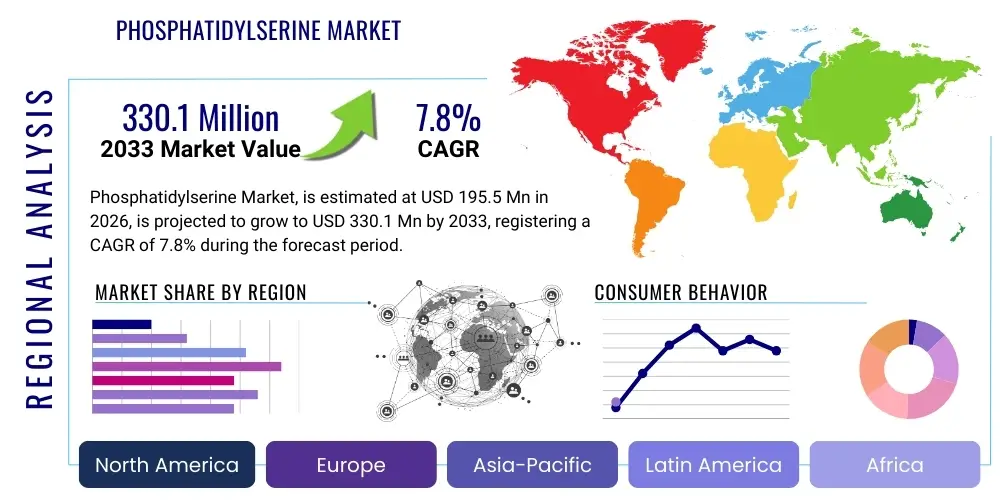

Phosphatidylserine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438292 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Phosphatidylserine Market Size

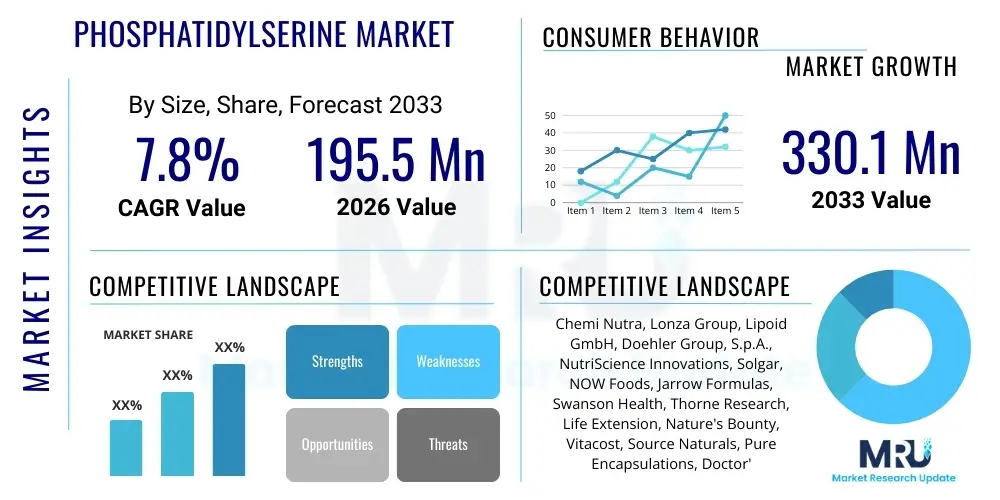

The Phosphatidylserine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 195.5 Million in 2026 and is projected to reach USD 330.1 Million by the end of the forecast period in 2033.

Phosphatidylserine Market introduction

The Phosphatidylserine (PS) market encompasses the global trade of this vital phospholipid, which is naturally present in the human cell membrane, particularly concentrated in the brain. Recognized primarily for its nootropic benefits, PS plays a crucial role in maintaining cellular function, specifically synaptic transmission and overall cognitive health. It is commercially sourced primarily from soybean lecithin and, increasingly, from sunflower lecithin to cater to non-GMO demands. The utilization of PS spans across various sectors, predominantly dietary supplements targeting brain function, stress reduction, and athletic performance enhancement.

Major applications of Phosphatidylserine include its incorporation into supplements formulated for age-related cognitive decline, attention deficit hyperactivity disorder (ADHD) management, and cortisol regulation for stress relief. The key benefits driving its demand are improved memory recall, enhanced focus, reduced mental fatigue, and crucial support for cellular communication within the central nervous system. As global populations age and awareness regarding proactive brain health grows, the demand for clinically supported ingredients like PS escalates significantly.

Driving factors for market expansion are multi-faceted, including strong clinical evidence supporting PS efficacy, increasing consumer preference for natural nootropics over synthetic alternatives, and the expanding geriatric demographic worldwide. Furthermore, the rising incidence of stress-related disorders and the intense focus on mental performance optimization among students and professionals are boosting its adoption in the functional food and beverage space, thereby diversifying its application portfolio beyond traditional supplements.

Phosphatidylserine Market Executive Summary

The Phosphatidylserine market is experiencing robust growth fueled by favorable business trends centered around ingredient innovation and application diversification. Key business trends include the shift towards non-GMO and allergen-free PS sources, particularly sunflower-derived PS, which opens access to broader consumer bases sensitive to soy. Furthermore, increasing investment in clinical trials to validate PS efficacy in specific areas like sports nutrition (cortisol reduction) and children's cognitive health is solidifying its premium market position. Manufacturers are focusing on developing highly bioavailable encapsulated forms to enhance product stability and consumer compliance, thereby driving revenue growth.

Regional trends indicate North America and Europe retaining dominant market shares due to high consumer spending on dietary supplements, established regulatory frameworks supporting nutraceutical claims, and widespread awareness among health practitioners. However, the Asia Pacific (APAC) region is poised for the highest growth rate, driven by rapid urbanization, rising disposable incomes, and the growing influence of Western dietary habits and supplement culture, particularly in countries like China, Japan, and India where traditional medicine systems are gradually integrating scientifically proven ingredients. Regulatory changes simplifying import procedures for high-quality functional ingredients in APAC are further accelerating market penetration.

Segment trends reveal that the dietary supplements application segment holds the largest market share, predominantly in capsule and softgel formats. Within the source segment, soybean-derived PS remains dominant due to cost efficiency and supply availability, although sunflower PS is gaining significant traction, reflecting premiumization trends. The functional foods and beverages segment, though smaller, is the fastest-growing application category, driven by increasing consumer demand for convenient, fortified products such as functional yogurts, energy bars, and health drinks that offer cognitive benefits, allowing manufacturers to tap into mainstream consumer consumption patterns effectively.

AI Impact Analysis on Phosphatidylserine Market

User queries regarding the impact of Artificial Intelligence (AI) on the Phosphatidylserine market primarily revolve around three key themes: how AI accelerates discovery and formulation, how it optimizes supply chain logistics for specialized ingredients, and its role in personalized nutrition recommendations involving PS. Users are keen to understand if AI can streamline the identification of new, more efficient natural sources of PS or novel extraction methods, thereby reducing production costs and environmental impact. A significant concern is whether AI-driven diagnostics will lead to highly individualized PS dosage recommendations, fundamentally changing the mass-market supplement model toward precision health solutions, thus raising expectations for faster, more targeted product development cycles.

- AI-driven genomics analysis accelerates the identification of plant strains (e.g., sunflower or microalgae) with enhanced PS yield, optimizing raw material selection.

- Predictive modeling using AI optimizes fermentation or enzymatic synthesis processes, reducing manufacturing variability and improving PS purity and consistency.

- AI algorithms analyze massive datasets of consumer health profiles, allowing for highly personalized Phosphatidylserine supplement formulations based on genetic markers and cognitive performance needs.

- Machine learning enhances clinical trial efficiency by identifying optimal patient cohorts for PS intervention studies, shortening the time-to-market for new health claims.

- AI-powered demand forecasting and supply chain management reduce inventory costs and minimize spoilage risks associated with sensitive phospholipid ingredients.

- Generative AI assists in creating highly optimized and compliant marketing content, improving the reach and relevance of PS product promotions to specific demographics (e.g., geriatric or sports nutrition).

DRO & Impact Forces Of Phosphatidylserine Market

The market for Phosphatidylserine is primarily driven by mounting scientific evidence validating its efficacy in cognitive enhancement and stress mitigation, coupled with global demographic shifts, especially the rapid growth of the aging population susceptible to neurodegenerative conditions. Restraints include the high production cost associated with extracting and purifying high-grade PS, particularly from non-soy sources, and the regulatory complexities surrounding health claims in different jurisdictions, which necessitate expensive and time-consuming clinical substantiation. Opportunities lie in diversifying PS applications into high-growth areas like specialized clinical nutrition and personalized sports recovery products, along with exploring novel, sustainable sources like microbial synthesis to overcome raw material constraints and address consumer non-GMO preferences. These forces collectively define the market trajectory, creating both momentum for expansion and significant hurdles related to cost and regulatory compliance.

The impact forces influencing the market are substantial. The increasing consumer demand for natural, 'clean label' ingredients that offer tangible health benefits exerts upward pressure on quality standards, pushing manufacturers toward more transparent sourcing and processing. Technological advancements in lipid chemistry and encapsulation are critical impact forces, allowing for better bioavailability and shelf stability, thereby enhancing product performance. Conversely, intense competition from other natural nootropics (such as bacopa monnieri or choline) and the threat of synthetic alternatives pose consistent market challenges, forcing PS suppliers to continuously innovate and substantiate their claims with robust clinical data to maintain premium pricing and market differentiation.

Segmentation Analysis

The Phosphatidylserine market is comprehensively segmented based on its source material, the form in which it is sold, and the end-user application, providing a detailed view of current market dynamics and future growth pockets. Segmentation by source is crucial as it addresses key consumer concerns regarding allergens (soy vs. sunflower) and GMO status, directly impacting pricing and consumer acceptance. Application segmentation highlights the dominance of the burgeoning dietary supplements sector, although the high-growth potential of functional foods and clinical nutrition segments is actively driving innovation in ingredient stability and formulation. Furthermore, segmentation by form (powder, liquid, softgel) is essential for mapping consumer convenience and product incorporation across diverse end-use formulations.

Analyzing these segments allows stakeholders to tailor their product development and marketing strategies effectively. For example, the shift towards sunflower-derived PS represents a strategic response to anti-soy sentiment and the growing demand for non-allergenic ingredients, positioning it as a premium segment. Similarly, the functional foods category requires PS in stable, dispersible powder forms, demanding specialized manufacturing techniques compared to the requirements for standard encapsulated supplements. Understanding the interaction between source, form, and application is vital for accurately forecasting revenue streams and identifying unmet market needs in specific geographical regions.

The continuous evolution of health consciousness globally ensures that segmentation boundaries remain dynamic. As clinical research validates PS effectiveness in specialized areas like pediatric nutrition or high-intensity sports recovery, sub-segments within clinical nutrition are expected to emerge as significant growth drivers. Manufacturers are increasingly integrating high-purity PS into multi-ingredient formulations targeting niche ailments, relying on detailed segmentation analysis to ensure competitive pricing and optimal distribution channel selection. The powder form segment is strategically important for B2B transactions supplying functional food manufacturers and custom supplement formulators, while softgels dominate the direct-to-consumer retail market.

- By Source:

- Soybean

- Sunflower

- Cabbage

- Others (Fish, Microbial Synthesis)

- By Application:

- Dietary Supplements

- Functional Foods and Beverages

- Infant Formula

- Clinical Nutrition

- By Form:

- Powder

- Liquid

- Softgel/Capsule

Value Chain Analysis For Phosphatidylserine Market

The Phosphatidylserine value chain begins with the sourcing of raw materials, primarily lecithin derived from soybeans or sunflowers (upstream analysis). This stage is critical as the quality, non-GMO status, and purity of the lecithin feedstock directly influence the final PS product attributes. Upstream activities involve agricultural practices, harvesting, and initial extraction of crude lecithin, requiring specialized knowledge in oilseed processing and rigorous quality control measures to minimize contaminants and ensure compliance with food and supplement standards. Suppliers must manage volatility in agricultural commodity prices and maintain sustainable sourcing practices, which directly impacts the profitability of the entire value chain.

The core manufacturing stage involves the enzymatic conversion of Phosphatidylcholine (PC) to Phosphatidylserine (PS), a highly specialized and technologically intensive process. Key players invest heavily in proprietary enzymatic synthesis methods and subsequent purification and concentration steps to achieve high-purity PS suitable for human consumption. Following manufacturing, the product is prepared in various forms (powder, liquid) and distributed. Distribution channels are bifurcated: direct channels involve B2B sales of bulk ingredients to large nutraceutical manufacturers, while indirect channels rely on distributors, wholesalers, and specialized agents who supply smaller formulators and regional supplement brands. The efficacy of the supply chain depends heavily on maintaining cold chain or controlled environment logistics due to the sensitivity of phospholipids to heat and oxidation.

The downstream analysis focuses on the final product formulation and end-user engagement. This includes pharmaceutical and nutraceutical companies formulating PS into finished products like capsules, functional bars, and clinical formulas. Retail distribution involves pharmacies, specialized health food stores, mass retailers, and, increasingly, e-commerce platforms. E-commerce plays a vital role in consumer education and direct-to-consumer sales, allowing niche brands to gain market access quickly. Key value addition at the downstream level involves branding, regulatory compliance for labeling, and conducting consumer education campaigns to highlight PS benefits, ultimately influencing purchase decisions by end-users in the dietary supplement and functional food sectors.

Phosphatidylserine Market Potential Customers

Potential customers for Phosphatidylserine span a diverse range of industries focusing on health, wellness, and specialized nutrition, with the primary end-users being manufacturers of finished dietary supplements and functional food products. Nutraceutical companies form the largest buying segment, seeking high-purity PS to formulate products targeting cognitive health, memory enhancement, and mood support for the general adult and geriatric populations. These customers prioritize clinical substantiation, consistent supply, and quality certifications (e.g., GMP, Kosher, Halal) when selecting PS suppliers, often requiring bulk powder forms for encapsulation or tablet pressing.

Another significant customer base comprises the functional food and beverage industry, including manufacturers of health bars, fortified cereals, and specialized dairy products. These buyers require highly stable and dispersible PS forms that do not affect the taste or texture of the final product, often incorporating PS to market their products as 'brain-boosting' or 'stress-reducing' alternatives to traditional snacks. The demand here is driven by the mass market appeal of consuming health benefits via everyday food items, leading to large volume requirements but often at a higher sensitivity to ingredient cost compared to the premium supplement segment.

Furthermore, specialized clinical nutrition companies and infant formula manufacturers represent crucial, albeit highly regulated, potential customers. Clinical nutrition providers use PS in formulations for specific medical purposes, such as neuro-recovery or geriatric malnourishment, demanding the highest quality and safety standards. Infant formula companies, particularly in regions where cognitive development supplements are highly valued, utilize PS, often in combination with DHA, requiring extremely stringent traceability and regulatory compliance due to the vulnerability of the target consumer group. These customers seek long-term supply agreements with established, trustworthy manufacturers capable of meeting pediatric-grade ingredient specifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 195.5 Million |

| Market Forecast in 2033 | USD 330.1 Million |

| Growth Rate | CAGR 7.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Chemi Nutra, Lonza Group, Lipoid GmbH, Doehler Group, S.p.A., NutriScience Innovations, Solgar, NOW Foods, Jarrow Formulas, Swanson Health, Thorne Research, Life Extension, Nature's Bounty, Vitacost, Source Naturals, Pure Encapsulations, Doctor's Best, GNC, Healthy Origins, BulkSupplements.com. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Phosphatidylserine Market Key Technology Landscape

The core technology driving the Phosphatidylserine market centers around enzymatic biosynthesis and advanced purification techniques. The most prevalent method involves converting phosphatidylcholine (PC), sourced from lecithin, into PS using phospholipase D (PLD) enzyme in the presence of L-serine. This enzymatic conversion is preferred over traditional chemical synthesis due to its higher yield, specificity, and ability to produce a natural, highly bioactive form of PS. Ongoing technological innovation focuses on engineering robust and highly efficient PLD enzymes and optimizing reaction conditions (temperature, pH) to reduce processing time and energy consumption, leading to lower production costs and improved scalability for commercial volumes.

Beyond the core conversion process, membrane filtration and chromatographic separation technologies are essential for the purification and concentration of PS, ensuring the removal of residual solvents, unconverted phospholipids, and reaction byproducts to meet stringent purity requirements for the nutraceutical and food industries. Manufacturers are increasingly adopting Supercritical Fluid Extraction (SFE) techniques, particularly for non-soy sources like sunflower lecithin, as SFE is a 'green chemistry' approach that avoids harsh chemical solvents, resulting in cleaner end-products and meeting the growing consumer demand for solvent-free ingredients. This focus on purification technology is crucial for achieving high PS concentrations (typically standardized to 20% to 70% in commercial ingredients).

Furthermore, encapsulation and delivery systems represent a vital technological area, particularly for integrating PS into functional foods and beverages where stability against heat, moisture, and oxygen is paramount. Microencapsulation technologies, including liposomal and complex coacervation techniques, are employed to protect the sensitive PS molecules, enhancing their shelf life and improving their bioavailability upon ingestion. These technological advancements not only preserve the ingredient’s efficacy but also facilitate its incorporation into a broader array of matrixes, thereby enabling market expansion into high-moisture functional beverages and baked goods where traditional PS powder would quickly degrade.

Regional Highlights

- North America (Dominant Market Share): North America, particularly the United States, holds the largest share of the Phosphatidylserine market. This dominance is attributed to high health expenditure, widespread consumer awareness regarding cognitive health supplements, and the strong presence of major nutraceutical manufacturers and retailers. The market here is characterized by high demand for premium, clinically-backed ingredients, with significant growth in the sports nutrition segment where PS is used for managing exercise-induced stress (cortisol levels). Regulatory acceptance of PS as a dietary ingredient under the FDA framework facilitates market accessibility, contributing to consistent demand across all age groups, especially among the affluent senior population.

- Europe (Mature and Quality-Focused): Europe represents a mature market with high penetration of functional foods and supplements, driven by sophisticated regulatory requirements (e.g., EFSA evaluations) that emphasize safety and substantiated claims. Germany, the UK, and France are key contributors. European consumers exhibit a strong preference for non-GMO and allergen-free sources, making sunflower-derived PS particularly popular here. Market growth is sustained by the ongoing societal focus on preventive healthcare and mental wellness, prompting the integration of PS into specialized products targeting occupational stress and student performance enhancement.

- Asia Pacific (Fastest-Growing Region): The APAC region is projected to register the fastest CAGR during the forecast period. This rapid growth is fueled by expanding middle-class populations, increasing acceptance of Western-style supplements, and rising awareness of neurodegenerative diseases in aging populations (especially in Japan and South Korea). China and India are emerging as powerful consumption hubs. The region's market is characterized by a strong demand for ingredients applicable in both traditional supplements and infant formula, although market development is highly reliant on navigating diverse and sometimes complex national regulatory standards regarding novel food ingredients and health claims.

- Latin America (Emerging Market Potential): The Latin American market for PS is still developing but shows high potential, driven by improving economic conditions and increased focus on chronic disease management. Brazil and Mexico are the primary markets, exhibiting rising supplement consumption. Growth is hampered slightly by fragmented distribution channels and lower average consumer spending compared to North America and Europe, but the increasing prevalence of international health brands offers avenues for market expansion.

- Middle East and Africa (Niche Growth Drivers): The MEA market is the smallest contributor but shows niche growth, mainly in the GCC countries (UAE, Saudi Arabia) where high disposable incomes support premium supplement purchases. Growth is linked to urbanization and rising health consciousness, though cultural factors and limited awareness sometimes constrain the widespread adoption of specialized cognitive supplements. Demand is mostly centered around clinical nutrition applications in specialized medical centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Phosphatidylserine Market.- Chemi Nutra

- Lonza Group

- Lipoid GmbH

- Doehler Group

- S.p.A.

- NutriScience Innovations

- Solgar

- NOW Foods

- Jarrow Formulas

- Swanson Health

- Thorne Research

- Life Extension

- Nature's Bounty

- Vitacost

- Source Naturals

- Pure Encapsulations

- Doctor's Best

- GNC Holdings

- Healthy Origins

- BulkSupplements.com

Frequently Asked Questions

Analyze common user questions about the Phosphatidylserine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Phosphatidylserine (PS) in the human body?

Phosphatidylserine is a crucial phospholipid found in cell membranes, primarily aiding in cell signaling, especially in the brain, where it supports synaptic function, memory, and cognitive processing. It is vital for nerve cell health and efficient neurotransmitter release.

Is soybean-derived Phosphatidylserine safe for consumers with soy allergies?

While PS is often derived from soybean lecithin, the final purified product generally contains negligible levels of residual soy protein. However, consumers with severe soy allergies should opt for alternative sources like sunflower-derived PS, which is non-GMO and allergen-free, to ensure complete safety.

What are the main applications driving the growth of the PS market?

The primary growth driver is the dietary supplements segment, targeting age-related cognitive decline, stress reduction (cortisol management), and general mental performance improvement. Functional foods and clinical nutrition segments are also rapidly expanding applications.

Which geographical region is expected to show the fastest growth rate for PS?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to increasing consumer wealth, growing awareness of Western nutraceuticals, and significant aging populations in major economies like China and Japan.

What technological advancements are impacting the production of Phosphatidylserine?

Key technological advancements include optimized enzymatic synthesis using phospholipase D for higher purity yields, the adoption of green chemistry methods like Supercritical Fluid Extraction (SFE), and microencapsulation techniques to enhance ingredient stability in complex food matrices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Phosphatidylserine (PS) Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Phosphatidylserine Market Size Report By Type (20% Content, 50% Content, Other Content), By Application (Dietary Supplement, Functional Foods, Medical Foods, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager