Pharmacy Automation Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432292 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Pharmacy Automation Equipment Market Size

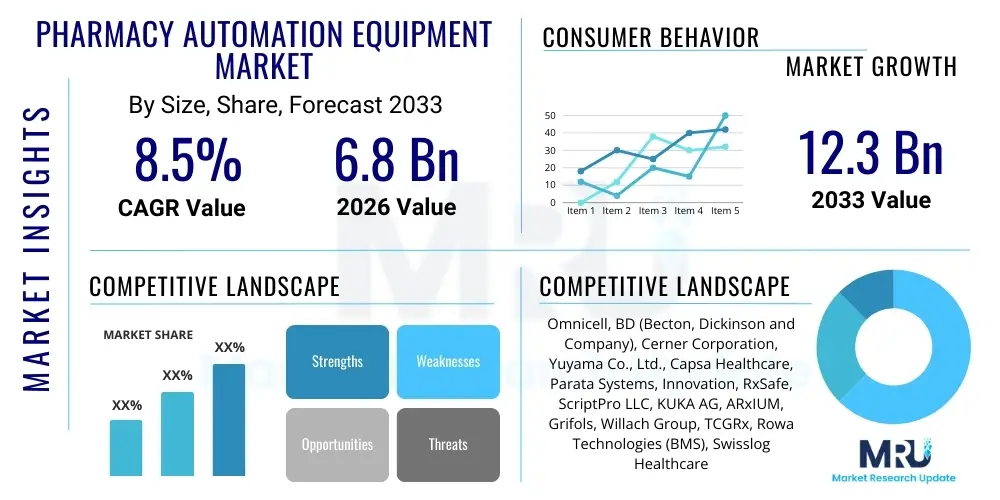

The Pharmacy Automation Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 6.8 Billion in 2026 and is projected to reach USD 12.3 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by the increasing need for enhanced operational efficiency, reduction of medication errors, and managing the growing volume of prescriptions globally. Investments in high-throughput systems, particularly in developed economies facing acute labor shortages in pharmaceutical settings, are major contributors to this expansion.

Pharmacy Automation Equipment Market introduction

The Pharmacy Automation Equipment Market encompasses mechanical and robotic systems designed to streamline, automate, and optimize various processes within pharmacies, ranging from prescription dispensing and compounding to inventory management and storage. Key products include automated dispensing cabinets, packaging and labeling systems, robotic dispensing systems, compounding robots, and tablet/pill counters. These technologies are crucial for healthcare facilities aiming to minimize human error, improve patient safety, and increase the speed and accuracy of medication fulfillment, thereby enhancing overall healthcare delivery efficiency. The primary applications span hospital pharmacies, retail drug stores, and centralized mail-order pharmacies, serving as essential tools for managing complex drug regimens and high volume workflows.

The primary benefits derived from adopting pharmacy automation equipment include significant cost reduction through optimized labor utilization, maximized inventory control minimizing waste and stockouts, and crucially, substantial mitigation of medication administration errors, which remain a serious concern in clinical settings. Furthermore, automation allows pharmacists to shift their focus from routine, manual tasks toward clinical consultation and patient care, aligning with modern healthcare mandates emphasizing clinical efficacy. The market is propelled by driving factors such as the increasing prevalence of chronic diseases requiring complex polypharmacy, stringent regulatory mandates emphasizing patient safety, and the demonstrable return on investment (ROI) that high-speed automation offers to large health systems managing extensive patient populations.

Pharmacy Automation Equipment Market Executive Summary

The Pharmacy Automation Equipment Market is characterized by accelerating integration of smart technologies and a strong business trend toward centralized fulfillment centers and large-scale hospital system adoption. Key business trends include consolidation among technology providers, robust investment in AI-driven inventory management tools, and a shift towards modular, scalable automation solutions that can cater to both large hospital enterprises and smaller independent retail pharmacies. The increasing pressure on healthcare systems globally to manage escalating operational costs while simultaneously improving quality standards fuels the demand for sophisticated automation. Furthermore, the development of specialized compounding robots for high-risk medications represents a significant technological leap and a lucrative market segment, addressing the specialized needs of compounding pharmacies and research institutions, positioning the market for sustained high-value growth.

Regionally, North America maintains market dominance due to high healthcare expenditure, early adoption of advanced robotics, and the widespread presence of established automation vendors and large hospital networks that mandate sophisticated inventory control systems. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth, driven by massive investments in modernizing healthcare infrastructure, rising disposable incomes leading to greater access to pharmaceuticals, and government initiatives promoting digitalization in healthcare settings. Within segment trends, the Robotic Dispensing Systems segment, particularly the centralized models used by mail-order pharmacies, is experiencing exponential demand due to their capability to handle extremely high volumes with unparalleled accuracy. The End-User segment shows a decisive shift, with hospital pharmacies remaining the largest adopters, though retail pharmacies are rapidly increasing their share, recognizing automation as a competitive necessity in a highly regulated and cost-sensitive environment.

AI Impact Analysis on Pharmacy Automation Equipment Market

Common user questions regarding AI's impact on the Pharmacy Automation Equipment Market often center on its capability to move beyond basic mechanization to predictive intelligence, specifically concerning inventory forecasting, personalization of medication adherence protocols, and enhancing error detection capabilities far beyond human capacity. Users are highly interested in how AI algorithms can integrate with existing Electronic Health Records (EHRs) and automation hardware to predict stock fluctuations based on population health trends, thereby optimizing supply chains and minimizing wastage of high-cost pharmaceuticals. Concerns frequently revolve around data privacy when integrating sophisticated machine learning models with sensitive patient data and the potential for initial system complexity and high implementation costs, leading to a need for skilled technicians capable of maintaining complex, intelligent automation systems.

AI is fundamentally transforming pharmacy automation by providing cognitive enhancements to traditional robotic systems. Machine learning algorithms are now utilized in advanced imaging systems to verify pill identification during the dispensing process, achieving error rates nearing zero by learning subtle visual characteristics of various medications and preventing dispensing errors that mechanical systems alone might miss. Moreover, AI-powered predictive maintenance capabilities allow pharmacy managers to anticipate hardware failures within automation equipment, scheduling necessary servicing proactively rather than reactively, minimizing costly downtime and ensuring continuous medication delivery services. This predictive capability significantly improves the reliability and longevity of substantial capital investments in automation infrastructure, making the overall operational framework more robust and cost-effective.

Furthermore, the application of AI extends into sophisticated inventory management, utilizing complex time-series analysis and external data sources (like seasonal illness patterns or local demographic changes) to generate highly accurate demand forecasts. This level of granular, predictive insight enables 'just-in-time' inventory strategies, dramatically reducing holding costs and the risk of dispensing expired medications. Ultimately, AI integration is repositioning pharmacy automation from a tool for efficiency to a platform for intelligent, patient-centric pharmaceutical management, moving the industry toward truly optimized and personalized drug delivery models, ensuring the right medication is available at the right time for every patient.

- AI-driven predictive inventory management optimizes stock levels and minimizes pharmaceutical waste.

- Machine learning enhances visual recognition systems for near-perfect dispensing error reduction.

- Predictive maintenance algorithms reduce equipment downtime and prolong the lifespan of automation hardware.

- AI facilitates personalized medication adherence tracking and intervention protocols.

- Natural Language Processing (NLP) aids in analyzing complex prescription details and flagging potential drug interactions.

- Integration of AI with EHR systems enables real-time, data-driven dispensing decisions.

- Automation of complex compounding processes using AI for precision and consistency.

DRO & Impact Forces Of Pharmacy Automation Equipment Market

The Pharmacy Automation Equipment Market is primarily driven by the imperative to mitigate the serious risks associated with medication errors, coupled with intensifying global pressures to control escalating healthcare expenditure through operational efficiency. Simultaneously, the market faces significant restraints, chiefly high initial capital outlay required for sophisticated robotic systems and the complex challenges associated with integrating new automation technology seamlessly into existing legacy IT and workflow systems within diverse healthcare settings. Opportunities are abundant in the expansion into emerging economies, especially in Asia Pacific, where healthcare infrastructure modernization is a national priority, and the burgeoning field of telepharmacy offers new avenues for centralized automation services. The interplay of these forces dictates market trajectory, with patient safety mandates and economic pressures acting as the dominant impact forces compelling continued technological adoption and innovation in the sector.

Drivers: A paramount driver is the rising volume of prescriptions globally, fueled by demographic shifts such as aging populations and the corresponding increase in chronic diseases, which necessitates high-throughput and accurate dispensing capabilities that manual processes cannot reliably provide. Another significant driver is the increasing scarcity of skilled pharmacy personnel in numerous developed countries, making automation a necessary strategy for maintaining service levels. Furthermore, regulatory bodies worldwide are increasingly emphasizing stringent reporting and tracking mechanisms for dispensed medications, pushing pharmacies towards automated solutions that inherently provide comprehensive audit trails and data integrity, ensuring compliance with evolving standards like track-and-trace mandates.

Restraints: The most prominent restraint is the prohibitive cost of acquiring, installing, and maintaining high-end robotic dispensing and compounding systems, making them financially challenging for smaller, independent pharmacies or facilities with limited budgets, especially in developing regions. Additionally, concerns regarding system downtime and the need for specialized technical expertise to troubleshoot and manage complex automation platforms can deter adoption. Resistance to change among existing pharmacy staff, coupled with the necessary workflow adjustments that accompany automation implementation, also presents a substantial organizational hurdle that must be overcome for successful integration.

Opportunities: Major opportunities exist in developing decentralized automation modules that are scalable and affordable for smaller retail pharmacy chains and clinics, expanding the addressable market beyond large hospitals. The rise of centralized prescription fulfillment centers, particularly for mail-order services, offers a massive growth area for large-scale, high-density automation systems. Moreover, technological advancements focusing on interoperability standards and modular design, facilitated by IoT and cloud connectivity, will lower integration barriers and create new service models, such as third-party managed automation services, maximizing equipment utilization across multiple small facilities. Finally, the specialized segment of compounded medications offers a niche but high-value opportunity for precision robotic compounding solutions.

Segmentation Analysis

The Pharmacy Automation Equipment Market is highly diversified and segmented based on product type, end-user, and application, reflecting the varying operational needs across the pharmaceutical supply chain. The segmentation analysis reveals distinct growth patterns across these categories, with product segments focusing on high-volume robotic systems experiencing accelerated adoption, particularly in centralized facilities seeking maximum throughput. End-user segmentation highlights the enduring significance of hospital pharmacies as the primary capital expenditure buyers, although the retail pharmacy segment is emerging as a critical growth engine due to increasing competition and the need for efficient counter services. Understanding these segments is vital for vendors to tailor their offerings, addressing specific pain points—whether it is high-precision compounding in specialty settings or high-speed dispensing in consumer retail environments.

The application-based segmentation provides insight into where automation delivers the most critical value, with medication dispensing remaining the cornerstone application due to its direct impact on patient safety and workflow efficiency. However, medication storage and retrieval systems are gaining traction as inventory optimization becomes paramount, driven by the need to manage temperature-sensitive and high-cost biologicals effectively. The market structure, therefore, is defined by a dichotomy between sophisticated, high-cost solutions demanded by large institutional buyers (often encompassing multiple functions like dispensing and packaging) and more accessible, single-function units targeted at smaller, decentralized settings. This multi-layered structure ensures sustained innovation across the entire spectrum of pharmaceutical operational needs.

- By Product:

- Automated Medication Dispensing Systems

- Automated Packaging and Labeling Systems

- Automated Medication Storage and Retrieval Systems

- Automated Medication Compounding Systems

- Tablets Splitters and Counters

- By End User:

- Hospital Pharmacies

- Retail Pharmacies

- Mail-Order Pharmacies

- Clinical Laboratories and Research Centers

- By Application:

- Medication Dispensing and Packaging

- Inventory Management

- Drug Compounding

- Medication Delivery and Administration

Value Chain Analysis For Pharmacy Automation Equipment Market

The value chain for the Pharmacy Automation Equipment Market begins with upstream activities dominated by component and raw material suppliers, including manufacturers of precision robotics, specialized sensors (optical and pressure), complex software platforms, and specialized hardware components like motors and actuators. Key upstream challenges involve maintaining high quality and precision standards for components, as the accuracy of the final pharmacy system relies heavily on the tolerance and reliability of these foundational parts. Strategic partnerships between automation OEMs and specialized sensor manufacturers are critical for introducing capabilities like AI-enhanced visual verification and real-time machine monitoring, ensuring the integration of cutting-edge technology at the manufacturing stage.

Midstream activities involve the core functions of equipment design, manufacturing, assembly, and rigorous quality assurance testing conducted by the major automation solution providers. This stage is highly capital and R&D intensive, focusing on developing modular, scalable, and interoperable systems that meet stringent healthcare safety standards (e.g., FDA clearance). Downstream activities focus on distribution, installation, post-sales support, and maintenance, which are critical given the complexity and reliance on these systems within clinical environments. Direct distribution channels, where manufacturers sell, install, and service systems directly to large hospital networks, are prevalent, providing specialized support and customized integration services necessary for complex installations. Indirect channels involve value-added resellers (VARs) or third-party integrators who manage sales and installation for smaller retail chains or international markets, leveraging local expertise and existing relationships.

Pharmacy Automation Equipment Market Potential Customers

The primary purchasers and key end-users of pharmacy automation equipment are large integrated delivery networks (IDNs) and hospital pharmacies, which demand high-throughput, centralized systems capable of managing substantial patient populations and complex inpatient medication regimens. These customers prioritize solutions that offer full integration with existing Electronic Health Records (EHRs) and comprehensive audit trails, ensuring regulatory compliance and maximizing patient safety within high-acuity environments. The procurement cycle for these large institutional buyers is often long and involves significant capital planning and detailed ROI justification, focusing heavily on reducing full-time equivalent (FTE) labor costs and minimizing medication-related adverse events.

Another major segment of potential customers includes mass-market retail pharmacy chains (e.g., CVS Health, Walgreens), which are increasingly adopting smaller, distributed dispensing robots and automated counting systems to enhance front-counter speed and accuracy, thereby improving customer satisfaction and managing rapidly increasing prescription volumes. Mail-order and specialty pharmacies represent a third crucial customer base, relying heavily on sophisticated, high-density robotic fulfillment centers that manage inventory, packaging, and sorting for millions of prescriptions annually. These centers often employ the most advanced, large-scale automation technologies designed purely for speed and efficiency in centralized distribution models, reflecting a distinct set of needs compared to a hospital’s focus on point-of-care dispensing safety.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.8 Billion |

| Market Forecast in 2033 | USD 12.3 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Omnicell, BD (Becton, Dickinson and Company), Cerner Corporation, Yuyama Co., Ltd., Capsa Healthcare, Parata Systems, Innovation, RxSafe, ScriptPro LLC, KUKA AG, ARxIUM, Grifols, Willach Group, TCGRx, Rowa Technologies (BMS), Swisslog Healthcare, McKesson Corporation, Baxter International, Euclid Medical Products, TOSHO. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pharmacy Automation Equipment Market Key Technology Landscape

The technological landscape of the Pharmacy Automation Equipment Market is rapidly evolving, moving beyond simple electromechanical devices toward sophisticated, interconnected, and intelligent systems driven by the Internet of Things (IoT) and advanced robotics. Central to this evolution is the deployment of high-precision robotic arms (often leveraging technologies from industrial automation leaders like KUKA or FANUC, adapted for cleanroom environments) capable of handling delicate medications and performing complex compounding tasks with sub-millimeter accuracy. Furthermore, advanced vision systems incorporating 2D and 3D imaging, coupled with AI algorithms for drug identification and verification, are now standard in high-end dispensing units, serving as the last line of defense against medication errors and significantly improving patient safety outcomes.

Interoperability remains a critical technological focus, with systems increasingly designed to communicate seamlessly using standardized protocols (HL7 and FHIR) with Electronic Health Records (EHRs), Hospital Information Systems (HIS), and supply chain management software. This connectivity enables real-time data exchange regarding prescription status, patient profiles, and inventory levels, providing pharmacists with an integrated and holistic view of the dispensing process. Cloud-based management and monitoring solutions are also gaining prominence, allowing multi-site organizations to centrally manage, update, and optimize their distributed automation fleet, enhancing system uptime and facilitating remote diagnostics and preventative maintenance, thereby maximizing operational efficiency and minimizing localized downtimes across large healthcare networks.

Regional Highlights

The regional analysis of the Pharmacy Automation Equipment Market reveals distinct maturity levels and growth drivers across major geographic zones. North America holds the largest market share, characterized by high adoption rates fueled by substantial healthcare expenditure, robust regulatory pressure to reduce medication errors, and widespread acceptance of advanced robotic systems across major hospital systems and pharmacy chains. The region benefits from the presence of numerous key market players and early technological implementers, sustaining a high-value market driven by continuous product upgrades, AI integration, and large-scale capital investments into centralized fulfillment centers, particularly in the United States.

Europe represents the second-largest market, with significant demand originating from Germany, the UK, and France. Adoption in Europe is highly influenced by national healthcare system efficiencies and government mandates aimed at controlling drug costs and optimizing pharmacy workflows. While adoption is high, integration complexities and diverse national regulatory environments present unique challenges. The rapid growth market, however, is Asia Pacific (APAC), which is experiencing explosive expansion driven by healthcare infrastructure modernization in countries like China, India, and Japan. Increased medical tourism, rising government investments in public health, and a growing emphasis on minimizing human error in burgeoning urban hospital settings are catalyzing widespread deployment of automated dispensing and packaging systems across the region, promising the highest CAGR over the forecast period.

- North America: Market leader; characterized by high capital spending, advanced technology adoption (AI/Robotics), and a dominant presence of large integrated delivery networks (IDNs). High demand for high-throughput robotic dispensing systems.

- Europe: Mature market; growth driven by efficiency mandates, focus on centralized inventory management, and high penetration of automated storage and retrieval systems in retail settings (especially Germany and Italy).

- Asia Pacific (APAC): Fastest-growing market; fueled by rapid healthcare infrastructure development, increasing pharmaceutical access, and government initiatives promoting digitalization and error reduction in public hospitals.

- Latin America (LATAM): Emerging market; gradual adoption focused initially on automated counting and basic dispensing systems in private sector hospitals, driven primarily by efforts to combat medication theft and improve security.

- Middle East & Africa (MEA): Nascent market; concentrated adoption in affluent countries (UAE, Saudi Arabia) driven by investments in world-class healthcare facilities and large-scale government projects to modernize hospital logistics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pharmacy Automation Equipment Market.- Omnicell, Inc.

- Becton, Dickinson and Company (BD)

- Cerner Corporation (now Oracle Health)

- Yuyama Co., Ltd.

- Capsa Healthcare

- Parata Systems, LLC

- Innovation Associates (A J M Smith Corporation Company)

- RxSafe, LLC

- ScriptPro LLC

- KUKA AG (Specialized Robotics Division)

- ARxIUM

- Grifols, S.A.

- Willach Group

- TCGRx (Part of the Swisslog Healthcare family)

- Rowa Technologies (Owned by BIEGLO GmbH)

- Swisslog Healthcare

- McKesson Corporation

- Baxter International Inc.

- Euclid Medical Products

- TOSHO Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Pharmacy Automation Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the Pharmacy Automation Equipment Market?

The primary driving factor is the critical need to minimize medication errors, which pose significant patient safety risks and incur massive costs for healthcare systems. Automation ensures accuracy, streamlines dispensing processes, and provides comprehensive audit trails for regulatory compliance.

Which segment of pharmacy automation equipment is projected to exhibit the fastest growth?

The Robotic Dispensing Systems segment is projected to show the fastest growth, particularly centralized, large-scale systems utilized by mail-order and specialty pharmacies, driven by the massive volumes and efficiency demands of e-commerce prescription fulfillment.

How does AI technology specifically enhance the value of pharmacy automation?

AI technology enhances automation by enabling predictive inventory management, reducing stockouts and waste; facilitating sophisticated visual verification of dispensed medications; and implementing predictive maintenance to maximize system uptime and reliability.

What major restraint affects the adoption of pharmacy automation in smaller healthcare settings?

The high initial capital investment required for purchasing and installing complex robotic systems, coupled with ongoing maintenance and integration costs, serves as a major financial restraint limiting adoption, especially among independent and community pharmacies.

Which geographical region currently dominates the global Pharmacy Automation Equipment Market?

North America currently dominates the global market, owing to high levels of healthcare expenditure, well-established hospital infrastructure, favorable reimbursement policies, and early, widespread adoption of advanced robotic and dispensing technologies in the United States.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager