Phenol & Acetone Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431864 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Phenol & Acetone Market Size

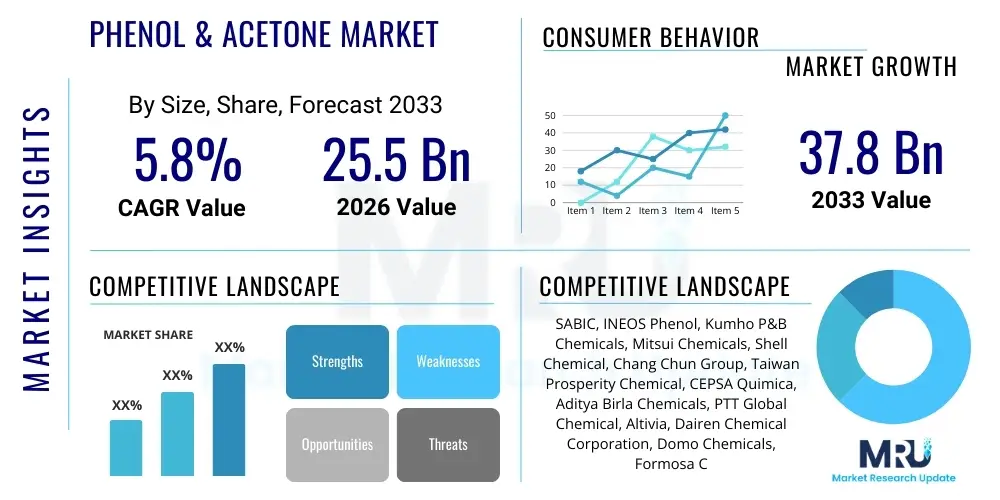

The Phenol & Acetone Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 25.5 Billion in 2026 and is projected to reach USD 37.8 Billion by the end of the forecast period in 2033.

Phenol & Acetone Market introduction

Phenol and acetone are foundational chemicals derived primarily from cumene, a derivative of benzene and propylene. Phenol, an aromatic organic compound, is critical for producing phenolic resins, bisphenol A (BPA), and caprolactam, serving essential roles in construction, automotive, and electronics sectors. Acetone, the simplest ketone, acts as a solvent in coatings, pharmaceuticals, and chemical synthesis, notably in the production of methyl methacrylate (MMA) and bisphenol A (BPA). The interconnected production process, where both chemicals are co-produced via the cumene process, dictates the supply dynamics and pricing structure across the global market. Given their ubiquitous application, the market trajectory is closely tied to the global economic stability and industrial output, particularly in rapidly urbanizing regions of Asia Pacific.

The core application sectors driving demand for phenol include its use in manufacturing BPA, a precursor for polycarbonate plastics and epoxy resins, which are vital components in electronic enclosures, medical devices, and protective coatings. Furthermore, the robust demand for phenolic resins in plywood, insulation materials, and laminates fuels sustained consumption. For acetone, the primary demand centers around its function as a high-pperformance solvent for various applications, including nail polish removers and paints, alongside its essential role in synthesizing high-value derivatives such as MMA, which is integral to acrylic plastics used in automotive lighting and construction panels.

Key benefits associated with these chemicals include the superior mechanical strength and heat resistance imparted by phenol-derived materials (like polycarbonates and epoxy resins) and the excellent solvency power and low toxicity profile of acetone compared to alternatives. Major driving factors encompass the burgeoning growth in the construction industry globally, increasing vehicle production requiring lightweight polycarbonate parts, and enhanced consumption of consumer electronics. Additionally, the growing focus on sustainable production methods and the exploration of bio-based phenol and acetone sources are emerging as significant long-term growth catalysts, promising to stabilize supply chains amid fluctuating fossil fuel prices.

Phenol & Acetone Market Executive Summary

The global Phenol & Acetone market demonstrates robust business trends characterized by significant capacity expansions, predominantly located in the Asia Pacific region, aiming to meet escalating regional demand from downstream industries such as construction, automotive, and electronics manufacturing. Pricing volatility remains a crucial determinant of profitability, influenced heavily by crude oil and natural gas prices, which directly impact feedstock costs (benzene and propylene). Strategic alliances and backward integration by major producers to secure feedstock supply chains are common strategies observed among key market players. Furthermore, the push towards sustainability is initiating R&D efforts focused on developing bio-based alternatives and improving the efficiency of the traditional cumene process, aligning market evolution with global environmental mandates.

Regionally, Asia Pacific maintains its dominance, driven by massive infrastructure investments and rapid industrialization in China, India, and Southeast Asian nations, positioning it as both the largest consumer and the hub for capacity addition. North America and Europe, while representing mature markets, exhibit stable demand, heavily weighted towards high-value applications such as specialty chemicals, performance materials (epoxy resins, polycarbonates), and medical devices. Regulatory pressures regarding environmental emissions and safety standards, particularly concerning BPA leaching, are more stringent in Western regions, prompting innovation in substitutes and safer manufacturing processes, which contrasts with the focus on volume growth prevalent in emerging economies.

Segmentation trends indicate that the Bisphenol A (BPA) segment holds the largest share in the Phenol application market, owing to its critical use in producing polycarbonate and epoxy resins, while the Methyl Methacrylate (MMA) segment drives the highest growth within the acetone application market, propelled by demand for high-performance acrylics. The shift towards increasing complexity in construction and automotive design necessitates materials with superior properties, bolstering the consumption of phenol derivatives. Conversely, while traditional solvent applications for acetone remain stable, the higher-margin derivatives are capturing a greater share of capacity utilization. The integration of advanced process control and digitalization in manufacturing is further optimizing yields and reducing operational expenditure across all segments.

AI Impact Analysis on Phenol & Acetone Market

User queries regarding AI's influence in the Phenol & Acetone sector primarily revolve around optimizing complex chemical processes, predicting feedstock price fluctuations, enhancing plant safety, and developing novel materials efficiently. Users are keenly interested in how Artificial Intelligence can stabilize production costs, considering the high sensitivity of profitability to benzene and propylene prices. Concerns often center on the capital investment required for AI integration and the necessity for specialized data science expertise within traditional chemical engineering environments. Expectations are high regarding AI’s potential to facilitate predictive maintenance (minimizing costly downtime), refine catalysis, and accelerate the discovery phase for sustainable, non-fossil-fuel-derived alternatives, thus addressing both economic efficiency and environmental compliance simultaneously.

The adoption of AI and Machine Learning (ML) is moving beyond simple data analysis into sophisticated process control and supply chain optimization. AI algorithms are now deployed to analyze real-time sensor data within cumene and cracking units, adjusting variables like temperature, pressure, and catalyst ratios dynamically to maximize yield and purity of both co-products—phenol and acetone. This predictive capability significantly reduces energy consumption and minimizes off-spec production batches. Furthermore, in procurement, ML models can analyze geopolitical trends, logistics data, and historical pricing correlations to forecast volatility in benzene and propylene markets months in advance, allowing producers to implement strategic hedging and inventory management.

Digital twins, powered by AI, are emerging as crucial tools for simulating the entire production lifecycle, from feedstock handling to final product delivery. These simulations enable quick scenario testing, crucial for troubleshooting potential bottlenecks or designing modifications without disrupting ongoing operations. While initial integration costs are substantial, the long-term benefits derived from increased operational uptime, optimized energy usage, and superior product consistency justify the investment, positioning AI as a critical competitive differentiator in high-volume commodity chemical manufacturing. This technological shift is also enabling smaller, more agile production lines capable of switching products based on dynamic market demands.

- Enhanced predictive maintenance resulting in near-zero unplanned plant shutdowns.

- Optimization of cumene process parameters (temperature, catalyst) using real-time ML models for maximum yield.

- Improved feedstock price forecasting and strategic inventory management via predictive analytics.

- Acceleration of R&D for bio-based phenol/acetone synthesis through materials informatics.

- Augmented reality (AR) and AI systems for enhanced operator training and safety protocols.

- Supply chain optimization and route planning to minimize logistics costs and environmental footprint.

DRO & Impact Forces Of Phenol & Acetone Market

The dynamics of the Phenol & Acetone market are shaped by a powerful confluence of drivers and restraints, creating significant impact forces across the value chain. Key drivers include the exponential growth in global demand for polycarbonate (PC) and epoxy resins, fundamental building blocks for modern infrastructure, electronics, and durable consumer goods. Rapid urbanization and corresponding construction booms in Asia Pacific necessitate vast quantities of insulation, adhesives, and coatings derived from phenol. However, this growth trajectory is counterbalanced by significant restraints, primarily the inherent volatility and high cost of raw materials (benzene and propylene), which directly compress operating margins for manufacturers. Furthermore, increasing regulatory scrutiny, particularly concerning the potential health hazards associated with Bisphenol A (BPA), presents a challenge, pushing industries toward investment in costly alternatives or new processing technologies.

Opportunities in the sector lie predominantly in technological innovation and market diversification. The rising awareness and governmental focus on sustainability globally are creating a viable path for the commercialization of bio-based phenol and acetone, potentially decoupling production economics from fossil fuel price swings and securing long-term supply stability. Additionally, the development of niche and high-purity grades of these chemicals for specialized applications in pharmaceuticals, aerospace, and advanced materials offers higher profitability margins than standard commodity production. Geographically, emerging markets outside of China, such as India, Vietnam, and Indonesia, represent untapped potential for market penetration as their industrial bases mature and local consumption grows significantly.

The primary impact forces include the increasing global integration of supply chains, making local market conditions highly susceptible to international trade policies and geopolitical events, especially regarding crude oil supply. Technological advancements, such as catalytic distillation and improved co-production technologies, act as transformative forces by enhancing efficiency and reducing the environmental footprint of existing plants. The collective push toward a circular economy model mandates investment in chemical recycling technologies for polycarbonate and epoxy materials, impacting the long-term consumption patterns of virgin phenol and acetone. These forces necessitate a proactive strategic response from market players, focusing on vertical integration, geographical diversification, and continuous process optimization to maintain competitiveness.

Segmentation Analysis

The Phenol & Acetone Market is meticulously segmented based on end-use applications, derivatives, and regional consumption patterns, providing a granular view of demand drivers and growth pockets. The segmentation highlights the critical interconnectedness between the two co-products, yet distinct growth trajectories based on their primary applications. Phenol's market dominance stems from its indispensable role in high-performance polymers, while Acetone's market growth is highly leveraged toward high-value chemical synthesis, surpassing its traditional use as a general solvent. Understanding these segments is crucial for strategic capacity planning and resource allocation by major chemical producers globally.

Key segments driving market dynamics include the Bisphenol A segment, which is highly correlated with the performance of the automotive and construction industries due to its application in epoxy resins and polycarbonates. The Phenolic Resins segment is crucial for the wood products and construction sectors, particularly in infrastructure projects requiring fire-resistant and durable binding agents. For the acetone market, the derivative Methyl Methacrylate (MMA) is experiencing accelerated demand, fueled by the booming requirements for transparent, shatterproof plastic in screens, automotive components, and medical devices. The high-purity needs of these end-user industries underscore the necessity for advanced manufacturing and strict quality control across the production lifecycle.

- By Application (Phenol):

- Bisphenol A (BPA)

- Phenolic Resins

- Caprolactam

- Alkylphenols

- Others (e.g., Pharmaceuticals, Fertilizers)

- By Application (Acetone):

- Methyl Methacrylate (MMA)

- Solvents (Industrial and Consumer)

- Bisphenol A (BPA)

- Methanol-based Solvents

- Others (e.g., Isophorone, Fine Chemicals)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Phenol & Acetone Market

The value chain for Phenol & Acetone is highly integrated and begins with the upstream procurement of essential feedstocks: benzene and propylene, both of which are derived from crude oil refining and natural gas cracking. The profitability of the entire chain is acutely sensitive to the pricing volatility of these precursors, making long-term supply contracts and efficient logistics paramount for manufacturers. Midstream activities involve the highly specialized cumene process, where these raw materials are reacted to co-produce phenol and acetone. Technological efficiency in this conversion stage, including catalyst performance and energy minimization, determines the cost competitiveness of the final products.

The downstream sector is characterized by extensive processing and diversification, where phenol and acetone are converted into various high-value derivatives such as polycarbonate plastics, epoxy resins, and MMA. This stage requires significant technological capability and serves a diverse array of end-user industries including automotive, construction, and electronics. The distribution channel structure relies heavily on efficient bulk shipping and specialized storage tanks due to the chemical properties of the products. Direct distribution is common for large, vertically integrated producers supplying major derivative manufacturers (e.g., BPA producers), ensuring quality control and stable supply. Indirect distribution, involving local chemical distributors and traders, caters primarily to smaller consumers and geographical regions with dispersed demand, particularly for solvent applications.

The value generated moves progressively downstream, with commodity phenol and acetone providing fundamental value, while the high-performance polymers and specialty chemicals derived from them capture the premium margins. Effective value chain management focuses on mitigating feedstock risk upstream, optimizing conversion processes midstream, and securing long-term relationships with large downstream consumers. The overall structure is capital-intensive, favoring large-scale operations with integrated refinery access and strong logistical networks to handle the global transportation of both inputs and outputs, thus creating high barriers to entry for new market participants.

Phenol & Acetone Market Potential Customers

The primary customers for phenol and acetone are major industrial processors and chemical manufacturers involved in the production of derivative chemicals and polymers. These large-scale buyers often operate continuous process plants and require stable, high-volume supply contracts, establishing long-term relationships with core phenol and acetone producers. Key end-user sectors include manufacturers of automotive parts requiring lightweight polycarbonates, construction material providers utilizing phenolic resins for insulation and laminates, and electronics companies relying on epoxy resins for circuit boards and components. These consumers are highly sensitive to product quality specifications and supply chain reliability, often mandating global certification standards.

A significant segment of potential customers comprises the automotive industry and its supply chain partners. As global regulations push for lighter vehicles to improve fuel efficiency and enable electric mobility, the demand for high-strength, low-weight plastics, particularly polycarbonate derived from BPA, surges. These customers prioritize materials offering excellent impact resistance, clarity, and thermal stability. Similarly, the growing healthcare and medical device sectors are major consumers, demanding high-purity acetone for sterilization and cleaning, and specialty phenol derivatives for producing robust medical-grade plastics.

Furthermore, the packaging industry represents a crucial potential customer base, utilizing polycarbonates for durable food and beverage containers, although this segment faces challenges due to regulatory scrutiny regarding BPA. Lastly, the textile and fiber industries, specifically those producing nylon (caprolactam derivative of phenol), remain steady buyers. The consumption patterns of these end-users are intrinsically linked to global macroeconomic performance, discretionary consumer spending, and specific regional infrastructure investment cycles, demanding customized technical support and tailored logistics solutions from chemical suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 37.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SABIC, INEOS Phenol, Kumho P&B Chemicals, Mitsui Chemicals, Shell Chemical, Chang Chun Group, Taiwan Prosperity Chemical, CEPSA Quimica, Aditya Birla Chemicals, PTT Global Chemical, Altivia, Dairen Chemical Corporation, Domo Chemicals, Formosa Chemicals & Fibre Corporation, Versalis S.p.A., Braskem, ExxonMobil Chemical, Hindustan Organic Chemicals Ltd. (HOCL), China National Petroleum Corporation (CNPC), Sumitomo Chemical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Phenol & Acetone Market Key Technology Landscape

The primary and most widely adopted technology for Phenol and Acetone production globally is the well-established cumene process, which accounts for over 90% of global capacity. This three-stage process involves the alkylation of benzene with propylene to form cumene, followed by the oxidation of cumene to cumene hydroperoxide (CHP), and finally the cleavage of CHP into phenol and acetone. Continuous technological advancements focus heavily on optimizing the catalytic systems and reaction conditions within the cumene cleavage stage to enhance selectivity, improve energy efficiency, and minimize hazardous waste byproducts. Key manufacturers invest significantly in proprietary catalyst formulations that allow for operation at lower temperatures and pressures, thereby reducing operational costs and maximizing co-product yield synchronization.

Beyond process optimization of the conventional route, the market is actively exploring and validating alternative technologies aimed at diversification and sustainability. One notable area is the development of single-step oxidation processes, attempting to convert benzene directly to phenol using nitrous oxide or molecular oxygen, circumventing the need for propylene and simplifying the co-product dependence. While these alternative routes currently face challenges regarding yield rates and industrial scalability, they represent the future direction for reducing energy intensity and eliminating byproduct formation. Additionally, the increasing focus on bio-based feedstocks is driving research into fermentation or catalytic conversion of renewable materials (e.g., biomass, lignin) into phenol and acetone, potentially revolutionizing the industry’s reliance on petrochemical inputs.

Digitalization technologies, including Advanced Process Control (APC) systems and Industrial Internet of Things (IIoT) sensors, are becoming standard across modern phenol and acetone plants. These technologies enable precise, real-time monitoring and automated adjustment of complex reaction parameters, ensuring optimal throughput and quality consistency. The integration of data analytics and predictive modeling helps preempt equipment failure and optimize utility consumption, fundamentally changing the operational expenditure profile of producers. The combined strategic implementation of catalytic innovation and digital process management is defining the competitive landscape, focusing on maximizing utilization rates while adhering to increasingly stringent environmental regulations.

Regional Highlights

- Asia Pacific (APAC): APAC is the global leader in both consumption and production capacity, driven primarily by massive infrastructural development and the expanding manufacturing base in China, India, and Southeast Asia. The region exhibits high demand for polycarbonates in consumer electronics and construction materials, necessitating continuous capacity additions. Competitive pricing and proximity to rapidly growing end-user markets define this region's dominance.

- North America: Characterized by stable, mature demand and a strong focus on high-performance materials. Demand is robust in the automotive, aerospace, and specialty chemical sectors. The region benefits from comparatively low natural gas prices, aiding feedstock supply (propylene), but faces stringent regulatory frameworks regarding environmental and health standards, particularly related to BPA usage.

- Europe: This market segment focuses heavily on innovation, quality, and sustainability. European demand is stable, primarily serving the automotive, construction, and advanced coatings industries, with an increasing emphasis on circular economy principles and the mandated use of bio-based or recycled content in manufactured goods. Regulatory pressure for BPA substitutes is most acute here.

- Latin America (LATAM): This region is an emerging market with moderate growth, highly reliant on imports of refined phenol and acetone. Market dynamics are dictated largely by domestic economic stability and major infrastructure projects, particularly in Brazil and Mexico. The local manufacturing base is smaller compared to APAC or North America, leading to fluctuating demand based on immediate economic health.

- Middle East & Africa (MEA): Growth in MEA is closely linked to its abundant oil and gas reserves, providing cost advantages for feedstock production (benzene and propylene). Saudi Arabia and the UAE are strategic hubs focusing on developing integrated petrochemical complexes aimed at regional self-sufficiency and export, positioning MEA as a significant global supplier in the medium to long term.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Phenol & Acetone Market.- SABIC

- INEOS Phenol

- Kumho P&B Chemicals

- Mitsui Chemicals

- Shell Chemical

- Chang Chun Group

- Taiwan Prosperity Chemical

- CEPSA Quimica

- Aditya Birla Chemicals

- PTT Global Chemical

- Altivia

- Dairen Chemical Corporation

- Domo Chemicals

- Formosa Chemicals & Fibre Corporation

- Versalis S.p.A.

- Braskem

- ExxonMobil Chemical

- Hindustan Organic Chemicals Ltd. (HOCL)

- China National Petroleum Corporation (CNPC)

- Sumitomo Chemical

Frequently Asked Questions

Analyze common user questions about the Phenol & Acetone market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand growth in the Phenol & Acetone Market?

The primary factor is the robust and escalating global demand for Bisphenol A (BPA) and related polycarbonates and epoxy resins. These derivatives are essential for the rapid expansion of the construction, automotive (especially electric vehicles), and consumer electronics industries worldwide, particularly across the Asia Pacific region where urbanization is accelerating.

How does feedstock price volatility impact the profitability of phenol and acetone manufacturers?

Phenol and acetone are co-produced from benzene and propylene, which are petrochemical derivatives highly susceptible to crude oil and natural gas price fluctuations. Volatility in these feedstock costs significantly impacts operating margins, necessitating advanced hedging strategies, vertical integration, and optimized inventory management among producers to stabilize profitability.

What regulatory challenges currently affect the phenol market, specifically concerning Bisphenol A (BPA)?

The main regulatory challenge centers on the potential health concerns associated with BPA leaching from plastics, particularly in food contact applications. This has led to strict regulations in regions like North America and Europe, driving manufacturers to invest heavily in BPA-free alternatives and advanced manufacturing techniques to maintain compliance and consumer trust.

Which application segment holds the highest growth potential for Acetone during the forecast period?

The Methyl Methacrylate (MMA) derivative segment is projected to exhibit the highest growth potential for acetone. MMA is crucial for producing high-performance acrylic plastics used extensively in automotive lighting, construction glazing, and medical devices, segments experiencing high demand driven by technological advancements and infrastructure spending.

What role does bio-based production technology play in the future of the Phenol & Acetone industry?

Bio-based production technology, involving the conversion of renewable feedstocks like biomass or lignin, is critical for future sustainability and supply stability. It offers the opportunity to decouple production economics from fossil fuels, reduce the industry's carbon footprint, and address consumer preference for environmentally friendly chemicals, although commercial viability is still under development.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager