Photosensitive Polymer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433366 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Photosensitive Polymer Market Size

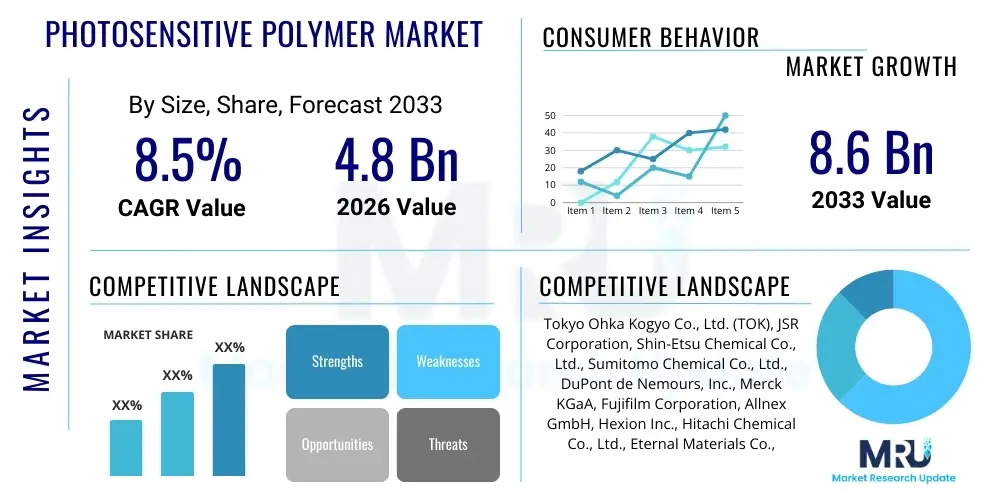

The Photosensitive Polymer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 8.6 Billion by the end of the forecast period in 2033.

Photosensitive Polymer Market introduction

Photosensitive polymers, also commonly referred to as photoresists, represent a critical class of functional materials whose solubility or physical properties are altered upon exposure to specific wavelengths of light, typically ultraviolet (UV) radiation or deep ultraviolet (DUV) light. These specialized materials are indispensable components in high-precision manufacturing, particularly within the electronics industry, where they facilitate the intricate process of photolithography. The market expansion is fundamentally driven by the relentless miniaturization trend in semiconductor fabrication and the surging global demand for high-performance electronic devices, including smartphones, IoT devices, and advanced computing hardware.

The primary applications of photosensitive polymers extend far beyond traditional circuitry. They are crucial in the production of flat panel displays (FPDs), microelectromechanical systems (MEMS), and specialized packaging technologies like wafer-level chip-scale packaging (WLCSP). Furthermore, emerging applications in biomedical devices, such as microfluidics and biosensors, are generating new avenues for market growth. The inherent benefits of these materials, including exceptional resolution capability, high thermal stability, and superior chemical resistance during etching processes, cement their status as essential materials in modern micro- and nano-fabrication techniques, ensuring the viability of next-generation electronic components.

Driving factors for sustained market growth include significant capital investment in new fabrication facilities (fabs), particularly in Asia Pacific, coupled with governmental initiatives promoting domestic semiconductor manufacturing. Continuous technological advancements, such as the transition to extreme ultraviolet (EUV) lithography, demand the development of novel, highly sensitive photoresist materials capable of working efficiently at shorter wavelengths. Moreover, the increasing complexity of integrated circuit designs and the need for high-density interconnects across various electronic platforms underscore the pivotal role photosensitive polymers play in enabling advanced functionality and maintaining competitive advantages in the global technology landscape.

Photosensitive Polymer Market Executive Summary

The Photosensitive Polymer Market demonstrates robust growth, primarily propelled by dynamic shifts in the global technology sector and aggressive expansion in advanced manufacturing capabilities. Key business trends indicate a focused effort among major market players on developing highly specialized chemically amplified resists (CARs) and dry film photoresists tailored for demanding applications such as 3D packaging and advanced memory chips. Strategic collaborations between material suppliers and leading semiconductor manufacturers are becoming crucial for accelerating product innovation cycles and ensuring material compatibility with evolving lithography equipment. Furthermore, sustainability is emerging as a significant business factor, with research increasingly dedicated to developing safer, environmentally friendlier, and lower-solvent content photoresists, addressing stringent regulatory requirements globally.

Regional dynamics highlight the Asia Pacific (APAC) as the undisputed epicenter of demand, driven by massive investments in semiconductor fabrication facilities, predominantly in China, South Korea, Taiwan, and Japan. This region not only serves as the largest consumer base but also dominates the global production capacity for consumer electronics and displays, necessitating vast quantities of high-quality photosensitive polymers. North America and Europe, while smaller in consumption volume, are focal points for innovation and high-end research, especially in specialized areas like advanced packaging, MEMS, and sophisticated biomedical applications. Government subsidies and geopolitical strategies aimed at localizing the semiconductor supply chain further amplify investment and production activity across these critical regions.

Segment trends reveal that the positive photoresist segment currently commands a substantial market share, primarily due to its widespread use in standard semiconductor and display manufacturing processes, offering excellent resolution and process control. However, the negative photoresist segment is projected to experience a slightly higher growth rate, fueled by its use in thicker film applications and specialized processes such as plating and etching for sophisticated packaging substrates. Application-wise, the semiconductor and microelectronics segment remains the largest revenue contributor, although the display manufacturing segment (covering LCD and OLED production) is rapidly growing, driven by the increasing adoption of large-screen and high-resolution displays globally, demanding high-performance photosensitive materials for pattern definition.

AI Impact Analysis on Photosensitive Polymer Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Photosensitive Polymer Market generally revolve around how AI can enhance the material development process, optimize manufacturing yields, and manage the complex logistics of the photoresist supply chain. Key themes frequently addressed include the potential for AI-driven simulation of photoresist performance under various lithography conditions, predicting defects based on material properties, and optimizing dose control during exposure to maximize throughput and minimize material waste. Users are keenly interested in predictive maintenance models for lithography equipment, which relies heavily on AI to analyze sensor data and ensure consistent polymer coating and exposure processes, thus guaranteeing the ultra-high precision required for sub-10nm chip production. The consensus expectation is that AI will transform photosensitive polymer utilization from a reactive process into a highly proactive and predictive one.

The application of AI and Machine Learning (ML) algorithms is set to revolutionize the R&D phase of new photosensitive polymers. Traditional synthesis and testing of novel chemical compounds are time-consuming and labor-intensive. AI can analyze vast datasets of chemical structures, process parameters, and resulting lithographic performance to rapidly identify promising new photoresist formulations, significantly shortening the material development lifecycle. This capability is particularly critical for developing EUV photoresists, which require exceptional sensitivity and extremely low line-width roughness (LWR). AI tools are capable of optimizing polymerization reactions and formulation blends to achieve precise target specifications much faster than conventional experimentation.

In manufacturing environments, AI facilitates real-time process optimization and quality control. By integrating sensors within coater-developers and lithography tracks, AI systems can monitor parameters such as spin coating thickness uniformity, soft bake temperature profiles, and exposure dose variances. ML models can detect minute deviations that might lead to pattern collapse or defects, automatically adjusting parameters or flagging wafers before significant yield loss occurs. This optimization capability reduces the consumption of expensive photosensitive materials and enhances the overall profitability of semiconductor fabrication. Furthermore, AI-driven demand forecasting helps material suppliers manage inventory and production schedules for highly specialized resists with limited shelf life.

- AI enhances photoresist formulation R&D by simulating chemical structures and predicting lithographic performance.

- Machine learning optimizes lithography process parameters, reducing dose errors and improving critical dimension uniformity (CDU).

- AI-powered defect detection and classification accelerate quality control and minimize yield loss in semiconductor fabs.

- Predictive maintenance models for coating and developing equipment ensure consistent material application reliability.

- AI-driven supply chain management optimizes inventory and logistics for photosensitive polymers, minimizing material expiration and ensuring timely delivery.

DRO & Impact Forces Of Photosensitive Polymer Market

The photosensitive polymer market is influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape its trajectory and competitive landscape. Primary drivers include the massive global investment in semiconductor fabrication facilities, fueled by the accelerating adoption of 5G technology, advanced computing, automotive electronics, and artificial intelligence hardware. The persistent demand for smaller, faster, and more power-efficient electronic components necessitates continuous innovation in lithography and, consequently, in the photosensitive materials used for patterning. Furthermore, the expansion of high-resolution displays (OLEDs and advanced LCDs) requires large volumes of high-performance photoresists, sustaining market momentum.

However, significant restraints temper this growth. The most prominent challenges involve the extremely high cost and technical complexity associated with developing next-generation photoresists, especially those compatible with EUV lithography. These materials require ultra-low impurity levels and exceptional chemical stability, driving up R&D expenses and manufacturing costs. Additionally, regulatory pressures concerning solvent usage and environmental impact (EHS regulations) necessitate expensive reformulation and compliance testing. The intellectual property landscape is also highly concentrated, making market entry challenging for new participants, and the sensitivity of these materials requires highly specialized and costly storage and handling infrastructure, limiting logistical flexibility.

Opportunities for future growth lie primarily in emerging applications and geographical expansion. The development of photosensitive polymers for advanced packaging (e.g., fan-out wafer-level packaging, 3D IC stacking) presents a lucrative opportunity outside traditional front-end semiconductor fabrication. The burgeoning market for flexible electronics, microfluidics, and biomedical sensors also demands specialized photoresist formulations that are biocompatible or offer unique physical properties. Geographically, significant opportunities are emerging in developing economies where local governments are aggressively promoting the establishment of domestic electronics manufacturing bases, leading to substantial new demand for photosensitive polymer imports and localized production partnerships. The transition to advanced materials like chemically amplified resists for DUV and EUV technology also represents a major long-term growth avenue.

Segmentation Analysis

The Photosensitive Polymer Market is broadly segmented based on chemistry type, application method, application end-use, and geographical region, reflecting the material's versatility and specialized roles across various industries. Understanding these segments is crucial for strategic planning, as the performance requirements and pricing structures vary significantly between, for instance, a high-resolution chemically amplified resist used in a leading-edge fab and a standard Novolac resin used in a mature display line. Market share distribution is heavily weighted towards segments associated with high-volume, advanced manufacturing processes, particularly in consumer electronics.

The segmentation by chemistry is vital, differentiating between positive and negative photoresists. Positive resists, which become soluble upon exposure, dominate the market due to their excellent resolution capability necessary for IC manufacturing. Negative resists, which polymerize and become insoluble upon exposure, are preferred for applications requiring higher film thickness and chemical resistance, such as plating molds and certain MEMS components. Within the chemistry type, advanced photoresists like chemically amplified resists (CARs) are the fastest-growing sub-segment, driven by the shift towards deep UV (DUV) and Extreme Ultraviolet (EUV) lithography, demanding superior sensitivity and resolution for pattern formation.

Application-based segmentation clearly highlights the dominance of the semiconductor and microelectronics sector, which accounts for the largest portion of revenue due to the rigorous and continuous need for high-precision patterning across all wafer processing steps. However, the display manufacturing segment, encompassing both Flat Panel Displays (FPDs) and newer OLED technologies, represents a massive volume consumer, often utilizing specialized color photoresists and protection layers. Other significant segments, including printing plates (flexographic and offset), biomedical devices, and specialized optical components, showcase the diverse utility of these functional polymers, maintaining stability and offering niche growth opportunities across various technological ecosystems globally.

- By Chemistry Type:

- Positive Photoresists (Novolac, Chemically Amplified Resists (CARs))

- Negative Photoresists (Epoxy-based, Polyimide-based)

- By Application Method:

- Liquid Photoresists

- Dry Film Photoresists (DFRs)

- By Application End-Use:

- Semiconductor and Microelectronics (IC Fabrication, Packaging)

- Display Manufacturing (LCD, OLED, MicroLED)

- Printed Circuit Boards (PCBs)

- Printing & Graphics (Flexography, Offset)

- MEMS and Sensors

- Biomedical and Microfluidics

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Photosensitive Polymer Market

The value chain for the photosensitive polymer market is intricate, starting with the upstream sourcing of highly purified raw materials and extending through specialized synthesis, precise formulation, sophisticated distribution, and highly technical end-use application. The upstream segment involves the procurement of key chemical building blocks, including specialized monomers (like phenolic resins or acrylates), photoactive compounds (PACs), photoacid generators (PAGs), and various solvents and additives. Purity is paramount at this stage; impurities as low as parts per billion can significantly compromise the final lithographic performance, necessitating high-cost, specialized purification techniques and strong relationships with certified chemical suppliers. This segment is dominated by large chemical and material science companies specializing in fine chemicals.

The midstream segment, focusing on manufacturing and formulation, is where the core intellectual property resides. Leading photosensitive polymer manufacturers synthesize the base resins, precisely blend them with PACs, PAGs, and stabilizers, and filter the final liquid or coat the dry film to meet stringent application specifications (e.g., viscosity, thermal stability, resolution). This blending and formulation process is highly proprietary and dictates the performance characteristics such as sensitivity and contrast. Quality control is rigorous, involving advanced analytical testing to ensure batch-to-batch consistency. The transition to EUV lithography requires manufacturers to invest heavily in specialized cleanroom facilities to prevent contamination.

The downstream segment encompasses distribution channels and end-user application. Due to the high sensitivity and limited shelf life of these materials, the distribution network must be tightly controlled, often involving specialized refrigerated logistics for international transport, primarily executed directly or through highly qualified, authorized distributors who manage regional inventory. End-users are typically sophisticated semiconductor fabs (like TSMC, Samsung, Intel) and large display manufacturers (like BOE, LG Display). Direct sales and technical support are crucial here, as successful implementation requires deep technical expertise and collaboration between the polymer supplier’s field application engineers and the customer’s process development teams, forming a tight, collaborative relationship that ensures optimal yield and performance.

Photosensitive Polymer Market Potential Customers

The primary customers for photosensitive polymers are global technology manufacturing giants whose business models rely on high-volume, high-precision patterning processes. The most significant segment of buyers comprises Integrated Device Manufacturers (IDMs) and pure-play semiconductor foundries, such as those producing microprocessors, memory chips (DRAM, NAND), and logic circuits. These customers utilize advanced photoresists (DUV and EUV CARs) in the front-end processing of silicon wafers, where resolution is critical for achieving multi-billion transistor densities. Their purchasing decisions are driven by material consistency, contamination control, and the ability of the material to meet ever-decreasing critical dimensions (CDs).

Another major customer base resides within the display manufacturing industry, particularly companies specializing in the production of high-resolution liquid crystal displays (LCDs) and organic light-emitting diode (OLED) screens. These end-users require photosensitive materials not only for the active matrix patterning but also for color filter fabrication, insulating layers, and protective coatings. While the resolution requirements may be less stringent than in leading-edge IC manufacturing, the demand for uniformity across large glass substrates, high throughput, and specialized chemistries (like highly pigmented color resists) dictates their purchasing behavior. The volume of material consumed by this segment is exceptionally large, making it vital for market stability.

Finally, a growing segment of potential customers includes companies focused on advanced electronic packaging (e.g., OSATs), MEMS fabrication (used in sensors, accelerometers), and specialized printing (flexographic plate makers). These buyers often utilize high-thickness negative photoresists or dry film resists for creating structures used in bump formation, redistribution layers (RDLs), or creating master molds for microfluidic devices. The criteria for these customers prioritize material robustness, adhesion characteristics, and compatibility with diverse substrate materials (e.g., glass, plastic, metal foil). The emerging biomedical sector, requiring biocompatible photosensitive materials for micro-device manufacturing, also represents a specialized, high-growth niche customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 8.6 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tokyo Ohka Kogyo Co., Ltd. (TOK), JSR Corporation, Shin-Etsu Chemical Co., Ltd., Sumitomo Chemical Co., Ltd., DuPont de Nemours, Inc., Merck KGaA, Fujifilm Corporation, Allnex GmbH, Hexion Inc., Hitachi Chemical Co., Ltd., Eternal Materials Co., Ltd., Asahi Kasei Corporation, Kolon Industries, Ltd., DJ MicroLaminates Inc., Kanto Chemical Co., Inc., Kempur Microelectronics, Mitsui Chemicals, Inc., MacDermid Alpha Electronics Solutions, MicroChem Corp., and Applied Materials, Inc. (Materials Division). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Photosensitive Polymer Market Key Technology Landscape

The technology landscape for photosensitive polymers is primarily defined by the evolution of lithography techniques, demanding materials capable of handling increasingly shorter wavelengths and smaller feature sizes. The current leading-edge technology involves Chemically Amplified Resists (CARs), which utilize photoacid generators (PAGs) to catalyze acid-driven reactions upon exposure, significantly enhancing sensitivity. This technology is essential for Deep Ultraviolet (DUV) lithography (193 nm immersion) and forms the foundation for the most advanced semiconductor manufacturing nodes (28 nm down to 7 nm). Continuous process refinement focuses on minimizing line edge roughness (LER) and improving the photoacid diffusion mechanism to maintain pattern fidelity at micro and nano scales.

The most critical technological shift currently underway is the transition to Extreme Ultraviolet (EUV) lithography (13.5 nm). This shift mandates an entirely new class of photoresist materials. Traditional organic CARs often struggle with EUV due to issues related to photon shot noise, low absorption, and stochastic defects. As a result, significant research investment is being channeled into developing metal-containing resists (MCRs), such as inorganic resists based on tin or hafnium oxides, which offer higher absorbance at 13.5 nm and potentially better resolution. The success of future sub-5 nm nodes is directly dependent on breakthroughs in these next-generation photoresist chemistries and their ability to integrate seamlessly with complex multi-patterning techniques.

Beyond traditional liquid photoresists, Dry Film Photoresists (DFRs) represent a vital technology, particularly in high-aspect ratio applications like advanced packaging (WLCSP, FOWLP) and Printed Circuit Board (PCB) manufacturing. DFRs offer advantages in handling thick films, minimizing solvent waste, and achieving highly uniform thickness across non-planar surfaces. Technological advances in DFRs are focused on improving resolution capabilities and thermal stability to handle high-temperature processing steps. Furthermore, the increasing use of advanced materials in 3D printing and additive manufacturing is spurring the development of specialized photocurable resins—a closely related photosensitive polymer technology—that allow for high-resolution 3D structuring for microfabrication and prototyping applications.

Regional Highlights

The Asia Pacific (APAC) region dominates the Photosensitive Polymer Market, both in terms of consumption and production capacity, holding the largest market share globally. This supremacy is attributable to the concentration of the world’s major semiconductor fabrication clusters in South Korea, Taiwan, Japan, and mainland China. South Korea and Taiwan, home to industry giants like Samsung, TSMC, and SK Hynix, are leading the global race in advanced lithography (EUV and DUV), requiring massive, consistent supplies of high-performance CARs. China is rapidly expanding its domestic semiconductor ecosystem, backed by extensive government subsidies, creating explosive demand for various grades of photoresists for mature and emerging fabrication lines. Japan, while seeing some manufacturing shift, remains a global powerhouse in the R&D and manufacturing of core photoresist chemicals, hosting leading suppliers like JSR and TOK.

North America maintains a significant position driven by technological innovation and specialized application needs. While large-scale, high-volume manufacturing has partially shifted to APAC, the US remains a crucial center for advanced R&D, specialized defense applications, and the resurgence of domestic IC manufacturing led by companies such as Intel and Micron. Demand in North America focuses heavily on ultra-high-performance resists for R&D, pilot manufacturing of advanced packaging materials, and the growing MEMS and biomedical device sectors. The region’s strength lies in its ability to quickly adopt and scale novel photoresist technologies, especially those targeting niche, high-value applications where complexity outweighs volume.

Europe represents a mature yet strategically important market, particularly in high-value niches like automotive electronics, industrial sensors, and sophisticated photonics applications. Countries such as Germany, the Netherlands, and Ireland host key manufacturing sites and research institutions, creating steady demand for advanced DUV resists and specialized polymer coatings. The European Union’s push towards digital sovereignty and strengthening its microelectronics supply chain will likely boost localized demand for photosensitive materials. Although Europe’s total volume consumption is lower than APAC, its focus on high-reliability, zero-defect standards for critical infrastructure components ensures sustained demand for premium-priced, top-tier photosensitive polymers.

- Asia Pacific (APAC): Dominates the market due to concentrated semiconductor manufacturing (Taiwan, South Korea, China) and large-scale display production; highest volume consumption and fastest growth.

- North America: Key center for advanced R&D, advanced packaging, and MEMS; focuses on high-performance, specialized photoresists for leading-edge technologies and domestic manufacturing initiatives.

- Europe: Strong market in automotive electronics, industrial applications, and photonics; steady demand for high-reliability DUV resists; growth supported by EU initiatives to strengthen the domestic electronics supply chain.

- Latin America & Middle East/Africa (LAMEA): Smaller current market share, primarily driven by downstream assembly and PCB manufacturing; emerging growth potential tied to localizing consumer electronics assembly and infrastructure development projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Photosensitive Polymer Market.- Tokyo Ohka Kogyo Co., Ltd. (TOK)

- JSR Corporation

- Shin-Etsu Chemical Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- DuPont de Nemours, Inc.

- Merck KGaA

- Fujifilm Corporation

- Allnex GmbH

- Hexion Inc.

- Hitachi Chemical Co., Ltd. (Showa Denko Materials)

- Eternal Materials Co., Ltd.

- Asahi Kasei Corporation

- Kolon Industries, Ltd.

- DJ MicroLaminates Inc.

- Kanto Chemical Co., Inc.

- Kempur Microelectronics

- Mitsui Chemicals, Inc.

- MacDermid Alpha Electronics Solutions

- MicroChem Corp.

- Applied Materials, Inc. (Materials Division)

Frequently Asked Questions

Analyze common user questions about the Photosensitive Polymer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Photosensitive Polymer Market?

The primary driver is the accelerating investment in advanced semiconductor fabrication facilities globally, especially those dedicated to manufacturing chips at sub-10 nanometer nodes. This miniaturization is fundamentally enabled by high-performance photoresists, particularly Chemically Amplified Resists (CARs) compatible with Deep Ultraviolet (DUV) and Extreme Ultraviolet (EUV) lithography. The relentless consumer demand for high-speed connectivity (5G/6G), advanced computing power required for AI, and the proliferation of IoT devices all necessitate denser, smaller circuits, ensuring continuous demand for these crucial patterning materials. Geopolitical efforts to localize and secure semiconductor supply chains across North America, Europe, and Asia also contribute significantly to increased capital expenditure and subsequent demand for photoresist volumes and specialized formulations. The push towards 3D integration and advanced packaging techniques further diversifies the application base, stabilizing long-term market expansion.

How does Extreme Ultraviolet (EUV) lithography affect the demand and complexity of photosensitive polymers?

EUV lithography (13.5 nm) is transforming the photosensitive polymer sector by demanding materials with fundamentally different chemical properties compared to DUV resists. EUV poses two major challenges: low photon flux absorption, which requires highly sensitive materials, and high-energy radiation, which increases line-width roughness (LWR) and pattern collapse risk. This has led to the development of highly advanced, often metal-containing, resists (e.g., tin-based or metal-oxide resists) that improve resolution and sensitivity while managing stochastic defects. While EUV adoption reduces the need for costly multi-patterning processes, it dramatically increases the complexity, R&D expense, and required purity standards for the photoresist, leading to higher average selling prices (ASPs) for these cutting-edge formulations. The successful mass adoption of EUV is entirely reliant on overcoming the materials challenge inherent to these next-generation photosensitive polymers.

What is the key difference between Positive and Negative Photoresists, and which segment leads the market?

The key functional difference lies in their reaction upon exposure to light. Positive photoresists are initially insoluble but undergo a chemical reaction (e.g., acid-catalyzed cleavage) upon exposure, making the exposed areas soluble to the developer solution, which are then washed away, leaving the unexposed areas. Negative photoresists, conversely, undergo cross-linking polymerization upon exposure, making the exposed areas insoluble, while the unexposed areas are washed away by the developer. The Positive Photoresist segment currently commands the largest market share, predominantly because of its superior resolution capabilities, which are essential for high-precision patterning required in front-end semiconductor manufacturing (IC fabrication). However, Negative Photoresists are critical for applications requiring thicker films, such as advanced packaging redistribution layers (RDLs) and MEMS manufacturing, and they are experiencing specialized growth in these niche, high-value segments.

Which geographical region exhibits the highest growth potential for photosensitive polymers?

The Asia Pacific (APAC) region demonstrates the highest growth potential, primarily driven by massive, sustained investments in semiconductor fabrication and display manufacturing across Taiwan, South Korea, and Mainland China. These three economies collectively account for the majority of global IC and display output. Government-backed initiatives, particularly in China, aimed at achieving self-sufficiency in semiconductor production are fueling significant capacity expansion, leading to unparalleled demand for all grades of photosensitive polymers, from high-end EUV resists to standard display coatings. Although North America and Europe contribute significantly to R&D and specialized, high-margin materials, the sheer volume requirements and continuous capacity expansion in APAC cement its position as the engine of market growth for the foreseeable future, driving both consumption and production innovation.

How do environmental regulations impact the formulation and development of photosensitive polymers?

Environmental, Health, and Safety (EHS) regulations, especially those regarding volatile organic compounds (VOCs) and specific solvents, impose significant constraints and costs on photoresist manufacturers. Regulations such as REACH in Europe and similar governmental guidelines globally pressure companies to develop "greener" formulations with lower solvent content or utilize less hazardous alternatives, driving the adoption of water-soluble systems or requiring substantial reformulation of existing products. This regulatory pressure directly impacts R&D focus, compelling manufacturers to invest in new purification and delivery systems, such as advanced filtration, to ensure compliance without compromising performance. Furthermore, the handling and disposal of photosensitive waste materials in fabrication facilities are also subject to increasingly strict environmental oversight, adding complexity and cost across the entire value chain.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager