Photon Counters Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433068 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Photon Counters Market Size

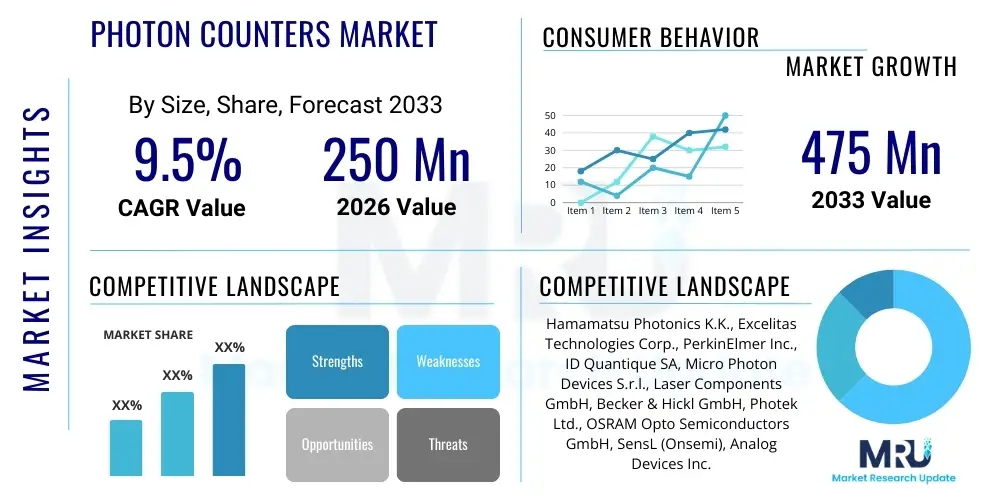

The Photon Counters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $250 Million in 2026 and is projected to reach $475 Million by the end of the forecast period in 2033.

Photon Counters Market introduction

The Photon Counters Market encompasses highly sensitive detectors and associated electronics designed to register individual photons, providing quantitative measurements of extremely low light levels. These devices operate on the principle of single-photon detection (SPD), distinguishing them from traditional photodiodes that measure continuous light flux. Key products include Single Photon Avalanche Diodes (SPADs), Photomultiplier Tubes (PMTs), and Silicon Photomultipliers (SiPMs), which are crucial components in advanced scientific, medical, and industrial applications requiring maximum sensitivity and high time resolution, often down to picosecond levels. This precision is essential for fields like Fluorescence Lifetime Imaging Microscopy (FLIM) and Quantum Key Distribution (QKD).

Major applications driving the market include advanced medical imaging, particularly Positron Emission Tomography (PET) and Optical Coherence Tomography (OCT), where fast timing and high detection efficiency are paramount. Furthermore, photon counters are indispensable in quantum information science, including computing and cryptography, due to their ability to reliably detect and characterize quantum light sources. In space and defense sectors, they are utilized in lidar systems for remote sensing and deep space communication, benefiting from their robust performance in low-flux environments. The inherent benefits of photon counting—superior signal-to-noise ratio, digital output, and linearity over wide dynamic ranges—are fueling their rapid adoption across these technically demanding verticals.

The market growth is primarily driven by escalating global investments in quantum technology research and the continuous miniaturization and performance improvement of solid-state detectors like SiPMs and SPAD arrays, making them viable alternatives to bulky PMTs. Increased demand for high-resolution diagnostic imaging in the healthcare sector, coupled with the necessity for ultra-precise measurement techniques in materials science and pharmaceutical research, further propels market expansion. However, high initial deployment costs and complexities associated with integrating these delicate systems pose minor restraints that are gradually being overcome by technological standardization and mass production efficiencies.

Photon Counters Market Executive Summary

The Photon Counters Market is undergoing robust expansion, characterized by a rapid shift from traditional Photomultiplier Tubes (PMTs) toward compact, solid-state solutions, particularly Silicon Photomultipliers (SiPMs) and Single Photon Avalanche Diodes (SPADs). This technological evolution is the primary business trend, driven by the need for enhanced integration into portable and clinical devices, especially in advanced medical imaging and wearable technology. Regional dynamics indicate North America and Europe maintaining leadership due to significant governmental funding in quantum research and established healthcare infrastructure, while the Asia Pacific region is emerging as the fastest-growing market, propelled by burgeoning industrial applications in countries like China and South Korea, coupled with expanding domestic research and development capabilities.

Segment trends highlight the dominance of the SiPM segment due to its superior performance attributes, including low power consumption, magnetic field immunity, and high photon detection efficiency (PDE) in the visible spectrum. Application-wise, medical imaging remains the largest revenue generator, benefiting directly from the increasing deployment of high-resolution PET scanners. Furthermore, quantum computing and quantum communication applications are experiencing the highest growth trajectory, reflecting the global race for quantum superiority. The market structure remains moderately consolidated, with key players focusing on strategic collaborations with research institutes and offering highly specialized, proprietary counting electronics and software to maintain a competitive edge and optimize detector performance.

Overall, the market trajectory is strongly upward, supported by fundamental science moving into commercial viability. The move toward array-based detectors and the utilization of Artificial Intelligence (AI) for real-time data processing and noise reduction are critical future trends. Companies are investing heavily in improving time resolution (Time Correlated Single Photon Counting or TCSPC techniques) and widening the spectral sensitivity of detectors, paving the way for photon counters to become standard components in next-generation analytical instruments and secure communication systems. Stakeholders must focus on optimizing manufacturing scale and reducing component costs to capitalize fully on the expansive opportunities within industrial quality control and environmental monitoring.

AI Impact Analysis on Photon Counters Market

User inquiries regarding the intersection of AI and Photon Counters primarily revolve around data management, noise mitigation, and enhanced resolution capabilities. Common user concerns include how AI can process the immense data streams generated by high-throughput photon counting systems, whether machine learning can effectively differentiate signal photons from background noise (dark counts and afterpulsing), and the potential for deep learning algorithms to reconstruct images with higher fidelity from fewer detected photons, thereby reducing scan times in medical applications. Users also frequently ask about AI's role in optimizing the operational parameters of sophisticated counting systems, such as automatically adjusting detector bias voltage or temperature stabilization for maximal performance in real-time environments.

The integration of Artificial Intelligence fundamentally transforms the capabilities and operational efficiency of photon counters, moving them beyond mere detection devices into highly sophisticated analytical platforms. AI algorithms, particularly those based on machine learning, are essential for handling the high dimensionality and high data rates produced by modern detector arrays (like large-area SiPMs). By employing neural networks for pattern recognition, AI significantly enhances the signal-to-noise ratio (SNR) by accurately filtering out instrumental noise, leading to improved measurement accuracy and sensitivity, especially crucial in low-light biological imaging or long-distance atmospheric sensing.

Furthermore, AI plays a pivotal role in advanced image reconstruction and data interpretation within applications such as PET and FLIM. Deep learning models can perform iterative reconstruction much faster than traditional computational methods, enabling faster clinical diagnostics and reducing patient exposure time. In quantum communication, AI is being used to analyze and predict atmospheric distortions or eavesdropping attempts based on the statistical properties of the detected photon streams, thereby enhancing the security and reliability of Quantum Key Distribution (QKD) protocols. This convergence of high-sensitivity hardware and intelligent software is unlocking performance thresholds previously unattainable, solidifying AI as a core component of future photon counting systems.

- AI-driven noise filtering dramatically reduces dark counts and improves the effective signal-to-noise ratio in low-light conditions.

- Machine learning algorithms optimize detector calibration and operational settings (e.g., bias voltage, thresholding) in real-time, ensuring peak performance.

- Deep learning facilitates faster and higher-fidelity image reconstruction in medical imaging (PET, SPECT) using sparse photon data.

- AI enhances data processing capabilities, enabling the analysis of massive data streams generated by high-density photon counting arrays.

- Neural networks are used in quantum information science for monitoring channel stability and detecting quantum state deviations.

- Predictive maintenance schedules for complex detector systems are managed using AI to analyze performance drift and component lifespan.

DRO & Impact Forces Of Photon Counters Market

The dynamics of the Photon Counters Market are shaped by a complex interplay of internal and external forces, categorized by Drivers, Restraints, and Opportunities. A primary Driver is the massive, ongoing global investment in quantum research and development, which necessitates highly reliable single-photon detection technology for components like quantum memories and entangled photon sources. Additionally, the medical sector's continuous pursuit of non-invasive, high-resolution diagnostic tools, particularly the increasing prevalence of Time-of-Flight PET systems, mandates the use of ultra-fast and efficient SiPM-based photon counters. Technological advancements, especially the shift toward solid-state, compact, and energy-efficient detectors, further fuel adoption across diverse industrial and consumer electronics fields.

Conversely, significant Restraints hinder growth, notably the high cost associated with manufacturing high-performance, large-area detector arrays, especially those optimized for specialized spectral ranges (e.g., UV or NIR). The complexity inherent in integrating and operating photon counting systems, including the requirement for precise temperature control, high vacuum environments (for PMTs), and sophisticated data acquisition electronics (TCSPC modules), presents a technical barrier for non-specialized users. Furthermore, the limited availability of highly skilled technical personnel capable of developing and maintaining these intricate systems acts as a bottleneck in several emerging geographical markets, slowing large-scale commercialization outside established research hubs.

The Opportunities within this market are vast, centered primarily on the proliferation of photon counting technology into mass-market applications such as advanced driver-assistance systems (ADAS) utilizing single-photon LiDAR, and the integration of SPAD arrays into consumer devices like smartphones and augmented reality headsets for enhanced 3D sensing. The development of new materials, such as superconducting nanowire single-photon detectors (SNSPDs), promises unprecedented speed and efficiency, opening new avenues in high-speed optical communication and fundamental physics experiments. Lastly, the growing requirement for enhanced homeland security and surveillance, utilizing advanced low-light imaging and detection methods, provides a resilient and long-term commercial opportunity for specialized photon counter manufacturers.

- Drivers: Growing investment in quantum computing and cryptography; increasing adoption of advanced medical imaging modalities (PET, FLIM); technological advancements leading to miniaturized and solid-state detectors (SiPMs, SPADs); rising demand for precise optical measurement in environmental monitoring and materials science.

- Restraints: High initial cost of advanced photon counting systems; technical complexity and stringent operating requirements (temperature stabilization, specialized electronics); reliance on high-precision fabrication processes resulting in lower yield rates for large arrays.

- Opportunities: Expansion into consumer electronics through LiDAR applications (autonomous vehicles, 3D sensing in mobile devices); development of novel detector architectures (e.g., SNSPDs for ultra-high speed); emergence of decentralized Quantum Key Distribution networks requiring reliable photon detection infrastructure.

- Impact Forces: The rapid technological obsolescence of legacy PMTs driven by superior solid-state alternatives; regulatory standards in medical imaging pushing for faster and safer diagnostics; geopolitical competition in quantum technology accelerating R&D spending and deployment.

Segmentation Analysis

The Photon Counters Market is comprehensively segmented based on Detector Type, Application, and End-User, reflecting the diverse technological needs and functional requirements across various industries. The Detector Type segmentation is critical as it defines the core performance characteristics—such as spectral range, time resolution, and cost—which largely determine the suitability for specific tasks. While traditional detectors like PMTs still hold ground in niche high-gain, large-area applications, the rapid market shift favors solid-state segments, driven by their scalability, robustness, and superior integration capabilities.

The Application segment highlights the primary demand centers, with medical and biological research consistently dominating due to the irreplaceable role of single-photon counting in techniques like Fluorescence Correlation Spectroscopy (FCS) and PET. However, the fastest growth is observed in nascent yet highly funded sectors, namely Quantum Technology and space-based remote sensing, which demand specialized, highly sensitive, and radiation-hardened detectors. Understanding the dynamics within these application segments is vital for manufacturers to tailor their product offerings and R&D focus toward future high-growth areas.

Lastly, the End-User segmentation differentiates between the primary purchasing entities. Research institutions and universities represent a foundational, stable demand source for high-specification, flexible instruments used in fundamental science. In contrast, the Healthcare segment drives high-volume, standardized procurement for clinical applications, whereas the Industrial sector, encompassing LiDAR and quality control, demands robust, cost-effective, and highly reliable photon counting systems suitable for continuous operational environments. Each segmentation layer provides strategic insights into market penetration and commercialization strategies.

- By Detector Type:

- Photomultiplier Tubes (PMTs)

- Single Photon Avalanche Diodes (SPADs)

- Silicon Photomultipliers (SiPMs)

- Hybrid Photodetectors (HPDs)

- Superconducting Nanowire Single-Photon Detectors (SNSPDs)

- By Application:

- Medical Imaging (PET, SPECT, OCT)

- Quantum Computing and Communication (QKD, Entanglement Studies)

- Scientific Research and Spectroscopy (FLIM, FCS)

- Environmental Sensing and Monitoring (Lidar, Remote Sensing)

- Defense and Aerospace

- By End-User:

- Academic and Research Institutions

- Hospitals and Diagnostic Centers

- Industrial (Semiconductors, Quality Control, Automotive Lidar)

- Defense and Government Laboratories

Value Chain Analysis For Photon Counters Market

The value chain for the Photon Counters Market is characterized by a high degree of specialization, starting with the complex upstream manufacturing of highly purified semiconductor materials and specialized vacuum tubes. Upstream activities involve producing ultra-low noise silicon or III-V materials necessary for creating high-performance SPADs and SiPMs, often requiring proprietary epitaxial growth techniques. Key players at this stage focus heavily on yield optimization and defect reduction, as detector quality directly dictates downstream system sensitivity and reliability. For PMTs, this stage involves the precise crafting of photocathodes and dynode structures within vacuum envelopes. The output of this stage is the core detector element.

Midstream activities involve the integration of these detectors with sophisticated electronics, specifically Time Correlated Single Photon Counting (TCSPC) modules, quench circuits, passive and active gating electronics, and signal conditioning processors. This integration step transforms the raw detector into a functional counting module or instrument. Companies specializing in this midstream phase leverage expertise in high-speed digital electronics and low-noise analog signal processing, adding significant intellectual property value. Calibration, packaging, and the incorporation of thermal management systems are crucial steps taken before the product is ready for distribution.

Downstream analysis focuses on the distribution channels and end-user deployment. The distribution network is primarily indirect, relying on specialized scientific equipment distributors and system integrators who possess the technical expertise to support highly technical products. Direct sales channels are typically reserved for large-scale governmental or institutional contracts where customization is required. System integrators play a vital role in bundling photon counting modules into larger analytical instruments (e.g., flow cytometers, confocal microscopes, PET scanners). Market success at this stage hinges on providing excellent technical support, application-specific software, and post-sales maintenance, especially given the sensitive nature and high capital expenditure associated with these instruments.

Photon Counters Market Potential Customers

Potential customers for Photon Counters span highly specialized sectors requiring ultimate sensitivity for measurement, imaging, and security protocols. The primary buyers include institutions engaged in fundamental and applied physics research, such as universities, national laboratories, and corporate R&D centers dedicated to materials science, chemistry, and biological imaging. These customers demand flexibility, high spectral range coverage, and specialized timing resolution capabilities to support diverse, constantly evolving experimental setups, often purchasing low-volume, high-specification instrumentation.

Another dominant customer segment is the healthcare and diagnostics industry, encompassing major hospital networks and medical device manufacturers. These buyers focus on standardized, reliable, and compliant photon counting modules integrated into commercial clinical systems, most notably PET scanners, which drive high-volume demand for SiPM arrays. Their purchasing criteria prioritize robustness, compliance with regulatory standards (e.g., FDA, CE), long operational lifespan, and ease of integration into existing clinical workflows, often requiring supply contracts for standardized components.

The emerging high-growth customer segment includes companies and government agencies invested in advanced technologies like autonomous vehicles and quantum security. Automotive manufacturers and Tier 1 suppliers are increasingly evaluating SPAD arrays for integration into next-generation LiDAR systems to improve ranging and object identification in harsh lighting conditions. Furthermore, national defense and telecommunications sectors represent key buyers for QKD systems, demanding specialized, high-efficiency, and low-dark-count detectors to secure fiber-optic and free-space communication links, representing a high-value, long-term procurement stream driven by geopolitical security priorities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $250 Million |

| Market Forecast in 2033 | $475 Million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hamamatsu Photonics K.K., Excelitas Technologies Corp., PerkinElmer Inc., ID Quantique SA, Micro Photon Devices S.r.l., Laser Components GmbH, Becker & Hickl GmbH, Photek Ltd., OSRAM Opto Semiconductors GmbH, SensL (Onsemi), Analog Devices Inc. (ADI), Texas Instruments Incorporated, Thorlabs Inc., PicoQuant GmbH, Quantum Composers Inc., Toptica Photonics AG, Menlo Systems GmbH, Licel GmbH, FMB Oxford Ltd., ZD Tech (Shanghai) Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Photon Counters Market Key Technology Landscape

The Photon Counters Market technology landscape is characterized by a dual trend: the continued optimization of mature technologies alongside the rapid commercialization of solid-state and superconducting novel approaches. Photomultiplier Tubes (PMTs) represent the mature technology, still unmatched in ultra-low noise detection and large area coverage, though their bulky nature and sensitivity to magnetic fields limit their use outside specialized labs. The core technological innovation driving market growth centers on solid-state detectors, particularly Silicon Photomultipliers (SiPMs), which utilize the Geiger mode operation of avalanche photodiodes (APDs). SiPM technology enables highly integrated, low-voltage, and compact sensors with high Photon Detection Efficiency (PDE) across the visible spectrum, making them ideal for clinical PET systems and large-scale particle physics experiments.

A second major technological advancement is the rise of Single Photon Avalanche Diode (SPAD) arrays, primarily implemented as integrated circuits (CMOS SPADs). This technology allows for the creation of millions of individual counting pixels on a single chip, facilitating the development of high-resolution, real-time 3D imaging systems, crucial for emerging applications like flash LiDAR and computational photography. The integration of SPADs with advanced CMOS fabrication processes drives down unit costs and enables massive parallelism, solving the long-standing challenge of achieving high spatial and temporal resolution simultaneously in a commercially viable package. Ongoing research focuses heavily on increasing the PDE in the near-infrared (NIR) spectrum for better performance in long-distance communication and outdoor sensing.

Finally, the high-end technology frontier is dominated by Superconducting Nanowire Single-Photon Detectors (SNSPDs). While requiring cryogenic cooling, SNSPDs offer unparalleled performance metrics, including near-unity detection efficiency (>95%) and picosecond-level timing resolution, which are crucial for demanding applications like linear optical quantum computing and ultra-high-speed quantum communication. Though currently niche and expensive, continuous efforts to miniaturize and simplify cryogenic systems, combined with their unmatched performance, position SNSPDs as the ultimate long-term technology for fundamental science and high-security communication infrastructure. The interplay between these three core detector families defines the technological competition and product roadmaps within the market.

Regional Highlights

Regional dynamics within the Photon Counters Market showcase distinct maturity levels and growth drivers across major geographic areas. North America, driven predominantly by the United States, represents the largest market share, characterized by significant governmental and private sector investment in cutting-edge research, particularly in quantum information science and defense applications. The region benefits from the presence of leading research universities, established pharmaceutical companies, and key technological innovators (both detector manufacturers and system integrators). This ecosystem fosters rapid prototyping and commercial adoption of advanced counting technologies, especially solid-state SiPM and high-speed TCSPC modules. The strong healthcare infrastructure further ensures consistent demand for advanced medical imaging equipment, maintaining North America's revenue leadership.

Europe holds a substantial market position, second only to North America, buoyed by robust academic research funding mechanisms such as Horizon Europe, which specifically targets quantum technologies and advanced medical diagnostics. Countries like Germany, the UK, and Switzerland are pivotal centers for manufacturing high-precision scientific instruments and specialized detector components. The European market exhibits strong demand for high-end photon counters utilized in fluorescence spectroscopy and environmental monitoring, driven by stringent regulatory requirements related to pollution control and quality assurance in manufacturing processes. European manufacturers are globally recognized for specialized, low-noise systems designed for demanding scientific measurements.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is primarily attributable to massive infrastructure development in China and South Korea, coupled with escalating investments in domestic R&D capabilities aimed at technological self-sufficiency. China's focused commitment to quantum technology dominance and the increasing adoption of modern diagnostic imaging systems across densely populated areas are key drivers. Furthermore, the region's burgeoning electronics manufacturing sector is adopting SPAD array technology for integration into commercial products like advanced 3D sensors and automotive LiDAR, signaling a fundamental shift from primarily research-based consumption to high-volume industrial deployment.

Latin America and the Middle East & Africa (MEA) currently hold smaller market shares but offer significant potential for future growth. In Latin America, institutional demand, mainly from governmental research institutes in Brazil and Mexico, drives the adoption of photon counters for spectroscopy and fundamental physics experiments. However, growth is often restrained by economic volatility and reliance on imported high-tech equipment. The MEA region is witnessing growing investment, particularly in the UAE and Saudi Arabia, focused on building world-class research infrastructure and diversifying their economies through technological advancement. Deployment is heavily concentrated in sophisticated defense applications and newly established healthcare centers requiring modern diagnostic machinery, signifying nascent but strategically important market segments.

- North America: Market leader; strong R&D funding (Quantum initiatives); high adoption rate in medical imaging (PET systems); presence of major tech innovators and defense contractors. Key countries: USA, Canada.

- Europe: Second largest market; driven by stringent scientific standards and high-end spectroscopy applications; strong manufacturing base for precision instruments. Key countries: Germany, UK, Switzerland, France.

- Asia Pacific (APAC): Fastest-growing market; high investment in quantum and indigenous technology development (China); rapid deployment in industrial and automotive LiDAR applications. Key countries: China, Japan, South Korea.

- Latin America (LATAM): Growth driven by academic research and institutional investment; market size constrained by economic factors. Key country: Brazil.

- Middle East & Africa (MEA): Emerging market; driven by defense applications, energy sector monitoring, and strategic government investments in high-tech healthcare infrastructure. Key countries: UAE, Saudi Arabia, South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Photon Counters Market.- Hamamatsu Photonics K.K.

- Excelitas Technologies Corp.

- PerkinElmer Inc.

- ID Quantique SA

- Micro Photon Devices S.r.l.

- Laser Components GmbH

- Becker & Hickl GmbH

- Photek Ltd.

- OSRAM Opto Semiconductors GmbH

- SensL (Onsemi)

- Analog Devices Inc. (ADI)

- Texas Instruments Incorporated

- Thorlabs Inc.

- PicoQuant GmbH

- Quantum Composers Inc.

- Toptica Photonics AG

- Menlo Systems GmbH

- Licel GmbH

- FMB Oxford Ltd.

- ZD Tech (Shanghai) Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Photon Counters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Photon Counters Market?

The primary growth driver is the exponential increase in global investment and research focus on Quantum Technologies, including Quantum Computing and Quantum Key Distribution (QKD), which critically rely on highly sensitive and reliable single-photon detection hardware.

How are Silicon Photomultipliers (SiPMs) changing the landscape compared to traditional Photomultiplier Tubes (PMTs)?

SiPMs are revolutionizing the market by offering solid-state, compact, energy-efficient, and magnetically immune detection solutions with high Photon Detection Efficiency (PDE). This allows for easier integration into clinical devices (like portable PET scanners) and mass-produced systems, where PMTs are too bulky and delicate.

In which application segment is the highest growth anticipated for photon counters?

The highest growth rate is anticipated in the Quantum Computing and Communication segment, followed closely by the Industrial application of LiDAR (Light Detection and Ranging) systems, particularly those integrated into autonomous vehicles and advanced 3D sensing devices.

What technological challenge currently limits the widespread adoption of high-performance Single Photon Avalanche Diodes (SPADs)?

The main technological challenge is increasing the Photon Detection Efficiency (PDE) in the near-infrared (NIR) spectrum while maintaining high time resolution and low noise characteristics. Improving NIR performance is essential for better range and penetration in outdoor LiDAR and long-distance free-space optical communication.

What role does Artificial Intelligence (AI) play in enhancing photon counting systems?

AI significantly enhances photon counting systems by applying machine learning algorithms for real-time noise reduction, effective separation of signal from dark counts, optimizing detector performance parameters, and accelerating high-fidelity image reconstruction in medical and biological imaging applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager