Photoelectric Detectors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438016 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Photoelectric Detectors Market Size

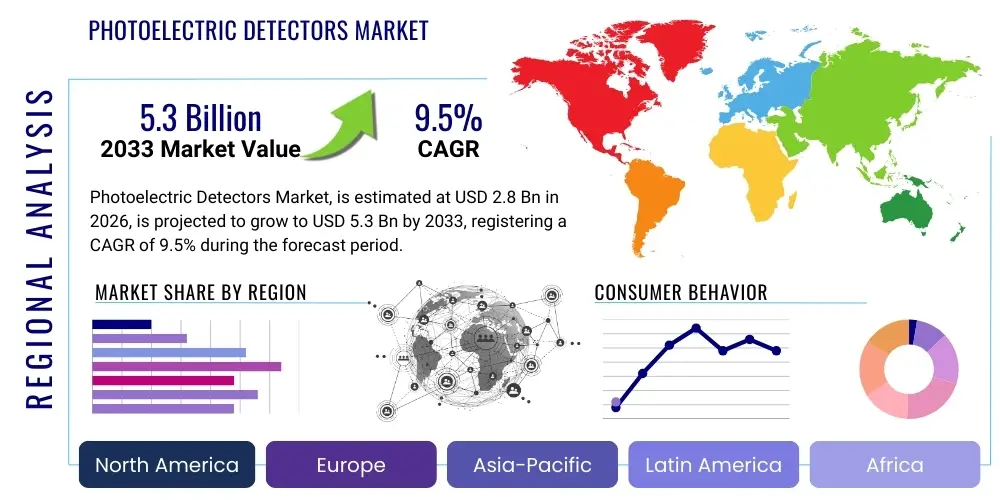

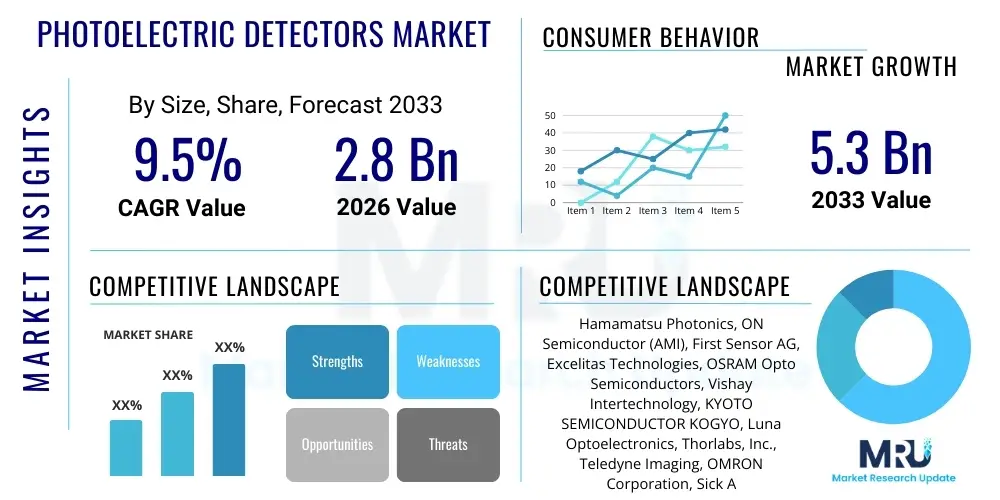

The Photoelectric Detectors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 2.8 Billion in 2026 and is projected to reach USD 5.3 Billion by the end of the forecast period in 2033.

Photoelectric Detectors Market introduction

The Photoelectric Detectors Market encompasses devices that convert incident light (photons) into an electrical signal (current or voltage). These detectors are fundamental components across various industrial, scientific, and consumer electronics applications, offering high sensitivity and rapid response times to electromagnetic radiation spanning from ultraviolet (UV) through visible light and into the infrared (IR) spectrum. Key product categories include photodiodes, photomultiplier tubes (PMTs), and phototransistors, each tailored for specific performance requirements concerning spectral response, noise characteristics, and operating conditions. The inherent reliability and capability of non-contact sensing provided by these detectors drive their pervasive adoption in complex automation systems.

Major applications for photoelectric detectors are centered within industrial automation, where they serve as proximity sensors, counting devices, and sorting mechanisms in manufacturing assembly lines. Beyond industrial uses, these devices are crucial in medical imaging (such as CT scanners and pulse oximetry), consumer electronics (remote controls, ambient light sensing), and advanced communication systems, particularly fiber optics. Their ability to accurately measure intensity, presence, and distance makes them indispensable tools for ensuring precision and safety across diverse operational environments. Furthermore, the proliferation of Internet of Things (IoT) devices and sophisticated surveillance equipment significantly bolsters demand for robust and miniaturized detection solutions.

The primary benefits associated with modern photoelectric detectors include exceptional detection reliability, high operational speed necessary for modern automated processes, and long operational lifetimes due to their solid-state construction. Driving factors influencing market expansion include rapid technological advancements leading to increased quantum efficiency and reduced cost of manufacturing, coupled with the global push towards smarter manufacturing environments (Industry 4.0). The escalating demand for high-speed data transfer solutions utilizing optical fibers, alongside the stringent requirements for safety sensors in automotive and aerospace sectors, further catalyzes market momentum, positioning photoelectric detectors as critical enablers of modern technological infrastructure.

Photoelectric Detectors Market Executive Summary

The Photoelectric Detectors Market is currently experiencing robust expansion driven primarily by the escalating adoption of automation technologies across manufacturing and logistics sectors globally. Business trends emphasize miniaturization, integration of smart features (such as self-diagnosis and networking capabilities), and the development of detectors optimized for specific harsh environmental conditions, enhancing performance and operational flexibility. Leading manufacturers are focusing heavily on R&D to improve the signal-to-noise ratio and spectral selectivity of detectors, addressing the demanding requirements of high-precision scientific instruments and medical devices. Strategic mergers, acquisitions, and partnerships aimed at expanding regional footprint and technology portfolios remain pivotal strategies among key market players.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by rapid industrialization, massive government investments in smart infrastructure, and the dominance of electronics and automotive manufacturing bases, particularly in China, Japan, and South Korea. North America and Europe, characterized by established regulatory frameworks and high R&D intensity, lead the market in the adoption of high-end specialized detectors used in aerospace, defense, and advanced medical diagnostics. These regions exhibit strong demand for advanced Silicon Photomultipliers (SiPMs) and Avalanche Photodiodes (APDs) due to their superior performance characteristics in low-light environments and high-energy physics research.

Segmentation trends indicate that the market for Photodiodes dominates the component landscape due to their cost-effectiveness and versatility across general sensing applications, while Avalanche Photodiodes (APDs) demonstrate the fastest growth rate driven by high-speed telecommunications and distance measurement (LiDAR) requirements. Application segmentation highlights industrial automation as the largest consuming sector, yet the telecommunication segment is forecasted to exhibit significant acceleration due to the global rollout of 5G networks and increased data center construction. End-user analysis underscores the crucial role of the automotive and healthcare sectors as high-value, high-specification consumers of advanced photoelectric detection technology.

AI Impact Analysis on Photoelectric Detectors Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Photoelectric Detectors Market frequently revolve around the potential for enhanced data processing, sensor fusion, and the development of self-calibrating smart sensors. Key themes reflect expectations that AI will optimize detector sensitivity and reliability by dynamically compensating for environmental variables (temperature, noise) and significantly improving the efficiency of pattern recognition tasks. Concerns often focus on the energy consumption required for integrated AI processing at the sensor level (edge computing) and the necessary standardization of interfaces to support complex machine learning algorithms. Overall, stakeholders anticipate that AI integration will shift photoelectric detectors from passive measurement tools to active, intelligent components capable of predictive maintenance and complex decision-making within automated systems, notably enhancing performance in quality control and autonomous navigation.

- AI integration enables sophisticated noise reduction and signal processing, enhancing the effective range and sensitivity of detectors.

- Machine learning algorithms optimize photoelectric sensor calibration and drift compensation, maximizing operational uptime.

- AI facilitates advanced object recognition and classification in industrial vision systems utilizing photoelectric arrays.

- Edge AI processing allows for faster, localized decision-making in autonomous vehicles and high-speed sorting applications, reducing latency.

- Predictive maintenance schedules for sensor replacement are improved through AI analysis of operational data and performance degradation trends.

- AI supports sensor fusion, combining data from photoelectric detectors with other sensor types (e.g., ultrasonic, thermal) for comprehensive environmental awareness.

- Development of smart photoelectric detectors with built-in pattern recognition capabilities reduces reliance on external processing units.

- Improved resource management in power-sensitive applications by dynamically adjusting detector operational parameters based on perceived environmental needs.

DRO & Impact Forces Of Photoelectric Detectors Market

The market dynamics for Photoelectric Detectors are heavily influenced by a potent combination of technological necessity and economic incentives across diverse industries. Key drivers include the pervasive global trend toward Industry 4.0 and the resulting demand for precision automation components, coupled with substantial growth in high-bandwidth optical communication infrastructure. Conversely, market restraints largely stem from the high initial costs associated with specialized, high-performance detectors (such as APDs and SiPMs) and the inherent fragility of some detector types when exposed to extreme environmental conditions. Opportunities are abundant, specifically in developing customized detectors for emerging applications like LiDAR in autonomous vehicles, advanced medical diagnostics, and the rapidly expanding satellite communication sector, requiring ruggedized and highly efficient devices. These interacting forces create a dynamic environment where technological innovation acts as the primary impact force accelerating market development, requiring continuous investment in materials science and manufacturing processes to maintain competitiveness.

The primary driver, the accelerating pace of industrial automation, necessitates detectors that can operate reliably under continuous strain and provide instantaneous feedback. This is particularly crucial in sectors requiring zero-defect manufacturing, such as semiconductor fabrication and pharmaceutical production. Furthermore, government initiatives worldwide supporting renewable energy, particularly solar power generation, create sustained demand for specialized photoelectric sensors used in maximum power point tracking (MPPT) systems and solar monitoring equipment. However, the lack of standardization across different communication protocols and the challenge of integrating various detector types from different vendors present significant hurdles, particularly for system integrators operating on a large scale.

Strategic opportunities lie in addressing the performance gaps in existing technology through novel semiconductor materials like Gallium Nitride (GaN) and Silicon Carbide (SiC) for UV detection and harsh environments, respectively. The evolution of Single-Photon Avalanche Diodes (SPADs) and their commercial availability present a considerable growth avenue, especially in advanced quantum computing and highly sensitive biological detection systems. The overall impact of these forces is overwhelmingly positive, characterized by an accelerating adoption curve contingent upon manufacturers successfully addressing cost-to-performance ratios and ensuring seamless integration capabilities into complex, networked industrial and consumer ecosystems.

Segmentation Analysis

The Photoelectric Detectors Market is comprehensively segmented based on factors including detector type, application, operating principle, and end-user industry, enabling precise analysis of market demand vectors and growth pockets. Segmentation by type, encompassing Photodiodes, Phototransistors, and Avalanche Photodiodes, reveals distinct performance characteristics and price points dictating their suitability for different market niches. Photodiodes, due to their simplicity and robustness, maintain volume leadership, while APDs are gaining traction due to superior gain and speed essential for high-performance applications. Understanding these segment dynamics is crucial for strategic planning, allowing companies to focus their resources on high-growth segments such as customized array detectors for imaging or specialized detectors for UV sensing.

Application-based segmentation highlights the market concentration in high-volume industries such as Industrial Automation, where proximity sensing and object detection are daily necessities, and Telecommunications, which requires ultra-fast detection for high-speed optical fiber links. Emerging applications like LiDAR, machine vision systems, and security surveillance are introducing new demand profiles requiring higher resolution and increased integration complexity. The diversity in required specifications across applications—ranging from robust, low-cost sensors for general consumer use to highly sensitive, calibrated detectors for scientific research—underscores the fragmented yet specialized nature of the overall market landscape.

The primary segmentation factors reflect the core technological distinctions and end-use requirements driving procurement decisions. The continuous innovation in semiconductor materials and fabrication techniques allows manufacturers to constantly redefine these segments, pushing the boundaries of sensitivity and integration capability. This continuous evolution requires market participants to maintain flexible manufacturing capabilities and robust product portfolios spanning the entire performance spectrum, from basic diffuse sensors to highly complex, specialized linear arrays and area detectors used in critical infrastructure.

- Detector Type:

- Photodiodes (PIN, PN Junction)

- Phototransistors

- Avalanche Photodiodes (APDs)

- Silicon Photomultipliers (SiPMs/MPPCs)

- Photomultiplier Tubes (PMTs)

- Photoresistors (LDRs)

- Operating Principle:

- Through-Beam Detectors

- Retro-Reflective Detectors

- Diffuse-Reflective Detectors

- Spectrum Type:

- Visible Light Detectors

- Infrared (IR) Detectors

- Ultraviolet (UV) Detectors

- Application:

- Industrial Automation and Safety

- Telecommunications and Data Centers

- Medical Imaging and Diagnostics

- Aerospace and Defense

- Consumer Electronics (Ambient Light Sensing)

- Automotive (LiDAR and Safety Systems)

- End-Use Industry:

- Manufacturing

- Healthcare

- IT and Telecom

- Automotive

- Energy and Utilities

Value Chain Analysis For Photoelectric Detectors Market

The value chain for the Photoelectric Detectors Market begins with the upstream suppliers responsible for sourcing and refining semiconductor materials, primarily silicon, germanium, and specialized III-V compounds (like InGaAs). The performance and cost efficiency of the final detector are fundamentally dependent on the quality and purity of these raw materials. The upstream segment also includes suppliers of fabrication equipment, precision optics, and encapsulation materials. Intense competition and specialized technical requirements characterize this stage, necessitating strong intellectual property rights protection regarding crystal growth and wafer processing techniques.

The midstream component involves the core manufacturing process, where raw wafers undergo complex fabrication steps, including lithography, doping, metallization, and packaging to create the finished detector chip. This stage requires significant capital investment in cleanroom facilities and sophisticated process control to achieve high yields and desired quantum efficiencies. Integration of the detector chip into a packaged module, often involving signal conditioning electronics and protective housings, prepares the product for distribution. Leading manufacturers often perform vertical integration to control material quality and proprietary design processes, particularly for high-performance APDs and SiPMs.

The downstream activities involve distribution channels, system integration, and end-user deployment. Distribution primarily occurs through specialized industrial distributors, electronics components suppliers, and direct sales channels, depending on the volume and customization required. Direct channels are common for large volume OEM contracts, particularly in the automotive and telecom sectors. System integrators play a crucial role, embedding these detectors into larger machinery, industrial robots, or communication infrastructure. Effective customer support, application engineering, and technical training are critical downstream elements, ensuring the detectors are optimally utilized in complex, demanding operational environments.

Photoelectric Detectors Market Potential Customers

Potential customers for Photoelectric Detectors span a vast array of industries where reliable, non-contact sensing and measurement of light are required. The largest volume consumers are original equipment manufacturers (OEMs) within the industrial automation sector, including robotics manufacturers, packaging machinery producers, and material handling system builders, who integrate these sensors for precision positioning, presence sensing, and quality control. Automotive manufacturers represent a rapidly growing high-value customer base, utilizing advanced photoelectric detectors for driver-assistance systems (ADAS), particularly LiDAR applications, and internal cabin sensing for safety and comfort features. The procurement decisions in this sector are heavily influenced by robustness, reliability in extreme temperatures, and automotive safety standards compliance.

The telecommunications industry, specifically fiber optic component manufacturers and data center operators, constitutes another essential customer segment, demanding ultra-fast, highly sensitive APDs and PIN photodiodes to ensure high-speed data transmission with minimal error rates. Furthermore, the medical device sector consistently procures specialized detectors for high-precision applications like diagnostic imaging equipment (PET scanners, CT scanners), blood analysis devices, and pulse oximeters, prioritizing high resolution, low noise characteristics, and bio-compatibility. Scientific research institutions and aerospace/defense contractors are also crucial customers, requiring custom, often radiation-hardened, detectors for particle physics experiments, space exploration, and sophisticated military guidance systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.8 Billion |

| Market Forecast in 2033 | USD 5.3 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hamamatsu Photonics, ON Semiconductor (AMI), First Sensor AG, Excelitas Technologies, OSRAM Opto Semiconductors, Vishay Intertechnology, KYOTO SEMICONDUCTOR KOGYO, Luna Optoelectronics, Thorlabs, Inc., Teledyne Imaging, OMRON Corporation, Sick AG, Bosch Sensortec, Canon U.S.A., Inc., Broadcom Inc., SemiLEDs Corporation, ROHM Co., Ltd., Texas Instruments, ADI (Analog Devices, Inc.), Renesas Electronics Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Photoelectric Detectors Market Key Technology Landscape

The technological landscape of the Photoelectric Detectors Market is characterized by continuous efforts to enhance quantum efficiency, reduce dark current, and improve thermal stability, pushing the performance limits of solid-state devices. A major trend involves the shift toward Silicon Photomultipliers (SiPMs), which are replacing traditional Photomultiplier Tubes (PMTs) in applications like nuclear medicine (PET) and high-energy physics due to their compact size, lower operating voltage, and magnetic field immunity, despite exhibiting higher dark count rates. Furthermore, advancements in specialized detector materials, particularly Indium Gallium Arsenide (InGaAs), are crucial for high-sensitivity detection in the short-wave infrared (SWIR) region, vital for military night vision and advanced optical inspection systems.

Integration and miniaturization represent significant technological imperatives, driven by the expanding IoT and wearable electronics sectors. Manufacturers are developing multi-functional integrated sensor modules that combine the photoelectric detector with signal conditioning, temperature compensation circuits, and communication interfaces on a single chip. This System-on-Chip (SoC) approach minimizes footprint, reduces power consumption, and simplifies the integration process for end-users, especially in complex autonomous platforms like drones and autonomous ground vehicles. The continuous refinement of CMOS fabrication techniques enables the mass production of highly uniform and cost-effective detector arrays, supporting the growth of machine vision and 3D sensing (LiDAR) technologies.

Another pivotal technological focus area is the development of advanced packaging techniques, ensuring detectors maintain high performance and reliability in demanding industrial and environmental settings. Hermetic sealing and robust shielding against electromagnetic interference (EMI) are increasingly important for detectors used in heavy industrial machinery and aerospace applications. The proliferation of optical communication requires advanced detection technologies like high-speed PIN photodiodes and APDs capable of handling data rates exceeding 100 Gbps, necessitating novel waveguide integration and reduced parasitic capacitance to maintain signal integrity over long distances. Innovation in this area is directly tied to the global expansion of high-speed data infrastructure and 5G networks.

Regional Highlights

- North America: Characterized by early adoption of advanced technologies, North America holds a dominant position in high-value segments like aerospace, defense, and specialized medical imaging. Robust R&D spending, particularly in the United States, drives demand for customized, high-performance APDs and SiPMs used in LiDAR systems for autonomous vehicles and in quantum sensing research. Strict safety regulations also foster the continuous replacement and upgrade of industrial safety sensors.

- Europe: Europe maintains a strong market share, primarily driven by stringent industrial automation standards (Industry 4.0 initiatives) in Germany and Italy, leading to high consumption of robust industrial-grade sensors (Through-Beam and Retro-Reflective). Furthermore, substantial investment in large-scale scientific research facilities (e.g., CERN) ensures a consistent demand for high-specification, specialized radiation detectors.

- Asia Pacific (APAC): APAC is the fastest-growing region, owing to massive manufacturing capabilities and rapid infrastructure development, particularly in China, South Korea, and India. The region dominates the volume market for low-to-mid-range detectors used in consumer electronics and high-volume industrial assembly lines. Government support for domestic semiconductor manufacturing and the accelerated deployment of 5G infrastructure further accelerate market expansion, positioning APAC as the primary hub for both production and consumption.

- Latin America (LATAM): The market in LATAM is emerging, primarily driven by investments in modernization of manufacturing infrastructure, particularly in Mexico and Brazil. Growth is steady, focused on basic industrial automation sensors and consumer electronics components, dependent largely on imports from APAC and North American suppliers.

- Middle East and Africa (MEA): Growth in MEA is concentrated in sectors related to oil and gas infrastructure, smart city initiatives, and security surveillance systems. Demand is focused on highly durable, environmentally hardened sensors capable of operating reliably in harsh desert conditions, particularly for security perimeter monitoring and renewable energy projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Photoelectric Detectors Market.- Hamamatsu Photonics

- ON Semiconductor (AMI)

- First Sensor AG (TE Connectivity)

- Excelitas Technologies

- OSRAM Opto Semiconductors (AMS OSRAM)

- Vishay Intertechnology

- KYOTO SEMICONDUCTOR KOGYO

- Luna Optoelectronics

- Thorlabs, Inc.

- Teledyne Imaging

- OMRON Corporation

- Sick AG

- Bosch Sensortec

- Canon U.S.A., Inc.

- Broadcom Inc.

- SemiLEDs Corporation

- ROHM Co., Ltd.

- Texas Instruments

- ADI (Analog Devices, Inc.)

- Renesas Electronics Corporation

Frequently Asked Questions

Analyze common user questions about the Photoelectric Detectors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Photoelectric Detectors Market?

The central factor accelerating market growth is the global imperative for industrial automation and the implementation of Industry 4.0 principles, necessitating high volumes of reliable, precision sensing components for process control, safety, and quality assurance in manufacturing.

How are Avalanche Photodiodes (APDs) different from standard Photodiodes (PIN) in performance?

APDs offer internal gain, meaning they amplify the electrical signal generated by incident light, providing superior sensitivity and faster response times compared to standard PIN photodiodes. This makes APDs indispensable for high-speed telecommunications and low-light detection applications like LiDAR.

Which geographical region is expected to exhibit the highest Compound Annual Growth Rate (CAGR) and why?

The Asia Pacific (APAC) region is projected to experience the highest CAGR due to extensive government investment in industrial infrastructure, rapid expansion of consumer electronics manufacturing bases, and accelerated deployment of 5G network technology across major economies like China and South Korea.

What role do Silicon Photomultipliers (SiPMs) play in advanced photoelectric detection?

SiPMs are solid-state detectors offering high gain and excellent timing resolution, increasingly replacing bulky Photomultiplier Tubes (PMTs) in medical imaging (PET scanners) and particle detection. Their compactness and immunity to magnetic fields are key technological advantages for modern system designs.

What are the major challenges restraining the broader adoption of advanced photoelectric detectors?

The primary restraints include the high unit cost of specialized detectors, particularly APDs and SiPMs, the technical complexity involved in integrating these high-performance devices into large-scale systems, and the vulnerability of certain materials to extreme thermal or radiation exposure in harsh operational environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager