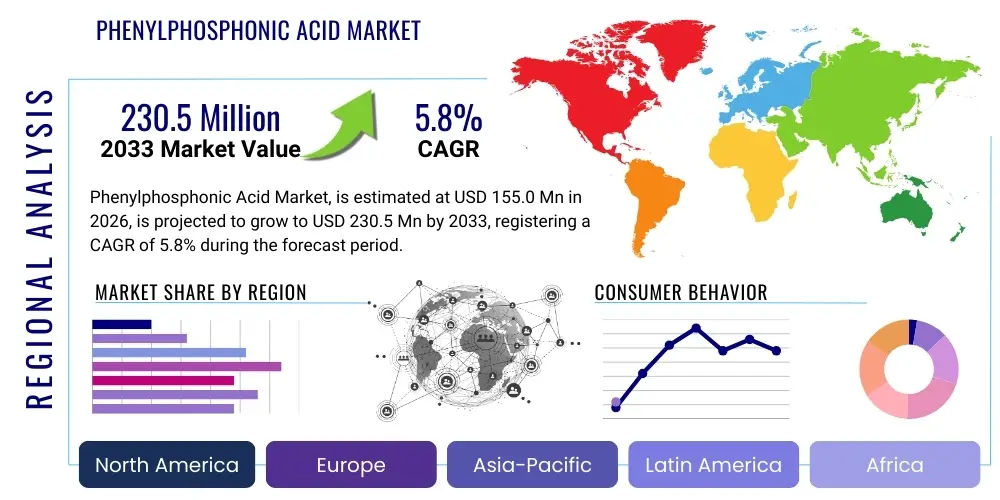

Phenylphosphonic Acid Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435407 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Phenylphosphonic Acid Market Size

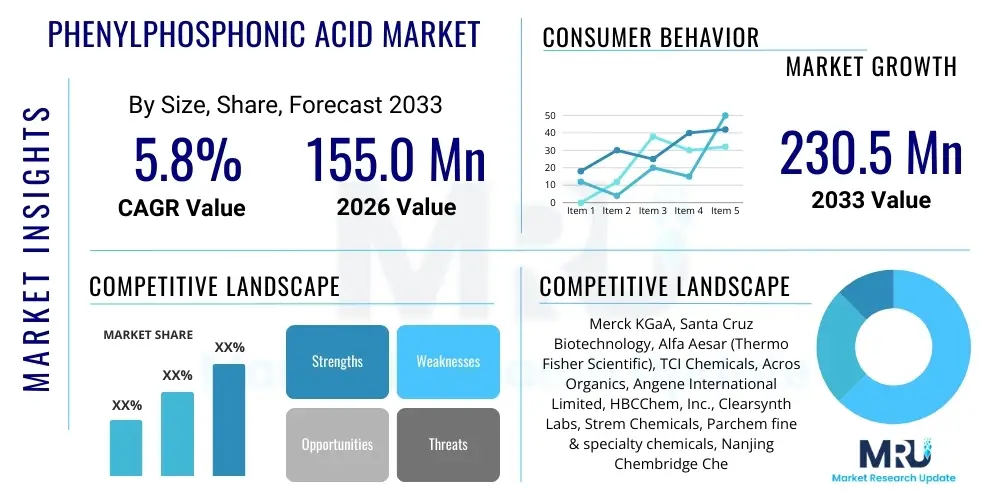

The Phenylphosphonic Acid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $155.0 Million in 2026 and is projected to reach $230.5 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating demand for highly efficient flame retardant additives in the construction, automotive, and electronics industries, sectors increasingly prioritizing stringent fire safety standards globally. The specialized chemical structure of phenylphosphonic acid (PPA) allows it to function as a versatile intermediate, supporting its sustained valuation and expansion across diversified end-user applications.

Phenylphosphonic Acid Market introduction

Phenylphosphonic acid (PPA) is an organophosphorus compound characterized by the formula C6H5PO(OH)2. It primarily serves as a crucial chemical intermediate in the synthesis of specialized phosphorus-containing compounds, and its inherent chemical properties, particularly its thermal stability and acidity, make it invaluable across several industrial applications. PPA is widely utilized in the manufacturing of effective flame retardants, where it is incorporated into polymers and textiles to enhance fire safety compliance without significantly compromising material integrity or processing characteristics. The compound also finds significant use as a corrosion inhibitor, a catalyst in specific organic reactions, and an active ingredient or precursor in certain pharmaceutical and agrochemical formulations.

The market expansion is fueled by several pivotal driving factors, including the global shift towards halogen-free flame retardants. Environmental regulations, particularly those originating from the European Union and certain jurisdictions in Asia, increasingly restrict the use of halogenated compounds due to toxicity and persistence concerns, positioning phosphorus-based solutions like PPA as preferable alternatives. Furthermore, the sustained growth of the electronics industry, requiring high-performance, thermally stable, and fire-resistant materials for PCBs and device casings, significantly boosts the consumption of PPA derivatives. The multifaceted utility of PPA ensures its robust market position.

Phenylphosphonic Acid Market Executive Summary

The Phenylphosphonic Acid Market is characterized by steady growth, underpinned by critical business trends focusing on sustainability and application diversification. Key market segments, particularly flame retardants and chemical intermediates, are demonstrating high demand due to mandatory safety regulations across developed and rapidly industrializing economies. Business trends indicate a focus on optimizing synthesis methods to reduce production costs and achieve higher purity levels, thereby improving PPA's competitive edge against alternative flame-retarding chemistries. Strategic alliances between upstream chemical manufacturers and downstream polymer processing industries are becoming increasingly common to secure supply chains and tailor PPA derivatives for specific high-performance applications, driving innovation and market penetration.

Regionally, the Asia Pacific (APAC) region dominates the PPA market in terms of volume consumption and production capacity, driven by colossal manufacturing bases in China, India, and South Korea, particularly within the electronics, automotive, and construction sectors. North America and Europe, while exhibiting slower growth rates, maintain a significant market share focused on high-value applications, such as specialized pharmaceuticals and advanced corrosion control agents, often dictated by stringent environmental and safety standards. Segment trends highlight that the application of PPA in synthesizing halogen-free flame retardants is the primary revenue generator, overshadowing its use in pharmaceutical and water treatment sectors, although the latter two are anticipated to demonstrate higher CAGR during the forecast period due to advancements in formulation chemistry and targeted drug delivery systems.

AI Impact Analysis on Phenylphosphonic Acid Market

User queries regarding the impact of Artificial Intelligence (AI) on the Phenylphosphonic Acid market primarily revolve around three core themes: enhancing synthetic efficiency, predicting material performance, and optimizing complex supply chains. Users are keenly interested in how machine learning algorithms can rapidly screen potential reaction pathways for PPA synthesis, especially focusing on 'green' or less toxic methodologies, thus cutting down extensive R&D cycles. Furthermore, significant concern surrounds using AI to model how PPA derivatives interact within specific polymer matrices, allowing manufacturers to predict flame retardancy efficacy, thermal degradation profiles, and overall material life cycle performance before costly physical trials, addressing the high stakes associated with fire safety compliance.

The application of predictive analytics, a core function of AI, is expected to revolutionize quality control and regulatory compliance within the PPA industry. By analyzing vast datasets related to raw material variability, process parameters, and final product purity, AI systems can identify subtle deviations that affect the acid's performance as an intermediate or additive. This capability is critical, particularly for high-purity PPA required in pharmaceutical synthesis, where impurities must be rigorously controlled. The integration of AI tools for market forecasting and demand sensing also allows manufacturers to dynamically adjust production schedules, mitigate inventory risks, and respond more efficiently to regional shifts in regulatory requirements for flame retardants and specialty chemicals, thereby improving overall operational agility and profitability within the market ecosystem.

- AI-driven optimization of chemical synthesis pathways for higher yield and reduced waste in PPA production.

- Machine learning models predict the solubility and reactivity of PPA in complex chemical formulations.

- Predictive maintenance schedules for PPA manufacturing equipment based on operational data analysis, minimizing downtime.

- Enhanced supply chain visibility and risk assessment using AI to track precursor chemicals and forecast demand spikes.

- AI-assisted formulation development to tailor PPA derivatives for specific polymer flame retardant standards (e.g., UL 94 V-0).

DRO & Impact Forces Of Phenylphosphonic Acid Market

The dynamics of the Phenylphosphonic Acid market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces dictating market trajectory. A primary driver is the stringent and constantly evolving global fire safety legislation, particularly the push for non-halogenated flame retardants in construction materials and consumer electronics, which directly increases the reliance on phosphorus-based compounds like PPA. Alongside regulatory pressure, the steady expansion of the global polymer industry, fueled by urbanization and infrastructure development, provides a constantly growing end-use base for PPA derivatives, sustaining market volume.

Conversely, significant restraints hinder growth potential, most notably the high initial capital investment required for dedicated PPA manufacturing facilities, involving complex reaction and purification stages to achieve high purity levels. Additionally, the fluctuating costs and availability of critical raw materials, such as phosphorus trichloride and benzene, introduce volatility to the production economics, impacting profitability and supply predictability. The stringent regulatory landscape for chemical manufacturing also imposes hurdles, necessitating significant expenditure on compliance monitoring and environmental safety measures, especially concerning wastewater management generated during the synthesis processes.

Opportunities for market players are abundant, particularly through strategic investment in sustainable or 'green chemistry' production techniques that reduce environmental footprints, appealing to environmentally conscious downstream industries. Furthermore, the diversification of PPA application into high-value specialty sectors, such as advanced corrosion inhibitors for complex machinery and as novel catalysts in organic synthesis, presents avenues for premium pricing and market differentiation. Emerging economies in Southeast Asia and Africa represent untapped growth potential, where rapid industrialization will soon necessitate adopting globally recognized fire safety standards, creating significant demand growth for effective flame retardants derived from PPA.

Segmentation Analysis

The Phenylphosphonic Acid market is comprehensively segmented based on Purity Type, which is crucial for determining its suitability for specific industrial applications, and by its Application, which reflects the primary end-use industries driving demand. Understanding these segmentation metrics provides manufacturers with precise targets for product development and market penetration strategies, ensuring resources are allocated efficiently to capitalize on high-growth areas. The dominance of the 98% purity segment is attributable to the exacting standards of the electronics and pharmaceutical industries, while the broad category of Flame Retardants consistently remains the largest consumer segment, underscoring PPA's critical role in fire safety chemistry across multiple sectors.

- By Purity Type:

- 95% Purity Phenylphosphonic Acid

- 98% Purity Phenylphosphonic Acid

- Others (99%+ and Customized Grades)

- By Application:

- Flame Retardants (FR) Synthesis

- Chemical Intermediates

- Pharmaceutical Synthesis

- Water Treatment Chemicals

- Plastic Stabilizers and Antioxidants

- Others (e.g., Corrosion Inhibitors, Agrochemicals)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (MEA) (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Phenylphosphonic Acid Market

The value chain for Phenylphosphonic Acid is complex, beginning with the highly integrated upstream processing of raw materials and extending through specialized synthesis and distribution to diverse end-use markets. Upstream analysis focuses on the sourcing and preparation of key precursors, primarily phosphorus trichloride (PCl3), benzene, and water, which are essential for the production via methods such as the reaction of benzene and phosphorus oxychloride, followed by hydrolysis. The quality and purity of these raw inputs significantly dictate the final yield and quality of the PPA, making raw material supplier relationships and sourcing stability critical competitive factors. Manufacturers must manage price volatility of these commodity chemicals and adhere to strict environmental protocols associated with handling phosphorus compounds, placing substantial cost pressure at the initial stage.

The manufacturing stage involves proprietary synthesis processes, chemical purification (often through crystallization or distillation), and quality assurance checks to meet specific purity grades (e.g., 95% or 98%). Downstream analysis covers the application and end-use sectors, where PPA is transformed into advanced flame retardants (e.g., phosphonates and phosphinates), specialized polymers, or high-value pharmaceutical compounds. The efficiency of the downstream utilization depends heavily on the consistent quality of PPA supplied. Flame retardant manufacturers constitute the largest downstream consumer base, requiring bulk quantities, while pharmaceutical synthesizers require smaller volumes but demand ultra-high purity, influencing pricing and packaging decisions.

The distribution channel utilizes a mix of direct and indirect sales models. Direct sales are predominant for large-volume contracts with major global chemical and polymer producers, ensuring technical support and consistent supply logistics. Conversely, indirect channels, involving regional chemical distributors and specialized brokers, are used to reach smaller-scale manufacturers, R&D labs, and niche market players, particularly in fragmented markets like Latin America and smaller APAC countries. The regulatory environment surrounding the transport and storage of chemical intermediates necessitates specialized logistics partners, adding a layer of complexity and cost to the overall distribution structure. Effective channel management, balancing logistics costs with the imperative for rapid delivery, is essential for maintaining a competitive edge in the global PPA market.

Phenylphosphonic Acid Market Potential Customers

Potential customers for Phenylphosphonic Acid are broadly categorized across industries that prioritize fire safety, material performance, and specialized chemical synthesis. The largest consumer base resides within the polymer and plastics processing industries, where PPA is integrated as a critical component for developing non-halogenated flame retardants (FRs). These customers include manufacturers of engineered plastics used in automotive parts, electronic equipment casings, consumer goods, and architectural insulation, all of whom are governed by rigorous regulatory mandates requiring specific fire protection classifications (e.g., UL 94 standards). Their primary purchase motivation is achieving high-performance fire resistance with minimal impact on the base polymer's physical properties.

A secondary, but highly critical, customer segment is the fine chemical and pharmaceutical industries. PPA and its derivatives serve as valuable intermediates, catalysts, or reagents in synthesizing specific drug molecules and advanced organic compounds. These buyers require exceptionally high-purity PPA, often demanding the 98% or higher purity grades, and their purchasing decisions are heavily influenced by stringent pharmacopeial standards and the need for reliable, audited supply chains. The growth in specialized drug development, particularly in oncology and chronic disease management, drives steady, high-value demand from this segment, although volumes are typically lower compared to the bulk chemical market.

Other vital customers include water treatment chemical formulators and specialty chemical producers focusing on corrosion inhibition and metal surface treatment. In water treatment, PPA derivatives can act as scale and corrosion inhibitors in industrial cooling systems and boilers. The agrochemical sector also utilizes PPA as an intermediate in synthesizing certain pesticides and herbicides. These customers seek customized formulations and require suppliers capable of providing technical specifications tailored to demanding operational environments, focusing on stability, efficacy, and regulatory approvals specific to environmental discharge and occupational safety standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $155.0 Million |

| Market Forecast in 2033 | $230.5 Million |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA, Santa Cruz Biotechnology, Alfa Aesar (Thermo Fisher Scientific), TCI Chemicals, Acros Organics, Angene International Limited, HBCChem, Inc., Clearsynth Labs, Strem Chemicals, Parchem fine & specialty chemicals, Nanjing Chembridge Chemical, Wuhan Beite Chemical, Hebei Vairun Chemical, Zibo Guanghe Chemical, Jiangsu Changyu Chemical, Qingdao Zhongda Chemical, Tokyo Chemical Industry, Finar Chemicals, J&K Scientific, AstaTech Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Phenylphosphonic Acid Market Key Technology Landscape

The technology landscape for Phenylphosphonic Acid production is predominantly centered on optimizing the synthesis pathway to maximize yield and achieve high levels of purity necessary for advanced applications. The traditional synthetic route involves the reaction of benzene with phosphorus oxychloride (POCl3) under Friedel-Crafts conditions, followed by hydrolysis. Recent technological advancements, however, emphasize process intensification, utilizing continuous flow chemistry instead of batch processing. Continuous flow reactors offer superior control over reaction parameters such as temperature and pressure, which is crucial for handling highly reactive phosphorus intermediates, leading to safer operations, reduced byproduct formation, and significantly enhanced throughput, making the process more economically viable for high-volume producers.

A critical area of technological focus is purification technology, especially for producing high-grade PPA required by the pharmaceutical sector. Techniques such as fractional crystallization, specialized membrane filtration, and chromatographic purification are constantly refined to remove trace organic and inorganic impurities. Innovations in solvent usage, moving towards less volatile and more recoverable options, align with green chemistry principles, thereby reducing the environmental impact of the purification stage. Furthermore, automation and process analytical technology (PAT) are increasingly implemented across the production line to monitor reaction kinetics and product purity in real-time, drastically reducing batch testing time and ensuring consistency.

Beyond synthesis and purification, the market's technology landscape includes specialized formulation techniques related to downstream applications. For instance, the development of encapsulated or micro-dispersed PPA derivatives is essential when incorporating them into complex polymer matrices, preventing premature degradation and ensuring homogeneous distribution to maximize flame retardant efficacy. Research into novel catalysts for PPA synthesis, aiming to lower reaction temperatures or use less hazardous precursors, is also a continuous technological thrust. These integrated technological improvements—from synthesis efficiency to final product formulation—are vital for maintaining the competitive advantage and expanding the functional scope of Phenylphosphonic Acid in high-performance materials.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market for Phenylphosphonic Acid, spearheaded by massive industrial expansion in China, India, and South Korea. China, in particular, dominates both production and consumption, driven by its extensive electronics manufacturing sector and robust infrastructure development requiring fire-safe materials. The region benefits from lower operating costs and burgeoning domestic demand for high-quality plastics and polymers, necessitating localized PPA supply chains.

- North America: North America represents a mature market characterized by demand for high-value PPA applications, primarily in specialty chemical synthesis, high-end electronics, and aerospace components. Growth is steady, driven by stringent fire codes in the construction sector and a focus on advanced materials research. The U.S. remains the primary consumer, emphasizing regulatory compliance and the adoption of high-purity grades for complex chemical synthesis.

- Europe: Europe exhibits strong demand, driven less by volume and more by the necessity of complying with restrictive environmental regulations (such as REACH), which favor non-halogenated retardants. Countries like Germany and France are key consumers, focusing on the automotive and industrial manufacturing sectors. The market emphasizes sustainable production and the use of PPA in innovative polymer applications that meet strict European Union safety and toxicity standards.

- Latin America (LATAM): The LATAM market, while smaller, is positioned for accelerated growth, particularly in Brazil and Mexico, due to increasing foreign investment in manufacturing and infrastructure. As these economies industrialize, the adoption of international fire safety standards creates a nascent but rapidly expanding market for PPA-based flame retardants, shifting away from outdated chemical additives.

- Middle East and Africa (MEA): Growth in the MEA region is intrinsically linked to large-scale construction projects, especially in the GCC countries, requiring significant volumes of fire-resistant building materials. The market is emerging, with demand focused on construction chemicals and water treatment applications. Supply often relies on imports, presenting opportunities for international PPA suppliers to establish regional distribution hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Phenylphosphonic Acid Market.- Merck KGaA

- Santa Cruz Biotechnology

- Alfa Aesar (Thermo Fisher Scientific)

- TCI Chemicals

- Acros Organics

- Angene International Limited

- HBCChem, Inc.

- Clearsynth Labs

- Strem Chemicals

- Parchem fine & specialty chemicals

- Nanjing Chembridge Chemical

- Wuhan Beite Chemical

- Hebei Vairun Chemical

- Zibo Guanghe Chemical

- Jiangsu Changyu Chemical

- Qingdao Zhongda Chemical

- Tokyo Chemical Industry

- Finar Chemicals

- J&K Scientific

- AstaTech Inc.

Frequently Asked Questions

Analyze common user questions about the Phenylphosphonic Acid market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Phenylphosphonic Acid primarily used for in the industry?

Phenylphosphonic Acid (PPA) is primarily utilized as a vital chemical intermediate, specifically in the synthesis of non-halogenated, phosphorus-based flame retardants for polymers, plastics, and textiles. Its high thermal stability also makes it valuable in pharmaceutical synthesis and specialized corrosion inhibition formulations, addressing critical safety and performance requirements across electronics and construction sectors.

How does the shift toward halogen-free flame retardants impact PPA market growth?

The global regulatory push, notably in Europe and North America, to phase out halogenated flame retardants due to environmental and health concerns is a fundamental driver for PPA market growth. As a precursor to effective phosphorus-based alternatives, PPA benefits directly from this mandate, positioning it as a preferred, non-toxic solution for achieving modern fire safety compliance in high-performance materials.

Which Purity Type of Phenylphosphonic Acid holds the highest market share?

The 98% Purity Type of Phenylphosphonic Acid commands a substantial market share. This high-grade purity is mandated by applications in the electronics, advanced polymer, and pharmaceutical sectors, where strict quality control is essential. While lower purity grades exist for bulk chemical synthesis, the value generation is concentrated in the high-purity segment due to premium pricing.

Which geographic region currently dominates the consumption of Phenylphosphonic Acid?

The Asia Pacific (APAC) region, led by manufacturing hubs in China and India, dominates the global consumption of Phenylphosphonic Acid. This dominance is attributable to rapid industrialization, large-scale polymer production, expansive electronics manufacturing bases, and the increasing adoption of modern building codes demanding fire-resistant construction materials.

What are the key technological advancements influencing PPA manufacturing efficiency?

Key advancements focus on implementing continuous flow chemistry and highly efficient purification methods, such as fractional crystallization and advanced membrane technology. These technological shifts enhance process safety, reduce production cycle times, improve yield, and ensure the consistent production of ultra-high purity PPA required for specialized, high-specification end-uses.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager