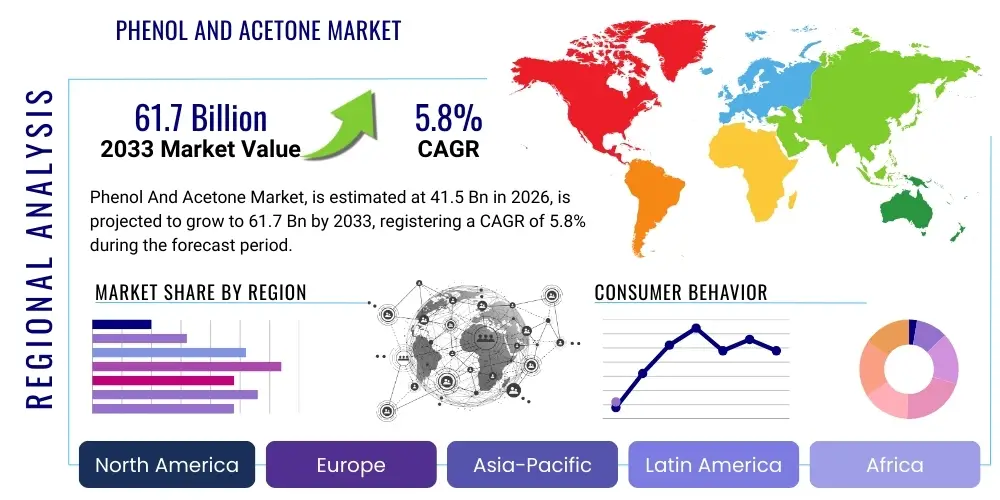

Phenol And Acetone Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439970 | Date : Jan, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Phenol And Acetone Market Size

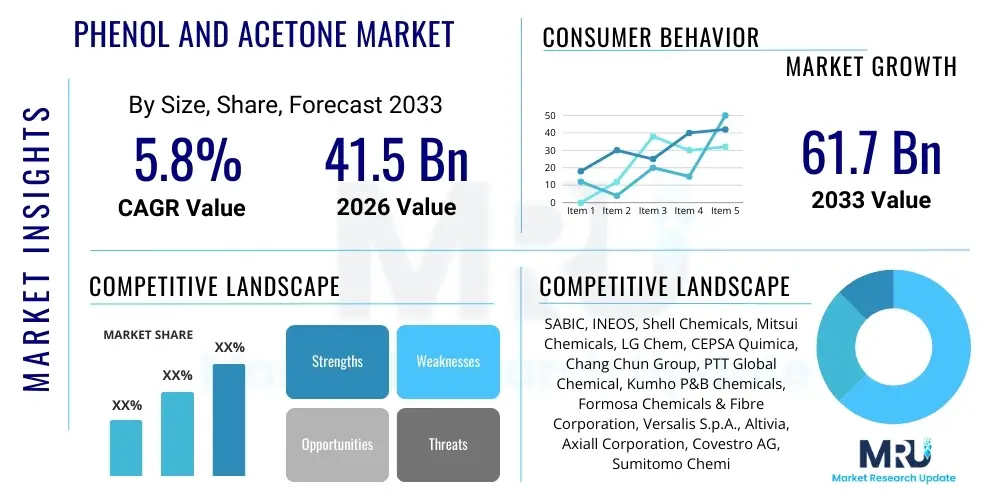

The Phenol And Acetone Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 41.5 Billion in 2026 and is projected to reach USD 61.7 Billion by the end of the forecast period in 2033. This growth trajectory is underpinned by the increasing demand from a diverse range of end-use industries, particularly in construction, automotive, electronics, and pharmaceuticals, where the derivatives of phenol and acetone are integral components. The expanding global population and rising urbanization trends continue to fuel the need for various consumer goods and infrastructure, thereby bolstering market expansion for these crucial petrochemicals.

Phenol And Acetone Market introduction

The Phenol And Acetone Market encompasses the global production, consumption, and trade of two fundamental organic chemical compounds: phenol (C6H5OH) and acetone (CH3COCH3). Phenol, also known as carbolic acid, is an aromatic organic compound primarily derived from crude oil via cumene oxidation. It is a highly versatile chemical intermediate, characterized by its acidic nature and reactivity, making it indispensable in the synthesis of a vast array of downstream products. Acetone, the simplest ketone, is a colorless, volatile, and flammable liquid that is also largely produced as a co-product of phenol synthesis through the cumene process, though other methods exist.

The major applications of phenol span across the production of bisphenol A (BPA), which is a key monomer for polycarbonates and epoxy resins; phenolic resins used in plywood, insulation, and molding compounds; and caprolactam, a precursor to nylon 6. Acetone is predominantly utilized in the manufacturing of methyl methacrylate (MMA), a building block for acrylic plastics; as a solvent in paints, coatings, and adhesives; and in the production of bisphenol A. The synergistic production of phenol and acetone through the cumene process means their market dynamics are often intertwined, influencing supply-demand balances and pricing structures for both.

Key benefits derived from these chemicals include their foundational role in creating durable plastics, protective coatings, advanced materials, and essential pharmaceutical intermediates. Driving factors for this market include the robust growth in the automotive sector, demanding lightweight and high-performance materials; the burgeoning construction industry, requiring strong adhesives and insulation; the expanding electronics sector, necessitating advanced resins; and the escalating demand for specialty chemicals in healthcare and consumer goods, all of which rely heavily on phenol and acetone derivatives for their production processes and end-product formulations.

Phenol And Acetone Market Executive Summary

The Phenol And Acetone Market is experiencing significant shifts driven by evolving industrial landscapes, technological advancements, and geopolitical influences. Business trends indicate a strong emphasis on capacity expansion, particularly in Asia Pacific, to meet burgeoning regional demand, alongside strategic mergers and acquisitions aimed at consolidating market share and achieving economies of scale. Sustainable production practices, including efforts to reduce environmental footprint and explore bio-based alternatives, are also gaining traction as regulatory pressures intensify and corporate responsibility becomes a key differentiator. Furthermore, the market is seeing a push towards derivative innovation, with manufacturers investing in R&D to develop specialized applications that can command higher margins and cater to niche industry needs.

Regional trends highlight Asia Pacific as the undeniable epicenter of growth, driven by rapid industrialization, urbanization, and a robust manufacturing base in countries like China, India, and Southeast Asian nations. This region is not only a major consumer but also a significant producer, leading to shifts in global trade flows and competitive dynamics. North America and Europe, while mature markets, continue to demonstrate stable demand, particularly for high-performance and specialty derivatives, with a growing focus on sustainability and circular economy principles. Latin America, the Middle East, and Africa are emerging markets with considerable untapped potential, fueled by infrastructure development and increasing domestic industrial activity, attracting investments for new production facilities and expanded distribution networks.

Segment trends reveal that Bisphenol A (BPA) remains the largest application segment for both phenol and acetone, underpinning the strong demand for polycarbonates in automotive, electronics, and medical devices, and epoxy resins in coatings and construction. The phenolic resins segment is also robust, driven by construction and industrial applications. For acetone, the Methyl Methacrylate (MMA) and solvent applications continue to exhibit steady growth due to their extensive use in paints, coatings, adhesives, and various industrial processes. The pharmaceutical sector's growing need for high-purity solvents and intermediates further solidifies the market position of these core chemicals, emphasizing the critical role of innovation in maintaining market relevance and profitability across diverse end-use industries.

AI Impact Analysis on Phenol And Acetone Market

User questions related to AI's impact on the Phenol And Acetone Market frequently revolve around optimizing production efficiency, enhancing supply chain resilience, improving product quality, and enabling predictive maintenance. Stakeholders are keen to understand how AI can revolutionize traditional chemical manufacturing processes, minimize operational costs, and reduce waste. There's also significant interest in AI's role in accelerating R&D for new derivatives and sustainable production methods, as well as its potential for market forecasting and demand planning. Concerns often include the initial investment costs, the need for specialized data infrastructure, cybersecurity risks associated with integrated systems, and the retraining of the workforce to adapt to AI-driven operations, highlighting a balance between optimism for technological advancement and practical implementation challenges.

- Process Optimization: AI algorithms can analyze vast datasets from plant sensors to optimize reaction conditions, energy consumption, and raw material utilization in phenol and acetone production, leading to higher yields and reduced operational costs.

- Predictive Maintenance: Machine learning models can predict equipment failures before they occur, scheduling maintenance proactively, thereby minimizing costly downtime and improving overall plant reliability and safety.

- Supply Chain Management: AI enhances logistics by optimizing transportation routes, inventory management, and warehousing, ensuring timely delivery of raw materials and finished products, and mitigating supply chain disruptions.

- Quality Control: AI-powered vision systems and analytical tools can monitor product quality in real-time, detecting impurities or deviations more rapidly and accurately than manual methods, ensuring consistent product specifications.

- R&D Acceleration: AI and machine learning expedite the discovery and development of new phenol and acetone derivatives by simulating molecular interactions and predicting material properties, shortening innovation cycles.

- Market Forecasting: Advanced AI models can analyze market trends, geopolitical factors, and economic indicators to provide more accurate demand forecasts for phenol and acetone, aiding strategic planning and inventory management.

- Sustainability Efforts: AI can identify opportunities to reduce waste, optimize energy use, and explore greener production pathways, contributing to more sustainable manufacturing processes and helping meet environmental regulations.

DRO & Impact Forces Of Phenol And Acetone Market

The Phenol And Acetone Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the impact forces that dictate its trajectory. Among the primary drivers is the escalating global demand from key end-use industries, including automotive, construction, and electronics, which heavily rely on derivatives like polycarbonates, epoxy resins, and phenolic resins for their manufacturing processes. The robust growth in emerging economies, coupled with rapid urbanization and industrialization, significantly amplifies this demand. Furthermore, the versatility of phenol and acetone as chemical intermediates allows for continuous innovation in new applications, sustaining their market relevance and expanding their utility across diverse sectors. These factors collectively create a strong momentum for market expansion, pushing for increased production capacities and technological advancements.

Conversely, the market faces several significant restraints. Volatility in crude oil prices, the primary feedstock for cumene production, directly impacts the cost of manufacturing phenol and acetone, leading to price fluctuations and potential margin erosion for producers. Stringent environmental regulations concerning emissions, waste disposal, and the use of certain chemicals (e.g., BPA restrictions in some applications) pose compliance challenges and necessitate substantial investments in cleaner technologies. Overcapacity in specific regions can also lead to downward pressure on prices and intensify competition. Additionally, the increasing focus on bio-based alternatives and sustainability initiatives, while an opportunity in itself, can also act as a restraint for conventional petrochemical-derived products if not adequately addressed through innovation.

Despite these challenges, numerous opportunities exist to propel market growth. The ongoing research and development into sustainable production methods, including bio-phenol and bio-acetone, offer a pathway for long-term growth and reduced environmental impact, aligning with global sustainability goals. The diversification of applications into niche segments, such as specialized resins for aerospace or high-performance composites, provides avenues for market expansion and value creation. Furthermore, strategic investments in capacity expansion in underserved or rapidly growing regions, coupled with technological advancements in process efficiency and catalysis, can unlock new market potential. The continuous development of advanced materials requiring phenol and acetone derivatives ensures a steady stream of demand, fostering an environment ripe for innovation and strategic growth for established players and new entrants alike.

Segmentation Analysis

The Phenol And Acetone Market is meticulously segmented to provide a granular understanding of its diverse landscape, reflecting variations in applications, end-use industries, and geographical distribution. This comprehensive segmentation allows for a precise analysis of demand drivers, competitive dynamics, and growth opportunities within specific market niches. Understanding these segments is crucial for strategic decision-making, enabling businesses to tailor their product offerings, marketing strategies, and investment plans to capture maximum value. The interdependence of these segments often means that growth in one area can significantly impact others, creating a complex yet dynamic market environment that requires careful monitoring and agile responses from market participants to capitalize on emerging trends.

- By Application (Phenol): This segment categorizes phenol consumption based on its immediate downstream products.

- Bisphenol A (BPA): The largest application, critical for polycarbonates (CDs, DVDs, automotive parts, electronic components) and epoxy resins (coatings, adhesives, composites).

- Phenolic Resins: Used in plywood, particleboard, insulation, abrasives, and molding compounds due to their excellent heat resistance and strength.

- Caprolactam: A key monomer for nylon 6 production, extensively used in textiles, carpets, and engineering plastics.

- Alkylphenols: Employed in the production of non-ionic surfactants, lubricants, and resins, offering varied functional properties.

- Others: Includes applications in salicylic acid, aniline, chlorophenols, and various specialty chemicals and pharmaceutical intermediates.

- By Application (Acetone): This segment focuses on the primary uses of acetone in various industrial processes.

- Methyl Methacrylate (MMA): A major application, serving as a building block for acrylic plastics (Plexiglas), paints, and adhesives.

- Bisphenol A (BPA): Co-produced with phenol from cumene, and also a direct application for acetone in its synthesis, highlighting the integrated nature of the market.

- Solvents: Widely used as a solvent in paints, coatings, lacquers, varnishes, resins, and cleaning agents due to its excellent dissolving power and volatility.

- Isopropanol (IPA): Produced from acetone, IPA is extensively used as a solvent, disinfectant, and cleaning agent in pharmaceuticals, cosmetics, and electronics.

- Others: Encompasses applications in producing methyl isobutyl ketone (MIBK), aldol chemicals, and in the pharmaceutical and cosmetics industries as an extraction solvent or raw material.

- By End-Use Industry (Phenol): This segment analyzes the demand for phenol derivatives across major industrial sectors.

- Automotive: Polycarbonates for lightweight components, epoxy resins for structural adhesives, and phenolic resins for brake linings and engine parts.

- Construction: Phenolic resins for plywood, particleboard, insulation, and epoxy resins for flooring, protective coatings, and structural adhesives.

- Electronics: Polycarbonates for electronic housings and optical media, epoxy resins for circuit boards and encapsulants.

- Consumer Goods: Polycarbonates for appliances, medical devices, and packaging, alongside various specialty plastics.

- Others: Includes applications in textile, marine, aerospace, and general industrial sectors, leveraging the diverse properties of phenol derivatives.

- By End-Use Industry (Acetone): This segment examines the consumption of acetone and its derivatives in various industrial applications.

- Paints & Coatings: As a solvent to dissolve resins and binders, facilitating application and quick drying.

- Adhesives & Sealants: Utilized as a solvent for various adhesive formulations, ensuring proper consistency and drying characteristics.

- Pharmaceuticals: As an extraction solvent, reaction medium, and cleaning agent in drug manufacturing and laboratories.

- Cosmetics & Personal Care: Used in nail polish removers, hair sprays, and other beauty products due to its solvent properties.

- Agriculture: Employed in pesticide formulations and as a solvent in agrochemical production.

- Others: Includes applications in printing inks, rubber processing, and laboratory chemicals.

- By Region: This geographical segmentation offers insights into regional market dynamics, trade flows, and consumption patterns.

- North America: Mature market with stable demand, focus on specialty applications and sustainability.

- Europe: Similar to North America, emphasis on stringent regulations, bio-based solutions, and high-value derivatives.

- Asia Pacific (APAC): Fastest-growing region, driven by industrialization, urbanization, and large manufacturing bases in China, India, and Southeast Asia.

- Latin America: Emerging market with increasing demand from construction, automotive, and consumer goods sectors.

- Middle East & Africa (MEA): Developing market with growing industrial activity, supported by investments in petrochemical infrastructure.

Value Chain Analysis For Phenol And Acetone Market

The value chain for the Phenol And Acetone Market is a intricate network, beginning with the sourcing of raw materials and culminating in the delivery of a myriad of end-use products. At the upstream stage, the primary raw materials are benzene and propylene, both of which are derived from crude oil refining and petrochemical cracking. The availability and pricing volatility of these feedstocks significantly influence the production costs and overall profitability for phenol and acetone manufacturers. Key players in this segment include major oil & gas companies and large petrochemical producers who engage in the initial extraction and processing of these fundamental hydrocarbons. Efficient procurement strategies and long-term supply contracts are crucial for ensuring stable operations and mitigating commodity price risks for the integrated chemical producers further down the chain.

Moving downstream, the core of the value chain involves the production of phenol and acetone, predominantly through the cumene process, which yields both chemicals simultaneously. This integrated production often means that manufacturers are large-scale chemical conglomerates. Following their production, phenol and acetone serve as vital intermediates for a vast array of derivative products. These include bisphenol A (BPA) for polycarbonates and epoxy resins, phenolic resins for wood composites and insulation, caprolactam for nylon 6, and methyl methacrylate (MMA) for acrylics, among others. Each of these derivatives forms its own mini-value chain, involving further processing, compounding, and formulation by specialized chemical companies before reaching the final end-use industries. The efficiency and scale of these downstream conversion processes are critical to realizing the full economic potential of phenol and acetone.

The distribution channels for phenol and acetone, along with their derivatives, are multifaceted, encompassing both direct and indirect sales. Direct sales are common for large-volume industrial customers, where producers establish long-term relationships and deliver directly to manufacturing facilities. This ensures consistent supply and often involves technical support. Indirect channels involve a network of distributors, agents, and traders who facilitate market access for smaller volume buyers, provide regional warehousing, and handle logistical complexities. These intermediaries play a vital role in reaching diverse end-use industries across various geographies, particularly for specialty grades or in fragmented markets. The selection of appropriate distribution channels is crucial for market penetration, cost efficiency, and maintaining strong customer relationships, ultimately impacting the market reach and profitability of phenol and acetone producers and their derivative manufacturers.

Phenol And Acetone Market Potential Customers

The Phenol And Acetone Market serves a vast and diverse customer base, essentially comprising any industry that requires high-performance plastics, resins, solvents, or chemical intermediates for its products and processes. At the forefront are manufacturers in the automotive sector, who rely on polycarbonates (derived from BPA) for lightweight components, interior parts, and headlamps, alongside phenolic resins for brake linings and engine insulators. The construction industry is another colossal end-user, utilizing phenolic resins extensively in plywood, particleboard, and insulation materials for structural integrity and thermal efficiency, while epoxy resins (also from BPA) find applications in durable coatings, adhesives, and flooring solutions, driven by urbanization and infrastructure development projects globally.

Beyond these, the electronics industry represents a significant segment of potential customers, consuming polycarbonates for appliance housings, optical discs, and display components, and epoxy resins for printed circuit boards and electronic encapsulants, demanding materials with excellent dielectric properties and heat resistance. The pharmaceutical and healthcare sectors are also crucial buyers, utilizing acetone as a high-purity solvent for drug extraction, purification, and as a raw material for various pharmaceutical intermediates, while phenol derivatives find use in disinfectants and antiseptics. This broad applicability underscores the foundational role of phenol and acetone across modern industrial economies, continuously generating demand from a wide spectrum of manufacturing and processing entities.

Furthermore, the consumer goods industry consistently drives demand for both phenol and acetone derivatives in everyday products. Polycarbonates are used in everything from household appliances and eyewear to medical devices, valued for their durability and aesthetic appeal. Acetone, particularly as a solvent, is indispensable for the paints and coatings industry, as well as in the production of adhesives, sealants, and ink formulations, catering to both industrial and consumer applications. The agricultural sector also features as a potential customer, albeit for more specialized applications, where these chemicals or their derivatives may be used in certain agrochemical formulations. The extensive reach across these critical sectors ensures a robust and expanding base of potential customers for phenol and acetone, making market intelligence on these varied end-users paramount for strategic planning.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 41.5 Billion |

| Market Forecast in 2033 | USD 61.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SABIC, INEOS, Shell Chemicals, Mitsui Chemicals, LG Chem, CEPSA Quimica, Chang Chun Group, PTT Global Chemical, Kumho P&B Chemicals, Formosa Chemicals & Fibre Corporation, Versalis S.p.A., Altivia, Axiall Corporation, Covestro AG, Sumitomo Chemical, Borealis AG, China National Petroleum Corporation (CNPC), Sinopec Group, Reliance Industries Limited, ExxonMobil Chemical |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Phenol And Acetone Market Key Technology Landscape

The Phenol And Acetone Market is significantly influenced by a dynamic technology landscape primarily centered around production processes and derivative innovations. The dominant technology for commercial production remains the cumene process, which involves the alkylation of benzene with propylene to produce cumene, followed by its oxidation and cleavage to yield phenol and acetone. Continuous advancements in this process focus on improving catalyst efficiency, optimizing reaction conditions, and enhancing separation techniques to maximize yields, reduce energy consumption, and minimize waste by-products. Research into novel catalysts, such as zeolite-based catalysts, aims to achieve higher selectivity and longer catalyst lifetimes, thereby driving down operational costs and improving the environmental profile of the production facilities. The integration of advanced process control systems and automation is also crucial for maintaining optimal performance and ensuring consistent product quality, especially given the scale of modern chemical plants.

Beyond the cumene process, alternative technologies are continuously explored and developed, albeit on a smaller commercial scale, to diversify feedstock options or offer more sustainable pathways. For instance, the direct oxidation of benzene to phenol, though challenging, is an area of ongoing research, aiming to eliminate the need for propylene and simplify the process. Similarly, there is increasing interest and investment in bio-based technologies to produce phenol and acetone from renewable resources such as biomass or agricultural waste. These bio-refinery concepts leverage fermentation or catalytic conversion of sugars and lignin-derived compounds to yield bio-phenol and bio-acetone, aligning with global sustainability goals and offering a hedge against fossil fuel price volatility. While these technologies are still maturing, their potential to reshape the market in the long term is substantial, prompting significant R&D efforts from chemical companies and academic institutions.

The technological landscape also extends to the development of phenol and acetone derivatives and their applications, which often dictates the demand for the base chemicals. Innovations in bisphenol A production, for example, focus on developing specialized grades for high-performance polycarbonates and epoxy resins, requiring improved purity and specific molecular structures. For phenolic resins, advancements include the creation of formaldehyde-free resins to address health concerns and enhanced fire-resistant or high-strength formulations for advanced construction and automotive applications. In the solvent market, new acetone-based co-solvents or formulations are being developed to meet increasingly stringent VOC (Volatile Organic Compound) regulations. Overall, the technology landscape is characterized by a dual focus: optimizing existing, highly efficient petrochemical routes while simultaneously exploring and scaling up greener, bio-based alternatives and continuously innovating in downstream derivative applications to cater to evolving industrial demands and environmental standards.

Regional Highlights

- Asia Pacific (APAC): This region dominates the global Phenol And Acetone market, accounting for the largest share in terms of both production and consumption. Driven by rapid industrialization, urbanization, and the flourishing manufacturing sectors in countries like China, India, Japan, and South Korea, the demand for derivatives in automotive, construction, and electronics is immense. Significant capacity expansions and new plant constructions are concentrated here, making APAC the primary growth engine and a key determinant of global market dynamics. The region also benefits from a competitive cost structure and a large consumer base, fueling domestic and export-oriented growth.

- North America: As a mature market, North America exhibits steady demand, particularly for high-value and specialty phenol and acetone derivatives. The United States is a significant consumer, with robust demand from the automotive, construction, and electronics industries. The region focuses on technological advancements in production efficiency and the development of sustainable, bio-based alternatives. Environmental regulations and the drive for circular economy principles are increasingly influencing market strategies, with investments in research and development to maintain competitive advantage and meet evolving industrial standards.

- Europe: The European market for phenol and acetone is characterized by stringent environmental regulations and a strong emphasis on sustainability, circular economy models, and bio-based chemical production. While a mature market, demand remains stable, particularly from the automotive, construction, and wind energy sectors, which require advanced materials and composites. Innovation in specialized derivatives, high-performance polymers, and solvent applications with reduced VOC emissions are key regional trends. Germany, France, and Benelux countries are major contributors to both consumption and specialized production.

- Latin America: This region is an emerging market with significant growth potential, driven by ongoing industrialization and infrastructure development, particularly in countries like Brazil, Mexico, and Argentina. The rising middle class and increasing consumption of consumer goods are boosting demand for plastics and coatings, which rely on phenol and acetone derivatives. Investments in local manufacturing capacities and improved supply chain logistics are crucial for market expansion, as the region seeks to reduce its reliance on imports and develop its petrochemical industry.

- Middle East and Africa (MEA): The MEA region is experiencing gradual growth, with the Middle East being a key petrochemical hub due to abundant and cost-effective feedstock resources. Countries like Saudi Arabia and UAE are expanding their production capacities not only for primary petrochemicals but also for downstream derivatives. Africa, while having a smaller market share, presents long-term growth opportunities as its economies develop, and industrial and construction activities increase. The region's strategic location also supports export-oriented production, serving markets in Asia and Europe.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Phenol And Acetone Market.- SABIC

- INEOS

- Shell Chemicals

- Mitsui Chemicals

- LG Chem

- CEPSA Quimica

- Chang Chun Group

- PTT Global Chemical

- Kumho P&B Chemicals

- Formosa Chemicals & Fibre Corporation

- Versalis S.p.A.

- Altivia

- Axiall Corporation

- Covestro AG

- Sumitomo Chemical

- Borealis AG

- China National Petroleum Corporation (CNPC)

- Sinopec Group

- Reliance Industries Limited

- ExxonMobil Chemical

Frequently Asked Questions

Analyze common user questions about the Phenol And Acetone market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of phenol and acetone in the current market?

Phenol is primarily used to produce Bisphenol A (BPA) for polycarbonates and epoxy resins, phenolic resins for adhesives and molding compounds, and caprolactam for nylon 6. Acetone's main applications include the manufacturing of Methyl Methacrylate (MMA) for acrylic plastics, as a versatile solvent in paints, coatings, and adhesives, and also in the production of Bisphenol A and Isopropanol. These chemicals are foundational to diverse industries such as automotive, construction, electronics, and pharmaceuticals, driving consistent demand.

How do fluctuating crude oil prices impact the phenol and acetone market?

Fluctuating crude oil prices significantly impact the phenol and acetone market as benzene and propylene, the primary raw materials for the cumene process, are derived from crude oil. Higher crude oil prices translate to increased feedstock costs, subsequently driving up the production costs for phenol and acetone. This can lead to price volatility for the finished products, affecting manufacturers' profit margins and potentially influencing the overall supply-demand balance in the market. Producers often seek to mitigate this through hedging strategies or by securing long-term supply contracts.

Which region is witnessing the most significant growth in the phenol and acetone market?

The Asia Pacific (APAC) region is currently experiencing the most significant growth in the phenol and acetone market. This robust expansion is fueled by rapid industrialization, burgeoning manufacturing sectors, extensive urbanization, and a growing consumer base, particularly in economies such as China, India, and Southeast Asian nations. The region not only accounts for a substantial portion of global production capacity but also represents the largest consumption market, driven by its burgeoning automotive, construction, and electronics industries. This makes APAC a critical region for future market development and investment.

What sustainable alternatives are being explored for phenol and acetone production?

Significant efforts are underway to develop sustainable alternatives for phenol and acetone production, primarily focusing on bio-based pathways. Researchers and chemical companies are exploring methods to produce these chemicals from renewable resources such as biomass, agricultural waste, and sugars, leveraging fermentation or catalytic conversion technologies. These "bio-phenol" and "bio-acetone" initiatives aim to reduce reliance on fossil feedstocks, lower the carbon footprint of production, and align with global sustainability goals. While still in early commercial stages, these technologies represent a promising future direction for the market.

How is AI expected to influence the efficiency and operations of the phenol and acetone industry?

AI is anticipated to profoundly influence the phenol and acetone industry by significantly enhancing operational efficiency and optimizing various processes. AI applications can include predictive maintenance for machinery, optimizing reaction parameters in production facilities to maximize yield and minimize energy consumption, and improving supply chain logistics through advanced forecasting and inventory management. Furthermore, AI can accelerate R&D for new derivatives and sustainable production methods by simulating molecular interactions, thereby leading to cost reductions, improved safety, higher product quality, and faster innovation cycles across the value chain.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Phenol and Acetone Market Statistics 2025 Analysis By Application (Bisphenol A, Phenolic Resin, Caprolactam, Methyl Methacrylate), By Type (Phenol, Acetone), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Phenol and Acetone Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Phenol, Acetone), By Application (Industrial, Pharmaceuticals, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager