, coupled with government initiatives focused on improving healthcare access and affordability, particularly in populous nations like India and China. While operational environments can be challenging due to infrastructural disparities and varying regulatory oversight across borders, the sheer potential volume of the market attracts significant local and international logistics investments. Distributors in APAC are increasingly utilizing advanced digital platforms and localization strategies to navigate complex national distribution licenses and regional logistics bottlenecks. The growing middle class and the subsequent rise in chronic lifestyle diseases are steadily increasing the demand for consistent and efficient pharmaceutical supply chains across both urban and expanding rural settings.

Europe represents a highly nuanced market where cross-border trade within the European Union (EU) is facilitated by common regulations (GDP) but complicated by individual national pricing and reimbursement policies. The European market is less consolidated than North America, featuring a mix of large pan-European groups and strong, nation-specific wholesalers often closely tied to local pharmacies. Regulatory compliance, particularly regarding preventing falsified medicines (FMD Directive), remains a central operational focus, requiring significant technological investment in verification systems. Economic stability and high standards of infrastructure generally ensure efficient cold chain maintenance, yet the fragmented nature of reimbursement systems requires distributors to be exceptionally skilled in managing highly decentralized market access strategies, often involving extensive engagement with national health service providers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pharmaceutical Wholesale & Distribution Market.- McKesson Corporation

- AmerisourceBergen Corporation

- Cardinal Health Inc.

- Walgreens Boots Alliance (Alliance Healthcare)

- China National Pharmaceutical Group (Sinopharm)

- PHOENIX group

- Zuellig Pharma

- Medipal Holdings

- Alfresa Holdings

- Celesio AG (McKesson Europe)

- Owens & Minor

- Morris & Dickson Co. LLC

- H. D. Smith (AmerisourceBergen)

- Nippon Rikagaku Kogyo Co., Ltd.

- Dubai Healthcare City (DHCC)

- Mawdsley Brooks & Co. Ltd.

- Anda Distribution (Teva)

- Grupo Coppel

- Imperial Health Sciences

- Adcock Ingram

Frequently Asked Questions

Analyze common user questions about the Pharmaceutical Wholesale & Distribution market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving growth in the Pharmaceutical Wholesale & Distribution Market?

The primary driver is the increasing global prevalence of chronic diseases, which necessitates a consistent and high-volume supply of medications, coupled with the rapid growth in the high-margin specialty pharmaceutical segment requiring advanced cold chain logistics.

How does AI technology benefit pharmaceutical distributors?

AI technology significantly benefits distributors by enhancing demand forecasting accuracy, automating complex warehouse operations (picking, sorting), optimizing transportation routes in real-time, and bolstering security through predictive analysis of counterfeit drug risks.

What are the key regulatory challenges facing wholesalers?

Key regulatory challenges include global compliance with Good Distribution Practices (GDP), implementing strict serialization and traceability mandates (like DSCSA or FMD) to combat counterfeiting, and navigating complex government pricing and reimbursement pressures that erode profit margins.

Which distribution channel is experiencing the fastest transformation?

The Mail-Order/E-commerce Pharmacy Distribution channel is experiencing the fastest transformation, driven by consumer demand for convenience, accelerated adoption of digital health platforms, and the necessity for direct-to-patient services, especially for specialized therapies.

Why is cold chain management increasingly critical in this market?

Cold chain management is critical due to the rising market share of temperature-sensitive biologics, vaccines, and advanced therapies. Failure to maintain precise temperature ranges can lead to product degradation, safety risks, and substantial financial losses, making robust monitoring essential for compliance and product integrity.

The global Pharmaceutical Wholesale & Distribution Market is fundamentally shifting its operational paradigm from simple logistics to sophisticated supply chain management, demanding seamless integration of digital technologies and highly specialized infrastructure. The intense focus on regulatory adherence, especially concerning temperature control and drug traceability, ensures product safety and integrity, forming the non-negotiable base layer of operations. Leading players are strategically investing in automation and AI to maintain tight profit margins against consistent pricing pressure from payers and governments. This investment enables superior service offerings, such as enhanced inventory financing and specialized patient support programs, distinguishing them in a highly competitive landscape. Furthermore, the strategic imperative is expanding geographic reach, particularly capitalizing on the massive, growing populations in the Asia Pacific region where healthcare infrastructure is rapidly developing, presenting both immense logistical challenges and unprecedented market opportunities. The successful distributor of the future will be defined not just by their logistical network size, but by their prowess in data management, regulatory compliance, and resilience against global supply chain disruptions.

Technological advancement remains the single most important differentiating factor for market participants seeking competitive advantage. The ability to deploy high-fidelity IoT monitoring systems for cold chain compliance is no longer a luxury but a baseline requirement for handling modern drug pipelines. Furthermore, the integration of blockchain technologies promises to revolutionize supply chain transparency by providing an unalterable record of custody, which addresses deep-seated concerns regarding counterfeit drugs, thereby building trust among manufacturers, regulators, and consumers. The complexity of operating internationally requires distributors to establish highly localized regulatory expertise, especially concerning customs, tariffs, and differing national pharmacy laws, while maintaining a unified global quality standard. As healthcare systems globally trend toward value-based care models, wholesalers are under pressure to provide data analytics services that help manufacturers and providers optimize inventory and improve patient outcomes, transitioning their role from mere shippers to strategic partners in healthcare delivery. This transition necessitates significant upskilling of the workforce and substantial capital outlay in IT infrastructure capable of handling massive volumes of sensitive transactional data securely and efficiently.

Looking ahead, the market structure is likely to see continued consolidation, especially as smaller, regional players struggle to meet the capital requirements necessary for advanced automation and regulatory compliance infrastructure. The large, dominant players will leverage their scale to drive further efficiencies and negotiate favorable terms with both manufacturers and downstream customers. Emerging trends such as the decentralization of clinical trials and the rise of personalized medicine will introduce new logistical hurdles, requiring distributors to develop hyper-specific, small-batch handling capabilities and patient-direct delivery models. This strategic adaptation is essential, moving beyond bulk distribution into niche, high-touch logistical solutions. Consequently, profitability will increasingly hinge on the provision of value-added services—such as sophisticated packaging, repackaging, and customized patient adherence programs—rather than solely on the traditional volume-based profit models. The interplay of public health demands, regulatory oversight, and technological innovation will define the competitive landscape for the next decade, with supply chain robustness and flexibility being paramount measures of success.

The Pharmaceutical Wholesale & Distribution sector is poised for sustained growth, albeit subject to external pressures like drug pricing legislation and macroeconomic volatility. Strategic growth areas include targeted expansion in biologics logistics, developing specialized cold chain solutions that can handle temperatures down to -80°C for advanced therapeutics, and enhancing digital interoperability across the global supply network. Distributors are actively exploring partnerships with technology firms and last-mile delivery specialists to optimize their final delivery stages, especially in densely populated urban centers and remote rural areas. Furthermore, environmental sustainability is emerging as a critical performance metric, prompting wholesalers to invest in energy-efficient warehousing, optimizing vehicle fleets for lower emissions, and reducing packaging waste. This commitment to sustainability not only aligns with corporate social responsibility goals but increasingly becomes a requirement for securing contracts with major manufacturers and government healthcare providers who are adopting greener procurement policies. The enduring value proposition of the wholesaler remains their ability to maintain operational fluidity, regulatory excellence, and security across the entire pharmaceutical ecosystem.

Finally, the market remains characterized by a fundamental tension between the need for speed and efficiency and the non-negotiable requirement for safety and security. Wholesalers must implement robust quality management systems (QMS) that cover all aspects of storage, handling, and transportation to prevent product degradation and diversion. This includes rigorous training programs for personnel involved in temperature-sensitive handling and secure transport protocols for controlled substances. The continuous threat of cyberattacks targeting sensitive inventory and patient data necessitates high-level investment in cybersecurity infrastructure, protecting the vast transactional data flows that define the modern pharmaceutical supply chain. By prioritizing resilience, compliance, and technological integration, pharmaceutical wholesalers are transforming their role into indispensable orchestrators of healthcare logistics, ensuring medications reach patients reliably, safely, and efficiently, which is a foundational requirement for global public health stability and economic productivity in the healthcare sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager