Photosensitive Glass Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435514 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Photosensitive Glass Market Size

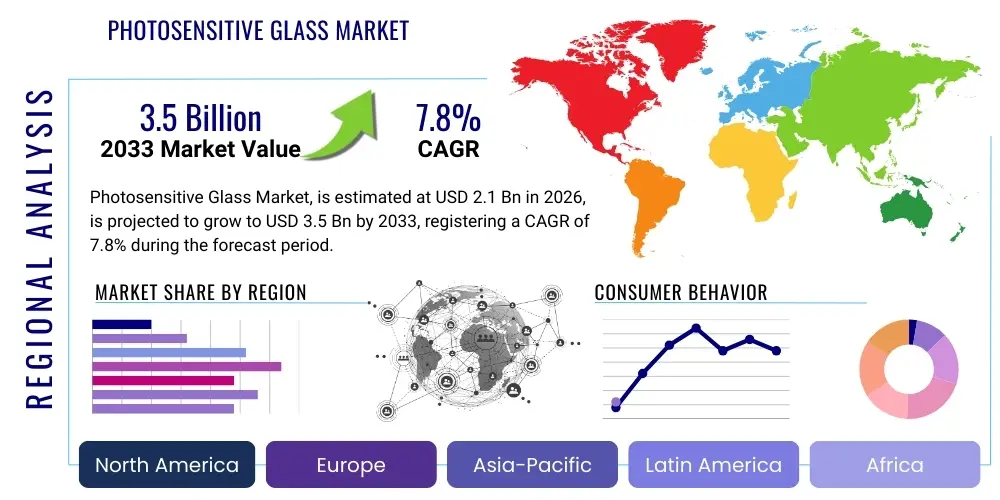

The Photosensitive Glass Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.5 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating demand for high-precision components in advanced electronics, particularly in microfluidics, MEMS devices, and augmented reality (AR) displays. The unique ability of photosensitive glass to allow complex 3D microstructures to be manufactured cost-effectively using UV exposure and thermal processing positions it as an indispensable material in miniaturization trends across several high-technology sectors. Continuous investment in R&D focusing on enhancing material properties, such as increased chemical resistance and optimized optical clarity, further supports this substantial market expansion over the forecast horizon.

Photosensitive Glass Market introduction

Photosensitive glass, a specialized material that changes its optical properties or solubility when exposed to ultraviolet (UV) light and subsequently heated, is pivotal in modern high-tech manufacturing. This material enables the fabrication of complex micro-structures, channels, and openings with extremely high precision and aspect ratios, far surpassing the limitations of traditional etching techniques. The unique composition, typically containing specific metallic ions (like silver or gold) acting as nucleation agents, allows for selective crystallization or etching in the exposed areas. This characteristic makes it highly valuable for applications requiring intricate patterns and controlled volume production, such as semiconductor packaging and sophisticated optical elements. The precision achieved through this process ensures minimal material waste and excellent repeatability, which are crucial metrics in critical applications like medical diagnostics and high-resolution imaging systems.

The primary applications of photosensitive glass span across electronics, where it is utilized for through-glass vias (TGVs) and interposers; in the biomedical sector for microfluidic chips, lab-on-a-chip devices, and specialized sensors; and within the optical industry for micro-lenses, diffractive elements, and precise optical mounts. Furthermore, the aerospace and defense sectors leverage its thermal stability and dimensional accuracy for producing ruggedized sensors and specialized display components. The key benefits driving its adoption include superior mechanical strength, excellent thermal endurance, extremely low coefficient of thermal expansion (CTE) matching silicon, and high chemical resistance, making it suitable for harsh operating environments. These inherent material advantages provide manufacturers with a reliable substrate for next-generation devices that demand performance under demanding conditions, thereby fueling continuous market penetration across new industrial verticals.

Major driving factors contributing to the robust growth of the photosensitive glass market include the rapid miniaturization trend across the electronics industry, specifically the increasing adoption of 3D integration and advanced packaging technologies (e.g., heterogeneous integration), which heavily rely on glass substrates for interconnection. The burgeoning demand for point-of-care diagnostics and personalized medicine is spurring innovation in microfluidics, a sector where photosensitive glass is the preferred fabrication material due to its inertness and ability to form intricate microchannels. Additionally, the proliferation of sophisticated optical systems, including those used in LiDAR, advanced driver-assistance systems (ADAS), and virtual and augmented reality (VR/AR) headsets, requires highly precise optical components manufactured using photosensitive glass techniques, thus cementing its crucial role in future technological advancements and ensuring sustained market growth throughout the forecast period.

Photosensitive Glass Market Executive Summary

The Photosensitive Glass Market is experiencing robust growth fueled primarily by global technological trends emphasizing miniaturization and high-density integration across diverse industries. Business trends indicate a strong shift towards strategic partnerships between material suppliers and high-tech device manufacturers (OEMs) to co-develop custom glass compositions optimized for specific etching profiles and performance requirements, particularly in the semiconductor and biomedical fields. Furthermore, market competition is increasingly focused on developing specialized photosensitive glass families, such as FOTURAN and related chemically strengthened variants, that offer enhanced mechanical resilience and superior thermal properties, expanding their usability in demanding environments like aerospace and high-power electronics. Investment in automated manufacturing processes is accelerating, aiming to reduce production costs and improve yield rates for complex microstructures, thereby making photosensitive glass fabrication more accessible for mass-market applications.

Regional trends highlight the Asia Pacific (APAC) region as the dominant and fastest-growing market, driven by the massive presence of electronics manufacturing hubs, semiconductor fabrication plants (fabs), and a rapidly expanding biomedical research sector, particularly in countries like China, South Korea, and Taiwan. North America and Europe maintain significant market shares, characterized by high investment in advanced R&D, specialized optics manufacturing, and a mature microfluidics industry supporting clinical diagnostics and drug discovery applications. The regional disparity in growth rates is linked to varying degrees of adoption of advanced packaging technologies and government initiatives supporting micro-electromechanical systems (MEMS) development. Specific regulatory changes in medical device manufacturing, particularly in Europe and the US, are also pushing manufacturers toward materials like photosensitive glass that meet stringent biocompatibility and precision standards.

Segment trends reveal that the Electronics application segment currently holds the largest market share, predominantly driven by the critical need for interposers, substrate carriers, and Through-Glass Vias (TGVs) in advanced IC packaging. Within the Type segmentation, chemically strengthened photosensitive glass materials are gaining prominence due to their superior structural integrity, addressing reliability concerns in demanding consumer electronics and automotive applications. The microfluidics sub-segment, while smaller in absolute value, is exhibiting the highest growth rate, reflecting the revolutionary impact of lab-on-a-chip technologies in diagnostics and drug screening. This increasing segmentation complexity necessitates suppliers to offer a diverse portfolio of materials, customized based on etch selectivity, transparency, and thermal thresholds, ensuring optimized performance for end-user specific requirements across all high-growth sectors.

AI Impact Analysis on Photosensitive Glass Market

User inquiries regarding AI's influence on the Photosensitive Glass Market frequently center around automation capabilities, predictive quality control, and the acceleration of material discovery processes. Common questions explore how AI algorithms can optimize the complex UV exposure and thermal treatment protocols required for precise microstructure fabrication, which traditionally relies heavily on empirical testing and manual calibration. Users are keenly interested in whether AI can enhance the yield rates of high-aspect-ratio features and predict defects in real-time, significantly reducing manufacturing waste and improving component reliability. Furthermore, there is substantial interest in leveraging AI for computational materials science—specifically, using machine learning models to design novel photosensitive glass compositions with tailored properties (e.g., faster etching rates or improved optical performance) that meet the evolving demands of cutting-edge applications like quantum computing and advanced sensors. The underlying theme across user concerns is the expectation that AI integration will drive down the cost of precision glass microfabrication, making it economically viable for larger-volume consumer applications.

- AI-driven optimization of UV exposure patterns and thermal processing cycles, minimizing stress and maximizing etch uniformity.

- Predictive maintenance and real-time quality control (QC) systems using computer vision to inspect complex 3D microstructures for defects during manufacturing.

- Acceleration of R&D for novel photosensitive glass chemistries via machine learning algorithms simulating reaction kinetics and material properties.

- Enhanced throughput and yield rate improvement in MEMS and microfluidic fabrication through process parameter self-adjustment based on continuous data feedback.

- Optimization of supply chain logistics and inventory management for specialty raw materials critical to photosensitive glass production.

DRO & Impact Forces Of Photosensitive Glass Market

The Photosensitive Glass Market is governed by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), collectively shaping its growth trajectory and exposure to external forces. Key drivers include the exponential growth in advanced electronics packaging, particularly 2.5D and 3D integration requiring glass interposers, which capitalize on the material’s superior flatness and thermal characteristics compared to traditional silicon. Simultaneously, the restraints are primarily focused on the high initial investment required for sophisticated UV patterning and etching equipment, alongside the complexity of achieving ultra-fine feature resolution in high volumes without inducing material stress. However, significant opportunities exist in emerging fields such as AR/VR displays, where the demand for lightweight, high-refractive index micro-optics is substantial, and in next-generation medical diagnostics utilizing miniaturized, disposable microfluidic cartridges, which promise vast market expansion potential.

The impact forces influencing the market are multifaceted, encompassing technological, regulatory, and competitive factors. Technologically, the ongoing push for smaller form factors and increased functional density in electronic devices exerts significant upward pressure on the demand for high-precision materials like photosensitive glass. Regulatory forces, particularly stricter standards for medical device materials regarding biocompatibility and sterilization, often favor inert glass solutions, boosting their adoption in clinical applications. Competitive intensity remains high, driven by major glass manufacturers striving for differentiated product offerings—such as optimized glass-ceramic compositions—to capture lucrative contracts in niche, high-value sectors like telecommunications and defense. Furthermore, the bargaining power of buyers, especially large semiconductor foundries, is moderate, driving suppliers to continually innovate and reduce manufacturing costs to secure long-term procurement agreements.

The market faces the critical challenge of competing etching and fabrication technologies, such as deep reactive-ion etching (DRIE) for silicon and advanced polymer molding for microfluidics, which offer alternative, sometimes lower-cost, solutions. However, photosensitive glass maintains a distinct advantage in applications requiring intrinsic optical transparency, high chemical resilience, and exceptional thermal stability, features often unattainable with polymer or silicon alternatives. Overcoming the cost barrier through increased process automation and scaling up production volumes represents the primary strategic focus for market players. Successful mitigation of these restraints, coupled with capital investment in harnessing key opportunities in photonics and advanced display technologies, will determine the overall market penetration and growth rate throughout the forecast period, solidifying photosensitive glass as a cornerstone material for micro-fabrication.

Segmentation Analysis

The Photosensitive Glass Market is segmented primarily based on the Type of glass composition, the specific Application area, and the End-Use Industry, reflecting the diversity of technical requirements across various high-tech sectors. The segmentation by Type generally differentiates between FOTURAN-type materials (characterized by silver-catalyzed crystallization and subsequent selective etching) and other specialized photosensitive compositions, including high-silica glasses used for optical components. Analyzing these segments helps in understanding which material properties—such as etching speed, optical clarity, or thermal resistance—are driving procurement decisions in specific fields. The high versatility inherent in photosensitive glass compositions necessitates a granular view of these types to cater to highly demanding manufacturing specifications across industries like biomedical diagnostics and microelectronics, ensuring material performance alignment with device functionality requirements.

The Application segment is critical, as it directly correlates material usage with industrial demand trends. Major applications include the fabrication of microfluidic devices, optical components (e.g., waveguides and diffractive gratings), and critical electronic components (e.g., interposers and Through-Glass Vias or TGVs). The growth rate within each application sub-segment often mirrors the adoption rate of advanced technologies in that field; for instance, the rapid expansion of point-of-care testing drives the microfluidics segment, while the push for smaller, faster chips fuels the electronics segment. Finally, the segmentation by End-Use Industry (e.g., Consumer Electronics, Healthcare, Telecommunications, Automotive) provides strategic insights into the volume demand, regulatory landscape, and necessary quality standards specific to these large vertical markets, allowing suppliers to tailor their offerings effectively and prioritize investments in high-growth industrial areas globally.

- By Type:

- FOTURAN (Glass-Ceramic)

- High-Silica Photosensitive Glass

- Chemically Strengthened Photosensitive Glass

- Others (Specialty Compositions)

- By Application:

- Microfluidics (Lab-on-a-chip, Drug Delivery Systems)

- Optical Components (Waveguides, Micro-lenses, Diffractive Elements)

- Electronic Components (Interposers, Through-Glass Vias - TGVs)

- MEMS Devices (Sensor Substrates)

- Advanced Displays (AR/VR Components)

- By End-Use Industry:

- Electronics & Semiconductor

- Healthcare & Biomedical

- Aerospace & Defense

- Telecommunications

- Automotive

- Consumer Goods

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, Taiwan, India, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa (UAE, Saudi Arabia, Rest of MEA)

Value Chain Analysis For Photosensitive Glass Market

The value chain for the Photosensitive Glass Market commences with the upstream analysis involving the sourcing and refinement of specialized raw materials, primarily high-purity silica, metal salts (such as silver, copper, or gold) which act as nucleation agents, and various fluxes and stabilizing agents. This initial stage requires stringent quality control as the final properties of the glass, including its photosensitivity and etch selectivity, are highly dependent on the purity and precise ratio of these components. Key suppliers in the upstream segment focus on chemical synthesis and high-temperature melting processes to produce the glass melt. Efficiency in this stage significantly impacts the final cost and technical feasibility of producing specialized photosensitive glass formulations required for high-precision applications like 3D printing of micro-optical components or semiconductor wafer fabrication.

The core manufacturing and processing segment involves the critical steps of glass melting, forming into substrate sheets or wafers, and then the proprietary post-processing, which includes UV exposure (photolithography) and thermal treatment (crystallization). This is where the specialized knowledge and core intellectual property of photosensitive glass manufacturers reside. Downstream analysis focuses on the integration of the precisely etched glass components into final products. This segment includes specialized companies involved in bonding (e.g., glass-to-silicon bonding for interposers), assembly of microfluidic systems (e.g., integrating pumps and sensors), and final device testing and packaging. The efficiency of the downstream process directly impacts the performance and commercialization speed of complex devices like advanced medical diagnostic instruments and high-speed telecom transceivers.

Distribution channels for photosensitive glass are primarily direct for large-volume customers such as major semiconductor manufacturers and established medical device OEMs, ensuring technical support and custom specifications are met precisely. Indirect channels involve specialized distributors or material brokers who cater to smaller R&D laboratories, academic institutions, and niche prototyping companies, providing smaller batch sizes and specialized advisory services. The selection of the channel is often dependent on the complexity of the component and the required level of technical engagement. Due to the high-value and highly technical nature of the product, maintaining strong direct relationships with key end-users remains crucial for material suppliers to quickly adapt to evolving technological standards and secure long-term supply contracts in this specialized high-performance materials sector.

Photosensitive Glass Market Potential Customers

Potential customers and end-users of photosensitive glass are primarily large corporations and specialized R&D entities operating within technology-intensive sectors that require micron-level precision and material stability unattainable with conventional materials. Major buyers include semiconductor foundries and advanced packaging companies (OSATs) that utilize glass interposers for high-density, heterogeneous integration of integrated circuits, focusing on minimizing signal loss and thermal expansion mismatch with silicon components. Additionally, leading manufacturers of consumer electronics, particularly those producing high-end smartphones, wearable devices, and AR/VR headsets, constitute a significant customer base, leveraging the material for miniaturized optical elements and protective coatings that demand exceptional scratch resistance and transparency.

The biomedical and healthcare industries represent another critical segment of potential customers, comprising pharmaceutical companies, medical device manufacturers, and clinical diagnostic laboratories. These entities are primary consumers of microfluidic chips manufactured from photosensitive glass due to its chemical inertness, biocompatibility, and ability to form extremely precise microchannels essential for efficient fluid handling in lab-on-a-chip systems and point-of-care testing devices. The demand here is driven by the global trend toward personalized medicine and rapid diagnostics, where reliability and sample integrity are paramount. Furthermore, aerospace and defense contractors represent high-value, albeit lower volume, customers, utilizing photosensitive glass for ruggedized sensor windows, specialized display components, and precision optical sighting systems that must withstand extreme environmental conditions while maintaining structural and optical integrity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.5 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Corning Inc., SCHOTT AG, Ohara Corporation, Hoya Corporation, AGC Inc., Nippon Sheet Glass Co., Ltd., Coorstek Inc., Tokuyama Corporation, Raydiance Inc., LPKF Laser & Electronics AG, MicroChemicals GmbH, OptiGrate Corp., Beijing Glass Group, Santec Corporation, Vesuvius plc, Marubeni Corporation, Kyocera Corporation, Heraeus Holding, CeeTee Industries, Zotefoams plc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Photosensitive Glass Market Key Technology Landscape

The technological landscape of the Photosensitive Glass Market is dominated by the sophisticated process combining UV lithography and controlled thermal processing, specifically tailored to the unique properties of the glass composition. The primary technique relies on exposing the glass to deep UV light through a mask, which initiates a photochemical reaction that converts metallic ions (typically silver) into neutral atoms, forming nano-sized metallic clusters. These clusters subsequently act as nucleation sites during a subsequent annealing step (thermal treatment). The key technological differentiation among manufacturers lies in optimizing the wavelength and intensity of the UV source, the composition of the mask, and the precise temperature and duration of the thermal cycle. Advanced methodologies focus on achieving superior control over the depth and feature size of the etched structures, crucial for complex devices such as high-density interposers and intricate micro-channel geometries in bio-sensors. Ongoing research aims to develop glass compositions requiring lower exposure energy and shorter processing times, enhancing manufacturing efficiency and reducing operational costs for high-volume production lines.

A significant technological development is the shift towards laser-assisted selective etching (LASE) or laser-induced deep etching (LIDE) processes, which utilizes femtosecond or picosecond lasers instead of broad-area UV lamps and physical masks. LIDE offers significant advantages, including maskless processing, enhanced flexibility in designing complex 3D structures, and the ability to process thicker glass substrates with exceptionally high aspect ratios and wall verticality. This technology is particularly relevant for creating Through-Glass Vias (TGVs) in advanced semiconductor packaging, where precise vertical connections through the glass substrate are essential for maintaining signal integrity and thermal management. Furthermore, advancements in chemical strengthening techniques applied post-etching are vital, as they improve the mechanical durability of the glass component, especially those with delicate microstructures. Surface quality improvement technologies, aimed at minimizing roughness and ensuring superior optical clarity in the etched channels, remain a strong area of R&D focus to meet the stringent performance requirements of telecommunications and high-end imaging applications.

Another crucial element in the technological ecosystem is the integration with complementary micro-fabrication technologies, such as thin-film deposition and precision bonding. Photosensitive glass components are increasingly being combined with silicon wafers, polymer layers, and metallic electrodes. Therefore, innovations in glass-to-silicon anodic bonding and low-temperature sealing processes are essential for the successful integration of complex micro-devices. The development of photosensitive glass ceramics, such as FOTURAN variants, which exhibit characteristics of both glass and ceramic materials, is crucial for applications demanding extremely high temperature resistance and structural rigidity. These technological advancements collectively reduce manufacturing complexity, enhance device functionality, and enable the creation of next-generation devices that leverage the unparalleled precision and material stability offered by photosensitive glass, sustaining the market's high technological barrier to entry and competitive edge over alternative materials.

Regional Highlights

- Asia Pacific (APAC): Dominance and Rapid Growth

The APAC region holds the largest market share and is projected to exhibit the highest growth rate during the forecast period. This dominance is intrinsically linked to the concentration of global electronics manufacturing, semiconductor fabrication, and consumer goods assembly within countries like China, Taiwan, South Korea, and Japan. The massive investment in 5G infrastructure, advanced display technologies (OLED/MicroLED), and high-volume production of smartphones and IoT devices drives the demand for photosensitive glass interposers and micro-optical components. Furthermore, rapid governmental and private sector investment in biomedical research and microfluidics development in emerging economies within APAC significantly contributes to the regional market expansion. The presence of sophisticated supply chains and a competitive manufacturing environment supports the rapid commercialization and adoption of photosensitive glass technology.

- North America: Innovation and High-Value Applications

North America, particularly the United States, is a key market driven by innovation in aerospace, defense, advanced optics (LIDAR, specialized telescopes), and a mature medical device industry. The region is characterized by substantial R&D expenditure in MEMS and advanced packaging technologies, focusing on high-performance, complex devices rather than sheer volume. Leading companies and academic institutions in the U.S. drive the development of novel photosensitive glass compositions optimized for specific military and medical diagnostic standards. Demand is strongly concentrated in high-value applications such as precision sensors, complex microfluidic devices for personalized medicine, and robust components for space-grade equipment, where cost is secondary to material reliability and performance.

- Europe: Biomedical and Automotive Focus

Europe represents a stable and growing market, largely driven by the strong presence of established manufacturers specializing in high-quality optical systems and a leading position in the global biomedical and pharmaceutical sectors. Germany and the UK are primary consumers, leveraging photosensitive glass for intricate optical waveguides and sensors used in telecommunications and industrial inspection equipment. Furthermore, the stringent safety and performance requirements within the European automotive industry, especially for advanced lighting systems and ADAS sensors, necessitate the use of highly reliable glass components. The European regulatory environment, particularly the Medical Device Regulation (MDR), encourages the use of highly inert and traceable materials like photosensitive glass in diagnostic consumables.

- Latin America (LA) and Middle East & Africa (MEA): Emerging Markets

These regions currently hold smaller market shares but are exhibiting promising growth potential, primarily driven by increasing healthcare expenditure and technological infrastructure development. In LA, the expansion of local electronics assembly and investment in medical diagnostics facilities creates growing demand for imported photosensitive glass components. In MEA, specifically the UAE and Saudi Arabia, diversification efforts away from oil economies, focusing on high-tech sectors, smart cities, and advanced healthcare, are expected to gradually increase the need for precision materials. Growth in these regions is heavily reliant on foreign direct investment, technology transfer, and establishing local technical expertise for device integration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Photosensitive Glass Market.- Corning Inc.

- SCHOTT AG

- Ohara Corporation

- Hoya Corporation

- AGC Inc.

- Nippon Sheet Glass Co., Ltd.

- Coorstek Inc.

- Tokuyama Corporation

- Raydiance Inc.

- LPKF Laser & Electronics AG

- MicroChemicals GmbH

- OptiGrate Corp.

- Beijing Glass Group

- Santec Corporation

- Vesuvius plc

- Marubeni Corporation

- Kyocera Corporation

- Heraeus Holding

- CeeTee Industries

- Zotefoams plc

Frequently Asked Questions

Analyze common user questions about the Photosensitive Glass market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Photosensitive Glass and how does it differ from traditional glass?

Photosensitive glass is a specialty glass containing metallic ions (e.g., silver) that allows it to be selectively modified using UV light and subsequent heat treatment. Unlike traditional glass, which requires mechanical machining or high-energy etching, photosensitive glass enables highly precise, mask-defined 3D microstructures to be chemically etched with superior accuracy and aspect ratios, making it ideal for micro-fabrication.

Which industry applications drive the highest demand for Photosensitive Glass?

The highest demand is driven by the Electronics and Semiconductor industry for fabricating Through-Glass Vias (TGVs) and interposers used in advanced 2.5D and 3D integrated circuit packaging. The Healthcare and Biomedical sector also contributes significantly, utilizing the material for high-precision microfluidic devices and lab-on-a-chip diagnostic systems.

What are the key technical challenges in manufacturing Photosensitive Glass components?

Key technical challenges include managing the high capital cost of specialized UV exposure and thermal processing equipment, ensuring uniform etching depth and feature resolution across large wafers, and mitigating potential material stress during the high-temperature annealing phase required for crystallization and subsequent etching processes.

Which geographic region dominates the global Photosensitive Glass Market?

The Asia Pacific (APAC) region dominates the global market. This leadership is primarily attributed to the high concentration of semiconductor fabrication plants, major electronics manufacturing centers, and strong governmental support for technological advancements in countries like China, Taiwan, and South Korea, driving massive demand for high-precision glass substrates.

How does Photosensitive Glass compare to silicon or polymers in microfluidic applications?

Photosensitive glass offers superior chemical inertness, high thermal stability, optical transparency, and excellent material biocompatibility compared to polymers. While silicon offers high precision via DRIE, photosensitive glass is preferred when optical access, high aspect ratios in transparent media, and compatibility with biological samples without surface modification are critical requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager