Photochromic Films Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432402 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Photochromic Films Market Size

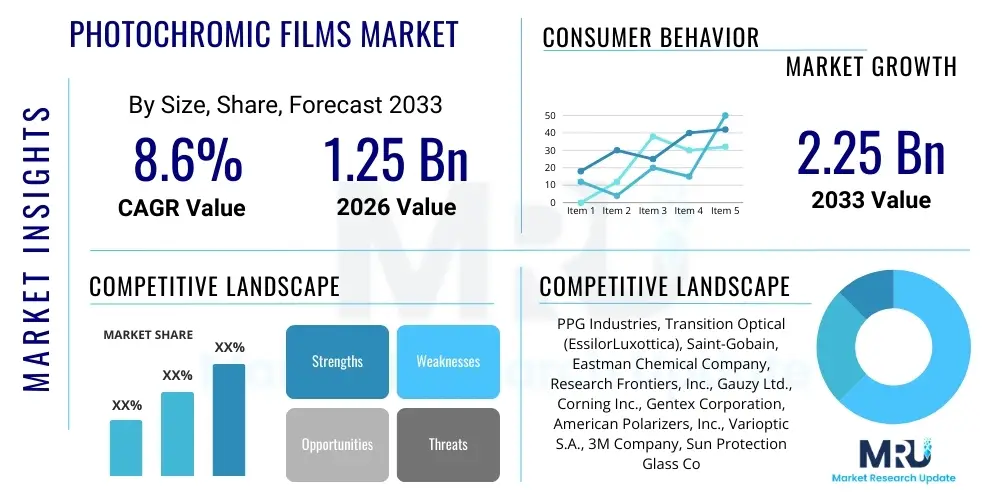

The Photochromic Films Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.6% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 2.25 Billion by the end of the forecast period in 2033.

Photochromic Films Market introduction

The Photochromic Films Market encompasses specialized polymer sheets or coatings that incorporate photochromic dyes or materials, allowing them to reversibly change their light transmission properties in response to ultraviolet (UV) or short-wavelength light exposure. These advanced materials transition from a transparent or lightly tinted state to a darker, light-absorbing state when exposed to sunlight, and revert to their original state when the light source is removed. This dynamic capability addresses the need for adaptive light management, enhancing user comfort, energy efficiency, and privacy across various sectors.

The core product description centers on highly engineered multi-layered film structures where the active photochromic layer is encapsulated or coated onto substrates like PET (Polyethylene Terephthalate) or polycarbonate. The key benefits driving adoption include superior UV protection, glare reduction, and passive solar control, which significantly contribute to lowering cooling costs in buildings and vehicles. Furthermore, the aesthetic appeal of dynamically tinted surfaces offers a premium solution over fixed-tint technologies. Major applications span architectural glazing (smart windows), automotive accessories (sunroofs, windshields, window tinting), and the ophthalmic industry (lenses), making it a versatile component in modern adaptive systems.

Driving factors propelling market expansion involve stringent energy efficiency regulations mandating solar heat gain reduction in construction, coupled with increasing consumer awareness regarding the detrimental effects of prolonged UV exposure on health and interior furnishings. Technological advancements, particularly the development of organic photochromic materials with faster transition speeds and improved durability, are further broadening the application scope beyond traditional eyewear into large-scale architectural and automotive integrations. The market is highly sensitive to innovations in material science that reduce manufacturing costs and enhance performance characteristics, making R&D a critical competitive dimension.

Photochromic Films Market Executive Summary

The Photochromic Films Market is undergoing rapid technological evolution, transitioning from niche ophthalmic applications to mainstream use in automotive and architectural sectors, driven primarily by sustainability mandates and rising demands for personalized and adaptive environments. Business trends indicate a strong move toward integration within smart building technologies and high-end vehicle manufacturing, where these films serve as critical components for energy management and enhanced passenger experience. Strategic partnerships between chemical manufacturers and large-scale film processors are defining the competitive landscape, focusing on scaling production and improving the kinetics of the photochromic response.

Regional trends highlight the Asia Pacific (APAC) region as the dominant growth engine, fueled by rapid urbanization, massive infrastructure development, and increasing adoption of energy-efficient building materials in China and India. North America and Europe, while mature, remain key markets focusing on premium applications and regulatory compliance, particularly in the automotive aftermarket and high-value architectural projects. European markets exhibit a strong preference for sustainable and eco-friendly products, pushing manufacturers toward developing solvent-free coating methods and highly durable film compositions. Meanwhile, emerging economies in Latin America and the Middle East are beginning to adopt these films, particularly for glare reduction and solar heat mitigation in harsh climates.

Segment trends reveal that the architectural segment is projected to exhibit the highest CAGR due to the increasing construction of green buildings and the widespread adoption of dynamic glass solutions. By product type, organic photochromic films, leveraging advanced molecules like naphthopyrans, are gaining significant traction over inorganic variants due to their flexibility, faster switching speeds, and ease of integration into polymer matrices. Furthermore, the shift towards thinner, flexible films capable of being integrated into complex curved surfaces, such as vehicle panoramic sunroofs and flexible displays, represents a key area of differentiation and investment for market participants, promising increased market penetration across diverse applications.

AI Impact Analysis on Photochromic Films Market

Common user questions regarding AI's impact on the Photochromic Films Market revolve around how artificial intelligence can accelerate the discovery of novel photochromic compounds, optimize film manufacturing processes for better consistency and lower cost, and enable predictive performance modeling in varied environmental conditions. Users are keenly interested in whether AI can solve existing material limitations, such as slow fade rates (reversion time) and material degradation under prolonged use. The central themes emerging from these inquiries concern the application of machine learning (ML) in high-throughput screening of potential molecular structures, the integration of AI-powered quality control systems during coating and lamination, and the development of truly adaptive smart windows that use real-time environmental data (collected via sensors and processed by AI) to modulate tinting precisely, thus optimizing indoor climate and energy consumption far more effectively than current passive or manually controlled systems.

AI's most significant immediate impact lies in accelerating material science R&D. Traditional development of photochromic dyes is time-consuming and relies heavily on empirical testing. Machine learning models, trained on vast chemical databases, can predict the photochromic performance (absorption spectrum, switching speed, fatigue resistance) of theoretical molecular structures before costly synthesis. This predictive capability dramatically narrows down the list of viable candidates, speeding up innovation cycles and leading to the creation of next-generation films with superior characteristics, such as enhanced durability and instantaneous switching capabilities, which are crucial for high-performance applications like automotive head-up displays (HUDs) or high-speed architectural applications.

In manufacturing, AI and machine vision systems are transforming the quality assurance and process control stages. Lamination and coating processes require extremely high precision to ensure uniform distribution of the photochromic material. AI algorithms monitor parameters like coating thickness, temperature, and curing time in real-time, instantly identifying and correcting minor deviations that could lead to defects or inconsistent tinting performance. This predictive maintenance and quality optimization drastically reduces material waste, improves manufacturing yields, and ensures that the final product adheres strictly to tight specifications, ultimately driving down the overall production cost per square meter, which is a major restraint for widespread adoption.

- AI accelerates the discovery of novel photochromic molecular structures through predictive modeling and high-throughput virtual screening.

- Machine Learning optimizes manufacturing processes, including coating thickness and lamination parameters, improving yield and reducing material defects.

- AI-driven sensor fusion enables truly adaptive smart windows, modulating tint intensity based on real-time solar irradiance and interior occupancy data.

- Predictive analytics minimizes material fatigue by modeling long-term performance under various climate stresses, enhancing film durability.

- Natural Language Processing (NLP) helps researchers quickly synthesize knowledge from patents and research papers to identify optimal chemical synthesis pathways.

- Robotics and AI-vision systems automate film cutting and handling, ensuring precise custom shapes required for complex automotive glazing applications.

DRO & Impact Forces Of Photochromic Films Market

The Photochromic Films Market is robustly driven by increasing global awareness regarding the necessity of energy conservation and the protective benefits of UV blocking, while simultaneously facing constraints related to inherent material limitations and high initial implementation costs. Significant growth opportunities arise from the ongoing innovation in flexible electronics and the widespread adoption of smart city technologies, particularly integrating dynamic materials into building envelopes and vehicle infrastructure. These drivers, restraints, and opportunities, when synthesized, create distinct impact forces that shape investment decisions, R&D priorities, and market penetration strategies, necessitating a balanced approach focused on improving performance-to-cost ratios.

Drivers include the accelerating adoption of sustainable building practices globally, driven by certifications like LEED and BREEAM, which favor materials capable of reducing energy loads. The aesthetic advantage these films offer—maintaining clear visibility while providing dynamic tinting—is also highly appealing to premium automotive and architectural designers. Restraints primarily involve the current speed limitations, specifically the time required for the film to fully revert to its clear state (fade rate), which can be perceptible and sometimes inconvenient for users. Furthermore, the relatively higher cost compared to traditional static window tints or specialized coatings acts as a barrier, particularly in price-sensitive developing markets or low-to-mid-range construction projects, demanding breakthroughs in scalable, low-cost synthesis of photochromic compounds.

Opportunities are vast, centered on integrating photochromic technology with next-generation applications such as flexible electronic displays, wearable technology, and large-format digital signage that require light management capabilities. The potential for these films to be paired with advanced sensing and IoT devices to create fully autonomous 'smart' window systems represents a significant untapped market segment. The collective impact forces highlight a strong shift towards regulatory compliance and consumer desire for convenience and safety. These forces compel manufacturers to invest heavily in nanotechnology and advanced polymer chemistry to address current performance drawbacks, ensuring the films can withstand harsh environments and provide long-lasting, rapid light adaptation, thereby accelerating their transition from a specialty product to a ubiquitous building and automotive material.

Segmentation Analysis

The Photochromic Films Market is analyzed based on product type, material composition, application, and end-user industry, providing a granular view of market dynamics and growth potential across various dimensions. Understanding these segments is crucial for manufacturers targeting specific market niches, such as high-performance automotive glazing versus large-scale residential window applications. The segmentation by material is particularly relevant as it dictates performance characteristics like switching speed, durability, and integration methods, while the segmentation by application directly reflects the diverse end-user requirements for solar control and aesthetics across commercial and private sectors.

By Product Type, the market is broadly divided into Inorganic Photochromic Films and Organic Photochromic Films. Inorganic films, typically using silver halides, are known for their robustness and durability but often exhibit slower kinetics. Conversely, Organic films, utilizing complex dyes such as naphthopyrans, offer superior flexibility, faster color changing and fading rates, and lighter weight, making them increasingly preferred for advanced polymer matrices and complex, curved applications. The shift towards organic compounds signifies a key technological trend enabling greater design freedom and enhanced end-user experience, particularly in architectural and automotive contexts where rapid, seamless transitions are highly valued.

The Application segment highlights the dominance of the Ophthalmic and Automotive sectors, with Architectural applications showing the fastest projected growth. Ophthalmic applications (prescription eyewear) established the foundational market, emphasizing high optical clarity and rapid response. The Automotive segment utilizes films for glare reduction, solar heat load minimization in cabin interiors, and enhancing privacy. Architectural applications, including smart windows for commercial and residential buildings, leverage these films for significant energy savings by passively controlling daylight harvesting and minimizing reliance on HVAC systems, thus positioning this segment as a major revenue contributor in the medium to long term.

- Product Type

- Inorganic Photochromic Films

- Organic Photochromic Films (Dominant growth driver due to flexibility and speed)

- Application

- Ophthalmic (Eyewear and Contact Lenses)

- Automotive Glazing (Windshields, Sunroofs, Side Windows)

- Architectural Glazing (Smart Windows, Façades)

- Consumer Electronics (Displays and Wearables)

- Other Applications (Security features, Sensor protection)

- End-User Industry

- Construction (Commercial and Residential)

- Transportation (OEM and Aftermarket)

- Healthcare & Optics

Value Chain Analysis For Photochromic Films Market

The value chain for the Photochromic Films Market is highly specialized, beginning with the complex synthesis of advanced chemical components and extending through multi-stage processing before reaching diverse end-user markets. Upstream analysis focuses intensely on chemical manufacturers responsible for producing high-purity photochromic dyes (such as naphthopyrans, spiropyrans, and fulgides) and specialized polymer resins (PET, PVC, Polycarbonate) that form the film matrix. The performance and cost efficiency of the final film product are heavily reliant on the successful R&D and scaling capabilities of these upstream raw material suppliers, necessitating strict intellectual property management and consistent quality control to ensure molecular stability and kinetics.

The midstream phase involves the core manufacturing processes, predominantly film coating and lamination. Film manufacturers convert raw polymers into thin film substrates and then apply the photochromic material through techniques like extrusion coating, dip coating, or specialized vacuum deposition. This processing stage is capital-intensive and requires significant technical expertise to achieve uniform dispersion of the photochromic material, which directly impacts the film's optical consistency and durability. Companies that integrate both chemical synthesis and film manufacturing capabilities often gain a competitive edge by controlling the entire supply chain, enabling faster iteration and customized product development for specific applications like architectural dynamic glass or curved automotive surfaces.

Downstream analysis involves the distribution channels and integration into final products. Distribution is channeled through specialized distributors who handle large rolls of film, or directly to large OEM partners (Original Equipment Manufacturers) in the automotive and construction sectors. Installation and integration services, particularly in the architectural sector (e.g., integrating films into insulated glass units or installing large format window films), represent the final value addition step. Both direct distribution (selling high-volume films directly to Tier 1 automotive suppliers) and indirect distribution (selling through regional aftermarket film installers and architectural glazing contractors) are utilized, with indirect channels requiring extensive technical training and support to ensure correct application and performance validation in the field.

Photochromic Films Market Potential Customers

The Photochromic Films Market targets a broad spectrum of industrial buyers and end-users whose primary needs involve energy management, enhanced safety, superior optical performance, and aesthetic flexibility in light control. Key potential customers include large-scale manufacturers in the automotive industry (both OEM assembly lines and aftermarket accessory providers) seeking solutions for glare reduction, UV protection, and cabin cooling efficiency in modern vehicle designs, including electric vehicles and autonomous fleet management solutions. The continuous requirement for weight reduction and increased energy efficiency in transportation makes these films a critical purchase for automotive engineers focusing on compliance with fuel economy standards and enhancing passenger comfort.

Another major segment constitutes the commercial and residential construction industry, encompassing architectural firms, large real estate developers, and specialized glazing contractors who require dynamic solutions for building envelopes. These buyers prioritize films that contribute positively to energy ratings, provide dynamic privacy, and offer an aesthetically pleasing alternative to traditional blinds or static low-E glass coatings. The growing trend towards smart buildings and sustainable infrastructure means that procurement managers are increasingly evaluating photochromic films based on their life cycle cost savings related to reduced heating, ventilation, and air conditioning (HVAC) demands, making them a strategic investment for long-term operational efficiency.

Furthermore, the ophthalmic industry remains a foundational customer base, purchasing these films for integration into spectacle lenses and contact lenses, focusing on superior optical clarity and fast, reliable switching mechanisms crucial for vision correction and protection under varied light conditions. Additionally, emerging buyers include manufacturers of consumer electronics, seeking protective and adaptive display covers for smart devices and wearables, and specialized security/defense contractors requiring adaptive camouflage or sensor protection films. These diverse buyer needs—spanning energy conservation, visual comfort, and product differentiation—underscore the versatility and expansive market potential of photochromic film technologies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 2.25 Billion |

| Growth Rate | 8.6% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | PPG Industries, Transition Optical (EssilorLuxottica), Saint-Gobain, Eastman Chemical Company, Research Frontiers, Inc., Gauzy Ltd., Corning Inc., Gentex Corporation, American Polarizers, Inc., Varioptic S.A., 3M Company, Sun Protection Glass Co., Ltd., Heliotronic Technologies, Rodenstock GmbH, Mitsui Chemicals, Inc., KDX Optical Material Co., Ltd., Carl Zeiss Vision, SDC Technologies, Inc., Evonik Industries AG, Hoya Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Photochromic Films Market Key Technology Landscape

The Photochromic Films Market relies on sophisticated chemical and material science technologies, primarily centered around the synthesis and incorporation of dynamic molecules into stable polymer matrices. The prevailing technology landscape involves two main groups of photochromic compounds: organic molecules, such as naphthopyrans, spirooxazines, and fulgides, which are highly favored for their tunable properties and fast response kinetics; and inorganic materials, primarily silver halides embedded in glass or specialized plastics. The current technological focus is heavily skewed toward enhancing the performance of organic systems, addressing historic drawbacks related to UV fatigue (longevity) and reducing the time taken for the film to revert to its clear state (thermal fade rate), which remains a critical consumer expectation, especially in high-end automotive applications.

Key manufacturing technologies include advanced coating techniques such as solvent coating, melt coating, and especially roll-to-roll (R2R) processing, which is essential for mass production and achieving the high degree of uniformity required for optical films. R2R processing allows for continuous, high-speed application of the photochromic lacquer onto thin, flexible polymer substrates, drastically reducing production costs and enabling the creation of large-area films necessary for architectural applications. Furthermore, the market is seeing increased adoption of nanotechnology, where photochromic dyes are encapsulated or dispersed at the nanoscale to improve light utilization efficiency, enhance thermal stability, and facilitate seamless integration into complex multi-layer structures, yielding films with superior transparency in their resting state and enhanced color depth when activated.

A significant technological frontier involves the development of hybrid photochromic-thermochromic systems and electrically switchable dynamic window films (Electrochromic/Photochromic hybrids). While photochromism is passive (triggered by UV light), combining it with electrochromic technology allows for active, user-controlled modulation of tinting, offering a superior level of light and glare management tailored to specific indoor conditions regardless of UV intensity. Furthermore, advancements in specialized UV-stabilizer packages and barrier coatings are crucial for protecting the sensitive photochromic dyes from degradation caused by heat and prolonged exposure, thereby extending the operational lifespan of the films, a major commercial requirement for long-life installations such as in building facades and permanent vehicle components.

Regional Highlights

- Highlight key countries or regions and their market relevance

- Asia Pacific (APAC): APAC commands the largest share of the global Photochromic Films Market, primarily driven by rapid infrastructural development, particularly in residential and commercial construction in economies like China, India, and South Korea. These nations exhibit high demand for energy-efficient building materials due to increasing energy costs and government mandates promoting green building initiatives. Furthermore, APAC is a major hub for ophthalmic lens manufacturing and automotive production, leading to high consumption rates of photochromic materials. The region also benefits from lower manufacturing costs, making it a critical production base for the global supply chain, characterized by fierce competition and rapid technology adoption in large-area film processing.

- North America: North America is characterized by high adoption rates in premium and specialized applications, particularly in the automotive OEM segment and high-end commercial architectural projects. Regulatory pressure for improved vehicle safety (glare reduction) and strict building energy codes (ASHRAE standards) push manufacturers toward advanced photochromic and smart window solutions. The U.S. remains the core market, focusing heavily on R&D for faster switching organic dyes and integrated smart glass solutions, often prioritizing superior performance and durability over initial cost, leading to higher average selling prices (ASPs) compared to other regions.

- Europe: The European market demonstrates steady growth, strongly influenced by stringent environmental protection policies and a mature automotive industry focused on advanced material integration. European consumers and regulators emphasize sustainability, prompting demand for eco-friendly coating processes and long-lasting, highly efficient solar control films. Countries like Germany and France lead in the adoption of dynamic architectural glazing in commercial office spaces. The ophthalmic market in Europe is robust, maintaining high standards for optical quality and aesthetic integration in eyewear.

- Latin America (LATAM): The LATAM region, led by Brazil and Mexico, presents significant growth opportunities, driven by increasing urbanization and the need for effective solar heat gain management in tropical and subtropical climates. Although characterized by higher price sensitivity, demand is growing in the mid-to-high-end construction sectors and the automotive aftermarket, fueled by rising disposable incomes and greater focus on vehicular comfort and interior protection from intense sunlight.

- Middle East and Africa (MEA): MEA exhibits unique demands stemming from extremely high solar irradiance and temperature extremes. This drives high demand for maximum solar heat rejection and UV blocking capabilities in construction and automotive applications. The rapid expansion of mega-projects and luxury construction in the Gulf Cooperation Council (GCC) states specifically fuels the demand for premium architectural photochromic films as essential components for energy efficiency and minimizing cooling loads in large glass structures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Photochromic Films Market.- PPG Industries

- Transition Optical (EssilorLuxottica)

- Saint-Gobain

- Eastman Chemical Company

- Research Frontiers, Inc.

- Gauzy Ltd.

- Corning Inc.

- Gentex Corporation

- American Polarizers, Inc.

- Varioptic S.A.

- 3M Company

- Sun Protection Glass Co., Ltd.

- Heliotronic Technologies

- Rodenstock GmbH

- Mitsui Chemicals, Inc.

- KDX Optical Material Co., Ltd.

- Carl Zeiss Vision

- SDC Technologies, Inc.

- Evonik Industries AG

- Hoya Corporation

- ChromaGen International

- DOW Chemical Company

- Sumitomo Chemical Co., Ltd.

- Opticote, Inc.

Frequently Asked Questions

Analyze common user questions about the Photochromic Films market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between organic and inorganic photochromic films?

Organic photochromic films utilize carbon-based dyes (like naphthopyrans) offering faster switching speeds, flexibility, and suitability for polymer substrates. Inorganic films typically use silver halides embedded in glass, providing higher durability and robustness but generally exhibiting slower activation and fade rates. Organic films are dominating new market growth due to their adaptability and kinetic performance improvements.

How do photochromic films contribute to energy efficiency in buildings?

Photochromic films dynamically adjust their tint level in response to sunlight, optimizing solar heat gain. By automatically darkening during intense sun, they significantly reduce the amount of heat entering the building, thereby lowering the dependence on and energy consumption of air conditioning systems, contributing directly to lower operational energy costs and LEED compliance.

What is the main restraint hindering the widespread adoption of photochromic film technology?

The primary restraint is the material’s performance limitations, specifically the speed of reversion (fade rate) and the relatively high initial cost compared to conventional static tints or low-E coatings. Efforts in R&D are focused on developing new molecular compounds with near-instantaneous fade rates and scaling production processes to lower the overall per-unit cost.

Which application segment is projected to show the fastest growth rate?

The Architectural Glazing segment is projected to exhibit the fastest Compound Annual Growth Rate (CAGR). This growth is fueled by increasing investments in smart windows, mandatory green building certifications, and the global trend toward sustainable infrastructure that requires adaptive solutions for light management and solar control in large commercial and residential complexes.

How is Artificial Intelligence impacting the future development of photochromic materials?

AI, particularly machine learning, is accelerating the development cycle by enabling high-throughput virtual screening of novel photochromic molecular structures. This speeds up the identification of compounds with desirable properties (such as rapid switching and high durability), optimizing material formulation and ensuring precise quality control during the manufacturing process.

The Photochromic Films Market, as detailed in this comprehensive report, represents a dynamic and technologically intensive segment within advanced materials science, poised for substantial growth driven by sustainability mandates and consumer demand for adaptive solutions. The projected CAGR of 8.6% underscores a sustained period of market expansion, moving the technology from specialized optics into large-scale architectural and automotive integration. Key players are continually investing in material refinement, focusing on enhancing the kinetics and longevity of organic photochromic dyes, which are essential for overcoming existing market restraints related to fade time and cost efficiency. The integration of smart technology, including AI-driven manufacturing and performance optimization, is expected to be a defining factor in competitive differentiation over the forecast period, ensuring that photochromic films transition successfully into the era of smart infrastructure and connected transportation. Regional dominance remains with the Asia Pacific due to manufacturing scale and construction booms, while North America and Europe lead in high-value, performance-critical applications.

Further analysis of the value chain reveals that controlling upstream chemical synthesis provides significant competitive advantages, allowing vertically integrated companies to rapidly iterate on new product formulations tailored for specific end-user environments. The high demand from the architectural sector, in particular, necessitates continued innovation in large-area coating technologies and compliance with increasingly stringent regional energy performance standards. The strategic focus for market participants must therefore center on reducing the total cost of ownership for end-users by improving film durability and energy-saving capabilities, thereby solidifying the position of photochromic films as an indispensable component of modern energy management systems. This extensive market analysis highlights clear opportunities for stakeholders positioned to leverage rapid advancements in organic material chemistry and smart sensor integration.

The rigorous segmentation analysis confirmed that organic films are outpacing inorganic counterparts due to their versatility and superior response characteristics, crucial for modern applications requiring seamless user experience. The potential customer base is expanding beyond traditional eyewear to include massive purchasers in the transportation and construction sectors, making B2B relationships and OEM partnerships increasingly vital for sustained revenue growth. As global concerns about climate change and UV exposure intensify, the inherent value proposition of photochromic technology—offering dynamic solar control and protection—becomes more compelling across diverse geographies, particularly those experiencing extreme weather conditions. Successfully navigating the challenges related to capital investment and achieving scale in complex manufacturing processes will determine long-term market leadership and profitability across the 2026–2033 forecast horizon.

Technological advancement is not solely limited to the dye chemistry itself; progress in thin-film deposition techniques, such as atomic layer deposition (ALD) and advanced sputtering, are being explored to create multi-functional photochromic layers that also possess properties like anti-reflection or self-cleaning capabilities. These integrated functionalities enhance the perceived value of the films and simplify the installation process for large-scale applications. Furthermore, the convergence of photochromic technology with flexible electronics opens up entirely new verticals, moving these adaptive materials into wearable technologies and interactive displays where dynamic light control is necessary for optimal performance and user privacy. This convergence represents a major long-term opportunity, driving R&D expenditures towards novel substrate materials and low-temperature processing methods compatible with flexible display manufacturing.

Regulatory frameworks across North America and Europe, mandating increased energy efficiency in new construction and automotive glass standards, serve as powerful non-market drivers for photochromic films. Compliance requires solutions that actively mitigate solar heat gain without compromising visibility or safety, criteria perfectly met by dynamic film technologies. In the automotive sector, the rise of panoramic sunroofs and expansive glass surfaces in electric vehicles (EVs) creates specific demand for lightweight, efficient solar control, ensuring cabin temperature stability and maximizing battery range by reducing the strain on the vehicle’s HVAC system. Consequently, manufacturers are actively collaborating with major automotive OEMs to design films optimized for curved surfaces and high-impact resistance, solidifying the market’s reliance on cross-industry technical partnerships for future innovation and commercial success.

The competitive environment remains concentrated, yet highly innovative. Key industry players are aggressively protecting their intellectual property related to novel dye compositions and unique processing methods. M&A activity is expected to remain robust as larger chemical conglomerates seek to acquire specialized photochromic technology firms to bolster their material portfolios and expand into high-growth application areas like smart architectural glass. Sustainable sourcing of raw materials and minimizing the environmental footprint of manufacturing processes are also emerging as competitive factors, particularly in environmentally conscious regions like Europe, demanding transparency in the supply chain and adherence to circular economy principles. This comprehensive analysis confirms the Photochromic Films Market is on a trajectory of significant expansion, underpinned by strong technological drivers and favorable regulatory tailwinds across core application sectors globally.

The detailed market size analysis confirms the robust health and projected high growth trajectory of the Photochromic Films Market, moving from USD 1.25 Billion in 2026 to an anticipated USD 2.25 Billion by 2033, reflecting an impressive 8.6% CAGR. This sustained growth rate is considerably higher than the average for the general window film market, indicating a strong technological pull from advanced applications and increased consumer acceptance of premium, adaptive solutions. This projection hinges on the successful commercialization of faster-switching organic materials that meet the stringent performance requirements of the automotive and architectural industries, which currently represent the most significant scaling opportunities for volume production and integration into OEM supply chains.

Further examination of the geographical distribution of demand confirms that while APAC dominates volume, the technological innovation and profitability per unit often stem from R&D activities and high-value deployments in North America and Europe. The market structure suggests that companies able to effectively manage the cost gap between conventional static solutions and photochromic dynamic films will capture the largest share of the rapidly expanding construction sector, especially in high-density urban areas prioritizing building energy efficiency. This balancing act between material cost, coating complexity, and end-user performance expectation is the central challenge defining the strategic landscape for the next seven years. Successfully addressing the longevity and fade-rate issues remains paramount for sustaining the projected 8.6% growth rate.

In summary, the Photochromic Films Market is positioned for transformational growth, driven by environmental responsibility, technological breakthroughs, and escalating consumer demands for personalized comfort and protection. The reliance on advanced material science, coupled with the emerging influence of AI in discovery and manufacturing, places this market at the nexus of several high-growth sectors, ensuring its relevance and increasing its market penetration across global markets. Stakeholders should focus on vertical integration, strategic alliances with large OEMs, and continuous investment in overcoming the kinetic limitations of current photochromic compounds to maximize their position within this expanding and lucrative sector.

The introduction of new regulatory compliance standards, particularly related to solar heat gain coefficients (SHGC) in global building codes, provides a consistent, powerful driver for adopting advanced glazing solutions. Photochromic films offer a flexible and non-invasive way for developers to meet these strict energy efficiency targets compared to fixed solutions that might compromise daylighting or views. This regulatory push is particularly noticeable in dense, temperate regions where both heating and cooling are significant seasonal energy expenditures. By mitigating peak solar heat load in summer, and allowing passive solar heating in their clear state during winter, photochromic films provide year-round adaptive thermal management, which is a key selling point for large-scale commercial property owners seeking to minimize operational expenses and enhance asset value.

Furthermore, the detailed analysis of segment trends highlights that while the ophthalmic market provides stable, high-margin revenue, the architectural and automotive sectors are critical for market scaling. The shift in automotive design toward large glass areas—including panoramic roofs and expansive rear windows—necessitates sophisticated light control to manage cabin glare and temperature without excessive weight, reinforcing the need for lightweight, flexible photochromic films integrated directly into the polymer glazing. This continuous pull from the high-growth automotive OEM segment ensures sustained R&D investment and continuous improvement in film specifications, pushing the entire industry forward in terms of performance and reliability, directly contributing to the projected market size expansion and robust CAGR outlined in the report's size estimate.

Lastly, the structure of the distribution channel is evolving to accommodate the technical complexity of the final products. In the architectural segment, there is a growing need for highly skilled integrators who can incorporate the films into insulated glass units (IGUs) under controlled manufacturing environments. This contrasts with the aftermarket automotive segment, which still relies heavily on trained film installers. As the technology matures and complexity increases (especially with hybrid electrochromic/photochromic systems), training and certification of downstream partners become crucial competitive differentiators, ensuring that the high performance characteristics achieved in the factory are maintained during installation, thereby protecting the brand and maximizing end-user satisfaction and long-term durability of the applied films.

The market’s sensitivity to geopolitical stability and supply chain resilience is also a critical consideration given the reliance on specialized chemical synthesis, often concentrated in specific geographical regions. Disruptions in the supply of key precursors for organic dyes or specialized polymer resins can significantly impact manufacturing cost and delivery timelines. Therefore, market leaders are increasingly adopting dual-sourcing strategies and investing in localized production capabilities across North America and Europe to mitigate geopolitical risks and ensure stable supply, thereby protecting the integrity of the projected growth trajectory and meeting the robust market demand across all key application segments detailed in the segmentation analysis.

In conclusion, the detailed framework provided herein, covering size projections, segmented analysis, technological impact (including AI), and critical DRO factors, confirms that the Photochromic Films Market is mature enough to deliver consistent growth while simultaneously dynamic enough to reward strategic innovation. The key to capturing market share lies in addressing the dual challenge of achieving material kinetics that mimic human eye response speeds and scaling production efficiently to reduce costs and enhance affordability across developing and developed economies.

The ongoing push towards sustainable practices and Net-Zero building targets globally further solidifies the essential role of photochromic technology. Countries and corporations committing to stringent carbon emission reductions are finding that adaptive solar control offers one of the most effective passive methods for reducing the operational carbon footprint of buildings. This long-term commitment to climate goals acts as a powerful, non-cyclical driver, ensuring sustained institutional investment in photochromic solutions, bolstering the market's stability beyond typical economic cycles and reinforcing the strong forecast growth rate of 8.6% through 2033.

The detailed value chain mapping emphasizes the high barriers to entry for new competitors, particularly in the upstream material synthesis phase, where intellectual property and proprietary chemical processes dictate product performance. Firms like PPG and EssilorLuxottica, with decades of experience in dye chemistry, maintain a significant competitive advantage. Success for new entrants will likely hinge on niche applications or the development of completely novel photochromic mechanisms that circumvent existing patents and offer radically improved switching performance or longevity. The complexity of the midstream coating process, requiring expensive vacuum deposition and specialized cleanroom environments, further necessitates substantial capital expenditure, reinforcing the dominance of established players with extensive manufacturing footprints and superior economies of scale.

Regarding the technology landscape, the market is gradually witnessing the integration of quantum dots (QDs) and other nanoscale materials alongside traditional organic dyes. While still nascent, this convergence holds the promise of developing next-generation photochromic films that are thinner, lighter, and exhibit enhanced color purity and faster thermal fade rates. These advancements are critical for meeting the stringent requirements of high-resolution displays and sophisticated consumer electronics, expanding the market scope beyond traditional glazing and optics. The ability to integrate such complex nanomaterials reliably into flexible polymer matrices through scalable R2R methods is currently the focus of significant industry-academia collaboration and venture capital investment, driving the forward edge of innovation in the photochromic sector.

Finally, the analysis of potential customers demonstrates a shift from a predominantly business-to-consumer (B2C) model (eyewear) to a strong business-to-business (B2B) focus (automotive OEM and commercial construction). This shift requires different sales and marketing strategies, moving from retail brand recognition to technical consultation and long-term contractual agreements focused on large volume supply and performance guarantees. Successfully managing the high degree of customization required by architectural projects and meeting the strict quality control demands of the automotive industry are essential capabilities for firms targeting market leadership in the dynamic Photochromic Films Market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager