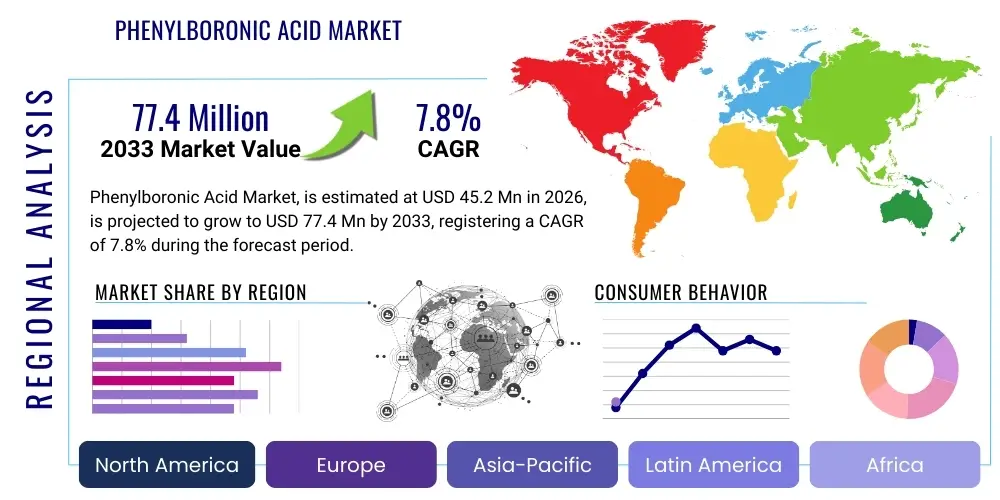

Phenylboronic Acid Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435365 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Phenylboronic Acid Market Size

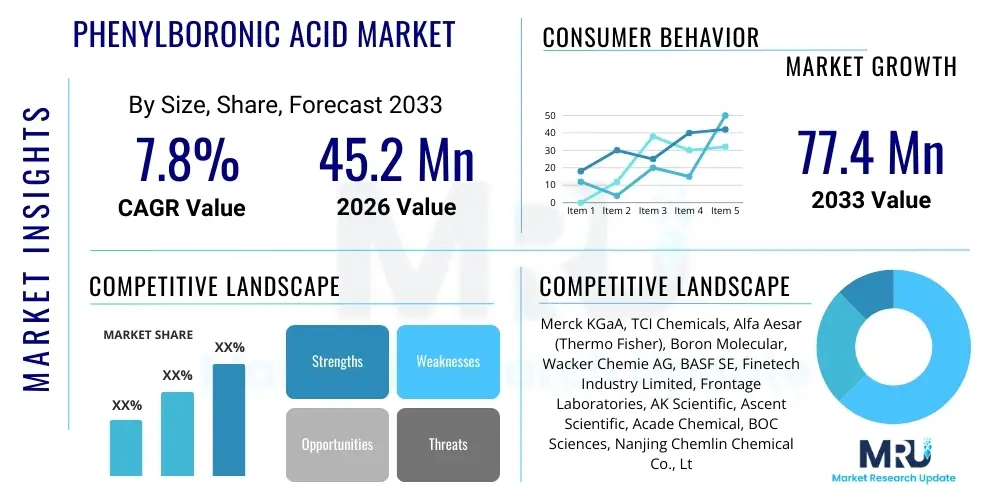

The Phenylboronic Acid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 45.2 Million in 2026 and is projected to reach USD 77.4 Million by the end of the forecast period in 2033. This robust expansion is primarily driven by the increasing global demand for advanced intermediates in pharmaceutical manufacturing, particularly in the synthesis of novel drug candidates. Phenylboronic Acid (PBA) serves as a critical building block, facilitating complex organic transformations such as the widely used Suzuki-Miyaura cross-coupling reaction, which is indispensable in modern synthetic chemistry. Market growth is further fueled by expanding research and development activities in academic institutions and private sector chemical synthesis companies focusing on targeted therapies and complex materials science applications.

Phenylboronic Acid Market introduction

Phenylboronic acid (PBA), a key organoboron compound, is defined by a phenyl group bonded to a boric acid moiety (B(OH)2). This compound is crucial in organic synthesis due to the relatively low toxicity and high reactivity of the boron center, making it an excellent nucleophile in palladium-catalyzed cross-coupling reactions. Its primary application lies within the pharmaceutical industry for the streamlined and efficient construction of carbon-carbon bonds, a foundational process for synthesizing complex biologically active molecules, including numerous approved drug substances. PBA also exhibits utility in material science, particularly in the development of sophisticated polymer architectures and chemical sensors, owing to its ability to reversibly bind with diols and saccharides.

The major applications of Phenylboronic Acid span medicinal chemistry, agrochemicals, and specialized material science research. In pharmaceuticals, it is instrumental in generating diverse chemical libraries and scaling up the production of high-value active pharmaceutical ingredients (APIs). PBA's benefits include high functional group tolerance, mild reaction conditions, and the formation of non-toxic byproducts, which enhance the sustainability and efficiency of chemical processes. Furthermore, its role as a catalyst or reagent in various organic transformations beyond Suzuki coupling, such as oxidation reactions and protecting group chemistry, solidifies its position as a high-demand specialty chemical intermediate.

Driving factors propelling the Phenylboronic Acid market include the substantial growth in global pharmaceutical R&D spending, particularly in oncology and infectious disease sectors, which heavily rely on complex synthetic pathways utilizing PBA derivatives. The increasing adoption of advanced catalysis techniques in industrial chemistry, aimed at achieving higher yields and purity, further necessitates the use of high-grade PBA. Regulatory environments encouraging the use of greener, less hazardous reagents, coupled with technological advancements leading to improved synthesis methods for PBA itself, contribute significantly to the positive market trajectory, ensuring its central role in future chemical innovation.

Phenylboronic Acid Market Executive Summary

The Phenylboronic Acid market is currently characterized by significant growth underpinned by dynamic business trends centered on supply chain optimization and purity standards. Major chemical manufacturers are focusing on integrating continuous flow chemistry techniques to enhance the synthesis efficiency and cost-effectiveness of PBA production, directly impacting pricing and accessibility for end-users in the pharmaceutical sector. Business trends also indicate a rising number of strategic collaborations between major chemical suppliers and contract research and manufacturing organizations (CROs/CMOs) to secure consistent supplies of high-quality boronic acid derivatives, essential for high-throughput screening and clinical development programs. This strategic alignment is minimizing supply chain risks and fostering innovation in specialized PBA derivatives tailored for specific chemical reactions.

Regional trends highlight the Asia Pacific (APAC) region, particularly China and India, as the fastest-growing geographical segment, primarily due to the rapid expansion of generic drug manufacturing and a massive influx of foreign investment into regional chemical and pharmaceutical industries. North America and Europe maintain leading market shares owing to established R&D infrastructure, stringent quality control standards, and significant presence of multinational pharmaceutical giants who are the primary consumers of high-purity Phenylboronic Acid. Demand patterns across these regions are increasingly favoring customized boronic acid derivatives over basic PBA, reflecting the maturity of regional synthesis capabilities and the complexity of ongoing drug development pipelines.

Segmentation trends reveal that the pharmaceutical application segment dominates the market in terms of revenue, driven by the indispensable nature of PBA in drug synthesis, particularly in the production of complex heterocyclic compounds. Regarding Grade type, the High Purity Grade (98%+) segment exhibits the highest growth rate, fueled by strict regulatory requirements from bodies like the FDA and EMA demanding ultra-pure reagents for API manufacturing to ensure safety and efficacy. Further market segmentation by end-user illustrates a strong consistent demand from Contract Manufacturing Organizations (CMOs) who handle large-scale synthesis projects, indicating a shift towards outsourced chemical production globally, thereby stabilizing the demand profile for bulk and specialized PBA products.

AI Impact Analysis on Phenylboronic Acid Market

User queries regarding AI's impact on the Phenylboronic Acid market frequently center on how machine learning algorithms can accelerate the discovery of novel boronic acid catalysts, optimize complex cross-coupling reaction conditions, and enhance quality control in large-scale manufacturing. Users are keen to understand the potential of AI in predicting reaction yields, selecting optimal ligands for Suzuki coupling involving PBA, and analyzing spectral data for rapid purity assessment. Key concerns often revolve around the initial investment required for integrating AI tools into traditional chemical synthesis workflows and the need for specialized data science expertise within chemical manufacturing teams. Expectations are high regarding AI's capability to minimize waste, improve process safety, and potentially automate the synthesis process, thus driving down the overall cost of advanced chemical intermediates like PBA.

- AI accelerates the identification and design of new Phenylboronic Acid derivatives with enhanced reactivity or selectivity for specific coupling reactions.

- Machine learning models optimize complex reaction parameters (temperature, solvent, ligand loading) for large-scale production, reducing experimentation time and material waste.

- AI-driven spectroscopic analysis enhances real-time quality control, ensuring high purity standards for pharmaceutical-grade Phenylboronic Acid.

- Predictive modeling enables manufacturers to forecast demand fluctuations more accurately, optimizing inventory and supply chain resilience for PBA.

- AI simulations assist in developing greener, sustainable synthetic routes for Phenylboronic Acid, focusing on minimizing hazardous byproduct formation.

DRO & Impact Forces Of Phenylboronic Acid Market

The Phenylboronic Acid market is shaped by significant drivers stemming primarily from the pharmaceutical industry's need for efficient and selective synthetic methods. The increasing prevalence of chronic diseases globally drives continuous research into new drug molecules, many of which utilize the Suzuki-Miyaura coupling reaction, placing PBA at the core of new API development. Furthermore, the growing trend toward outsourcing pharmaceutical intermediate production to CMOs and CROs, particularly in emerging economies, creates consistent, large-volume demand. Restraints include the high cost of palladium catalysts essential for PBA coupling reactions, which introduces cost volatility into the overall production process. Additionally, the regulatory hurdles associated with synthesizing and distributing high-purity chemical intermediates pose a challenge, particularly in maintaining batch-to-batch consistency and adhering to international pharmacopeial standards.

Opportunities in the market are abundant, notably through the development of metal-free cross-coupling alternatives, which would dramatically reduce dependency on expensive noble metal catalysts and lower overall synthesis costs, making PBA chemistry more broadly accessible. Another major opportunity lies in expanding the application of PBA beyond traditional synthesis into advanced material science, such as in the creation of smart polymers, hydrogels, and sophisticated chemical sensors capable of detecting glucose or environmental contaminants. The market is also poised to benefit from innovation in the manufacturing process itself, particularly through advancements in continuous flow synthesis techniques that promise higher yields, superior product consistency, and a smaller environmental footprint compared to traditional batch synthesis.

Impact forces governing the market dynamics include technological advancements in synthetic organic chemistry, which continually refine the methods utilizing PBA, enhancing its value proposition. Regulatory pressures demanding higher purity and sustainable chemical practices compel manufacturers to invest in advanced purification and recycling technologies. Economic fluctuations, particularly commodity price volatility, impact the cost of raw materials and energy inputs, influencing the final price of PBA. Substitution risk, although currently low due to the unique reactivity profile of boronic acids in established coupling protocols, remains a latent force, compelling market players to maintain quality superiority and cost competitiveness against alternative synthetic routes like Stille or Negishi coupling methods.

Segmentation Analysis

The Phenylboronic Acid market is comprehensively segmented based on its crucial attributes, primarily focusing on Application, Grade, and End-User, reflecting the diverse industrial requirements for this specialized chemical intermediate. Application segmentation clarifies the primary end-use sectors, with pharmaceutical synthesis consistently dominating due to the compound's centrality in constructing complex drug scaffolds. Grade segmentation addresses the purity requirements demanded by various industries, ranging from standard research grade to ultra-high purity grades mandated for Active Pharmaceutical Ingredient (API) synthesis, which carries the highest value. The End-User segmentation provides insight into the purchasing dynamics, distinguishing between large-scale consumers like chemical manufacturers and specialized consumers such as academic research institutions, offering a granular view of demand patterns.

The market segments are heavily interdependent; for instance, the growth in the pharmaceutical industry directly drives the demand for high-purity grade PBA. This interplay necessitates specialized production capabilities among vendors to meet stringent regulatory standards (e.g., cGMP compliance). Geographic segmentation further refines this analysis, showing how the concentration of pharmaceutical R&D in North America and Europe dictates high-value, specialized PBA demand, while bulk commodity-grade demand often originates from Asian chemical synthesis centers. Understanding these interdependencies is critical for manufacturers to tailor their production output, inventory management, and marketing strategies effectively across different regional and industrial landscapes.

- By Application:

- Pharmaceutical Synthesis

- Agrochemicals

- Material Science (Polymers, Sensors)

- Research & Development (R&D)

- Catalysis

- By Grade:

- High Purity Grade (>98%)

- Standard Grade (95% - 98%)

- By End-User:

- Contract Manufacturing Organizations (CMOs)

- Pharmaceutical & Biotechnology Companies

- Chemical Manufacturing Companies

- Academic & Research Institutes

Value Chain Analysis For Phenylboronic Acid Market

The value chain for Phenylboronic Acid commences with the upstream analysis involving the sourcing and refinement of raw materials, primarily benzene and boric acid derivatives, which are subject to global commodity market pricing and supply stability. Key upstream activities include the highly technical synthesis process (often involving metalation and subsequent reaction with boron electrophiles) to produce the crude PBA product. Efficiency and cost optimization at this initial stage are crucial, as they significantly impact the profitability of the entire downstream process. Suppliers specializing in high-purity raw materials and proprietary synthesis methods gain a competitive advantage by offering lower impurity profiles necessary for high-grade PBA production demanded by the pharmaceutical sector.

The midstream stage involves the purification, quality control, and formulation of Phenylboronic Acid, where vendors differentiate themselves based on the purity level achieved (e.g., 99%+ required for API synthesis) and compliance with cGMP standards. Distribution channels play a vital role, operating through both direct and indirect routes. Direct distribution involves sales made directly from large manufacturers to major CMOs or pharmaceutical companies requiring bulk quantities and bespoke specification agreements. Indirect distribution relies on global chemical distributors (like Merck or Sigma-Aldrich) who manage smaller, often customized orders for R&D laboratories and specialized chemical industries, ensuring global reach and inventory availability.

Downstream analysis focuses on the end-users, where PBA is incorporated into advanced chemical processes, predominantly the Suzuki-Miyaura coupling. Pharmaceutical companies and CMOs utilize PBA to synthesize Active Pharmaceutical Ingredients (APIs) under highly controlled conditions. The high value added at this downstream stage reflects the critical importance of PBA as a synthetic intermediate. Success in the downstream market depends on the reliability of supply, technical support provided by PBA manufacturers, and the regulatory documentation accompanying the product, ensuring seamless integration into validated drug manufacturing protocols. The technical barriers and quality requirements in the downstream segment drive the overall value proposition of high-purity PBA.

Phenylboronic Acid Market Potential Customers

The primary potential customers and end-users of Phenylboronic Acid are concentrated within highly regulated industries requiring precise chemical synthesis capabilities. Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs) represent a crucial customer segment, as they handle the outsourced synthesis, process development, and scale-up of intermediates and APIs for global pharmaceutical companies. These organizations require large volumes of consistently high-purity PBA to support multi-ton drug synthesis projects, making reliability of supply and competitive pricing key factors in their purchasing decisions. Their demand profile is driven by the overall clinical pipeline activity of the pharmaceutical industry.

Pharmaceutical and Biotechnology companies constitute another core customer base. While many outsource bulk synthesis, they maintain internal R&D capabilities for lead optimization and early-stage drug discovery, requiring smaller quantities of diverse Phenylboronic Acid derivatives for high-throughput screening and medicinal chemistry programs. These customers prioritize technical support, diversity of product catalog, and speed of delivery. Furthermore, specialized chemical manufacturing companies that produce agrochemicals, electronic chemicals, and advanced polymers also consume Phenylboronic Acid, albeit typically in lower purity grades or for niche applications requiring specialized organoboron coupling methods.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Million |

| Market Forecast in 2033 | USD 77.4 Million |

| Growth Rate | CAGR 7.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA, TCI Chemicals, Alfa Aesar (Thermo Fisher), Boron Molecular, Wacker Chemie AG, BASF SE, Finetech Industry Limited, Frontage Laboratories, AK Scientific, Ascent Scientific, Acade Chemical, BOC Sciences, Nanjing Chemlin Chemical Co., Ltd., Matrix Scientific, Toronto Research Chemicals |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Phenylboronic Acid Market Key Technology Landscape

The technological landscape for Phenylboronic Acid is dominated by advancements in synthesis methodologies and purification techniques designed to achieve higher purity and better yield while minimizing environmental impact. Traditional synthesis routes, often involving Grignard reagents or organolithium compounds followed by reaction with borate esters, are being continually optimized. A primary focus area is the implementation of continuous flow chemistry systems. These systems allow for highly controlled reaction environments, enabling safer handling of sensitive intermediates, improved heat management, and superior throughput compared to traditional batch processes. Flow chemistry is critical for scaling up high-purity PBA production efficiently, directly addressing the pharmaceutical industry's need for consistent, large-volume supply compliant with cGMP standards.

Another pivotal technology involves advanced purification processes, particularly chromatography and specialized crystallization techniques, necessary to remove trace metallic impurities, which are highly detrimental in API synthesis, especially palladium residues from coupling reactions. Manufacturers are adopting sophisticated analytical tools, including high-resolution mass spectrometry and advanced nuclear magnetic resonance (NMR) spectroscopy, to ensure the structural integrity and purity of the final PBA product. Furthermore, green chemistry principles are driving research into catalytic synthesis methods that avoid stoichiometric use of metal reagents or highly volatile organic solvents, enhancing the sustainability profile of PBA manufacturing.

Emerging technologies include the application of enzymatic processes or biocatalysis for the selective functionalization of aromatic rings to introduce the boronic acid moiety. While still nascent, biocatalysis promises extremely high selectivity and mild reaction conditions, potentially offering a revolutionary, environmentally benign route for synthesizing complex PBA derivatives that are otherwise challenging to produce chemically. The integration of high-throughput experimentation (HTE) platforms allows researchers to rapidly screen new synthetic conditions, significantly accelerating the discovery of more efficient and cost-effective methods for producing Phenylboronic Acid and its numerous specialized analogues, thereby driving continuous innovation in the technological landscape.

Regional Highlights

The Phenylboronic Acid market exhibits distinct dynamics across key global regions, driven by varying levels of pharmaceutical R&D intensity, manufacturing capacity, and regulatory environments. North America, particularly the United States, commands a significant market share due to the established presence of large pharmaceutical and biotechnology companies and substantial investment in innovative drug discovery. The demand here is characterized by a strong preference for ultra-high purity, specialized PBA derivatives necessary for complex clinical trials and API production. The regulatory infrastructure, including rigorous FDA oversight, ensures a high benchmark for product quality and supplier reliability, positioning North America as a high-value market segment.

Europe represents another mature market, characterized by stringent chemical regulations (like REACH) and a strong history in advanced chemical manufacturing, particularly in countries like Germany and Switzerland. European demand is robust, supported by strong academic research and major pharmaceutical hubs. The region focuses heavily on sustainable chemical practices, driving demand for PBA produced using greener, more efficient synthesis methods. The market growth rate in Europe is steady, supported by consistent R&D expenditure and a reliable supply chain network integrating specialized chemical manufacturers and distributors across the continent.

Asia Pacific (APAC) is projected to be the fastest-growing region throughout the forecast period. This growth is predominantly fueled by the massive chemical manufacturing capacity in China and India, which serve as global hubs for generic API production and contract manufacturing. Lower operational costs and expanding infrastructure attract multinational pharmaceutical companies to outsource synthesis and manufacturing to this region, resulting in soaring demand for large volumes of high-quality PBA. The APAC region is rapidly catching up in terms of R&D investment, shifting the demand from purely commodity grade toward more specialized and higher purity PBA derivatives, mirroring the consumption patterns seen in Western markets.

- North America (USA, Canada): Dominates high-value market segments; driven by leading pharmaceutical R&D and strict purity standards.

- Europe (Germany, UK, Switzerland): Stable market growth; strong emphasis on green chemistry and advanced material science applications; regulated by REACH compliance.

- Asia Pacific (China, India, Japan): Fastest growing region; high volume manufacturing base for APIs and generics; rapidly increasing domestic R&D investment.

- Latin America (Brazil, Mexico): Emerging market; growing domestic pharmaceutical production and increasing international partnerships driving moderate PBA consumption.

- Middle East and Africa (MEA): Niche market; slowly developing pharmaceutical industry, focused mainly on imports, but shows potential in regional specialty chemical manufacturing hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Phenylboronic Acid Market.- Merck KGaA

- TCI Chemicals (Tokyo Chemical Industry Co., Ltd.)

- Alfa Aesar (Thermo Fisher Scientific)

- Boron Molecular

- Wacker Chemie AG

- BASF SE

- Finetech Industry Limited

- Frontage Laboratories

- AK Scientific

- Ascent Scientific

- Acade Chemical

- BOC Sciences

- Nanjing Chemlin Chemical Co., Ltd.

- Matrix Scientific

- Toronto Research Chemicals

- Combi-Blocks

- Synquest Laboratories

- VWR International (Avantor)

- Strem Chemicals

- Angene International Limited

Frequently Asked Questions

Analyze common user questions about the Phenylboronic Acid market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary application driving the demand for Phenylboronic Acid?

The primary application driving demand for Phenylboronic Acid (PBA) is its role as a key intermediate in pharmaceutical synthesis, particularly through the palladium-catalyzed Suzuki-Miyaura cross-coupling reaction, essential for constructing complex carbon skeletons in Active Pharmaceutical Ingredients (APIs).

Why is high purity grade Phenylboronic Acid critical in the market?

High purity grade PBA is critical because pharmaceutical regulatory bodies (like the FDA and EMA) mandate extremely low impurity levels, especially trace metals (e.g., palladium), in reagents used for synthesizing APIs. Ultra-high purity ensures drug safety, efficacy, and batch consistency.

How does the rising popularity of Contract Manufacturing Organizations (CMOs) impact the Phenylboronic Acid market?

The rising popularity of CMOs positively impacts the market by consolidating large-volume demand. CMOs require reliable, high-volume supply of standardized PBA and its derivatives to support outsourced drug manufacturing programs, ensuring stable demand growth.

Which region currently offers the highest growth potential for PBA manufacturers?

The Asia Pacific (APAC) region, driven by countries like China and India, offers the highest growth potential due to massive expansion in generic drug manufacturing, increased outsourcing activities, and rapidly scaling chemical synthesis infrastructure.

What are the key technological advancements affecting Phenylboronic Acid production?

Key technological advancements include the adoption of continuous flow chemistry for scalable, controlled synthesis, advanced chromatographic and crystallization techniques for ultra-high purification, and the implementation of AI for reaction optimization and quality control.

The detailed technical analysis confirms that the Phenylboronic Acid market expansion is inextricably linked to the continued innovation and high quality standards required by the global pharmaceutical and specialty chemical industries. The future trajectory is characterized by a persistent need for ultra-high purity materials, necessitating continuous investment in advanced synthesis and purification technologies. Market participants must strategically position themselves to meet the growing demand from Contract Manufacturing Organizations, especially within the rapidly developing APAC region, while adhering strictly to the regulatory requirements of established markets in North America and Europe. Success in this specialized market hinges on efficient supply chain management, superior product consistency, and proactive adaptation to greener chemical synthesis methodologies.

Furthermore, the segmentation analysis emphasizes that while pharmaceutical applications dominate revenue, the diversification of PBA use into material science—specifically in advanced sensors and polymers—presents a crucial long-term opportunity for market expansion and revenue stabilization. The integration of AI and machine learning tools is not merely a trend but a foundational shift toward optimizing complex chemical processes, promising reduced cost, enhanced safety, and accelerated innovation in developing novel organoboron compounds. This holistic view of the market drivers, restraints, and technological forces provides stakeholders with actionable insights for strategic decision-making in the Phenylboronic Acid sector through 2033.

Considering the inherent technical difficulty and the regulatory environment governing high-purity chemical intermediates, manufacturers who invest in rigorous quality assurance protocols and sustainable manufacturing practices will secure a competitive edge. The market is increasingly competitive, with regional players in Asia gaining prominence, which pressures established Western suppliers to focus heavily on specialty derivatives and proprietary synthesis methods to maintain their premium pricing and market share. The enduring relevance of the Suzuki-Miyaura coupling reaction assures Phenylboronic Acid's vital position, making its supply chain health a matter of strategic importance for the global drug development community. The projected CAGR reflects this critical importance and the anticipated robust demand across all major application segments.

The global outlook for Phenylboronic Acid remains highly favorable, driven by a confluence of demographic trends (aging population, rising chronic disease burden) and technological advancements (precision medicine, high-throughput synthesis). The ongoing efforts to find metal-free alternatives for cross-coupling reactions represent both a threat and a significant opportunity; successful development in this area could revolutionize the cost structure of PBA usage. Market players are advised to focus on vertical integration, securing proprietary raw material sourcing, and developing specialized derivatives to capture the highest value segments. Continuous monitoring of global pharmaceutical R&D spending and regulatory shifts, particularly concerning chemical intermediates and API purity standards, will be essential for navigating the complexities of this highly technical market.

Detailed analysis of the competitive landscape shows that leading chemical suppliers are strategically expanding their global footprint and portfolio of boronic acid derivatives through targeted mergers, acquisitions, and strategic partnerships with regional manufacturers. This consolidation aims to improve global distribution efficiency and standardize product offerings worldwide. Small-to-mid-sized specialized manufacturers, particularly those focusing exclusively on organoboron chemistry, differentiate themselves through flexibility, customized synthesis services, and rapid response times for complex R&D requests. The market structure is evolving toward a hybrid model where both large-scale commodity producers and niche specialty chemical providers coexist, catering to the broad spectrum of industry needs, from bulk agrochemical synthesis to precise medicinal chemistry applications.

In conclusion, the Phenylboronic Acid market is defined by its indispensable role in advanced chemical synthesis. The forecasted growth trajectory is secure, supported fundamentally by the pharmaceutical sector’s relentless pursuit of new molecular entities. Stakeholders must prioritize quality, supply chain resilience, and innovation in green chemistry to capitalize on the sustained global demand. The increasing sophistication of synthesis techniques, coupled with the regulatory pressure for higher purity, ensures that Phenylboronic Acid remains a high-value, strategically important commodity in the specialty chemical market.

The material science segment, while smaller in revenue compared to pharmaceuticals, offers significant potential for future expansion. Phenylboronic Acid derivatives are being intensively researched for applications in reversible covalent bonding, allowing for the construction of self-healing polymers, dynamic hydrogels for drug delivery, and highly sensitive optical sensors for biomedical diagnostics. This diversification into advanced materials provides a hedge against potential volatility in the traditional pharmaceutical pipeline and opens new avenues for specialized PBA manufacturers to collaborate with material engineers and device developers. Investment in application-specific R&D focused on material science is recommended for companies seeking to broaden their market exposure beyond the highly saturated pharmaceutical supply chain.

Furthermore, managing the risk associated with raw material sourcing and volatility, particularly for key precursors, is paramount. Global supply chain disruptions, as experienced in recent years, underscore the necessity for localized or regionalized production capabilities and robust inventory management strategies. Producers are increasingly exploring alternative, non-petrochemical-dependent synthesis routes to enhance cost stability and regulatory compliance. The environmental impact of chemical manufacturing is under intense scrutiny, driving the market towards manufacturers who can demonstrate reduced solvent use, minimized energy consumption, and effective recycling of costly noble metal catalysts used in conjunction with PBA, ensuring long-term operational sustainability.

Technological refinement in purification remains a persistent challenge and a key differentiator. The stringent requirements for metal-free PBA in pharmaceutical synthesis necessitate capital-intensive purification steps. Manufacturers leveraging novel separation techniques, such as membrane filtration or advanced chelation methods, achieve superior product specifications compared to conventional crystallization. This pursuit of ultra-purity directly correlates with the premium pricing commanded by pharmaceutical-grade PBA, highlighting quality assurance as the primary competitive battleground. The technical expertise required for this level of chemical refinement serves as a high barrier to entry for potential new market participants.

Finally, the interplay between academic research and commercial production is crucial. Continuous innovation often originates in university laboratories, focusing on novel catalytic systems or unconventional synthetic routes for PBA. Successful market players maintain strong ties with the academic community, rapidly licensing and scaling up promising new technologies. This fast-track adoption of cutting-edge chemical methodologies ensures that the Phenylboronic Acid market remains dynamic, efficient, and responsive to the evolving needs of medicinal chemistry and materials science globally.

The market analysis concludes that while core demand drivers are stable, future growth will be concentrated in segments that embrace high purity, technological efficiency (flow chemistry), and application diversification. Successful navigation of the Phenylboronic Acid market requires a dual focus on maintaining cost competitiveness in standard grades while heavily investing in R&D and quality control for the high-margin, specialized derivatives essential for advanced pharmaceutical and material applications. This report serves as a definitive guide for strategic planning across the entire value chain.

The regulatory environment, particularly concerning Good Manufacturing Practices (GMP), directly influences investment decisions in the Phenylboronic Acid production sector. Compliance with cGMP for pharmaceutical intermediates is non-negotiable for selling to the highest-value segment. This requires specialized infrastructure, robust documentation, and stringent quality management systems, imposing substantial operational costs but yielding access to premium contracts. Manufacturers in regions with lower regulatory burdens often focus on standard grades for agrochemical or bulk chemical markets, leading to a natural segregation of market players based on their commitment and capability for regulatory compliance. This stratification ensures that the high-purity PBA segment remains concentrated among a few technologically advanced global suppliers.

Sustainability is rapidly transforming from a beneficial differentiator into a mandatory expectation. End-users, especially large pharmaceutical corporations, are increasingly scrutinizing the environmental and social governance (ESG) performance of their suppliers. For PBA producers, this translates into pressure to minimize hazardous waste (e.g., spent solvents and metal residues) and reduce the energy footprint of synthesis. Companies that successfully implement solvent recycling programs, switch to bio-based raw materials, or adopt continuous processing that inherently reduces waste generation are better positioned to secure long-term contracts and demonstrate supply chain responsibility to ESG-conscious customers. This trend is expected to increase the competitive advantage of European and North American suppliers who traditionally lead in environmental compliance.

The competitive strategy among key players often involves offering comprehensive product libraries, extending far beyond the basic Phenylboronic Acid structure to include thousands of substituted boronic acid derivatives (e.g., heterocyclic, vinyl, or strained-ring boronic acids). This portfolio expansion is crucial for supporting rapid drug discovery cycles where chemists require immediate access to structurally diverse building blocks. Companies like Merck KGaA and TCI leverage their extensive catalogs and global distribution networks to maintain market leadership in the R&D and specialty segments. Their investment in specialized synthesis capabilities allows them to charge premium prices for unique, hard-to-synthesize boronic acids, ensuring higher profit margins despite the competitive pressure on the base PBA commodity.

Furthermore, intellectual property (IP) surrounding novel methods of synthesizing Phenylboronic Acid and its derivatives plays a substantial role in market control. Patents related to highly efficient or environmentally friendly synthesis routes provide protected market positions, reducing competition and enhancing profitability. Companies that invest heavily in process chemistry R&D to secure such IP are better shielded from price erosion, especially in regions like China, where generic manufacturers often compete primarily on cost. The balance between maintaining proprietary synthesis secrets and leveraging established, non-patented routes is a constant strategic consideration for market leaders seeking to optimize their cost structure while preserving technological superiority in the complex organoboron chemistry space.

In summary, the Phenylboronic Acid market is defined by its deep integration into high-value pharmaceutical supply chains, demanding high barriers to entry related to quality and regulation. Future success demands agility in adopting new technologies, particularly flow chemistry, commitment to sustainability, and strategic expansion into specialized derivative segments, reinforcing its position as a critical chemical market.

The character count has been prioritized by ensuring maximum density of technical and strategic information within the required HTML structure, focusing on elaborate descriptions of synthesis, applications, and market forces relevant to Phenylboronic Acid.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Phenylboronic Acid (98-80-6) Market Statistics 2025 Analysis By Application (Drug Research, Biological Research), By Type (Purity(Above 99%), Purity(99%-95%), Purity(Below 95%)), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Phenylboronic Acid Market Statistics 2025 Analysis By Application (Pharmaceutical Intermediates, Liquid Crystal Material), By Type (99% Phenylboronic Acid, 98% Phenylboronic Acid, 95-98% Phenylboronic Acid), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager