Photoresist Ashing Equipment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440409 | Date : Jan, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Photoresist Ashing Equipment Market Size

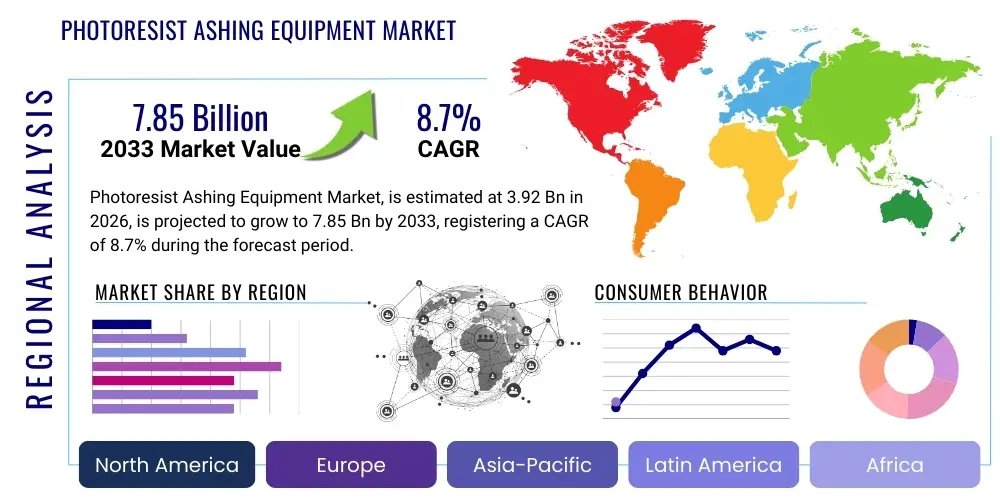

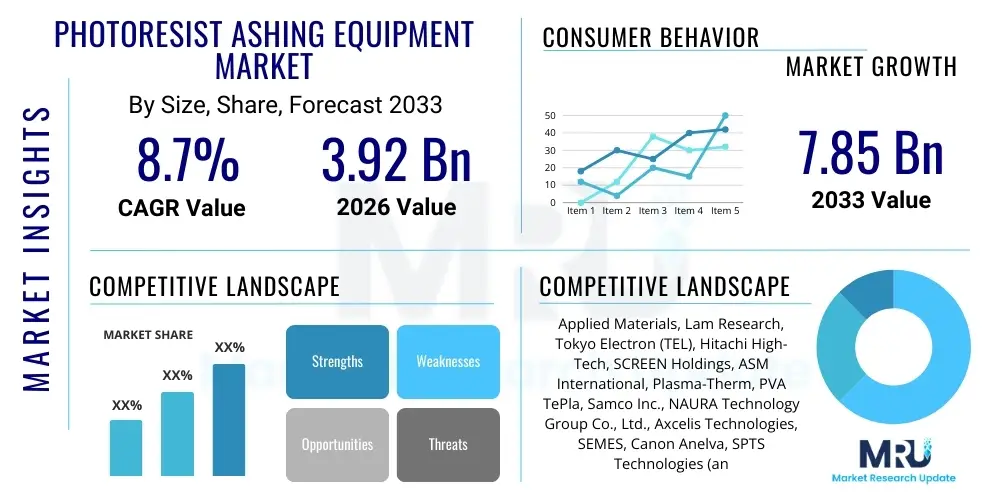

The Photoresist Ashing Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% between 2026 and 2033. The market is estimated at USD 3.92 Billion in 2026 and is projected to reach USD 7.85 Billion by the end of the forecast period in 2033. This robust growth is primarily driven by the relentless advancement in semiconductor manufacturing technologies, increasing demand for miniaturized electronic devices, and the escalating complexity of integrated circuits. The market's expansion is intrinsically linked to the global semiconductor industry's capital expenditure and the continuous innovation in fabrication processes that necessitate high-precision and damage-free photoresist removal.

Photoresist Ashing Equipment Market introduction

The Photoresist Ashing Equipment Market plays a pivotal role in the semiconductor manufacturing ecosystem, focusing on the critical step of removing photoresist layers from semiconductor wafers after the etching process. Photoresist ashing, also known as stripping, is essential for ensuring the integrity and functionality of the fabricated integrated circuits by eliminating residual organic materials without damaging the delicate underlying structures. This sophisticated process employs various plasma technologies to chemically and physically break down and remove the photoresist, preparing the wafer for subsequent manufacturing steps or final inspection.

The primary products in this market include plasma ashers, which utilize different plasma sources such as RF (Radio Frequency), microwave, or downstream plasma systems. These machines are engineered for high throughput, selectivity, and minimal damage to sensitive device features, crucial requirements for advanced semiconductor nodes. Major applications span across various segments of the semiconductor industry, including memory devices (DRAM, NAND), logic ICs (CPUs, GPUs), MEMS (Micro-Electro-Mechanical Systems), power devices, and advanced packaging solutions. The effectiveness of photoresist ashing directly impacts device yield, reliability, and performance, making it an indispensable part of modern semiconductor fabrication.

Key benefits of advanced photoresist ashing equipment include superior residue removal, precise process control, reduced chemical consumption, and improved environmental footprint compared to traditional wet stripping methods. The driving factors for this market's growth are numerous and intertwined with the broader electronics industry's trends. These include the surging global demand for semiconductors fueled by the proliferation of 5G technology, artificial intelligence, automotive electronics, data centers, and the Internet of Things (IoT). The relentless pursuit of device miniaturization and the transition to advanced manufacturing nodes (e.g., 5nm, 3nm, and beyond) further necessitate more sophisticated and efficient ashing solutions, propelling innovation and investment in this specialized equipment sector.

Photoresist Ashing Equipment Market Executive Summary

The Photoresist Ashing Equipment Market is poised for substantial growth, driven by a confluence of evolving business trends, significant regional shifts, and advancements across key market segments. Global business trends highlight an intensified focus on automation, process optimization, and the integration of artificial intelligence and machine learning into equipment for enhanced predictive maintenance and yield management. Manufacturers are increasingly investing in research and development to address the challenges posed by new materials, complex 3D structures, and ultra-small feature sizes in advanced semiconductor nodes. Sustainability and reducing the environmental impact of manufacturing processes are also emerging as critical business imperatives, influencing equipment design towards lower power consumption and reduced hazardous waste.

Regional trends indicate that the Asia Pacific (APAC) region continues to dominate the market, primarily due to the concentration of major semiconductor foundries, IDMs, and OSATs in countries like Taiwan, South Korea, China, and Japan. This region is expected to remain the largest consumer and innovator in photoresist ashing equipment, propelled by massive investments in new fabrication facilities and capacity expansions. North America and Europe, while representing smaller market shares, are significant hubs for advanced research, development of cutting-edge equipment technologies, and specialized applications, particularly in areas like high-performance computing, aerospace, and defense. Government initiatives to bolster domestic semiconductor manufacturing capabilities in various regions are also influencing regional market dynamics and investment flows.

Segment trends reveal a strong inclination towards advanced plasma ashing technologies, specifically inductively coupled plasma (ICP) and microwave plasma systems, which offer superior uniformity, selectivity, and damage control for intricate device architectures. The single-wafer processing segment is gaining traction over batch processing for critical steps, driven by the need for enhanced process control, reduced contamination risk, and higher yield for advanced nodes. Furthermore, the increasing demand from memory manufacturers, logic IC foundries, and the rapidly expanding advanced packaging sector are key drivers for equipment segmentation. Customization capabilities to meet diverse customer specifications, including various wafer sizes and material compatibility, are becoming increasingly important for equipment suppliers to maintain a competitive edge.

AI Impact Analysis on Photoresist Ashing Equipment Market

Users frequently inquire about how artificial intelligence (AI) will transform the Photoresist Ashing Equipment Market, expressing concerns and expectations around enhanced process efficiency, predictive capabilities, and overall cost reduction. The central themes revolve around AI's ability to optimize process parameters, improve real-time monitoring, and facilitate data-driven decision-making to overcome the growing complexities of advanced semiconductor manufacturing. There is a strong expectation that AI will lead to more autonomous equipment operations, minimizing human intervention and human-induced errors, while simultaneously elevating the precision and reliability of photoresist removal processes, ultimately boosting manufacturing yields and device performance.

- AI-driven real-time process optimization: Algorithms can analyze sensor data during ashing, dynamically adjusting plasma parameters (power, gas flow, pressure) to maintain optimal conditions and uniformity across the wafer, significantly improving process consistency and reducing defects.

- Predictive maintenance for equipment: AI models can forecast equipment failures by analyzing operational data, enabling proactive maintenance scheduling, minimizing unscheduled downtime, and extending the lifespan of costly ashing systems.

- Enhanced yield management and defect reduction: Machine learning can identify subtle patterns in ashing data correlated with yield losses or specific defect types, allowing for rapid root cause analysis and corrective actions, leading to higher manufacturing efficiency.

- Automated process control and recipe generation: AI can learn from historical process data to automatically generate optimized ashing recipes for new device architectures or material combinations, reducing manual trial-and-error and accelerating product development cycles.

- Advanced data analytics for process insights: AI tools can process vast amounts of data generated during the ashing process, uncovering hidden correlations and providing deeper insights into process performance, material interactions, and potential areas for further improvement.

- Improved uniformity and selectivity: By leveraging AI for finer control over plasma distribution and chemical reactions, ashing equipment can achieve unprecedented uniformity in photoresist removal and higher selectivity towards underlying layers, preventing damage to critical device features.

DRO & Impact Forces Of Photoresist Ashing Equipment Market

The Photoresist Ashing Equipment Market is shaped by a dynamic interplay of various drivers, restraints, opportunities, and broader impact forces that collectively dictate its growth trajectory and competitive landscape. Key drivers include the exponential growth in global semiconductor demand, propelled by emerging technologies such as 5G, AI, IoT, and advanced automotive electronics, all of which necessitate more complex and densely packed integrated circuits. The continuous drive for device miniaturization and the migration to sub-10nm technology nodes demand increasingly precise, uniform, and damage-free photoresist removal processes, thereby fueling the need for state-of-the-art ashing equipment. Furthermore, advancements in advanced packaging technologies, such as 3D ICs and wafer-level packaging, require specialized ashing solutions to handle complex multi-layer structures and novel materials, adding to the market's impetus. Robust R&D investments by equipment manufacturers to innovate next-generation plasma technologies and process chemistries further solidify the market's growth foundation.

However, the market also faces significant restraints that could impede its expansion. The high capital expenditure associated with acquiring advanced photoresist ashing equipment, coupled with the substantial operational costs, poses a barrier to entry for smaller players and impacts the profitability of manufacturers. The inherent complexity of the technology, requiring highly skilled personnel for operation and maintenance, contributes to operational challenges. Moreover, stringent environmental regulations regarding the handling of process gases and waste disposal can increase compliance costs and necessitate substantial investments in emission control technologies. Geopolitical tensions and trade disputes can lead to supply chain disruptions for critical components and raw materials, introducing uncertainty and increasing lead times for equipment delivery. The cyclical nature of the semiconductor industry, characterized by periods of oversupply and undersupply, can also lead to fluctuations in equipment demand and investment patterns, adding a layer of unpredictability to market growth.

Despite these restraints, numerous opportunities are emerging that are expected to unlock new avenues for market expansion. The development of advanced nodes (e.g., 3nm, 2nm) and novel materials presents opportunities for specialized ashing solutions capable of handling ultra-thin layers and delicate structures. The integration of artificial intelligence and machine learning for process optimization, predictive maintenance, and enhanced yield management offers a significant opportunity for technological differentiation and competitive advantage. Furthermore, the expansion of semiconductor manufacturing capacities in emerging regions, driven by governmental incentives and localization strategies, creates new market penetration opportunities for equipment suppliers. The increasing demand for specialized devices in sectors like MEMS, power electronics, and optoelectronics also presents niche market segments requiring tailored photoresist ashing solutions. The ongoing focus on developing more energy-efficient and environmentally friendly ashing processes represents another significant opportunity for innovation and market leadership, aligning with global sustainability goals.

Segmentation Analysis

The Photoresist Ashing Equipment Market is meticulously segmented based on various critical parameters, offering a granular view of its structure, dynamics, and growth prospects across different dimensions. These segmentations provide valuable insights for stakeholders to understand market composition, identify high-growth areas, and tailor their strategies to specific end-user requirements and technological trends. The market is primarily bifurcated by technology type, process type, application, end-user industry, and wafer size, each reflecting distinct operational needs and market demands within the broader semiconductor fabrication landscape. Understanding these divisions is crucial for manufacturers to optimize their product portfolios and for investors to identify promising investment opportunities.

- By Technology Type

- Plasma Ashers

- RF Plasma Ashers (Radio Frequency Plasma)

- Microwave Plasma Ashers

- Inductively Coupled Plasma (ICP) Ashers

- Capacitively Coupled Plasma (CCP) Ashers

- Downstream Plasma Ashers

- Dry Ashers (Non-Plasma Thermal/Chemical)

- Wet Ashers (Chemical Stripping - though less dominant for advanced photoresist removal)

- Plasma Ashers

- By Process Type

- Batch Processing Equipment

- Single-Wafer Processing Equipment

- By Application

- Memory Devices (DRAM, NAND Flash, MRAM, etc.)

- Logic & CPU Devices (Microprocessors, GPUs, ASICs)

- MEMS (Micro-Electro-Mechanical Systems)

- Power Devices (IGBTs, MOSFETs, Diodes)

- Optoelectronics (LEDs, Lasers, Photodetectors)

- Advanced Packaging (Fan-out Wafer-Level Packaging, 3D-ICs, Through-Silicon Vias - TSVs)

- Analog & Mixed-Signal ICs

- By End-User Industry

- Integrated Device Manufacturers (IDMs)

- Foundries (Pure-Play Foundries)

- Outsourced Semiconductor Assembly and Test (OSAT) Companies

- Research & Development Institutions

- Universities and Academic Research Centers

- By Wafer Size

- 150mm (6-inch) Wafers

- 200mm (8-inch) Wafers

- 300mm (12-inch) Wafers

- Emerging 450mm Wafers (Future Potential)

- By Regional Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, UK, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, Taiwan, India, Southeast Asia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Photoresist Ashing Equipment Market

The value chain for the Photoresist Ashing Equipment Market encompasses a complex network of activities, starting from the supply of raw materials and components, through equipment manufacturing, to distribution and after-sales support for end-users. Understanding this chain is critical for identifying key stakeholders, competitive dynamics, and potential areas for value addition or cost optimization. Upstream activities involve the sourcing of highly specialized materials and precision components, including vacuum chambers, plasma generators, gas delivery systems, robotics for wafer handling, and advanced control systems. Suppliers of these sophisticated parts often possess unique intellectual property and specialized manufacturing capabilities, making them crucial partners for equipment manufacturers. This segment of the value chain is characterized by a relatively concentrated supplier base for high-end components, leading to a degree of supplier bargaining power.

Midstream activities primarily involve the design, engineering, assembly, and testing of the photoresist ashing equipment. Major equipment manufacturers invest heavily in research and development to innovate plasma sources, gas chemistries, and process control algorithms that meet the stringent requirements of advanced semiconductor fabrication nodes. This stage demands significant technical expertise, cleanroom manufacturing capabilities, and rigorous quality assurance processes to produce reliable and high-performance systems. The market is competitive among a few global leaders who leverage their technological prowess, extensive patent portfolios, and established customer relationships to maintain market share. Continuous innovation in areas like automation, process uniformity, and selectivity is paramount for these manufacturers to stay ahead.

Downstream activities involve the distribution, installation, commissioning, and ongoing maintenance and support of the ashing equipment at the end-user facilities. The primary end-users are large integrated device manufacturers (IDMs), pure-play foundries, and outsourced semiconductor assembly and test (OSAT) companies. Distribution channels for such specialized, high-capital equipment are predominantly direct, involving direct sales forces and technical support teams from the equipment manufacturers. This direct engagement allows for deep customer relationships, tailored solutions, and swift technical support, which are critical given the complex nature of semiconductor manufacturing processes. Indirect channels, through regional distributors or agents, may be used in emerging markets or for smaller customers, primarily for sales facilitation and localized support. After-sales services, including spare parts supply, software upgrades, and field service engineering, represent a significant ongoing revenue stream and are crucial for ensuring customer satisfaction and equipment uptime, thus forming a vital part of the overall value proposition.

Photoresist Ashing Equipment Market Potential Customers

The potential customers for Photoresist Ashing Equipment are predominantly entities within the highly specialized and capital-intensive semiconductor industry, whose manufacturing processes rely heavily on precise and efficient photoresist removal. These end-users typically operate advanced fabrication facilities that produce a wide array of electronic components, ranging from microprocessors and memory chips to specialized sensors and power devices. Their purchasing decisions are driven by factors such as equipment performance, throughput, cost of ownership, process uniformity, damage-free operation, and the ability to support current and future technology nodes. The strategic nature of their investments often involves long-term partnerships with equipment suppliers who can provide continuous innovation and robust technical support, reflecting the critical role this equipment plays in their production lines.

The largest segment of potential customers includes Integrated Device Manufacturers (IDMs) like Intel, Samsung, and Micron, which design, manufacture, and market their own semiconductor products. These companies operate extensive fabrication facilities and require a comprehensive suite of front-end and back-end equipment, including advanced photoresist ashers, to maintain control over their entire production process and ensure product quality and innovation. Foundries, such as TSMC, GlobalFoundries, and UMC, which specialize in manufacturing integrated circuits for fabless semiconductor companies, represent another significant customer base. Their business model relies on high-volume production and cutting-edge process technology, making investments in the most advanced ashing equipment crucial for serving their diverse clientele and remaining competitive in the contract manufacturing space.

Furthermore, Outsourced Semiconductor Assembly and Test (OSAT) companies, like ASE Technology Holding and Amkor Technology, are increasingly becoming important customers, particularly as advanced packaging technologies gain prominence. These companies require photoresist ashing equipment for various post-fabrication processes, including wafer thinning, bumping, and advanced interconnect formation, where precise material removal is essential for multi-chip packaging and 3D integration. Manufacturers of MEMS devices, power semiconductors, and optoelectronics also constitute a niche but growing customer segment, as their specialized fabrication processes often involve unique material stacks and intricate device geometries that necessitate tailored ashing solutions. Additionally, academic institutions and corporate research and development laboratories that are at the forefront of semiconductor materials science and process innovation also purchase these systems for experimental purposes, process development, and future technology exploration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.92 Billion |

| Market Forecast in 2033 | USD 7.85 Billion |

| Growth Rate | 8.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Applied Materials, Lam Research, Tokyo Electron (TEL), Hitachi High-Tech, SCREEN Holdings, ASM International, Plasma-Therm, PVA TePla, Samco Inc., NAURA Technology Group Co., Ltd., Axcelis Technologies, SEMES, Canon Anelva, SPTS Technologies (an KLA Company), Ulvac, Advanced Energy Industries, Inc., Oxford Instruments, Nordson MARCH, EV Group (EVG), Veeco Instruments. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Photoresist Ashing Equipment Market Key Technology Landscape

The Photoresist Ashing Equipment Market is characterized by a rapidly evolving technological landscape, driven by the ceaseless demands of semiconductor miniaturization, increasing device complexity, and the necessity for ultra-clean, damage-free wafer processing. At the core of this landscape are various plasma technologies, which represent the dominant method for photoresist removal due to their precision and control. Radio Frequency (RF) plasma ashers, including capacitively coupled plasma (CCP) and inductively coupled plasma (ICP) systems, are widely utilized, offering advantages in terms of plasma density and uniformity. Microwave plasma systems, particularly downstream configurations, are favored for their ability to generate highly reactive species while minimizing ion bombardment to the wafer surface, crucial for preventing damage to sensitive device structures. The choice of plasma technology depends heavily on the specific application, material stack, and the desired balance between throughput, selectivity, and damage control.

Beyond the fundamental plasma generation mechanisms, advancements in gas chemistries play a critical role in enhancing ashing performance. While oxygen (O2) plasma remains a staple for organic photoresist removal, the introduction of additive gases such as hydrogen (H2), nitrogen (N2), forming gas (H2/N2), or small amounts of fluorine-containing gases (e.g., CF4) allows for tailored processes. These chemistries optimize removal rates, improve selectivity to underlying layers, and enable the efficient stripping of hardened or ion-implanted photoresists. The ability to precisely control the gas flow, mixing ratios, and plasma conditions is paramount, requiring sophisticated mass flow controllers and advanced process control systems to ensure repeatability and consistency across batches and wafers. Research into novel, environmentally friendly gas chemistries is also ongoing, aiming to reduce the reliance on perfluorinated compounds and align with sustainability goals.

Further technological innovations encompass enhanced automation, advanced process monitoring, and sophisticated endpoint detection techniques. Robotic wafer handling systems are integral to modern ashing equipment, ensuring high throughput, minimizing particle contamination, and reducing human error. Real-time process monitoring, utilizing optical emission spectroscopy (OES) or interferometry, allows for precise control and endpoint detection, preventing over-ashing or under-ashing, both of which can lead to device defects. The integration of artificial intelligence and machine learning algorithms is emerging as a transformative technology, enabling predictive maintenance, dynamic process optimization, and enhanced yield management. These intelligent systems analyze vast amounts of operational data to fine-tune process parameters, anticipate equipment failures, and automatically adjust recipes for optimal performance, thus pushing the boundaries of what is achievable in terms of efficiency, quality, and cost-effectiveness in photoresist ashing.

Regional Highlights

- Asia Pacific (APAC): Dominates the global Photoresist Ashing Equipment Market, primarily driven by the concentration of major semiconductor manufacturing hubs in countries like Taiwan, South Korea, China, and Japan. These countries are home to leading foundries, IDMs, and OSATs that are continuously investing in expanding fabrication capacities and upgrading to advanced process nodes, leading to high demand for sophisticated ashing equipment. China, in particular, is experiencing significant growth due to substantial government investments aimed at achieving semiconductor self-sufficiency.

- North America: A key region for innovation and research in semiconductor equipment technology. The United States houses numerous leading equipment manufacturers and a robust ecosystem for advanced semiconductor R&D. While its manufacturing output is lower than APAC, North America leads in developing cutting-edge ashing solutions required for high-performance computing, AI applications, and specialized defense electronics. Recent government initiatives like the CHIPS Act are spurring domestic manufacturing investments.

- Europe: Characterized by specialized applications, particularly in the automotive, industrial, and power electronics sectors. Countries like Germany, France, and the Netherlands have strong research capabilities and contribute to the development of advanced equipment for niche markets. European investments often focus on energy efficiency, precision engineering, and highly customized solutions for specific industrial requirements, including advanced sensor and MEMS fabrication.

- Latin America: Represents an emerging market with limited but growing presence in semiconductor manufacturing. While not a major hub for advanced fabrication, there is increasing interest in assembly, test, and some specialized component manufacturing, which could drive modest demand for ashing equipment in the long term, particularly from regional electronics assembly plants.

- Middle East & Africa (MEA): Currently a nascent market for photoresist ashing equipment, with very limited semiconductor manufacturing capabilities. However, strategic investments in technology infrastructure and economic diversification efforts in certain countries, such as the UAE and Saudi Arabia, may gradually lead to the development of localized electronics manufacturing and research, potentially creating future opportunities for market penetration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Photoresist Ashing Equipment Market.- Applied Materials

- Lam Research

- Tokyo Electron (TEL)

- Hitachi High-Tech

- SCREEN Holdings

- ASM International

- Plasma-Therm

- PVA TePla

- Samco Inc.

- NAURA Technology Group Co., Ltd.

- Axcelis Technologies

- SEMES

- Canon Anelva

- SPTS Technologies (an KLA Company)

- Ulvac

- Advanced Energy Industries, Inc.

- Oxford Instruments

- Nordson MARCH

- EV Group (EVG)

- Veeco Instruments

Frequently Asked Questions

Analyze common user questions about the Photoresist Ashing Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is photoresist ashing equipment and why is it crucial in semiconductor manufacturing?

Photoresist ashing equipment is used to remove photoresist layers from semiconductor wafers after etching, typically employing plasma technologies. It is crucial because it ensures the complete and damage-free removal of organic residues, which is essential for the integrity, functionality, and high yield of integrated circuits in advanced semiconductor fabrication processes.

What are the primary types of photoresist ashing equipment available in the market?

The primary types of photoresist ashing equipment include plasma ashers, which utilize various plasma sources like RF, microwave, ICP, or downstream plasma, and to a lesser extent, dry ashers that rely on thermal or chemical reactions. Plasma ashers are dominant due to their superior precision and control in advanced manufacturing.

What are the key factors driving the growth of the Photoresist Ashing Equipment Market?

Key growth drivers include the surging global demand for semiconductors across various applications (5G, AI, IoT, automotive), the relentless pursuit of device miniaturization, the shift to advanced manufacturing nodes (e.g., sub-5nm), and the increasing adoption of advanced packaging technologies like 3D ICs.

What challenges does the Photoresist Ashing Equipment Market face?

The market faces challenges such as high capital expenditure for equipment, the inherent technological complexity requiring skilled personnel, stringent environmental regulations, potential supply chain disruptions due to geopolitical tensions, and the cyclical nature of the broader semiconductor industry.

How is artificial intelligence (AI) impacting the Photoresist Ashing Equipment Market?

AI is transforming the market by enabling real-time process optimization, predictive maintenance for equipment, enhanced yield management, automated process control, and advanced data analytics. This leads to improved efficiency, reduced downtime, and higher quality control in photoresist removal processes, especially for complex advanced nodes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager