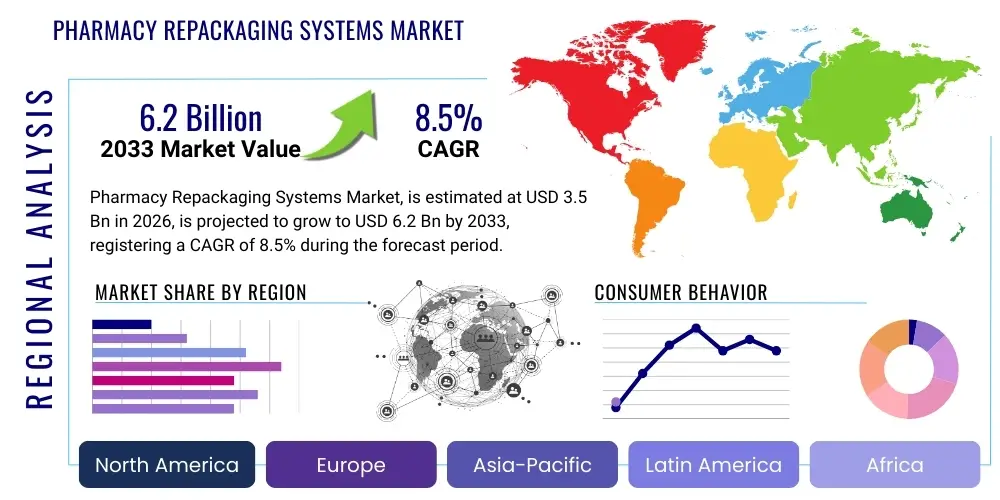

Pharmacy Repackaging Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438895 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Pharmacy Repackaging Systems Market Size

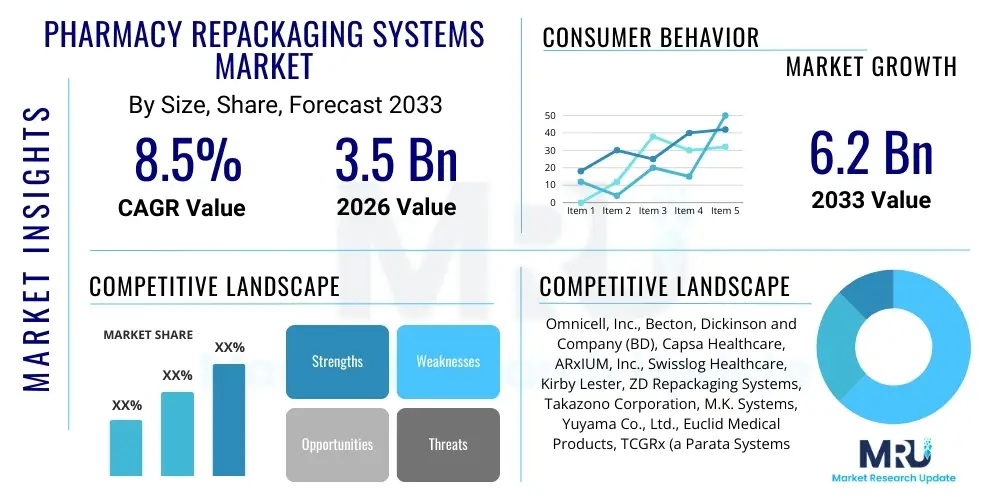

The Pharmacy Repackaging Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033.

Pharmacy Repackaging Systems Market introduction

The Pharmacy Repackaging Systems Market encompasses automated and semi-automated solutions designed to efficiently and accurately sort, count, package, and label medications into unit-dose, multi-dose, or patient-specific formats. These systems are crucial for enhancing patient safety, improving operational efficiency in healthcare settings, and ensuring compliance with stringent regulatory standards regarding drug dispensing and accountability. The primary product offerings include solid dosage repackaging systems, liquid dosage systems, and ancillary equipment such as barcode scanners and verification software, all integrated within the pharmacy workflow to reduce manual errors inherent in traditional dispensing methods.

Major applications of these systems span across diverse healthcare infrastructure, including hospitals, retail pharmacies, long-term care facilities, and centralized mail-order pharmacy services. In hospital settings, these systems streamline inventory management and facilitate faster turnaround times for inpatient medication dispensing, particularly in high-volume wards. For retail and mail-order pharmacies, repackaging systems enable the consolidation of bulk medication into ready-to-dispense packages, significantly improving prescription fulfillment accuracy and speeding up delivery logistics. The intrinsic value proposition lies in the reduction of medication errors—a critical public health concern—and the lowering of operational costs associated with manual labor and inventory shrinkage.

The market growth is primarily driven by the escalating demand for centralized and automated pharmacy operations, fueled by rising labor costs, and an increasing global geriatric population requiring complex medication regimens. Furthermore, stringent regulatory mandates imposed by bodies such as the FDA and equivalent international agencies, emphasizing traceability and unit-dose accountability, necessitate the adoption of sophisticated repackaging technology. The benefits of improved dosage accuracy, reduced contamination risks, and enhanced workflow productivity solidify the central role of pharmacy repackaging systems in modern healthcare delivery infrastructure, pushing providers towards greater automation adoption.

Pharmacy Repackaging Systems Market Executive Summary

The Pharmacy Repackaging Systems Market is characterized by robust growth, driven fundamentally by the imperative to improve patient safety and optimize labor-intensive processes within global healthcare ecosystems. Business trends indicate a strong move toward integrated systems that combine repackaging capabilities with sophisticated inventory management software and electronic health record (EHR) systems, fostering a seamless digital workflow. Key market players are concentrating on developing modular and scalable solutions that cater equally to large hospital systems requiring high throughput and smaller independent pharmacies needing compact, cost-effective automation. Furthermore, the rising adoption of outsourced centralized repackaging services, particularly in North America and Europe, represents a significant structural shift influencing vendor strategies and distribution models, focusing on service contracts alongside equipment sales.

Regionally, North America maintains its dominance due to high levels of automation penetration, favorable reimbursement policies, and significant investments in pharmaceutical infrastructure modernization, particularly in hospital pharmacy redesigns aimed at decentralized dispensing. The Asia Pacific (APAC) region is poised for the highest growth rate, propelled by rapid urbanization, expanding healthcare access, and increasing government initiatives focused on modernizing public healthcare facilities and controlling medication errors in populous countries like China and India. European growth remains steady, underpinned by standardization efforts across the European Union and the widespread integration of automated dispensing cabinets (ADCs) which often complement unit-dose repackaging operations.

In terms of segmentation, the Unit-Dose Repackaging Systems segment holds the largest market share, driven by their superior safety profile and widespread adoption in institutional settings. However, the Blister Card and Multi-Dose Repackaging Systems segment is experiencing rapid expansion, particularly in the long-term care and retail pharmacy sectors, reflecting the growing trend toward adherence packaging for chronic care patients. Technology trends highlight the increasing incorporation of high-definition imaging, Artificial Intelligence (AI) for quality control verification, and advanced robotics to handle diverse drug forms and volumes with minimized human intervention, thus addressing scalability and accuracy demands effectively across the entire supply chain.

AI Impact Analysis on Pharmacy Repackaging Systems Market

Users frequently inquire about AI's role in verifying medication accuracy, predicting equipment maintenance needs, and optimizing dynamic inventory levels within the repackaging workflow. A primary concern is whether AI-driven vision systems can reliably replace human checks for pill integrity and count accuracy, especially considering variations in drug size, color, and packaging material. Expectations center around AI improving throughput without compromising the stringent quality control required for drug dispensing. Consequently, the key themes summarize the transition from rule-based automation to adaptive, intelligent automation, focusing on anomaly detection, predictive failure analytics, and enhancing the overall security and integrity of the medication packaging process from bulk source to patient-ready unit.

- AI-powered visual inspection systems enhance quality control by detecting subtle defects, verifying pill counts, and confirming label integrity far beyond human capacity.

- Predictive maintenance analytics, driven by machine learning (ML), minimize system downtime by forecasting component failure in high-volume repackaging machinery.

- Optimization of drug inventory management through AI algorithms, forecasting demand fluctuations and optimizing repackaging schedules to reduce stock-outs and expiry waste.

- Integration of AI with electronic prescribing (e-prescribing) data facilitates personalized unit-dose packaging and labeling based on specific patient adherence profiles.

- Enhanced cybersecurity protocols through AI-driven anomaly detection, protecting sensitive patient and drug inventory data flowing through integrated repackaging networks.

DRO & Impact Forces Of Pharmacy Repackaging Systems Market

The dynamics of the Pharmacy Repackaging Systems Market are shaped by powerful drivers such as the global focus on reducing medication errors and the increasing adoption of unit-dose dispensing practices, which are recognized internationally as the gold standard for patient safety in institutional settings. Simultaneously, technological advancements, including miniaturization and the integration of robotics, make these systems more accessible and efficient. However, the market faces significant restraints, primarily the substantial initial capital investment required for high-throughput automated systems, which can be prohibitive for smaller, independent pharmacies and healthcare facilities in developing regions. Furthermore, the complexities associated with integrating new automation technologies into legacy IT and pharmacy management systems pose ongoing technical challenges, requiring specialized training and maintenance expertise.

Opportunities for market growth are abundant, particularly in leveraging the expanding home healthcare and long-term care sectors, where multi-dose adherence packaging is becoming increasingly necessary to manage polypharmacy in chronic patients. The rise of centralized fulfillment centers (CFCs) and the outsourcing of pharmacy services present lucrative avenues for vendors specializing in high-capacity, industrial-scale repackaging machinery. Moreover, the increasing regulatory pressure for track-and-trace capabilities, mandated by legislation such as the Drug Supply Chain Security Act (DSCSA) in the US, necessitates technology upgrades, driving continuous replacement cycles and demand for systems with advanced serialization features.

Impact forces acting on this market include the pervasive influence of healthcare policy shifts regarding medication safety funding and the accelerating adoption of telehealth, which indirectly drives demand for mail-order and remotely managed repackaging logistics. The primary impact force is the undeniable push towards cost containment across all healthcare systems globally; automation in repackaging is viewed not just as a safety measure, but as a crucial operational efficiency tool that offsets rising labor costs. The resultant demand for robust, reliable, and error-free systems ensures continuous investment, positioning regulatory compliance and operational ROI as the central impact forces dictating adoption speed and technology choices within the pharmaceutical supply chain.

Segmentation Analysis

The Pharmacy Repackaging Systems Market is extensively segmented based on the type of packaging format, the application setting, the dosage form being handled, and the level of automation employed. Understanding these segments is crucial for market participants as it highlights areas of high growth, specific customer needs, and the technological specialization required for competitive differentiation. The primary segmentation by packaging format—Unit-Dose versus Multi-Dose/Blister—reflects the two major workflow paradigms in institutional versus outpatient care. Segmentation by dosage form is critical due to the varying technical complexities involved in handling solids, liquids, and injectable medications, each requiring distinct machinery and safety protocols.

The application-based segmentation, dividing the market among Hospitals, Retail Pharmacies, and Long-Term Care (LTC) facilities, provides insights into demand volume and technological requirements. Hospitals typically prioritize high-speed, unit-dose capabilities, while LTC facilities heavily rely on compliance packaging for long-term patient adherence. Furthermore, the growing segment of centralized fulfillment centers (CFCs) represents a specialized high-volume category requiring industrial-grade robotics and seamless integration with complex logistics software. This multifaceted segmentation helps vendors tailor their sales strategies, focusing on the specific regulatory environments and operational constraints of each distinct end-user group, thereby maximizing market penetration.

- By Type of System:

- Unit-Dose Repackaging Systems (Solid, Liquid)

- Multi-Dose/Blister Packaging Systems

- Pouch/Strip Packaging Systems

- Vial Filling and Labeling Systems

- By Dosage Form:

- Solid Dosage Repackaging (Tablets, Capsules)

- Liquid Dosage Repackaging (Oral Solutions, Syrups)

- Powder and Granules Repackaging

- By End User:

- Hospital Pharmacies (Inpatient, Outpatient)

- Retail and Community Pharmacies

- Long-Term Care (LTC) Facilities

- Mail-Order and Centralized Fulfillment Centers (CFCs)

- By Technology:

- Automated Repackaging Systems

- Semi-Automated Repackaging Systems

- Manual Repackaging Systems (decreasing share)

Value Chain Analysis For Pharmacy Repackaging Systems Market

The value chain for the Pharmacy Repackaging Systems Market begins with the upstream suppliers of raw materials and core technology components, including specialized robotics, precision sensors, vision systems, and proprietary packaging films and materials (blister foil, unit-dose plastic). Key upstream activities involve the research and development of robust, sterile, and high-speed mechanical components capable of handling various drug properties without compromising efficacy or safety. Manufacturers of the repackaging equipment then integrate these components, focusing on software development for inventory management, quality control verification, and seamless communication with existing hospital information systems (HIS) and pharmacy management systems (PMS). The quality and reliability of upstream component supply directly influence the final product's performance and maintenance requirements.

The midstream stage involves the design, manufacturing, and assembly of the complex repackaging machines, followed by rigorous testing and certification according to medical device and pharmaceutical compliance standards. This stage also includes significant investment in software development, ensuring user interfaces are intuitive for pharmacy staff and that the systems comply with serialization and track-and-trace mandates. Distribution channels are critical in the downstream segment, often relying on specialized medical device distributors who possess the technical expertise to install, calibrate, and service these highly specialized machines. Direct sales channels are frequently employed by major manufacturers for large hospital contracts, where complex implementation and integration consultancy are necessary, establishing direct long-term relationships with key customers.

Indirect distribution involves partnerships with regional equipment distributors who serve smaller community pharmacies and long-term care facilities. Post-sales service and maintenance, including preventative maintenance contracts and software updates, constitute a vital part of the downstream value chain, providing substantial recurring revenue streams. The final stage involves the end-user adoption and operational integration within the pharmacy workflow, where effective training and sustained technical support determine the realized Return on Investment (ROI) and overall customer satisfaction. Efficiency in this value chain is continuously enhanced by vertical integration among large players, seeking to control proprietary software and service provision.

Pharmacy Repackaging Systems Market Potential Customers

The primary customers and buyers of pharmacy repackaging systems span the institutional healthcare spectrum, driven by mandatory safety protocols and economic incentives for operational efficiency. Acute care hospitals, particularly those with high patient turnover and extensive inpatient medication requirements, represent a cornerstone of demand for high-speed, fully automated unit-dose repackaging systems. These facilities utilize automation to minimize dispensing errors in critical care settings, manage large formularies, and integrate seamlessly with robotic dispensing cabinets (ADCs) installed across different wards.

Another rapidly expanding customer base is the long-term care (LTC) pharmacy sector. LTC facilities prioritize multi-dose compliance packaging systems, such as blister cards or strip pouches, designed to improve medication adherence for elderly residents managing multiple chronic conditions. These systems streamline the nursing administration process and significantly reduce the likelihood of missed or incorrect doses, making them essential tools for quality control and compliance in skilled nursing environments. The third major segment includes retail and community pharmacies, which increasingly adopt semi-automated systems to handle personalized packaging needs and participate in centralized fulfillment initiatives to compete against large pharmacy chains and mail-order providers.

Finally, centralized fulfillment centers (CFCs) and large mail-order pharmacies constitute a high-growth customer segment, requiring industrial-scale, robotics-intensive repackaging solutions. These centers prioritize maximum throughput, speed, and advanced serialization capabilities to manage national or international prescription volumes. These end-users typically purchase large fleets of equipment and require sophisticated enterprise software solutions for centralized control and inventory logistics, emphasizing long-term service agreements and robust scalability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Omnicell, Inc., Becton, Dickinson and Company (BD), Capsa Healthcare, ARxIUM, Inc., Swisslog Healthcare, Kirby Lester, ZD Repackaging Systems, Takazono Corporation, M.K. Systems, Yuyama Co., Ltd., Euclid Medical Products, TCGRx (a Parata Systems company), AutoMed Technologies, Rx-Safe, Jones Healthcare Group, Rowa Technologies (Becton, Dickinson and Company), ScriptPro LLC, Parata Systems, Innovation Associates, Inc., Medacist Solutions Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pharmacy Repackaging Systems Market Key Technology Landscape

The technological landscape of the Pharmacy Repackaging Systems Market is rapidly evolving, moving beyond simple counting and packaging towards sophisticated, integrated, and intelligent solutions. Core technologies center around advanced robotics, which facilitate high-speed, precise handling of diverse solid and liquid drug forms, ensuring minimal human intervention and reducing cross-contamination risks. Furthermore, high-resolution machine vision systems, increasingly augmented by AI and deep learning algorithms, are standardizing quality assurance. These vision systems verify the identity, integrity, and accurate count of medications within the package, serving as a critical layer of quality control to ensure that the correct drug strength and form are sealed, and that the accompanying label is compliant with all regulatory requirements.

Serialization and track-and-trace technology constitute another vital pillar of the current technology landscape. Driven by global regulatory mandates aimed at combating counterfeit drugs and securing the supply chain (such as DSCSA and the EU Falsified Medicines Directive), modern repackaging systems must generate unique serial numbers for each unit-dose or package. This capability mandates seamless integration of high-speed printing and scanning modules directly onto the packaging line, along with secure data capture and reporting software that interfaces with national traceability databases. Vendors are competing on the efficiency and robustness of their serialization modules, as well as their ability to handle both human-readable and 2D barcode data matrices without slowing throughput.

Moreover, modern systems are defined by their ability to integrate seamlessly within the broader digital pharmacy ecosystem. This involves utilizing advanced proprietary or open APIs (Application Programming Interfaces) to connect with Electronic Health Records (EHRs), Pharmacy Management Systems (PMS), and Automated Dispensing Cabinets (ADCs). The shift is towards comprehensive workflow solutions that manage the entire medication lifecycle—from procurement and bulk inventory management to dispensing verification and patient records update. Cloud-based platforms are increasingly being utilized for data storage, remote monitoring, predictive maintenance, and standardized software updates, ensuring systems operate at peak performance and remain compliant with evolving pharmaceutical informatics standards.

Regional Highlights

- North America (U.S. and Canada): Dominates the global market share owing to the early adoption of automation, robust healthcare IT infrastructure, significant expenditure on pharmaceutical safety technology, and stringent regulatory requirements promoting unit-dose dispensing in hospitals and long-term care facilities.

- Europe (Germany, U.K., France): Exhibits mature market characteristics with steady growth, fueled by government initiatives to modernize healthcare infrastructure, the standardization efforts across the EU impacting packaging and labeling (FMD compliance), and a high adoption rate of centralized pharmacy services.

- Asia Pacific (China, Japan, India, South Korea): Poised for the highest Compound Annual Growth Rate (CAGR). Growth is driven by rapid expansion of the healthcare sector, increasing investment in hospital infrastructure, and the growing awareness and subsequent mandate to reduce medication errors in highly populated nations.

- Latin America (Brazil, Mexico): Emerging market characterized by increasing healthcare expenditure and gradual transition from manual to semi-automated systems, driven by multinational hospital chains and efforts to improve overall pharmacy quality standards.

- Middle East and Africa (MEA): Represents a nascent market, primarily driven by government investments in centralized, large-scale medical cities (e.g., Saudi Arabia, UAE) requiring state-of-the-art pharmacy automation and logistics solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pharmacy Repackaging Systems Market.- Omnicell, Inc.

- Becton, Dickinson and Company (BD)

- Capsa Healthcare

- ARxIUM, Inc.

- Swisslog Healthcare

- Kirby Lester

- ZD Repackaging Systems

- Takazono Corporation

- M.K. Systems

- Yuyama Co., Ltd.

- Euclid Medical Products

- TCGRx (a Parata Systems company)

- AutoMed Technologies

- Rx-Safe

- Jones Healthcare Group

- Rowa Technologies (Becton, Dickinson and Company)

- ScriptPro LLC

- Parata Systems

- Innovation Associates, Inc.

- Medacist Solutions Group

Frequently Asked Questions

Analyze common user questions about the Pharmacy Repackaging Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the adoption of pharmacy repackaging systems?

The fundamental driver is the global imperative to minimize medication errors and enhance patient safety. Automated repackaging systems ensure accurate unit-dose dispensing, which directly correlates with reduced clinical risk, alongside the need for operational efficiency to combat rising labor costs in healthcare facilities.

How do automated systems support compliance with drug serialization regulations?

Automated repackaging systems integrate specialized printing and scanning technologies to generate and apply unique serial numbers (2D data matrices) to individual packages. They capture and report this data securely, ensuring full compliance with stringent track-and-trace mandates like the U.S. DSCSA and EU FMD, securing the supply chain against counterfeiting.

Which segment, Unit-Dose or Multi-Dose, is experiencing faster market growth?

While Unit-Dose systems currently hold the largest market share due to institutional adoption, the Multi-Dose and Blister Card Repackaging Systems segment is exhibiting the fastest growth rate. This acceleration is driven by the expansion of the long-term care and home healthcare sectors requiring personalized adherence packaging for chronic patients.

What are the main financial challenges associated with implementing repackaging automation?

The primary financial challenge is the high initial capital investment required for purchasing and installing fully automated, high-throughput robotic systems. Additional costs include specialized staff training, ongoing maintenance contracts, and the significant IT investment needed for seamless integration with existing hospital information and pharmacy management systems.

Which regional market is expected to show the highest growth rate through 2033?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) for pharmacy repackaging systems. This growth is spurred by government-led healthcare infrastructure modernization projects, increasing public awareness of medication safety, and the expanding presence of multinational pharmaceutical logistics companies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager