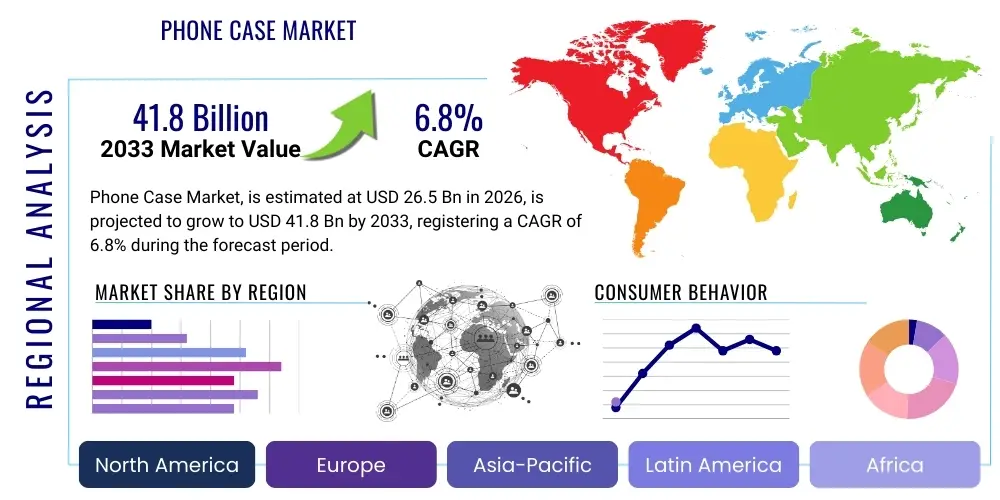

Phone Case Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435583 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Phone Case Market Size

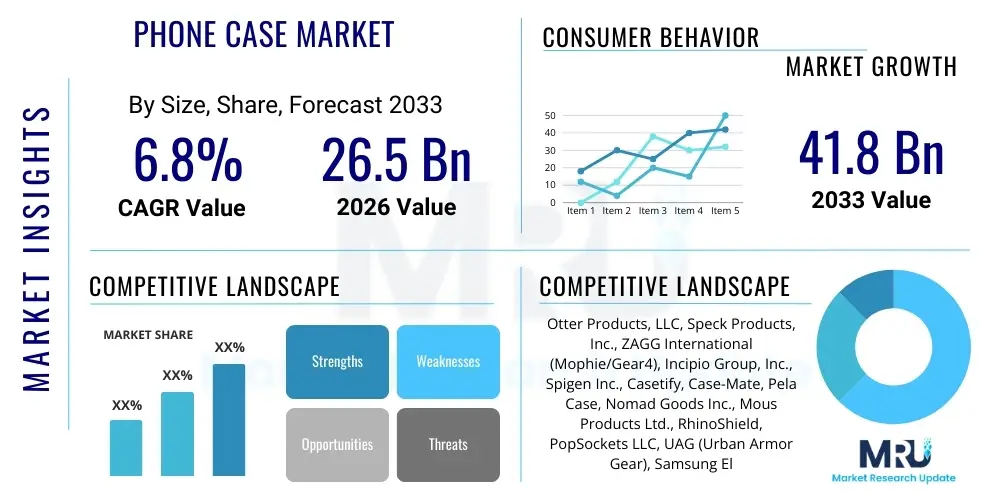

The Phone Case Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 26.5 Billion in 2026 and is projected to reach USD 41.8 Billion by the end of the forecast period in 2033.

Phone Case Market introduction

The Phone Case Market encompasses the design, manufacturing, and distribution of protective and aesthetic accessories utilized for mobile devices globally. These products serve the primary function of protecting smartphones and tablets from physical damage, including scratches, drops, and impacts, thereby extending the device's operational lifespan. Beyond protection, phone cases have rapidly evolved into fashion statements and tools for personalization, driven by increasing consumer desire for unique aesthetics and customized functionality. Product types span materials such as silicone, plastic, leather, and specialized biodegradable polymers, catering to diverse consumer needs from rugged outdoor use to sleek, professional environments. Major applications involve integration with rising smartphone penetration across developing economies, increasing average device costs, and the fast-paced cycle of new device releases that necessitate tailored protection solutions. The primary benefits include enhanced durability, improved grip, device personalization, and integration of secondary functions like wallets or portable batteries.

Key driving factors fueling market expansion include the substantial growth in smartphone shipments globally, particularly in Asia Pacific and Latin America, where first-time smartphone users prioritize protection investments. Furthermore, the introduction of expensive flagship models by major manufacturers (Apple, Samsung, Huawei) increases consumer willingness to spend on high-quality protective gear to safeguard their significant investment. Technological advancements in material science, leading to thinner, lighter, and more protective materials like advanced polycarbonate and aramid fiber, continually refresh the market and attract repeat purchases. The market is also heavily influenced by e-commerce penetration, which facilitates direct-to-consumer sales and allows smaller, niche manufacturers to compete effectively on design and material innovation.

The market landscape is characterized by intense competition, with players focusing on product differentiation through patented shock-absorption technologies, sustainable materials, and licensing agreements with popular media franchises for branded cases. Demand is inherently cyclical, tied directly to the refresh cycle of major smartphone lines, requiring manufacturers to maintain highly agile supply chains and design pipelines. The regulatory environment concerning material safety and environmental impact, particularly regarding plastics and packaging waste, is increasingly shaping product development toward eco-friendly and sustainable solutions, positioning sustainability as a critical market driver.

Phone Case Market Executive Summary

The Phone Case Market Executive Summary indicates robust expansion fueled primarily by emerging market adoption of high-value smartphones and sustained consumer demand for personalization and specialized protection. Business trends highlight a strong shift towards the premium segment, where consumers prioritize advanced features such as anti-microbial coatings, MagSafe compatibility, and integrated utility functions (e.g., stands, cardholders), driving higher average selling prices (ASPs). Strategic partnerships between case manufacturers and major device OEMs for optimized product fit and early access design specifications are becoming crucial competitive differentiators, emphasizing ecosystem integration over generic fit solutions. The proliferation of biodegradable and recycled material usage is a major operational shift, responding to global regulatory pressures and escalating consumer environmental consciousness, influencing procurement and manufacturing investment strategies significantly across all major segments.

Regional trends reveal Asia Pacific (APAC) as the undisputed leader in volume growth, driven by massive installed bases in China and India, although North America and Europe maintain the highest ASPs due to strong brand loyalty and high demand for specialized rugged and designer cases. Developing regions are experiencing rapid urbanization and disposable income increases, translating into faster market penetration for mid-range and premium device accessories. Supply chain risks, particularly reliance on Eastern manufacturing hubs, are prompting strategic diversification, with some companies exploring localized production or advanced automation to mitigate geopolitical and logistical instabilities, ensuring greater resilience and faster time-to-market for new designs coinciding with device launches.

Segment trends underscore the dominance of the protective case category, though niche segments like battery cases and specialty material cases (e.g., wood, carbon fiber) exhibit above-average growth rates. Distribution channel dynamics show a sustained migration towards online sales platforms (e-commerce and proprietary brand websites), offering richer product customization tools and bypassing traditional retail markups. However, the brick-and-mortar presence, especially through authorized reseller channels, remains vital for immediate purchases and tactile product evaluation, particularly in the mid-to-high-end market where material feel and fit are decisive purchase factors. The ongoing modularization of phone accessories, exemplified by magnetic attachment systems, is defining future segment expansion possibilities.

AI Impact Analysis on Phone Case Market

User questions related to AI's impact on the Phone Case Market often center on its role in design optimization, personalized consumer experiences, and supply chain efficiency. Key themes include how AI can predict future design trends based on social media data and color palettes, how predictive maintenance and quality control can be improved in manufacturing, and whether AI-driven customization platforms will revolutionize the direct-to-consumer model. Concerns revolve around the intellectual property rights of AI-generated designs and the potential displacement of human designers. Expectations are high regarding hyper-personalized products, faster concept-to-market cycles, and enhanced inventory management that drastically reduces waste by aligning production volumes precisely with fluctuating consumer demand patterns across various geographic and demographic segments.

The integration of Artificial Intelligence is fundamentally transforming the phone case value chain, moving beyond simple automation to sophisticated decision-making and optimization. In product development, Generative Design AI is employed to create complex lattice structures and material geometries that maximize shock absorption while minimizing material usage and thickness, resulting in superior protective performance that is often counter-intuitive to traditional human engineering principles. This AI-driven material science simulation allows for rapid testing of thousands of structural variations virtually, drastically cutting down on prototyping time and costs. Furthermore, AI analytics are instrumental in market forecasting, ingesting data from historical sales, seasonal trends, and social media sentiment analysis to predict style longevity and color popularity with unprecedented accuracy, ensuring manufacturers invest optimally in materials and SKUs that guarantee high sell-through rates.

In manufacturing and supply chain management, AI algorithms are optimizing factory floor operations by predicting equipment failures before they occur (predictive maintenance), adjusting production lines dynamically based on real-time component availability, and improving quality control through automated visual inspection systems that detect microscopic defects faster and more reliably than human operators. For consumers, AI powers recommendation engines that suggest personalized case designs and materials based on device usage patterns, lifestyle data, and linked purchase histories, thereby enhancing conversion rates in e-commerce channels. Moreover, machine learning facilitates highly efficient dynamic pricing strategies, allowing brands to adjust prices instantly in response to competitor actions, inventory levels, and location-specific demand fluctuations, maximizing revenue yield without compromising brand perception or perceived value.

- AI-Powered Generative Design: Optimizes complex protective geometry for maximum shock absorption and minimal bulk.

- Predictive Trend Forecasting: Uses social listening and sales data to forecast popular colors, textures, and licensed themes months in advance.

- Automated Quality Inspection: Utilizes computer vision systems to ensure precise fit and detect subtle manufacturing flaws in real-time.

- Supply Chain Optimization: Machine Learning algorithms improve inventory planning and dynamic warehousing decisions, reducing obsolescence risk.

- Hyper-Personalization Engines: AI-driven e-commerce platforms offer unique, customized case designs based on individual user data and preferences.

- Enhanced Production Efficiency: Predictive maintenance reduces machine downtime, ensuring high manufacturing throughput during critical product launch periods.

DRO & Impact Forces Of Phone Case Market

The Phone Case Market is governed by a dynamic set of Drivers, Restraints, and Opportunities (DRO) which collectively define the trajectory and competitive intensity of the industry. Primary drivers include the continuous increase in global smartphone penetration, especially the transition of entry-level users to more expensive, fragile devices, creating an immediate need for protection. The relentless pace of technological obsolescence, where major manufacturers release new phone models annually, compels consumers to purchase compatible new cases, sustaining market turnover. Restraints primarily involve the high saturation in developed markets, leading to intense price competition and margin pressure, coupled with growing consumer resistance to plastic waste, which necessitates costly shifts toward sustainable and bio-degradable materials. Opportunities lie in the burgeoning integration of enhanced functionality, such as embedded payment chips, advanced thermal management layers, and modular attachment systems, moving the case beyond mere protection into a multifaceted accessory platform.

Drivers are heavily influenced by consumer behavior, specifically the rising willingness to invest in aesthetic customization as smartphones become central to personal identity. This trend supports the premiumization of the market, where design, brand reputation, and celebrity endorsements command high prices, often surpassing the cost of basic protective functionality. Furthermore, the increasing repair costs for high-end smartphone displays and chassis incentivize preventive spending on robust cases, positioning the accessory as a necessary insurance policy rather than a luxury item. The expansion of 5G networks and associated power consumption also creates a demand for specialized cases that incorporate enhanced thermal dissipation features, ensuring optimal device performance during demanding applications like gaming and high-definition streaming, catering to the needs of power users.

Restraints are compounded by the complexity of managing a vast product portfolio required to cover thousands of unique device models and variations across different generations, leading to challenges in inventory management and forecasting accuracy. The proliferation of low-cost, counterfeit products, particularly through unregulated online marketplaces, erodes the market share and brand equity of established premium manufacturers, forcing continuous legal and technological expenditure on anti-counterfeiting measures. Impact forces, which are the synergistic effects of these DRO elements, emphasize the critical nature of speed-to-market; manufacturers who can deliver high-quality, customized cases simultaneously with the global launch of flagship devices gain significant competitive leverage, capturing the immediate surge in accessory demand and consolidating early market presence. The sustainability mandate acts as a transformative impact force, driving rapid material innovation and shifting consumer preferences towards certified eco-friendly options, requiring significant R&D investment.

The convergence of advanced materials science and digital manufacturing processes, such as 3D printing for rapid prototyping and limited-edition customization, offers powerful opportunities for market differentiation. Exploiting licensing deals with major media properties (movies, games, sports teams) further expands the addressable market by tapping into fan loyalty, adding a significant layer of emotional value to the product. Effectively navigating the regulatory landscapes concerning e-waste and material sourcing, particularly in Europe and parts of Asia, will determine long-term operational viability and brand trust. The strategic pivot towards accessory ecosystems, moving from standalone cases to interconnected modular systems, represents the most significant forward-looking opportunity for value creation and sustained growth in the latter half of the forecast period.

Segmentation Analysis

Segmentation analysis of the Phone Case Market is critical for understanding the diverse needs across the consumer base and identifying high-growth niches. The market is primarily segmented based on material type, distribution channel, device type compatibility, and case features. Material segmentation, covering silicone, plastic, leather, and specialized textiles, reflects varying consumer priorities regarding cost, protection level, and aesthetic appeal. Plastic, including polycarbonate and TPU, remains the volume leader due to cost-effectiveness and versatility, while specialized materials like aramid fiber dominate the high-end rugged segment, commanding premium pricing. Distribution channels are polarizing between the hyper-convenience of e-commerce platforms and the necessity of specialized brick-and-mortar stores for immediate or specialized purchases, demanding an omnichannel presence from major vendors.

Further segmentation by device type reveals that smartphone cases overwhelmingly dominate the market, though tablet and wearable device cases are emerging high-growth subsegments driven by educational technology adoption and increasing sales of smartwatches. Feature-based segmentation is becoming increasingly granular, differentiating between basic protective cases, wallet cases offering financial utility, battery cases providing extended power, and specialized rugged cases designed for industrial or extreme outdoor use. The proliferation of feature-rich cases signals a mature market moving toward value-added functionality rather than purely defensive protection. The interplay between these segments often dictates pricing power; for example, a biodegradable TPU case sold through a brand's direct-to-consumer e-commerce channel often achieves higher margins than a generic plastic case sold via mass retail.

The analysis confirms that the market is not monolithic; successful market penetration requires tailored product strategies for each segment. For instance, the younger demographic often prioritizes customization and transient aesthetic trends, favoring lower-cost, high-design plastic or silicone cases, while business professionals gravitate toward high-durability, leather, or understated polycarbonate cases purchased through premium retail or carrier channels. Geographic and demographic variances also heavily influence segment adoption rates, with rugged cases being more popular in regions with physical outdoor activities and designer cases thriving in fashion-forward metropolitan areas. Continuous monitoring of these segment dynamics is essential for efficient inventory allocation and targeted marketing campaigns to maximize the return on SKU investment.

- By Material Type:

- Plastic (Polycarbonate, TPU, TPE)

- Silicone/Rubber

- Leather (Natural and Synthetic)

- Fabric/Textile

- Wood/Bamboo

- Metal (Aluminum, Alloys)

- Hybrid/Composite (Aramid Fiber, Carbon Fiber)

- By Distribution Channel:

- Online (E-commerce Platforms, Brand Websites)

- Offline (Specialty Stores, Multi-brand Retail, Carrier Stores, Mass Retail)

- By Device Type:

- Smartphones

- Tablets

- Wearables (Smartwatches)

- By Case Feature/Product Type:

- Basic Protective Cases (Slim Fit)

- Rugged/Heavy-Duty Cases

- Wallet/Folio Cases

- Battery Cases

- Customized/Designer Cases

Value Chain Analysis For Phone Case Market

The value chain for the Phone Case Market starts with upstream activities involving raw material procurement and advanced material science research. Upstream analysis focuses heavily on securing high-quality, specialized polymers (TPU, PC), sustainable bio-plastics, and premium textiles or leather. Manufacturers are increasingly negotiating long-term contracts with material suppliers who can ensure traceability and sustainability certifications, especially for recycled content, mitigating volatility in commodity prices. Key upstream concerns include the dependence on oil-derived plastics, driving intense R&D investment into alternatives like plant-based polymers and glass-reinforced composites to ensure the protective integrity of the final product while meeting environmental mandates. Successful upstream management involves strategic relationships with chemical companies capable of rapid formulation changes to align with evolving smartphone cooling and connectivity requirements (e.g., non-interference with 5G signals).

Midstream activities encompass design, prototyping, manufacturing, and assembly. This stage is dominated by the need for speed-to-market, requiring manufacturers to employ sophisticated CAD software and rapid prototyping techniques (like 3D printing) immediately following the leak or official announcement of new device dimensions. High precision injection molding and advanced CNC machining are essential for producing cases with exact tolerances to ensure a perfect fit, a non-negotiable quality factor for consumers. Downstream analysis focuses on packaging, logistics, distribution, and end-user sales. Efficient downstream execution necessitates robust warehousing capabilities and scalable fulfillment centers, particularly crucial for handling the high volume of smaller, high-mix orders characteristic of the e-commerce channel, where customer expectations for fast, trackable shipping are non-negotiable.

Distribution channels are broadly divided into direct and indirect routes. Direct distribution (D2C) via proprietary brand websites and flagship stores allows for maximum control over pricing, brand experience, and direct consumer feedback capture, enabling faster product iterations. Indirect channels, which include major electronics retailers, mobile carriers (telcos), and large e-commerce marketplaces (Amazon, eBay), provide the necessary scale and reach, particularly in emerging markets. Carrier stores are critical for capturing accessory sales at the point of device purchase. The distribution strategy must balance high-volume efficiency offered by indirect channels with the brand integrity and margin preservation afforded by direct sales. Effective value chain management, from material sourcing to shelf placement, is the primary determinant of profitability in this highly commoditized yet competitive accessory sector.

Phone Case Market Potential Customers

Potential customers for the Phone Case Market span the entire spectrum of mobile device users, but segmentation reveals distinct purchasing profiles based on device value, usage environment, and demographic factors. The largest segment comprises average consumers seeking general protection against daily wear and tear for their mid-range or flagship smartphones. These buyers prioritize a balance between moderate protection, aesthetic appeal, and cost-effectiveness. Their purchase decisions are heavily influenced by mainstream retail displays, carrier recommendations, and social media trends, often opting for branded, slim-fit or hybrid material cases that offer reliable drop protection without excessive bulk.

A significant high-value customer group includes business professionals and early technology adopters who own expensive flagship devices. These buyers are less price-sensitive and demand premium materials (leather, carbon fiber) or highly functional cases (MagSafe compatible, integrated wallet features). For this demographic, the case serves as a status symbol and a productivity tool; purchases are often made through authorized premium retailers or directly from specialized high-end accessory brands known for quality and refined design aesthetics. Durability and compatibility with corporate charging ecosystems are critical factors influencing their purchasing behavior and brand loyalty within this segment.

Niche but rapidly expanding segments include the "Rugged User" (construction workers, outdoor enthusiasts, military personnel) who require maximum, uncompromising protection against extreme environments, favoring highly durable, sealed, multi-layered cases often meeting military-grade drop standards (MIL-STD-810G). Conversely, the "Aesthetic-Focused User" (young adults, fashion-conscious consumers) views the case purely as an extension of style, frequently purchasing multiple cases to match outfits or seasonal trends. These buyers are heavily influenced by influencer marketing, limited-edition collaborations, and customization options, driving demand for innovative design, unique textures, and licensed artwork, often transacting through direct-to-consumer e-commerce platforms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 26.5 Billion |

| Market Forecast in 2033 | USD 41.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Otter Products, LLC, Speck Products, Inc., ZAGG International (Mophie/Gear4), Incipio Group, Inc., Spigen Inc., Casetify, Case-Mate, Pela Case, Nomad Goods Inc., Mous Products Ltd., RhinoShield, PopSockets LLC, UAG (Urban Armor Gear), Samsung Electronics Co., Ltd. (Accessory Division), Apple Inc. (Accessory Division), Xiaomi Corporation (Accessory Division), Belkin International, Inc., Element Case, Inc., Griffin Technology, 3SIXT. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Phone Case Market Key Technology Landscape

The technological landscape of the Phone Case Market is increasingly sophisticated, driven by the need to offer high protection in slimmer form factors and integrate seamless device functionality. Core technologies center on material science innovation, focusing on multi-layer polymer composites that achieve military-grade drop protection through advanced shock dispersion techniques, often utilizing patented internal lattice structures or proprietary cushioning geometry (e.g., D3O, Poron XRD). This requires continuous investment in materials R&D to develop polymers that resist yellowing, possess anti-microbial properties, and maintain elasticity over the device's lifespan, ensuring sustained protective performance. Furthermore, the integration of specialized coatings, such as oleophobic or scratch-resistant layers, enhances user experience and maintains the aesthetic integrity of the case despite heavy usage, adding measurable perceived value.

Beyond physical protection, critical technological advancements involve magnetic and modular connectivity systems. The introduction of MagSafe technology by Apple, and similar proprietary systems by other OEMs, has necessitated a massive technological shift across the accessory ecosystem. Case manufacturers must now incorporate precise magnetic arrays directly into the case structure, ensuring flawless alignment with the device for charging, secure attachment of wallets, and compatibility with mounting systems. This requires high-precision manufacturing processes to embed these magnetic components without compromising wireless charging efficiency or structural integrity. This modular approach is driving innovation in functional accessories that snap on and off, transforming the case from a singular protector into a customizable platform for specialized tools and peripherals.

Manufacturing technology also plays a pivotal role, with rapid prototyping via industrial 3D printing allowing companies to drastically compress the design cycle, moving from concept to production-ready mold in days rather than weeks, a critical advantage coinciding with rapid device launch cycles. Automation, particularly high-speed injection molding and robotic assembly lines, ensures mass production meets stringent quality control standards regarding fit and finish, reducing human error and boosting scalability. The future technology landscape will increasingly focus on embedded intelligence, potentially incorporating low-power sensors into cases for monitoring environmental conditions, UV exposure, or even basic device health metrics, further expanding the case's utility beyond passive defense into active enhancement of the mobile experience.

Digital technologies, specifically in the realm of personalization and manufacturing, are also key differentiators. Advanced dye-sublimation and UV printing techniques allow for high-resolution, complex graphical printing directly onto various case materials, facilitating the rise of fully customized, one-off cases ordered through direct-to-consumer digital portals. This technological capability supports the lucrative designer and licensed merchandise segments by allowing rapid deployment of complex artwork. Moreover, the pursuit of sustainable technologies, including closed-loop recycling processes for used plastic cases and the utilization of certified compostable bioplastics, represents a major technological challenge, requiring manufacturers to maintain protective strength while satisfying strict degradability criteria without impacting device connectivity or thermal management.

Regional Highlights

The global Phone Case Market exhibits significant regional variations in growth rate, consumer preference, and market maturity, dictating tailored strategies for successful penetration. North America (NA) and Europe remain established, high-value markets characterized by a mature consumer base that prioritizes quality, brand reputation, and advanced functionality. Consumers in these regions show a high propensity to spend on premium cases, including ruggedized, sustainable, and designer options, driving high Average Selling Prices (ASPs). The prevalence of major OEM launches, coupled with strong e-commerce infrastructure and high brand loyalty, cements these regions as centers for accessory innovation and the early adoption of new technologies like MagSafe compatibility and advanced material science. However, market growth here is generally steady rather than explosive, focusing on replacement cycles and upgrades.

Asia Pacific (APAC) stands out as the primary engine for volume growth, driven by massive smartphone ownership and rapid penetration in emerging economies like India, Indonesia, and Southeast Asia. While the volume is enormous, the price sensitivity in many APAC sub-regions leads to a higher demand for mid-range and budget-friendly cases. However, China, Japan, and South Korea represent significant premium segments where customized designer cases and licensed character themes are highly sought after. The competitive landscape in APAC is fragmented, with strong local manufacturers competing fiercely with global brands on speed and price. The rapid adoption of new smartphone models in APAC necessitates agile manufacturing and distribution networks capable of delivering high-volume SKUs quickly across diverse retail environments.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging high-growth regions, benefiting from increasing disposable incomes and expanding mobile network coverage, particularly 4G and 5G penetration. These regions show strong demand for robust protective cases due to varying infrastructure quality and consumer concern over device damage, making the rugged segment highly lucrative. MEA markets, in particular, are characterized by high brand awareness for premium global players but also strong local demand for value-oriented products, creating a complex dual market structure. Challenges in these regions include underdeveloped formal retail channels and logistical complexities, often making online marketplaces and informal distribution networks key access points for accessory sales. Strategic investments in localized fulfillment and anti-counterfeiting measures are crucial for capitalizing on the high growth potential in LATAM and MEA, targeting the substantial base of mid-range smartphone users upgrading to flagship-level protection.

- North America: Mature market characterized by high ASPs, strong demand for premium, rugged, and functional cases (e.g., MagSafe, wallet integration). Focus on sustainability and high brand loyalty.

- Europe: Similar to North America, emphasizing design aesthetics, eco-friendly materials, and adherence to strict EU regulations regarding material safety and recyclability. Strong online distribution dominance.

- Asia Pacific (APAC): Leading region in sales volume, fueled by massive smartphone installed base in China and India. Exhibits a dual market structure with high price sensitivity in mass markets and significant demand for designer/licensed cases in developed economies (Japan, Korea).

- Latin America: High growth potential driven by increasing smartphone penetration and urbanization. Strong preference for protective, durable cases due to local usage conditions.

- Middle East and Africa (MEA): Emerging market with rapidly growing demand for both budget and premium protection. Characterized by increasing uptake of flagship devices and subsequent demand for reliable accessory protection.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Phone Case Market.- Otter Products, LLC (OtterBox, LifeProof)

- Speck Products, Inc.

- ZAGG International (Mophie, Gear4)

- Incipio Group, Inc.

- Spigen Inc.

- Casetify

- Case-Mate

- Pela Case

- Nomad Goods Inc.

- Mous Products Ltd.

- RhinoShield

- PopSockets LLC

- UAG (Urban Armor Gear)

- Samsung Electronics Co., Ltd. (Accessory Division)

- Apple Inc. (Accessory Division)

- Belkin International, Inc.

- Element Case, Inc.

- Griffin Technology

- 3SIXT

- Nillkin Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Phone Case market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Phone Case Market?

The Phone Case Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between the forecast years of 2026 and 2033. This growth is driven primarily by increasing global smartphone shipments and the sustained consumer need for premium device protection.

How is the shift towards sustainable materials impacting phone case manufacturers?

The demand for sustainable materials is a critical market driver, compelling manufacturers to invest heavily in R&D for compostable bioplastics, recycled polymers, and ethically sourced textiles. This shift addresses growing consumer environmental consciousness and legislative pressures, particularly in European and North American markets, influencing material sourcing and manufacturing processes.

Which segmentation factor currently holds the largest market share in the phone case industry?

The segmentation by product type indicates that the Basic Protective Cases and Hybrid Cases (combining hard plastic and soft TPU) currently hold the largest market share in terms of volume. However, the Rugged/Heavy-Duty and specialized functional cases (like battery or wallet cases) command the highest Average Selling Prices (ASPs).

What role does Artificial Intelligence (AI) play in modern phone case design and manufacturing?

AI is increasingly utilized for Generative Design, optimizing complex lattice structures for superior shock absorption with minimal material usage. Furthermore, AI predictive analytics are crucial for accurate trend forecasting, supply chain optimization, and ensuring rapid, high-precision quality control during automated manufacturing processes.

Which geographic region is expected to generate the highest volume sales in the coming years?

The Asia Pacific (APAC) region is forecasted to generate the highest volume sales, spearheaded by the massive installed base and rapidly growing smartphone adoption rates in countries such as China and India. This region benefits from significant population size and ongoing digital transformation initiatives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager