Pharmacy Automation Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435356 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Pharmacy Automation Systems Market Size

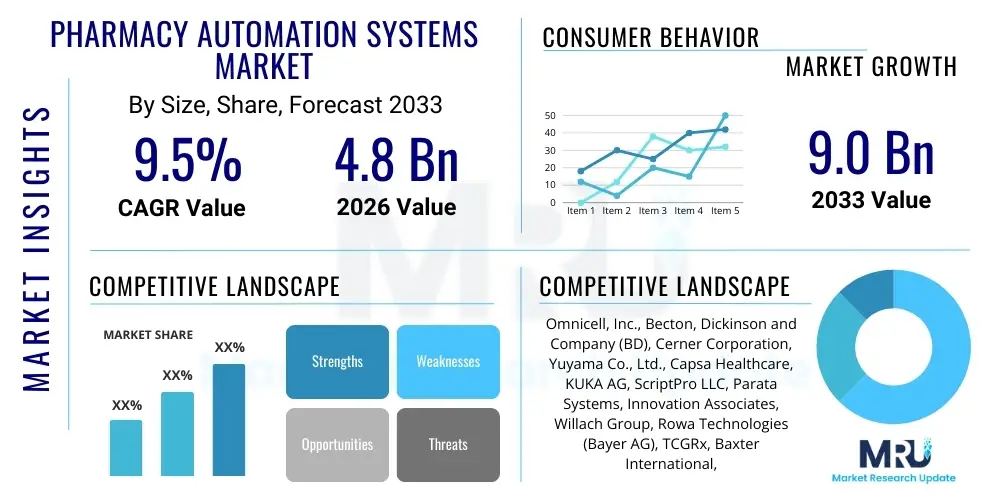

The Pharmacy Automation Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 9.0 Billion by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by the increasing global emphasis on patient safety, coupled with the critical necessity for healthcare facilities to enhance operational efficiency and mitigate medication errors. The transition from manual dispensing processes to sophisticated automated solutions across hospital, retail, and long-term care settings is the primary factor contributing to this robust market expansion. The high cost of specialized labor and the consistent pressure on pharmacies to manage inventory effectively further drive the adoption of these advanced systems.

Market expansion is also fueled by technological advancements, including the integration of sophisticated robotics, machine learning, and comprehensive data analytics into traditional automation platforms. These innovations allow for greater precision in compounding, packaging, and dispensing medications, offering a significant return on investment for large healthcare networks. Furthermore, the rising volume of prescriptions globally, particularly among the aging population who require polypharmacy management, demands scalable and reliable automation solutions that current manual systems cannot adequately provide. The push for centralized pharmacy services and the expansion of mail-order pharmacy models globally necessitate high-throughput automation technologies, ensuring timely and accurate fulfillment.

Geographically, North America currently holds the largest market share due to well-established healthcare infrastructure, high purchasing power, and stringent regulatory environments promoting patient safety, which drives the mandatory implementation of automation. However, the Asia Pacific region is anticipated to demonstrate the fastest growth rate, propelled by rapid urbanization, substantial investments in healthcare infrastructure development, and growing awareness regarding the benefits of pharmacy automation in emerging economies like China and India. Competitive dynamics revolve around continuous product innovation, particularly focusing on miniaturization, interoperability with existing electronic health records (EHRs), and enhancing user interface for pharmacy staff.

Pharmacy Automation Systems Market introduction

The Pharmacy Automation Systems Market encompasses devices and software designed to streamline complex and repetitive tasks within pharmacy operations, ranging from prescription verification and inventory management to automated dispensing and sterile compounding. These systems include robotic dispensing units, automated packaging and labeling systems, centralized dispensing cabinets, and automated medication compounding systems. The primary objective is to minimize human intervention in routine tasks, thereby reducing the likelihood of medication errors, improving patient safety outcomes, and freeing up highly skilled pharmacy personnel to focus on clinical and patient counseling roles. The major applications span across institutional pharmacies (hospitals, clinics), retail pharmacies, and specialized settings such as mail-order and long-term care facilities, offering tailored solutions to meet diverse operational needs.

The core benefits derived from implementing pharmacy automation systems are multifaceted, significantly improving operational throughput and financial viability. These systems drastically enhance inventory accuracy through real-time tracking and optimized storage, preventing stockouts and reducing expired medication waste. Furthermore, they accelerate the dispensing process, leading to reduced patient wait times and improved overall satisfaction. Key driving factors include the global shortage of qualified pharmacy technicians, the necessity to comply with increasingly strict regulatory requirements concerning medication handling and tracking, and the undeniable trend toward digitalization and interconnected healthcare ecosystems. The imperative to manage rising healthcare expenditure while maintaining high standards of care solidifies the critical role of automation.

Pharmacy Automation Systems Market Executive Summary

The Pharmacy Automation Systems Market is currently characterized by intense competition driven by technological convergence, focusing predominantly on integrating artificial intelligence (AI) and machine learning (ML) capabilities to predict demand, optimize inventory, and enhance error detection in compounding. Business trends indicate a strong shift towards modular and scalable solutions that can be adapted across different institutional sizes, alongside an increasing preference for cloud-based software services over traditional on-premise installations, facilitating easier maintenance and updates. Regionally, while North America and Europe maintain dominance due to high adoption rates and well-established regulatory support, the APAC region is poised for explosive growth, fueled by government initiatives to modernize healthcare infrastructure and increasing investments in health IT. Segment trends highlight that automated medication dispensing systems, particularly robotic systems, account for the largest revenue share due to their widespread application in hospital inpatient settings, while automated packaging and labeling systems are witnessing rapid adoption in high-volume retail and mail-order pharmacies. The shift towards outpatient care and specialty pharmacy services is driving demand for specific high-density storage and retrieval systems.

AI Impact Analysis on Pharmacy Automation Systems Market

Common user questions regarding AI's impact on pharmacy automation systems frequently revolve around the potential for predictive error detection, the cost-benefit analysis of implementing complex ML algorithms versus traditional rule-based systems, and the future role of human pharmacists in an AI-driven environment. Users are particularly concerned about ensuring data privacy and security when AI models process vast amounts of prescription data. They seek clarity on how AI can move beyond simple inventory optimization to genuine clinical decision support embedded within the automation workflow, such as identifying potential drug interactions with higher accuracy than current software. Furthermore, there is significant inquiry into how AI integration will influence initial capital expenditure and maintenance requirements for robotic dispensing units, ensuring that these sophisticated systems remain economically viable for smaller community pharmacies.

AI's influence is transforming pharmacy automation by introducing true predictive intelligence, allowing systems to anticipate prescription volume based on historical trends and external factors like seasonal illness patterns, thereby optimizing stock levels automatically and minimizing expiry risk. In compounding, computer vision and machine learning models are being deployed to monitor sterile procedures in real-time, identifying minute deviations from protocols that humans might miss, drastically enhancing sterility assurance and quality control. This transition from purely mechanical automation to cognitive automation fundamentally changes the operational efficiency paradigm, making systems proactive rather than reactive. AI also powers enhanced robotic navigation and error recovery, reducing downtime and the need for frequent human intervention during operational failures.

The most profound impact, however, lies in personalized patient care and clinical decision support. AI-integrated automation systems can flag complex dosing regimens or potential drug-gene interactions during the dispensing phase, offering pharmacists critical, data-backed insights instantaneously. While the initial investment in AI-enabled platforms is higher, the long-term benefits in terms of drastically reduced medication errors (a major source of healthcare cost and liability) and optimized labor allocation solidify AI as a critical differentiator and future standard in pharmacy automation. This continuous evolution necessitates pharmaceutical companies and technology providers to continuously update software and ensure seamless interoperability with legacy systems.

- AI enhances predictive inventory management, reducing waste and optimizing procurement cycles.

- Machine learning algorithms improve the accuracy of dispensing and compounding processes by identifying subtle anomalies.

- Computer vision systems, powered by AI, enable real-time quality control checks on packaged medications.

- AI supports clinical decision-making by integrating patient data to flag potential adverse drug events during dispensing.

- It facilitates enhanced data security and compliance monitoring within automated workflows.

- AI integration drives the development of more sophisticated, autonomous robotic systems requiring less human oversight.

DRO & Impact Forces Of Pharmacy Automation Systems Market

The Pharmacy Automation Systems Market is primarily driven by the imperative need for heightened operational efficiency and reduction of catastrophic medication errors across healthcare settings globally. Restraints primarily involve the substantial initial capital investment required for implementing sophisticated robotic systems, alongside the technical challenges associated with integrating new automation platforms into existing, often fragmented, health information technology (HIT) infrastructure. Opportunities are abundant in the expansion of telepharmacy services, the increasing demand from emerging economies rapidly developing their healthcare sector, and the continuous innovation in modular, subscription-based automation models catering to smaller pharmacies. The impact forces indicate that the intense competitive rivalry among established vendors pushing technological limits, coupled with stringent regulatory standards (such as track-and-trace mandates), exert significant pressure on the market, demanding continuous high investment in research and development to maintain relevance and compliance.

Segmentation Analysis

The Pharmacy Automation Systems Market is comprehensively segmented based on product type, end-user, and application, reflecting the diverse needs of the global pharmaceutical dispensing ecosystem. Product segmentation differentiates between large-scale robotic dispensing systems, crucial for hospital centralized pharmacies, and smaller, decentralized automated dispensing cabinets (ADCs) used at the point of care, alongside specialized systems for packaging, labeling, and compounding. The end-user segments clarify market penetration across hospitals, which dominate adoption due to high medication volumes and complexity, retail pharmacies striving for efficiency and customer service, and long-term care facilities requiring specialized unit-dose packaging. Understanding these granular segments allows vendors to tailor product development and marketing strategies to address specific operational bottlenecks and regulatory requirements unique to each segment, ensuring optimal market relevance and penetration.

Further analysis within the product type segmentation highlights the growing prominence of automated medication compounding systems (AMCS), driven by the stringent regulations for sterile preparations and the increasing complexity of specialized pharmaceuticals, especially in oncology and nutritional support. Simultaneously, the software and consulting services segment is rapidly expanding, as pharmacies increasingly require specialized software for inventory management, workflow optimization, and analytics, often delivered via the cloud. Geographic segmentation reveals varied adoption patterns influenced by healthcare spending and regulatory maturity. While established markets focus on replacement cycles and integrating cognitive automation, emerging markets prioritize fundamental dispensing and inventory automation to address basic supply chain inefficiencies and reduce labor dependency.

- By Product:

- Automated Medication Dispensing Systems (AMDS)

- Decentralized Automated Dispensing Cabinets (ADCs)

- Centralized Automated Dispensing Cabinets

- Robotic Dispensing Systems

- Automated Packaging and Labeling Systems

- Automated Medication Compounding Systems (AMCS)

- Automated Storage and Retrieval Systems (AS/RS)

- Tabletop Counters

- Software and Services (Inventory Management, Workflow Optimization)

- Automated Medication Dispensing Systems (AMDS)

- By End User:

- Retail Pharmacies (Chain Pharmacies, Independent Pharmacies)

- Hospital Pharmacies (Inpatient and Outpatient)

- Mail-Order Pharmacies

- Long-Term Care Facilities

- Clinical Laboratories

- By Application:

- Drug Dispensing and Packaging

- Inventory Management

- Drug Compounding

- Clinical Decision Support

Value Chain Analysis For Pharmacy Automation Systems Market

The value chain for the Pharmacy Automation Systems Market begins with upstream activities involving component and raw material suppliers, including manufacturers of high-precision robotics, specialized microprocessors, sophisticated sensors, and advanced software platforms. Key technology providers contribute essential elements like high-speed electromechanical components, proprietary algorithms for error checking, and networking hardware necessary for system integration. The core stage involves the system designers and manufacturers who integrate these components, focusing heavily on R&D to enhance speed, accuracy, and modularity, while adhering to rigorous safety and quality standards (e.g., FDA clearance, ISO certification). Manufacturing complexity is high, necessitating specialized expertise in precision engineering and software development, which acts as a barrier to entry for new players.

Downstream analysis focuses on the distribution and implementation phases. Most major vendors utilize a combination of direct sales forces for large institutional accounts (hospitals, major pharmacy chains) where installation and customization are critical, and indirect distribution channels through specialized healthcare technology distributors for smaller clinics and independent pharmacies. Post-sale services, including installation, maintenance contracts, software updates, and training, constitute a crucial revenue stream and a significant factor in customer retention. The effectiveness of the maintenance network, ensuring minimal system downtime, directly impacts end-user satisfaction and operational efficiency. The integration stage requires close collaboration between the automation vendor and the hospital’s IT department to ensure seamless communication with Electronic Health Records (EHR) and Pharmacy Information Systems (PIS).

The entire chain is heavily regulated, increasing scrutiny on suppliers regarding component quality and on manufacturers regarding system validation and cybersecurity robustness. The value addition progresses significantly from the raw hardware components to the final integrated system, with software and service components capturing an increasing share of the total system value. Direct distribution channels offer greater control over pricing and customer relationship management, which is essential for complex, high-value robotic installations. Conversely, indirect channels allow for broader geographic reach and specialized regional support. Optimization of the supply chain focuses on securing specialized components and reducing the lead time for highly customized installations, ensuring timely project completion and maximizing the customer's return on investment.

Pharmacy Automation Systems Market Potential Customers

The primary customers for Pharmacy Automation Systems are institutions and enterprises operating high-volume pharmaceutical dispensing operations where efficiency, regulatory compliance, and patient safety are paramount. Hospital pharmacies, particularly those in large acute care facilities and integrated delivery networks (IDNs), represent the largest buyer segment. These customers require sophisticated centralized robotics for bulk dispensing and decentralized automated dispensing cabinets (ADCs) for point-of-care medication administration, emphasizing seamless integration with existing clinical workflows and robust security features. The continuous need for inventory control in complex hospital settings, coupled with reducing labor costs, makes them essential purchasers of comprehensive automation suites.

Retail pharmacy chains and large independent pharmacies form the second major customer base. These entities focus on improving customer experience by reducing wait times, optimizing prescription filling accuracy, and managing diverse product inventories. Automated packaging and counting systems are highly valued in this segment to handle high daily prescription volumes efficiently, supporting both traditional walk-in business and growing mail-order fulfillment operations. Furthermore, the burgeoning segment of long-term care pharmacies requires specialized automation for unit-dose packaging and customized patient medication management, driven by increasing regulatory requirements for medication management in vulnerable populations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 9.0 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Omnicell, Inc., Becton, Dickinson and Company (BD), Cerner Corporation, Yuyama Co., Ltd., Capsa Healthcare, KUKA AG, ScriptPro LLC, Parata Systems, Innovation Associates, Willach Group, Rowa Technologies (Bayer AG), TCGRx, Baxter International, Arxium, RxSafe LLC, TouchPoint Medical, Medacist, Swisslog Healthcare, Health Robotics S.R.L., Synergy Medical |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pharmacy Automation Systems Market Key Technology Landscape

The current technology landscape of the Pharmacy Automation Systems Market is dominated by advanced robotics, sophisticated software platforms, and secure networking capabilities essential for interoperability. Robotic dispensing systems utilize highly precise electromechanical components and sophisticated sensors to manage medication storage, counting, and retrieval with unparalleled accuracy and speed. These systems often incorporate machine vision technology to verify pills and labels, further minimizing human error. The core technology relies on robust proprietary software algorithms that manage complex drug databases, dosage protocols, and inventory logistics, often integrating real-time data analytics to optimize workflow and predict demand.

Beyond hardware, the shift towards cloud-based software as a service (SaaS) is a major technological trend. This architecture facilitates easier updates, better scalability, and enhanced data security and accessibility, especially for multi-site pharmacy networks. Radio-Frequency Identification (RFID) technology is increasingly integrated into automated storage and retrieval systems to improve the track-and-trace capability of high-value or controlled substances, ensuring stringent compliance with regulatory mandates. Furthermore, the foundational technology relies heavily on secure communication protocols, ensuring the seamless and compliant exchange of prescription data between the automation system, Electronic Health Records (EHRs), and pharmacy information systems (PIS).

Emerging technological areas include the deployment of Artificial Intelligence (AI) and Machine Learning (ML) for advanced pattern recognition, which is critical for error detection in medication compounding and predictive maintenance of robotic systems. Another innovation is the development of smaller, more modular, and mobile automated dispensing cabinets (ADCs) suitable for diverse clinical environments, including satellite pharmacies and emergency departments. These technological innovations collectively aim to achieve "The Five Rights" of medication administration—the right patient, right drug, right dose, right route, and right time—with minimal human intervention, driving the next generation of safe dispensing practices.

Regional Highlights

The regional analysis of the Pharmacy Automation Systems Market reveals significant disparity in adoption rates and market maturity, primarily influenced by healthcare expenditure, regulatory frameworks, and technological readiness. North America, driven predominantly by the United States, commands the largest market share due to universal high adoption of advanced automation in both hospital and retail sectors. Factors underpinning this dominance include substantial R&D spending by key vendors, early adoption of robotics, and stringent regulatory pressures from bodies like the FDA mandating error reduction.

Europe represents the second largest market, characterized by strong governmental focus on centralized dispensing (especially in Scandinavian countries and the UK) and efficient hospital logistics. While Germany and France are significant contributors, the region faces challenges related to diverse regulatory environments across member states and varying levels of centralized healthcare purchasing power. However, the high density of aging populations ensures sustained demand for automated solutions to manage chronic care prescriptions efficiently.

Asia Pacific (APAC) is poised to be the fastest-growing region, stimulated by rapid infrastructural development, increasing awareness of automation benefits, and significant government investments in modernizing healthcare systems in China, India, and Japan. While initial adoption focuses on basic dispensing and packaging systems, the demand for complex robotic solutions is accelerating, particularly in urban, private healthcare settings. Latin America and the Middle East & Africa (MEA) are emerging markets, where adoption is currently limited by budget constraints and infrastructure gaps, but future growth is expected to be driven by private sector investment in specialty hospitals and large pharmacy retail chains.

- North America: Market leader, driven by mandatory safety standards, high capital spending capacity, and the presence of major automation vendors.

- Europe: Mature market focusing on optimization and replacement cycles, with high demand for centralized hospital pharmacy systems and efficiency tools.

- Asia Pacific (APAC): Highest projected growth rate, fuelled by increasing healthcare IT spending, urbanization, and a push to professionalize retail pharmacy operations.

- Latin America (LATAM): Developing market with increasing adoption in large urban hospitals and private clinics, gradually moving towards integrated solutions.

- Middle East & Africa (MEA): Growth centered around Gulf Cooperation Council (GCC) countries due to high per capita healthcare spending and expansion of high-tech hospitals.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pharmacy Automation Systems Market.- Omnicell, Inc.

- Becton, Dickinson and Company (BD)

- Cerner Corporation (Now Oracle Health)

- Yuyama Co., Ltd.

- Capsa Healthcare

- KUKA AG (Specialized Robotics Supplier)

- ScriptPro LLC

- Parata Systems (A JV of Becton, Dickinson and Company and TCGRx)

- Innovation Associates

- Willach Group

- Rowa Technologies (A division of CareFusion, now part of BD)

- TCGRx (Now part of Parata Systems)

- Baxter International Inc.

- Arxium

- RxSafe LLC

- TouchPoint Medical

- Azkoyen Group (Automated Vending Solutions)

- Medacist (Specialized in Drug Diversion Analytics integrated with ADCs)

- Swisslog Healthcare (KUKA Group)

- Health Robotics S.R.L. (Focused on Compounding Robotics)

- TOSHO Pharmaceutical & Medical Devices Co., Ltd.

- Synergy Medical

- Fagor Healthcare

Frequently Asked Questions

Analyze common user questions about the Pharmacy Automation Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of Pharmacy Automation Systems?

The primary driver is the critical need to mitigate medication errors and enhance patient safety outcomes, which are major concerns in both hospital and retail settings. Automation significantly reduces human reliance in high-volume tasks, ensuring precision and compliance with regulatory standards, alongside addressing rising labor costs and shortages of skilled pharmacy staff.

What are the largest restraints facing the Pharmacy Automation Systems Market?

The most significant restraint is the extremely high initial capital expenditure required for purchasing and installing sophisticated robotic and centralized dispensing systems. Furthermore, integrating new, complex automation platforms with older, legacy Electronic Health Record (EHR) and Pharmacy Information Systems (PIS) poses substantial technical and financial challenges for healthcare providers.

How does AI impact inventory management within pharmacy automation?

AI significantly optimizes inventory management by utilizing machine learning algorithms to analyze historical dispensing data, seasonal trends, and external patient flow indicators. This predictive analytics capability allows automated systems to forecast drug demand with higher accuracy, preventing stockouts of critical medications and minimizing wastage due to expiration.

Which end-user segment holds the largest share in the Pharmacy Automation Systems Market?

Hospital Pharmacies, encompassing both inpatient and outpatient services, hold the largest share. This dominance is due to the high volume and complexity of medication protocols, the necessity for decentralized dispensing cabinets (ADCs) at the point of care, and greater financial capacity for investing in comprehensive, centralized robotic dispensing solutions.

What role does telepharmacy play in the growth of automation systems?

Telepharmacy, which involves remote dispensing and consultation, is a major growth opportunity. Automation systems, particularly centralized filling facilities and remote verification software, are essential to making telepharmacy operational. They ensure accurate, high-speed fulfillment and allow pharmacists to remotely verify prescriptions processed by automated equipment in distant, often rural, locations, expanding access to care.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager