Pharmacy Retailing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438824 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Pharmacy Retailing Market Size

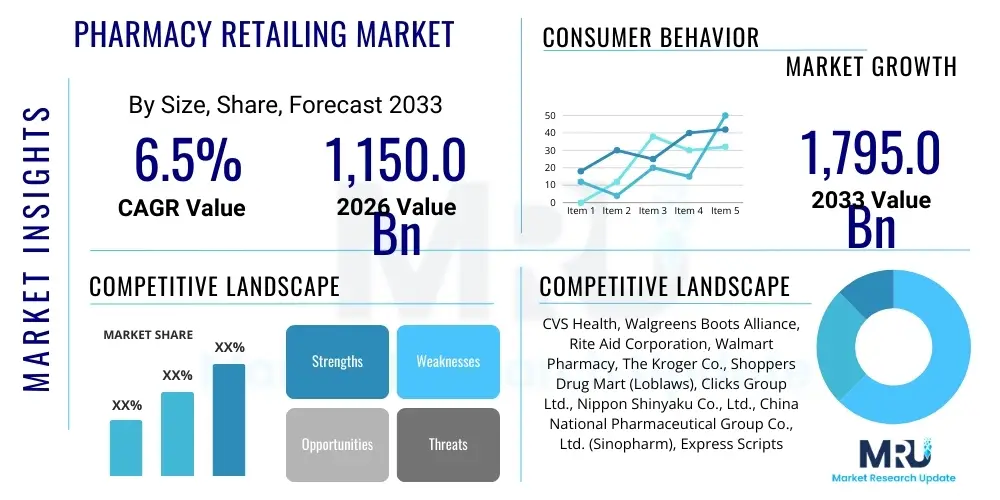

The Pharmacy Retailing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1,150.0 billion in 2026 and is projected to reach USD 1,795.0 billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the accelerating shift towards convenience-based healthcare services, the aging global population requiring chronic disease management, and the massive ongoing digitalization transforming the traditional retail pharmacy model into a comprehensive health and wellness destination. Demand for specialized pharmacy services, including compounding and personalized medication management, is significantly contributing to market expansion across developed economies, while emerging markets focus on increasing accessibility and reducing out-of-pocket expenditure through regulated dispensing channels.

Pharmacy Retailing Market introduction

The Pharmacy Retailing Market encompasses the sales and distribution of prescription medications, over-the-counter (OTC) drugs, medical devices, and various health, wellness, and beauty products through retail pharmacy outlets, including traditional brick-and-mortar stores, national chains, and advanced online platforms. The core product offering revolves around pharmaceutical dispensing, underpinned by professional counseling and patient education services crucial for promoting medication adherence and ensuring public safety. Major applications span chronic disease management, acute illness treatment, preventative health care, and specialized services like immunizations and health screening, positioning pharmacies as essential primary care access points within the healthcare ecosystem.

Key benefits derived from a robust pharmacy retailing infrastructure include enhanced access to essential medications, reduced burden on acute care facilities through preventative services, and significant convenience for consumers via extended operating hours and localized distribution networks. Driving factors sustaining this market expansion include evolving regulatory landscapes favoring pharmacist-led initiatives, technological integration enabling seamless omnichannel experiences, the global rise in non-communicable diseases (NCDs) necessitating long-term pharmacological treatment, and increasing consumer expectations for instant access and personalized health advice. The rapid integration of telehealth services and prescription delivery mechanisms further accelerates the market's evolution, fundamentally shifting the competitive landscape toward efficiency and comprehensive patient engagement.

Pharmacy Retailing Market Executive Summary

The Pharmacy Retailing Market is characterized by intense competition driven by consolidation among major chain pharmacies and the disruptive entry of large e-commerce entities, leading to a strong focus on omnichannel service delivery models and supply chain optimization. Business trends indicate a pivot toward high-margin ancillary services, such as specialized clinical pharmacy programs, vaccination services, and point-of-care testing, designed to maximize operational efficiency and revenue streams beyond traditional dispensing. Technology adoption, particularly in inventory management, patient communication, and AI-driven predictive analytics for prescription adherence, remains a critical strategic priority for leading market players aiming for sustained competitive differentiation and improved patient outcomes.

Regional trends highlight North America and Europe maintaining dominant market shares due to well-established regulatory frameworks, high per capita healthcare spending, and sophisticated pharmaceutical supply chain infrastructure. Conversely, the Asia Pacific (APAC) region is projected to register the highest growth rate, fueled by expanding universal health coverage initiatives, rapid urbanization, increasing accessibility to retail outlets in emerging economies like India and China, and the burgeoning adoption of digital pharmacy platforms. Demographic shifts, specifically the massive aging populations in countries like Japan and South Korea, further amplify the demand for specialized long-term care pharmacy services in the APAC landscape.

Segmentation trends indicate that Chain Pharmacies continue to dominate based on sales volume, capitalizing on economies of scale and widespread geographic coverage, while Online Pharmacies are witnessing the fastest growth due to enhanced convenience, competitive pricing, and successful integration with telehealth platforms. The product segment shows robust growth in the Over-the-Counter (OTC) and Wellness & Beauty categories, reflecting increased consumer self-care awareness and preventative health investments. Strategic investments are consistently directed towards developing secure and scalable digital infrastructure to support the demand for prescription fulfillment and digital health monitoring tools across all operational segments.

AI Impact Analysis on Pharmacy Retailing Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Pharmacy Retailing Market often center on themes of automation efficiency, personalized patient care, job displacement risks for pharmacy staff, and the security implications of utilizing vast amounts of patient data. Users frequently inquire about AI's role in optimizing inventory management—specifically minimizing spoilage and stock-outs—and its ability to enhance medication adherence through predictive risk stratification and targeted patient interventions. Furthermore, there is significant interest in how AI can expedite prescription verification, detect potential drug-drug interactions with higher accuracy, and facilitate truly personalized digital health counseling, ultimately moving the pharmacy experience beyond transactional dispensing toward sophisticated clinical support.

The implementation of AI algorithms is poised to revolutionize pharmacy operations by dramatically improving predictive capabilities related to patient demand, inventory forecasting, and complex supply chain logistics, ensuring timely drug availability even in remote locations. AI-driven chatbots and virtual assistants are increasingly handling routine customer queries and managing refill reminders, freeing up human pharmacists to focus on complex clinical consultations and high-touch patient interactions, thereby maximizing professional skill utilization. The deployment of machine learning models for analyzing electronic health records (EHRs) allows retailers to identify at-risk populations proactively and deploy tailored interventions, significantly boosting medication adherence rates which remains a critical challenge in chronic disease management across global healthcare systems.

- AI-powered predictive inventory management reducing waste and optimizing stocking levels.

- Machine learning models for detecting medication non-adherence risks and recommending timely interventions.

- Automated prescription verification and clinical decision support systems enhancing safety and reducing dispensing errors.

- AI-driven personalized marketing and loyalty programs based on individual health profiles and purchase history.

- Implementation of robotic dispensing systems guided by AI for high-throughput fulfillment in centralized pharmacies.

- Use of generative AI for rapid synthesis of complex drug information for both pharmacists and patients.

DRO & Impact Forces Of Pharmacy Retailing Market

The dynamics of the Pharmacy Retailing Market are primarily driven by the escalating global prevalence of chronic diseases, demanding continuous pharmaceutical interventions, coupled with significant advancements in regulatory support for expanded pharmacy scope of practice, allowing pharmacists to administer vaccines and manage minor ailments. Restraints include complex and fragmented reimbursement policies across different geographies, stringent regulations pertaining to prescription drug advertising and dispensing, and the continuous pressure on margins stemming from the proliferation of generic drugs and intense competition from both large retail chains and agile digital pure-plays. Opportunities are vast, centered on the expansion into telehealth integration, the commercialization of specialized clinical services (e.g., pharmacogenomics), and leveraging predictive analytics to customize patient care pathways, all of which are critical for future differentiation.

The market is significantly impacted by strong demographic shifts, particularly the global aging demographic, which inherently increases pharmaceutical consumption and the need for personalized care services like home delivery and complex medication management. Economic forces, including fluctuating healthcare expenditure, government price controls on pharmaceuticals, and the overall affordability concerns faced by consumers, directly influence purchasing behavior and retailer profitability models. Sociocultural forces emphasize convenience, self-care, and preventative health, steering consumers toward easily accessible pharmacy services and high-quality OTC products, forcing retailers to redesign their physical layouts and digital user interfaces to enhance the overall customer experience.

Technological impact forces are arguably the most transformative, driving the shift towards omnichannel retail through sophisticated e-commerce platforms, secure mobile applications for refills, and the utilization of data analytics to optimize operations from supply chain resilience to targeted patient outreach. Furthermore, regulatory scrutiny, specifically concerning data privacy (like HIPAA and GDPR) and the verification standards for online dispensing, acts as a crucial barrier to entry for new competitors while simultaneously compelling existing players to invest heavily in robust cybersecurity infrastructure and rigorous compliance mechanisms to maintain public trust and operational licenses.

Segmentation Analysis

The Pharmacy Retailing Market is comprehensively segmented based on the Type of outlet, the specific Product Category sold, and the geographic Location of operations, providing a granular view of consumer purchasing patterns and distribution channel efficacy. Analyzing these segments is crucial for understanding regional variances in healthcare access and consumer preferences, particularly the ongoing transition from traditional, independent pharmacies toward large, integrated chain operations capable of offering diversified services and technological convenience. The growth differential between physical and digital channels is currently the most dynamic segmentation factor, dictating investment strategies for supply chain automation and last-mile delivery capabilities to maintain competitive advantage in a rapidly evolving healthcare retail environment.

The dominance of specific product segments, such as prescription drugs, necessitates robust regulatory compliance and cold chain logistics management, while the expansion of wellness and beauty segments provides higher-margin revenue diversification, shielding retailers from pressure on core drug pricing. Furthermore, the segmentation by location (urban vs. rural) highlights disparities in service delivery, where rural areas often depend on integrated community pharmacies providing expanded primary care functions, whereas urban centers prioritize speed, efficiency, and a broad range of specialized services offered by massive chain retailers. This multi-dimensional segmentation ensures that stakeholders can tailor their market entry strategies and product offerings to address specific regional and demographic needs effectively, optimizing resource allocation and improving overall market penetration.

- Type:

- Traditional Independent Pharmacies

- Chain Pharmacies (Drugstores)

- Mail-Order Pharmacies

- Online/E-commerce Pharmacies

- Product:

- Prescription Drugs (Branded, Generics)

- Over-the-Counter (OTC) Products

- Medical Devices and Equipment

- Wellness, Nutrition, and Beauty Products

- Personal Care and Hygiene Products

- Location:

- Urban

- Rural

Value Chain Analysis For Pharmacy Retailing Market

The Pharmacy Retailing Value Chain begins with upstream activities involving pharmaceutical manufacturers and generic drug producers, followed by primary distribution handled by large wholesalers like McKesson, AmerisourceBergen, and Cardinal Health, who manage complex procurement, storage, and logistics including stringent cold chain requirements. Efficiency at this stage is crucial, as any disruption in the pharmaceutical supply chain directly impacts dispensing capability and patient outcomes. Pharmacy retailers, positioned in the middle stream, focus intensely on efficient inventory management, regulatory compliance, and securing favorable purchasing agreements, often relying on group purchasing organizations (GPOs) to maximize pricing leverage against primary suppliers.

The downstream component of the value chain involves direct interaction with the end consumer/patient, encompassing professional services such as dispensing, counseling, immunization, and increasingly, complex clinical services like chronic disease monitoring and medication therapy management (MTM). The primary distribution channels are increasingly bifurcated: Direct channels include owned brick-and-mortar stores and corporate e-commerce platforms, offering immediate contact and brand control. Indirect channels involve third-party delivery services, partnerships with telehealth providers, and integration with PBMs (Pharmacy Benefit Managers) who influence patient flow and reimbursement rates. Optimization across both channels—ensuring a seamless omnichannel experience—is paramount for maximizing market reach and maintaining patient loyalty in the current competitive environment.

Pharmacy Retailing Market Potential Customers

Potential customers for the Pharmacy Retailing Market span the entire demographic spectrum, broadly categorized into chronic disease patients, acutely ill individuals requiring short-term pharmacological intervention, and the general population focused on preventative health, wellness, and self-care. Chronic patients, often managing conditions such as diabetes, hypertension, or cardiovascular disease, represent the core and most stable customer base, necessitating recurrent prescription refills and specialized adherence support services like automatic refills and detailed medication reviews. The elderly population (65+) forms a particularly vital segment, characterized by high rates of polypharmacy and a greater need for personalized care, compounding, and delivery services due to mobility constraints.

A growing segment includes digitally native consumers who prioritize convenience, price transparency, and rapid delivery, primarily utilizing online and mail-order pharmacies for routine needs and over-the-counter purchases. Furthermore, healthcare providers—including physicians and clinics—act as significant B2B customers when utilizing specialized retail pharmacies for complex or compounded medications required for their patients, often integrating pharmacy services directly into their care protocols. Retail pharmacies are strategically targeting wellness consumers who purchase high-margin supplements, nutrition products, and cosmetic items, capitalizing on the shift toward holistic self-care and consumer-driven health management to diversify revenue streams beyond strictly regulated prescription dispensing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,150.0 billion |

| Market Forecast in 2033 | USD 1,795.0 billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CVS Health, Walgreens Boots Alliance, Rite Aid Corporation, Walmart Pharmacy, The Kroger Co., Shoppers Drug Mart (Loblaws), Clicks Group Ltd., Nippon Shinyaku Co., Ltd., China National Pharmaceutical Group Co., Ltd. (Sinopharm), Express Scripts (Cigna), McKesson Corporation (Retail Services), Dis-Chem Pharmacies, Jean Coutu Group (Metro Inc.), Boots UK, A.S. Watson Group, Guardian Pharmacy Services, PillPack (Amazon Pharmacy), DocMorris (Zur Rose Group). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pharmacy Retailing Market Key Technology Landscape

The technology landscape of the Pharmacy Retailing Market is rapidly shifting towards digital integration and automation to enhance operational efficiency and patient safety. Central to this transformation is the widespread adoption of robust Pharmacy Management Systems (PMS), which handle dispensing, billing, inventory control, and crucial regulatory reporting functions. These systems are increasingly cloud-based, offering scalability and real-time data access across decentralized networks. Furthermore, Electronic Health Record (EHR) integration capabilities are mandatory, enabling seamless communication between pharmacies and prescribing physicians, thereby reducing medication errors and streamlining prescription refill processes across various healthcare settings and ensuring compliance with mandated digital reporting standards.

Automation technologies, particularly robotic dispensing systems and automated compounding devices, are becoming commonplace in high-volume central fill operations and large retail chain pharmacies, maximizing dispensing accuracy and allowing pharmacists to dedicate more time to clinical services rather than manual counting. E-commerce platforms and secure mobile applications represent the consumer-facing technological front, facilitating features like remote prescription submission via photo, secure payment gateways, appointment scheduling for vaccinations, and personalized medication reminder alerts. The sophistication of these digital interfaces, particularly their ability to offer personalized recommendations and integrate with wearable health monitoring devices, directly influences customer engagement and adherence rates.

Crucially, advanced data analytics and Artificial Intelligence (AI) platforms are being deployed for demand forecasting, supply chain risk management, and clinical decision support. AI algorithms analyze patient profiles and purchasing history to predict adherence gaps and suggest proactive interventions, contributing significantly to improved public health outcomes. Cybersecurity technologies are also paramount, given the sensitive nature of patient health information (PHI) managed by retailers, requiring continuous investment in encryption, multi-factor authentication, and compliance frameworks to protect against increasingly sophisticated cyber threats and maintain public trust in digital health services.

Regional Highlights

Regional dynamics within the Pharmacy Retailing Market exhibit significant variation driven by local regulatory environments, population health profiles, and economic development levels. North America, encompassing the U.S. and Canada, currently holds the largest market share, characterized by high pharmaceutical expenditure, a sophisticated chain pharmacy infrastructure, and advanced adoption of PBMs and specialty pharmacy services. The U.S. market, in particular, is highly consolidated, with major players driving aggressive omnichannel strategies and investing heavily in clinical services like MinuteClinics to establish pharmacies as integrated primary care hubs.

Europe represents a mature market, governed by diverse national healthcare systems. Western European countries emphasize strict dispensing regulations and often feature a higher ratio of independent pharmacies, although large groups like Boots and A.S. Watson maintain strong influence. Key trends include the expansion of centralized dispensing operations and a growing acceptance of e-pharmacy, particularly in countries like Germany and the UK, spurred by regulatory clarity favoring digital prescription fulfillment. The pressure on generic drug pricing across the continent, driven by national health service mandates, compels retailers to focus on high-margin front-of-store sales and value-added clinical services to sustain profitability.

Asia Pacific (APAC) is the fastest-growing region, powered by escalating healthcare needs of massive populations in China and India, expanding health insurance coverage, and rapid infrastructure development supporting modern retail formats. Urbanization and increased disposable income are shifting purchasing habits toward branded products and wellness supplements, while governments prioritize enhancing access to essential medicines, often utilizing public-private partnerships. Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets focusing on standardizing supply chains, combating counterfeiting, and increasing the geographical reach of organized retail pharmacy chains to serve previously underserved rural populations effectively.

- North America: Dominant market share; rapid consolidation; strong focus on clinical services and PBM integration; leading adoption of robotics and centralized fulfillment.

- Europe: Mature market with fragmented national regulations; high generic penetration; accelerating transition toward e-pharmacy and advanced dispensing automation, particularly in Germany and the UK.

- Asia Pacific (APAC): Highest projected CAGR; expansion driven by China and India; focus on retail chain expansion, digital adoption, and addressing massive population health needs.

- Latin America (LATAM): Growth tied to economic stability and health system reforms; improving supply chain integrity; increasing penetration of global chain operators seeking new growth territories.

- Middle East & Africa (MEA): Emerging market focused on infrastructure investment, countering pharmaceutical counterfeiting, and enhancing access to organized retail healthcare services in key urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pharmacy Retailing Market.- CVS Health

- Walgreens Boots Alliance

- Rite Aid Corporation

- Walmart Pharmacy

- The Kroger Co.

- Shoppers Drug Mart (Loblaws)

- Clicks Group Ltd.

- Nippon Shinyaku Co., Ltd.

- China National Pharmaceutical Group Co., Ltd. (Sinopharm)

- Express Scripts (Cigna)

- McKesson Corporation (Retail Services)

- Dis-Chem Pharmacies

- Jean Coutu Group (Metro Inc.)

- Boots UK (WBA Subsidiary)

- A.S. Watson Group

- Guardian Pharmacy Services

- PillPack (Amazon Pharmacy)

- DocMorris (Zur Rose Group)

Frequently Asked Questions

Analyze common user questions about the Pharmacy Retailing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Pharmacy Retailing Market?

The Pharmacy Retailing Market is projected to grow at a CAGR of 6.5% between 2026 and 2033, driven by digitalization, expansion of clinical pharmacy services, and demographic shifts including an aging global population requiring chronic care.

How is technology, specifically AI, reshaping traditional retail pharmacy operations?

AI is fundamentally reshaping pharmacy operations by optimizing inventory and logistics through predictive analytics, enhancing patient safety via advanced drug interaction checks, and automating prescription dispensing, thereby allowing pharmacists to focus more on clinical consultations and complex patient care.

Which segmentation factor is experiencing the fastest growth in the pharmacy retail sector?

The Online/E-commerce Pharmacies segment is experiencing the fastest growth, primarily due to increased consumer demand for convenience, competitive pricing, seamless integration with telehealth platforms, and secure medication delivery options, accelerating the shift towards omnichannel retailing models.

What are the primary restraints affecting the profitability of pharmacy retailers globally?

Key restraints include increasing pressure on drug pricing, particularly generic medicines, complex and often inconsistent reimbursement policies managed by governments and PBMs, and the significant capital expenditure required to maintain compliance with stringent regulatory and data privacy standards (e.g., HIPAA and GDPR).

Which region currently holds the largest market share in Pharmacy Retailing, and what drives its dominance?

North America holds the largest market share. This dominance is driven by high per capita healthcare spending, the robust presence of consolidated national chain pharmacies (like CVS and Walgreens), and early adoption of integrated specialty and clinical pharmacy services, positioning retail outlets as critical primary care access points.

The strategic deployment of AI in pharmacy workflows extends beyond mere operational efficiency; it is central to enhancing the role of the pharmacist as a frontline healthcare provider. For instance, sophisticated AI-driven algorithms are being utilized to analyze adherence patterns based on refill history and demographic data, allowing pharmacists to prioritize proactive outreach to patients most likely to lapse in their medication regimes. This shift from reactive dispensing to proactive clinical management creates significant value both for the retailer—through improved customer retention and reduced healthcare costs—and for the patient, who benefits from superior health outcomes. The integration of AI with remote monitoring devices also facilitates continuous care management, enabling personalized dosage adjustments and intervention recommendations based on real-time physiological data.

Furthermore, technological innovation is critical in addressing the inherent complexities of the global pharmaceutical supply chain. Blockchain technology is emerging as a powerful tool to enhance transparency and security, tracking medicines from the manufacturer through distribution to the end consumer, thereby mitigating risks associated with counterfeiting and diversion—a major concern, especially in emerging markets. Retail pharmacy companies are investing heavily in cold chain logistics technologies, including IoT sensors and specialized transport systems, to reliably handle the increasing volume of temperature-sensitive biological and specialty medications, which represent a high-growth, high-value segment of the market. This technological mastery over logistics is a core competitive differentiator, ensuring product quality and integrity throughout the distribution network, thereby safeguarding patient health and maintaining regulatory trust across international borders.

The shift towards preventive healthcare and wellness is profoundly impacting the retail floor space and product mix of modern pharmacies. Retailers are dedicating more square footage to professional consultation areas, clinical service rooms for immunizations and health screenings, and specialized sections for durable medical equipment (DME) and high-margin nutritional supplements. This transformation reflects a calculated effort to position pharmacies not just as places to pick up prescriptions, but as essential destinations for holistic health maintenance. This diversification strategy, often supported by enhanced digital interfaces guiding consumers toward relevant in-store services or products, buffers retailers against the perpetual pricing pressures characterizing the core prescription drug market.

In terms of regulatory impact, key markets are increasingly permitting pharmacists to prescribe for minor ailments, expanding their scope beyond traditional dispensing. This regulatory liberalization, particularly notable in parts of North America and Australasia, transforms the pharmacy into a genuine primary care access point, relieving pressure on physician offices and emergency departments. This expansion necessitates specialized training and credentialing for pharmacy professionals, forcing retailers to invest in continuous professional development and robust clinical governance frameworks. The success of pharmacy retailing in the coming decade will be strongly correlated with its ability to capitalize on these regulatory allowances by successfully integrating these expanded clinical services into their daily operational models, ensuring service quality and maintaining public confidence in the pharmacist's evolving professional role.

The intense competition within the Chain Pharmacies segment globally—led by industry giants—demands sophisticated strategic responses from smaller, independent operators. Many independent pharmacies are successfully differentiating themselves by focusing on specialized niche services such as complex pharmaceutical compounding, geriatric care medication synchronization, or personalized functional medicine consultations, services that larger chains often cannot replicate with the same level of tailored attention. Furthermore, these independents often leverage technology through affiliation with pharmacy services administrative organizations (PSAOs) and regional buying groups to achieve better economies of scale and access to advanced PMS technology, allowing them to compete effectively in dispensing while retaining a strong community-focused clinical approach. This dual strategy of niche specialization and leveraging group buying power is crucial for the long-term viability of the independent sector against major corporate entities.

The geographical analysis of the Pharmacy Retailing Market further reveals how regulatory barriers and public health priorities influence market structure. For instance, in several European Union countries, regulations often limit ownership models, fostering a highly fragmented market dominated by thousands of individual, small-scale pharmacies, resulting in higher operational costs but often ensuring a deep integration into local community healthcare systems. Conversely, the market structure in China and India is characterized by rapid development of large, vertically integrated chains supported by venture capital, aggressively expanding digital channels and battling issues related to drug quality control and last-mile delivery challenges across vast geographical distances. Understanding these fundamental structural differences is paramount for multinational corporations planning their investment and expansion strategies across these diverse global markets, requiring highly localized approaches to partnership formation, regulatory compliance, and consumer outreach efforts.

Analyzing the potential customers by condition, the rise of specialized pharmacy services targeting complex chronic and rare diseases stands out. Specialty pharmacy is a high-growth, high-margin sector focused on high-cost, high-touch medications that often require complex handling, distribution, and intensive patient education and compliance support. Patients needing these specialty drugs represent an essential customer base for advanced pharmacy retailers, necessitating sophisticated logistical capabilities, specialized clinical training for pharmacists (e.g., in oncology or rheumatology), and seamless integration with insurance providers and patient assistance programs. Retailers successful in this domain often establish dedicated specialty pharmacy centers of excellence, ensuring the continuity of care and the efficacy of these critical, often life-saving, therapies, thus solidifying their position as strategic partners within the complex healthcare continuum.

The investment trajectory across the market is visibly skewed toward digitalization. Retailers are increasingly viewing their mobile applications and e-commerce portals not just as sales channels, but as integral patient engagement tools capable of facilitating medication synchronization, virtual consultations with pharmacists, and access to personalized health content. The objective is to create a unified customer experience, known as 'omnichannel retailing,' where patients can seamlessly transition between ordering online, picking up in-store, and consulting virtually, regardless of the physical location or time of day. This technological convergence is directly aimed at maximizing medication adherence—a major driver of healthcare quality metrics—and enhancing customer loyalty in an environment saturated with numerous competing retail health providers and direct-to-consumer pharmacy models.

The evolving regulatory environment also demands continuous updates to the key technology landscape. Compliance software, specifically designed to monitor dispensing limits, controlled substance tracking, and mandated reporting requirements (such as track-and-trace systems), is now non-negotiable. Furthermore, as telepharmacy services expand—allowing pharmacists to supervise dispensing remotely—advanced video conferencing and secure network infrastructure are becoming essential technological requirements. This expansion into remote services not only broadens access to pharmaceutical expertise in remote or rural areas but also optimizes labor costs and utilization rates for major retail chains, reflecting a strategic investment in technologies that support distributed clinical practice models while maintaining stringent quality control.

Finally, the value chain faces ongoing pressure from vertical integration, primarily driven by the merger of Pharmacy Benefit Managers (PBMs) with large insurance companies and retail chains (a prime example being CVS Health and Aetna). This vertical structure consolidates control over drug pricing, formulary placement, and patient steering, heavily influencing which retailers patients use and the margins available across the distribution chain. For non-integrated pharmacy retailers, this necessitates forming strong, strategic alliances with smaller PBMs or specializing in areas where vertical integration is less dominant, such as compounding, complex infusion services, or community-based clinical programs, in order to protect their share of the dispensing market and maintain adequate profitability.

The proliferation of digital health tools, including specialized pharmacy apps and secure patient portals, significantly contributes to addressing the restraint posed by complexity in accessing health services. These digital solutions offer functionalities such as medication reminders, direct messaging with pharmacists, and digital records of immunization status, making it easier for consumers to manage their healthcare proactively. This is especially vital for the chronic patient segment, where ease of repeat prescription management and proactive monitoring directly correlates with improved adherence and reduced hospital readmission rates. Pharmacy retailers are thus evolving into sophisticated technology companies focused on health management, leveraging these platforms to enhance patient engagement and loyalty, thereby transforming a traditional retail model into a future-ready digital health hub capable of competing with specialized telehealth providers.

The opportunity landscape is also heavily shaped by the global interest in personalized medicine and pharmacogenomics. As testing becomes more accessible and affordable, forward-thinking pharmacy retailers are beginning to offer pharmacogenomic testing services, which use an individual's genetic profile to predict their response to specific medications. By integrating these test results into dispensing protocols, pharmacists can advise prescribers on the most effective drug and dosage, minimizing adverse effects and optimizing therapeutic outcomes. This capability elevates the pharmacy from a simple dispensing location to a provider of highly customized, high-value clinical consultation, capturing a premium service segment and reinforcing the pharmacist’s role as an indispensable member of the patient care team. Retailers who successfully market and operationalize these precision medicine services will gain a significant competitive advantage in attracting specialized patient populations and building strong referral relationships with prescribing physicians.

Furthermore, sustainable growth in the Pharmacy Retailing Market is inextricably linked to maintaining high standards of data security and regulatory compliance. The immense volume of sensitive patient data handled by pharmacy systems makes them prime targets for cyberattacks. Therefore, continuous investment in advanced cybersecurity measures, including intrusion detection systems, rigorous staff training on data handling protocols, and regular external audits, is essential. The cost of non-compliance, encompassing massive financial penalties and significant reputational damage, far outweighs the cost of preventative investment. Effective risk management, supported by compliant technology architecture, is a non-negotiable impact force that dictates the viability and trustworthiness of every participant within the modern pharmaceutical retail ecosystem, particularly those utilizing large-scale digital platforms for prescription fulfillment and clinical data processing.

The segmentation of the market by Product highlights the increasing consumer interest in the Wellness, Nutrition, and Beauty Products category. This shift reflects a broader societal trend toward preventative health and lifestyle choices aimed at improving longevity and quality of life. For pharmacy retailers, this segment offers significantly higher profit margins compared to highly regulated prescription drugs. Successfully merchandising these non-pharmaceutical items, often by integrating them with digital health advice and professional pharmacist recommendations, allows retailers to capitalize on impulse purchasing and strengthen their brand identity as comprehensive health experts, distinct from general merchandise retailers. Strategic buying and category management within this space are key drivers for revenue diversification and sustaining overall financial health against the continuous downward pressure on prescription drug pricing.

The role of Pharmacy Benefit Managers (PBMs) in the market is an undeniable impact force, particularly in North America, where they act as powerful intermediaries negotiating drug prices and determining which drugs are covered (the formulary). PBM policies directly affect retailer reimbursement rates and patient out-of-pocket costs, fundamentally shaping the competitive landscape. Retailers must dedicate substantial resources to navigating PBM contracts and audit requirements. The growing trend of vertical integration, where PBMs own their mail-order pharmacies and specialty pharmacies, poses a severe structural challenge to independent retailers and non-integrated chains, forcing them to find innovative operational efficiencies and enhance local clinical differentiation to remain relevant and financially sustainable within this complex, vertically controlled environment.

The ongoing development and market entry of biosimilars also represent a crucial impact force within the Prescription Drugs segment. Biosimilars, which are highly similar versions of approved biological medicines, introduce competition and cost savings but require sophisticated handling and patient education to ensure acceptance and adherence. Pharmacy retailers play a critical role in facilitating the adoption of biosimilars by educating both prescribers and patients, navigating complex interchangeable status regulations, and managing inventory shifts. Their ability to manage the introduction of these lower-cost alternatives efficiently will be vital for supporting national healthcare systems in controlling expenditure on specialty pharmaceuticals, while also impacting the profitability of the retail dispensing business through altered margins and dispensing volumes within this high-value category.

Finally, the sustainability aspect of pharmacy retailing is gaining momentum as a crucial determinant of corporate reputation and consumer choice. Retailers are increasingly focusing on sustainable supply chain practices, reducing pharmaceutical waste, and implementing eco-friendly packaging and store operations. Consumers, particularly younger generations, are demonstrating a preference for businesses that align with environmental and social governance (ESG) standards. Pharmacy chains that demonstrate a commitment to sustainability—for example, through drug take-back programs, energy-efficient facilities, and ethical sourcing of wellness products—can enhance brand loyalty and attract environmentally conscious customers, turning ethical practice into a competitive market advantage in an increasingly socially aware retail landscape.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager