Photosensitive Polyimide Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432188 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Photosensitive Polyimide Market Size

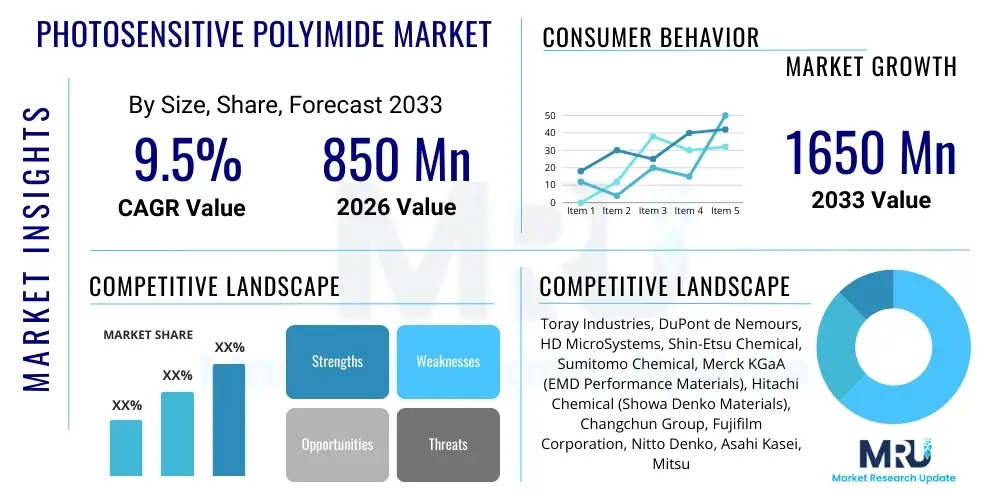

The Photosensitive Polyimide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 850 million in 2026 and is projected to reach USD 1650 million by the end of the forecast period in 2033. This significant expansion is primarily attributed to the burgeoning demand for high-performance dielectric materials essential for advanced semiconductor packaging, particularly in applications requiring fine-pitch lithography and superior thermal stability. The continuous drive toward device miniaturization and the increasing complexity of integrated circuits (ICs) necessitate materials like photosensitive polyimide (PSPI) that can be precisely patterned using standard photolithographic processes, thereby streamlining manufacturing and improving overall component reliability, making this material indispensable for next-generation electronics.

Photosensitive Polyimide Market introduction

The Photosensitive Polyimide (PSPI) Market encompasses specialized polymeric materials utilized predominantly as protective coatings, stress buffers, and insulation layers in advanced microelectronics and semiconductor manufacturing. PSPIs are unique because they combine the exceptional thermal and mechanical properties inherent to traditional polyimides—such as high glass transition temperature, excellent chemical resistance, and low coefficient of thermal expansion—with the capability of being directly patterned through photolithography, eliminating the need for separate photoresist layers, which significantly simplifies processing steps and reduces manufacturing costs. This dual functionality allows for high-resolution patterning, critical for the production of advanced packaging components like fan-out wafer-level packaging (FOWLP) and 3D integrated circuits (3D ICs), where precise layer thickness and pattern definition are mandatory.

Major applications of PSPI include the fabrication of stress buffer layers in integrated circuits, dielectric insulation films in multilayer flexible printed circuits (FPCs), inter-layer dielectrics (ILD) in high-density interconnect (HDI) substrates, and passivation layers for advanced display technologies such as OLEDs. The primary benefits driving market adoption are enhanced device reliability under extreme operating conditions, superior electrical insulation properties (low dielectric constant, high breakdown voltage), and compatibility with existing high-volume manufacturing (HVM) processes. Key driving factors involve the rapid expansion of the 5G and future 6G infrastructure, demanding high-frequency, low-loss materials, coupled with the aggressive development cycles within the automotive sector for autonomous driving systems and robust sensor technologies requiring durable electronic components.

Photosensitive Polyimide Market Executive Summary

The Photosensitive Polyimide market is undergoing rapid transformation, driven primarily by evolving semiconductor manufacturing standards and aggressive technological scaling across Asia Pacific, which dominates both consumption and production volumes due to established fabrication hubs in Taiwan, South Korea, and China. Current business trends indicate a strong shift towards developing lower dielectric constant and lower dissipation factor PSPI formulations, essential for minimizing signal integrity issues in high-speed data transmission required by 5G devices and data centers. Furthermore, there is an increasing preference for positive-tone PSPIs, offering improved resolution and smaller feature sizes compared to traditional negative-tone counterparts, although negative-tone materials maintain their relevance in thick film applications requiring robust mechanical properties. Segmentation analysis reveals the liquid form segment retaining the largest market share owing to its adaptability in spin-coating processes utilized in wafer fabrication, while film/sheet formats are gaining traction in large-area flexible display applications.

Regionally, Asia Pacific is the unrivaled leader, fueled by massive investment in foundry capacity expansion and government incentives supporting domestic semiconductor industries, positioning countries like China and Taiwan as central figures in PSPI demand. North America and Europe, while smaller in volume, are crucial centers for material innovation, focusing heavily on ultra-pure, specialty PSPIs designed for harsh environment applications such as aerospace and high-reliability medical devices, often driving premium pricing strategies. Segment trends show advanced packaging applications—specifically high-density redistribution layers (RDLs) and wafer bumping—exhibiting the highest growth rate, as these processes critically depend on the photo-patternability and thermal resilience of PSPI materials to achieve the necessary interconnect densities for modern ICs, thus solidifying PSPI’s role as a cornerstone material in heterogeneous integration and advanced chip design.

AI Impact Analysis on Photosensitive Polyimide Market

Common user questions regarding AI's impact on the Photosensitive Polyimide market frequently revolve around optimization, quality control, and material discovery. Users seek to understand how Artificial Intelligence can enhance manufacturing yield rates, specifically mitigating defects during the critical photolithography and curing stages. There is significant interest in utilizing AI and machine learning (ML) models to predict and optimize the complex formulation parameters of PSPIs, such as viscosity, photospeed, and thermal stability, based on desired end-use characteristics for specific electronic devices. Furthermore, users frequently question how AI-driven design tools, which often require complex heterogeneous integration schemes, will accelerate the need for novel, ultra-low-loss PSPI materials capable of handling extremely high-frequency signals and heat dissipation requirements far exceeding current specifications. The prevailing theme is that AI acts both as an optimization tool for existing production lines and as a powerful catalyst driving the necessity for new, high-performance material solutions.

AI's primary influence will manifest in three key areas: R&D acceleration, manufacturing optimization, and demand generation. By leveraging ML algorithms to analyze vast datasets relating processing conditions (temperature, spin speed, exposure time) to final film properties (stress, dielectric constant, resolution), manufacturers can significantly reduce experimental time and costs associated with new material development, leading to faster commercialization of next-generation PSPIs optimized for low-k performance or high thermal cycling stability. In the manufacturing sector, AI-powered automated defect inspection systems and predictive maintenance models will be deployed to monitor minute variations in material thickness or pattern fidelity in real-time on the wafer, dramatically improving yield rates, which is critical given the high cost associated with semiconductor fabrication and the high purity requirements for PSPIs.

The proliferation of AI hardware—specifically high-performance computing (HPC) chips and specialized AI accelerators—directly drives demand for the most advanced PSPI materials. These AI chips, characterized by high power density and complex 3D stacking, rely heavily on PSPIs for robust inter-dielectric insulation and thermal stress management within advanced packaging architectures like 2.5D and 3D integration. Consequently, the performance limitations of PSPI materials directly translate into performance constraints for AI hardware. As AI applications become ubiquitous, the requirement for superior high-frequency performance and better heat dissipation will compel material scientists to innovate rapidly, using AI itself as a tool to engineer PSPIs with tailor-made properties, such as lower moisture absorption and superior adhesion to diverse substrates, ensuring the material landscape evolves quickly to support the exponential growth in computational power.

- AI-driven optimization reduces defect rates in PSPI photolithography, boosting semiconductor manufacturing yield.

- Machine Learning accelerates R&D for novel PSPI formulations with enhanced low-k properties and thermal stability.

- Predictive analytics optimize processing parameters, minimizing material waste and enhancing production efficiency.

- Increased demand for high-density, power-efficient AI chips necessitates ultra-performance PSPIs for advanced packaging (RDLs).

- AI facilitates supply chain resilience through optimized inventory management of specialty PSPI monomers and precursors.

DRO & Impact Forces Of Photosensitive Polyimide Market

The Photosensitive Polyimide market dynamics are dictated by a delicate balance between technological necessity, material cost, and complexity of integration. The market is primarily driven by the unstoppable trend of device miniaturization and the increasing functionality of electronic devices, particularly the global rollout of 5G and impending 6G networks, which demand materials capable of ultra-high frequency operation with minimal signal loss, positioning PSPIs as critical enablers for next-generation communication infrastructure and advanced chip architectures. However, the high manufacturing cost associated with producing ultra-pure monomers required for electronic-grade PSPIs, coupled with the capital-intensive nature of specialized coating and curing equipment, acts as a significant restraint, especially for new entrants. Opportunities abound in emerging sectors such as flexible electronics for IoT devices, high-reliability automotive sensors (ADAS systems), and the growing biomedical device market, all requiring materials that offer both pattern precision and superior stability, allowing the market to maintain a robust growth trajectory despite cost pressures and supply chain volatility. These forces collectively shape the competitive landscape and influence strategic decisions regarding capacity expansion and product portfolio diversification within the industry.

A major driving force is the transition towards advanced semiconductor packaging techniques, particularly fan-out wafer-level packaging (FOWLP) and system-in-package (SiP) solutions, which utilize PSPI extensively for creating multi-layer redistribution layers (RDLs) that connect multiple dies within a single package. The ability of PSPI to be patterned precisely at feature sizes below 5 micrometers while offering a reliable dielectric layer under high heat load is non-negotiable for these sophisticated structures, directly linking market growth to semiconductor innovation pace. Conversely, a prominent restraint involves the technical challenges related to material stress management; as PSPI films shrink during the high-temperature curing process, they can induce significant stress on delicate substrates, leading to warping or performance degradation in the final device, necessitating ongoing, expensive R&D into low-stress formulations that are often difficult to scale up rapidly.

Impact forces on the PSPI market are largely centered on material science advancements and geopolitical trade stability. The persistent opportunity lies in developing environmentally friendly, solvent-free PSPI systems and those featuring ultra-low dielectric constants (low-k materials, ideally k < 2.5) that can handle terahertz frequencies required by future communication technologies, offering manufacturers a premium market segment. The main challenge, or restraint, remains the complex intellectual property landscape and the required deep technical expertise, creating high barriers to entry and consolidating power among a few key established players. The sustained need for components with longer operational lifetimes in demanding environments, such as deep-sea telecommunications or aerospace, reinforces the high-impact nature of thermal stability and material purity standards, pushing the entire supply chain towards stricter quality control and traceability, which ultimately drives up operational costs but ensures long-term profitability and strategic importance of PSPIs in the global electronics ecosystem.

Segmentation Analysis

The Photosensitive Polyimide market is comprehensively segmented based on its chemical composition (Type), its physical form (Form), and the specific end-use application (Application), allowing for granular analysis of demand drivers across the microelectronics value chain. Segmentation by Type, including both positive-tone and negative-tone PSPIs, reflects the trade-off between lithographic resolution and mechanical robustness, with positive-tone gaining prominence in high-resolution, fine-pitch applications. Segmentation by Form, comprising liquid and film/sheet formats, differentiates materials used in standard spin-coating wafer fabrication from those applied in flexible substrate processes like roll-to-roll manufacturing. Application segmentation highlights the material's critical role across diverse high-growth sectors, notably advanced semiconductor packaging, flexible displays, and specialized medical and automotive electronics, confirming its versatile utility as a high-performance dielectric material in the modern electronics landscape.

- By Type:

- Negative-Tone Photosensitive Polyimide (PSPI)

- Positive-Tone Photosensitive Polyimide (PSPI)

- By Form:

- Liquid (Solvent-based and Aqueous)

- Film/Sheet (Pre-cured or Partially Cured)

- By Application:

- Advanced Semiconductor Packaging (RDLs, Wafer Bumping, Inter-dielectric Layers)

- Flexible Printed Circuits (FPCs)

- Display Technologies (OLED, MicroLED Passivation Layers)

- MEMS and Sensors

- Automotive Electronics

- Medical Devices and Biomedical Sensors

- By End-User Industry:

- Semiconductors and Integrated Circuits (IC)

- Consumer Electronics

- Automotive

- Aerospace and Defense

- Healthcare

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Photosensitive Polyimide Market

The Photosensitive Polyimide value chain begins with the highly specialized upstream sector focused on the synthesis and purification of critical raw material monomers, predominantly high-purity dianhydrides (such as PMDA, BPDA, or ODPA) and diamines (such as ODA or MDA), along with specific photoactive compounds (PACs) or photogenerators. This upstream segment is characterized by stringent quality control requirements and high capital expenditure due to the necessity for maintaining ultra-low impurity levels suitable for electronic grade applications, placing significant control in the hands of a few established chemical suppliers. Moving midstream, the PSPI resin manufacturers perform the polymerization and formulation processes, blending the resultant polyamic acid solutions with photoinitiators and specific solvents to create the final photosensitive product, demanding deep chemical expertise and robust intellectual property concerning the specific formulations tailored for high-resolution lithography and thermal performance.

The downstream segment involves the application and integration of the PSPI materials into electronic devices by large-scale semiconductor foundries, OSAT (Outsourced Semiconductor Assembly and Test) companies, and specialized flexible printed circuit board manufacturers. These end-users utilize PSPIs for critical functions such as fabricating redistribution layers (RDLs) in advanced packaging, creating protective passivation layers, or serving as inter-layer dielectrics in complex multilayer structures. The efficiency and yield achieved at this stage heavily depend on the consistency and performance of the midstream PSPI product. The distribution channel is often highly centralized and direct for major high-volume clients, facilitating technical support and proprietary material handling, especially within the APAC region where the majority of semiconductor manufacturing capacity resides. However, indirect channels, typically involving specialty chemical distributors, are utilized for smaller volume, specialized PSPI formulations required by R&D institutions or low-volume, high-mix fabricators in North America and Europe, ensuring broader market reach and localized technical servicing capabilities.

The interdependence within this value chain is strong; upstream material costs heavily influence the final product price, and any disruption in the supply of high-purity monomers can directly impact global semiconductor production schedules. Conversely, the stringent technical requirements set by downstream users, driven by increasing device complexity and performance demands (e.g., thermal budget, lithographic resolution), constantly push midstream formulators and upstream material suppliers to innovate. The trend towards direct distribution in high-growth segments reflects the need for tighter collaboration between the PSPI manufacturer and the fab/assembly house to optimize material usage and troubleshoot complex process integration issues, distinguishing this market from conventional chemical supply chains where standard indirect distribution dominates. This structure emphasizes technical support and specialized application knowledge as a critical competitive differentiator, complementing the raw material's inherent performance characteristics.

Photosensitive Polyimide Market Potential Customers

The primary potential customers for Photosensitive Polyimide are entities deeply embedded in the fabrication of high-end electronic components, particularly those requiring ultra-precise dielectric layers and exceptional thermal resilience. Integrated Circuit (IC) foundries, which are responsible for manufacturing microprocessors and application-specific integrated circuits (ASICs), represent a cornerstone customer base, utilizing PSPI as inter-layer dielectric and stress buffer coatings on wafers. Crucially, Outsourced Semiconductor Assembly and Test (OSAT) providers constitute another major consumer segment, as they heavily rely on PSPI for building Redistribution Layers (RDLs) and insulation layers in advanced packaging technologies like 2.5D and 3D integration, fan-in/fan-out wafer-level packaging, essential for high-performance computing and mobile device processors where minimizing package size and maximizing interconnect density are paramount design goals.

Beyond traditional semiconductor fabrication, the burgeoning flexible electronics sector is a significant and rapidly growing consumer of PSPI materials. This includes manufacturers of Flexible Printed Circuits (FPCs), which use PSPI as the core insulation layer due to its superior mechanical flexibility and chemical resistance, enabling the creation of components necessary for modern smartphones, wearables, and IoT devices. Additionally, panel manufacturers specializing in advanced display technologies, notably Organic Light-Emitting Diode (OLED) and MicroLED displays, utilize PSPI as a reliable, high-temperature passivation layer to protect thin-film transistors (TFTs) and enhance display longevity and performance. The demand profile of these customers is defined not just by volume but by demanding specifications related to photolithographic resolution, low moisture absorption, and thermal cycling stability, making them sophisticated buyers focused on material performance rather than cost minimization.

Furthermore, specialized industrial segments such as automotive electronics suppliers, focusing on Advanced Driver-Assistance Systems (ADAS) and electric vehicle battery management systems, are increasingly becoming key buyers, requiring highly reliable PSPIs capable of withstanding extreme temperature fluctuations and vibrational stress common in vehicle operation. The aerospace and defense sector also represents a high-value customer group, where the exceptional thermal stability and radiation resistance of certain specialized PSPI formulations make them essential for satellite components and high-reliability avionics. These diverse end-users are interconnected by the common requirement for microelectronic components that offer superior long-term reliability and performance advantages, which only high-grade Photosensitive Polyimide materials can consistently deliver, cementing the product's role as an enabling technology across multiple high-tech industries.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1650 Million |

| Growth Rate | 9.5% CAGR ( Include CAGR Word with % Value ) |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Toray Industries, DuPont de Nemours, HD MicroSystems, Shin-Etsu Chemical, Sumitomo Chemical, Merck KGaA (EMD Performance Materials), Hitachi Chemical (Showa Denko Materials), Changchun Group, Fujifilm Corporation, Nitto Denko, Asahi Kasei, Mitsubishi Gas Chemical, SKC Kolon PI, DIC Corporation, Microchem Corp., Huntsman Corporation, Dow Chemical, Kaneka Corporation, Jiangsu Xinzhi Material Technology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Photosensitive Polyimide Market Key Technology Landscape

The technological landscape of the Photosensitive Polyimide market is defined by continuous innovation focused on optimizing lithographic performance, enhancing thermal reliability, and reducing dielectric loss for high-frequency applications. The core technology revolves around formulating the polyamic acid precursor with specific photosensitive functional groups, primarily utilizing Diazo Naphthoquinone (DNQ) chemistry for positive-tone PSPIs or acrylate/epoxy chemistries for negative-tone materials, where the choice directly impacts resolution capabilities and thermal resistance post-curing. Current research is intensely focused on developing aqueous-developable PSPIs, moving away from environmentally unfriendly organic solvents, which significantly streamlines the manufacturing process and reduces disposal costs for semiconductor fabs, providing a substantial technological competitive edge to manufacturers who successfully commercialize these 'green' formulations while maintaining required performance metrics, particularly adhesion and low stress.

A major technological frontier is the development of ultra-low dielectric constant (low-k) PSPI materials, critical for minimizing signal propagation delay and crosstalk in chips operating at gigahertz and eventually terahertz frequencies, demanded by advanced AI and high-speed networking components. Achieving low-k properties (typically k below 2.8) often involves incorporating specific fluorinated monomers or generating controlled porosity within the cured polyimide structure without compromising mechanical integrity, representing a complex synthesis challenge. Furthermore, technological advancements are addressing mechanical stress issues through the development of low-coefficient of thermal expansion (CTE) and low-stress PSPIs, which is essential for use on large, sensitive substrates like silicon wafers or flexible glass panels, preventing warpage and ensuring compatibility during multi-layer stacking and subsequent high-temperature packaging processes, which is particularly relevant for 3D integrated circuits (3D ICs) where thermal management is paramount for device functionality and longevity.

Finally, processing technologies related to PSPI application are also undergoing transformation, particularly the move towards advanced coating techniques beyond traditional spin-coating, such as spray coating or curtain coating, which allow for uniform deposition of thicker films over large or non-planar substrates, vital for packaging applications that require robust protection or complex topography. Compatibility with Chemical-Mechanical Planarization (CMP) remains a vital technological requirement, as PSPI layers often need to be polished down to achieve the extremely smooth surfaces necessary for subsequent high-resolution lithographic steps. Manufacturers are continually refining material purity and process windows to ensure PSPI films are CMP-friendly, exhibiting minimal defects and high removal rates, directly contributing to higher overall yield in advanced fabrication lines and solidifying PSPI's position as a high-tech material requiring specialized handling and precise integration into the complex semiconductor manufacturing environment.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of the global Photosensitive Polyimide market, accounting for the largest share in both consumption and production, driven by the colossal semiconductor manufacturing ecosystems located in China, Taiwan, South Korea, and Japan. Taiwan, home to the world's leading pure-play foundries, exhibits massive captive consumption of PSPI for advanced wafer processing and packaging, particularly for Redistribution Layers (RDLs) utilized in cutting-edge smartphone and HPC chips. South Korea and Japan, boasting major players in display technology (OLED) and material science innovation, drive demand for high-purity PSPIs used as passivation layers and flexible substrates. China's aggressive investment in domestic semiconductor self-sufficiency further bolsters regional demand, with substantial capacity expansion across FPC and advanced packaging facilities. The competitive landscape here is intense, characterized by large-scale production and rapid adoption of the latest technological formulations, making regional market dynamics crucial for global pricing and supply chain stability.

- North America: The North American market, predominantly centered around the United States, is a key hub for research and development, focusing on specialty, ultra-high-performance PSPIs required for high-reliability applications in aerospace, defense electronics, and advanced biomedical devices. While manufacturing volumes are lower compared to APAC, the market commands a premium for highly customized and specialized materials, often developed in close collaboration with defense contractors and IC design houses focused on next-generation computing architectures, including those for quantum and neuromorphic processing. Demand is also strong from leading technology companies involved in microelectromechanical systems (MEMS) and advanced sensor manufacturing, which require the precise patterning capabilities and robust environmental resistance inherent in PSPIs, fostering innovation in areas like low-stress and high-frequency compatible formulations.

- Europe: Europe represents a mature market segment, characterized by strong demand from the automotive electronics sector, particularly in Germany and France, where high-reliability PSPIs are essential for sensors and control units in electric vehicles and sophisticated ADAS systems that must endure stringent operational standards. The region also hosts significant R&D activities focused on specialty chemicals and advanced materials science, often targeting niche applications like high-frequency telecommunications components and industrial sensors. Market growth is stable, driven by regulatory requirements for cleaner manufacturing processes, encouraging the adoption of European-developed aqueous-developable and halogen-free PSPI formulations, although overall consumption volume remains constrained compared to the high-volume consumer electronics production dominated by Asia.

- Latin America, Middle East, and Africa (MEA): These regions currently hold smaller market shares, with demand primarily confined to local assembly operations, maintenance of existing infrastructure, and limited manufacturing activities, mostly for flexible printed circuits and general electronics assembly. Growth opportunities are emerging, particularly in the MEA region, driven by governmental investment in data center infrastructure and telecommunications network upgrades (5G deployment), which necessitates imported high-performance electronic components utilizing PSPI. Latin America's market growth is tied closely to local consumer electronics assembly and automotive parts production, where PSPI usage is increasing as local fabrication shifts towards more sophisticated PCB and packaging standards to keep pace with global technological advancements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Photosensitive Polyimide Market.- Toray Industries

- DuPont de Nemours

- HD MicroSystems

- Shin-Etsu Chemical

- Sumitomo Chemical

- Merck KGaA (EMD Performance Materials)

- Hitachi Chemical (Showa Denko Materials)

- Changchun Group

- Fujifilm Corporation

- Nitto Denko

- Asahi Kasei

- Mitsubishi Gas Chemical

- SKC Kolon PI

- DIC Corporation

- Microchem Corp.

- Huntsman Corporation

- Dow Chemical

- Kaneka Corporation

- Jiangsu Xinzhi Material Technology

Frequently Asked Questions

Analyze common user questions about the Photosensitive Polyimide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between positive-tone and negative-tone Photosensitive Polyimide?

Positive-tone PSPIs, typically based on DNQ chemistry, are soluble where exposed to UV light, allowing for higher resolution and fine-pitch patterning crucial for advanced RDL structures (5 microns or less). Negative-tone PSPIs, which polymerize and become insoluble upon exposure, generally offer better chemical resistance, mechanical strength, and are preferred for thicker film applications and use as stress buffer layers where robust physical properties are prioritized over ultra-high resolution capabilities.

How is the adoption of 5G technology influencing the demand for Photosensitive Polyimide?

The widespread rollout of 5G infrastructure significantly increases the demand for PSPIs, as high-frequency 5G components require dielectric materials with exceptionally low dielectric constants (low-k) and low dissipation factors to minimize signal loss and maximize data transfer rates. PSPIs are essential in advanced chip packaging and flexible circuits utilized in 5G devices and base stations, acting as highly stable insulation layers that maintain signal integrity under demanding operational conditions, thus directly linking PSPI market growth to telecommunications infrastructure development.

Which geographical region dominates the Photosensitive Polyimide market and why?

Asia Pacific (APAC) dominates the Photosensitive Polyimide market, primarily due to its concentration of leading semiconductor manufacturing foundries, large-scale OSAT (Outsourced Semiconductor Assembly and Test) providers, and major consumer electronics fabrication hubs in countries such as Taiwan, South Korea, and China. This regional dominance is driven by the massive captive consumption of PSPI for advanced packaging (RDLs) and flexible display production, necessitating high-volume supply and rapid adoption of new material technologies required for miniaturization and performance enhancement.

What are the key technical challenges facing PSPI material development today?

Key technical challenges include the development of ultra-low dielectric constant (low-k) PSPIs to support higher operating frequencies (6G), mitigating the issue of internal stress and warpage caused by the high curing temperatures on delicate substrates, and improving material compatibility with environmentally friendly processing, such as transitioning from organic solvent-based systems to aqueous-developable formulations, all while maintaining superior thermal and mechanical integrity required for long-term device reliability in advanced integrated circuits and flexible electronics applications.

Beyond semiconductors, what are the emerging application areas for Photosensitive Polyimide?

Emerging applications for Photosensitive Polyimide are rapidly expanding into high-reliability sectors such as advanced automotive electronics (especially for ADAS sensors and control units requiring high thermal stability), flexible and stretchable biomedical devices (wearable sensors, diagnostic equipment), and specialized aerospace and defense systems. These areas leverage PSPI’s combination of high thermal resistance, chemical inertness, and precise patternability to produce durable, high-performance components capable of surviving harsh operating environments and complex integration requirements often exceeding commercial electronics standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager